Last updated on June 6th, 2021

Are you sick and tired of checking each individual banking app while consolidating your finances?

This may be a thing of the past with the new SGFinDex feature! Here’s how this services works and how it can make managing your finances so much easier:

Contents

What is SGFinDex?

Singapore’s Financial Data Exchange (SGFinDex) is a feature launched by GovTech. SGFinDex aims to consolidate all of your financial information onto one platform. This information is gathered from both financial institutions and government organisations.

That way, you would not need to check your different bank accounts all the time!

SGFinDex uses API to share the data

To ensure that all the banking databases can be combined together, SGFinDex uses an API to communicate between the banks. This allows all of your data can be presented on one platform.

As such, you can have a good overview of your financial health!

If you would like to find out more about SGFinDex, you can view the MAS infographic.

There are 2 types of institutions that allow you to consolidate all of your financial data:

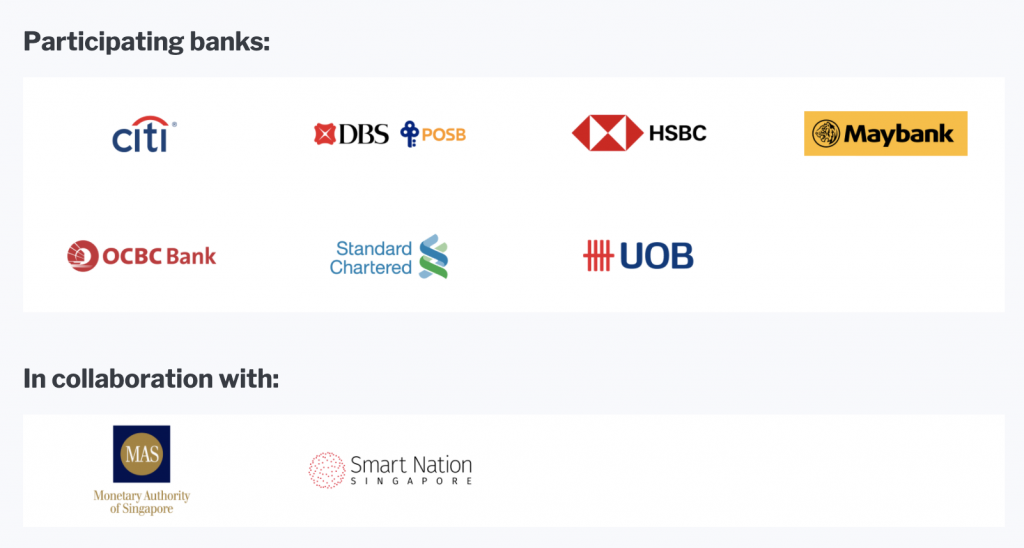

#1 Financial Institutions (i.e. banks)

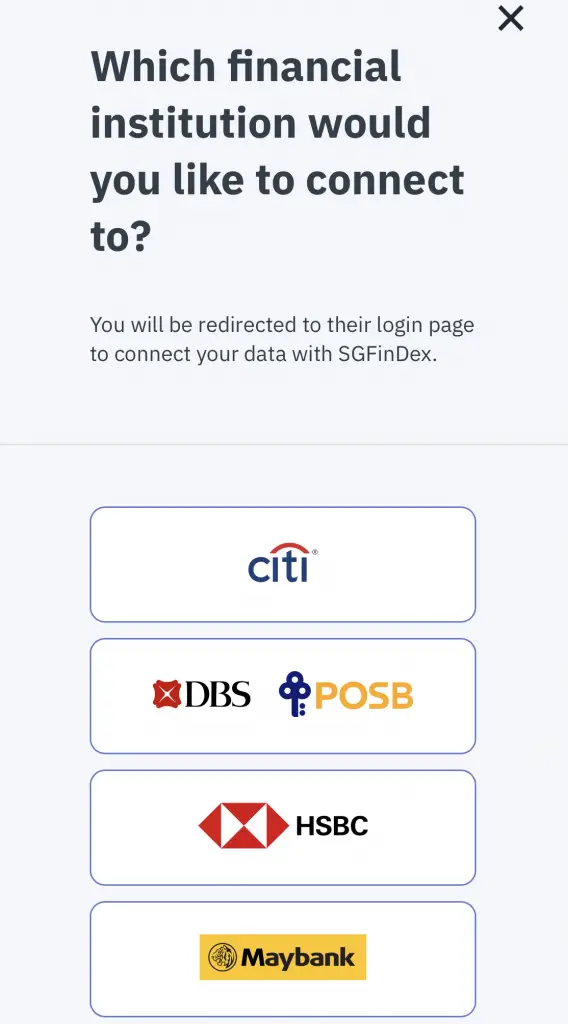

You are able to link your accounts from 7 different banks, including:

- Citibank

- POSB / DBS

- HSBC

- MayBank

- OCBC

- Standard Chartered

- UOB

Unfortunately, you are unable to link your ICBC or RHB savings account.

The type of data that you can retrieve includes:

- Current and Savings Account (CASA) balances

- Fixed deposits balances

- Unit trust holdings

- SRS accounts and holdings

- CPF Investment Scheme (CPFIS) accounts and holdings

- Unsecured and secured loan outstanding balances

Here are some types of secured and unsecured loans that you may incur:

| Unsecured Loans | Secured Loans |

|---|---|

| Credit cards | Home loan |

| Personal loan | Car loan |

I’ve noticed that your PayLah balance will not be included inside SGFinDex as well.

Moreover, regular savings plans like OCBC BCIP and Invest Saver will not be reflected in SGFinDex too.

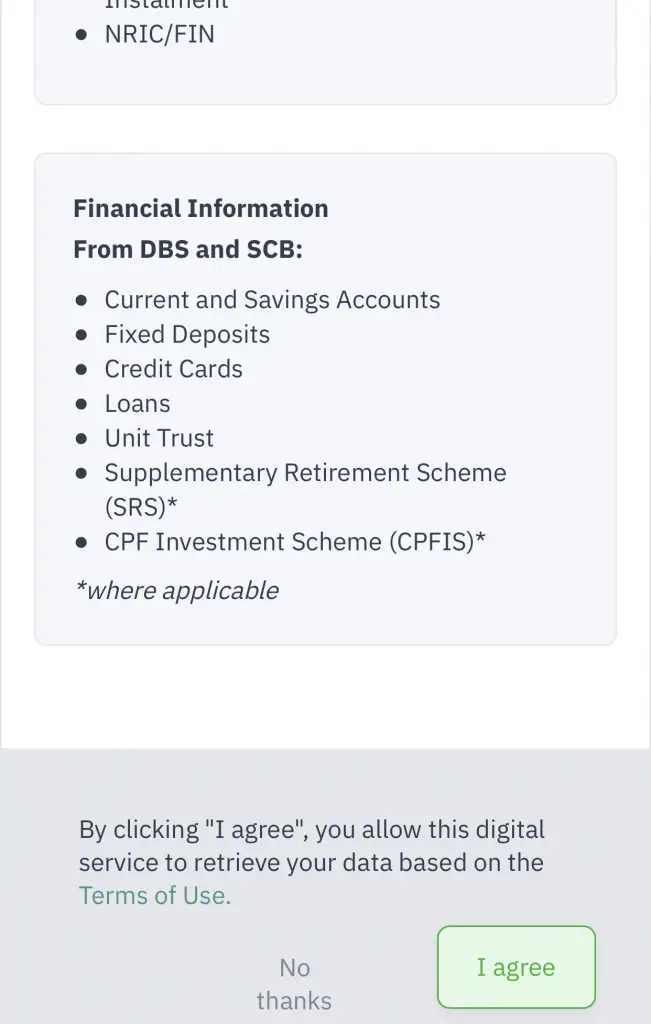

#2 Government Organisations (CPF, IRAS, HDB)

You are able to retrieve financial information from these 3 government organisations too.

The type of information that you’ll retrieve includes:

- CPF Account Balance (OA, MA, SA, RA)

- Notice of Assessment (i.e. your tax bill)

- Outstanding HDB Loan Balance and Monthly Loan Instalment

- NRIC/FIN

How do I link my accounts?

The linking process may be a bit tedious at first. So far, I am only able to access SGFinDex from DBS’ or Standard Chartered’s platforms.

Accessing SGFinDex

Here are the ways that you can access SGFinDex from these platforms:

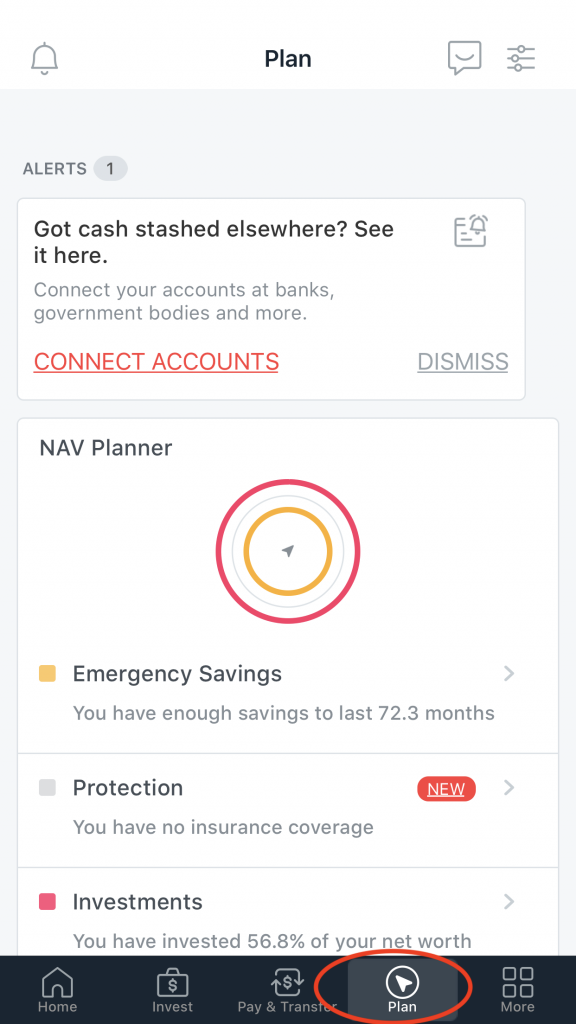

#1 NAV Planner on DBS mobile banking app

You can access SGFinDex via DBS’ NAV planner. You can find the NAV planner on the ‘Plan‘ tab in the mobile banking app,

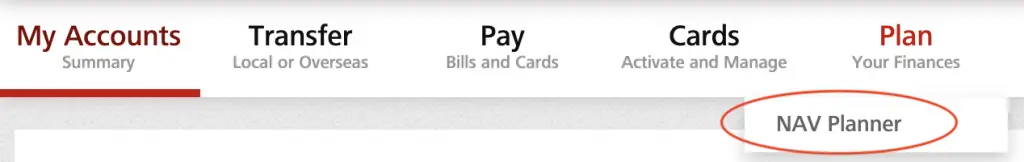

or on the web platform.

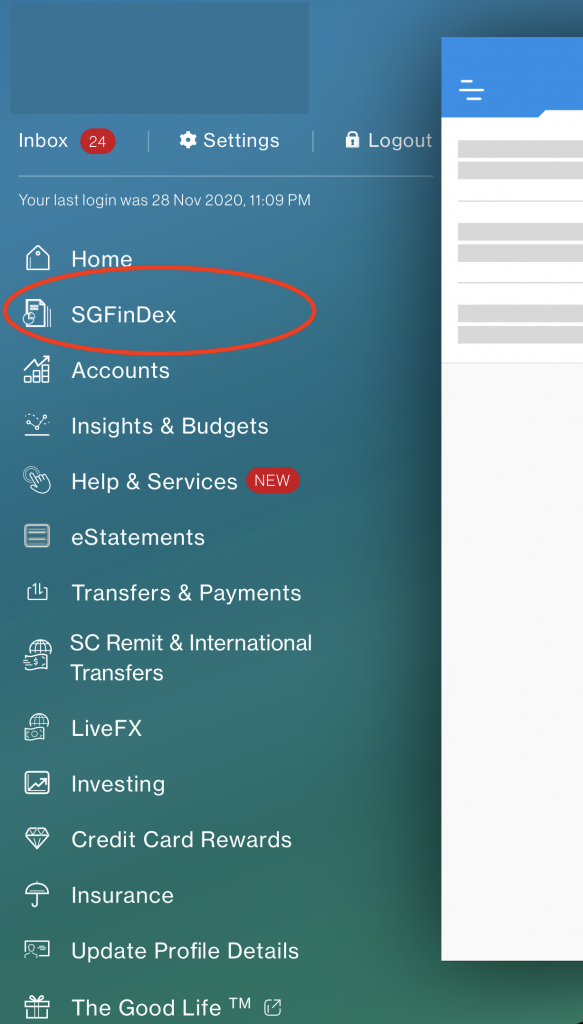

#2 Standard Chartered iBanking

You are also able to access SGFinDex from the Standard Chartered online banking platforms. Standard Chartered has a specific tab available both on mobile,

and online.

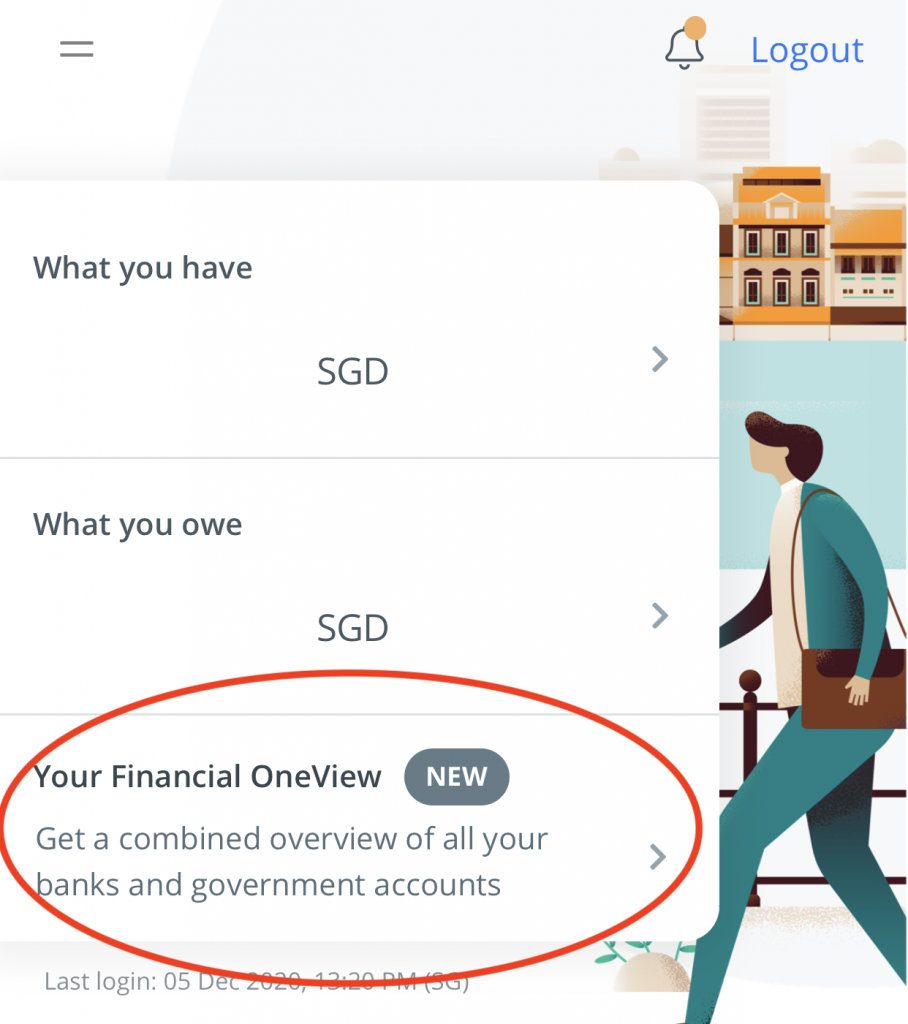

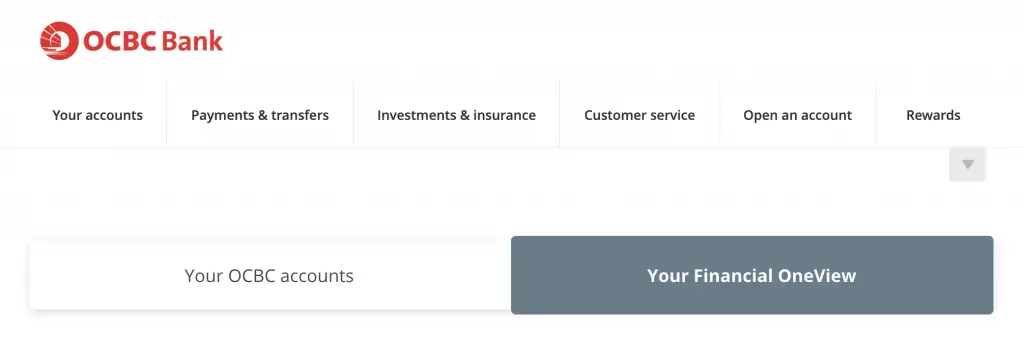

#3 OCBC iBanking

You can access SGFinDex with OCBC’s iBanking app too,

as well as their web platform.

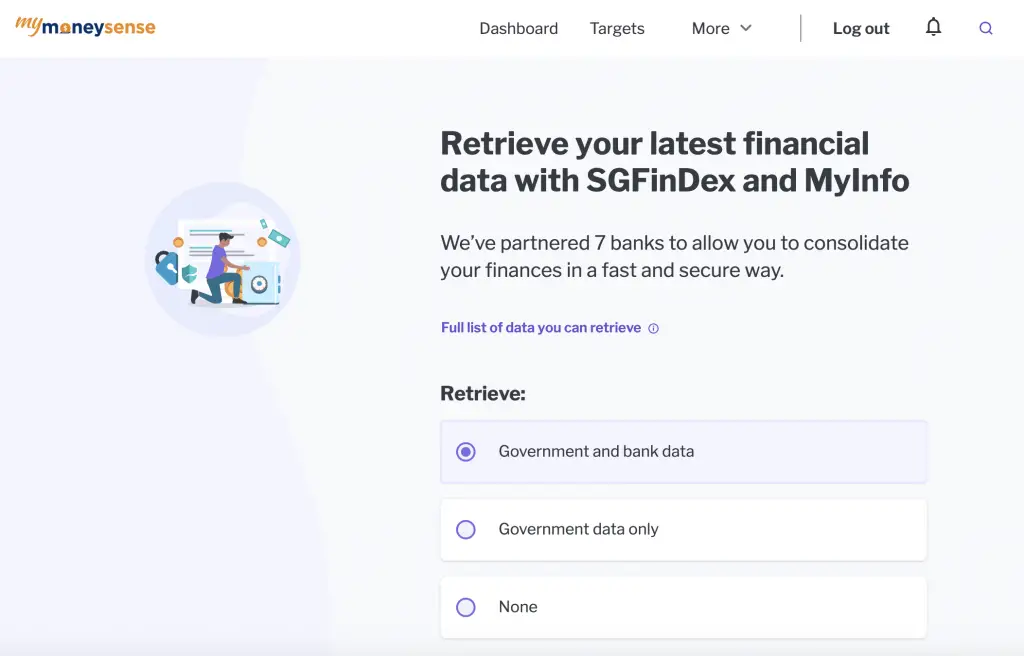

#4 MyMoneySense (Singapore Government)

You are able to access SGFinDex via MyMoneySense, a joint project with MOM and GovTech.

Unfortunately, there is no mobile app for MyMoneySense. You can only access it via the web platform.

Link your accounts

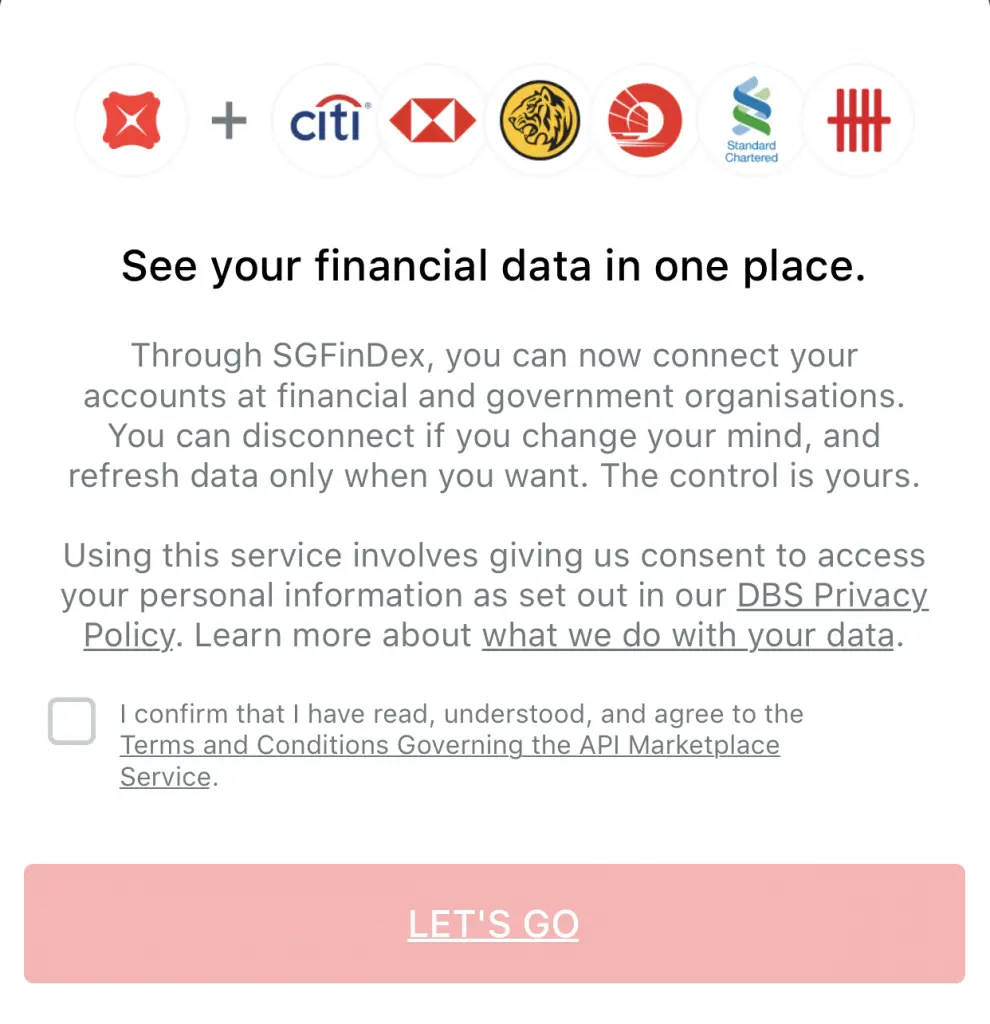

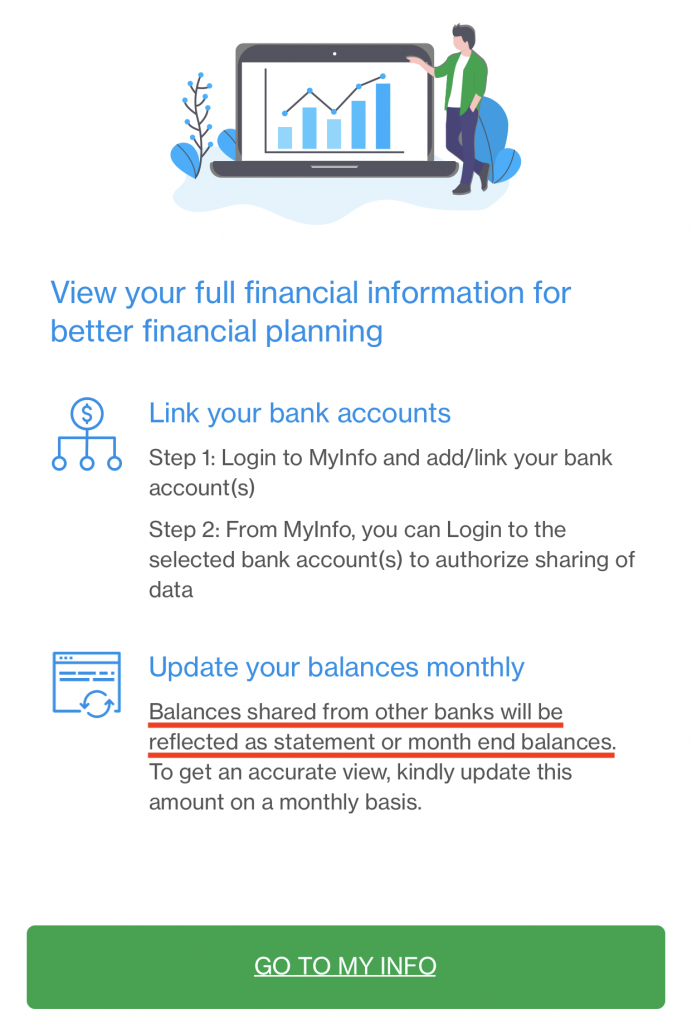

When you are using SGFinDex for the first time, you will need to link your accounts together.

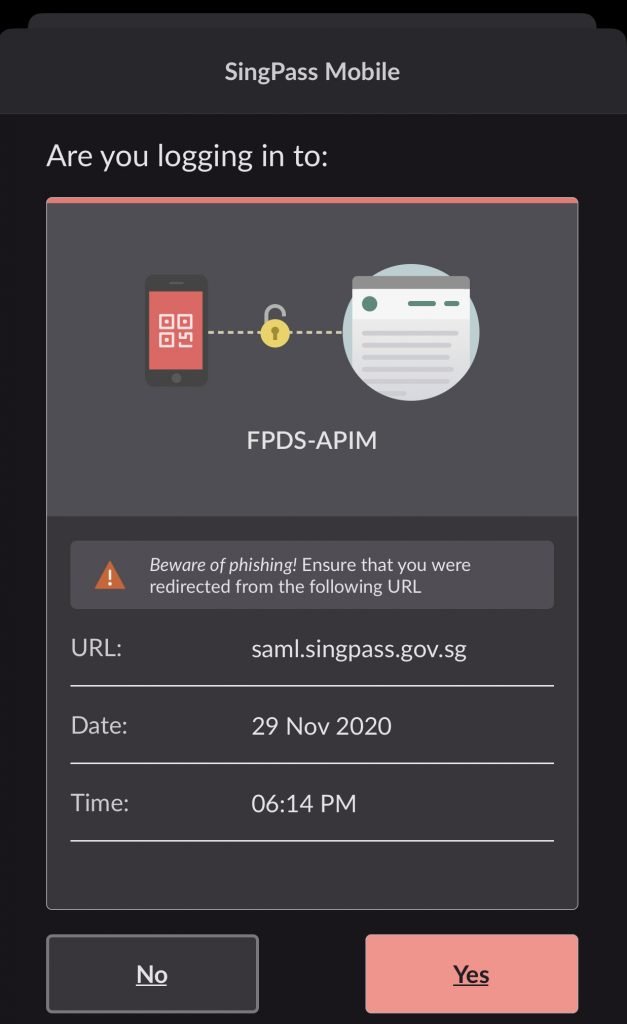

To login to SGFinDex, you will require your SingPass. To make things easier, I would recommend downloading the SingPass Mobile app.

You will need to choose the banks you wish to link from. After that, you will be redirected to that bank’s login page.

Your information from CPF, IRAS and HDB will be automatically linked via MyInfo when you login using SingPass.

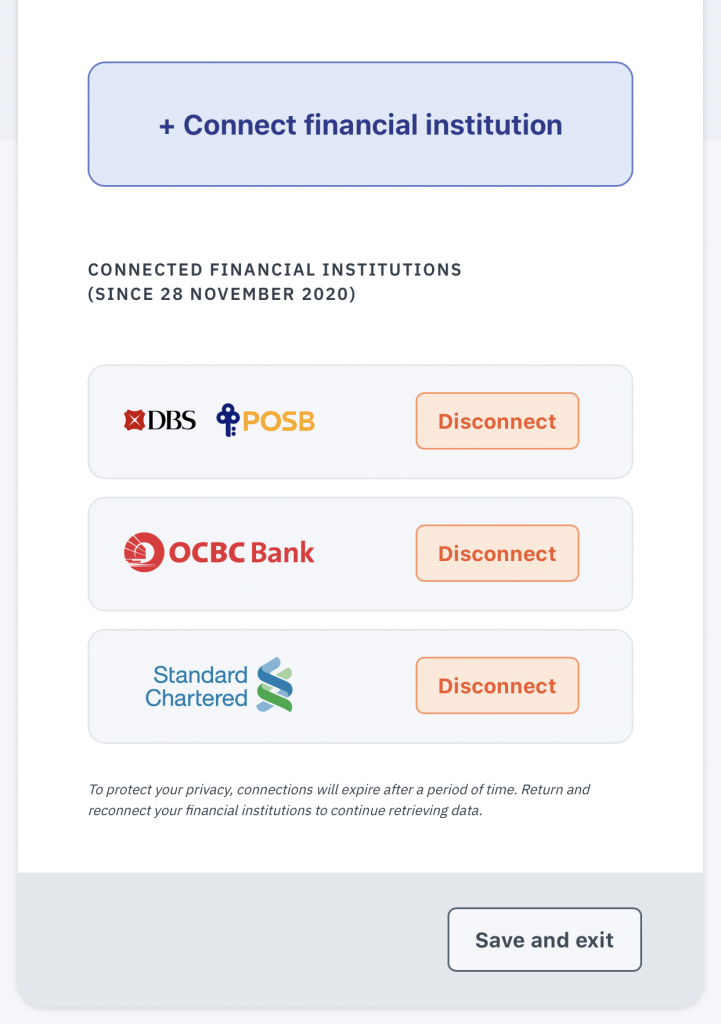

Linking accounts from 3 different banks

I have accounts from 3 different banks: DBS, OCBC and Standard Chartered. So far, I do not have any issues with linking all of them together.

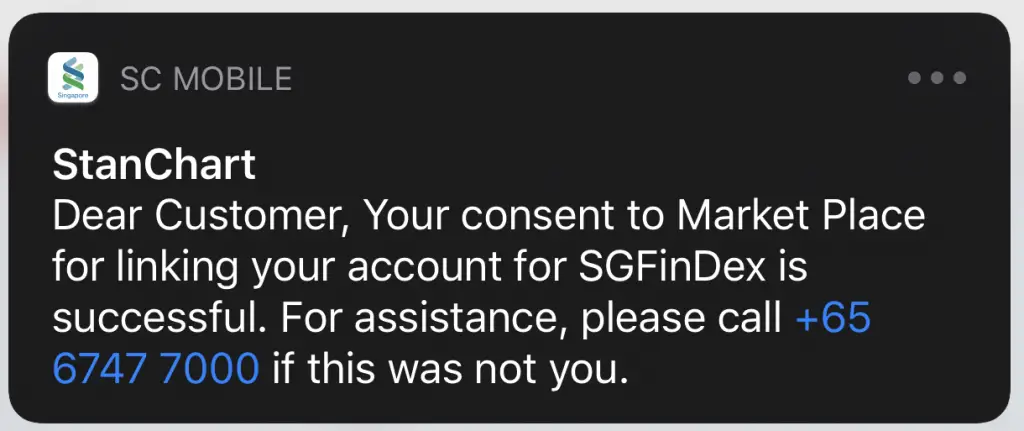

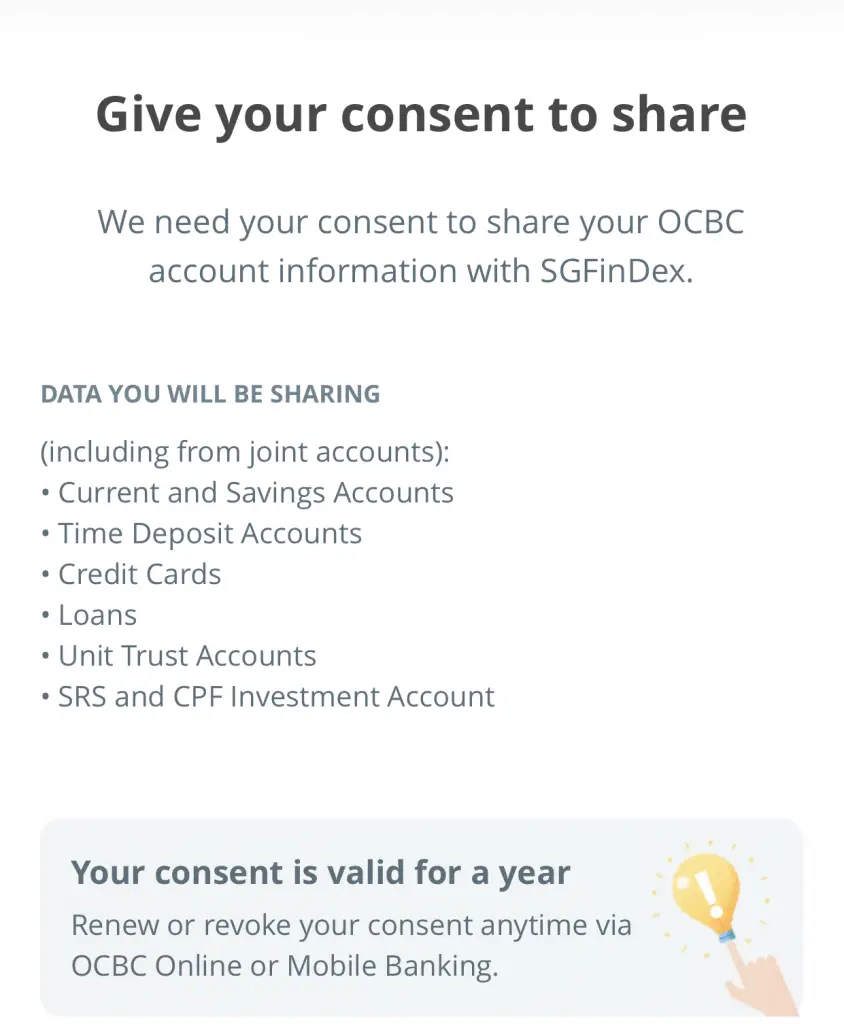

Give your consent for SGFinDex to use your data

After successfully linking all of your accounts together, you will be asked for consent to your data one more time.

You are now able to view all of your accounts using SGFinDex!

Your consent to sharing your data with SGFinDex will last a year

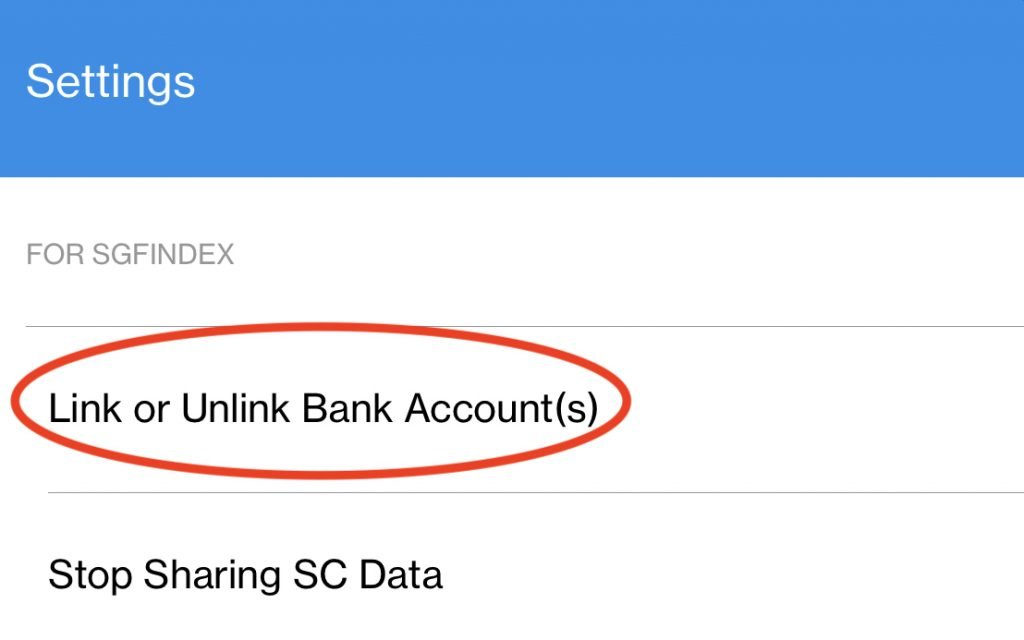

Your consent to sharing your data will only last a year. At any time, you can choose to unlink your bank accounts, or renew your consent.

You can also choose to unlink any account on the SGFinDex page at any time.

How does SGFinDex look like?

The SGFinDex interface is different on the different platforms.

#1 DBS NAV Planner

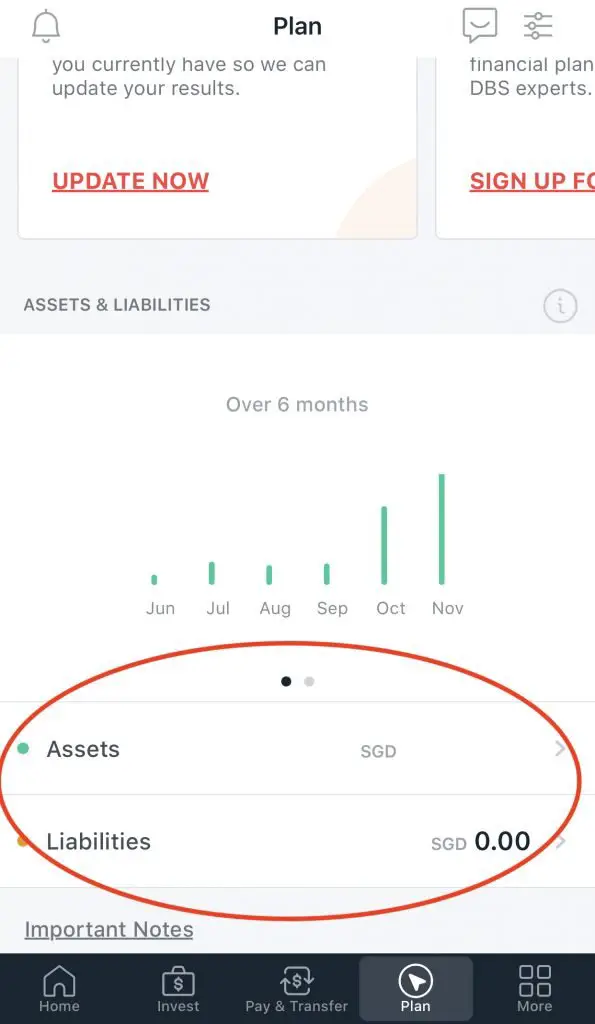

SGFinDex is integrated under DBS’ NAV Planner, and it is rather hard to navigate to view all of your accounts. You will have to scroll down under the ‘Plan’ tab and click on your assets or liabilities.

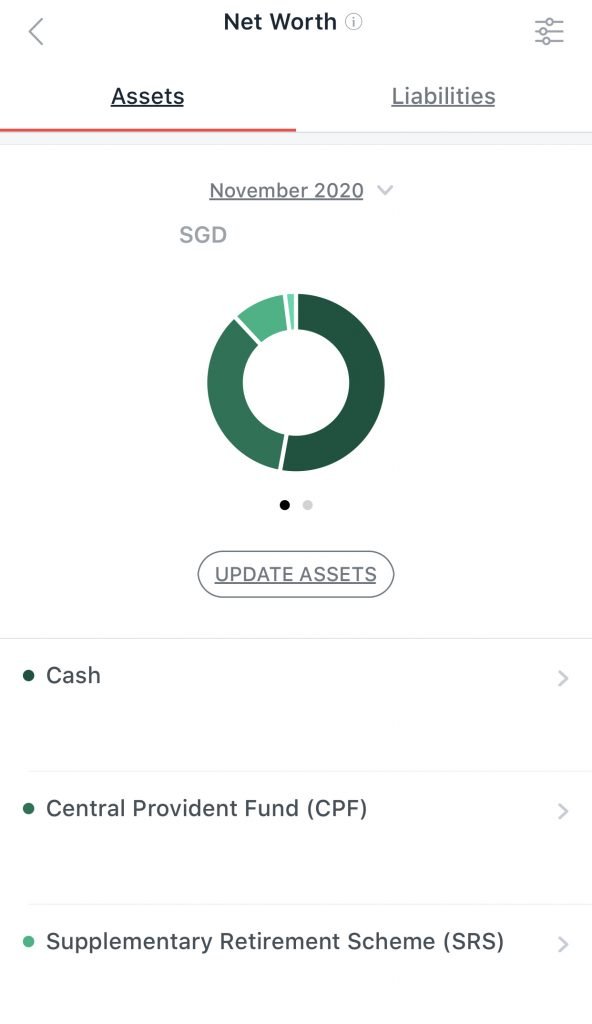

You are then able to see your assets and liabilities in a pie chart. My cash component includes my POSB bank accounts along with the JumpStart account.

You are also able to calculate your net worth (assets minus liabilities).

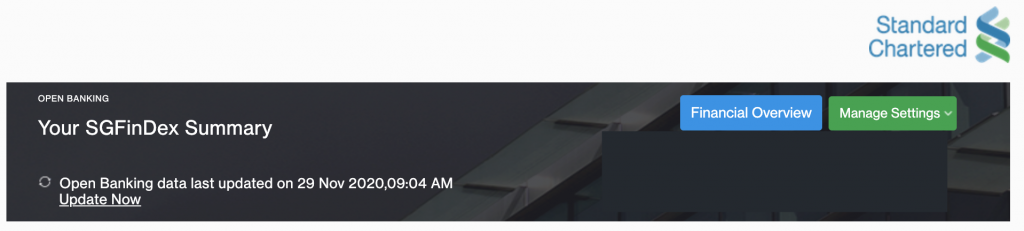

#2 Standard Chartered

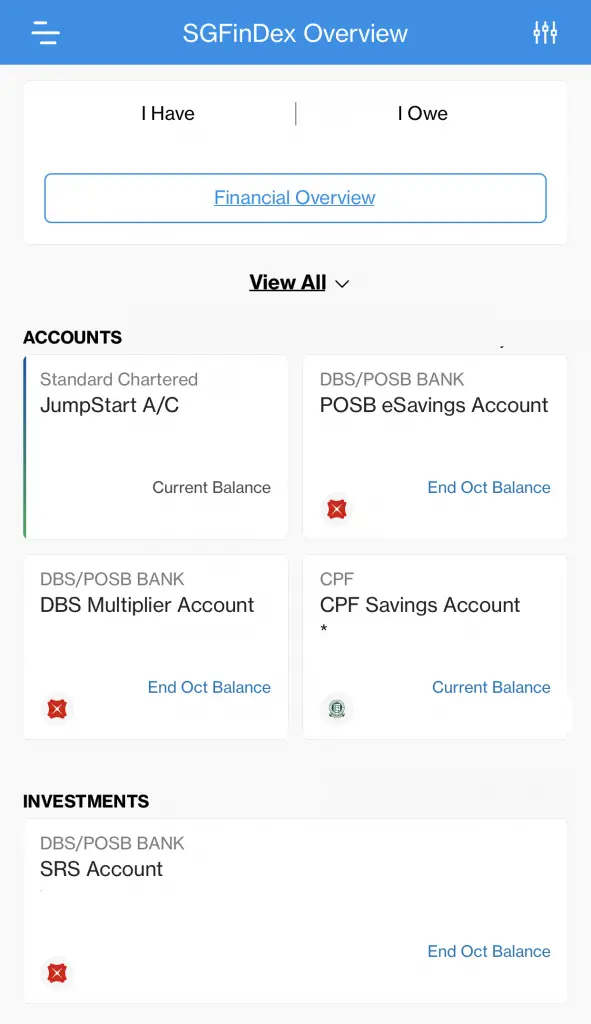

Meanwhile, Standard Chartered shows all of your accounts after going to the SGFinDex tab.

Standard Chartered only refreshes your balances monthly

If you are using Standard Chartered’s version of SGFinDex, your account balances may not be updated real-time. This is because the balances from other banks will only be updated each month.

This is different from DBS which updates your account balances in real time.

Changing your linked accounts

You are able to add or remove any of your linked accounts as well.

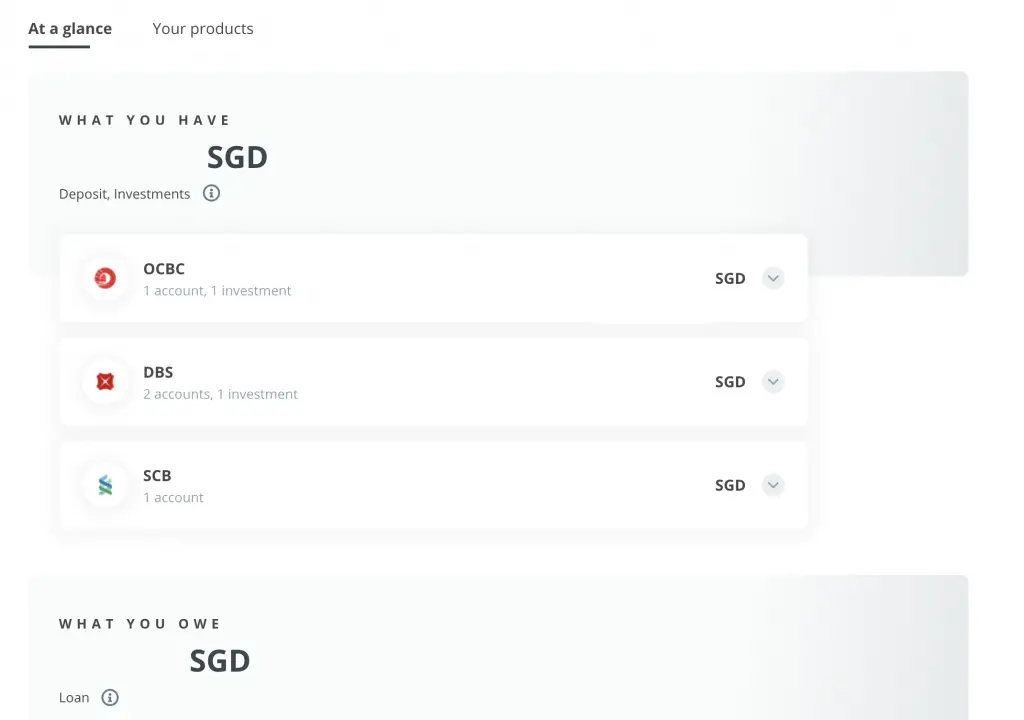

#3 OCBC

The OCBC platform allows you to view your finances in 2 different views:

1. At a glance

You are able to see your net worth by looking at what you have and what you owe.

This way, you are able to calculate your net worth too.

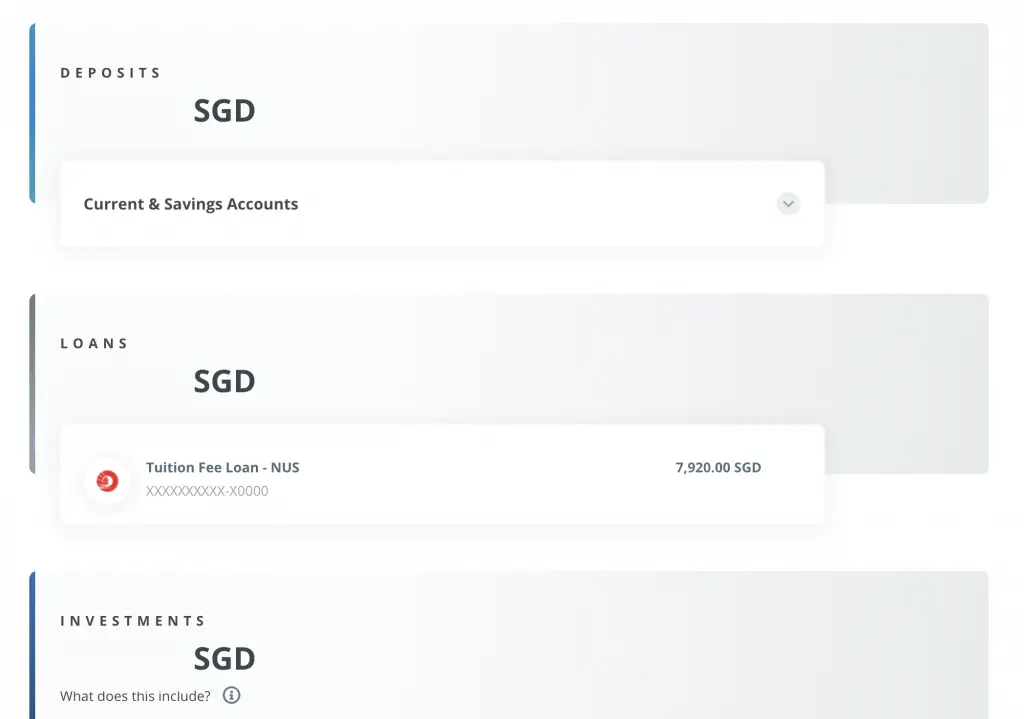

2. Your products

This view splits your money into 4 different categories:

- Deposits

- Loans

- Investments

- Others (e.g. CPF)

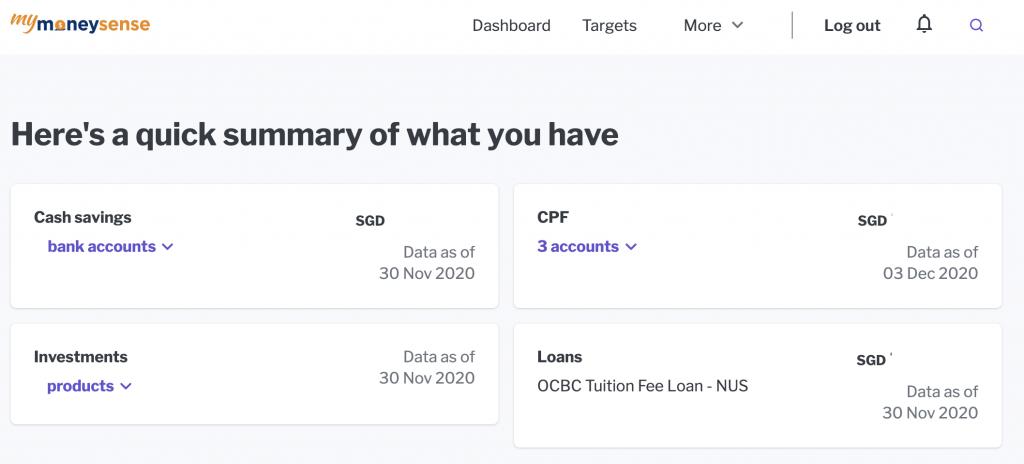

#4 MyMoneySense

On MyMoneySense, it does look much neater and it loads quite fast as well.

Unfortunately, MyMoneySense does not allow you to see the amount in your Investments.

Is SGFinDex safe?

All of your information is secured with SingPass MyInfo, which links your accounts together. Every time you wish to add or refresh the information in SGFinDex, you will be redirected to login via SingPass.

This makes the whole process really secure and your data should be safe!

SGFinDex uses a consent framework

To use SGFinDex, you will need to give your consent to share your data from a certain bank with the API.

This consent only lasts for one year, and you can choose to remove any bank at any time.

This gives you full control over which data you want to be shared with SGFinDex.

Banks may use your data for financial planning services

However when you link all of your accounts together, you are giving permission to every financial institutions to view your data. These banks are able to use these data to offer you financial planning services.

These financial planning services can include anything from:

- Money management

- Insurance

- Investment

- Retirement

- Estate planning

If you are worried about sharing your financial data, this service may not be that attractive to you.

You can view the entire terms and conditions regarding the sharing of your data with SGFinDex.

You cannot perform any transactions with SGFinDex

You are only able to view the total amount that you have in each bank / government organisation. As such, you are not able to perform any transactions using SGFinDex. This helps to ensure that your money in your bank accounts are safe and secure.

Security features can make SGFinDex quite tedious

There are many security features that help to make SGFinDex very secure. However, this comes at a cost as the entire process can be rather tedious.

When you are linking your bank accounts together, it can take quite some time for the pages to load. The user experience is pretty frustrating now, but I hope that this can be improved in the future.

Verdict

Is SGFinDex useful? Here are some key features of this service:

#1 A useful tool to consolidate all your information on one platform

The SGFinDex is a huge step towards helping you consolidate your financial information together. I am really excited as I usually have to go into each bank’s mobile app to view my account balance. With SGFinDex, I can view everything at the same time!

Unfortunately, there is no feature that allows you to export your data into a .csv file.

#2 Constantly logging into SingPass may make it a bit troublesome

The process is slightly troublesome as you will need to constantly login to SingPass to approve any sharing of data.

With these added security features, it does take some time to load all of your information. However, I still feel that the loading is faster compared to Seedly’s app or Planner Bee.

If you do not have the SingPass Mobile app, I would highly recommend you to get it. It will help you to save a lot of time, especially when you are first linking up the services together!

#3 This service could expand to sync even more services

SGFinDex only collates your investments from SRS and CPFIS. This means that if you have other investment products like regular savings plans, they will not be reflected on the platform.

In due time, I do hope that this service can be expanded to include other financial services as well. Some examples include robo-advisory investments, insurance savings plans like SingLife Account or GIGANTIQ, and online brokerages like Tiger Brokers.

In the meantime, you can consider using StocksCafe to track all of your investments under one platform.

By consolidating our investments with our CPF and bank accounts, it will give us a clearer picture of our financial status. This will make it so much easier to calculate our net worth!

#4 The features are not consistent across the different platforms

SGFinDex is a service to sync all of your accounts together. It does not control how the information is displayed on the different platforms.

As such, there is a bit of inconsistency when you are toggling among the different platforms. The same information may be presented in different ways across these platforms.

I feel that you should try to see which platform is the best for you and just stick to using that app.

Conclusion

SGFinDex is certainly the right step forward by GovTech and MAS to make financial planning more accessible. You are now able to see your bank accounts, SRS and CPF holdings at one glance.

There are some issues with this services, but I do hope that it can be expanded further to make it even more useful for us!

Standard Chartered Promotion (Get $5 Cashback when you use SGFinDex)

Standard Chartered is offering a $5 cashback promotion from 7 December until the first 30,000 participants have completed the following steps below:

- Login to Standard Chartered Online Banking (mobile app or web platform)

- Register for SGFinDex

- Link your Standard Chartered data to SGFinDex

- Link another bank’s data to SGFinDex

- Refresh and update your data

You will receive an email when you successfully completed the steps above. The $5 cashback will be credited to your bank account.

You can view more information about this promotion by Standard Chartered here.

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?