Last updated on September 7th, 2021

Did you know that DBS and POSB are actually the same bank?

DBS actually acquired POSB back in 1998, but decided to keep POSB separate from DBS.

Why did they choose to do so? And what does this mean for their banking services?

Contents

The difference between POSB and DBS

POSB and DBS started out as different banks. POSB was then acquired by DBS on 16 November 1998. POSB chose to keep its identity, but it is still a subsidiary of DBS. This allows you to use services from both banks together.

Here’s an in-depth look into the differences between POSB and DBS:

History of DBS and POSB

Here is a quick roundup of the history of these 2 banks.

1) POSB was founded earlier

POSB was founded in 1877 by the British government to provide banking services for lower-income citizens.

They were one of the earliest banks and many Singaporeans had a POSB bank account.

POSB was also associated with offering low-cost banking services to Singaporeans.

In 1971, they became a statutory board, and in 1974 was transferred to be part of the Ministry of Finance.

By 1976, POSB had one million depositors and had deposits over $1 billion.

After they were acquired by DBS, they were no longer a statutory board under the MOF.

2) DBS was established by the Economic Development Board

DBS was formed by the Singaporean Government in 1968. The main aim of DBS was to take over industrial financing activities from the Economic Development Board.

It has since expanded its financial services to other Asian countries. Furthermore, it has received many good ratings too.

3) POSB was acquired by DBS in 1998

In 1998, POSB was acquired by DBS for SGD$1.6 billion. This gave DBS a huge market share as they now had over 4 million customers.

Even though they are now under the same bank, POSB still chose to keep its identity.

With this acquisition, POSB and DBS integrated their facilities together. You could walk into a POSB branch to get banking services for your DBS account, and vice versa.

The main thing that is different between these 2 banks is the branding. Other than that, they are essentially the same bank!

How does this affect their banking services?

Even though the banks are 2 separate banks, they have integrated their services together. Here are some of the banking services that you can do at either bank:

- ATM withdrawals

- Cheque deposits

- Account opening

- digibank platform

- PayLah!

- Debit and credit cards

- Salary credit for DBS Multiplier

- DBS Vickers

- Invest saver

- SRS account

- Bank and SWIFT codes

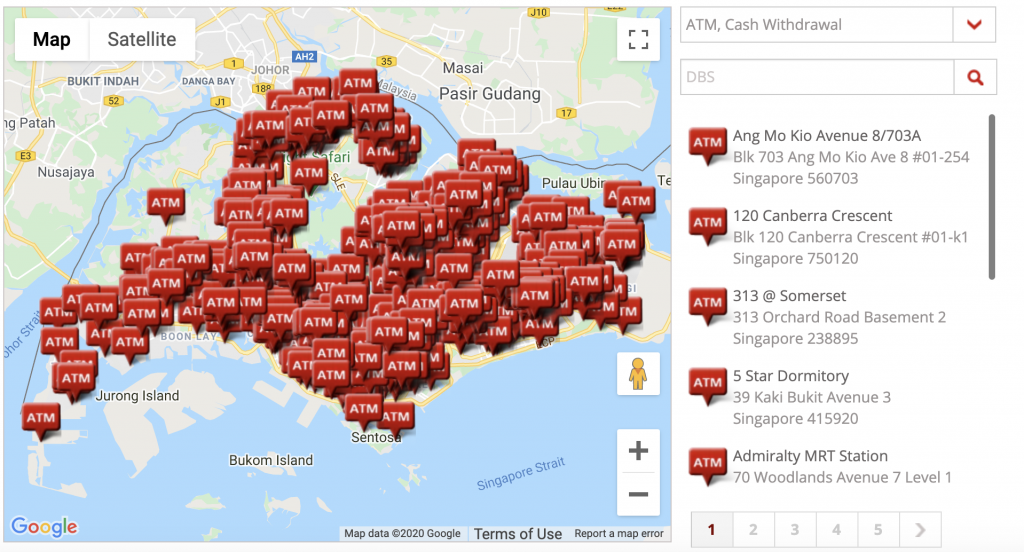

#1 ATM withdrawals

Both banks have their different ATMs across Singapore. If you have either a POSB or ATM card, you are able to withdraw money from either ATM.

Can I use a DBS card at a POSB ATM?

If you have a DBS ATM card, you are able to use it at a POSB ATM to withdraw your money.

You are able to make a withdrawal from any DBS or POSB ATMs. So long as you have a POSB or DBS ATM card, you can make a withdrawal from the ATM.

You can find out the full list of DBS and POSB ATMs here.

There are many ATMs available to withdraw your cash!

Even if you forgot to bring your ATM card, there are other ways that you can withdraw cash. One of these methods is to use the soCash app.

#2 Cheque deposits

Singapore is aiming to become cheque-free by 2025. However, you may still need to deposit a cheque during this time.

When you want to deposit a cheque, you can drop it off at any POSB or DBS branch. The cheque will be deposited into a POSB or DBS account of the recipient.

#3 Account opening

Since both banks share the same services, you are able to open any bank account at any branch.

Can I open a DBS account at POSB?

You are able to open a DBS account at a POSB branch or via online banking. For example, you are able to apply for a DBS Multiplier Account even when you’re on the POSB website.

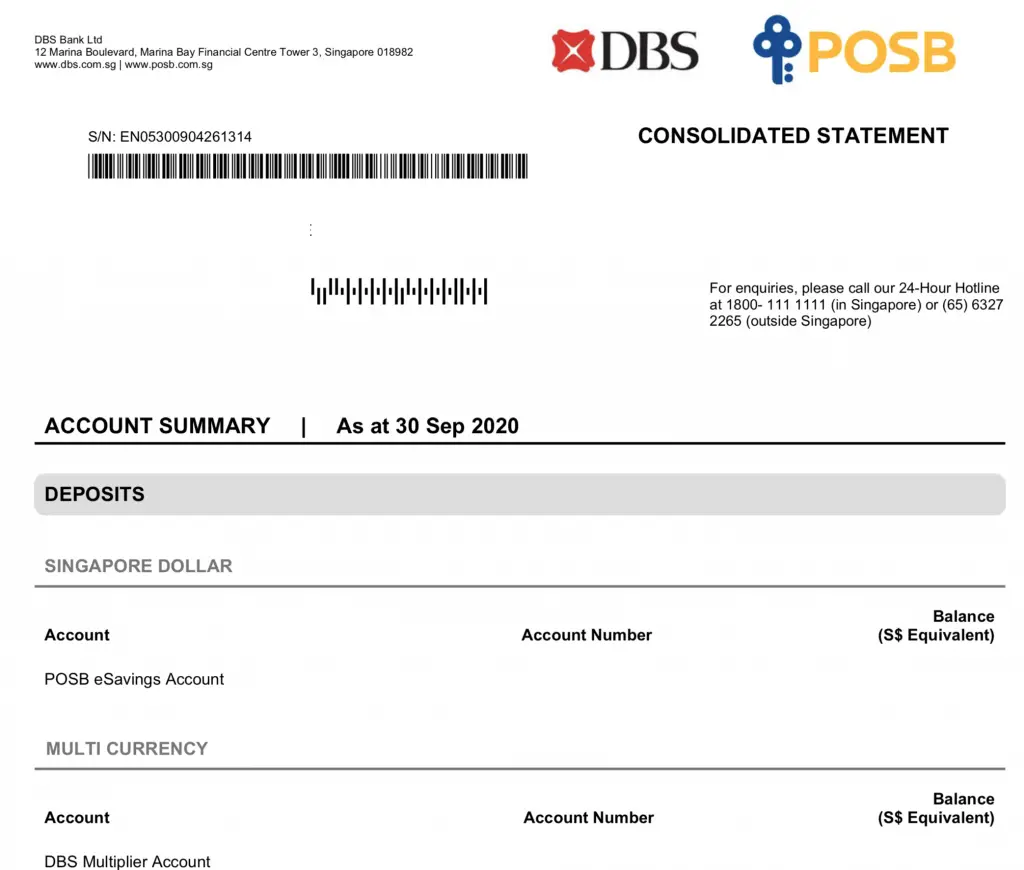

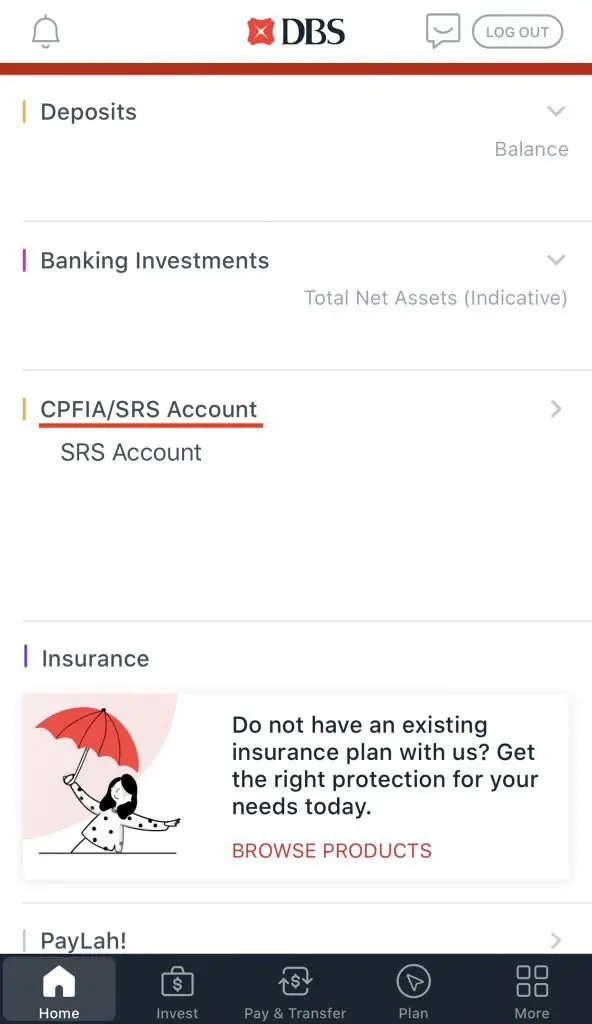

All of your DBS and POSB accounts will be consolidated together in the digibank platform.

#4 digibank platform

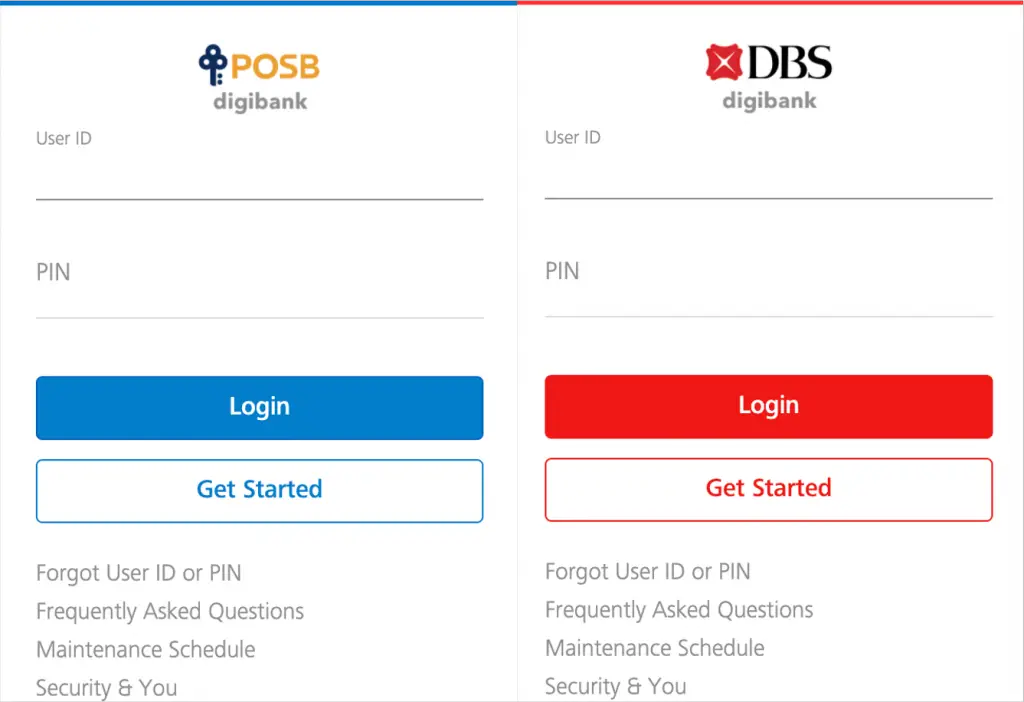

POSB and DBS share the same iBanking platform (digibank). For all of your POSB and DBS banking needs, you will just need to use this platform.

Consolidated bank statement

You will be able to view your bank statement at the end of each month. Your POSB and DBS accounts will be consolidated into one statement.

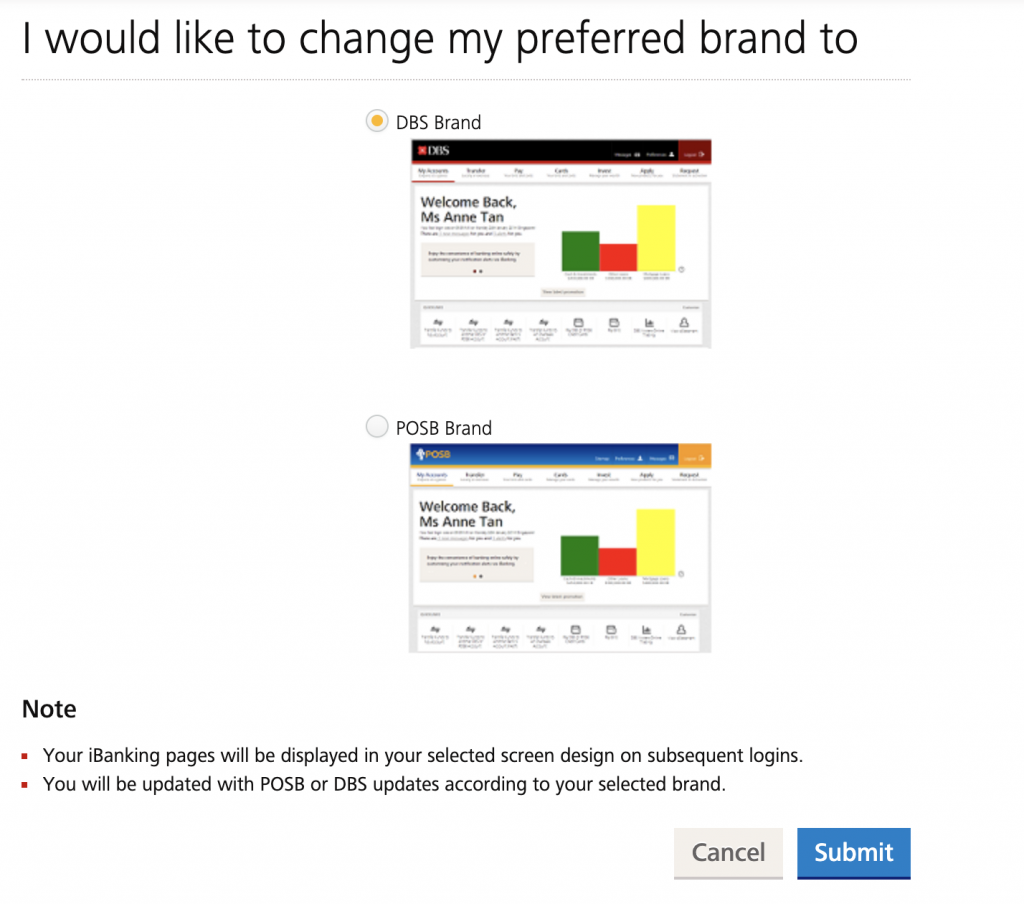

You can change the skin of the web platform

When you use the mobile web platform, it does not matter whether you login to DBS or POSB.

You will still be greeted by the same interface.

In fact, you are even able to change the skin of the platform to the one your prefer!

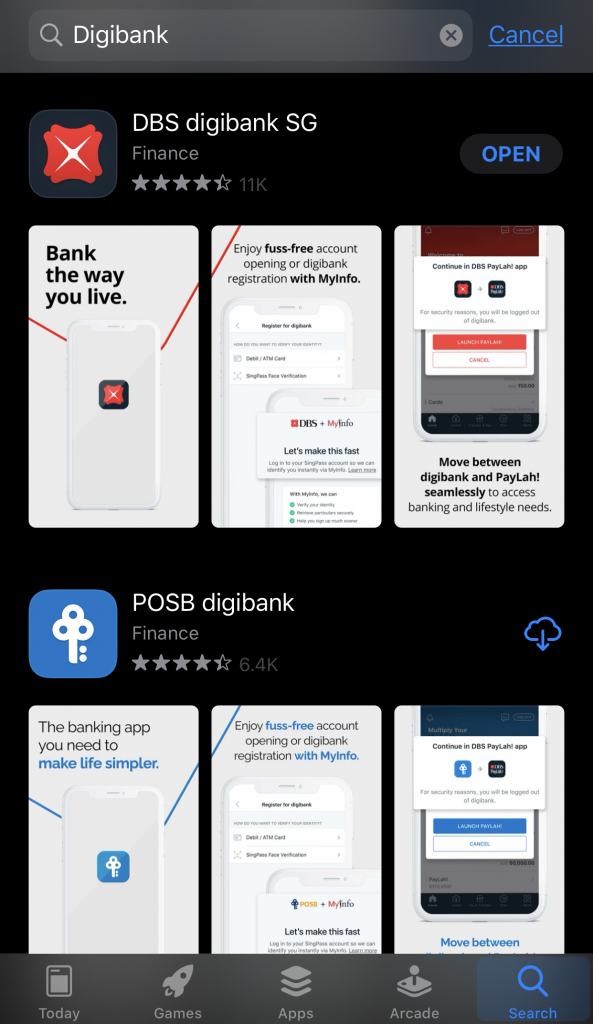

Different mobile apps that serve the same purpose

You can find both the DBS and POSB digibank apps on the App Store.

In actual fact, they are exactly the same mobile app, just with a different skin!

One thing you may want to note is that you can’t be logged into both apps. You will be forced to logout of one app to be able to login to the other.

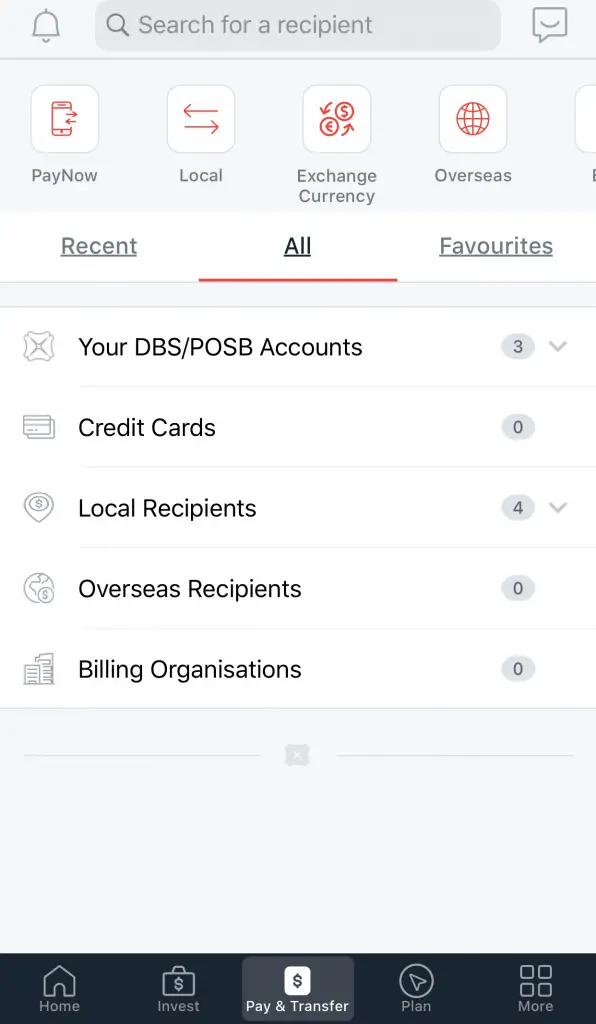

Your DBS and POSB bank accounts can be seen together

On the digibank platform, your DBS and POSB accounts will be combined into a single section too.

This makes it easy for you to transfer between your accounts.

You can combine your balances from your DBS / POSB accounts with accounts from other banks using SGFinDex as well!

#5 PayLah!

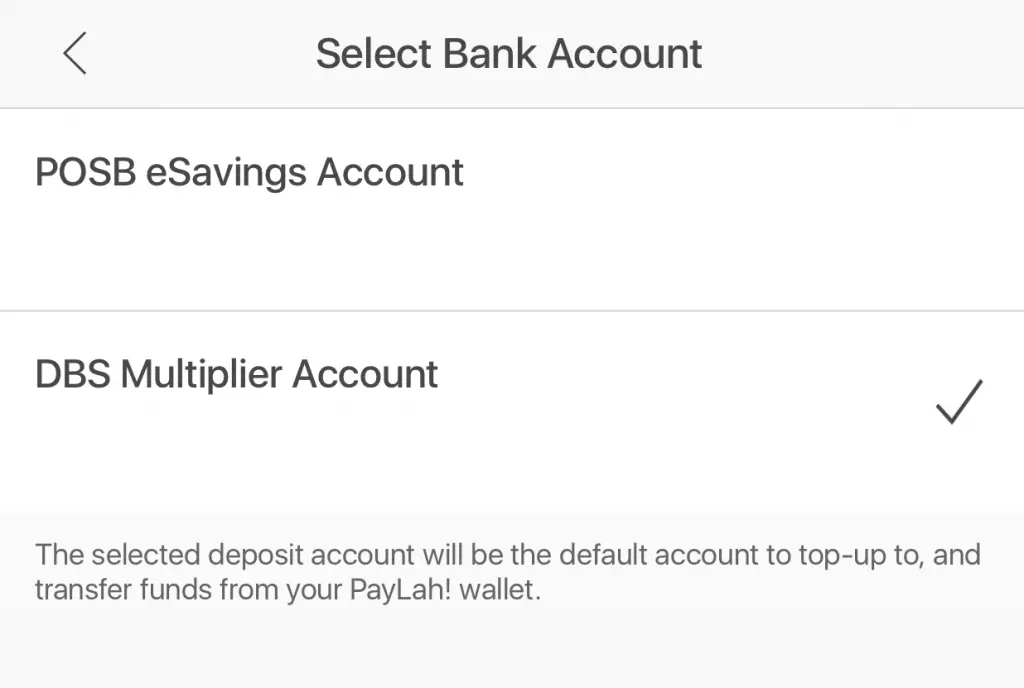

When you sign in to your PayLah! mobile wallet, you are required to link a bank account to the wallet.

This allows you to easily transfer money between your mobile wallet and bank account.

If you are a digibank user, you are able to link any POSB or DBS account that you have.

After choosing your linked bank account, you are able to withdraw money from PayLah! to your bank account.

#6 Credit and debit cards

DBS and POSB have their own debit and credit cards:

| Card | DBS | POSB |

|---|---|---|

| Debit Cards | DBS Visa Debit Card DBS Takashimaya Card | PAssion POSB Debit Card HomeTeamNS-Passion- POSB Debit Card |

| Credit Cards | DBS Altitude DBS Black DBS Live Fresh DBS Woman’s Card SAFRA DBS Card | POSB Everyday |

The two POSB debit cards are something that you can consider to use with the POSB Save As You Serve Account.

Even though you only have a POSB bank account, you are able to apply for a DBS debit card as well!

In the same manner, you are also able to apply for DBS credit cards too.

This is because you are using your digibank account to apply for these cards.

Your credit card bills will be deducted using digibank

When you wish to pay for your credit card bills, you will have to select where your bills will be deducted from.

Since you are using the digibank platform, you can choose to deduct the bill from either your POSB or DBS bank account!

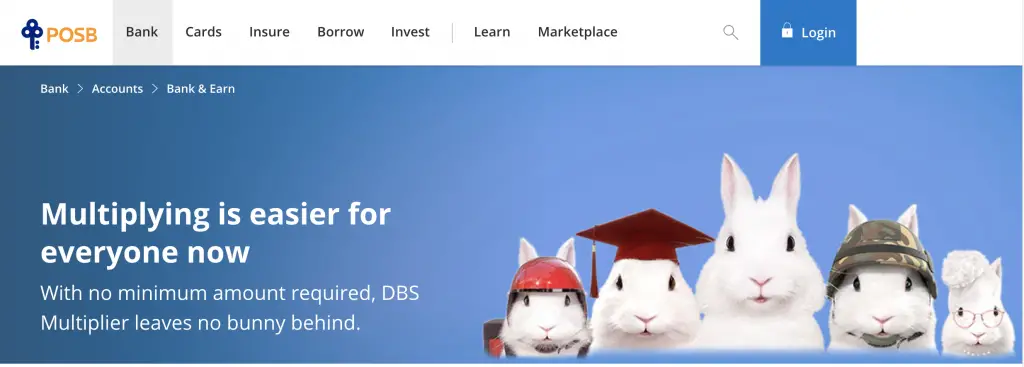

#7 Salary credit for DBS Multiplier

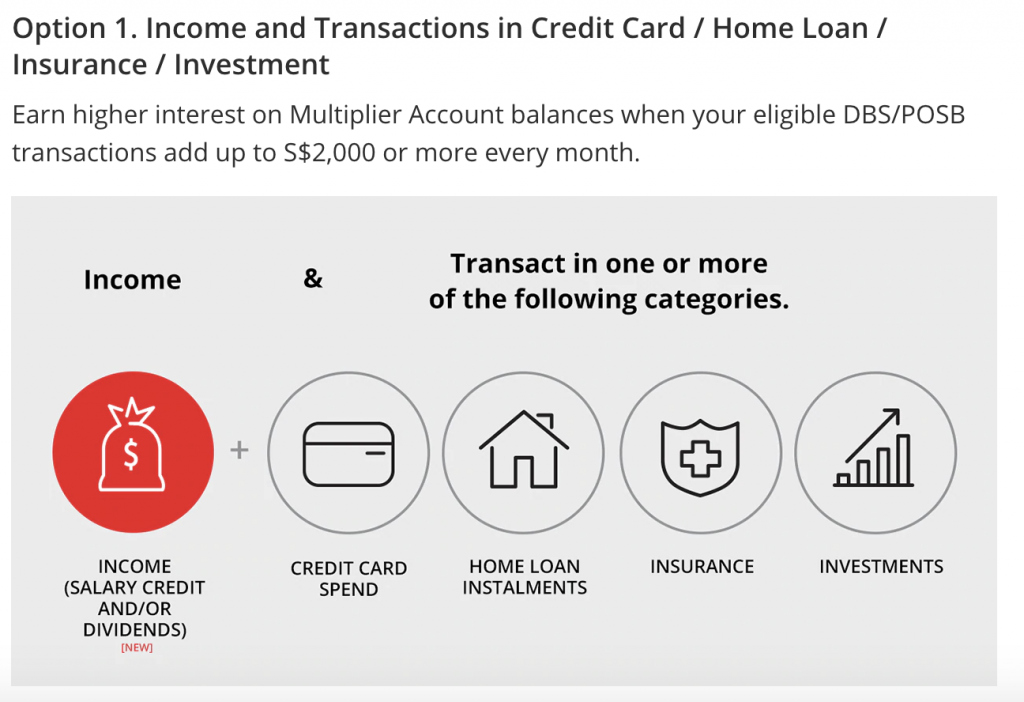

The DBS Multiplier is a high yield savings account offered by DBS. One of the requirements to earn a higher interest rate is to credit your salary into the account.

Even though it is considered as a DBS bank account, you can still credit your salary to a POSB account.

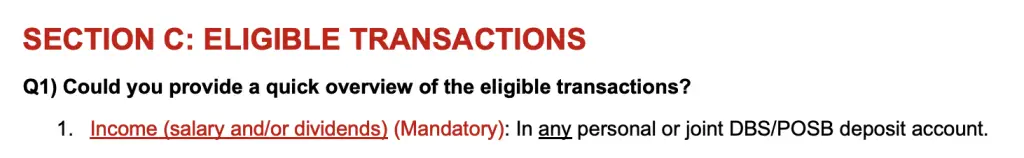

Under the Multiplier’s FAQs, your salary can be credited into any joint or personal DBS / POSB account.

Even when you credit your salary to a POSB account, you will get to enjoy the higher interest rates!

If you are a NSF, you can find out how the DBS Multiplier can help you to earn some extra interest.

#8 DBS Vickers account

When you want to open a DBS Vickers account to start trading, you are required to have either a POSB or DBS account.

This allows DBS Vickers to deduct any money you owe them directly from your linked account.

If you would like to use a broker with more affordable commissions, you can consider Tiger Brokers instead.

#9 Invest Saver

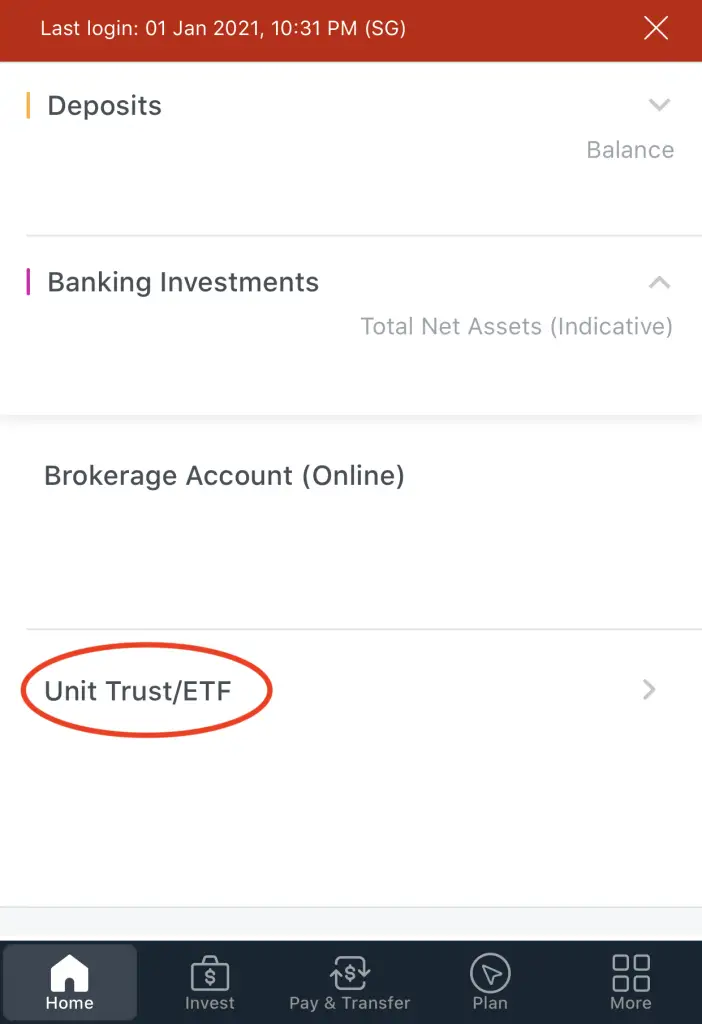

Both DBS and POSB allow you to invest in a regular savings plan. However, it does not matter whether you invest using POSB or DBS.

In the end, your regular savings plan will still appear on the digibank app under Unit Trust / ETF.

As such, investing in the DBS or POSB Invest Saver is essentially the same thing.

#10 SRS Account

It does not matter whether you apply for a DBS or POSB SRS account. In the end, your SRS account will still be in your digibank account.

There are many things that you can invest your SRS funds in, such as:

- StashAway Income Portfolio

- ETFs like S27, O87, MBH and A35

- Cash management solutions like Endowus Cash Smart

#11 Bank and SWIFT codes

Any account that belongs to both POSB and DBS will share the same bank code (7171). These accounts will also have the same SWIFT code (DBSSSGSG).

The SWIFT code is more applicable if you wish to receive money from an overseas account.

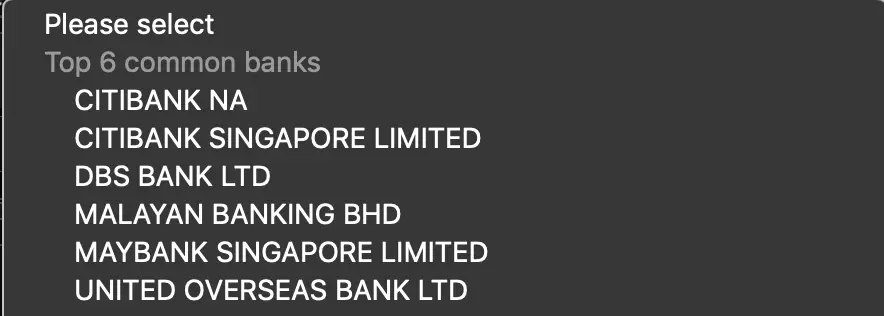

When you want to transfer money from OCBC to a POSB account, you may realise that you can’t find POSB on the list.

This is because your POSB accounts are also under ‘DBS BANK LTD’!

Are POSB account numbers the same as DBS?

POSB account numbers are different from DBS. POSB accounts have an additional branch code that you will need to add to your account number (081). For DBS accounts, the branch code is the first 3 digits of your account number.

This is another way that the 2 banks are different from each other.

Conclusion

DBS and POSB mainly differ in terms of their branding. When it comes to all other parts of the banking services, they are essentially the same bank!

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?