Last updated on September 14th, 2021

You may have heard about topping up your CPF to earn high interest rates on your funds.

However, the focus has mainly been on SA or MA top ups, while OA top ups are not as commonly mentioned.

So here’s what you need to know about topping up your OA:

Contents

- 1 Can I top up my CPF Ordinary Account (OA)?

- 2 Can I top up my OA after 55 years old?

- 3 How do I solely top up my CPF OA with cash, instead of topping up all 3 accounts?

- 4 What is the limit to topping up my CPF OA?

- 5 Am I able to receive tax relief by topping up my OA?

- 6 How to top up your CPF OA with cash

- 7 Can I top up my spouse’s CPF OA?

- 8 Conclusion

Can I top up my CPF Ordinary Account (OA)?

You are able to top up your CPF Ordinary Account using cash via the Voluntary Contribution. However, you cannot contribute solely to your Ordinary Account. This is because your funds will be split into your 3 CPF accounts (OA, MA and SA), based on the current allocation rates.

Topping up your OA is slightly more restrictive compared to topping up your MA or SA.

This is because you can top up your MA or SA directly!

The only way you can top up your OA is via a Voluntary Contribution into all 3 of your accounts. The funds that you contribute will be split into the 3 accounts, based on the allocation by CPF.

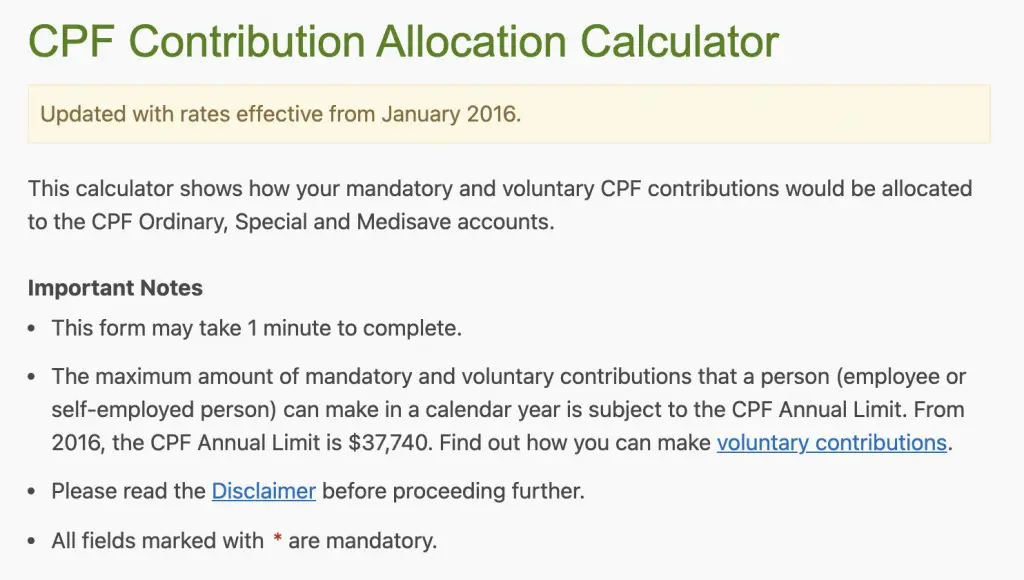

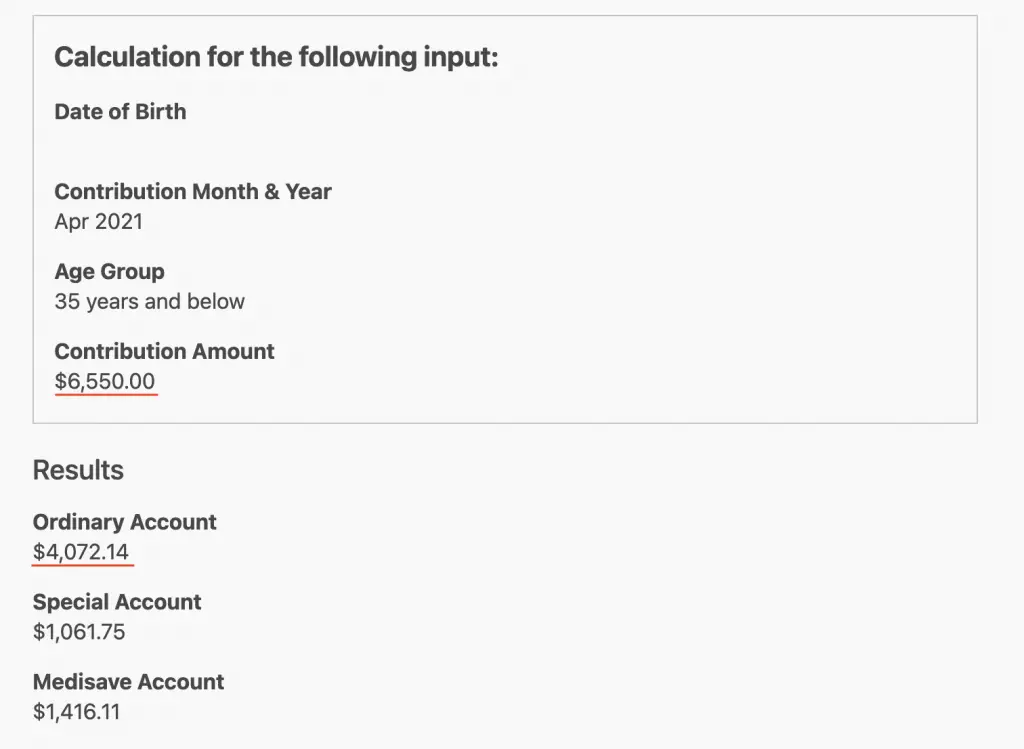

You can use the CPF Contribution Allocation Calculator to calculate how much of your contribution will go into each account.

The amount being contributed into each account depends on your age.

If you want to top up a specific amount to your OA, you can use this calculator to determine how much you’ll need to top up in total to receive that sum in your OA.

For example, you may want to add $4k to your CPF OA. If you are less than 35 years old, you would need to contribute around $6.55k via a Voluntary Contribution to receive $4k in your OA.

Considering on topping your CPF Special Account or SRS instead for higher returns? You might want to check out this guide.

Can I top up my OA after 55 years old?

It is possible to make top ups to your CPF OA via a Voluntary Contribution, even after you are 55 years old. The maximum amount you can contribute to your OA each year is the difference between the CPF Annual Limit and your mandatory CPF contributions.

When you are topping up your OA, the only way you can do so is via the Voluntary Contribution.

If you are topping up your Retirement Account (after 55 years old), you can do so using the Retirement Sum Top Up (RSTU) Scheme.

If you want to top up your RA from age 55 onwards, the maximum limit you can top up to is the prevailing Enhanced Retirement Sum (ERS).

As such, the limit to making a Voluntary Contribution depends on 2 factors:

- CPF Annual Limit

- Mandatory contributions

The CPF Annual Limit is currently fixed at $37,740.

There are mandatory contributions made to your CPF accounts, which includes:

- CPF contributions on the Ordinary and Additional Wages for employees

- MediSave contributions by self-employed persons

The amount that you can contribute to your CPF OA via a Voluntary Contribution is the difference between these 2 amounts.

Max Voluntary Contribution = CPF Annual Limit – Mandatory Contributions

However, when you reach 55 years old, it may not be that necessary to top up your OA.

By that time, you should have been able to pay off all your housing-related expenses!

If you want to make a contribution to your CPF, you may want to consider boosting your Retirement Sum to receive a higher CPF Life payout.

How do I solely top up my CPF OA with cash, instead of topping up all 3 accounts?

There is no possible way to solely top up your CPF OA. This is in contrast to you being able to top up your MA or SA directly. The only way that you can top up your CPF OA with cash is by making a Voluntary Contribution to all 3 of your CPF accounts (OA, MA and SA).

What is the limit to topping up my CPF OA?

There is no maximum cap on the amount that you can top up to your CPF OA. However, there is an annual limit that you can top up to your CPF each year, which is currently at $37,740. The amount of Voluntary Contributions that you can make to your CPF is the difference between the Annual Limit and any Mandatory Contributions.

Am I able to receive tax relief by topping up my OA?

For CPF VCs, the system for tax reliefs differs for employees and self-employed persons.

Employees

If you are employed in a company, you are unable to receive any tax relief through topping up your OA under a Voluntary Contribution.

This is because employees are already enjoying tax reliefs for their compulsory CPF contributions under the CPF Act.

Thus, the only Voluntary Contribution that is tax deductible are contributions that you make solely to your MediSave account.

Self-Employed

On the other end, you will be able to enjoy tax reliefs through topping up your OA under a Voluntary Contribution if you are self-employed.

Self-employed persons are not subject to compulsory OA and SA contributions, hence they do not enjoy the tax reliefs employees do.

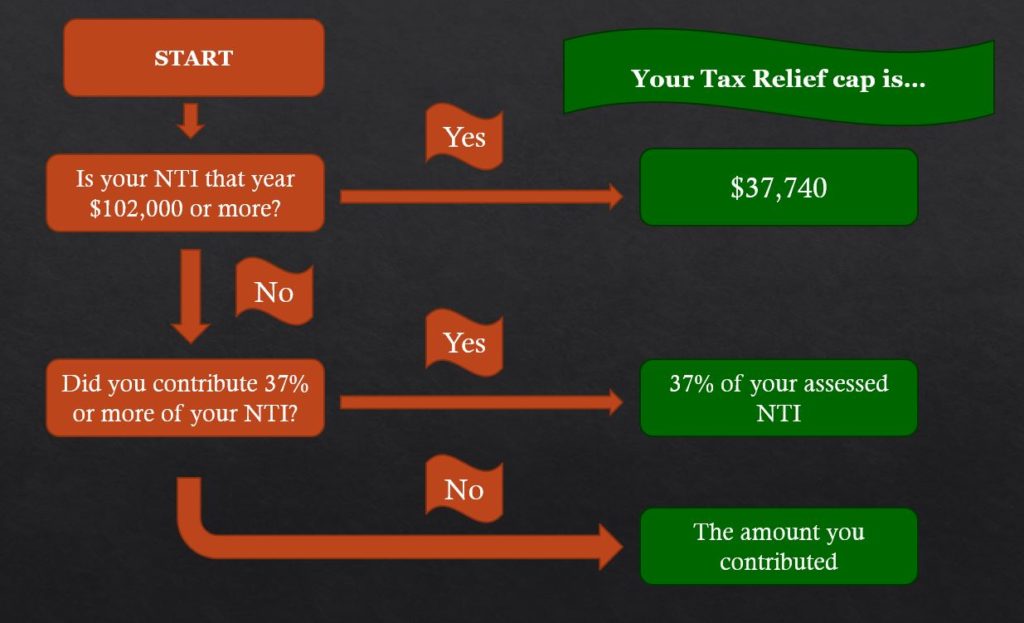

However, your tax reliefs will be capped at the lower of:

- 37% of your Net Trade Income (NTI) assessed; or

- CPF relief cap of $37,740 (The Annual Limit) ; or

- The amount you contributed

NTI is your gross trade income minus all allowable business expenses, capital allowances and trade losses as determined by the Inland Revenue Authority of Singapore (IRAS).

Source: CPF

With the flowchart below, you can find out which tax relief cap applies to you as a self-employed person.

Types of Voluntary Contributions

There are 2 main types of Voluntary Contributions:

- Contributions to all 3 of your CPF accounts

- Contributions to only your MediSave account

The contributions that you make solely to your MA can be tax deductible. This depends on certain limits to the amount of tax relief you can receive.

If you are an employed worker, the contributions that you make to all 3 of your accounts are not tax deductible.

In this case, you can either top up your MA (Voluntary Contribution) or your SA (Retirement Sum Top-Up Scheme) to reduce your taxes via CPF top ups,.

How to top up your CPF OA with cash

Here’s what you need to do to make a voluntary contribution to your CPF OA:

- Go to the CPF’s E-Cashier

- Enter your NRIC

- Select ‘Contribute to my 3 CPF Accounts’

- Check your Voluntary Contribution limit

- Enter your contact number and contribution amount

- Select your mode of payment

Here is each step explained in detail:

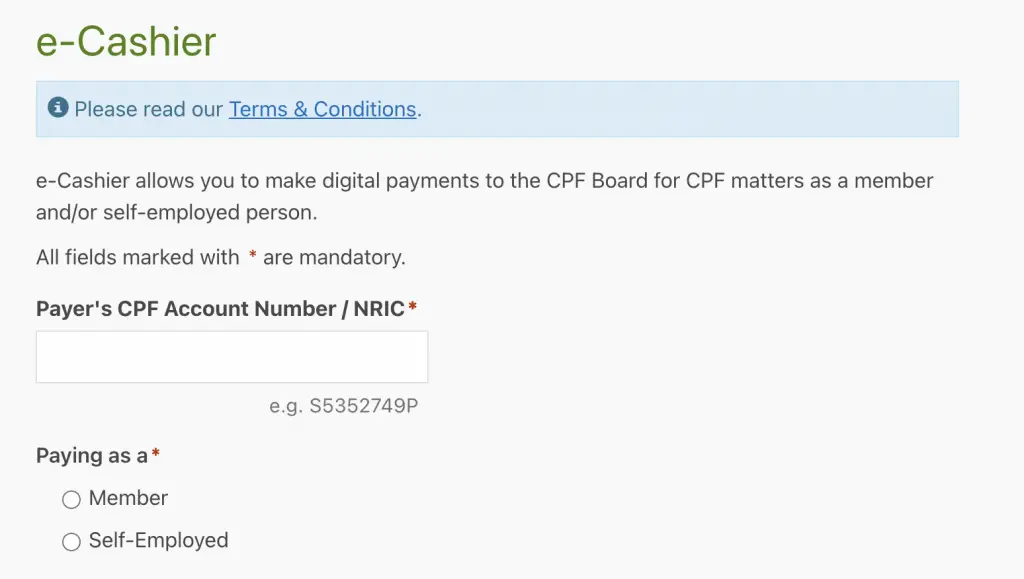

#1 Go to the CPF’s E-Cashier

To top up your CPF, you’ll need to go to CPF’s E-Cashier service.

This is the portal you can use to top up your CPF online.

#2 Enter your NRIC

You’ll be asked to enter your NRIC, as well as if you are paying as a member (employed worker) or self-employed.

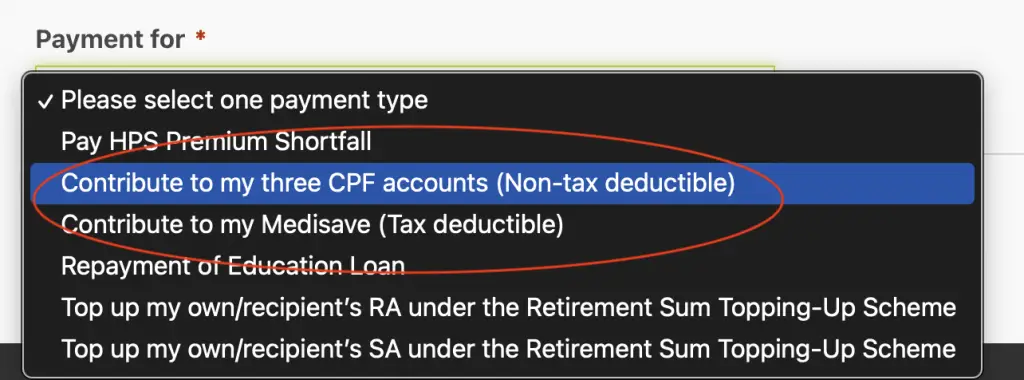

#3 Select ‘Contribute to my 3 CPF Accounts’

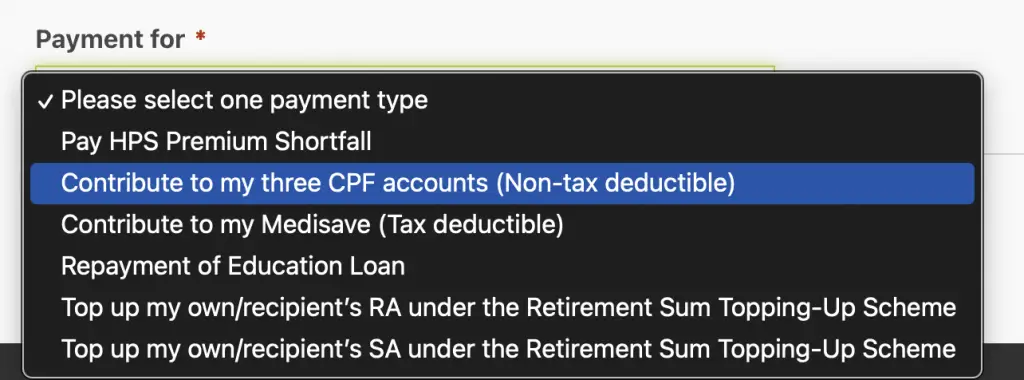

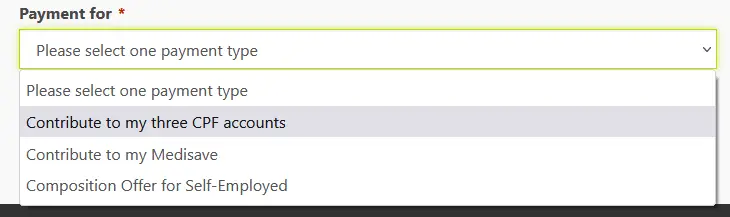

There are a few ways for you to contribute to your CPF. If you are looking to top up your OA as an employed worker, you would need to select ‘Contribute to my 3 CPF Accounts (Non-tax deductible)’.

Similarly if you are self-employed, you would need to select ‘Contribute to my 3 CPF accounts’.

#4 Check your Voluntary Contribution limit

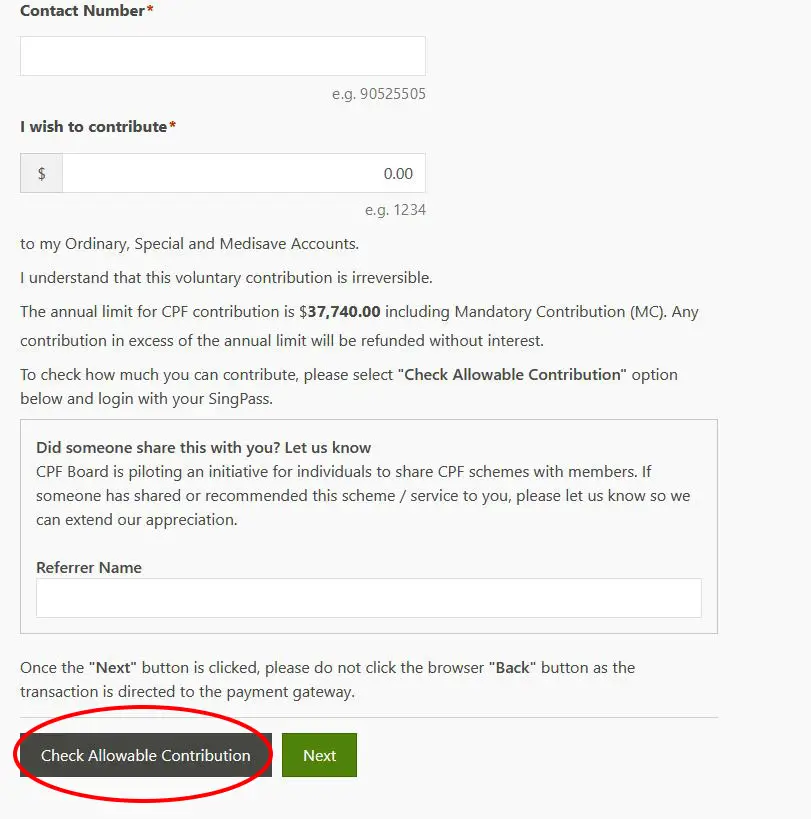

To check the maximum amount of voluntary top-ups you are able to make, scroll to the bottom of the webpage and click on ‘Check Allowable Contribution’.

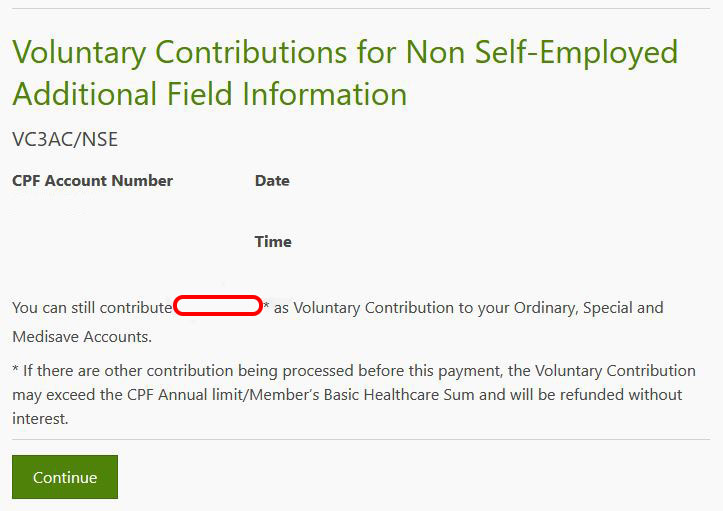

You may then need to login into your CPF Account via Singpass if you have not done so. Thereafter, you will be directed to view your Voluntary Contribution limit.

Afterwards, click on ‘Continue’ to return to the previous webpage.

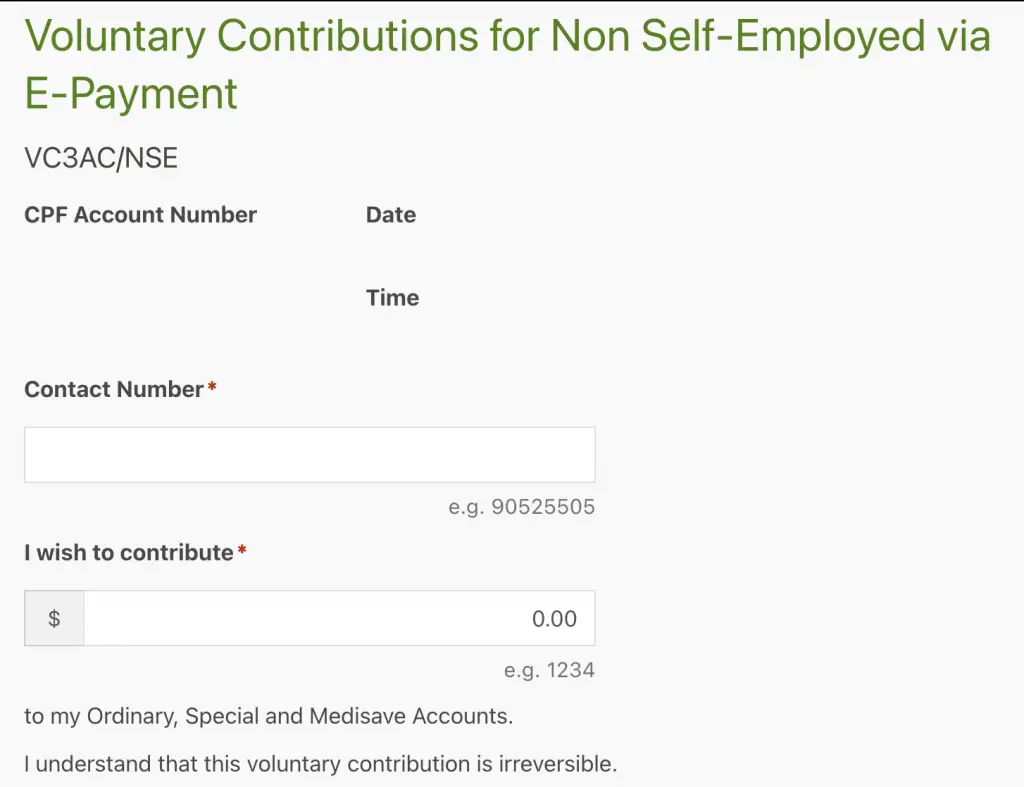

#5 Enter your contact number and contribution amount

Once you have decided on your contribution amount, enter your contact number and the amount you wish to contribute.

This is the amount that you’ll be contributing to all 3 of your accounts. If you want to calculate how much goes into your OA, you’ll need to use the CPF Allocation Calculator.

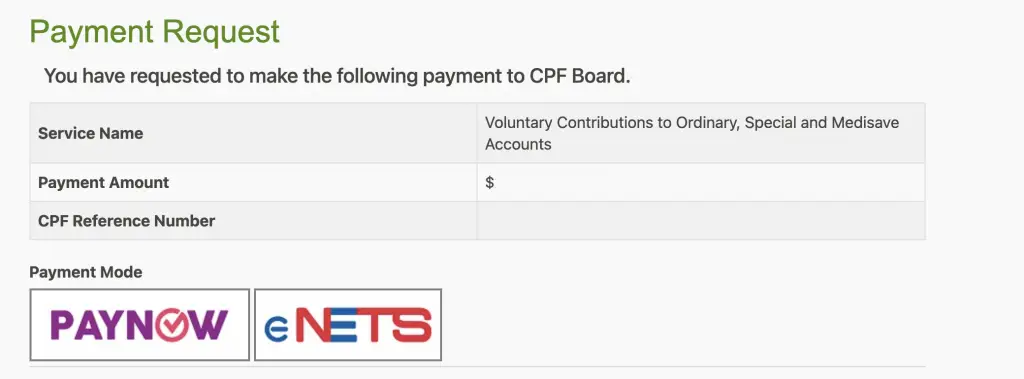

#6 Select your mode of payment

You’ll be asked to select your mode of payment for the top up.

This can be done either using:

- PayNow

- eNETS

After making the transfer, you should receive an email confirmation regarding your successful top up.

Can I top up my spouse’s CPF OA?

When you are making a Voluntary Contribution to your CPF Ordinary Account, you can only contribute to your own CPF funds, and not your spouse’s funds. You can only top up your spouse’s CPF via the Retirement Sum Topping Up (RSTU) Scheme.

It is not possible to make a Voluntary Contribution to your spouse’s CPF funds via the E-Cashier.

When you select the Voluntary Contribution as the option in the E-Cashier, you can only make contributions to yourself.

However, you can contribute to your spouse’s SA funds via the Retirement Sum Topping Up (RSTU) Scheme.

The RSTU is different from the Voluntary Contribution scheme!

In this scheme, you can only top up to your spouse’s SA, and not their MA or OA.

Your spouse would have to make a Voluntary Contribution by his/herself if he/she wants to top up their OA funds!

Conclusion

It is not possible for you to solely top up your OA. This is in contrast to topping up your MA or SA, which you can directly top up to either account.

The only way you can top up your OA is via a Voluntary Contribution to all 3 of your CPF accounts. The allocation towards your OA will be based on the Allocation Calculator.

You can make this top up to pay for your flat’s downpayment, or for your DPS premiums.

Lastly, if you are an employed worker, this top up is not eligible for tax relief! Instead, consider topping up either your MA or SA to reduce your taxable income.

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?