Congratulations on reaching this important milestone at 55 years old! Now that you have greater control over your CPF, you may be wondering how to go about withdrawing your funds.

My dad allowed me to use his CPF account to perform a withdrawal, and here’s a step-by-step guide on how to do so:

How to withdraw CPF using PayNow

Here are 7 steps you’ll need to withdraw your CPF using PayNow after reaching 55 years old:

- Go to ‘Retirement income’ and select ‘Withdrawing for immediate retirement needs’

- Scroll down to ‘Withdraw CPF savings’

- Enter the amount that you wish to withdraw from your CPF SA and OA funds

- Enter the amount that you wish to withdraw from your CPF RA funds

- Select the mode of payment of your withdrawal

- Decide if you want to transfer your CPF savings to your loved ones

- Confirm your transaction details

And here is each step explained in-depth:

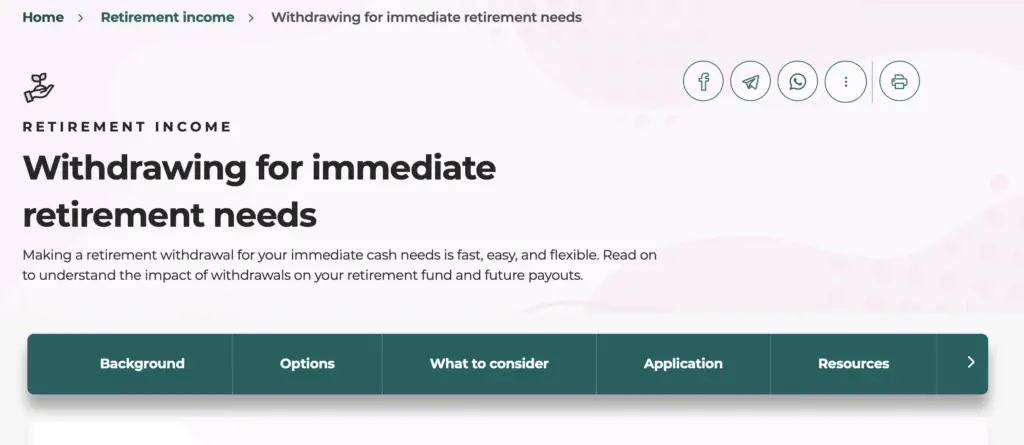

Go to ‘Retirement income’ and select ‘Withdrawing for immediate retirement needs’

When you have logged into the CPF Portal, you can click on the ‘Retirement income‘ tab at the top. After that, you can click on ‘Withdrawing for immediate retirement needs‘.

This will bring you to the Retirement Income dashboard, which allows you to withdraw your CPF savings.

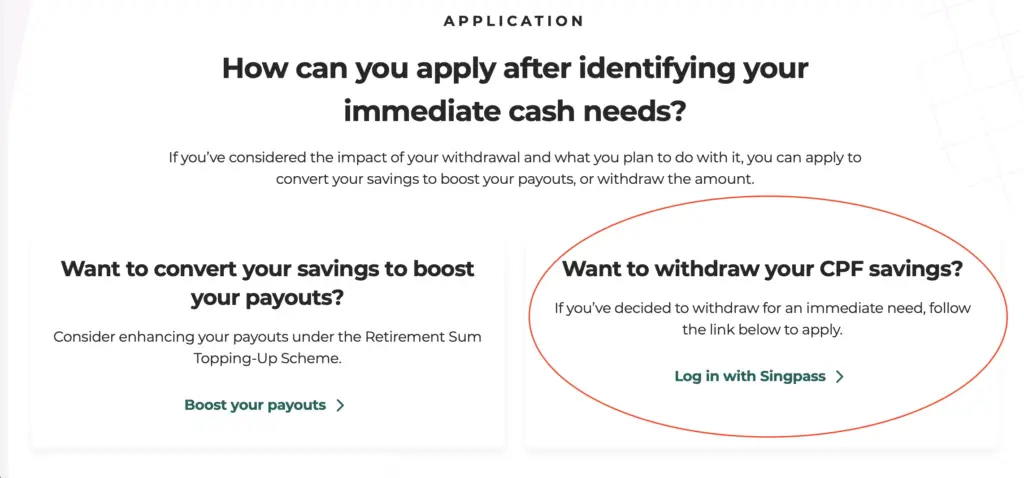

Scroll down to ‘Withdraw CPF savings’

This dashboard is rather hard to navigate, and you’ll need to scroll all the way down to the ‘Application‘ section.

You will need to click on the ‘Want to withdraw your CPF savings?’ section and login with your SingPass account.

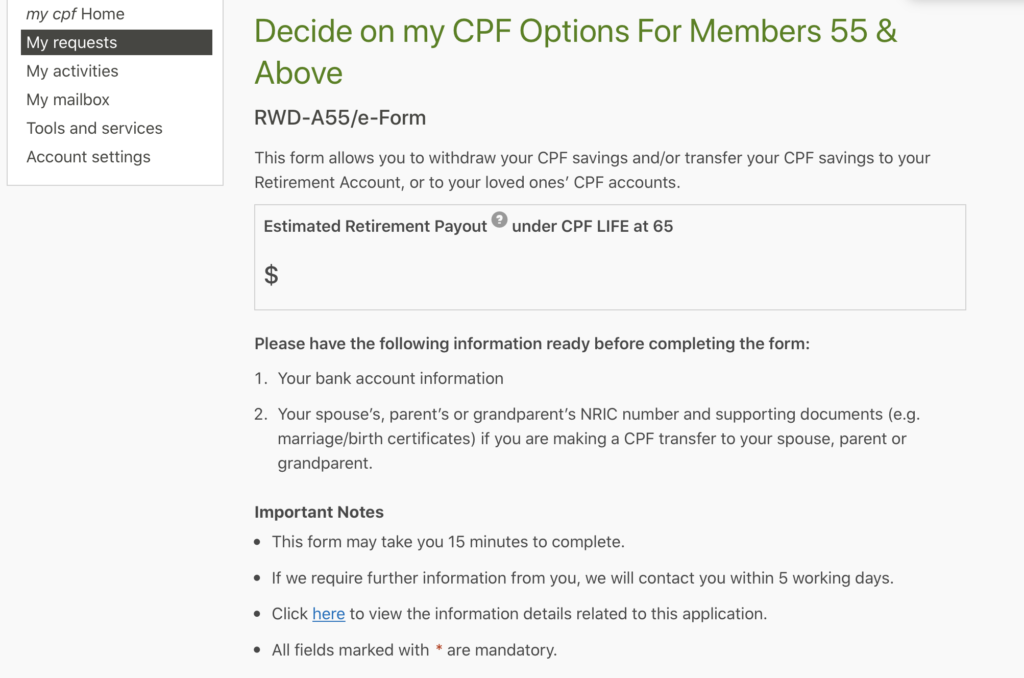

This will bring you to a form that you’ll need to fill up to withdraw your CPF savings.

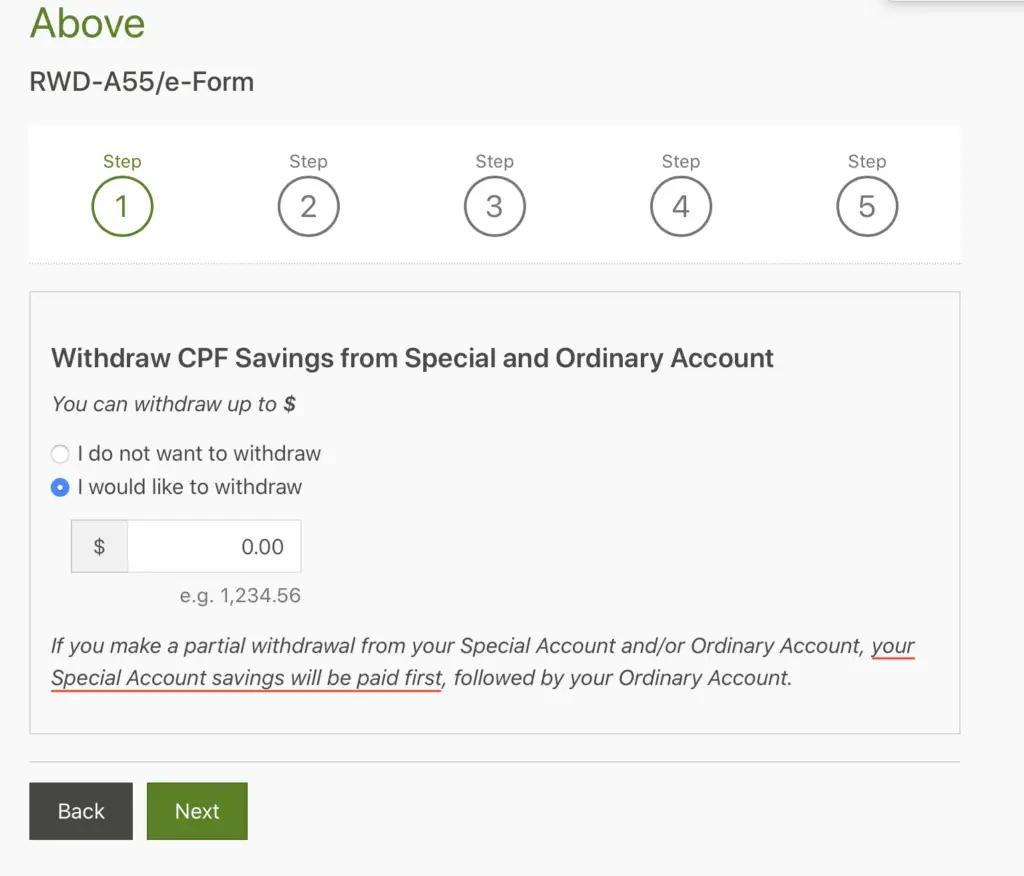

Enter the amount that you wish to withdraw from your CPF SA and OA funds

After starting this form, the first step will be to enter the amount that you want to withdraw from both your CPF OA and SA accounts.

You may want to note that the funds are withdrawn from your CPF Special Account first, followed by your Ordinary Account.

This means that you will be forgoing the higher interest rate that the CPF SA offers you when you withdraw your money from your CPF.

As such, it would be best to think carefully if you really need the money!

If you do not need this money right away, it may be better to leave it in your CPF SA to continue earning this higher interest rate.

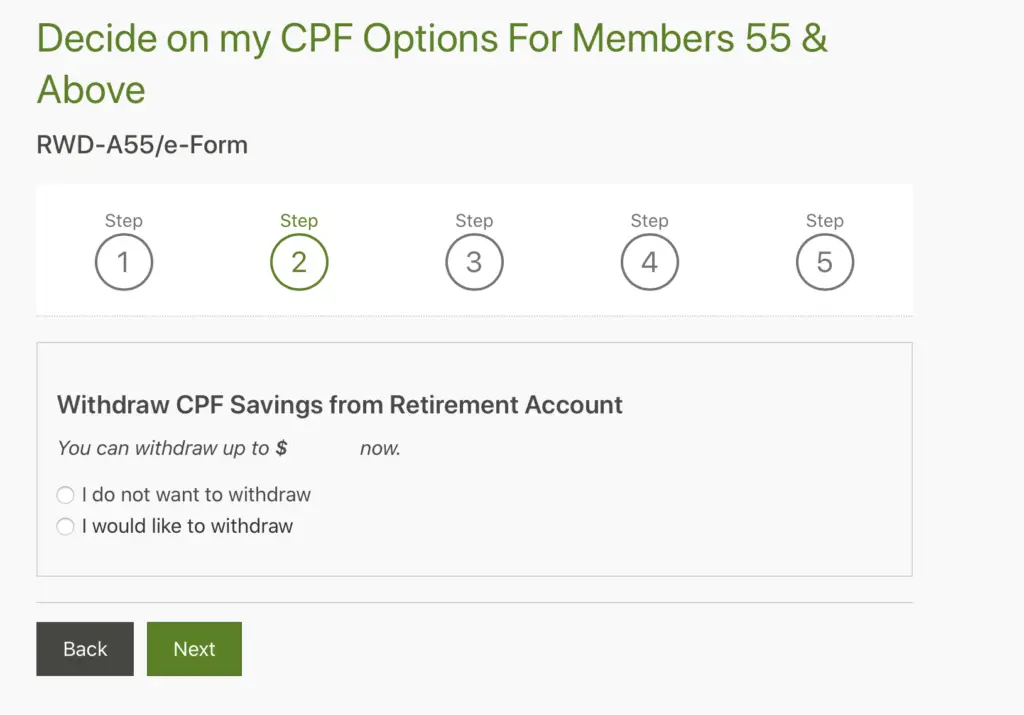

Enter the amount that you wish to withdraw from your CPF RA funds

You are also able to withdraw funds from your CPF RA. You will be able to see the amount that you can withdraw from this account.

It is possible for you to just withdraw from your CPF OA and SA, without touching your RA funds.

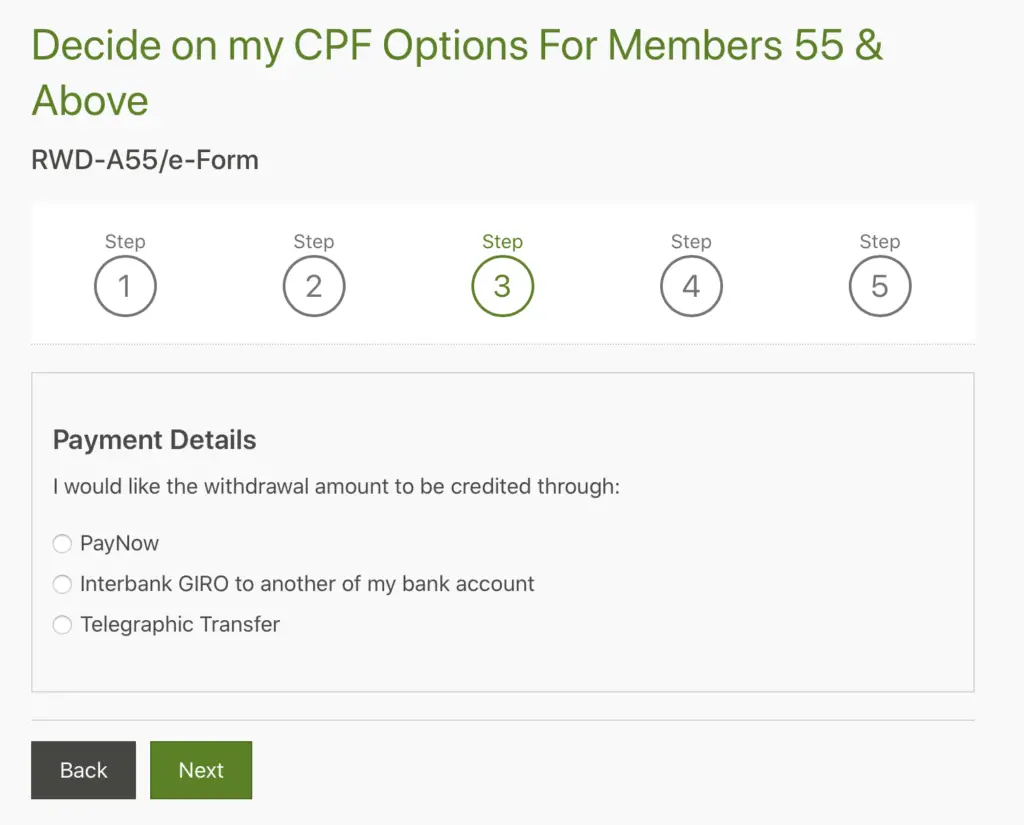

Select the mode of payment of your withdrawal

The next step will be to select how you wish to receive your CPF withdrawal. There are 3 methods available:

- PayNow

- Interbank GIRO

- Telegraphic Transfer

If you have a PayNow account that is linked to one of your bank accounts, this will be the fastest way to receive your funds!

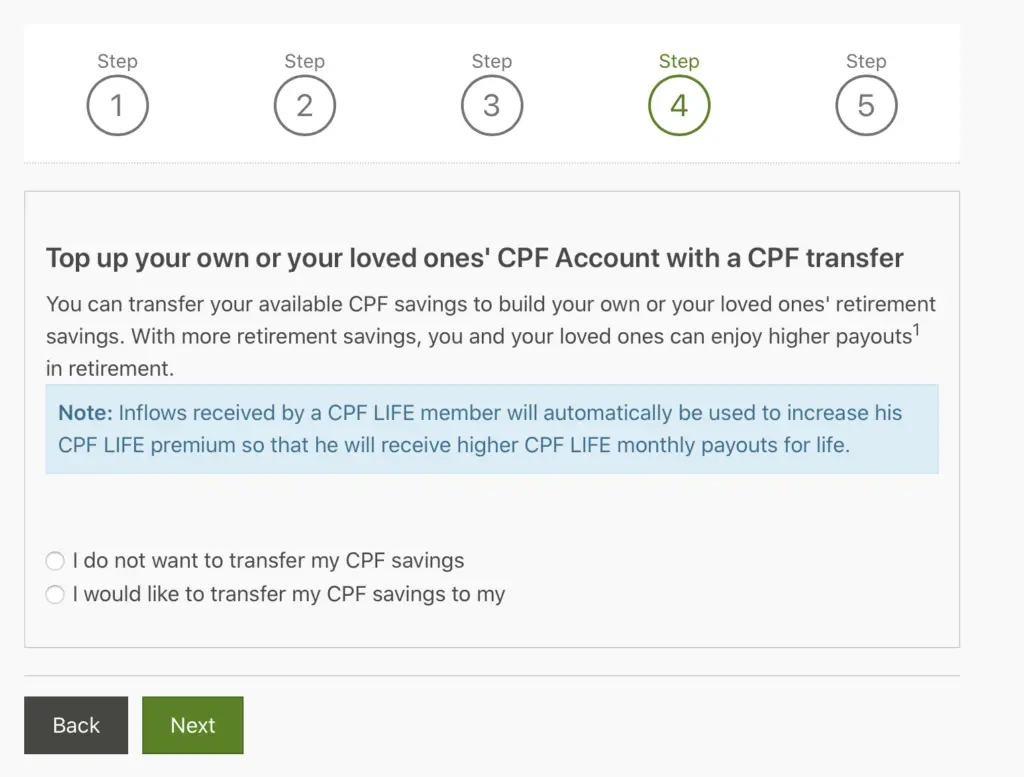

Decide if you want to transfer your CPF savings to your loved ones

Before confirming your withdrawal, CPF will ask if you wish to transfer your CPF savings to your loved ones instead.

The people who fit the criteria of your ‘loved one’ includes:

- Spouse

- Parents and Grandparents

- Parents-in-law and Grandparents-in-law

- Siblings

The advantage would be that you will be able to help your loved ones to grow their CPF Life premiums. This will be helpful if your loved one does not have enough funds to hit a certain retirement sum in their CPF.

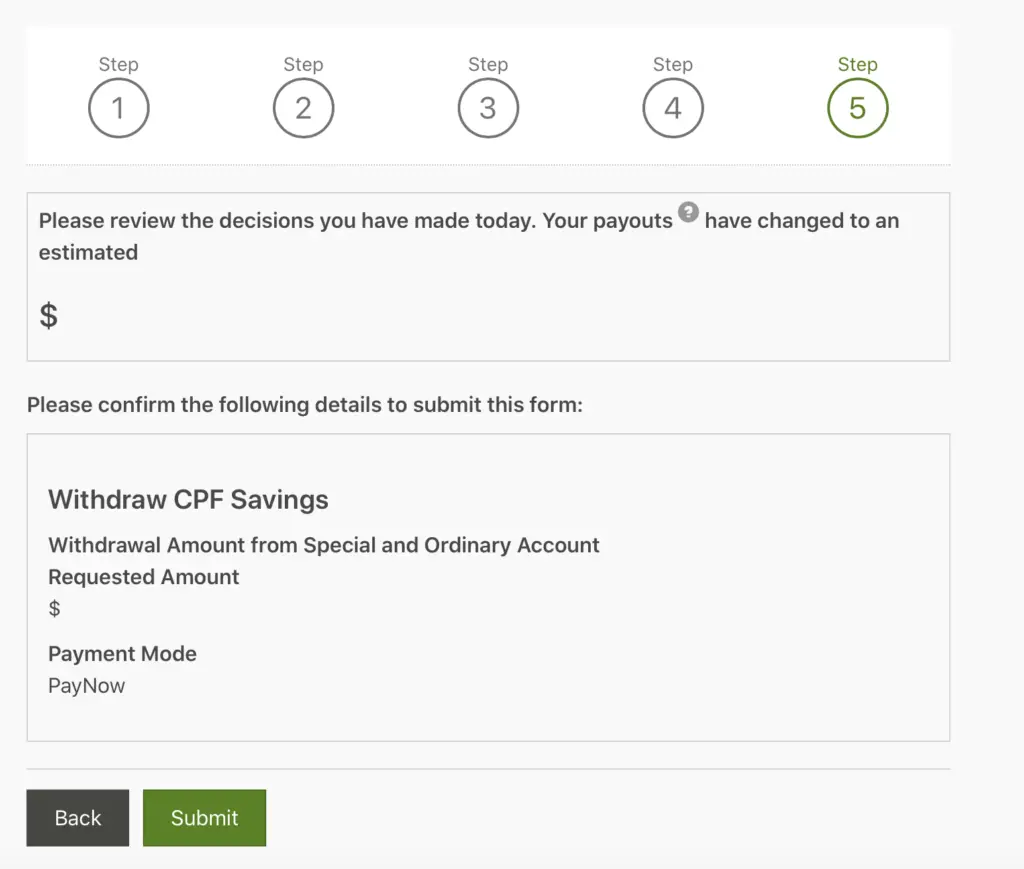

Confirm your transaction details

If you decide not to transfer the funds to your loved ones, you will be brought to the last page to confirm your transaction details.

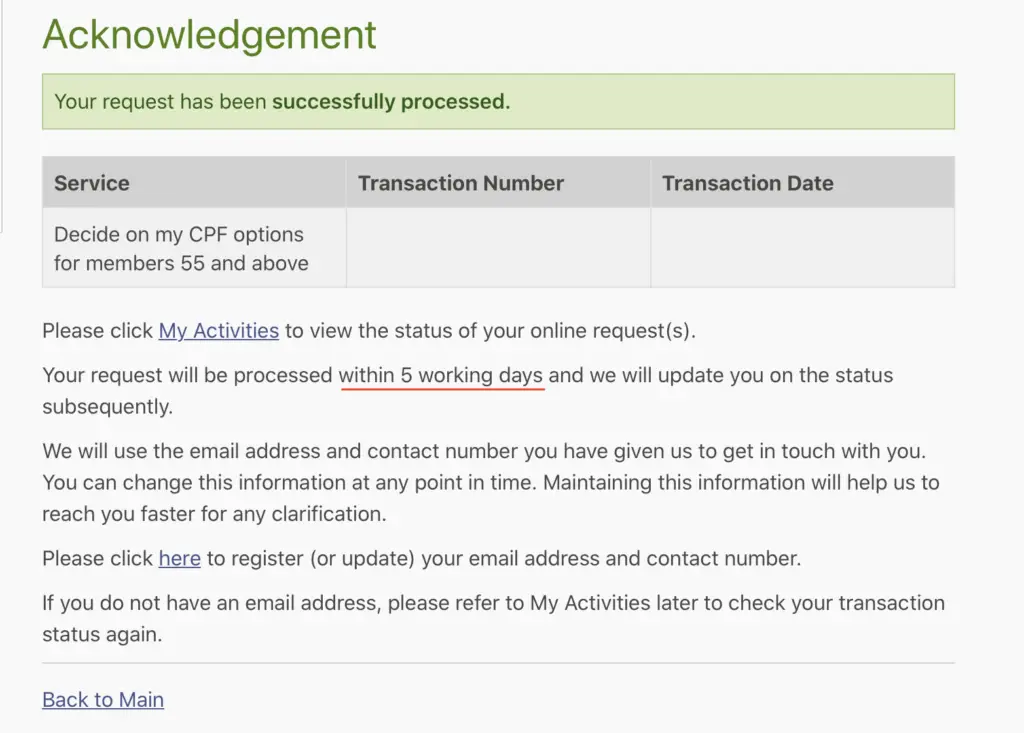

After submitting your request, you will receive an acknowledgement from CPF.

CPF mentioned that it may take up to 5 working days before your funds will be transferred to you.

How long does a CPF withdrawal take?

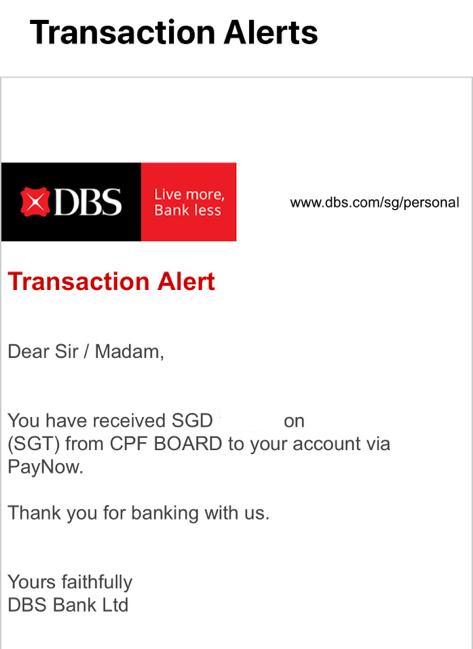

A CPF withdrawal may take up to 5 working days before you can receive the funds in your bank account. However, if you choose to withdraw via PayNow, it is possible to receive your funds on the same day.

My dad performed the withdrawal on a public holiday, and he received the funds in his bank account almost immediately!

If you are in a hurry to receive your funds from CPF, the best way will be to withdraw them via PayNow.

Conclusion

Once you have reached 55 years old, you are given the freedom to decide when you want to withdraw your CPF funds after setting aside your Retirement Sum.

However, it may be better to leave your funds in your CPF account if you do not need them immediately. This is because it will continue to earn a high interest rate, especially for your Special Account!

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?