Last updated on June 6th, 2021

If you have taken a Tuition Fee Loan with OCBC, you may have created a FRANK account.

However, you may also have heard that the Standard Chartered JumpStart Account is the best account for students.

Which account should you be using for spending and saving?

Here’s a breakdown of what these 2 accounts offer:

Contents

Type of Account

JumpStart is a Standard Chartered account, while FRANK is an OCBC account. As such, both of them are normal savings account.

They are both protected under the Deposit Insurance Scheme. If the bank happens to close down, you are insured up to $75k.

Interest rate

Both bank accounts have a tiered interest rate, depending on the amount that you have in your account.

| Tier | FRANK | JumpStart |

|---|---|---|

| Tier 1 | 0.1% for first $25k | 0.4% for first $20k |

| Tier 2 | 0.2% for next $25k | 0.1% for any amount above $20k |

| Tier 3 | 0.05% for any amount above $50k |

JumpStart allows you to earn a higher interest rate on your funds.

Eligibility

Here’s the eligible age that you can apply for both accounts:

| FRANK | JumpStart |

|---|---|

| Minimum 16 y/o | 18-26 y/o |

The FRANK account is more accessible as you are able to create it even when you are 16 years old. In contrast, you can only open a JumpStart account when you reach 18 years old.

You may be thinking of opening the FRANK account when you’re 16 years old. However, you may want to consider the Vivid Savings Account or Etiqa’s GIGANTIQ. These 2 products provide a higher interest rate than FRANK.

Initial deposit

Both accounts do not require an initial deposit. As such, you are able to create both accounts right away!

Fall-below fee

The JumpStart account does not have any fall-below fee.

OCBC FRANK does not have a fall below fee if you are below 26 years old. Once you are 26 years old, the minimum account balance is $1,000.

If you fall below $1,000, you will have to pay a monthly service fee of $2.

As such, JumpStart is the more flexible option as it does not have any minimum account balance at all!

Debit card

Both JumpStart and FRANK come with their own debit cards. Here is a breakdown of both cards.

#1 Debit card design

The JumpStart debit card only has a single fixed design.

In contrast, the FRANK debit card gives you a lot more flexibility.

You are able to choose from 60 different designs.

If you prefer customisability, you may want to go for the FRANK debit card.

#2 Debit card cashback

Both cards will give you a cashback based on the transactions that you make.

JumpStart cashback

You will receive a 1% cashback for any eligible Mastercard transactions that you make when using the JumpStart debit card.

What’s more, there is no minimum spend. This means that you will be able to receive a cashback for any amount that you spend!

The cashback will be credited to your account by the end of each month.

FRANK cashback

The terms and conditions are much more rigid for the FRANK debit card cashback. You are able to receive a 1% cashback if you fulfil these criteria:

#1 Eligible transactions

You are only able to claim your 1% cashback from these transactions:

- Fast food (Visa Merchant Category Code 5814)

- Selected convenience stores

- Selected online merchants

- Selected transport merchants

For convenience stores, online and transport merchants, there are only a few stores that you can claim the cashback from!

#2 Minimum spend requirement

FRANK has a minimum spend requirement of $400. If you hit below the $400 in the eligible transactions, you will not be able to receive the cashback.

Cashback is inflexible and slow

Moreover, your cashback may take a while to be credited into your FRANK account. This is unlike JumpStart which credits your cashback at the end of each month.

I would still prefer to use the JumpStart debit card as:

- The cashback is credited at the end of every month

- More transactions are eligible for cashback

- There is no minimum spend requirement

ATM availability

Even though Singapore is gearing towards a cashless society, there may be times when you need to withdraw cash.

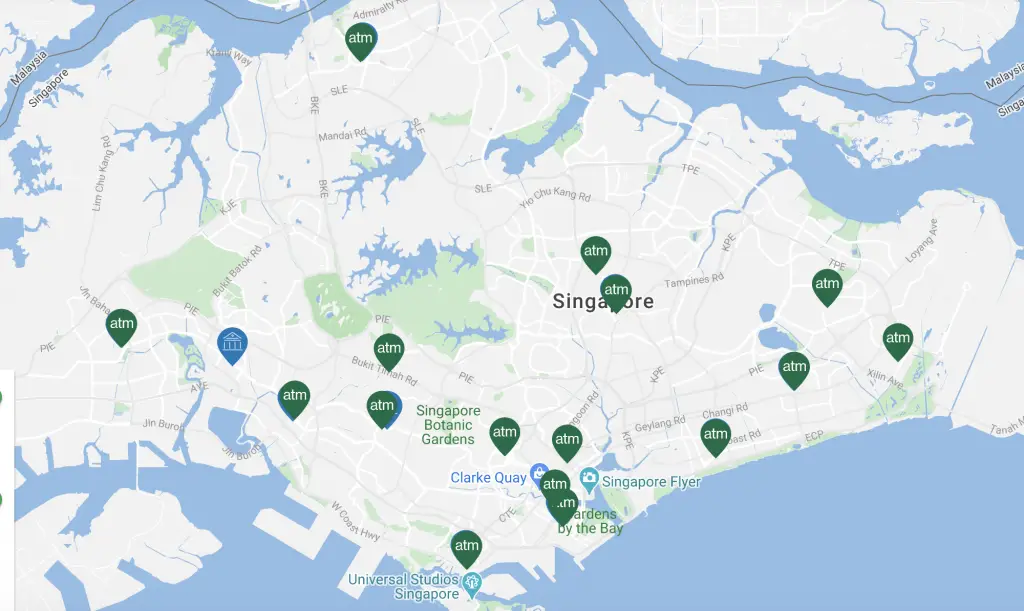

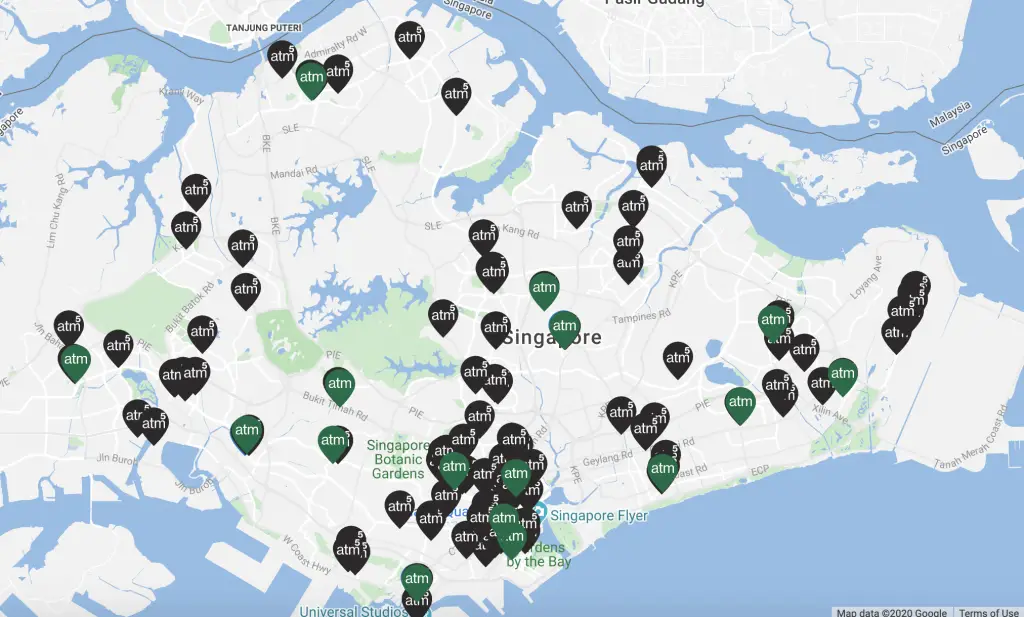

OCBC ATMs

OCBC has an extensive list of ATMs that you can withdraw money from. You should be able to find one that is near your location.

Standard Chartered ATMs

Standard Chartered does have pretty limited ATMs across Singapore.

However, Standard Chartered is part of the atm5 interbank network. This increases the number of ATMs that you can withdraw from your JumpStart account.

Withdraw your money via SoCash

With the high costs of maintaining ATMs, banks may reduce the number of ATMs they have eventually.

However, the FinTech firm SoCash is helping to solve this problem. This firm allows you to withdraw cash from their partner merchants.

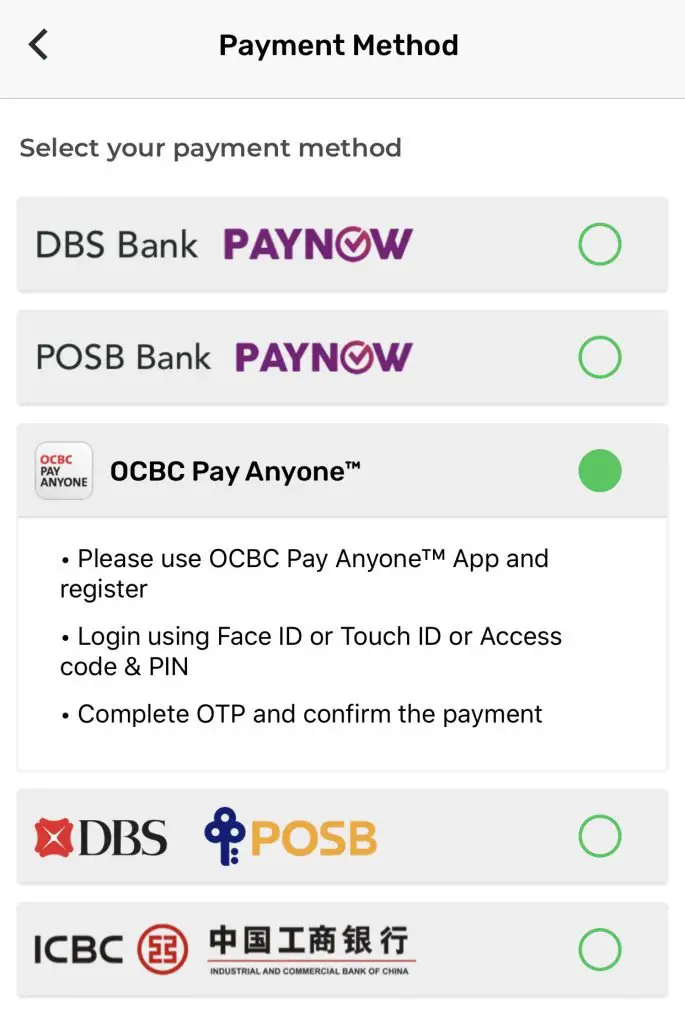

Both OCBC and Standard Chartered are part of the SoCash network.

You are able to withdraw cash using OCBC’s Pay Anyone on the SoCash app.

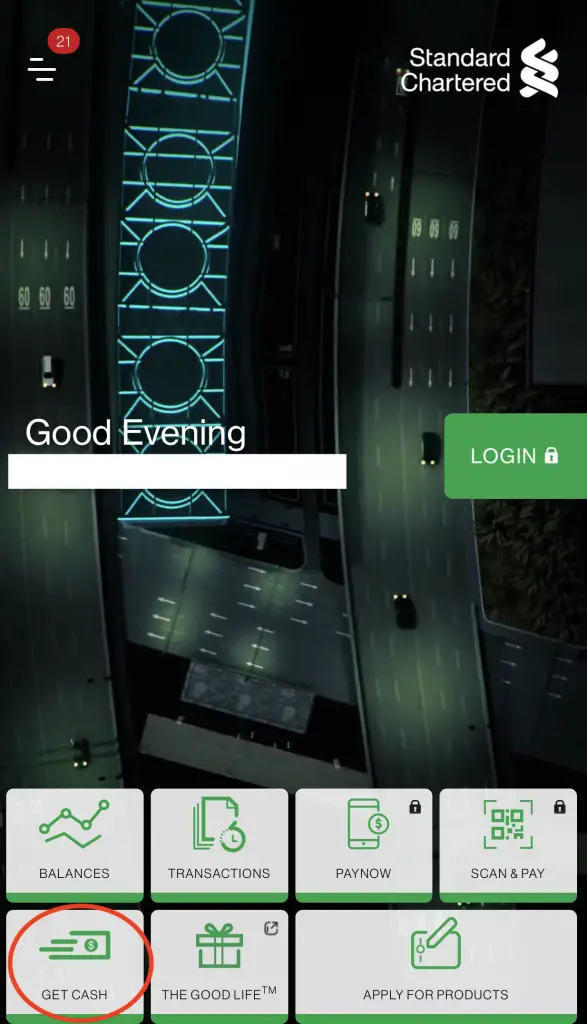

Using a bank account from Standard Chartered is slightly different. You will have to use Socash directly from the Standard Chartered mobile banking app.

As such, the availability of ATMs may no longer be a worry. You are still able to withdraw cash from nearby partner merchants!

Verdict

Here’s a summary of the comparison between OCBC FRANK and Standard Chartered JumpStart:

| Comparison | OCBC FRANK | Standard Chartered JumpStart |

|---|---|---|

| Type of Account | Bank Account | Bank Account |

| Interest rate | 0.1% for first $25k 0.2% for next $25k 0.05% for any amount above $50k | 0.4% for first $20k 0.1% for any amount above $20k |

| Eligibility | Minimum 16 y/o | 18-26 y/o |

| Initial deposit | No initial deposit | No initial deposit |

| Fall-below fee | Waived until 26 y/o $2 if account balance is below $1k | No fall-below fee |

| Debit card design | More than 60 designs | Only one design |

| Debit card cashback | For specific categories and requires a minimum spend | 1% cashback on all eligible Mastercard transactions |

| ATM availability | Higher | Lower |

Based on these comparisons, the JumpStart account is the clear winner here.

It beats the FRANK account in terms of:

- Interest rate

- No fall-below fee

- More flexible cashback

The only thing that it really loses out to FRANK is the ATM availability. However with SoCash, this increases the number of places that you can withdraw cash from!

Is there a reason to open a FRANK account?

With so many disadvantages, should you even be considering a FRANK account?

Some companies may only allow bank transfers to and from bank accounts from the big 3 banks (OCBC, DBS, UOB). As such, you may have issues when you wish to transfer from your Standard Chartered bank account.

I believe that it will still be good to have a DBS or OCBC account. However, the minimum requirement of $1000 for FRANK is pretty steep. I have a FRANK account and I will be closing it once I hit 26 years old.

I will be opening the Monthly Savings Account as the minimum amount is only $500.

JumpStart is still the better option

You may have opened a FRANK account when you applied for a Tuition Fee Loan with OCBC. I believe it is still a good account to keep, at least until 26 years old.

The JumpStart account is better than the FRANK account in almost every aspect. As such, you definitely should have the JumpStart account, especially if you’re a student!

Standard Chartered JumpStart Account Referral (Receive a $10 Starbucks Gift Card)

Are you interested in signing up for a Standard Chartered JumpStart Account?

You can use my referral link (up till 31st May 2021) to sign up for an account. Upon successful registration, you will be able to receive a $10 Starbucks Gift Card!

Here’s what you need to do:

- Sign up for a JumpStart Account

- Deposit ≥ $5k in fresh funds into your JumpStart Account

- Maintain ≥ $5k in your JumpStart Account for 2 calendar months

For more information, you can view the Terms and Conditions on Standard Chartered’s website.

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?