Last updated on February 26th, 2022

The S&P 500 has always been one of the most prominent indices in the world. However, you may have heard of other indices too, such as the FTSE 100.

What are the key differences between these two indices, and which should you invest in?

Here is what you need to know to help you decide:

Contents

The difference between the S&P 500 and FTSE 100

The S&P 500 is an index that measures the performance of the top 500 companies in the US. In contrast, the FTSE 100 (also known as the “Footsie”), tracks the performance of the top 100 companies in the UK.

The indices differ in the type of markets and sectors they expose you to.

The S&P 500 provides you with greater diversification with US stocks, and the FTSE 100 with UK stocks.

Here is an in-depth comparison between these 2 indices.

Country diversification

The S&P 500 includes the 500 largest US companies. One of the criteria to be included in the S&P 500 is that the companies must have a market capitalization of at least USD 13.1 billion. The S&P 500 also has a total market cap of $36.54 Trillion.

On the other hand, the FTSE 100 is also only exclusive to the top 100 UK companies which are trading on the London Stock Exchange (LSE). Meanwhile, the FTSE 100 only has a total market cap of $2.8 Trillion.

What does this mean for investors like you and me?

The sheer size of the companies in the S&P 500 will inevitably provide a greater global influence compared to the companies in the FTSE 100.

To put things into perspective, the largest company in the S&P 500, Apple, has a market cap of $2.34 Trillion. Meanwhile, the total market cap of the FTSE 100 is $2.8 Trillion!

As such, due to its scale, it may be better if you choose to invest in the S&P 500 if you believe that the global economy will do well.

What risk do the S&P 500 and FTSE 100 have?

Both the S&P 500 and the FTSE 100 are quite exposed to global risk and volatility. Even though the FTSE 100 may have a slightly less global presence compared to the S&P 500, it is still heavily affected by global market movements.

During the coronavirus selloff in March 2020, the S&P 500 fell by 35%, while the FTSE 100 fell by 30%.

As such, you might want to consider the countries’ relations, or if there is anything that could detrimentally affect their economy such as:

- Natural disasters

- Unemployment numbers

- Brexit

- US treasury decisions

Types of stocks

The S&P 500 contains the top 500 large cap companies from the US while the FTSE 100 contains the top 100 large and mid cap companies in the UK.

A large cap company is one that has a market capitalisation of more than $10 billion.

Meanwhile, a mid cap company has a market capitalisation of between $2 to $10 billion.

Investopedia

The market cap of a company can be determined by multiplying the stock price by the number of outstanding shares.

The S&P 500 also has a bigger proportion of their portfolio tracking growth stocks. Meanwhile, the FTSE 100 has a bigger proportion of tracking dividend stocks.

A growth stock is any share in a company that is anticipated to grow at a rate significantly above the average growth for the market.

Dividend stocks are companies that pay out regular dividends. Dividend stocks are usually well-established companies with a track record of distributing earnings back to shareholders.

Investopedia

As such, investing in the S&P 500 has a greater growth potential since these companies will continue to innovate.

The FTSE 100, on the other hand, has more stocks that have already hit their maximum growth potential, and are not incentivised to innovate as much.

As a result, the FTSE 100 contains more dividend stocks compared to the S&P 500. The dividend yield for the FTSE is 3-4%, while the S&P 500 has a yield of just above 1%.

A dividend is the distribution of some of a company’s earnings to a class of its shareholders.

Investopedia

As such, the index that you choose to track depends on whether you prefer dividend stocks or growth stocks.

Top Sectors

Here is a comparison between the top sectors that are found in the S&P 500 and the FTSE 100 as of 30th September 2021.

| S&P 500 | FTSE 100 |

|---|---|

| Information technology (IT) 27.5% | Healthcare 11.6% |

| Healthcare 13.3% | Industrial goods & services 10.9% |

| Consumer discretionary 12.4% | Energy 10.2% |

| Financials 11.4% | Basic resources 9.7% |

| Communication Services 11.2% | Personal care drug and grocery stores 9.3% |

You may notice that healthcare is the top holding for the FTSE 100, while it is also the second-largest for the S&P 500.

Being a non-cyclical sector, healthcare is a strong industry to have a large weightage in as it will always be relevant. Healthcare provision will always be needed as long as people require medical attention.

Healthcare also includes pharmaceutical businesses that develop groundbreaking healthcare treatments and products. These treatments and products can help to boost a company’s value and your investments too.

Here are some of the top healthcare companies listed in the FTSE 100 and S&P 500:

Other than that, the indices have a very different spread in its weightage. The one that may catch your eye is the allocation towards technology.

The S&P 500 has 27.5% in Information Technology (IT), which is its highest weightage. The FTSE 100, on the other hand, only has 1.1%!

Why is this relevant?

With the technology sector leading rapid growth for the S&P 500, the lack of technology in the FTSE 100 is something you may want to look out for.

What else is different?

As seen above, the FTSE 100 has a large percentage of its weightage in industrial goods & services, and basic resources.

These include a lot of oil & gas and metals & mining companies, including:

- Antofagasta Holdings (Metals & Mining)

- Rio Tinto (Metals & Mining)

- Royal Dutch Shell (Oil & Gas)

- DCC (Oil & Gas)

Most of these companies naturally have higher dividends. However, they do not have much room to grow anymore as they are in a rather mature industry.

Since there is a higher allocation towards these industries compared to the S&P 500, the dividend yield for the FTSE 100 is much higher.

A mature industry is one that has passed both the emerging and growth phases of industry growth. Companies in these industries tend to be larger, older, and more stable.

Investopedia

Overall, both indices have a large proportion of their weightage in sectors like healthcare which have plenty of room to grow.

The difference in the indices lies in what they focus on, the S&P 500 is more focused on growth stocks in the IT sector. Meanwhile, the FTSE 100 has a greater focus on more mature industries such as oil & gas and mining.

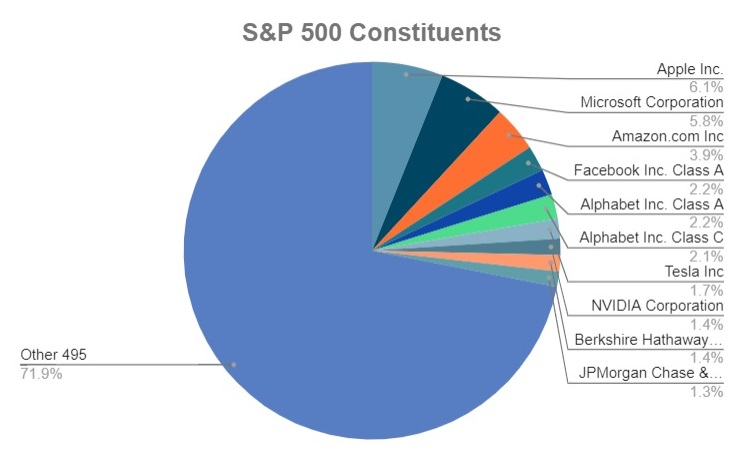

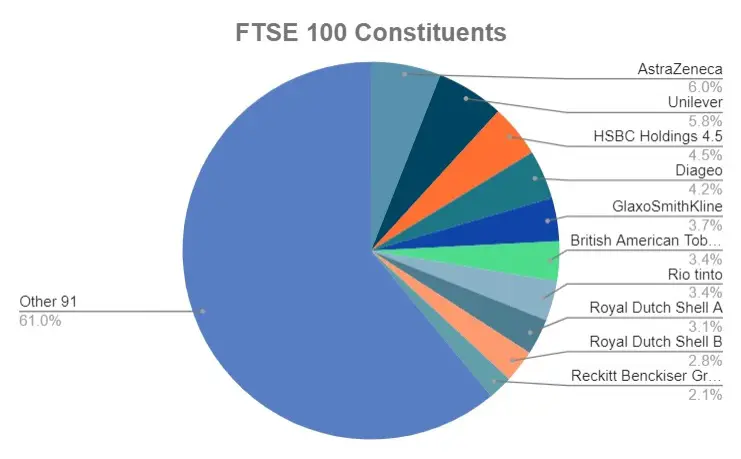

Top holdings

Now, let’s take a look at the top 5 holdings of each of the indices.

| S&P 500 | FTSE 100 |

|---|---|

| Apple 6.1% | AstraZeneca 6.0% |

| Microsoft 5.8% | Unilever 5.8% |

| Amazon 3.9% | HSBC Holdings 4.5% |

| Facebook inc A 2.2% | Diageo 4.2% |

| Alphabet Inc A (Google) 2.2% | GlaxoSmithKline 3.7% |

The top 5 holdings of the S&P 500 are some of the biggest companies in the world, being household names all across the globe. They are all mostly part of the IT sector except for Amazon, which is in the consumer service sector.

The top 5 holdings of the FTSE 100 are a little more diversified. Their top holdings are spread across 4 different sectors, which include:

| Company | Industry |

|---|---|

| AstraZeneca | Healthcare/ Pharmaceuticals |

| GlaxoSmithKline | Healthcare/ Pharmaceuticals |

| Unilever | Consumer Goods |

| HSBC Holdings | Financials |

| Diageo | Food & Beverage |

The FTSE 100 may have a better diversification in terms of its sectors and how its top 5 holdings are all not from the same industry. However, since it only has 101 holdings, the FTSE 100 is naturally a more concentrated index.

The S&P 500 is more diverse as it contains 505 holdings!

The FTSE 100’s top 10 holdings amount to about 40% of its entire portfolio. On the other hand, the top ten holdings of the S&P 500 amounts to about 28% of its entire portfolio.

As such, you will have to take into consideration the exposure you would have if you decide to invest in either of these indices.

Performance

With a clear uptrend and an average of 8-11% annual return, the S&P 500 heavily outperforms the FTSE 100.

If you were to purchase both indices 5 years ago, you would be up 98.9% for the S&P 500 (almost double your initial investment). The FTSE 100 on the other hand, would have only returned a measly 2.9%.

To add to this, if we take a look at their all-time highs, the S&P 500 has constantly been hitting higher highs every year. On the other hand, the FTSE 100 has not hit its all-time high ever since 2018, but is slowly climbing back to it.

However, past performance does not indicate future returns, so it will be good to do your own research first, before investing in either index!

Availability of ETFs

You are unable to buy directly into either of these indices. Instead, you will need to buy into a fund that tracks this index.

2 types of funds that can track an index include exchange-traded funds (ETFs) and mutual funds.

The S&P 500 index is such a prominent index, so ETFs that track it are listed all over the world!

You are able to find an S&P 500 ETF listed on exchanges from many different countries:

- New York Stock Exchange (NYSE)

- London Stock Exchange (LSE)

- Australia Stock Exchange (ASX)

- Tokyo Stock Exchange (TSE)

- Singapore Exchange (SGX)

- Korea Stock Exchange (KRX)

Here are some of the ETFs that track the S&P 500:

| ETF Ticker | Exchange |

|---|---|

| S27 | SGX |

| VOO | NYSE |

| IVV | NYSE |

| SPY | NYSE |

| VUSA | LSE |

| VUSD | LSE |

| VUAA | LSE |

| SPX5 | LSE |

| CSPX | LSE |

| IUSA | LSE |

| IDUS | LSE |

There are many S&P 500 ETFs listed on the LSE as there are both accumulating and distributing ETFs.

There are less investing options if you want to invest in the FTSE 100

In contrast, there aren’t many ETFs that track the FTSE 100. There are no ETFs listed on the US exchanges which track the FTSE 100. Instead, these ETFs are exclusively listed on the European stock exchanges.

You can decide if you want an accumulating fund, where dividends are accumulated and reinvested, or a distributing fund, where dividends are paid out at intervals (usually quarters or biannually).

Here are the tickers that track the FTSE 100.

| ETF Ticker | Exchange |

|---|---|

| ISF (Distributing) | LSE SIX Swiss Exchange Borsa Italiana |

| CUKX (Accumulating) | LSE SIX Swiss Exchange |

| VUKE (Distributing) | LSE SIX Swiss Exchange Stuttgart Stock Exchange Borsa Italiana |

| HUKX (Distributing) | LSE SIX Swiss Exchange |

The FTSE 100 is only available in 3 currencies:

| Stock exchange | Currency |

|---|---|

| London Stock Exchange | GBP |

| SIX Swiss Exchange | USD |

| Other European Stock Exchanges | EUR |

As the most accessible European stock exchange is the London Stock Exchange, any ETF you purchase to track the FTSE 100 will have to be traded in GBP. Meanwhile, most S&P 500 ETFs are denominated in USD.

However, there are plenty of ETFs that are denominated in other currencies as well. These include GBP, EUR, SGD or any currency the stock exchange you trade on that lists an S&P 500 ETF.

As such, you might want to take into consideration the currency exchange fees and risks that you might incur if you were to purchase either of these indices.

The availability of ETFs for either index is also much more diverse compared to other indices like the FTSE All-World and the FTSE Global All Cap.

Verdict

Here is a comparison between the S&P 500 and the FTSE 100:

| S&P 500 | FTSE 100 | |

|---|---|---|

| Type of stocks | Large-cap US equities | Large and mid- cap UK equities |

| Number of holdings | 505 | 101 |

| Top sectors | Information Technology (IT) 27.5% Healthcare 13.3% Consumer discretionary 12.4% Financials 11.4% Communication Services 11.2% | Healthcare 11.6% Industrial goods & services 10.9% Energy 10.2% Basic resources 9.7% Personal care drug and grocery stores 9.3% |

| Exposure to global economy | Greater | Slightly weaker |

| Past performance | Stronger | Weaker |

| Availability of ETF | Wider | Weaker |

So which index should you choose to invest in?

Choose the S&P 500 if you are confident in the US economy

The S&P has historically been one of the best performing indices. Tracking the very best companies in the US, you are theoretically buying into the US economy as a whole.

The S&P 500 has survived and eventually climbed to all-time highs after every major crash in the past decade. Thus, the S&P 500 is a rather safe way of buying into an already diversified portfolio.

With many of the S&P 500 companies having an impactful global influence as well, you can also buy into the S&P 500 if you are bullish on the global economy.

Despite this, you should take note that the S&P 500 is still very concentrated in just the US. You might want to consider other indices which are more diversified.

One such example is the MSCI World index, which contains many of the US companies listed in the S&P 500, but also companies from 22 other developed countries! You can take a look at our comparison between the MSCI World Index and the S&P 500 here.

Choose the FTSE 100 if you prefer a better diversification among mature sectors

Although the FTSE 100 has not reached its all-time high in a while, it is still a good index to invest in if you want to buy into the UK economy.

Since it is quite diversified among mature sectors, you can decide to invest in this index if you believe that these sectors will remain stable and strong.

If you are looking for a wider diversification in the UK, you can also take a look at other FTSE indexes, such as:

Conclusion

Both indices allow you to purchase into a country’s top companies. The biggest difference between the indices is their exposure to the technology sector.

The main considerations you should have include:

- If you are more confident in the US or UK economy

- What sectors you believe will flourish in the future

- How exposed you want to be in the technology sector

Do you like the content on this blog?

To receive the latest updates, you can follow us on our Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?