Last updated on February 19th, 2022

You’ve decided to get a NETS card. However, there’s so many different types of cards out there, like the FlashPay and CashCard!

How are they different and which one should you be using?

Contents

The difference between NETS FlashPay and CashCard

Both cards are stored value cards that are provided by NETS Singapore. NETS CashCards can only be used in carparks and ERP. Meanwhile, NETS FlashPay can also be used for public transport and retail shopping with eligible merchants.

Here’s a more in-depth comparison between these 2 cards:

Type of card

There are different types of cards that are available for both FlashPay and CashCard:

FlashPay is a contactless card

NETS FlashPay cards are all contactless. This means that you do not need to insert your card into the terminal.

All you’ll need to do is to tap your card on any terminal to make a transaction!

This is similar to the new NETS Tap contactless ATM cards that the banks are issuing out now.

CashCard has contact and contactless versions

There are both the contact and contactless versions of the CashCard available in Singapore.

The old CashCard requires you to slot in your card at carpark gantries which do not support automatic fee deduction.

However, the new contactless CashCard is much more convenient. All you’ll need to do is tap on the carpark reader to deduct your fees.

The contactless CashCard is only compatible with the Dual-Mode IU. It is not compatible with the First Generation IU.

Where can I use this cards?

Here is a simple table to illustrate where you can use these cards:

| CashCard | Contactless CashCard | FlashPay | |

|---|---|---|---|

| Retail Spend | ✕ | ✕ | ✓ |

| Public Transport | ✕ | ✕ | ✓ |

| Carpark Charges | ✓ | ✓ | ✓ |

| ERP Charges | ✓ | ✓ | ✓ |

The NETS FlashPay card seems to be the most versatile as they can be used for all types of transactions!

You are able to use your FlashPay card with the old In-Vehicle Unit as well.

For both the CashCard and contactless CashCards, you are only able to use them for vehicle-related charges.

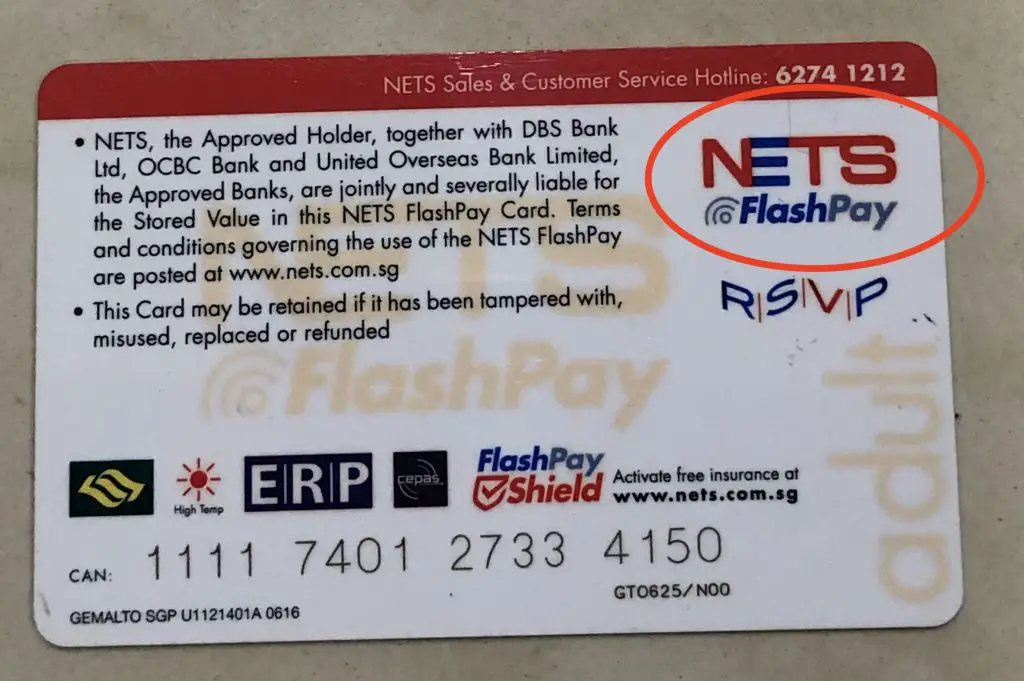

However, your contactless CashCard may have NETS FlashPay capabilities inside too. You can look out for the NETS FlashPay logo at the back of your contactless CashCard.

Maximum stored value

For all 3 cards, the maximum amount that you can hold in each card is $500. You will be unable to make any more top-ups once you’ve reached this limit.

Purchasing a card

Here are the different places where you can purchase these cards:

| Location | CashCard | Contactless CashCard | FlashPay |

|---|---|---|---|

| Convenience stores (7-Eleven, Cheers and Caltex) | ✓ | ✓ | ✓ |

| VICOM | ✓ | ✓ | ✓ |

| NETS Customer Service Centre | ✓ | ✕ | ✓ |

| Online (Custom Cards, ReCreations, Lazada) | ✕ | ✕ | ✓ |

| TransitLink Ticket Offices | ✕ | ✕ | ✓ |

| SBS Transit & SMRT Passenger Service Counters | ✕ | ✕ | ✓ |

| Changi Airport (Travelex Moneychangers and UOB Moneychangers) | ✕ | ✕ | ✓ |

Card fees

If you want to buy any of these 3 cards, you will need to pay $5 to purchase the card.

However, some of these cards come with an additional stored value inside. As such, you may need to pay a higher amount when purchasing your card.

| CashCard and Contactless CashCard | FlashPay | |

|---|---|---|

| Purchase Amount | $10 ($5 stored value) | $12 ($7 stored value, at convenience stores) $5 ($0 stored value, online) |

Only the NETS FlashPay cards give you the option to purchase them online without any stored value.

Card designs

The CashCard and contactless CashCards both do not seem to have multiple card designs. As such, you will be stuck with the designs that are available at the shop.

In contrast, one of NETS FlashPay’s selling points is its customisability. There are many different designs that you can choose to have on the front of your FlashPay card.

Here are 3 ways that you can create your own designs:

If you prefer to have a card that has a design that you like, NETS FlashPay may be a better card for you.

Top up locations

Here are the different top-up locations for the different types of cards:

| Location | CashCard | Contactless CashCard | FlashPay |

|---|---|---|---|

| Local Bank ATMs | ✓ | ✓ | ✓ |

| Convenience Stores | ✓ | ✓ | ✓ |

| NETS Top-Up Machines | ✕ | ✓ | ✓ |

| NETS Self-Service Stations | ✕ | ✓ | ✓ |

| NETS Customer Service Centre | ✕ | ✓ | ✓ |

| NETS FlashPay Reader App | ✕ | ✓ | ✓ |

| Add Value Machine Plus (AVM+) | ✕ | ✕ | ✓ |

| General Ticketing Machines (GTMs) | ✕ | ✕ | ✓ |

| TransitLink Ticket Office | ✕ | ✕ | ✓ |

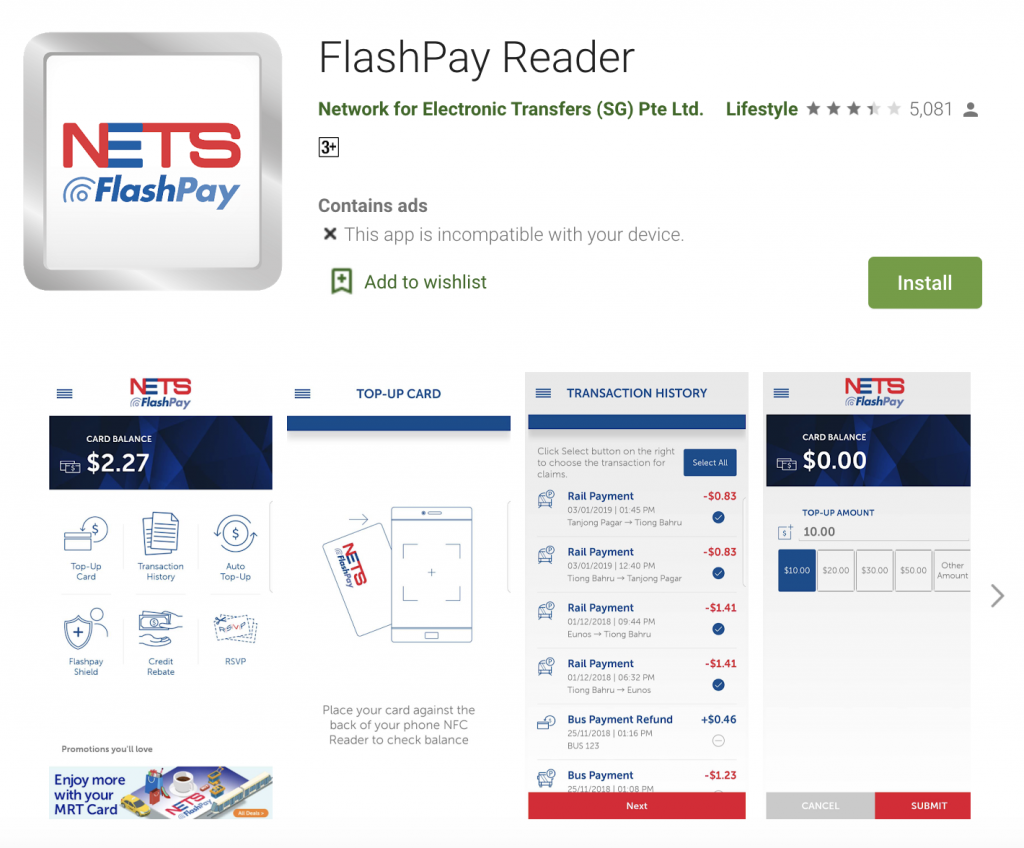

Auto Top-Up with NETS FlashPay Reader

If you have a NFC-enabled Android phone, you can use the Auto-Top Up function instead. This feature is available only for the contactless CashCard and FlashPay cards.

All you’ll need to do is to download the NETS FlashPay Reader App from Google Play Store.

Your NFC-enabled Android phone is able to use Google Pay as a contactless payment as well.

The Auto Top-Up function uses your linked debit or credit card to automatically transfer the funds to your FlashPay card.

However, there will be a $0.25 fee that will be charged to your card for each top up!

Minimum top up

You are required to top up a minimum of $10 to your maximum amount ($500) for the Contactless CashCard.

However, there is no minimum top up mentioned for both the CashCard and FlashPay cards.

Viewing transaction history

You are able to view your transaction history from these cards through different methods:

| CashCard | Contactless CashCard | FlashPay | |

|---|---|---|---|

| Local Bank ATMs | ✓ | ✓ | ✕ |

| NETS Self-Service Station | ✓ | ✓ | ✕ |

| NETS Top-Up Terminals | ✓ | ✓ | ✕ |

| NETS FlashPay Reader App | ✕ | ✓ | ✓ |

The number of transactions you can view depends on the method that you use:

| Method | Number of Transactions |

|---|---|

| Local Bank ATMs | 10 |

| NETS Self-Service Station | 30 |

| NETS Top-Up Terminals | 30 |

| NETS FlashPay Reader App | 30 |

You will also need to pay a $0.20 fee if you print out any statements at the local banks’ ATMs.

Rewards

There are some rewards that you can earn while using these NETS cards. However, they are rather limited.

Retailer Stored Value Programme (RSVP)

NETS FlashPay cards have a Retailer Stored Value Programme (RSVP).

There are 2 types of rewards you can earn with RSVP:

- Dollar promotions (receive a discount on your transaction)

- Item promotions (purchase a set of items for a discount)

This is something similar to how FavePay works.

However, there are some caveats to this programme:

- RSVP is only available on NETS FlashPay cards or a merchant co-branded card

- You can only redeem the deals from the same merchant that you’ve purchased from before

- Your NETS FlashPay card can only store RSVP rewards from 20 different merchants

- Your RSVP wallet is different from your NETS FlashPay stored value

Overall, this rewards programme is not well utilised by both merchants and customers.

WINK+ Go

When you use your contactless CashCard to make ERP payments, you will be able to earn WINK+ points.

You will first need to link your contactless CashCard to your WINK+ app. This can be done with the 16-digit CAN ID on your card.

After linking your card, you will earn 1 WINK+ point for each ERP transaction you make.

These points can be used at:

- Participating retailers

- iMOB Shop

Other promotions

From time to time, there may be other attractive promotions when you use your NETS cards to make payments.

You can check them out at the promotion page on NETS’ website.

Card protection

You will receive free card insurance for these 3 cards as well:

| CashCard | Contactless CashCard | FlashPay | |

|---|---|---|---|

| Card Insurance | 6 months | 1 year | 1 year |

All of these card insurance policies are underwritten by HL Assurance.

CashCard Shield

In the even of car theft, you can be reimbursed up to $50 of the remaining value in your CashCard.

The complimentary coverage will only last for 6 months before you are required to pay the premiums.

Contactless CashCard and FlashPay Shield

In the event of theft or robbery, you will be reimbursed up to $50 of your stored value in the card. Your coverage will last up to 1 year.

The application form only mentions FlashPay Shield. However, I believe that you can apply for the coverage using a contactless CashCard as well.

Expiry date

Here are the number of years before your card will expire from the date of issue:

| CashCard | Contactless CashCard | FlashPay | |

|---|---|---|---|

| Card Expiry Date | 5 years | 7 years | 7 years |

For the CashCard, you will need to apply to receive a full refund 2 years from the date of expiry. Otherwise, you will be charged a $1 service fee per month. This is deducted from the stored value.

You can use the FlashPay Reader App to view your card’s expiry date for:

- FlashPay card

- Contactless CashCard

However for the CashCard, you can only view the expiry date on either:

- A top-up receipt

- A statement print receipt

The expiry date for the NETS FlashPay card is longer compared to the EZ-Link card.

Refund

When your cards expire, you are eligible to get a refund on your remaining balance in the card.

You are eligible for a refund within 2 years of the expiry date.

However for the contactless CashCard and NETS FlashPay cards, you will need to apply for a refund within 1 year of its expiry. If not, you will be subject to a service charge of $1 a month!

This service charge will be deducted from your stored value until:

- It is fully depleted, or

- After 6 calendar years have passed

For the CashCard, the service charged will only start 2 years after your card has expired.

Verdict

Here’s how these cards compare with each other:

| CashCard | Contactless CashCard | FlashPay | |

|---|---|---|---|

| Type of Card | Requires inserting into terminal | Contactless | Contactless |

| Card Uses | Carpark charges ERP | Carpark charges ERP | Carpark charges ERP Public transport Retail |

| Maximum Stored Value | $500 | $500 | $500 |

| Card Purchase Locations | 3 | 2 | 7 |

| Card Fees | $5 | $5 | $5 |

| Card Design | Only one | Only one | Multiple |

| Top Up Locations | 2 | 6 | 9 |

| Auto Top-Up | No | Yes | Yes |

| Minimum Top-Up | None | $10 | None |

| Rewards | None | Wink+ | RSVP |

| Card Insurance | 6 months | 1 year | 1 year |

| Card Expiry Date | 5 years | 7 years | 7 years |

The NETS FlashPay card seems to be the most versatile among the 3 cards! However if your contactless CashCard has NETS FlashPay enabled, it is equally as versatile as well.

Is the NETS FlashPay card considered as a CashCard?

The NETS FlashPay card is a different type of card issued by NETS compared to the CashCard. NETS FlashPay cards have much more utility compared CashCards, as they can be used for public transport and retail spending.

Conclusion

The NETS cards have been a common way that we make payments for carpark, public transport and retail spend.

However, there have been significant changes in the cashless payment methods. There are now many ways that we can make payments as well!

As such, these NETS cards may not be as well utilised compared to other forms of payments, such as Visa payWave.

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?