Last updated on June 6th, 2021

Have you wanted to withdraw cash, but the ATM queues are too long?

Or perhaps the nearest ATM is too far away from your current location.

You will not need have this problem with SoCash. It gives you an option to withdraw cash from shops in your neighbourhood!

Here’s how this app helps to make withdrawing cash more accessible.

Contents

SoCash Review

SoCash provides an alternative way for you to withdraw money, even without your ATM card. The main drawback of this app is that it can be rather slow and laggy at times.

Here is SoCash reviewed in depth:

What is SoCash?

SoCash is a FinTech firm started by its CEO, Hari Sivan. It allows you to withdraw cash from minimarts and supermarkets, just by scanning a barcode.

Hari believes that even when countries are going cashless, there is still a need for cash.

SoCash thus provides an alternative option for you to withdraw cash instead of ATMs.

This makes withdrawing cash even more convenient and accessible for you!

How does SoCash work?

SoCash allows you to withdraw cash from their partner merchants. After making a bank transfer to SoCash, you will receive a barcode that the merchant can scan. The merchant will then hand over the cash to you.

Here’s how SoCash works in detail:

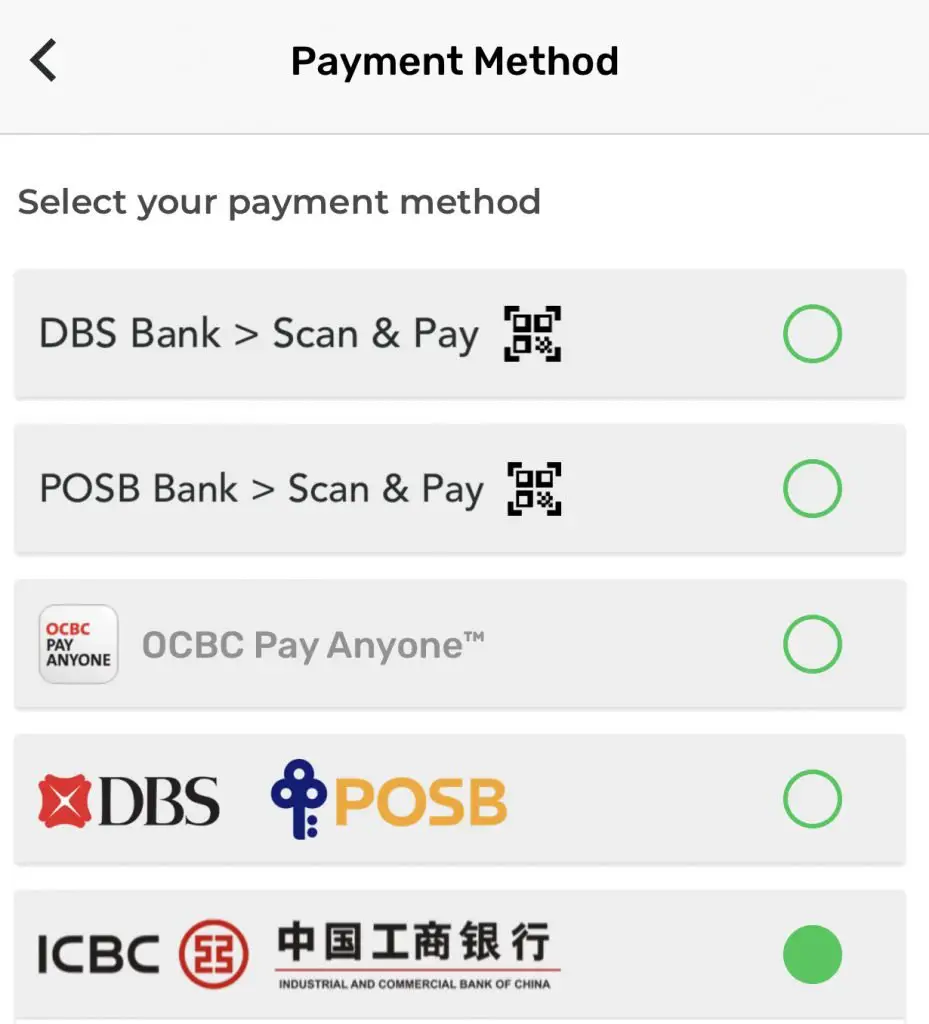

#1 Select Your Payment Method

There are 4 payment methods you can select via the app.

These include:

- DBS / POSB

- ICBC

- OCBC PayAnyone

- DBS Bank (PayNow)

SoCash does not allow you to use UOB as a payment method at this time.

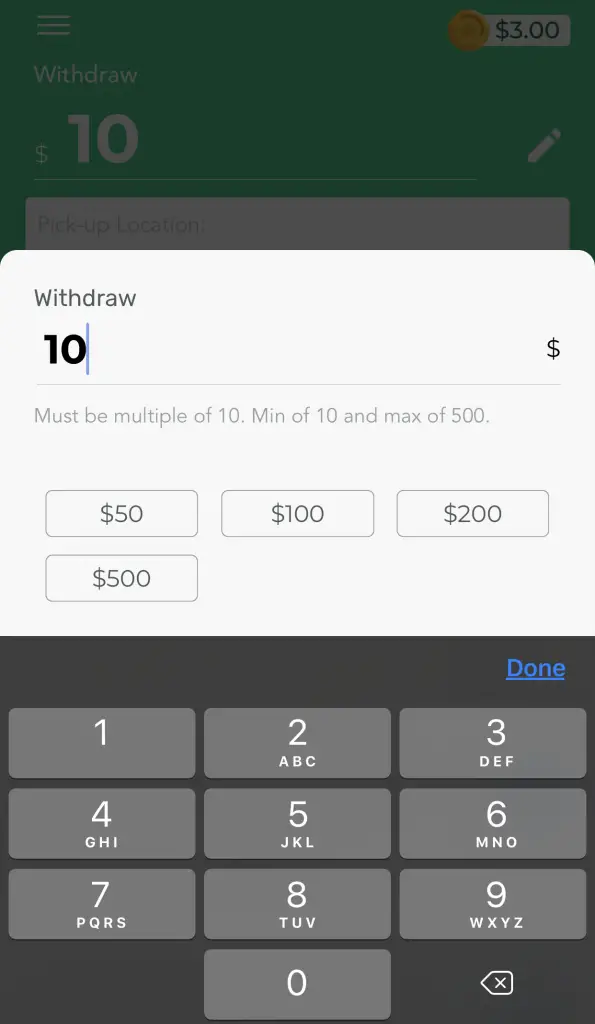

#2 Select the amount you wish to withdraw

You will need to select the amount you wish to withdraw.

You can only withdraw in multiples of $10.

Maximum withdrawal limits

SoCash has a maximum withdrawal limit of $500 per transaction. However, the daily, monthly and yearly limits depend on each bank.

For example, here are the transaction limits for ICBC.

| Type of Limit | Limit Amount |

|---|---|

| Daily | $600 |

| Monthly | $5,000 |

| Yearly | $10,000 |

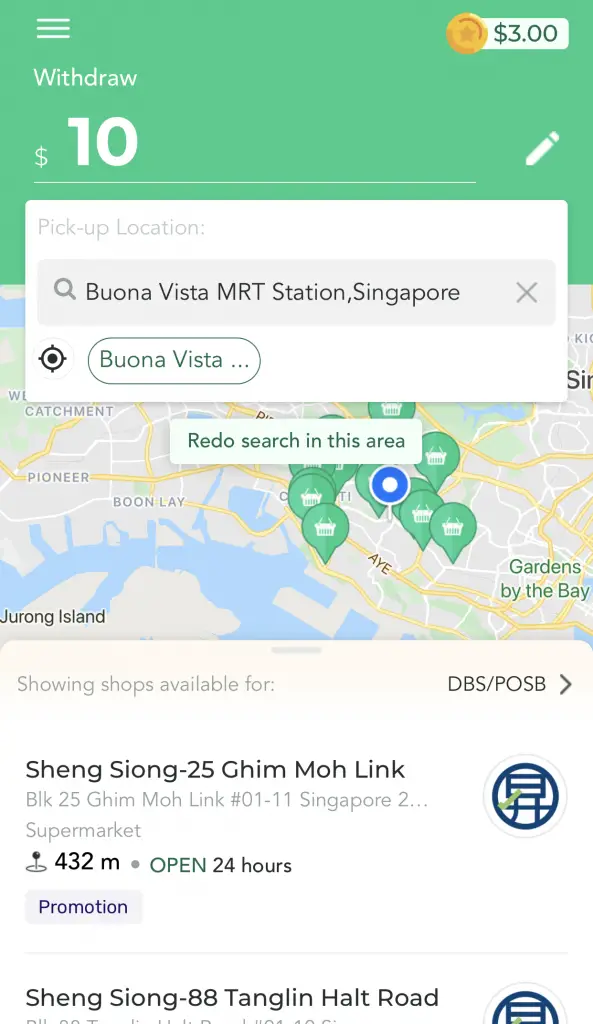

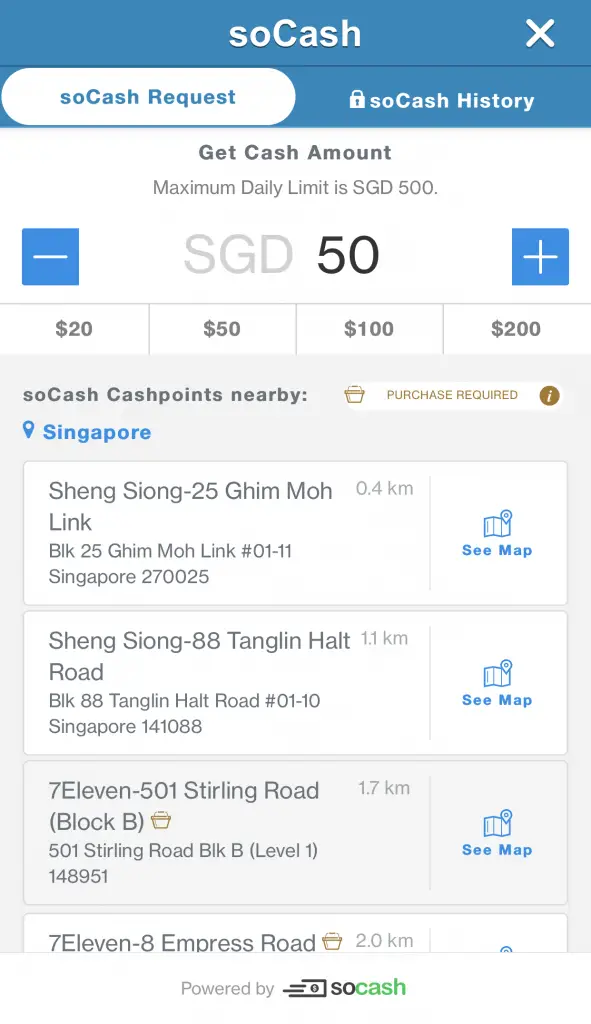

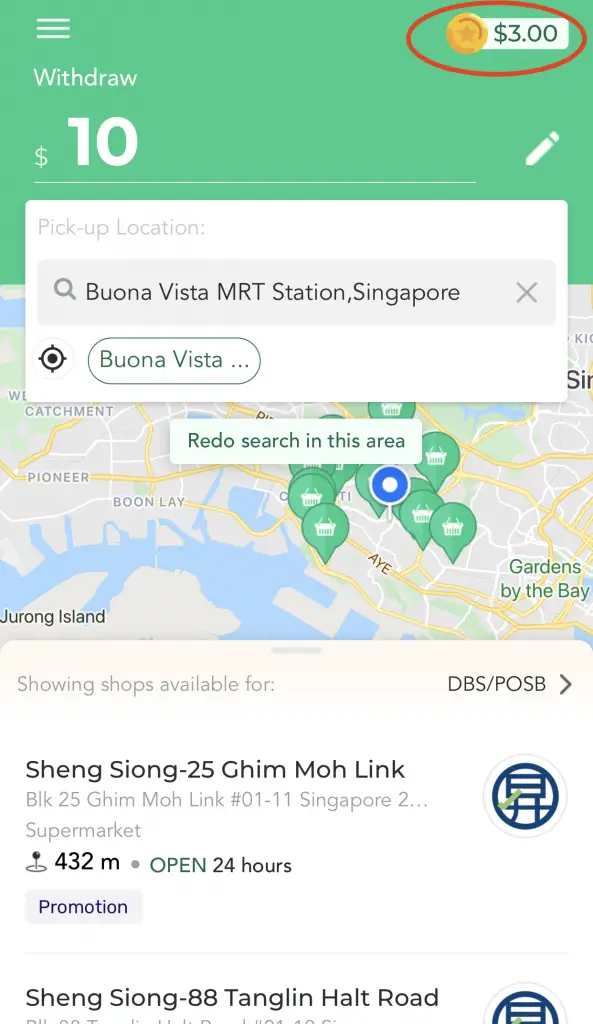

#3 Select a merchant to withdraw cash from

Based on your location, you can choose to withdraw from nearby merchants.

Some of the merchants that SoCash partners with include:

- Sheng Siong

- Hao Mart

- UStars Supermarket

- Killiney

- 7-Eleven

- Buzz

- Phoon Huat

- Prime Supermarket

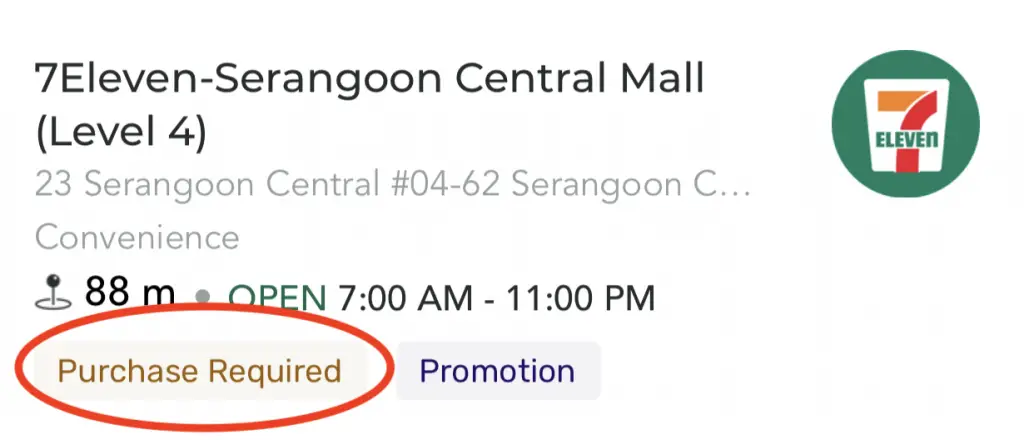

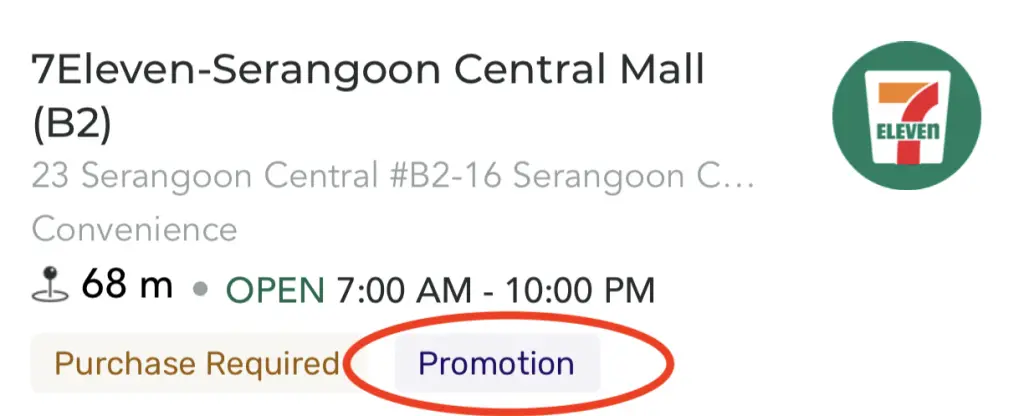

Some shops such as 7-Eleven may require you to make a purchase before you can withdraw cash from them.

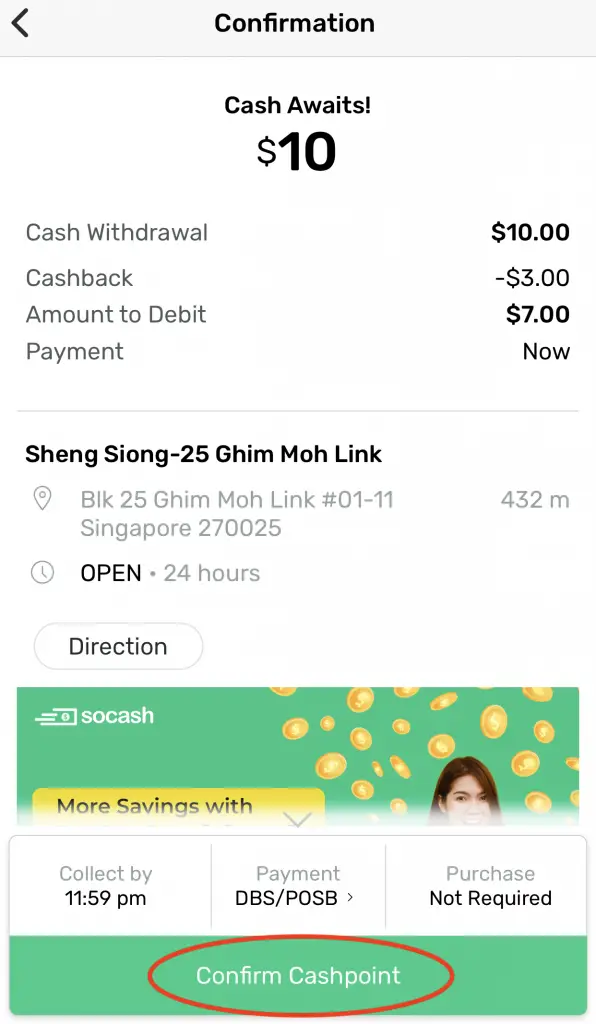

#4 Transfer money to SoCash via iBanking

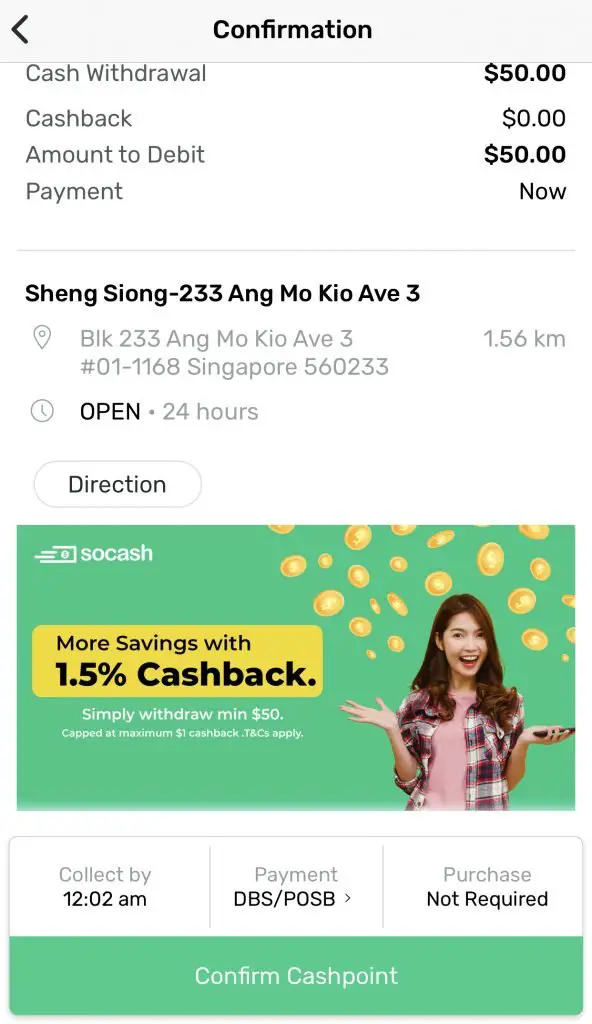

Once you’ve selected your merchant, you will need to confirm the cashpoint.

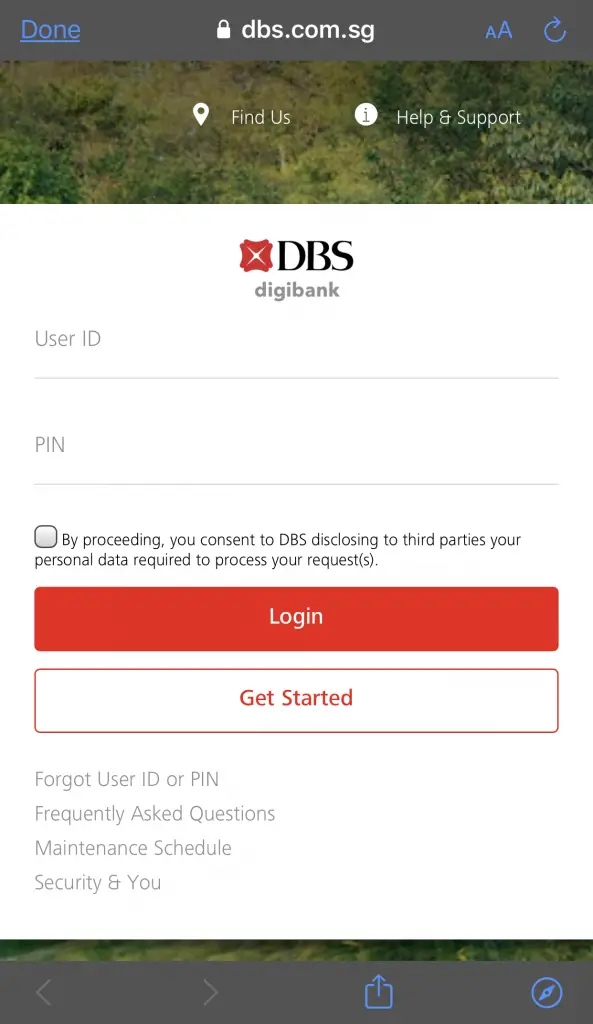

You will then be redirected to your iBanking platform to transfer the money to SoCash.

I used DBS for my payment method.

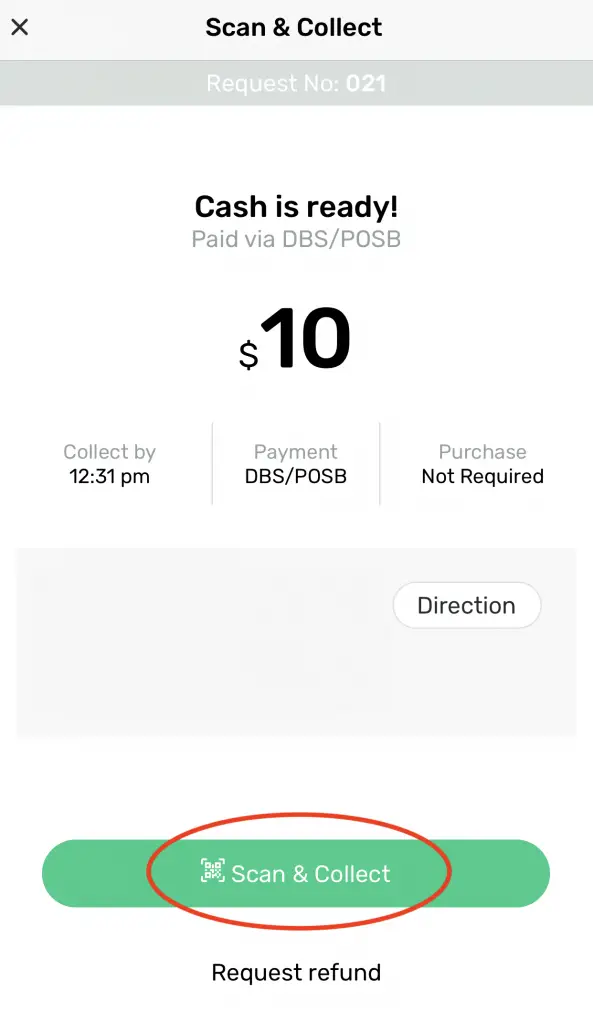

After successfully transferring the money, you will need to tap on ‘Scan and Collect‘.

You are also able to request for a refund if you wish to do so.

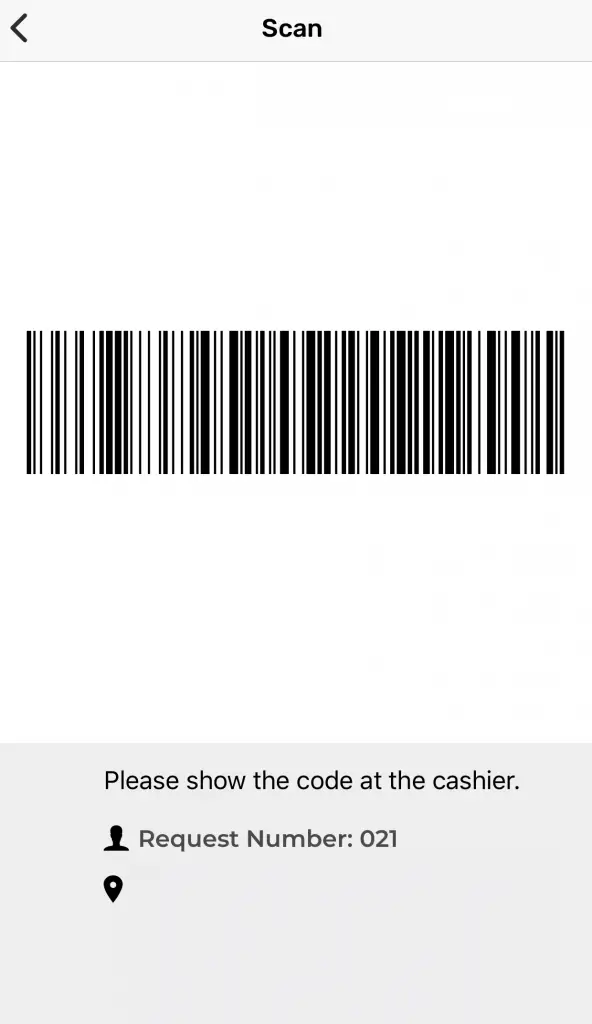

You will be given a barcode that you’ll need to let the merchant scan.

I would suggest to do these steps before going to the merchant. The app can be a bit laggy, so you may want to have some extra buffer time!

#5 Collect your money from the merchant

After scanning the barcode, the merchant will pass you the cash.

You will receive a receipt in your email too.

And that’s all you need to do to withdraw your cash!

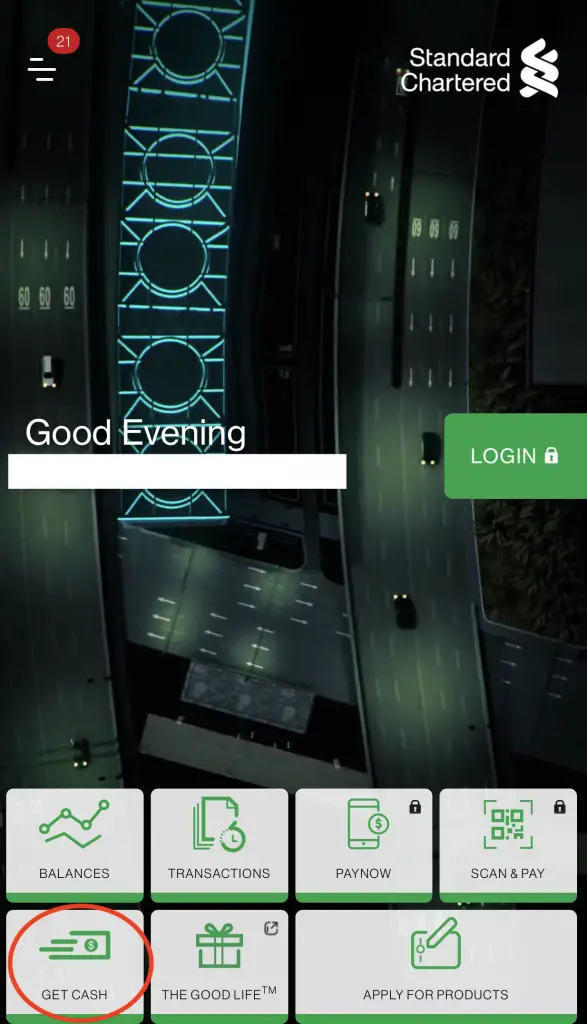

Alternative: Standard Chartered mobile banking app

You aren’t able to use Standard Chartered as one of your payment methods in the SoCash app.

However, you are able to use the SoCash service in Standard Chartered’s mobile banking app.

Similar to above, you can choose the merchant to withdraw your cash from.

How does SoCash earn money?

SoCash earns revenue from the transaction fees they charge banks for each withdrawal. To ensure that consumers make more withdrawals, they will have to expand their network of merchants too. They attract merchants to their network by offering them increased footfall and a commission for each withdrawal made.

Here’s a quote by SoCash’s CEO, Hari Sivan, in a previous interview:

Our business is primarily driven by the number of transactions, which in turn is driven by the size of our network and the number of banks or financial institutions partnering us.

Hari Sivan

Here’s how SoCash’s business model works in detail:

#1 SoCash earns revenue from banks

SoCash provides an attractive option for banks.

Currently, banks rely on ATMs and bank branches to distribute cash to consumers.

However, SoCash estimates that banks are paying around USD$200 million a year on ATM expenses!

As such, SoCash offers banks to use merchants as their virtual ATMs instead. Banks no longer need to maintain so many ATMs. This reduces their costs significantly.

For each withdrawal made by a customer, SoCash will charge the bank a transaction fee.

This transaction fee is how SoCash generates its revenue.

#2 Expansion of merchant network

To allow customers to make more withdrawals, SoCash must expand their network of merchants. This will make SoCash more accessible for customers to make withdrawals.

To increase the number of merchant partners, SoCash provides these benefits to merchants:

- Increased footfall for merchants

- Receiving a cut of the transaction fee

1. Increased footfall for merchants

SoCash helps to increase the flow of customers into their merchants’ stores.

Most merchants do not require you to make a purchase before you can make a withdrawal. However, when you are at their store, you may decide to buy something else too.

This helps to increase the business for that merchant!

2. Receiving a cut of the transaction fee

Moreover, SoCash gives the merchant a commission for each successful withdrawal.

With these perks being offered to merchants, it is hoped that more of them will be a SoCash partner.

As such, this allows SoCash to expand their network of merchants.

Business model looks sustainable

SoCash’s business model looks pretty sustainable.

They mainly rely on 2 things:

- There must be a large network of merchants that act as cashpoints

- There must be enough withdrawals made by consumers

If there are enough withdrawals made, SoCash should be able to survive in the long run.

What are the benefits of SoCash?

Here are 4 benefits of using SoCash:

#1 Greater convenience in withdrawing cash

I rarely withdraw cash as the nearest ATM is rather far from my house.

However, SoCash provides me with greater convenience. I am now able to withdraw cash at nearby merchants!

Moreover, the withdrawal process may be even faster than withdrawing from an ATM.

All you’ll need to do is present the barcode to the merchant to scan. You’ll be able to receive your cash right away!

SoCash does provide a lot of convenience when you are looking to withdraw cash.

#2 No transaction fees

Currently, SoCash does not charge consumers any fees for using this service. As such, it provides a great alternative option to queuing up at ATMs.

Hopefully SoCash will continue not to charge us any transaction fees!

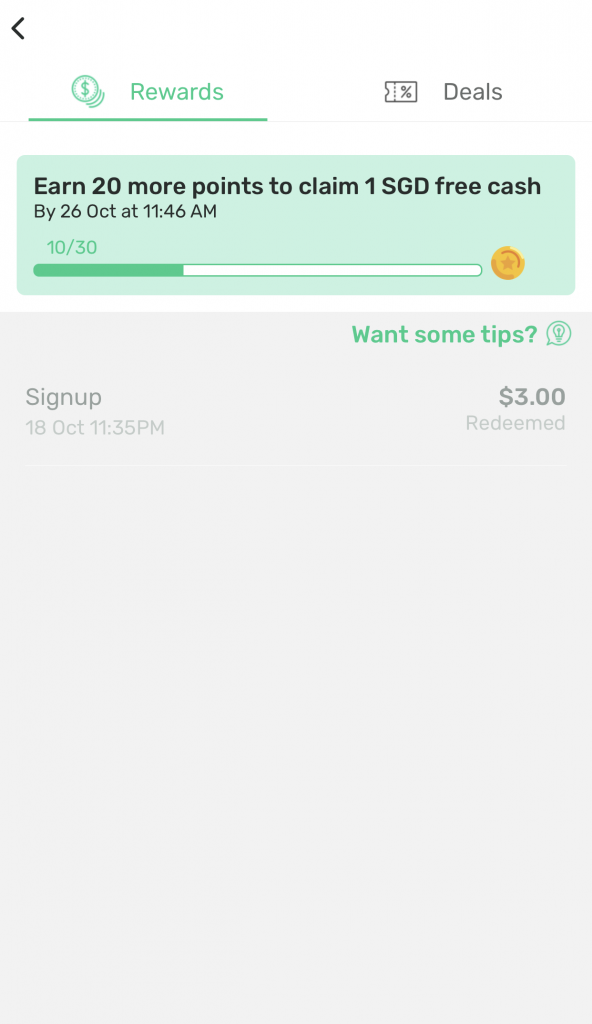

#3 Rewards

You are able to receive rewards when you make 3 withdrawals within a 7-day period.

You will need to make 3 qualifying transactions (min $30) on 3 different days. Moreover, you will need to make the other 2 transactions within 7 days of your first transaction.

This will give you a $1 cashback on your 4th transaction!

If you are constantly in need of cash, this can help you to be rewarded when you make withdrawals.

#4 Promotions

There are promotions that are available when you withdraw cash from certain cashpoints.

These merchants will have the ‘Promotion’ label.

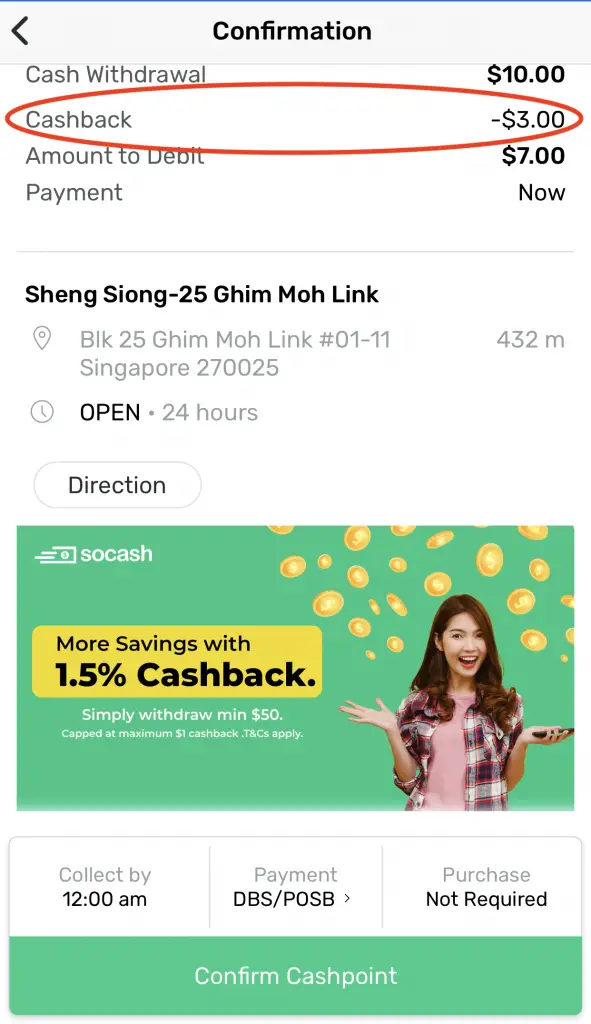

Currently, the only promotion that is running is the 1.5% cashback.

When you withdraw a minimum of $50, you will be eligible for a 1.5% cashback.

However, this cashback is capped at a maximum of $1.

Is SoCash safe?

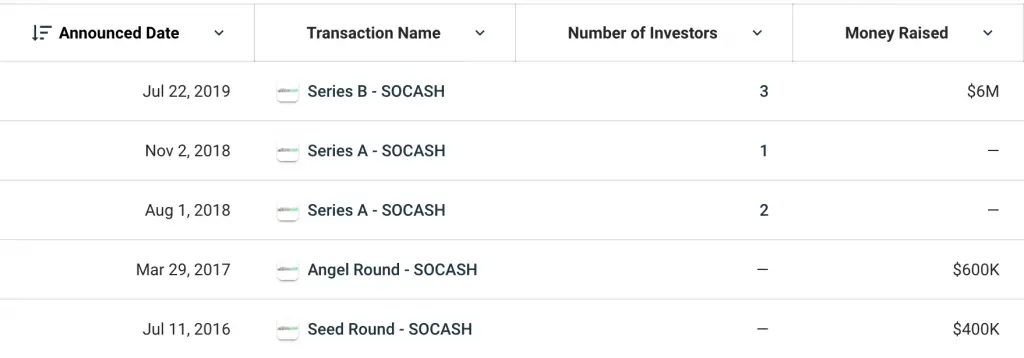

SoCash has received backing from both the MAS and investors. Moreover, their payment methods require you to use mobile banking platforms which are secure.

Based on Crunchbase, SoCash has managed to receive their Series A and Series B fundings.

If a company is able to receive funding, it shows that investors have confidence in their business prospects.

Moreover, SoCash was one of the few firms that received the Financial Sector Technology and Innovation (FSTI) Scheme Proof-of-Concept grant from the Monetary Authority of Singapore (MAS).

This grant also shows that MAS is keen to help SoCash in its developmental stage.

As such, SoCash is a rather safe service to use.

Conclusion

Here are the pros and cons of using SoCash.

| Pros | Cons |

|---|---|

| Fast and convenient withdrawals | App is a bit laggy |

| Able to transfer money via different payment methods | UOB accounts are not accepted for payment |

| Cashback and promotions available | |

| No transaction fee for withdrawals |

The major disappointment about this app is that it is rather laggy. Being a FinTech firm, I expected the app to have a better user experience.

Nevertheless, SoCash is a great alternative to ATMs. If you are ever in need of cash, you may want to consider popping into your nearby minimart!

You can find out other ways that you can withdraw cash without needing an ATM card too.

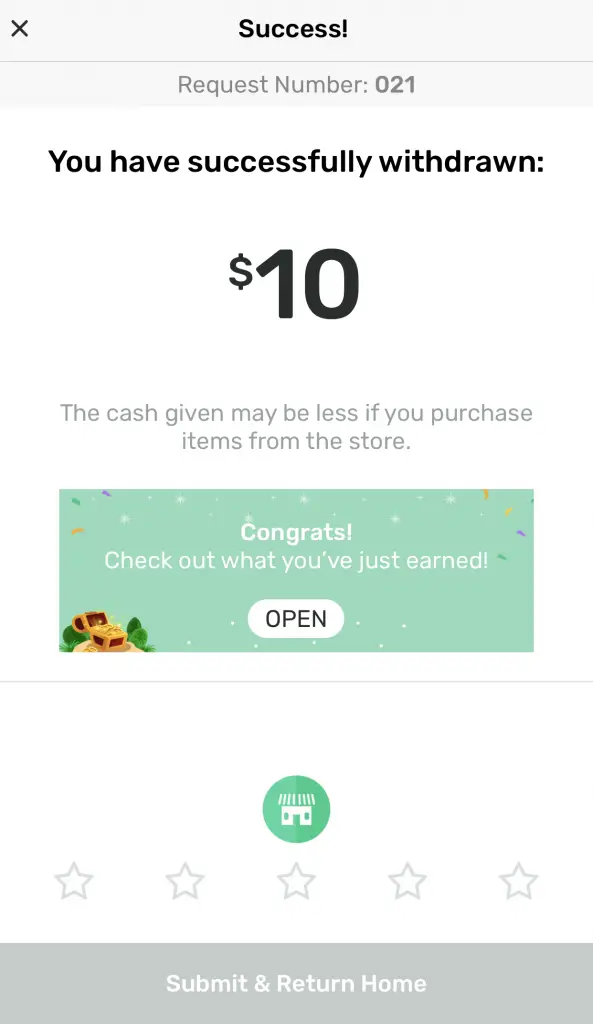

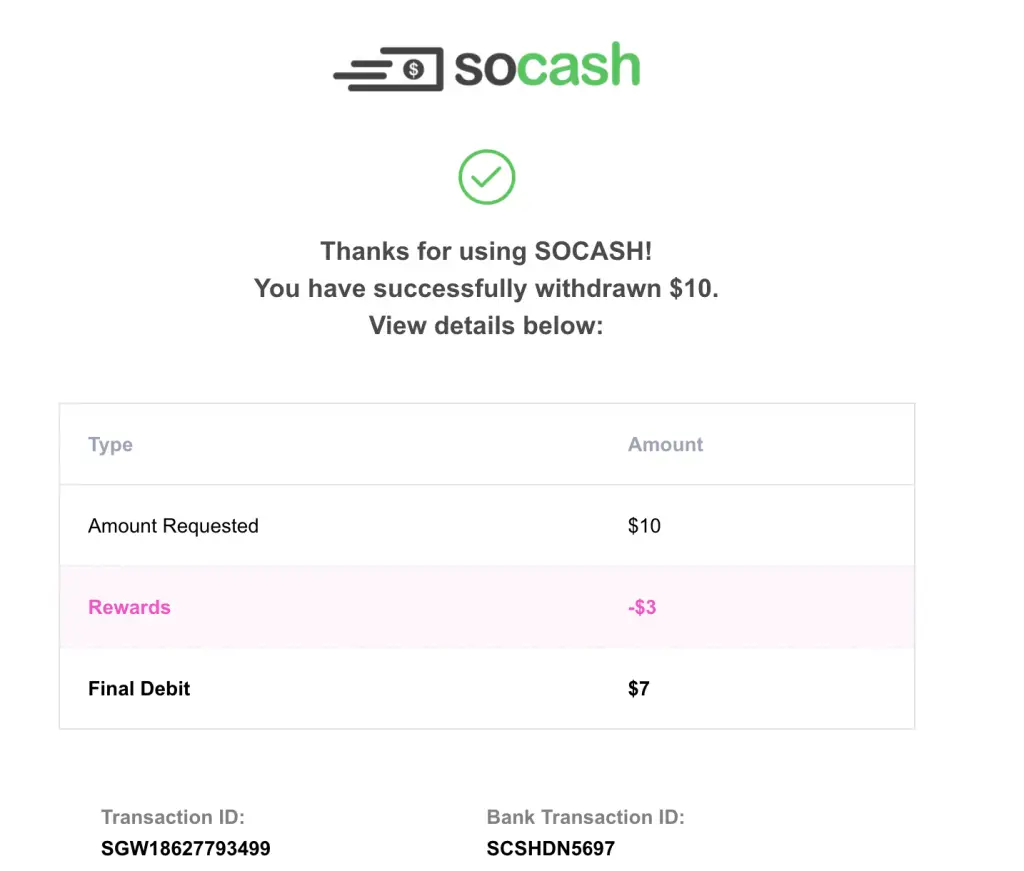

SoCash Referral (Get $3 off your first withdrawal)

If you would like to use SoCash, you can sign up using my referral link. You will get $3 off your first withdrawal.

For example, if you wish to withdraw $10, you will only need to transfer $7 to SoCash.

Here’s how you can get your free $3:

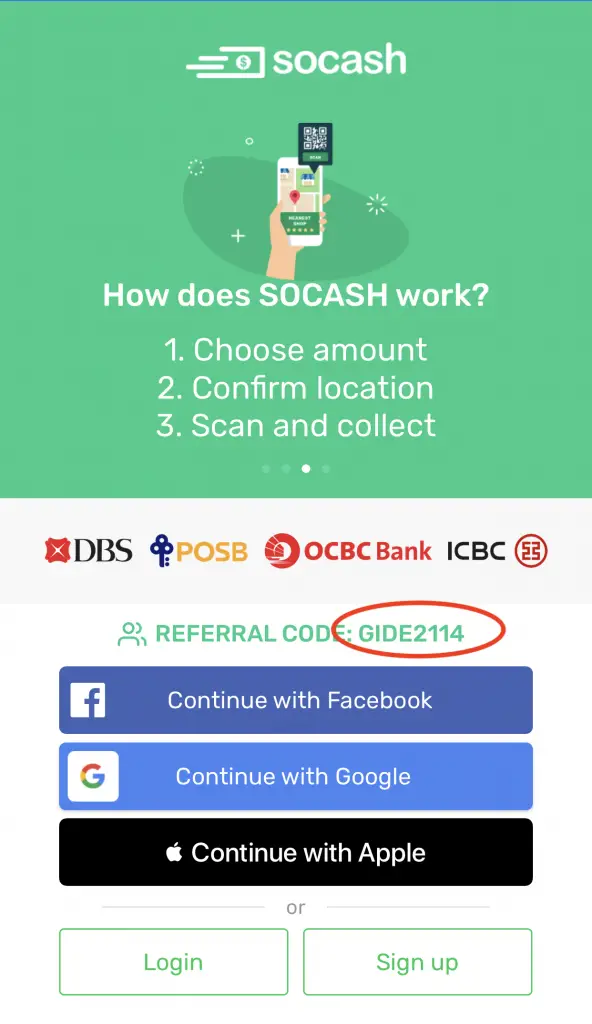

#1 Use my referral link

When you click on my referral link, you will be redirected to download the app.

#2 Sign up for an account

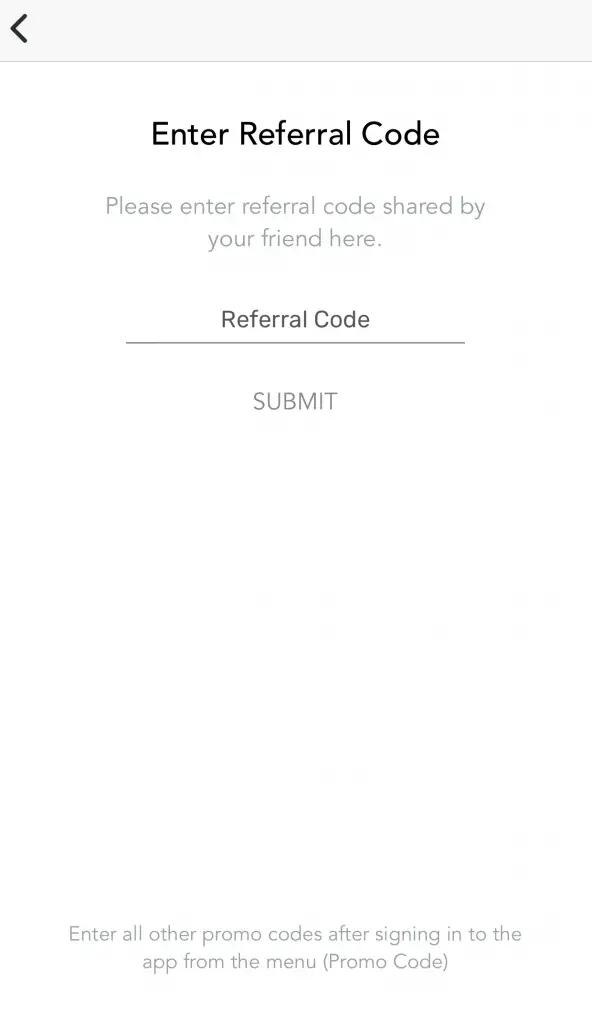

You will be given different options to create your account.

My referral code should already be included too.

Alternatively, you can enter my referral code ‘GIDE2114‘ into the field if it’s empty.

#3 Receive your $3 referral bonus

Once you’ve completed the signup process, you should receive the $3 reward.

You are able to claim this cashback when you make your first withdrawal!

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?