Last updated on January 4th, 2022

Tiger Brokers allows you to easily convert SGD to USD on their platform.

You may be thinking of using their platform to obtain USD to deposit to FTX. However, how do you go about withdrawing USD from Tiger Brokers’ platform?

Here’s what you need to know about transferring USD to and from Tiger Brokers to your bank account.

Contents

- 1 Can I withdraw USD from Tiger Brokers?

- 2 How do I withdraw USD from Tiger Brokers to a Singapore bank acount?

- 3 What is withdrawable cash on Tiger Brokers?

- 4 Why can’t I withdraw the full amount of USD from my Tiger Brokers account?

- 5 Are there any fees to withdraw USD from Tiger Brokers to my bank account?

- 6 How do I deposit USD from a Singapore bank account to Tiger Brokers?

- 7 Should I deposit USD or SGD into Tiger Brokers?

- 8 Conclusion

- 9 👉🏻 Referral Deals

Can I withdraw USD from Tiger Brokers?

You are able to withdraw USD from Tiger Brokers to your bank account. The bank account that you withdraw to should be a multi-currency account that accepts USD, to avoid any currency exchange fees that you may incur from the bank.

Tiger Brokers allows you to withdraw USD from your Tiger Account to your bank account, including the dividends that you’ve received. This is convenient if you intend to use this USD for some transactions after selling a stock on the platform.

You do not need to incur any currency spreads if you had exchanged your USD back to SGD!

How do I withdraw USD from Tiger Brokers to a Singapore bank acount?

Here are 5 steps to withdraw USD from Tiger Brokers to a Singapore bank account:

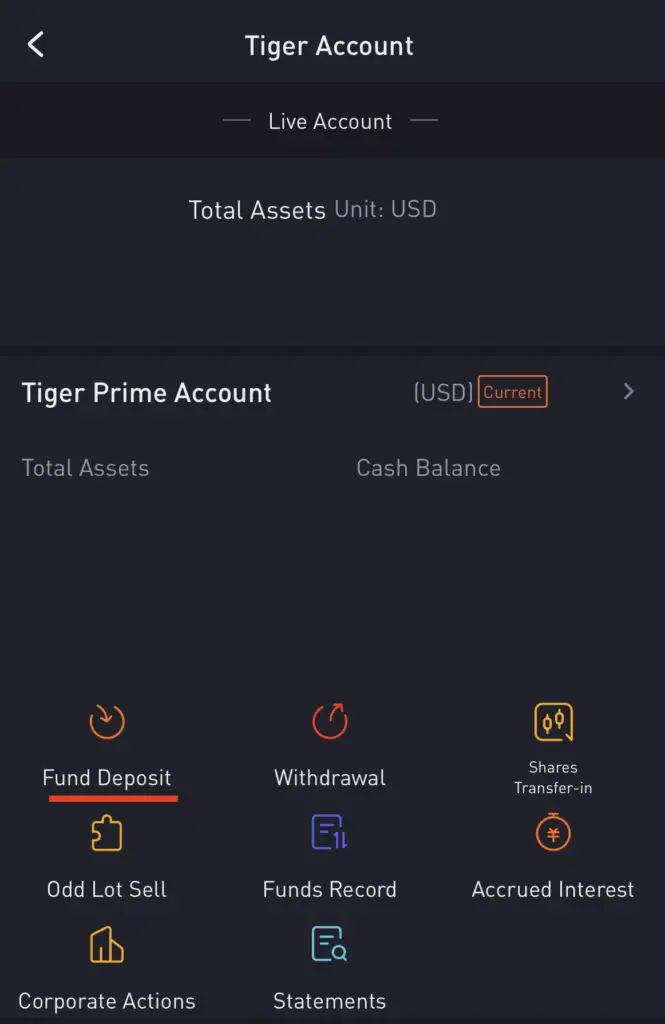

- Go to Tiger Account

- Select ‘Withdrawal’ and select ‘Withdraw USD’

- Add or select an existing bank account

- Enter the withdrawal details

- Receive the funds in your DBS Multi-Currency Account

The account that I’m using is a DBS Multiplier Account, as it is a multi-currency account that can store USD and other foreign currencies.

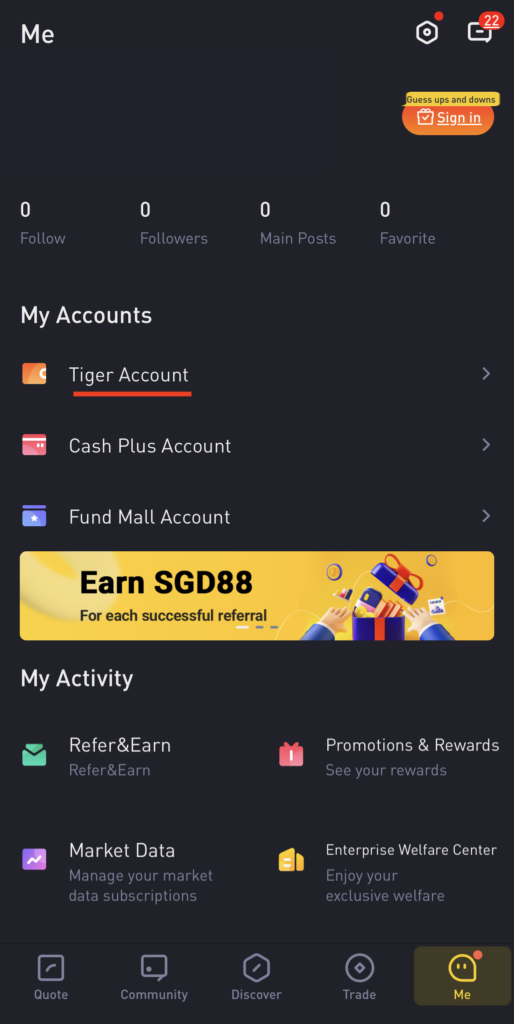

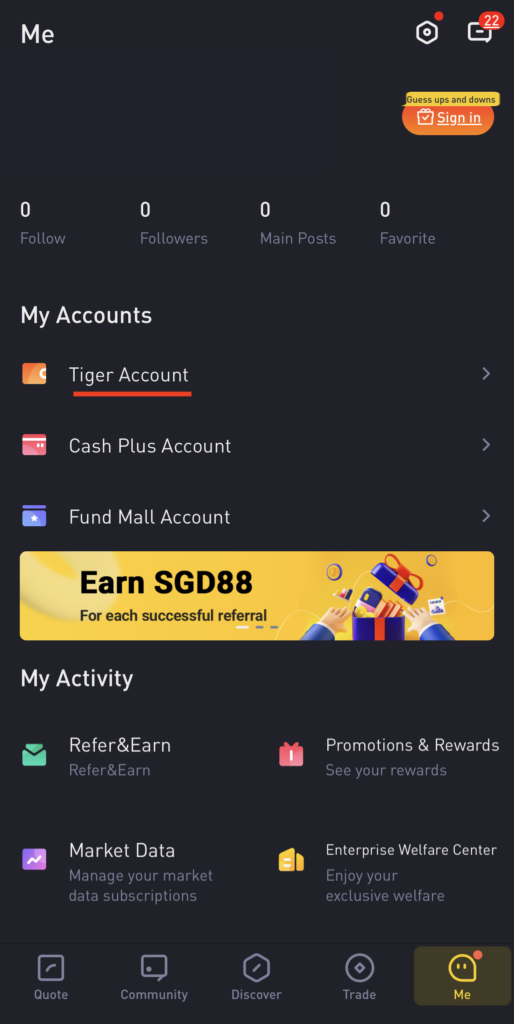

Go to Tiger Account

First, you’ll need to go to your Tiger Account on the Tiger Brokers app.

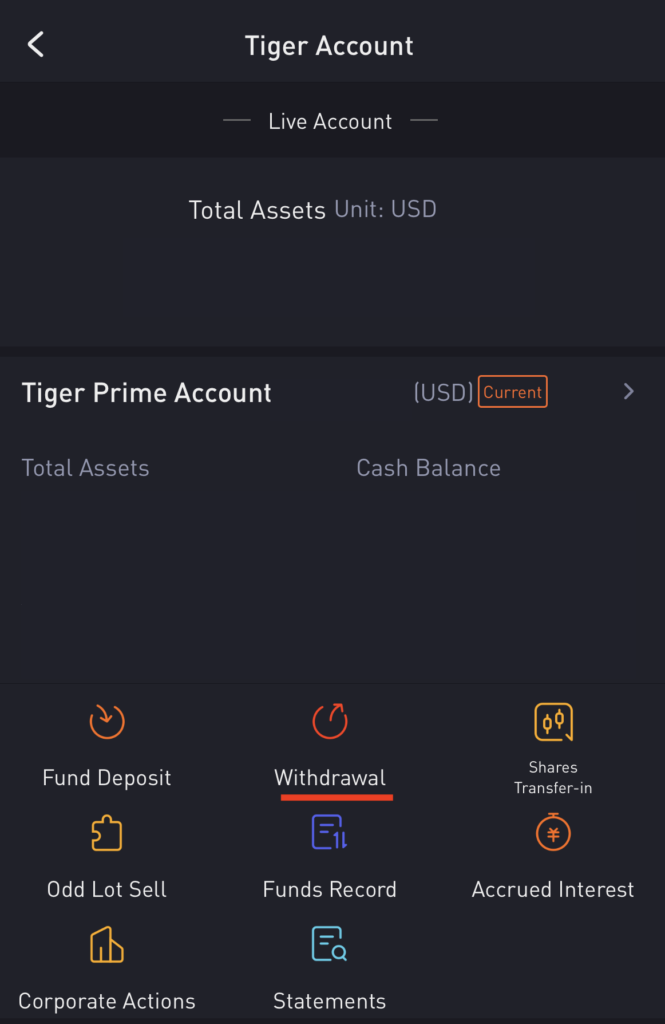

Select ‘Withdrawal’ and select ‘Withdraw USD’

After that, you’ll need to select ‘Withdrawal‘,

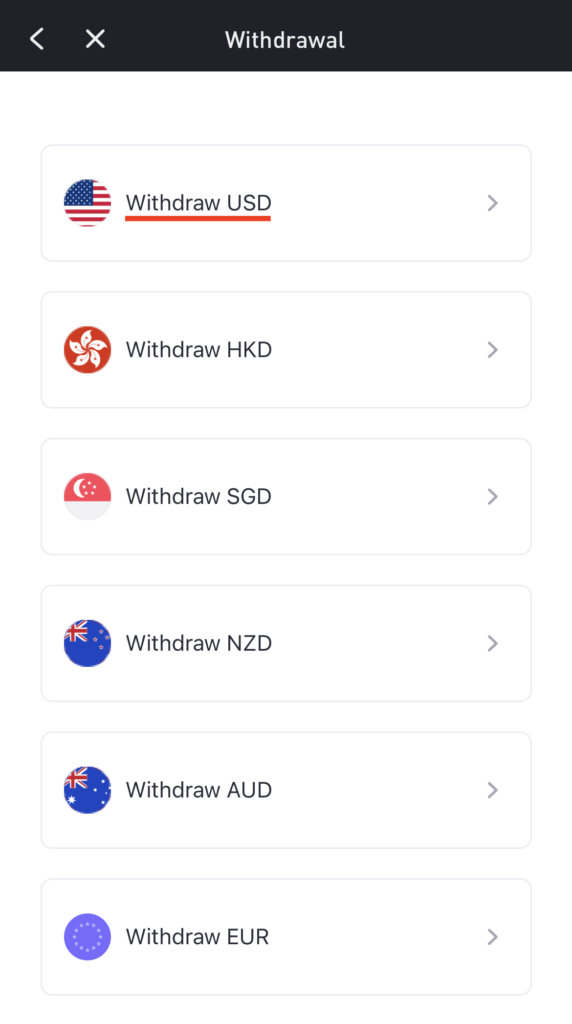

and then select ‘Withdraw USD‘.

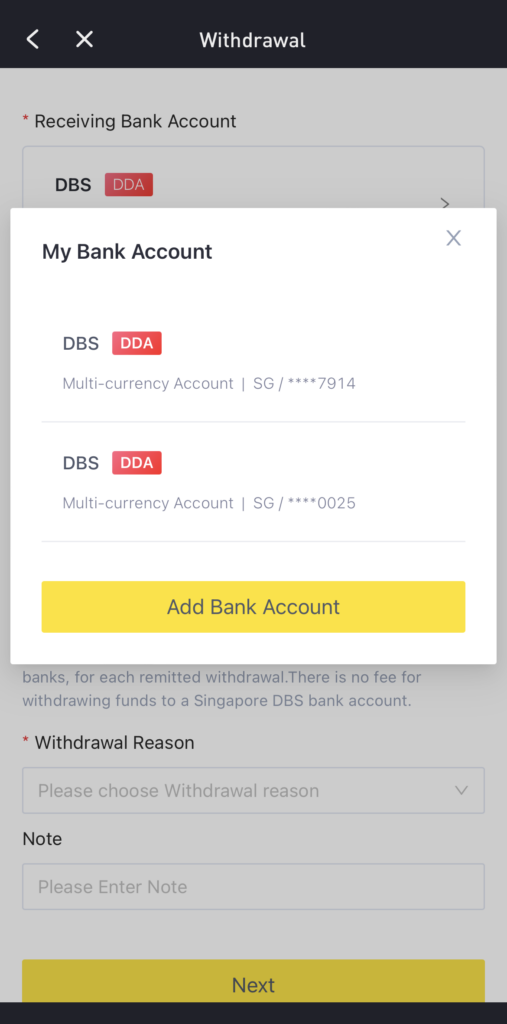

Add or select an existing bank account

You will need to add a bank account to receive your deposit. I would prefer to use a DBS account since Tiger Brokers allows Direct Debit Authorisation, which makes the fund transfer more efficient.

Also, you may want to select a multi-currency account that accepts USD deposits. If you choose to transfer your USD to a bank account that only accepts SGD deposits, you may incur some currency exchange fees!

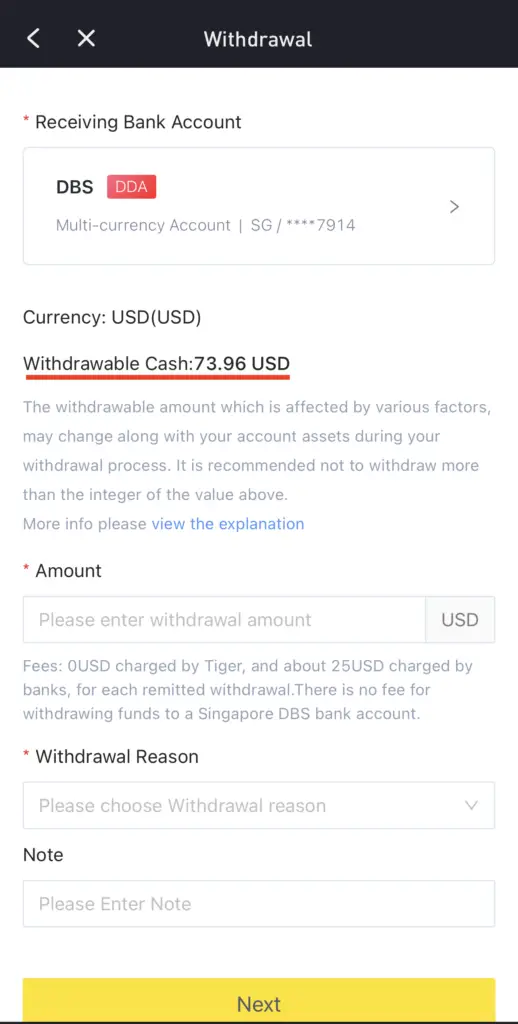

Enter the withdrawal details

After selecting the bank account, you will need to enter the amount that you wish to withdraw. You are only able to withdraw the maximum of your withdrawable cash in your USD account.

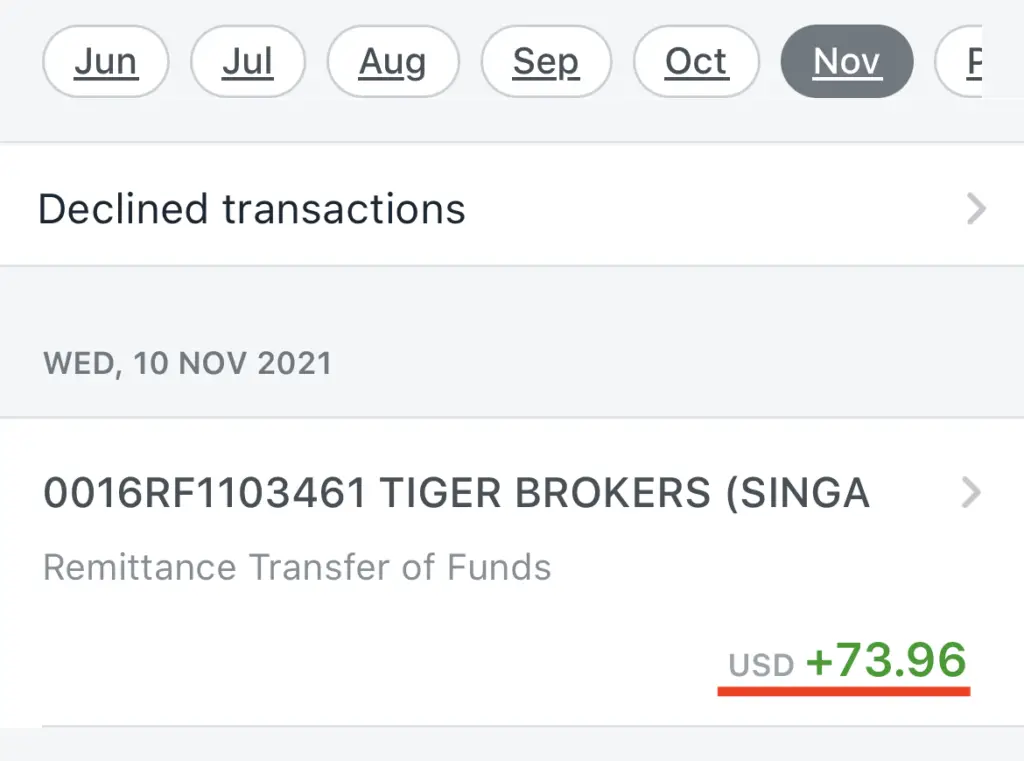

Receive the funds in your DBS Multi-Currency Account

Once you have submitted the withdrawal request, your funds will be credited to your DBS Multi-Currency Account.

I receive my funds a few hours after making the request, so I’m pretty satisfied with the speed.

What is withdrawable cash on Tiger Brokers?

The withdrawable cash on Tiger Brokers represents the maximum amount of cash that you can withdraw from your Tiger account to your bank account. If the amount of cash in your Tiger Account is greater than your withdrawable cash, it means that your cash has not been settled yet.

Why can’t I withdraw the full amount of USD from my Tiger Brokers account?

If you have just sold a stock for USD or if you have recently exchanged your SGD to USD, you will need to wait for two trading days before the settlement is reached. Otherwise, you will be unable to withdraw funds that have not been settled yet.

Tiger Brokers mentioned that it takes around 2 trading days for your funds to settle, after you’ve performed either:

- Selling a stock for USD

- Exchanging a currency for USD

As such, this does slow down the process if you are looking to withdraw USD immediately. You may want to take this ‘time lag’ into consideration when you are planning to withdraw USD to your bank account.

Are there any fees to withdraw USD from Tiger Brokers to my bank account?

Tiger Brokers does not charge any withdrawal fees if you are withdrawing USD from Tiger Brokers to a DBS Multi-Currency Account.

This is because Tiger Brokers has set up a DBS Multi-Currency account in Singapore, which makes sending and receiving funds much more convenient.

Since you are making a local transfer from Tiger Brokers’ DBS account to your DBS account, you will not incur any fees.

DBS only charges a fee for incoming transfers if the bank account is an overseas bank account.

However, I am not sure if you will incur any fees if you are withdrawing your USD to another multi-currency account in Singapore, such as OCBC or UOB.

How do I deposit USD from a Singapore bank account to Tiger Brokers?

Here are 5 steps you’ll need to deposit USD to Tiger Brokers:

- Go to Tiger Account

- Select ‘Fund Deposit’ and then ‘Deposit USD’

- Obtain the deposit details

- Add Tiger Brokers’ bank account as a payee

- Transfer USD to Tiger Brokers’ bank account

If you have some spare USD that you wish to trade on Tiger Brokers, here’s how you can do so. I am using my DBS Multi-Currency account for this method as well.

Go to Tiger Account

Similar to withdrawing USD, you’ll need to go to your Tiger Account.

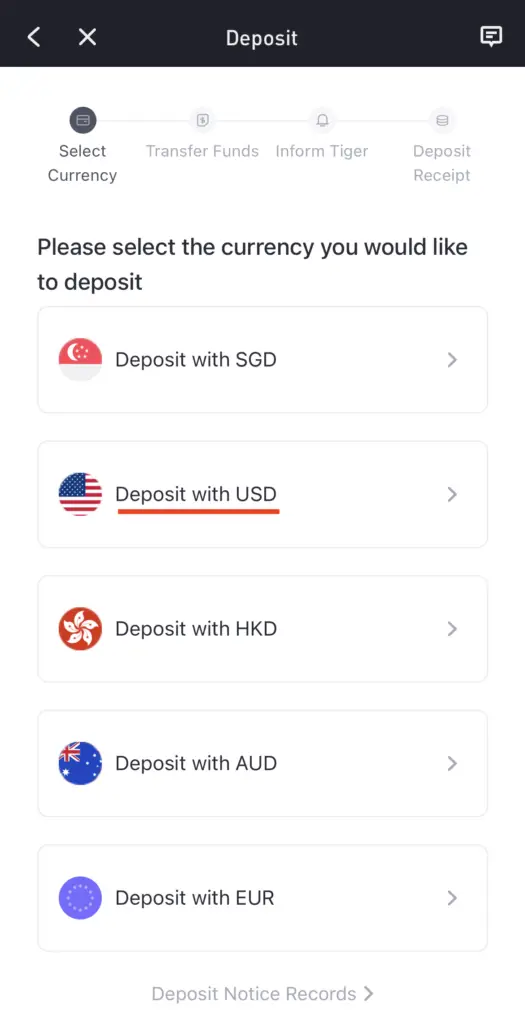

Select ‘Fund Deposit’ and then ‘Deposit USD’

After that, select ‘Fund Deposit‘,

and then select ‘Deposit with USD‘.

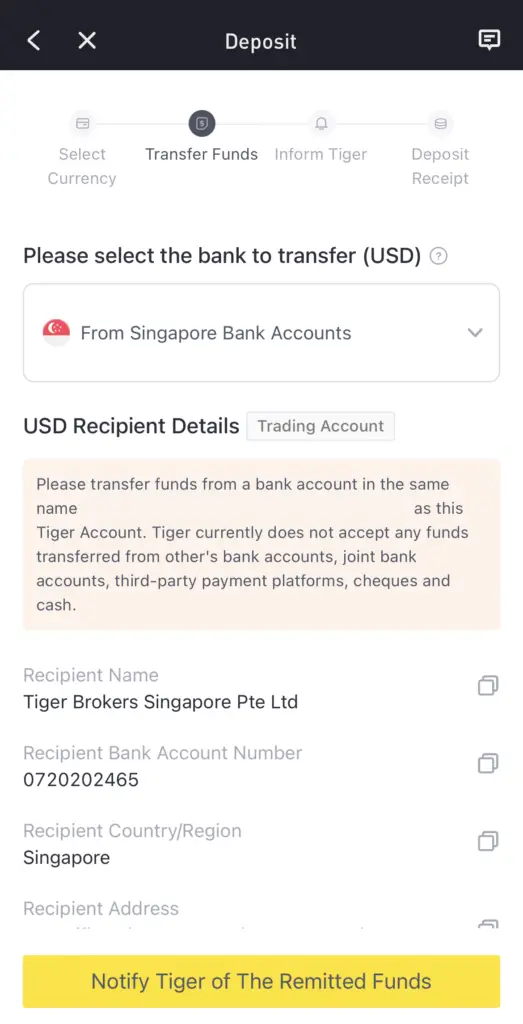

Obtain the deposit details

You will obtain the bank details that you’ll need to send your USD funds to.

If you are transferring USD from your Singapore Multi-Currency Account, you will be transferring your USD to Tiger Brokers’ DBS account.

Add Tiger Brokers’ bank account as a payee

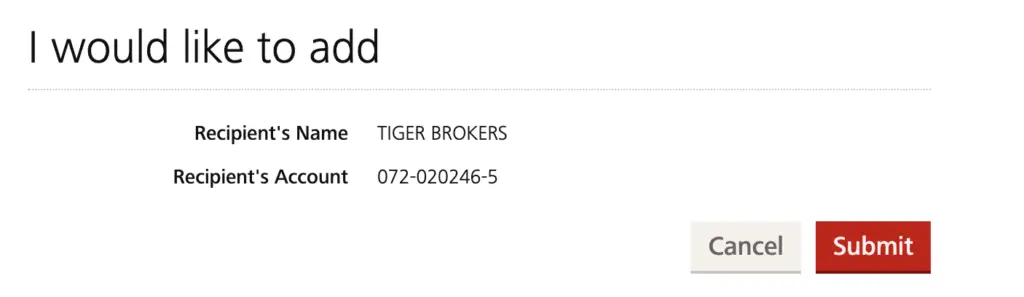

With the bank details, you will need to add Tiger Brokers’ bank account as a payee in your iBanking platform.

Transfer USD to Tiger Brokers’ bank account

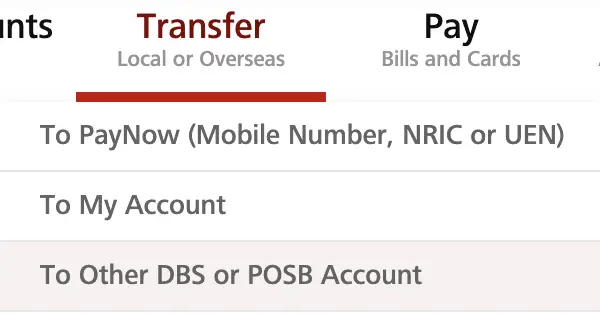

Once you have done so, you can go to ‘Transfer‘, and then ‘To Other DBS or POSB Account‘.

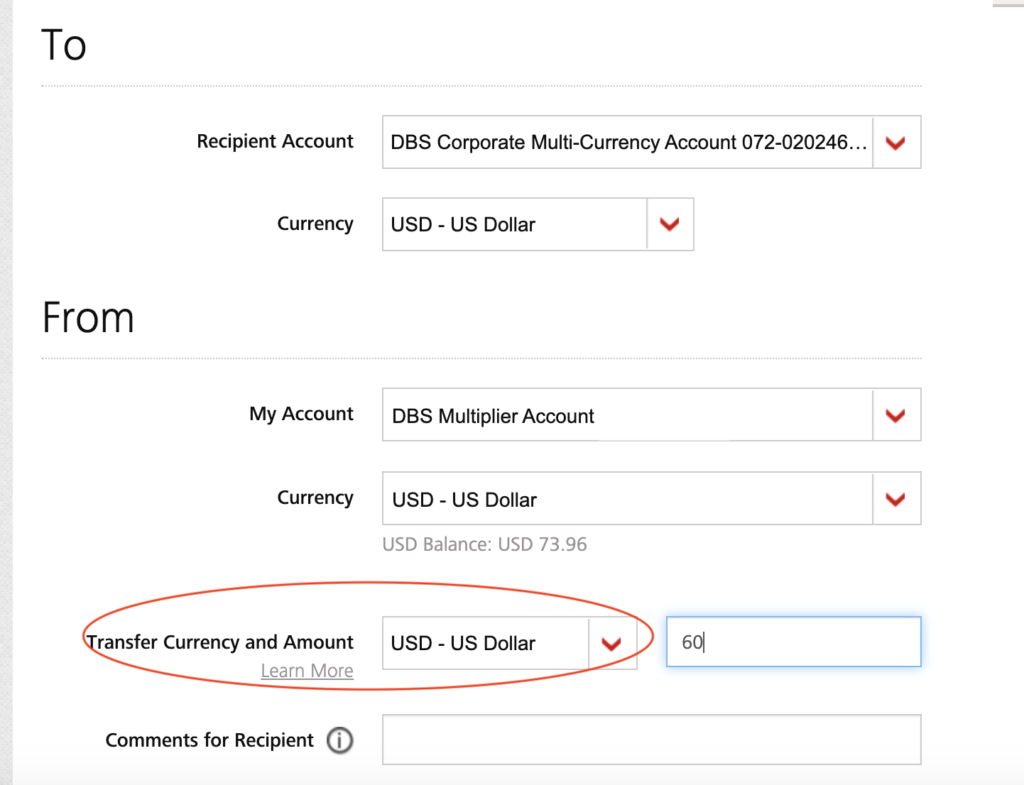

This will bring you to a page where you can add some details. You will need to indicate that you are sending USD.

An important thing will be to select USD under ‘Transfer Currency and Amount‘.

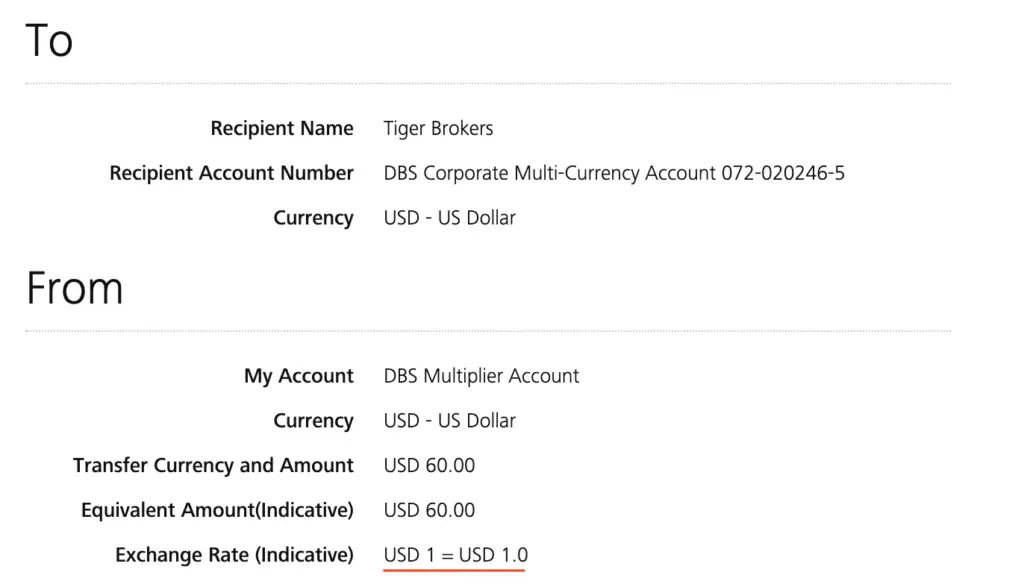

By doing so, you will be transferring your USD balance from your Multi-Currency Account to Tiger Brokers. You can view this on the next page, which shows the amount of USD that you’re sending.

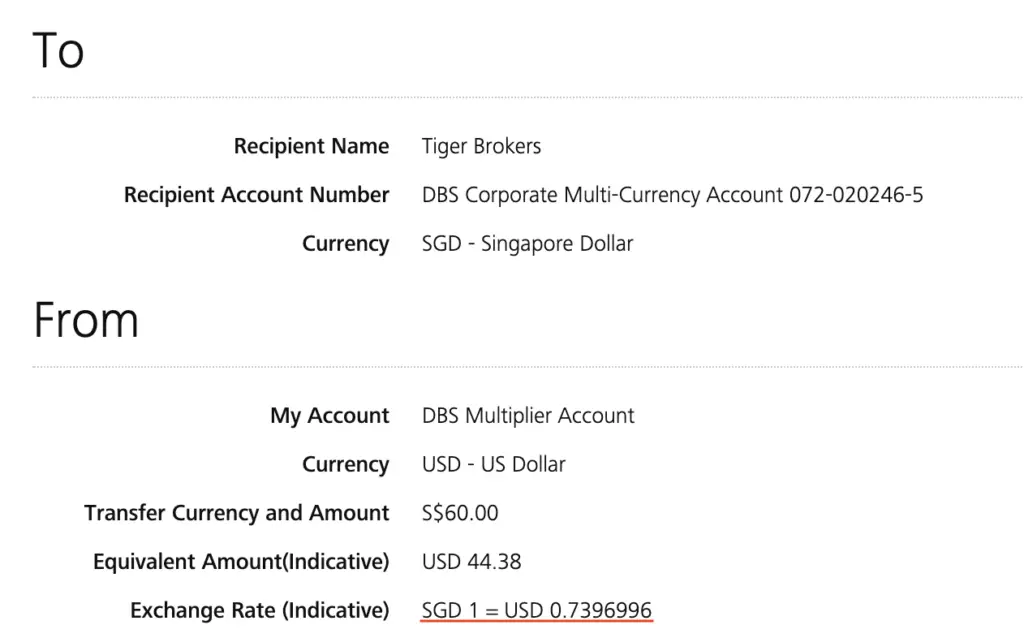

If you choose SGD as the ‘Transfer Currency and Amount’, you will be sending your SGD to Tiger Brokers. DBS will make the conversion from SGD to USD for you.

The exchange rate that DBS offers is usually less favourable compared to the current rates. As such, it will be better to deposit SGD into Tiger Brokers, and then exchange to USD.

The exchange rate on Tiger Brokers is slightly more favourable compared to DBS.

Once you have transferred the funds, you should receive them in your Tiger Account within a few hours.

Should I deposit USD or SGD into Tiger Brokers?

If you have USD in your bank account, it is recommended to deposit USD onto Tiger Brokers to buy US stocks or ETFs. However, if you only have SGD in your bank account, it is better to deposit SGD into Tiger Brokers and exchange for USD before trading in the US exchanges.

This is because the spread is slightly more favourable in Tiger Brokers compared to the one that DBS charges you!

Conclusion

Tiger Brokers has a DBS Multi-Currency Account in Singapore, which means that you will not incur any deposit or withdrawal fees from DBS when you are transferring USD to and from your DBS bank accounts.

This is because you are using a local transfer, instead of an overseas bank transfer!

The process is similar when you are depositing or withdrawing USD from moomoo too.

As such, you may want to consider using Tiger Brokers to exchange your SGD to USD, and then withdraw it back to your DBS bank account. Tiger Brokers has a better spread, which will help to save on some of the costs you’ll incur.

This will be especially useful if you are intending to deposit your USD to FTX to buy cryptocurrencies.

👉🏻 Referral Deals

If you are interested in signing up for any of the products mentioned above, you can check them out below!

Tiger Brokers Referral (Free AAPL Share and 60 Commission-Free Trades)

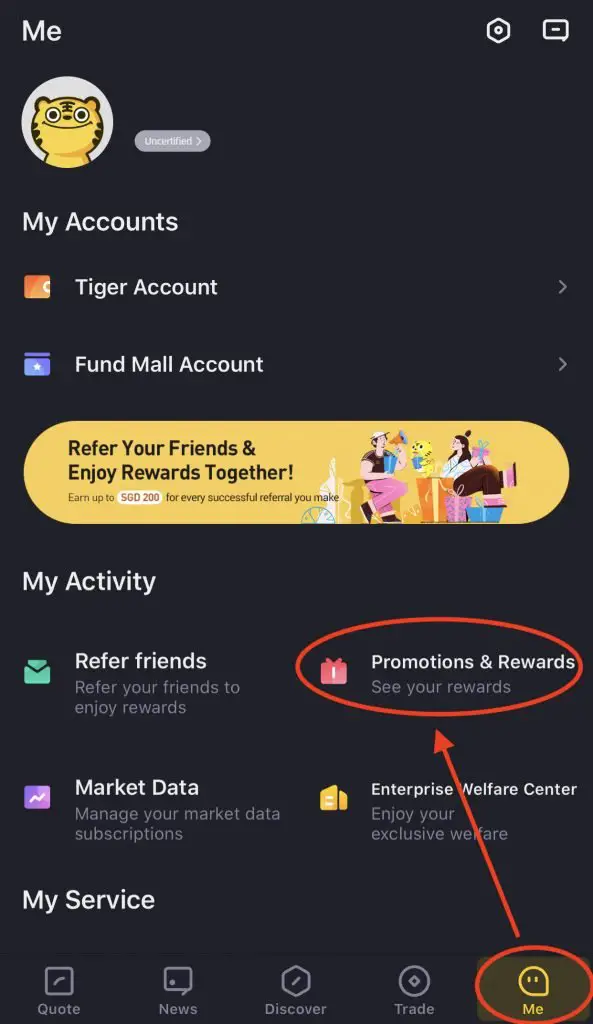

If you sign up for a Tiger Brokers account using my referral link, you will be eligible for some rewards. You can view and claim your rewards by going to ‘Me → Promotions & Rewards‘.

Here are 3 bonuses that you can receive:

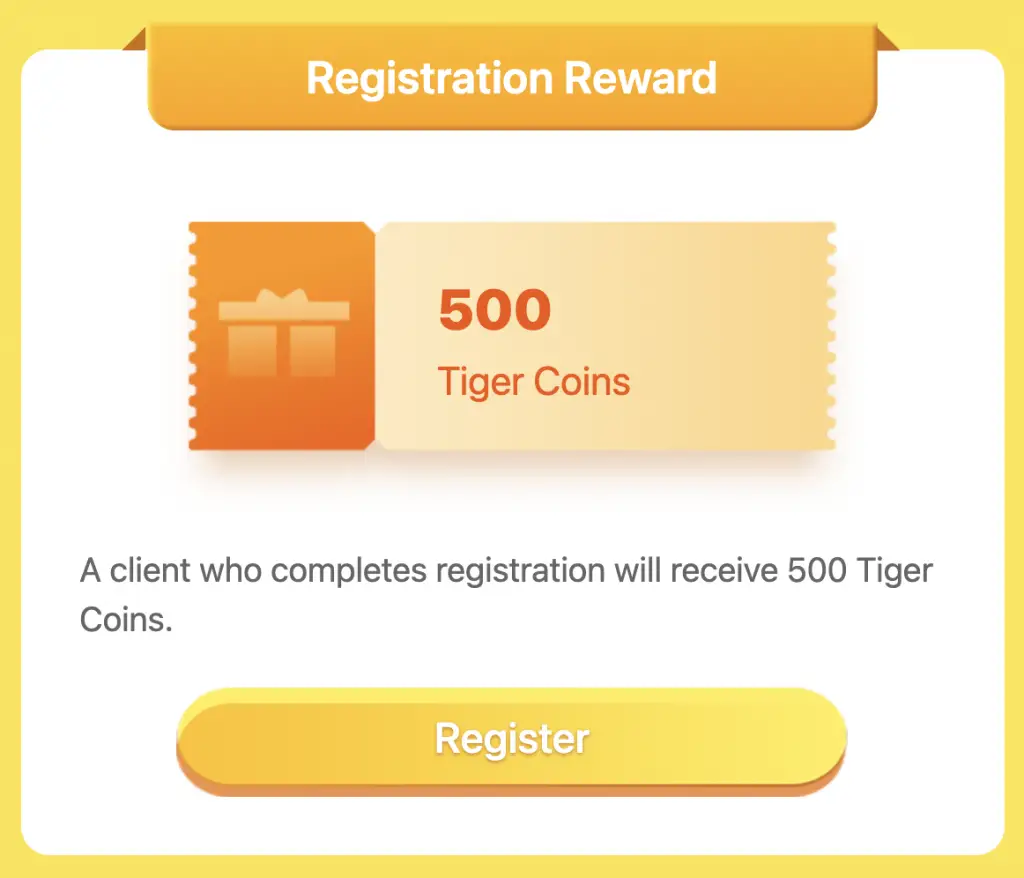

#1 Registration Reward

When you register for a Tiger Brokers Account, you will receive 500 Tiger Coins.

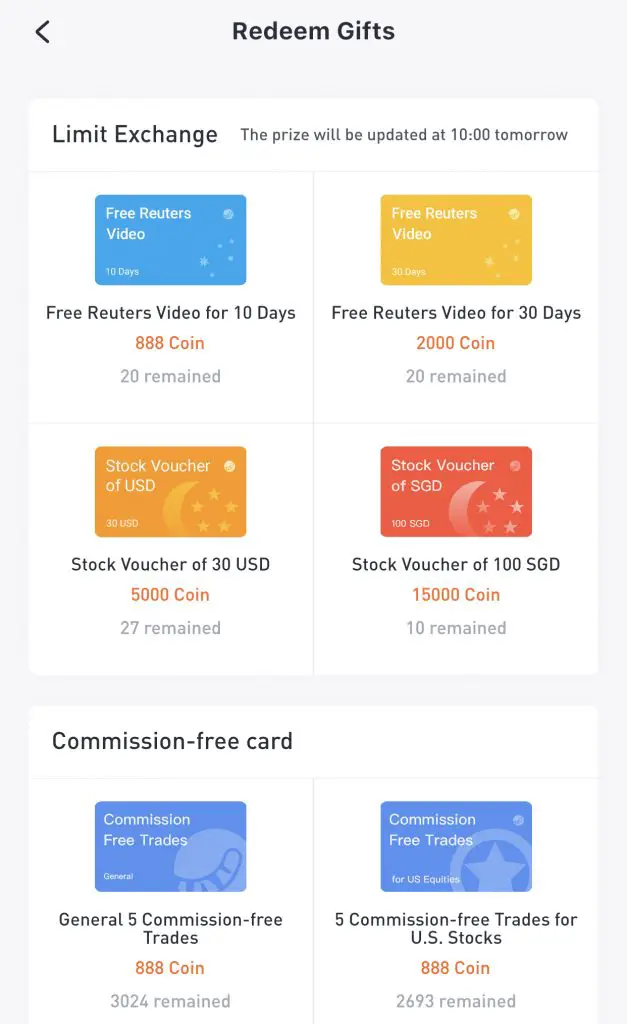

These Tiger Coins can be used to redeem a variety of rewards, such as:

- Stock vouchers

- Commission-free trades

- Reuters videos

#2 Account Opening Reward

After successfully opening your account, you will receive 60 commission-free trades that you need to use within 180 days.

These commission free trades can be used for:

- US stocks

- HK stocks

- Singapore stocks

- Australia stocks

On top of that, you will receive 5 commission-free trades for futures within 30 days.

You will still need to pay the commission first. The commission should be refunded to you on the next working day.

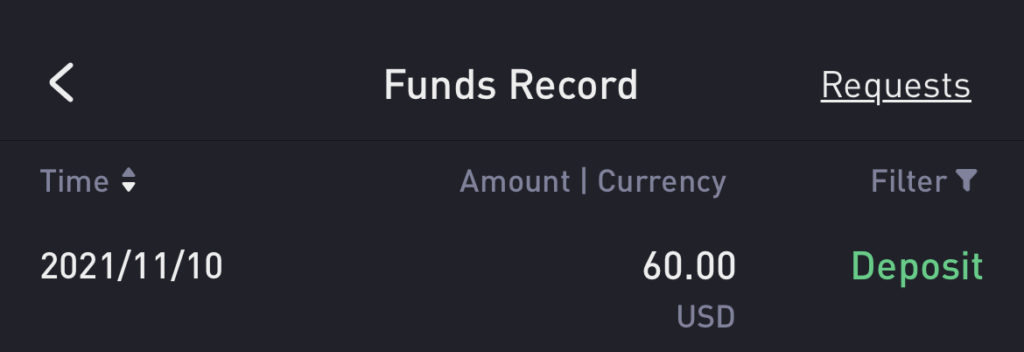

#3 Funding Reward

If you fund at least $2,000 SGD into your Tiger Brokers account for your very first deposit, you will receive a free Apple (AAPL) share.

The shares will be added into your account within 10 working days.

On top of that, you will receive a stock voucher (SGD5) for SGX stocks only.

You can view the terms and conditions of this promotion on Tiger Brokers’ website.

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?