Last updated on June 6th, 2021

Who says NSFs don’t get the best benefits?

The POSB Save As You Serve (SAYS) Programme is a deal that’s exclusive for NSFs.

By contributing at least $50 a month, you can possibly receive between 2.05% to 2.25% on your savings!

Here’s how it works and why all NSFs should consider this savings account.

Contents

- 1 POSB Save As You Serve Review

- 2 What is the SAYS Programme?

- 3 Who qualifies for the SAYS Programme?

- 4 How does the interest rate work?

- 5 How do I open a SAYS Account?

- 6 What happens if I apply for the SAYS when I’m already a few months into my NS?

- 7 What can SAYS be used for?

- 8 What debit card promotions are available for this account?

- 9 Verdict

POSB Save As You Serve Review

The POSB SAYS Programme helps you to earn some attractive interest on your monthly contributions. However, you are unable to withdraw any amount from your account, if not you will lose the bonus interest.

Here is the SAYS reviewed in-depth:

What is the SAYS Programme?

The POSB SAYS Programme is a special programme that is under the POSB Save As You Earn (SAYE) Account.

For the POSB SAYE Account, you will have to credit a salary to be eligible for the bonus interest rate.

However, under the SAYS Programme, your NS allowance is considered as your salary. This allows you to receive the bonus 2% interest rate as well!

You will receive this bonus interest rate if you fulfil the following criteria:

- Your NS allowance is credited to a DBS/POSB Account

- You have to set a monthly savings contribution (min. $50)

- You cannot withdraw the money in your SAYE Account

Looking at the criteria, the SAYS Programme actually acts like a short-term endowment plan that lasts throughout your NS.

You may be wondering what’s the difference between DBS and POSB, so here’s some ways they are similar.

Your bonus interest will be forfeited if you make any withdrawals

The 2% sounds really attractive, and you may be tempted to put in a large sum each month to maximise the interest.

However, I strongly recommend you to consider how much you can realistically save, before committing to a savings amount.

Once you make a withdrawal from your SAYE Account, the 2% bonus rate will be forfeited!

As such, you should put in an amount that you’re comfortable with saving every month.

Who qualifies for the SAYS Programme?

So long as you’re a NSF, you are eligible for the SAYS Programme.

This is regardless of whether you’re from the:

- Singapore Armed Forces (SAF)

- Republic of Singapore Navy (RSN)

- Republic of Singapore Air Force (RSAF)

- Singapore Police Force (SPF)

- Singapore Civil Defence Force (SCDF)

How does the interest rate work?

There are 2 components to the interest rate that you can receive under the SAYS Programme:

#1 Base Interest

Depending on your monthly contribution savings, you will receive a base interest rate of between 0.05% to 0.25%.

| Monthly Savings Amount | Interest Rate |

|---|---|

| $50 – $290 | 0.05% |

| $300 – $790 | 0.2% |

| $800 – $1,490 | 0.25% |

| $1,500 – $3,000 | 0.25% |

The minimum monthly savings contribution you can make is $50. You can make a higher contribution in multiples of $10.

The maximum contribution you can make is $3000 each month.

If you save at least $300, you will be able to earn a 0.2% base rate!

You will only earn 0.05% if you have these

However, you will only earn a 0.05% interest rate if you:

- Have a failed crediting of the monthly savings amount

- Make a withdrawal

- Close your account during the month

It’s really important to make sure you do not meet the criteria above. This will ensure you do not unnecessarily forfeit some of the base interest!

#2 Bonus Interest

On top of the 0.05% to 0.25% that you receive as the base interest, you can receive the bonus Cash Gift Interest as well.

With the Cash Gift Interest, you can earn an additional 2% on top of your base interest rate!

The bonus interest is credited to you yearly. This is different from the base interest rate which is credited to you each month.

You should ensure that you do not make any withdrawals from your account.

If you do make a withdrawal, you will forfeit your entire Cash Gift Interest amount for that year!

How much interest can I earn?

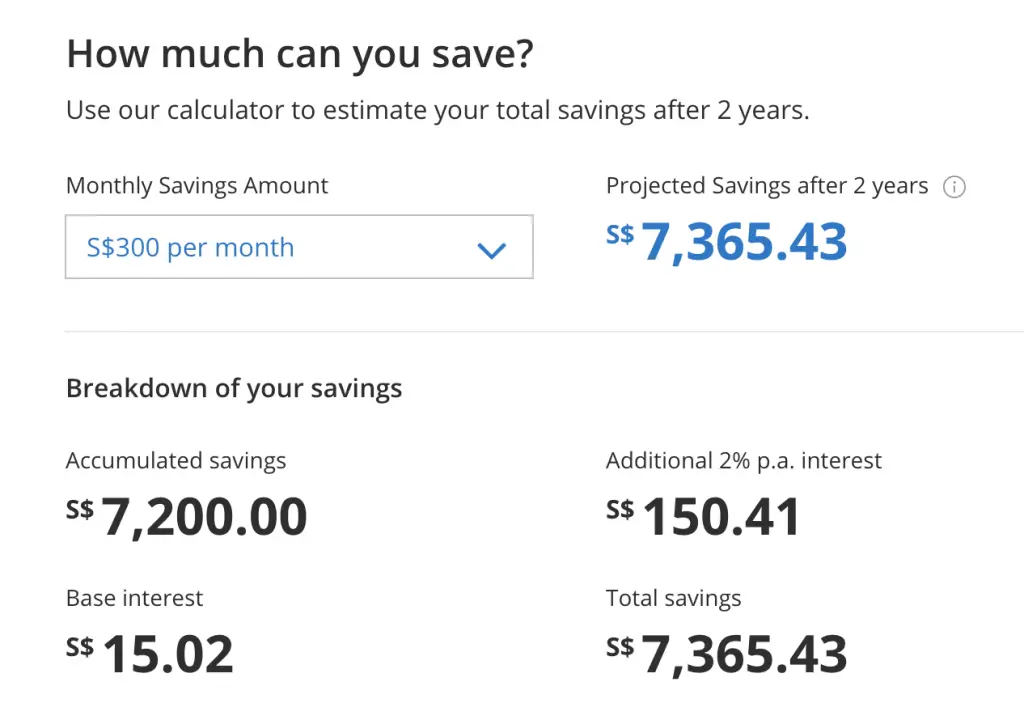

POSB provides a calculator for you to estimate your savings after 2 years.

If you save $300 a month without any withdrawals, you will receive $7365.43 at the end of your NS!

With interest rates at an all-time low, POSB SAYS offers a really attractive rate of at least 2.05%. This is much higher than the other accounts that you are eligible for as a NSF.

The only account that beats this rate is the SingLife Account, which offers 2.5% for your first $10k.

This is provided that you participate in SingLife’s Save, Spend, Earn Campaign which allows you to earn the extra 0.5%.

How do I open a SAYS Account?

Here’s a step-by-step guide to start earning the bonus interest:

- Have a POSB/DBS Account for debiting

- Update your bank account number on the NS Portal

- Link your debiting account to the SAYS account

- Earn your interest rate

#1 Have a POSB/DBS Account for debiting

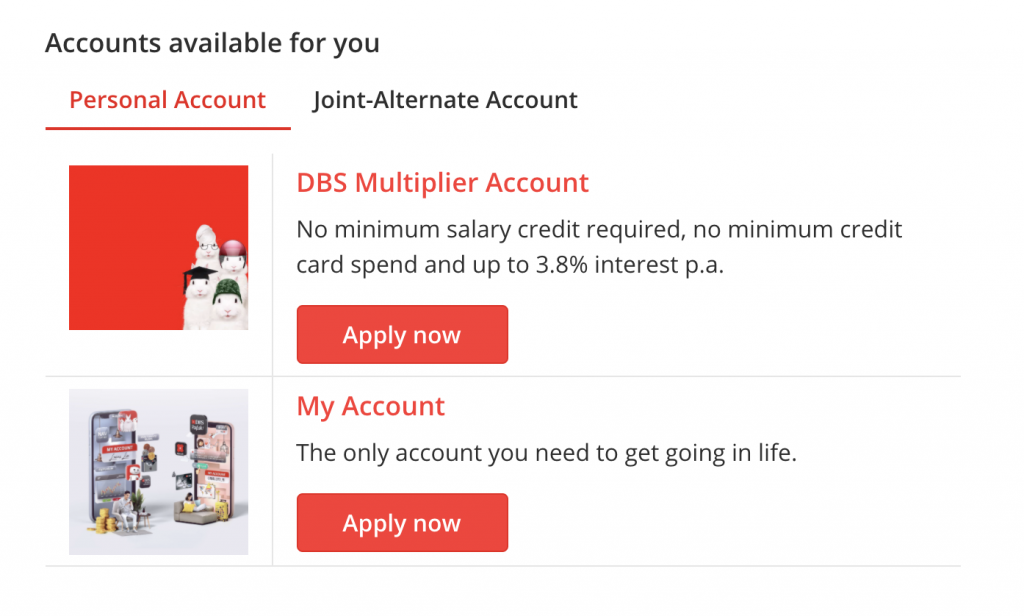

You will need to have a separate POSB/DBS Account that receives your NS allowance.

If you don’t have an account with POSB or DBS, here are 3 options that DBS is offering:

If you already have an account, you can skip this step.

All of these accounts do not have any account fees until you reach 29 years old. As such, you can leave as little as you wish inside these accounts.

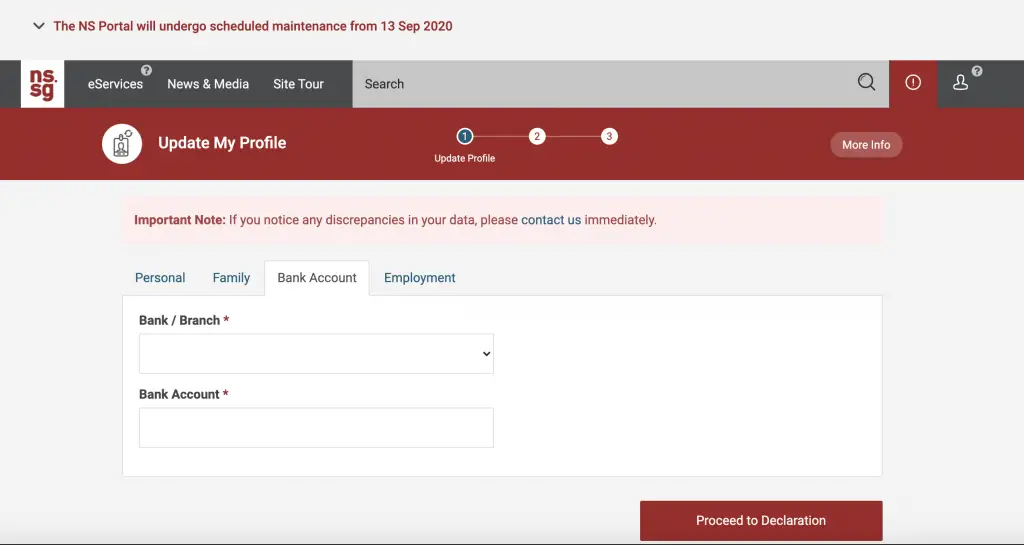

Update your bank account number in the NS Portal

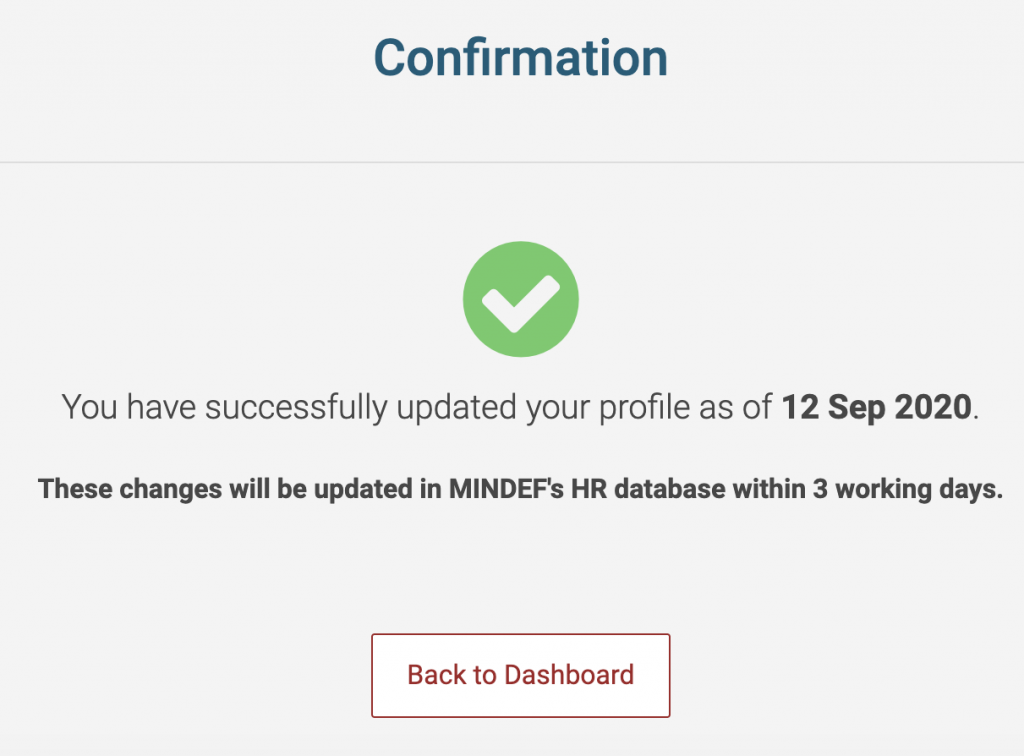

After creating your account, remember to update your profile in the NS Portal!

You can do so under eServices → eSelfUpdate → Update My Profile.

It will take around 3 working days for your bank account to be updated.

This step is really important. If you do not credit your NS allowance to a POSB/DBS Account, you will not be able to receive the bonus 2% interest.

It would be good to double check that your allowance is being credited with the reference code ‘SAL’ or ‘PAY’.

#3 Create your SAYS Account

After settling the debiting portion of your account, you can create your SAYS account.

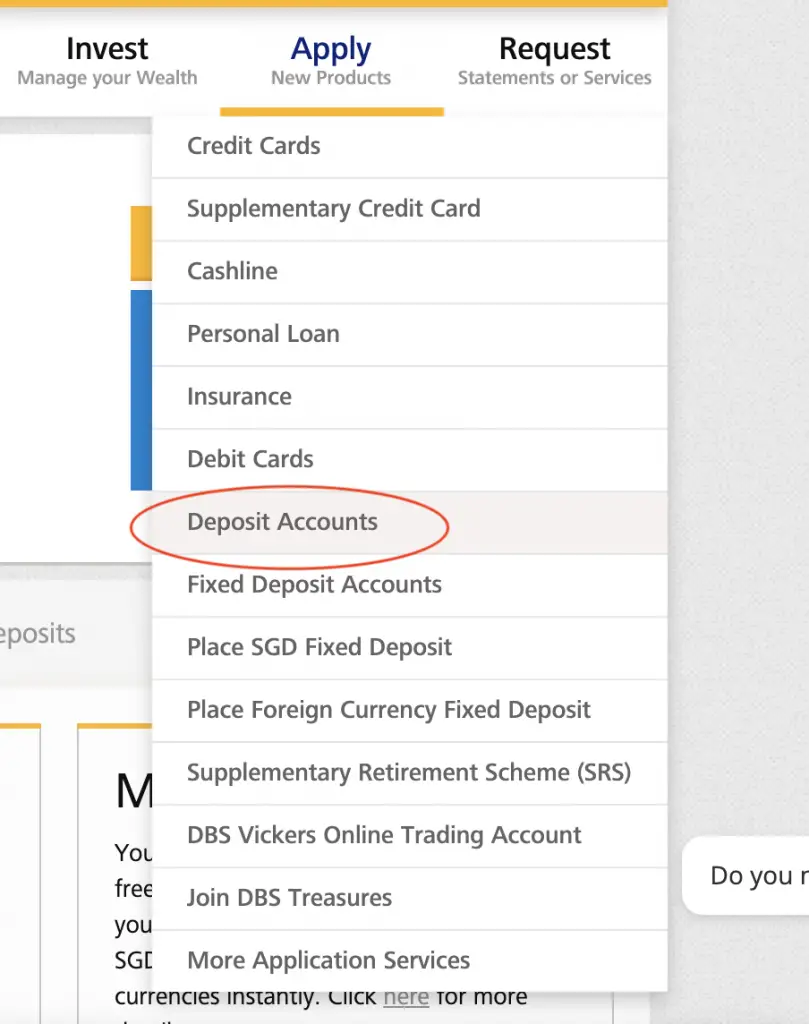

Login to your POSB or DBS iBanking, and select the ‘Apply’ Tab, and then select ‘Deposit Account’.

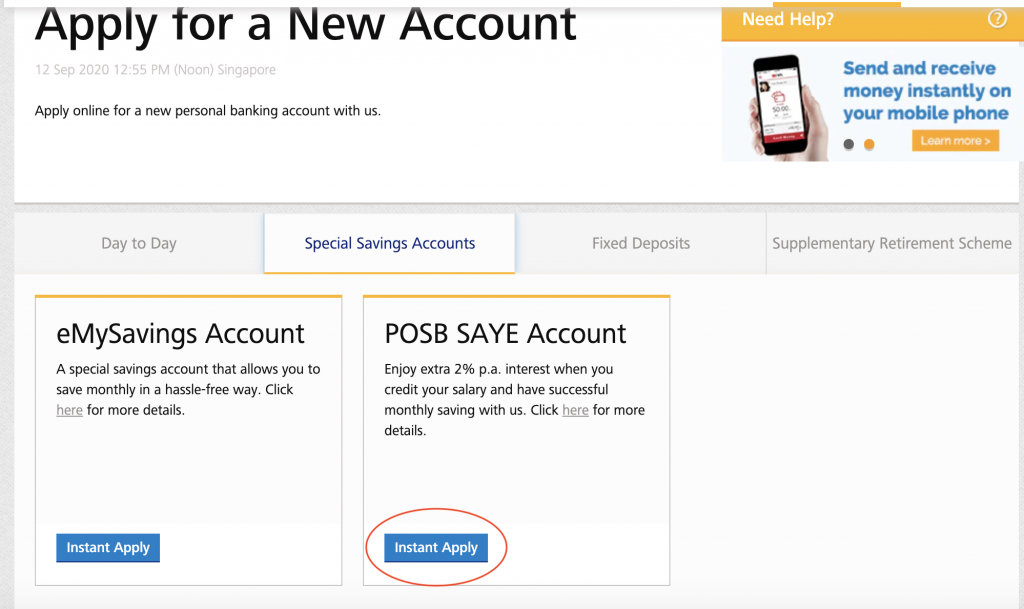

From there, you’ll need to select ‘Special Savings Accounts’, and then the ‘SAYE Account‘.

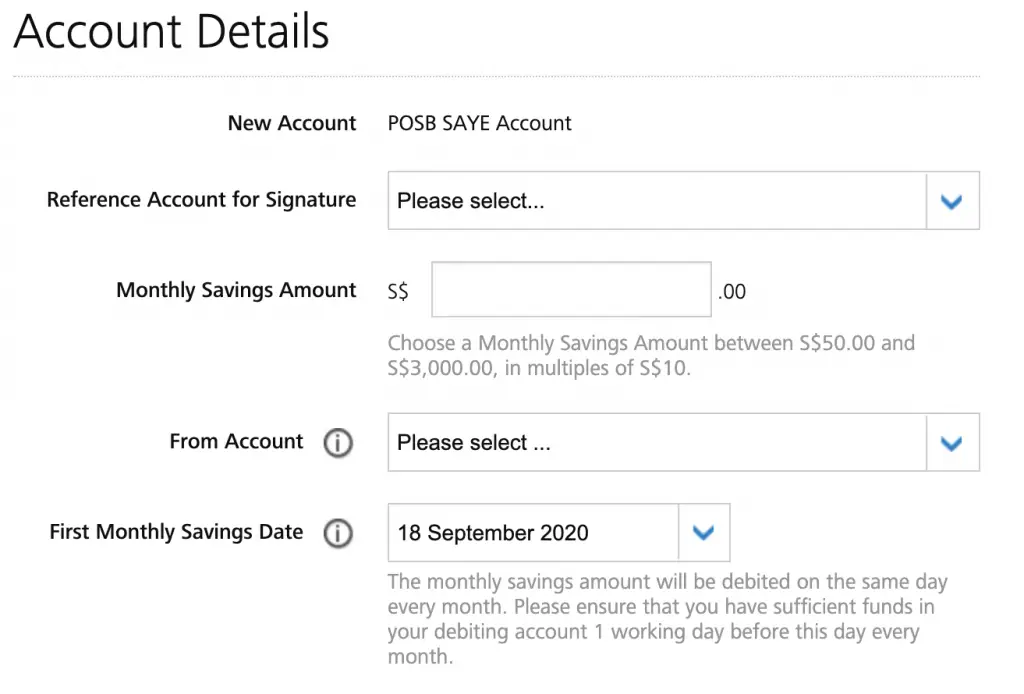

After selecting the SAYE account, you will need to fill in the following details:

- Reference Account for Signature (select an existing account)

- Monthly Savings Amount

- From Account (the account that you wish to debit the savings amount from)

- Monthly Savings Date

For the ‘From Account’ field, make sure you select the account which your allowance is being credited to!

Changing your contributions

POSB understands that you may wish to change your contributions during these 2 years. Here are some things that you can change along the way:

- Monthly Savings Amount

- Monthly Savings Date

- Debiting Account

All of these options can be found under the “Change MySavings/SAYE Account Instruction” menu in POSB’s iBanking.

However, here are some limitations to the parameters that you can change:

| Monthly Savings Amount | $50 – $3000 per month |

| Monthly Savings Date | 1st – 25th day of the month |

#4 Earn your interest rate

Your base interest rate will be credited each month. The amount of base interest you earn depends on your monthly savings amount.

For the bonus interest rate, you will only receive it on the 13th and 25th month after you create the account.

This means the interest accumulated for the first 12 months will be credited on the 13th month.

The same applies for the next 12 months. The accumulated interest will be credited on the 25th month.

What happens if I apply for the SAYS when I’m already a few months into my NS?

For example, let’s say that you are in the 6th month of your NS, and you apply for the SAYS Account.

This means that you only have 18 months left to enjoy the bonus interest rate.

Here are the number of months that you’ll be eligible for the bonus interest rate.

| Month That Bonus Interest Is Credited | Number of Eligible Months |

|---|---|

| 13 | 12 |

| 25 | 6 |

Since you only have 18 months of NS left, you can only receive the bonus interest for these 18 months.

As such, the bonus interest being credited on the 25th month will only consist of the last 6 months of your NS. You can only receive the bonus interest rate if your NS allowance is credited to your POSB/DBS Account.

Once you ORD, you will no longer have your allowance. As such, you will not be eligible for the bonus interest for these remaining months.

What can SAYS be used for?

The SAYS Programme is great for you to start a savings habit every month.

I would recommend to save at least $300 each month using the SAYS Programme. This allows you to receive an interest rate of 2.2%.

The current monthly allowance of a Recruit is $580. Saving around 50% of your monthly allowance is definitely achievable!

You’ll most likely be spending most of your time in camp. This only leaves the weekends for you to spend.

By setting aside some money for your savings, it may help you to spend even less.

What’s more, as your allowance increases, you can increase your contribution to your SAYE account. This will help to increase your savings even more!

Here are 2 possible ways that you can use the SAYS for:

Short-term goals

Short-term goals are goals with a short time horizon, usually less than 5 years.

One such goal may be your higher education after NS.

You may need to take a Tuition Fee Loan (TFL) to pay for your school fees. However, the TFL only covers 90% of the fees.

You can start to save for the remaining 10% during your NS!

Emergency funds

You can use the SAYS Programme to build up your emergency funds too.

Emergency funds are an important part of any financial plan. If you are able to build it up during your NS, you will be less stressed once you’ve started working.

However, an emergency fund needs to be extremely liquid.

If you make a withdrawal for an emergency, you will forfeit all of the bonus interest you accumulated for that year!

I would recommend using the SingLife Account instead for your emergency funds. This account does not penalise you if you make a withdrawal.

The SAYS Programme may be a good way to start building up your emergency fund. However, there are better options for you to choose from.

What debit card promotions are available for this account?

With the SAYS Programme, you are able to apply for 2 debit cards, that provide you with some benefits.

These cards can be linked to any DBS/POSB Account. As such, you should link it to your debiting account, and not the SAYE Account!

These 2 debit cards are:

Both of them provide you with cash rebates, which include:

- 2% cash rebate on local Mastercard transactions (including bus/train rides via SimplyGo)

- 1% cash rebate on online spend

- 0.3% cash rebate on all other retail spend

You require a minimum spend of $400 for the SAFRA DBS Debit Card if you want to enjoy the rebates.

This minimum spend does not apply to HomeTeamNS-PAssion-POSB Debit Card if you’re a NSF.

The way that you can claim the cash rebates are different for both cards, which is explained below.

#1 HomeTeamNS-PAssion-POSB Debit Card

For the HomeTeamNS-PAssion-POSB Debit Card, you will receive the rebate in the form of HomeTeam NS$.

You can only redeem the HomeTeamNS$ at HomeTeamNS Clubhouses and participating merchants.

Moreover, if you do not redeem your HomeTeamNS$ within 1 calendar year, it will be forfeited.

You can enjoy other benefits too

There are other benefits that you get to enjoy, such as:

- HomeTeamNS membership benefits

- PAssion membership priveleges

- 1-for-1 deals on the 10th day of every month for certain attractions

- 1% cashback at Takashimaya Department Store and Takashimaya Square, B2

However, to sign up for this card, you will need to be an existing HomeTeamNS member.

You will need to pay a membership fee of either:

- $100 for 5 years

- $150 for 10 years

SAFRA DBS Debit Card

For the SAFRA DBS Debit Card, you will receive your cash rebate will be in the form of SAFRA$.

There are 2 ways that you can redeem it:

- Direct redemption when you make a purchase at the 6 SAFRA Clubs and participating merchants

- Online redemption using iBanking (the rebate will be credited to the account linked to the debit card)

On top of that, you can earn SAFRAPOINTS as well. These points are earned when you spend at participating outlets and facilities in SAFRA.

These SAFRAPOINTS are on top of any cash rebates that you receive.

To apply for the debit card, you will need to be a SAFRA member. As such, SAFRA membership fees will apply.

This card is pretty attractive, provided you hit the minimum spend of $400.

However, you’ll have an additional hassle of claiming your rebates each month.

Both debit cards may not be suitable for you

Ultimately, both debit cards may not be suited to your spending habits, as you:

- Have to pay for a HomeTeamNS or SAFRA membership

- Need to meet a minimum spend for the SAFRA debit card

- Can only redeem the HomeTeamNS$ at participating outlets, and not as cash

- Can redeem SAFRA$ as cash, but you have to manually withdraw it from the iBanking platform

The better option that you may want to consider is the Standard Chartered JumpStart debit card.

This card provides you with 1% cashback on any Mastercard transaction. Moreover, it has no minimum spend requirements or any fees.

The amount that you spend each month during NS may be very little, since you’ll be in camp most of the time.

As such, a flexible card like the JumpStart debit card may be more suitable for you.

Verdict

If you have not enlisted yet, you’re in the best position to take advantage of this great deal.

You can apply for the SAYS Programme within the first month of your NS allowance being credited to you. This ensures that you’re making full use of the 24 months of your NS allowance!

However, if you’ve already enlisted into NS, do not worry just yet. You can still enjoy the interest rate, but for a shorter period of time.

There are other accounts that you can use to maximise your savings, such as:

As such, do not be disheartened that you’ve lost out on the interest rate!

To summarise, here are the pros and cons of this account:

| Pros | Cons |

|---|---|

| 0.05 to 0.25% Base Interest Rate with 2% Bonus Interest Rate | No withdrawals can be made from the account |

| Smooth account setup | Debit cards are not that attractive |

| Flexible Monthly Savings Amount between $50 – $3000, which you can change at any time |

The SAYS Programme is great for you to cultivate a savings habit.

I really regret not finding out about this programme when I was still in NS. I hope that you would not make the same mistake as me.

After your 2 years in NS, you may be surprised by how much you’ve managed to save!

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?