The YouTrip card is one of the multi-currency cards that are available in Singapore.

You may have topped up a huge sum into your card, and are looking to withdraw it.

Is it even possible for you to withdraw the money from your YouTrip card?

Here’s what you need to know.

Contents

- 1 Can I withdraw money from YouTrip in Singapore?

- 2 Can I transfer money from my YouTrip app to a bank account in Singapore?

- 3 How can I withdraw money from my YouTrip card in Singapore?

- 4 Can I use my YouTrip card as an EZ-Link card?

- 5 Can I use YouTrip to make online transactions?

- 6 Can I use YouTrip to top up my GrabPay wallet?

- 7 Can I add YouTrip to Apple Pay?

- 8 Can I add YouTrip to my PayPal account?

- 9 Can I use YouTrip for Amazon?

- 10 Conclusion

- 11 👉🏻 Referral Deals

Can I withdraw money from YouTrip in Singapore?

YouTrip currently does not allow you to make withdrawals from a Singaporean ATM using your YouTrip card. You are only able to make cash withdrawals from overseas ATMs.

If you want to make a withdrawal from an ATM using your YouTrip card, you can only do so in another country outside of Singapore.

However, you will have to pay a SGD $5 fee (or equivalent in a foreign currency) for every withdrawal that you make.

Can I transfer money from my YouTrip app to a bank account in Singapore?

You are unable to withdraw the money from you YouTrip mobile wallet to a bank account in Singapore. YouTrip does not support this function, which means that you cannot withdraw the funds that you have deposited into your YouTrip wallet.

Your YouTrip card is a stored value debit card. This means that you’ll have to deposit funds into your card, before you can make any purchases.

However, you can’t withdraw the amount that you have deposited into your YouTrip wallet back into your bank account!

This is different from other mobile wallets like GrabPay or Singtel Dash. Both wallets now offer a feature to withdraw funds to your bank account.

How can I withdraw money from my YouTrip card in Singapore?

While you can’t directly withdraw your funds from your YouTrip wallet in Singapore, here are 2 ways you can consider to spend the funds in your YouTrip card:

- Make a payment at a local store that accepts Mastercard

- Make an online transaction at stores that accept Mastercard

#1 Make a payment at a local store that accepts contactless payments

So long as the shop has a contactless terminal, you should be able to use your YouTrip card to make a payment.

Usually, these terminals will be able to accept Visa payWave and Mastercard contactless.

#2 Make an online transaction at stores that accept Mastercard

If you are making any online transactions, you should be able to use the YouTrip card on any platforms that accept Mastercard.

You can consider adding your YouTrip to platforms like Shopback or Fave, so that you can earn extra rewards on your purchases.

Can I use my YouTrip card as an EZ-Link card?

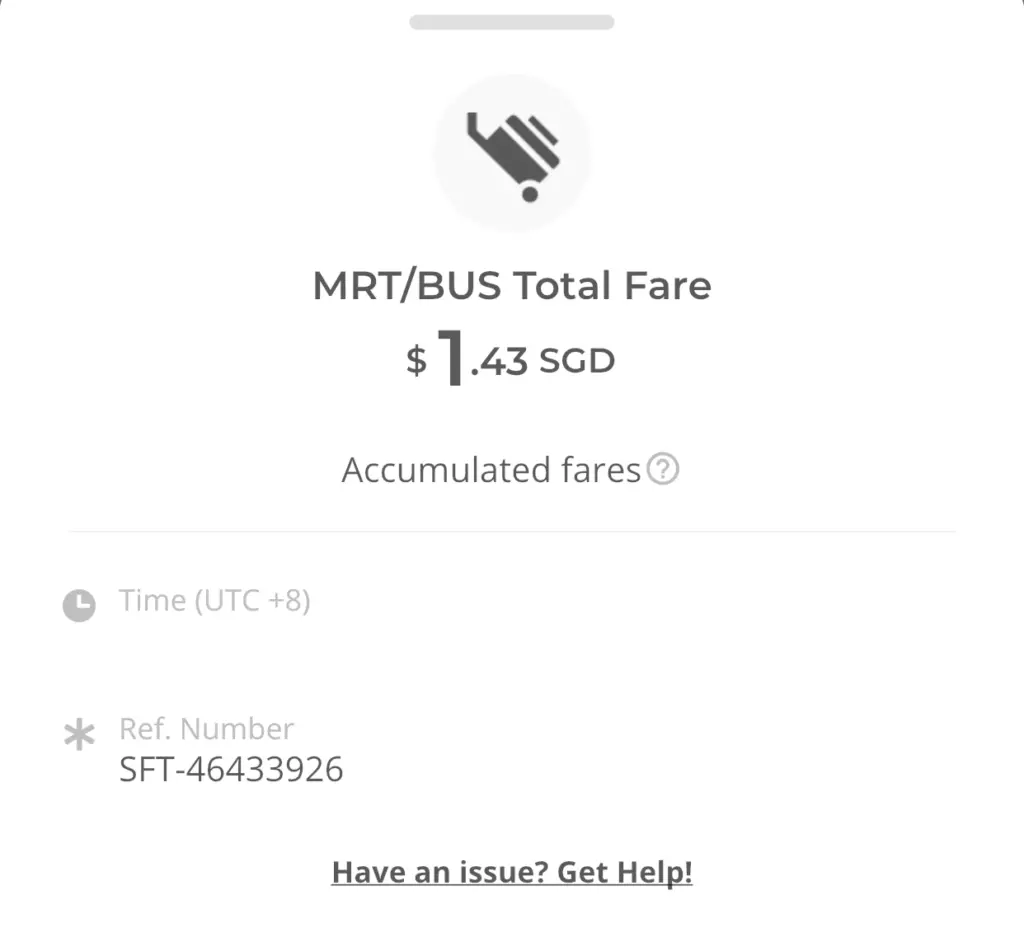

While the YouTrip card is not a CEPAS-compliant EZ-Link card, you are able to use it to pay for public transport as a prepaid Mastercard. The transport fare will be deducted from your YouTrip mobile wallet when certain conditions are met.

The YouTrip card functions in the same way as an EZ-Link card, where you can pay for your transport rides.

However, the YouTrip card is not actually an EZ-Link card. It is a prepaid Mastercard, but you can still use on the bus or MRT.

This is because the LTA has allowed the use of credit and debit cards for transport fare payments using SimplyGo.

When you use the YouTrip card for your bus and MRT rides, you may notice that the fares are not deducted right away from your card.

Instead, it will be deducted in either of these scenarios:

- 5 days after your first MRT / bus fare

- When your total fare exceeds $15

If you want to track each individual transaction, you can do so by linking your YouTrip card with SimplyGo.

Can I use YouTrip to make online transactions?

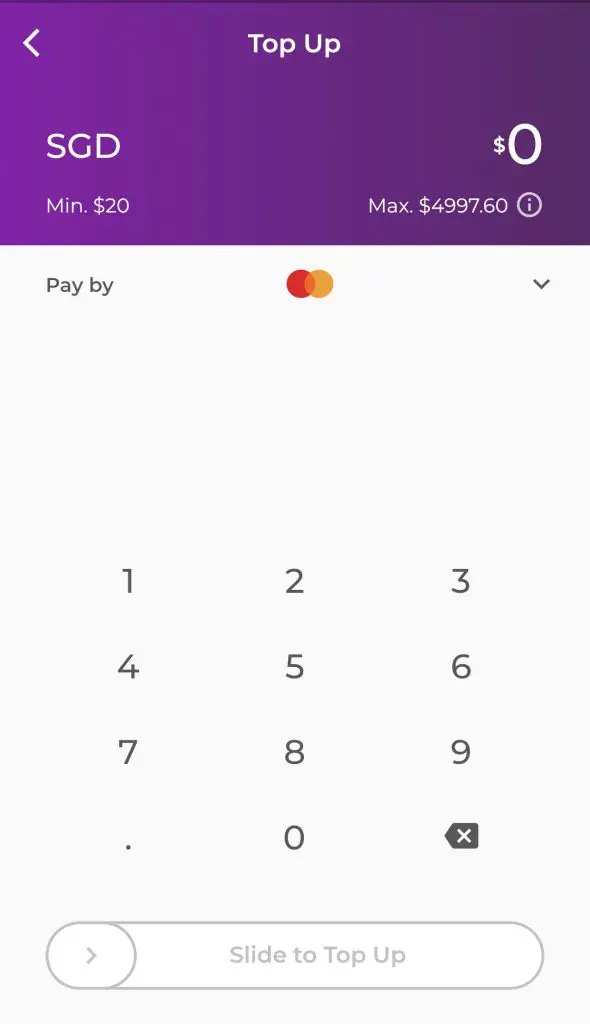

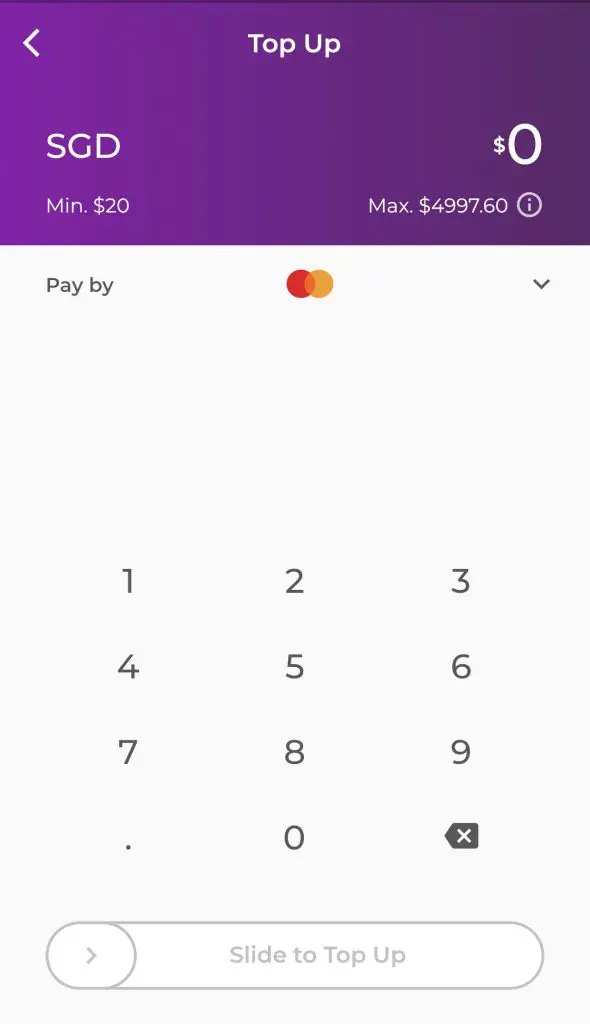

You can use the YouTrip card to make online payments at any merchants that support Mastercard payments. However, you will need to top up the value before making the payment, as YouTrip is a prepaid card.

You can use the YouTrip card just like any other credit or debit card that you have to make online payments.

However, YouTrip is a debit card. This means that you’ll need to top up the amount you want to pay in your card first, before making the purchase!

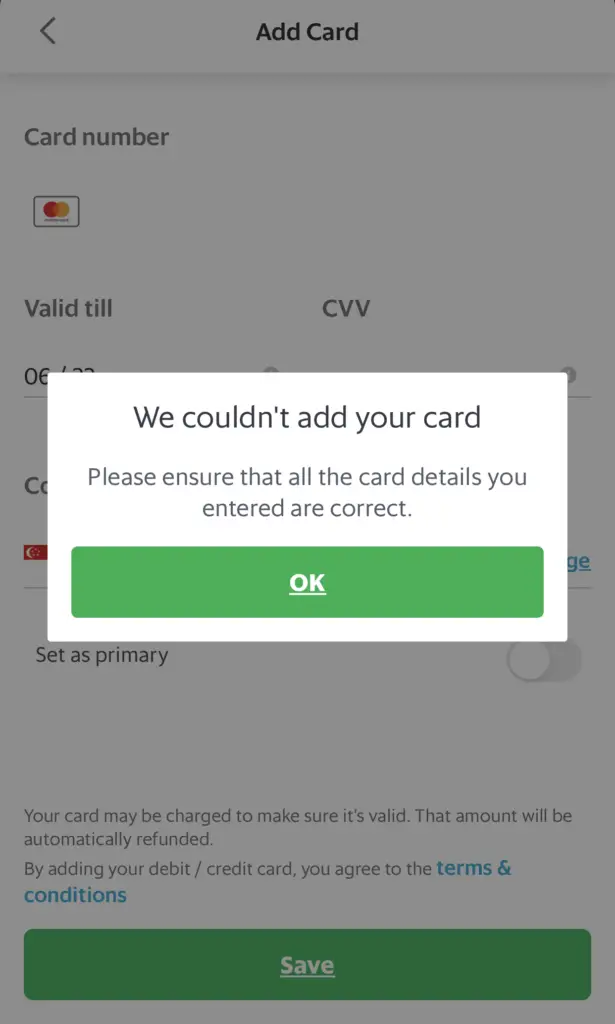

Can I use YouTrip to top up my GrabPay wallet?

The GrabPay wallet currently does not support any top-ups made from your YouTrip card.

I tried to add my YouTrip card to my GrabPay wallet, but I received this error message.

Interestingly, it is not one of the wallets that YouTrip does not support, which includes other wallets like:

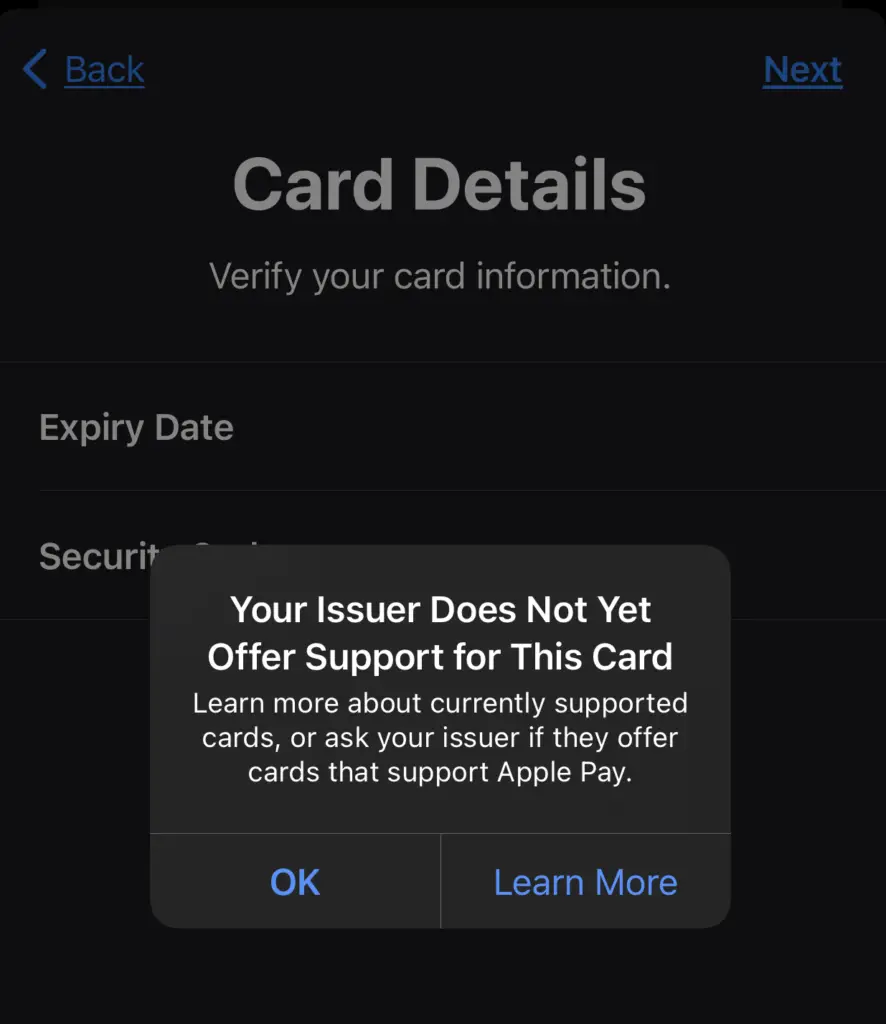

Can I add YouTrip to Apple Pay?

You are unable to add your YouTrip card to Apple Pay in Singapore. You are only able to add Mastercard debit cards that are issued by Citibank, DBS, OCBC, POSB, Standard Chartered or UOB.

Apple listed down the credit and debit cards that can be added to your Apple Pay wallet in Singapore.

The only Mastercard debit cards that Apple Pay supports are those that are being issued by certain banks.

I tried to add my YouTrip card to Apple Pay, but I received this error message.

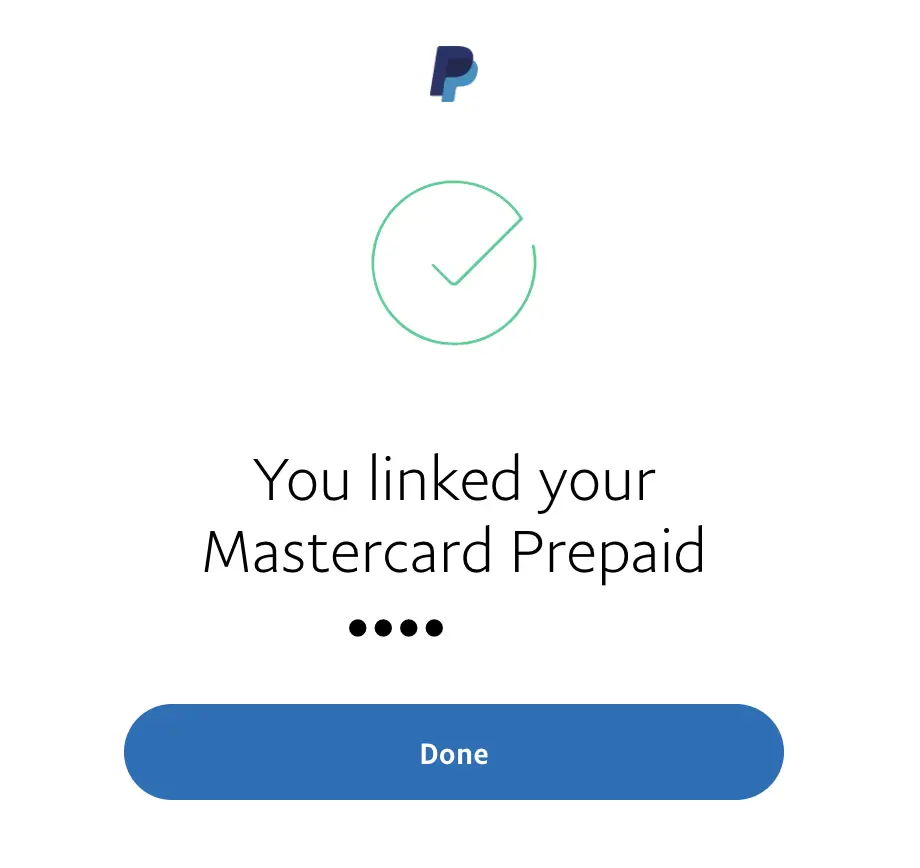

Can I add YouTrip to my PayPal account?

You are able to link your YouTrip card to your PayPal account. This allows you to make overseas purchases via PayPal using your YouTrip card.

I was able to link my YouTrip card to my PayPal account.

This allows you to use your YouTrip card to make purchases via PayPal. However, you’ll need to ensure that you’re paying in USD, and not SGD!

If you choose to pay in SGD, you will lose quite a bit of money. This is because:

- The conversion rate from SGD to USD is much poorer in PayPal

- You will be charged a currency conversion fee by PayPal

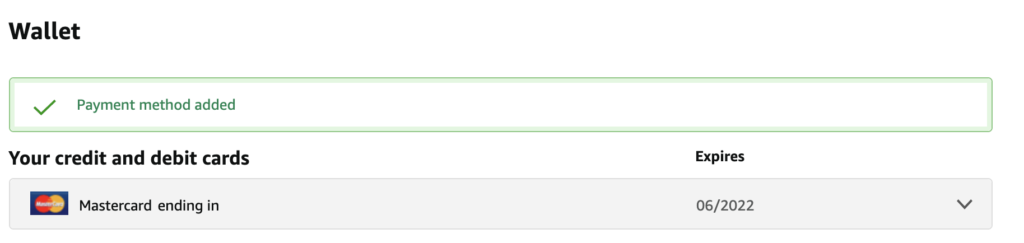

Can I use YouTrip for Amazon?

You are able to add your YouTrip card to make purchases on Amazon.com, as well as Amazon.sg. By making purchases in USD on Amazon.com, you will be able to reduce the foreign currency fees that you may incur.

If you are using Amazon.com instead of Amazon.sg for your purchases, you may incur foreign currency fees when making purchases in USD.

You can add your YouTrip card to Amazon.com, instead of your usual debit or credit card.

That way, you will be able to save on these conversion fees!

Conclusion

YouTrip is a multi-currency card that you can consider using to pay for your overseas payments.

This is because it does not charge you any currency conversion fees. You will be making your purchase at the prevailing exchange rate.

This will help to reduce the amount of fees that you’ll incur when making overseas transactions!

The only downside with YouTrip is that you won’t receive any rewards when you make transactions using their card.

You may want to consider either BigPay or the Crypto.com Visa Card that offers some rewards for you.

👉🏻 Referral Deals

If you are interested in signing up for any of the products mentioned above, you can check them out below!

YouTrip Referral (Receive $5 when you sign up)

If you are interested in signing up for a YouTrip account, you can use my referral link.

You will receive $5 in your YouTrip account after making your first top-up to the account.

You can view more details of this referral program on YouTrip’s website.

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?