Last updated on February 19th, 2022

You may be really confused by the different types of NETS cards in the market.

NETS recently released their new NETS contactless ATM cards. So how exactly are they different from the NETS FlashPay cards?

Contents

The difference between NETS Tap and NETS FlashPay

NETS Tap cards are contactless cards which automatically deduct your transaction amount from your bank account. Meanwhile, NETS FlashPay cards are stored value cards which require topping up to pay with them. You are able to use either card to make payments so long as the cashier accepts NETS.

Here is a breakdown between these 2 cards:

Type of card

NETS Tap cards are rather different from NETS FlashPay cards.

NETS Tap is a contactless ATM card

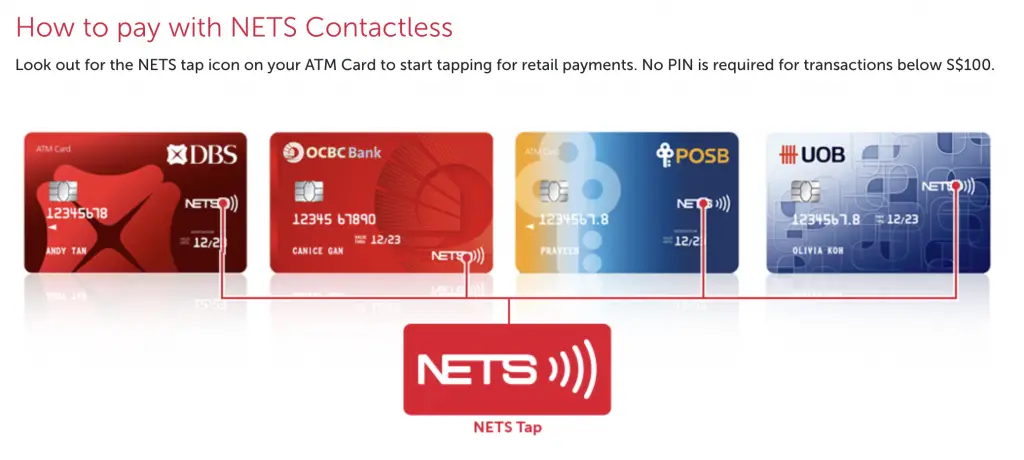

The new NETS Tap cards are all contactless ATM cards. With these cards, you no longer need to insert your NETS card into the terminal and enter a PIN!

The contactless function is only available for any purchase under $100. You will still need to enter a PIN for transactions over $100.

To see if your ATM card has this contactless feature, the card must have the ‘NETS Contactless‘ symbol.

There are 6 different banks that allow you to use this contactless feature:

- DBS

- POSB

- OCBC

- UOB

- HSBC

- Maybank

You may think that DBS and POSB are different banks, but they are actually the same bank!

These cards directly debit money from your bank account

Since these cards are ATM cards, they will have access to your bank account. Similar to how other NETS cards work, the amount that you pay will be deducted from your bank account.

This deduction is immediate, which is much faster than payWave debit cards. These cards may take a few days to process the deduction.

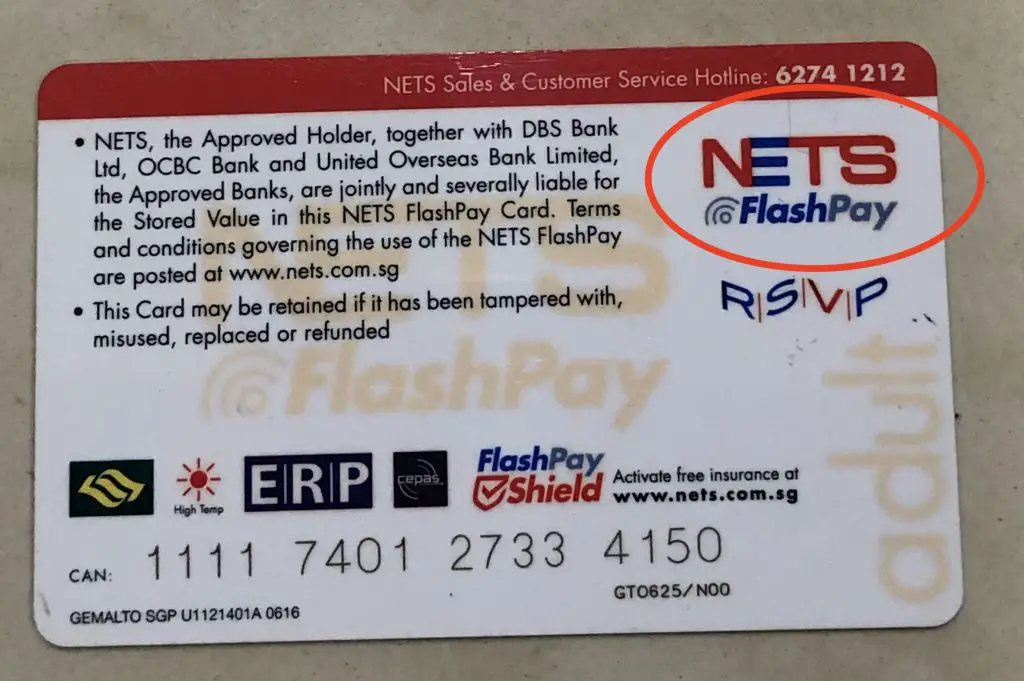

NETS FlashPay is a stored value card

NETS FlashPay is also a contactless card. To see which cards have FlashPay capabilities, you would need to look out for this logo on your card:

However, these cards are stored value cards. NETS FlashPay is not directly connected to your bank accounts.

This is similar to the CashCards that are issued by NETS as well.

Instead, they have a certain amount of money (up to $500) that is stored in the card.

This is somewhat similar to stored value mobile wallets like GrabPay and Singtel Dash which are not directly linked to your bank account.

Uses

Both of these cards can be used the same way for these 2 main scenarios:

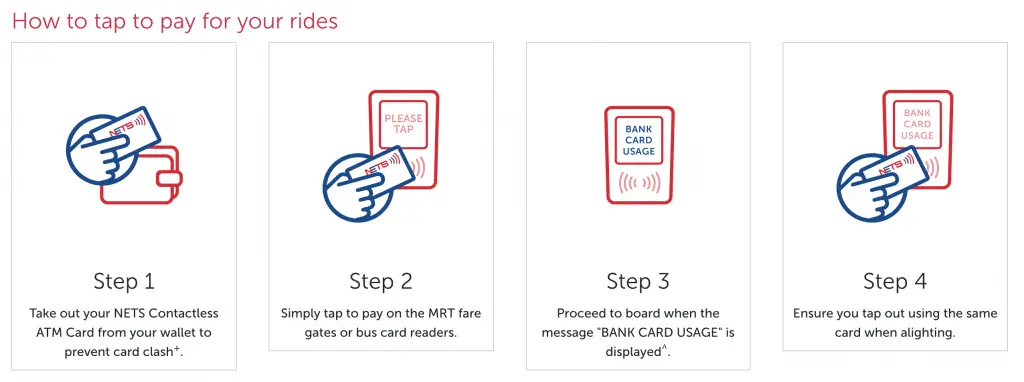

#1 Public transport

You are able to use either card to pay for your public transport rides. All you’ll need to do is to tap your card on the MRT gantries or bus card readers.

For NETS Tap, the ‘BANK CARD USAGE‘ message will be displayed instead of the amount in your card.

This is because your public transport fee is immediately deducted from your bank account via NETS!

#2 Payment at local stores with NETS terminals

You can use either card to pay at any NETS terminal. These terminals can be found in most retail shops, as well as hawker centres!

There are a lot more shops that offer payment by NETS, compared to Visa or Mastercard contactless payments.

This is most likely due to the higher transaction fees that Visa and Mastercard charge.

As such, you will be able to use both cards in a wide variety of shops!

Overseas transactions

NETS terminals are now found in Malaysia as well! As such, you can use your NETS cards overseas too.

However, the FAQs on NETS’ website only mentioned that NETS enabled cards issued by DBS, POSB, OCBC or UOB can be used overseas. This may mean that you cannot use a NETS FlashPay card overseas.

Here are some things to note when you’re making an overseas transaction with NETS:

- You will need to enter a PIN to perform an overseas transaction

- Your transaction will be done in the foreign currency and will be converted to SGD based on NETS’ prevailing currency

- The exchange rate will be reflected on your NETS charge slip after you make a payment

- There are no bank admin charges or foreign currency conversion fees charged by NETS

You can view the entire list of NETS enabled merchants found in Malaysia to find out more.

Obtaining a card

To obtain a NETS Tap card, you will need to approach your bank to swap your old NETS ATM card for the contactless card.

However, when you create a new bank account with any of the banks, they will start to issue you the new contactless cards!

When you wish to buy a NETS FlashPay card, you can do so at these locations:

- Convenience stores (7-Eleven, Cheers and Caltex)

- VICOM

- NETS Customer Service Centre

- Online (Custom Cards, ReCreations, Lazada)

- TransitLink Ticket Offices

- SBS Transit & SMRT Passenger Service Counters

- Changi Airport (Travelex Moneychangers and UOB Moneychangers)

Since FlashPay is a stored value card, you will be able to obtain one from a wider variety of places!

Top-up

NETS Tap contactless cards do not require any top-ups. This is because they are not stored value cards. Instead, you are directly deducting the amount from your bank account.

However since NETS FlashPay is a stored value card, you are required to do a top-up.

There are a few places where you are able to top up your NETS FlashPay card:

- Local Bank ATMs

- Convenience Stores

- Convenience Stores

- NETS Self-Service Stations

- NETS Customer Service Centre

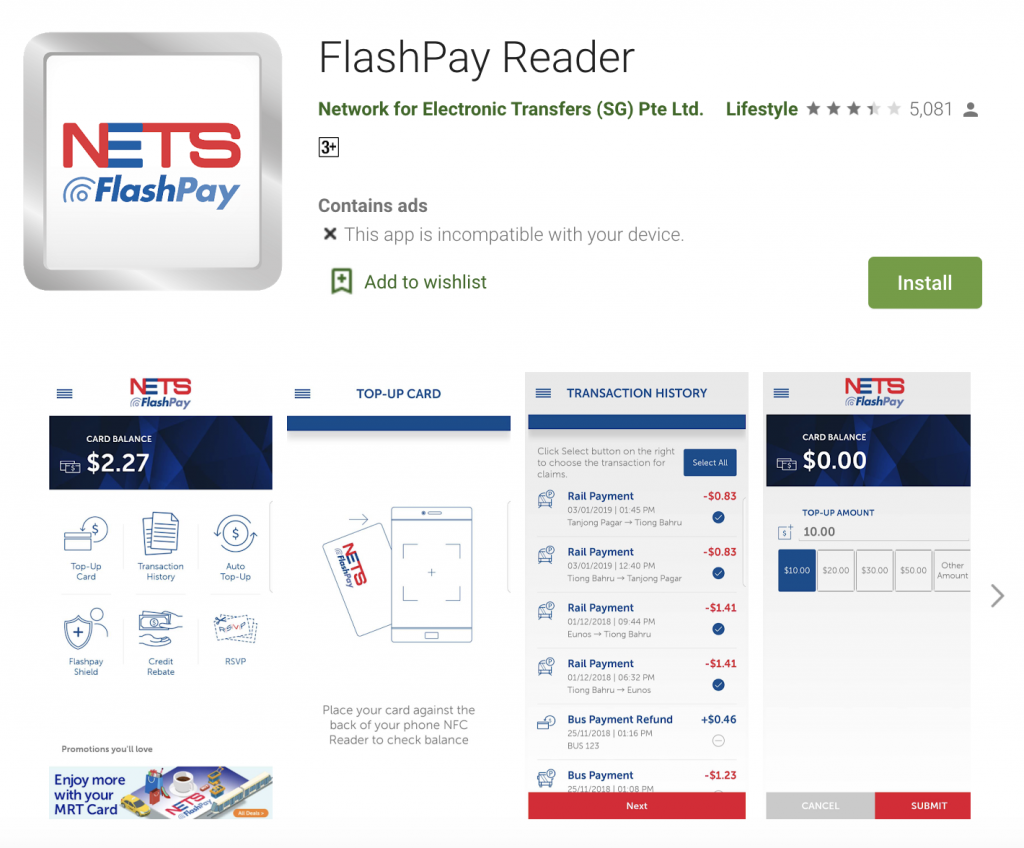

- NETS FlashPay Reader App

- Add Value Machine Plus (AVM+)

- General Ticketing Machines (GTMs)

- TransitLink Ticket Office

If you have a NFC-enabled Android phone, you can use the Auto-Top Up function instead. All you’ll need to do is to download the NETS FlashPay Reader App from Google Play Store.

Your NFC-enabled Android phone is able to use Google Pay as a contactless payment as well.

The Auto Top-Up function uses your linked debit or credit card to automatically transfer the funds to your FlashPay card.

However, there will be a $0.25 fee that will be charged to your card for each top up!

Design

The NETS Tap contactless ATM cards all have the same design for each specific bank.

In contrast, one of NETS FlashPay’s selling points is its customisability. There are many different designs that you can choose to have on the front of your FlashPay card.

Here are 3 ways that you can create your own designs:

If you prefer to have a card that has a design that you like, NETS FlashPay may be a better card for you.

This is similar to how EZ-Link cards have custom designs as well.

ATM withdrawal

Since your NETS Tap card is also an ATM card, you are able to make withdrawals from ATMs using the same card.

However, NETS FlashPay is a stored value card. It is not linked to any ATM at all. As such, you are unable to make any ATM withdrawals with your FlashPay card.

Fees charged

NETS Tap is integrated into the banks’ ATM cards. As such, you do not need to pay any additional fees to use this card.

In contrast, you will need to pay a $5 fee for every NETS FlashPay card that you purchase. This is regardless of whether you buy it from a convenience store or online.

Rewards

NETS Tap contactless cards use the same network as other NETS cards. As such, there are no enticing rewards for using NETS cards.

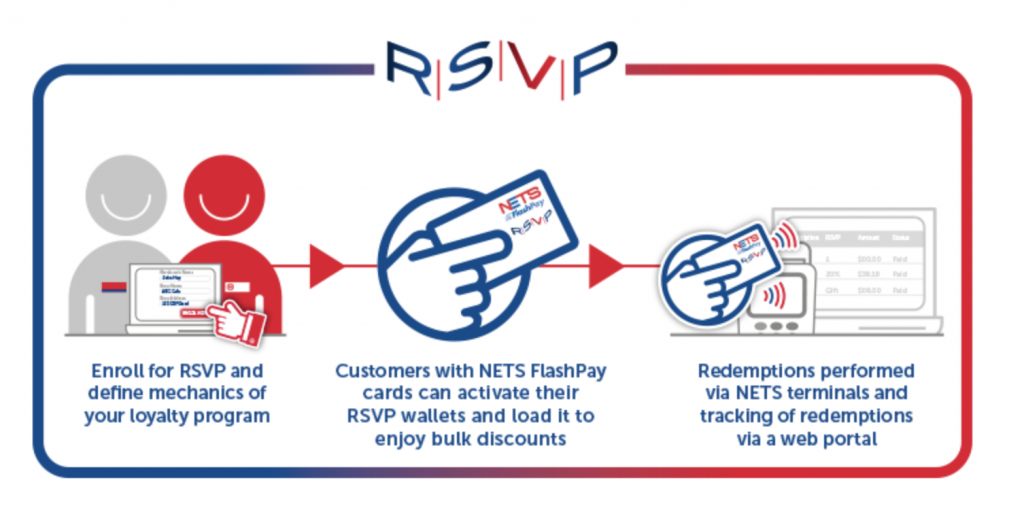

Meanwhile, when you use NETS FlashPay cards, you can earn rewards via the Retailer Stored Value Programme (RSVP).

There are 2 types of rewards you can earn with RSVP:

- Dollar promotions (receive a discount on your transaction)

- Item promotions (purchase a set of items for a discount)

However, there are some caveats to this programme:

- You can only redeem the deals from the same merchant that you’ve purchased from before

- Your NETS FlashPay card can only store RSVP rewards from 20 different merchants

- Your RSVP wallet is different from your NETS FlashPay stored value

Overall, this rewards programme is not really well utilised by both merchants and customers.

As such, NETS does not provide much incentives to use their payment platform.

The only other reward you can receive for using NETS are special offers with certain shops. However, the number of shops that reward you are really limited!

Verdict

Here’s a breakdown between these 2 cards:

| NETS Tap | NETS FlashPay | |

|---|---|---|

| Type of Card | Contactless ATM card | Contactless stored value card |

| Method of Deduction | Direct from bank account | From stored value in card |

| Type of Local Transactions | Retail stores Public transport | Retail stores Public transport |

| Overseas Transactions | Yes | No |

| Ways to Obtain Card | Directly from bank | From convenience stores etc. |

| Top-up | Not required | From various places or NETS FlashPay Reader app |

| Design | Fixed design based on banks | Customised designs available |

| ATM Withdrawal | Yes | Not possible |

| Fees Charged | No fees | $5 fee for every card purchased |

| Rewards | Special discounts at certain stores | RSVP Special discounts at certain stores |

Since both cards use the NETS payment network, there is not much incentive to use these cards compared to other contactless methods.

Conclusion

Both of these contactless cards provide you with a fast way of making a cashless payment. However, the main difference is that NETS Tap cards are linked to your bank account, while NETS FlashPay cards requiring constant topping up.

Moreover, other payment methods give you better rewards for using them. As such, you may want to consider using these methods instead of NETS!

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?