Last updated on March 8th, 2022

Tencent is a gigantic Chinese investment holding company that offers a myriad of technological services internationally. Like many companies, Tencent is listed on multiple exchanges.

Among them, its ticker symbols are 0700 and TCEHY.

If you are thinking of buying Tencent stock, you might be confused or curious about the differences between these two ticker symbols.

In this article, let’s explore them.

Contents

- 1 The difference between 0700 and TCEHY

- 2 They are traded in different markets

- 3 Different trading process

- 4 Different trading currency

- 5 Minimum number of units to invest in

- 6 Different trading hours

- 7 Different commissions charged

- 8 Type of holding

- 9 Both stocks are fully fungible

- 10 Converting between these two stocks

- 11 Verdict

- 12 Conclusion

The difference between 0700 and TCEHY

0700 is listed on the HKEX whereas TCEHY is an ADR listed on the OTC market. While they both represent shares of the same company, they vary in the type of market they trade in, their currency and the minimum number of units required to invest in them.

To understand their differences, it is crucial to know some background information about them.

In June 2004, Tencent was listed as 0700 in the Hong Kong Exchange (HKEX). Since then, it has not been listed in any other market exchange.

So, where does TCEHY come from?

A little known fact is that Tencent’s shares are also traded as American Depository Receipts (ADRs) on the over-the-counter (OTC) market. They can also be referred to as an unlisted stock.

So what does this actually mean?

As ADRs, they represent Tencent’s shares in a US stock. This effectively authorises Tencent’s shares to be traded in the US market.

In addition, as TCEHY is traded on the OTC market, trades are handled by a broker-dealer.

A broker-dealer is a person or firm in the business of buying and selling securities for its own account or on behalf of its customers.

Investopedia

Now that we are up to speed about Tencent and its ticker symbols, let’s compare them.

They are traded in different markets

As mentioned earlier in this article, the ticker symbol 0700 represents the stock listed on the HKEX. TCEHY, instead, represents the stock that is traded on the OTC market and is not listed on any market exchange.

Being listed on a standard market exchange like HKEX and being represented for its actual stock is something that is rather common.

However, as an OTC stock, it has a different set of characteristics. There are a few reasons why shares are often chosen to be traded over-the-counter as opposed to a standard market exchange. Some reasons include:

- not wishing or unable to meet the listing requirements

- high costs and time needed to be listed

- providing faster access to capital

- having less regulations to follow

However for Tencent, there are no known reasons as to why it decided not to list its stock on a standard market exchange.

In any case, it is important to keep in mind of a few caveats.

For example, OTC stocks have less regulations to follow. This means that their financial information can be hard to find and may be outdated even if found. As a result of unreliable records, this might decrease our confidence to invest in them.

Moreover, their stock prices can be highly volatile in light of new financial data. If you are intending to invest in an OTC stock, it helps to be aware about whether you are able to stomach the huge swings in the stock prices.

Different trading process

The process of trading on the OTC market is different compared to a standard exchange. On the outside, you can buy and sell both types of shares through the broker’s platform after setting up a brokerage account. Internally though, they are carried out differently.

When it comes to stocks listed on a standard market exchange, the shares are typically traded through an automated software system. This has important consequences:

- price quotations are accurately recorded

- trades are effected instantly

In contrast, trades in the OTC market are negotiated via the telephone. The manual procedures inevitably results in unreliable information and execution delays.

If you are looking to trade on the OTC market, it is essential to understand these shortcomings.

Different trading currency

As long as both stocks are represented in different countries, they will have different trading currencies.

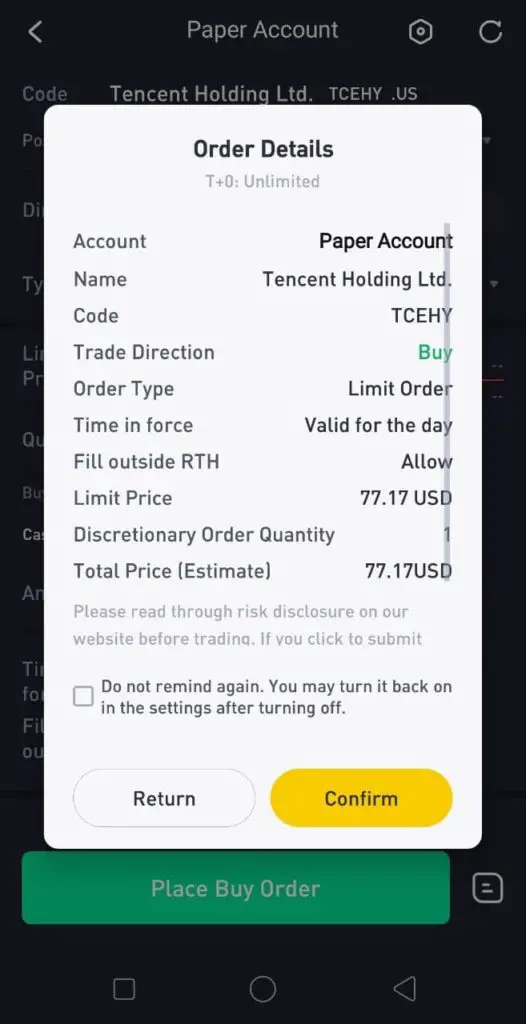

0700 is traded in HKD while TCEHY is traded in USD.

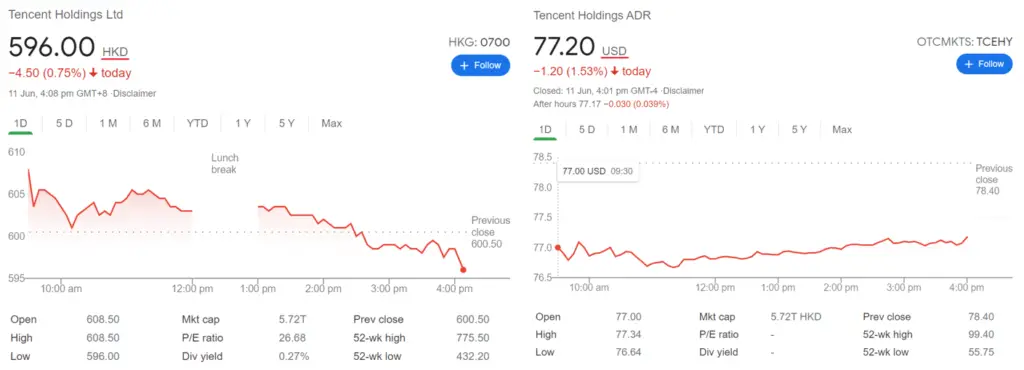

As seen on Google on 11 June 2021, below are the prices and currencies recorded.

The exchange rate is at 1 USD to 7.76 HKD. If we are to convert and compare the prices, they are almost the same.

Minimum number of units to invest in

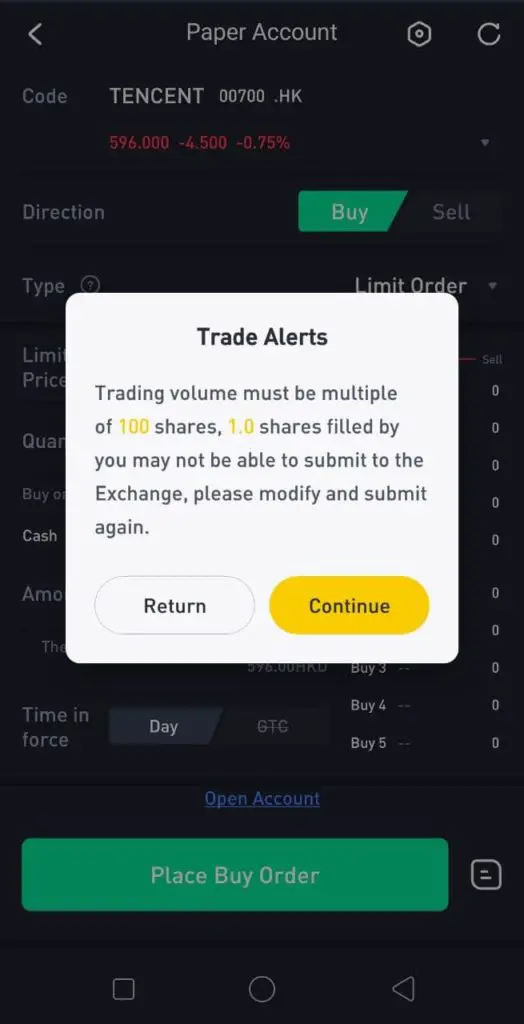

For ticker symbol 0700, HKEX’s rules require investors to trade a minimum of 100 shares per trade.

This differs from TCEHY which allows you to buy and sell 1 share for each trade you make.

If you calculate the cost of buying 100 shares of 0700 and convert it to USD, it comes up to about $7.7k USD!

This is unlike TCEHY which lets you own Tencent’s stock at a lower amount of $77 USD.

For investors with a small capital, buying shares of TCEHY would be a much more attainable choice to own Tencent’s stock.

Different trading hours

Their trading hours will differ because 0700 and TCEHY are listed on exchanges in different countries.

Here are the trading hours for both listings:

| 0700 | TCEHY | |

|---|---|---|

| Trading Hours | 0930-1200 1300-1600 | 2230-0500 |

The timings are taken with reference to Singapore Standard Time (GMT +8).

If you are someone who considers the trading hours for investing, this would be important for you.

Different commissions charged

Before you buy Tencent’s shares, it would be helpful to know the trading fees that you will incur. That way, you can factor them into your costs.

Here are some examples of the commissions that you’ll be charged when trading in different markets:

| Broker | TCEHY Rates | 0700 Rates |

|---|---|---|

| Tiger Brokers | 0.005 USD/share Min 1.99 USD/trade | 0.03% * trade value Min 15 HKD/trade |

| moomoo (powered by FUTU SG) | Min. 1.99 USD/trade | 0.03% * trade value Min. 18 HKD/trade |

| FSMOne | 0.08% Min USD 8.80 | 0.08% Min HKD 50 |

| Saxo | 0.02 USD Min USD 7 (Classic) | 0.15% Min HKD 100 (Classic) |

| Standard Chartered | 0.00231% (Sell trades only) Min USD 10 | 0.005% Min HKD 100 |

| DBS Vickers | 0.18% Min USD 25 | 0.18% Min HKD 100 |

Both Tiger Brokers and moomoo (powered by FUTU SG) have rather low fees to trade in either the HKEX or US markets.

Type of holding

Although there is a difference in the type of holdings – one is a stock, another is an ADR, both of them are practically the same.

Stock holdings are common, but ADRs might be an unfamiliar name to you. To put it briefly, ADRs are a representation of a foreign stock in the United States.

ADRs are a form of equity security that was created specifically to simplify foreign investing for American investors.

Fidelity

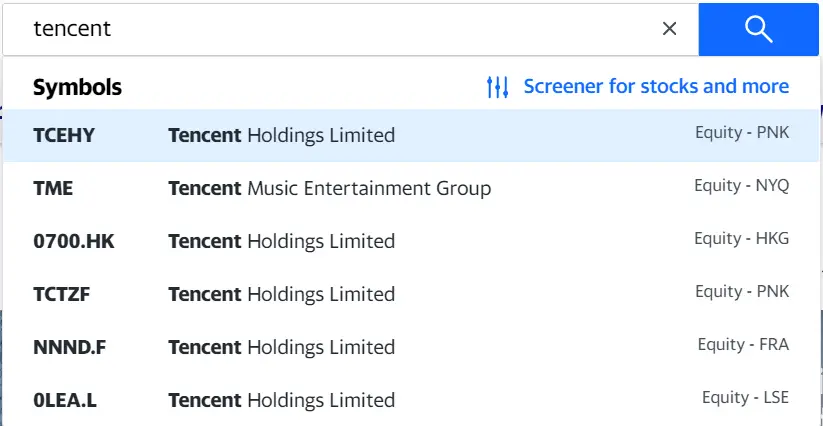

To recognize ticker symbols that are actually ADRs, you can always refer to them as seen below on Google.

Importantly, Tencent runs their business through a Variable Interest Entity (VIE) structure in both Hong Kong and the US. This is largely due to China’s restrictions that prevent them from seeking foreign investments.

So far, it has proved to be a successful workaround.

A variable interest entity (VIE) refers to a legal business structure in which an investor has a controlling interest despite not having a majority of voting rights.

Investopedia

In this case, when you buy into 0700 or TCEHY stock, you are actually investing in the VIE and not the company. This also means that you do not have voting rights in Tencent.

Both stocks are fully fungible

Both 0700 and TCEHY are considered fungible stocks.

Fungible investments can be bought and sold on multiple exchanges.

The Balance

When you have shares of 0700, you can sell them as TCEHY. Inversely, when you have shares of TCEHY, you can sell them as 0700.

This can come in handy when you are thinking of converting between them.

Converting between these two stocks

So, how do we convert these stocks?

The official conversion rate for these two ticker symbols is 1-to-1.

First of all, you will need to find a broker that gives you access to the HKEX and the OTC market.

Next, you can follow the procedures according to the respective broker to convert them.

However, these conversions can be quite expensive.

For example, Interactive Brokers charge a number of fees to help you convert, like

| Type | Cost |

|---|---|

| Creation fee | 0.05 USD/share |

| Processing fee | 500 USD |

| Cable wire fee | 17 USD |

Not only that, there are risks involved in these conversions, such as

- price fluctuations

- exchange rate fluctuations

As the costs of these fluctuations are paid by you, it is helpful to account for these losses into your decisions.

Verdict

After laying out the factors above, let’s recap on the main points:

| 0700 | TCEHY | |

|---|---|---|

| Type of Holding | Full stock (VIE) | ADR (VIE) |

| Type of Market | Standard market exchange | Over-the-counter market |

| Trading Process | Automated | Manual |

| Currency | HKD | USD |

| Minimum Units to Invest | 100 | 1 |

So which stock should you be choosing? Here are some points you can consider when making your decision:

#1 Type of market

Investing in the OTC market can pose more risks relative to a national exchange. Then again, the performance of TCEHY is likely to follow that of 0700 because they represent the same company. As such, it will be prudent to take reference from 0700 for their financial information.

#2 Trading process

An automated software can feasibly be more accurate and less error-prone than a manual process. This can help put your mind at ease when you are investing with 0700.

#3 Minimum units to invest

If you invest in 0700, you would be expected to fork out a few thousand dollars. Conversely, TCEHY would require less than a hundred dollars, which would be more within reach.

This is especially so if you have limited capital or do not want to commit too much in one go.

Conclusion

To summarise, both 0700 and TCEHY are ticker symbols that represent Tencent Holdings. While you can invest in their stocks and take a share in their profits, keep in mind that you do not actually own a part of the company.

This should not deter you too much, but it helps to take these risks into account. In particular, they help you to decide the proportion of your portfolio allocated for the company.

The type of market and trading process may deter you from trading in TCEHY, in view of the extra risks that you need to take on. Nevertheless, this should not dissuade you, if you are confident in the fundamentals of the company and know that you are buying them at a good price.

Spending more than $7k USD at a time on a stock can be too much to take in, unless you:

- really love the company or

- are optimistic about the price

Nonetheless, what’s important is knowing that the price can still go up further at the time that you buy. If you only have a small amount of capital, buying into TCEHY may be considered a good start.

Besides buying them in the standard market exchange or the OTC market, you can opt to invest in ETFs that have Tencent as one of their holdings. Some examples include Hang Seng Tech ETF and Hang Seng Index ETF. Both of them have substantial weightage in Tencent Holdings which might interest you!

If you’re looking for a way to track the markets and your portfolio, you can consider using TradingView, which allows you to monitor more than 50 stock exchanges.

Do you like the content on this blog?

To receive the latest updates, you can follow us on our Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?