If you’re looking to buy US stocks on moomoo, you may want to deposit USD to your moomoo account.

The good thing is that moomoo has a DBS Multi-Currency account, so you will be able to send and receive USD without any fees if you have a DBS Multi-Currency account too!

Here’s what you need to know:

Contents

How to deposit USD to moomoo

Here are 5 steps you’ll need to deposit USD to moomoo:

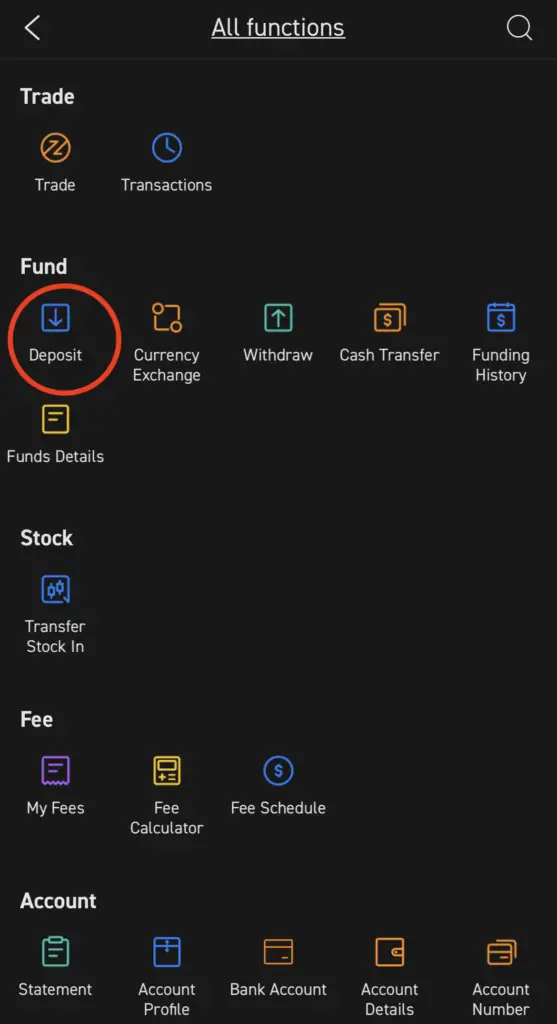

- Select ‘Deposit’ on moomoo

- Select ‘Bank Transfer’

- Copy down bank details from moomoo

- Add moomoo’s bank details as a recipient on DBS iBanking

- Transfer USD to moomoo

Here is each step explained in-depth:

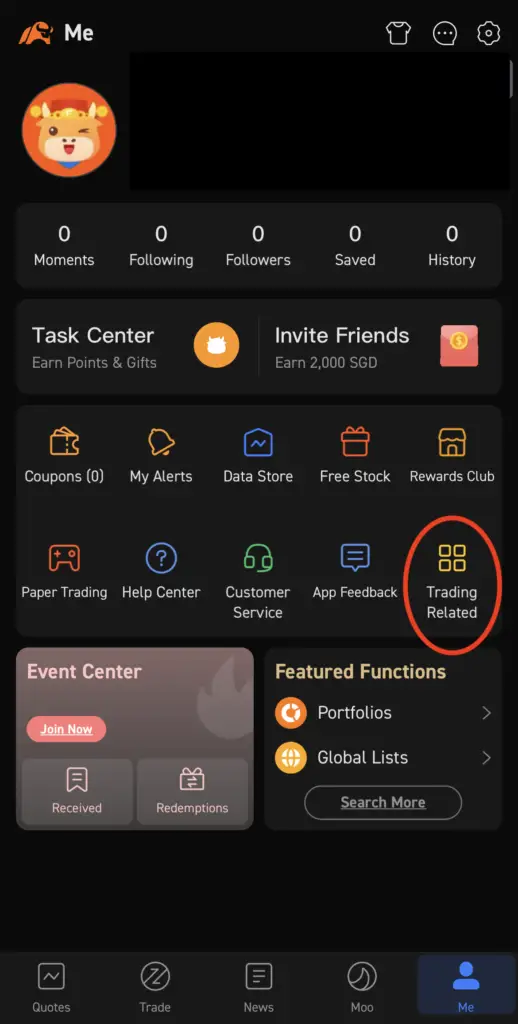

Select ‘Deposit’ on moomoo

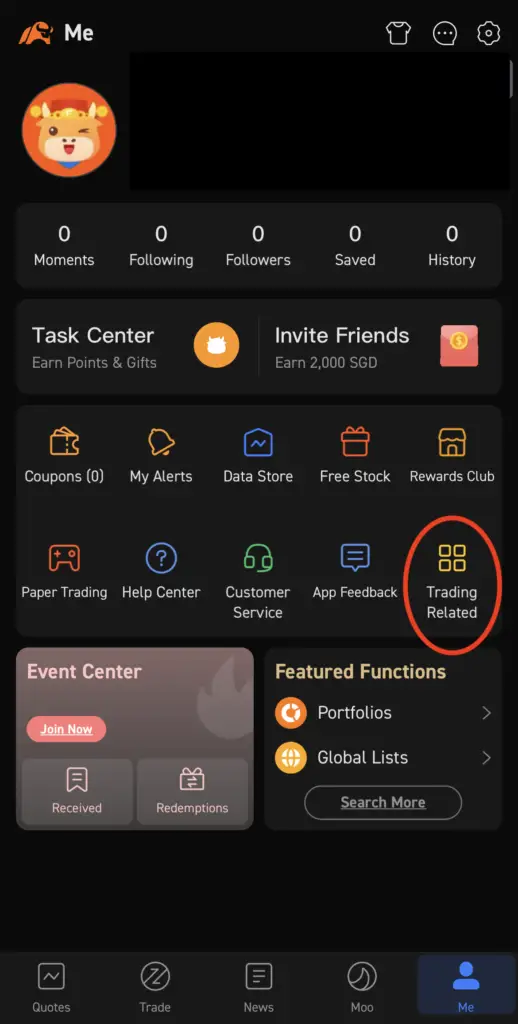

To deposit USD to moomoo, go to ‘Trading Related‘,

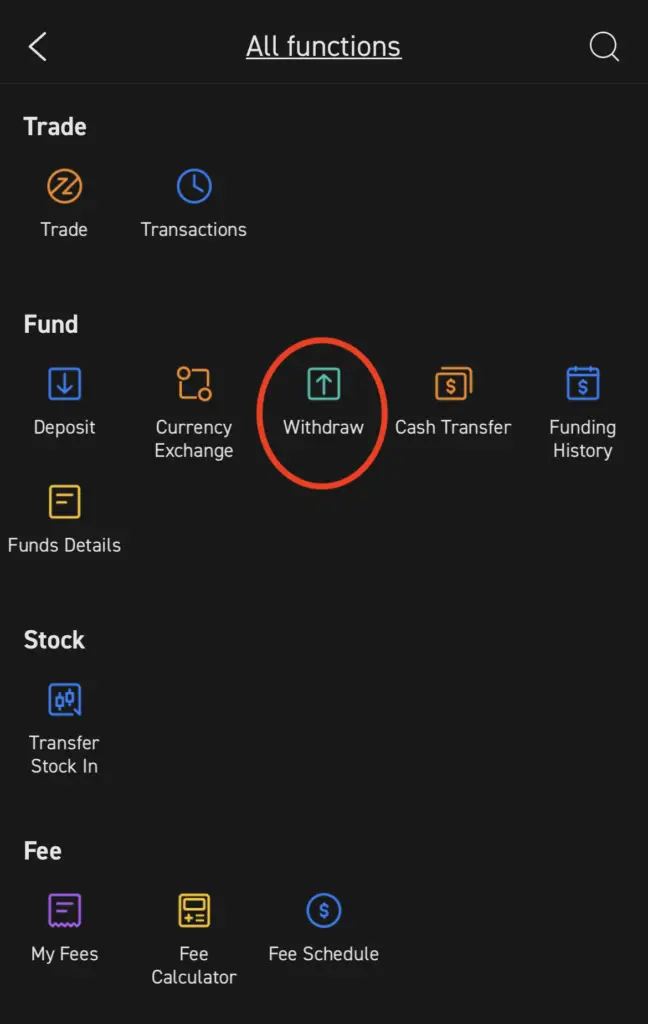

and then select ‘Deposit‘.

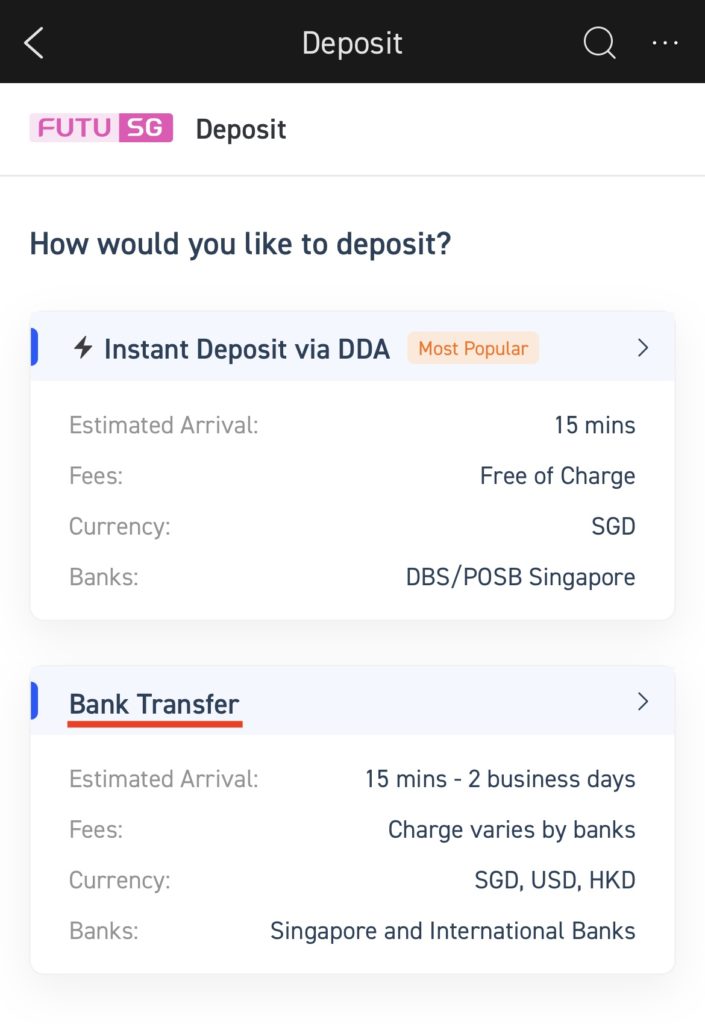

Select ‘Bank Transfer’

If you are depositing USD to moomoo, you can only do so via bank transfer.

The instant deposit via direct debit is only applicable for SGD deposits.

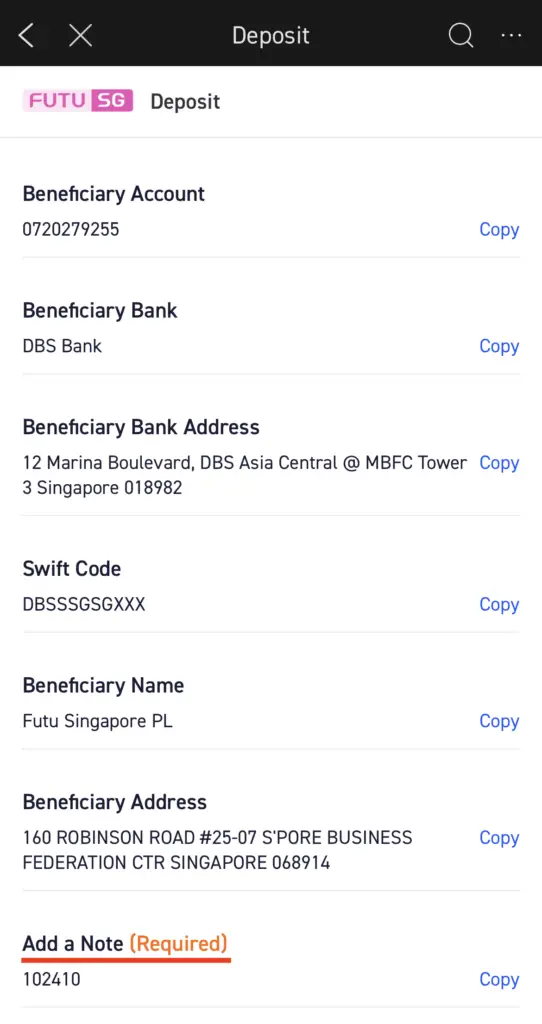

Copy down bank details from moomoo

You will see the bank details being provided by moomoo to deposit your funds.

The most important is the note section, where you’ll need to add this reference number in the comments of any transfer you make.

This helps moomoo to track where the deposit is coming from.

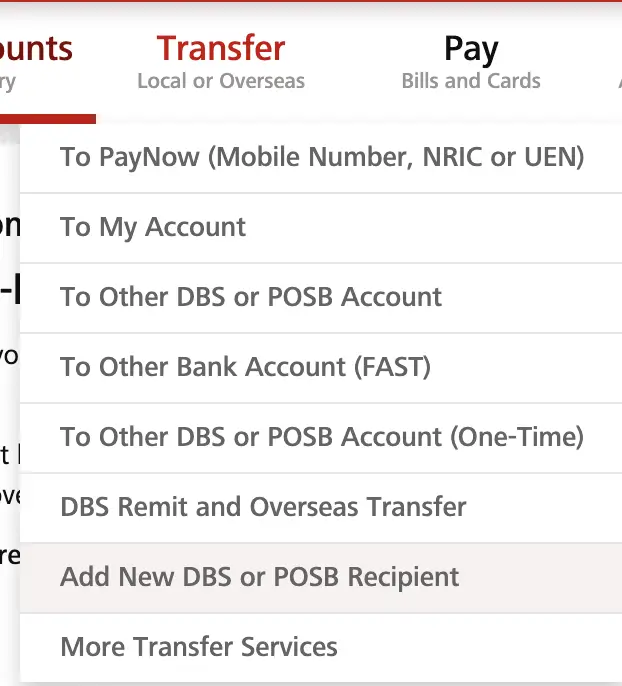

Add moomoo’s bank details as a recipient on DBS iBanking

After obtaining moomoo’s bank details, you can now go to your DBS iBanking account and select ‘Add New DBS or POSB Recipient‘.

After entering the account details from the moomoo app, you will be asked to confirm the addition of moomoo as a receipient.

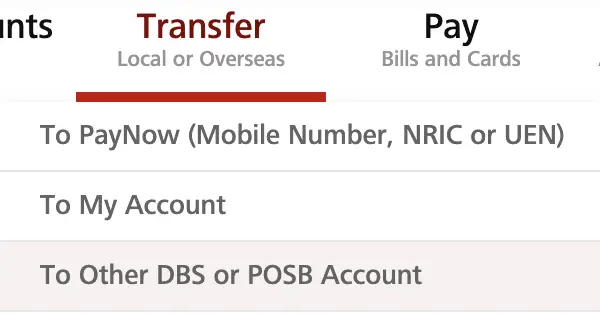

Transfer USD to moomoo

The last part you’ll need to do is to transfer USD to moomoo.

To do so, you can go to ‘Transfer‘, and then ‘To Other DBS or POSB Account‘.

It will be best to use a Multi-Currency account to deposit USD, such as DBS Multiplier or My Account.

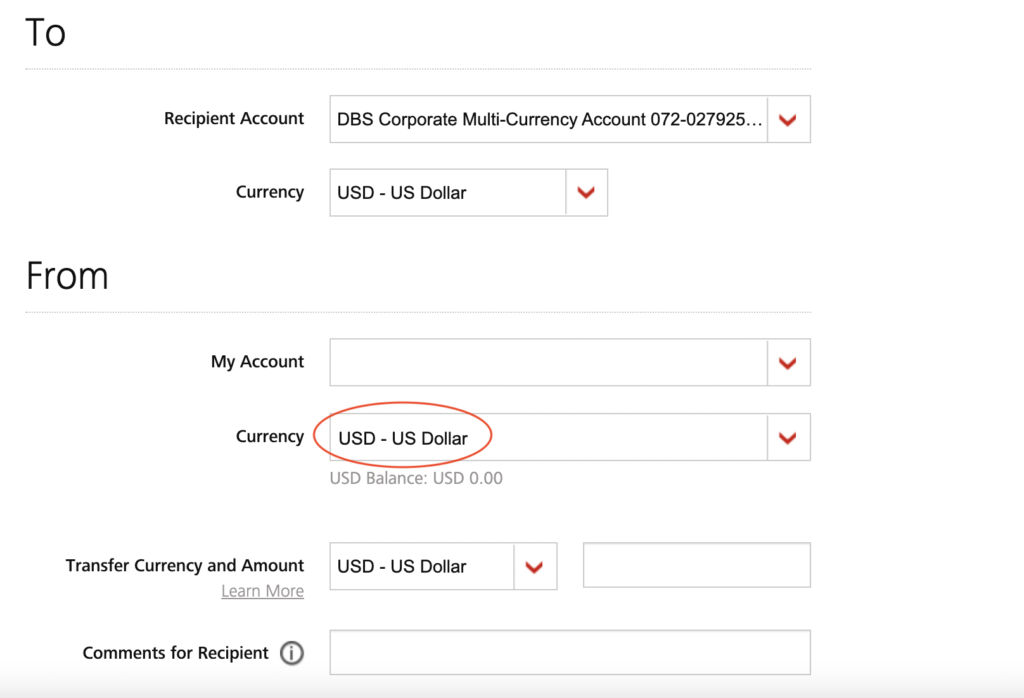

This will bring you to a page where you can add some details. You will need to indicate that you are sending USD. An important thing will be to select USD under ‘Currency‘.

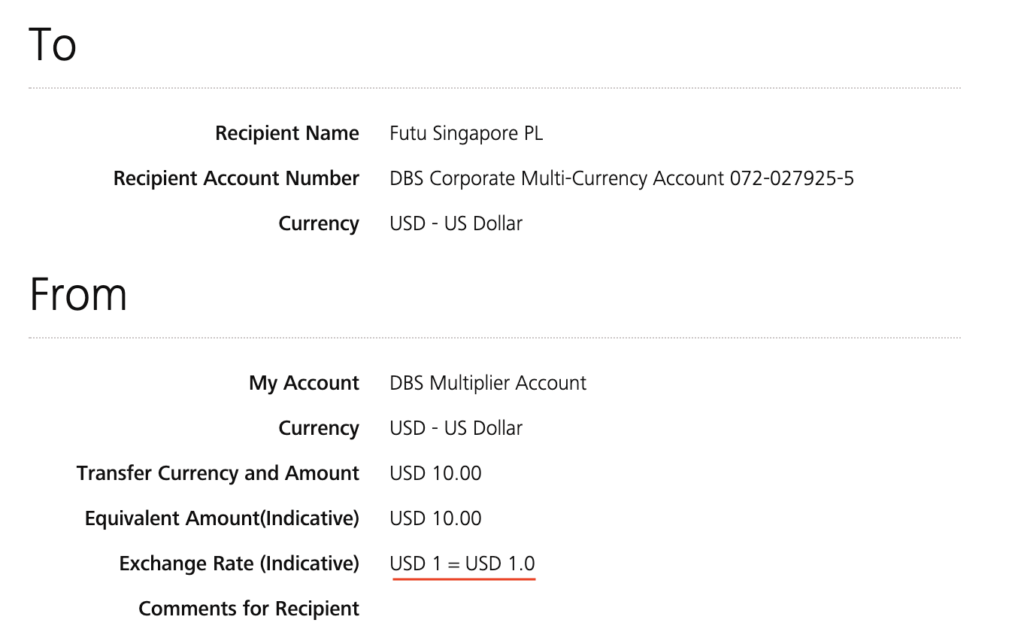

By doing so, you will be transferring your USD balance from your Multi-Currency Account to moomoo. You can view this on the next page, which shows the amount of USD that you’re sending.

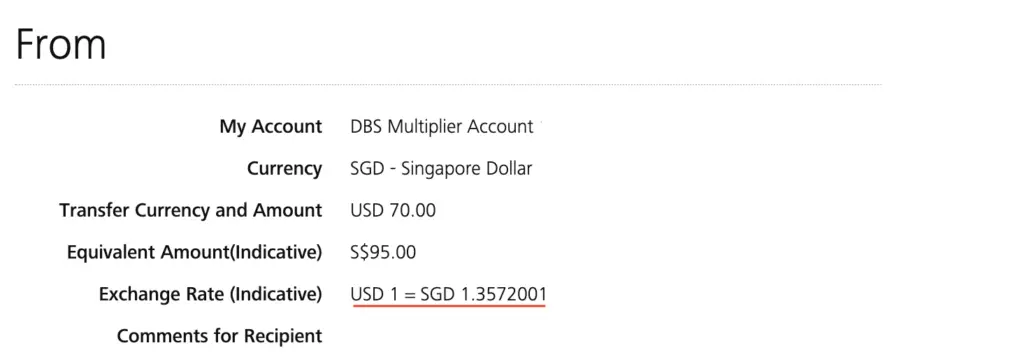

If you choose SGD as the ‘Currency’, you will be sending your SGD to moomoo, instead of the funds from your USD balance.

DBS will make the conversion from SGD to USD for you, at their defined exchange rate.

The exchange rate that DBS offers is usually less favourable compared to the current rates. As such, it will be better to deposit SGD into moomoo, and then exchange for USD.

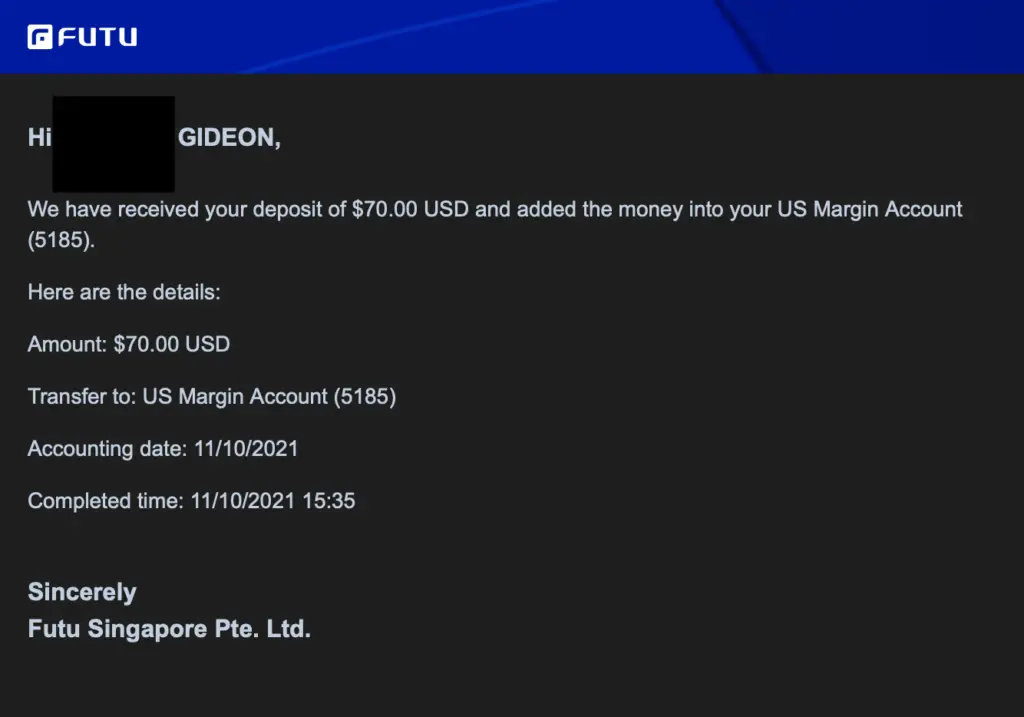

Once you have transferred the funds, you should receive them in your moomoo US Margin Account within a few hours.

How to withdraw USD from moomoo

Here are 4 steps to withdraw USD from moomoo:

- Select ‘Withdraw’ on moomoo

- Select the account you wish to withdraw USD from

- Select the amount and destination for USD

- Confirm the withdrawal of USD from mooomoo

And here is each step explained:

Select ‘Withdraw’ on moomoo

To withdraw USD from moomoo, you will need to go to ‘Trading Related’,

and then select ‘Withdraw‘.

Select the account you wish to withdraw USD from

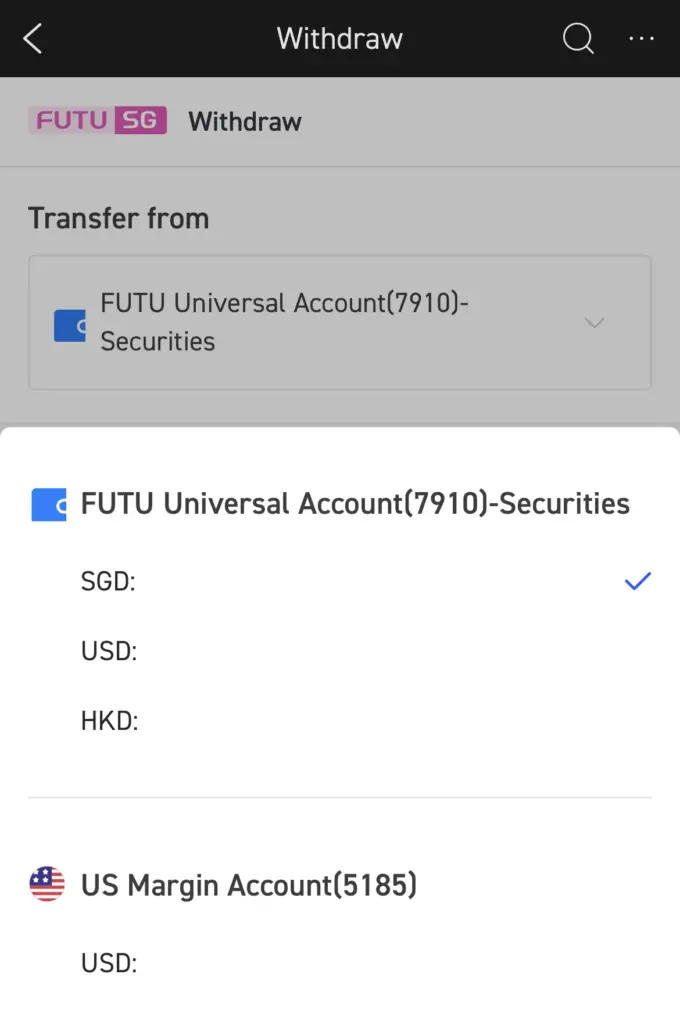

You are able to withdraw your USD from either your Universal Account or US Margin Account.

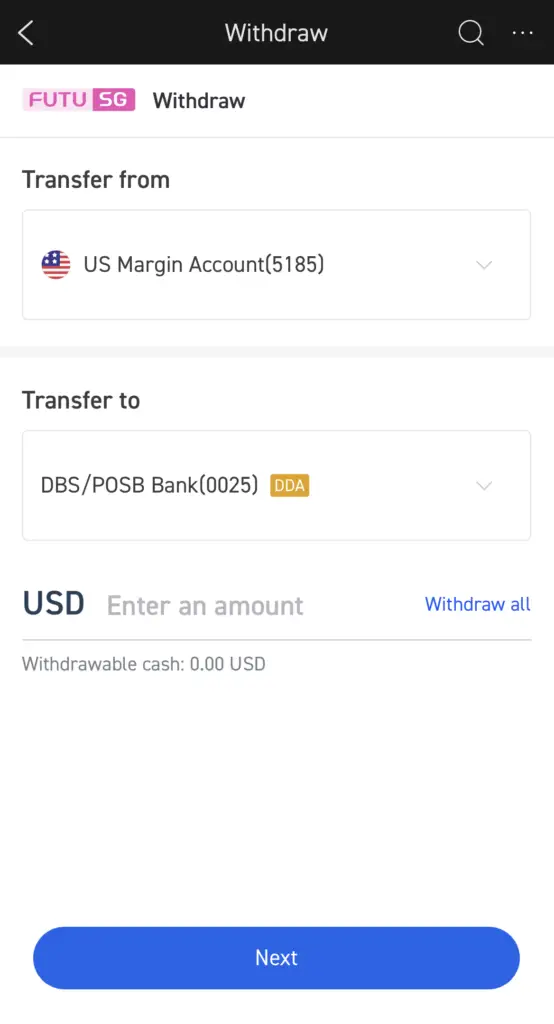

Select the amount and destination for USD

After selecting the account, you will be asked to enter:

- The amount of USD you wish to withdraw

- The account you wish to withdraw to

You may want to select a multi-currency account that accepts USD deposits. If you choose to transfer your USD to a bank account that only accepts SGD deposits, you may incur some currency exchange fees!

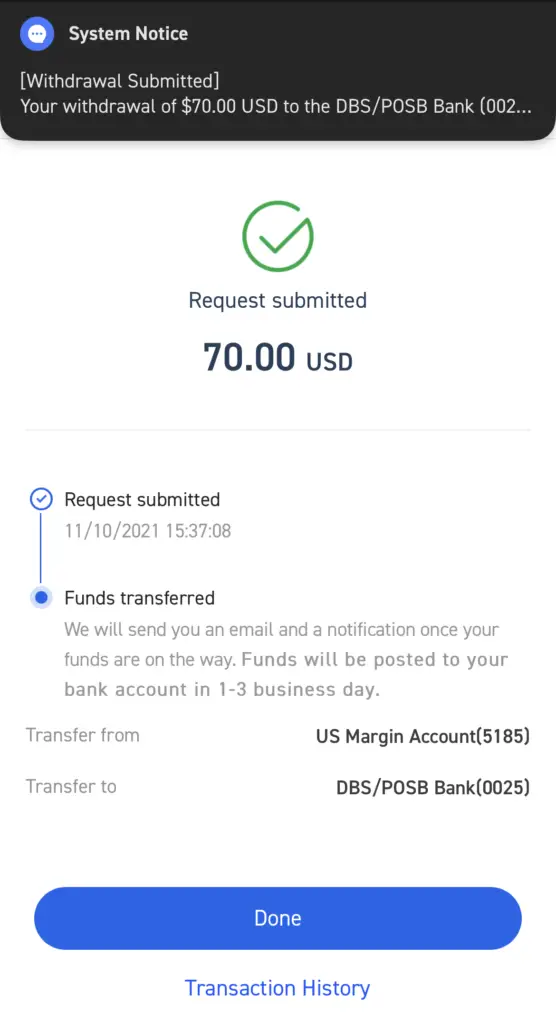

Confirm the withdrawal of USD from mooomoo

Once you have selected ‘Submit‘, you will receive a confirmation of the amount of USD that will be sent to your DBS multi-currency account.

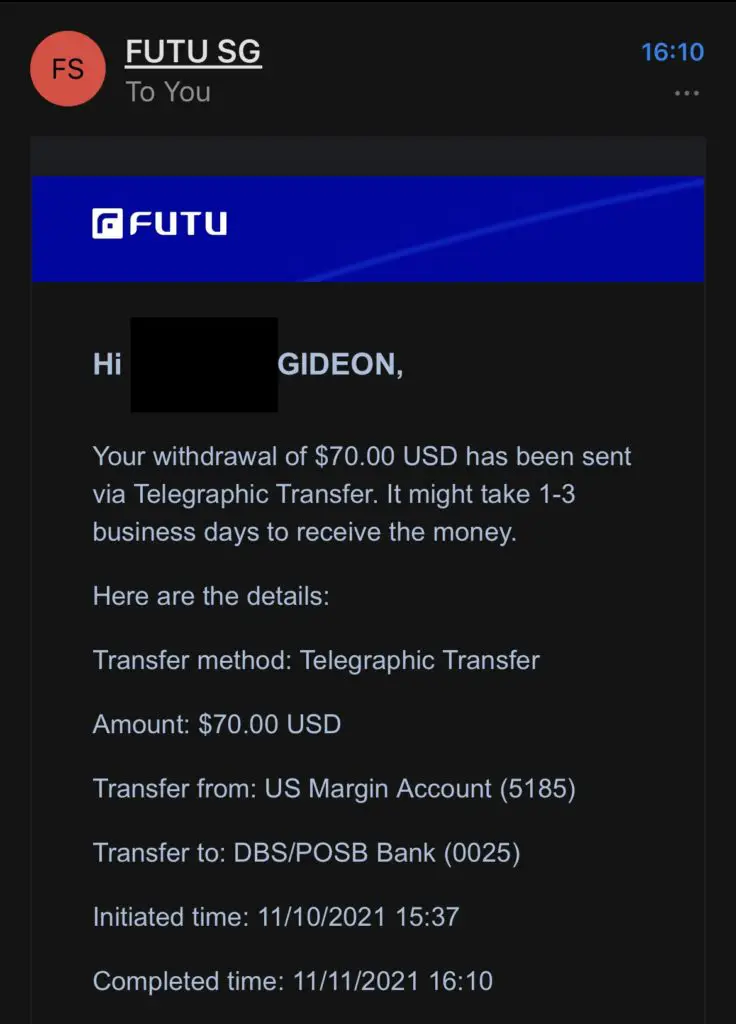

Once the funds have been transferred, you will receive an email notification from moomoo.

From the timestamp on the email, it roughly took around 1 business day for the USD withdrawal to be processed.

If you’re using a DBS multi-currency account, you should be able to see the amount of USD that you’ve received from the exchange.

Are there any fees to withdraw USD from moomoo to my bank account?

moomoo does not charge any withdrawal fees if you are withdrawing USD from moomoo to a DBS Multi-Currency Account.

This is because moomoo has set up a DBS Multi-Currency account in Singapore, which makes sending and receiving funds much more convenient.

Since you are making a local transfer from moomoo’s DBS account to your DBS account, you will not incur any fees.

DBS only charges a fee for incoming transfers if the bank account is an overseas bank account.

However, I am not sure if you will incur any fees if you are withdrawing your USD to another multi-currency account in Singapore, such as OCBC or UOB.

Should I withdraw USD or SGD from moomoo?

Since moomoo’s exchange rates are usually more favourable compared to those being offered by DBS, it may be advantageous to exchange your USD to SGD first on moomoo’s platform before you withdraw the SGD back to your account.

However, if you are looking to use USD for another purpose such as remitting to another platform, it will be better to withdraw USD instead.

If you receive USD from moomoo to DBS with the intention of converting it back to SGD, it would be better to perform the currency exchange on moomoo instead.

The exchange rate is usually more competitive for moomoo compared to DBS.

However, you may intend to use USD for another purpose, such as:

- Depositing USD to FTX

- Depositing USD to Crypto.com to receive USDC in your account

- Deposit to another brokerage account (e.g. Interactive Brokers)

If you intend to use your USD, it would be better to leave your funds as USD. Otherwise, you may incur a lot of unnecessary fees when you convert your currencies!

Conclusion

moomoo has a DBS Multi-Currency Account in Singapore, which means that you will not incur any deposit or withdrawal fees from DBS when you are transferring USD to and from your DBS bank accounts.

This is because you are using a local transfer, instead of an overseas bank transfer!

The process is similar when you are depositing or withdrawing USD from Tiger Brokers too.

As such, you may want to consider using moomoo to exchange your SGD to USD, and then withdraw it back to your DBS bank account. moomoo has a better spread than DBS, which will help to save on some of the costs you’ll incur.

This will be especially useful if you are intending to deposit your USD to FTX to buy cryptocurrencies.

👉🏻 Referral Deals

If you are interested in signing up for any of the products mentioned above, you can check them out below!

moomoo Referral ($200 Stock Cash Coupon Bundle, AAPL Shares and Commission Free Trades for 180 Days)

If you are interested in signing up for a moomoo (powered by FUTU SG) account, you can use my referral link.

Here are some of the rewards you can receive (From 2 Oct 2021):

- Commission-free trading for 180 days (SGX, HKEX and US markets)

- $200 or $2,000 Stock Cash Coupon Bundle (First Deposit Reward)

- Apple share and iPhone 13 (First Transfer-In Rewards)

To receive these bonuses, here are the steps you’ll need to do:

#1 Sign up for a Moomoo account

You’ll need to use my referral link to sign up for a moomoo (powered by FUTU SG) account.

Once you have successfully opened a FUTU SG Securities Account, you will receive:

- 180 days unlimited commission-free trading for the US, HK & SG stock market (to be activated within 90 days)

- Lvl 2 US stock Market Data

- Lvl 1 SG stock Market Data

- Lvl 1 China A-Shares Market Data

First Deposit Reward

You will be able to receive a Stock Cash Coupon Bundle, depending on the amount that you deposit for your very first deposit:

| S$ 2,700 – S$ 199,999 | $200 Stock Cash Coupon Bundle |

| ≥ S$ 200,000 | $2,000 Stock Cash Coupon Bundle |

First Transfer-In Reward (US & HK stocks only)

If you transfer your US or HK stocks from another brokerage account to moomoo, you will be able to receive some rewards:

| SGD 50,000 – SGD 99,999 | 1 Free Apple (AAPL) share |

| SGD 100,000 – SGD 199,999 | 2 Free Apple (AAPL) shares |

| ≥ SGD 200,000** | 1 iPhone 13 (256GB; first 50 sets) OR 3 Free Apple (AAPL) shares |

To learn more, you can view more about this promotion on the FUTU SG website.

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?