Last updated on June 6th, 2021

Everyone’s been telling you to invest in gold.

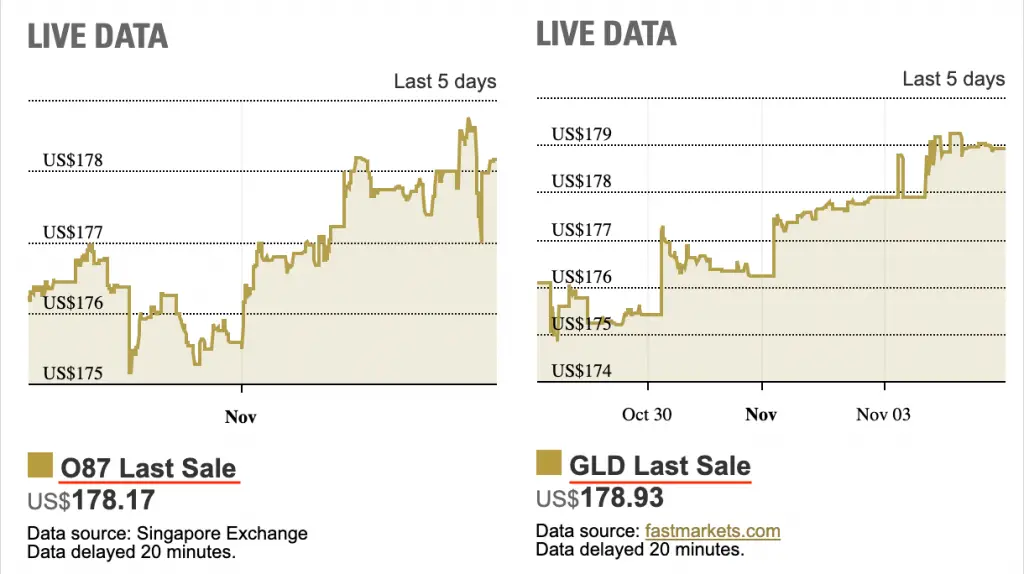

However, you see that there are different gold ETFs in the market. One is listed on the SGX (O87) while another is listed on the NYSE (GLD)!

How are they different and which one should you choose?

Here’s a complete breakdown on these 2 gold ETFs:

Contents

Both ETFs are managed by SPDR

Both of these ETFs are managed by SPDR. Since both funds are offered by the same fund manager, there is not much difference between the 2 ETFs.

They are on different exchanges

GLD is listed on the NYSE while O87 is listed on SGX.

Due to different trading hours, the prices may be slightly different.

Even in the SGX, O87 is denominated in USD! As such, you may want to consider the currency exchange risk when investing in either ETF.

Since they are listed on different exchanges, they have some minor differences:

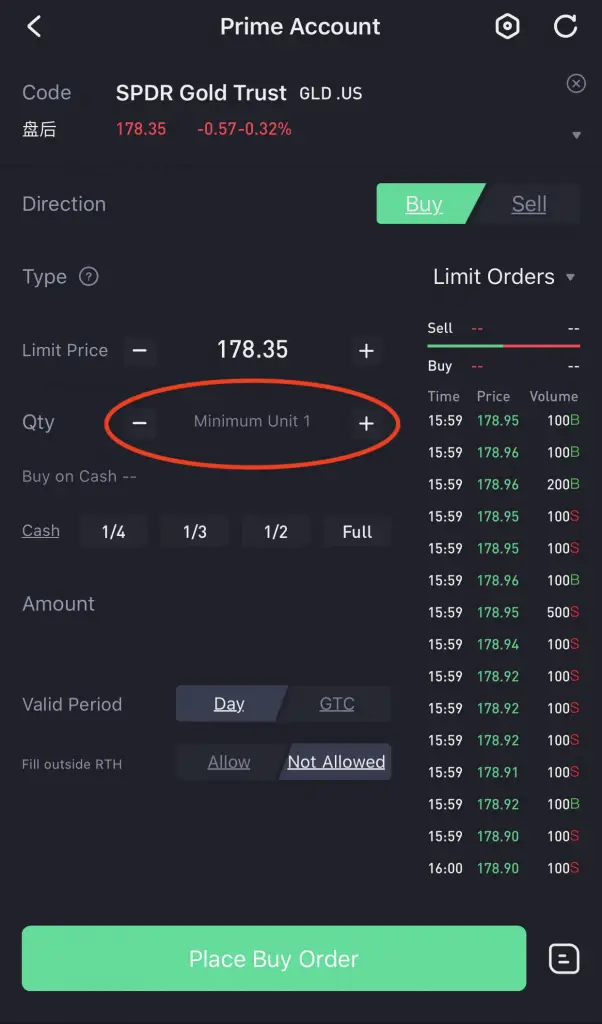

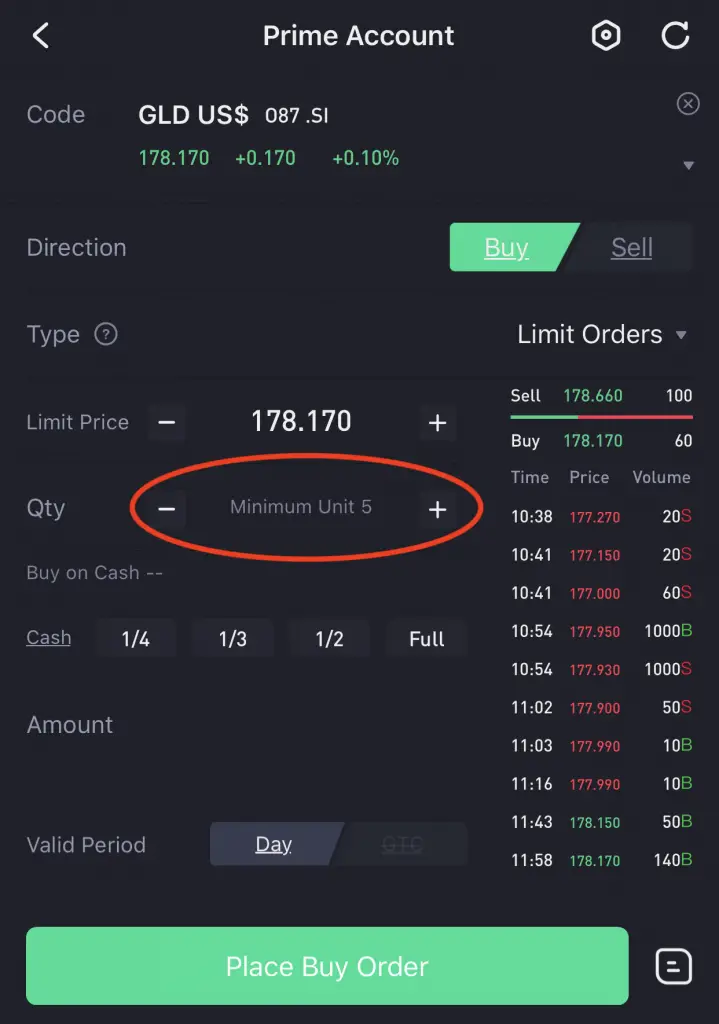

#1 Different minimum units

The minimum number of units that you can purchase for each ETF will be different.

You are able to buy a minimum of 1 unit for GLD.

However, the minimum number of units for O87 is 5.

As such, you will need to have a higher amount to start investing in O87.

#2 Commissions may be different

Depending on your brokerage, you may receive different commission rates for both GLD and O87.

For example, here are the commissions being charged by Tiger Brokers:

| SGX | US Markets |

|---|---|

| 0.08% * trade value, minimum SGD$2.88 | 0.01 USD per share, minimum $1.99USD per trade |

You may want to choose the more cost effective option, depending on the amount that you can invest.

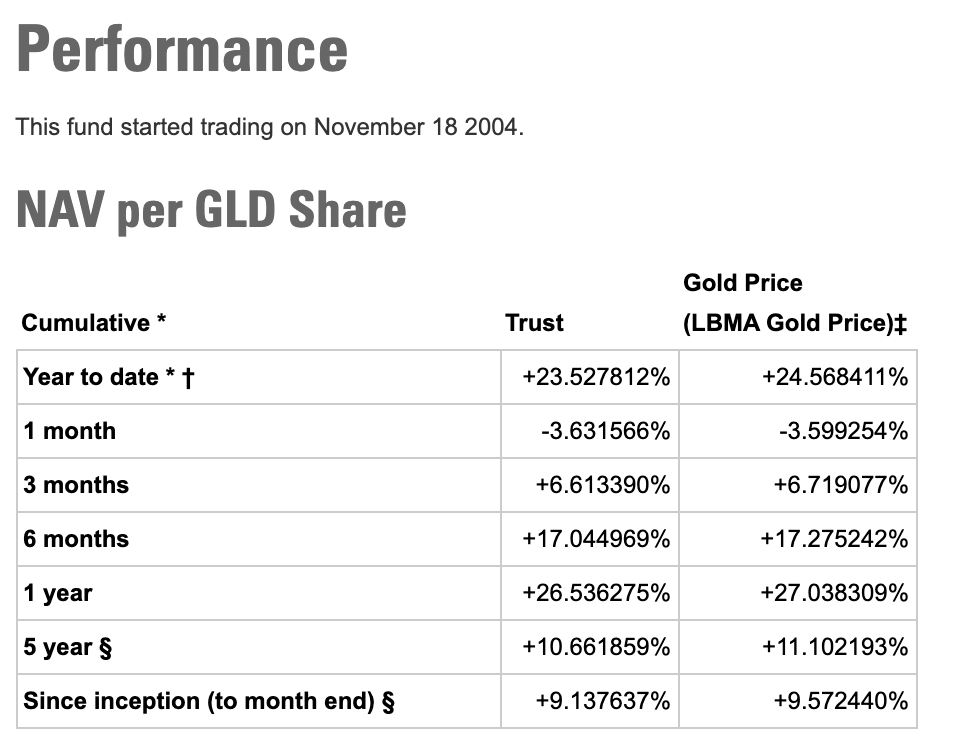

Both ETFs have the same performance

Since they are the same fund but just listed in different exchanges, both ETFs will have the same performance.

You can track either ETF’s performance along with other investments using StocksCafe’s platform.

Both ETFs do not issue dividends

Since the ETF only tracks the performance of gold, both ETFs will not issue a dividend. As such, you would not receive any dividends when investing in either gold ETF.

Both ETFs will have the same estate tax

Both O87 and GLD are domiciled in the US. When you pass away, there will be an estate tax levied on the total amount of your assets in US.

The fund’s domicile is more important than where the fund is listed on. Even though O87 is listed on the SGX, it will still incur the same estate tax!

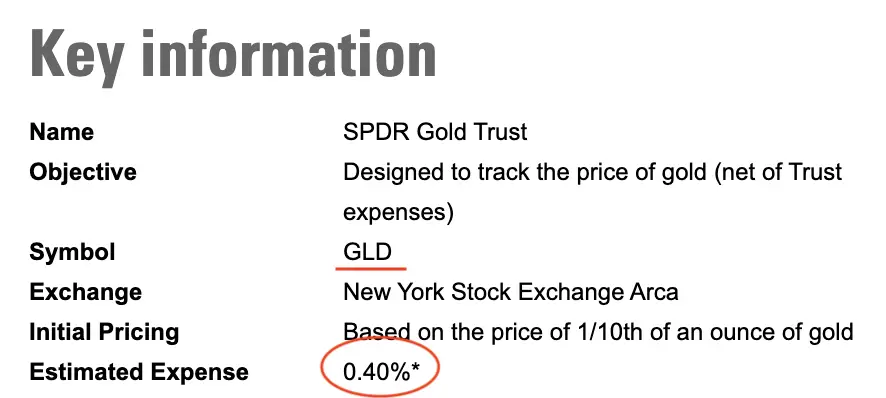

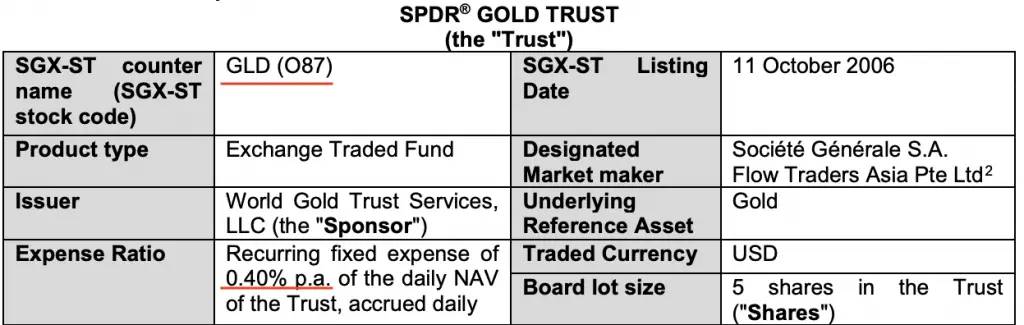

Expense ratio

The expense ratio is something that you’ll need to consider when investing. However, both O87 and GLD have the same expense ratio (0.4%).

As such, there is no cost savings when you invest in one ETF over the other.

GLD has much higher liquidity

If you wish to make frequent trades, liquidity might be something you want to consider. ETF liquidity is often measured by the trading volume.

Here’s the average trading volume for these 2 ETFs from Yahoo Finance:

| GLD | O87 | |

|---|---|---|

| Average Trading Volume | 12,000,000 | 27,000 |

It’s clear that GLD has the far superior trading volume!

You may purchase or sell O87 at unfavourable prices

Would the poor liquidity of O87 affect you? Due to the low trading volume, it may be hard to buy or sell at your intended price.

If you are a long term investor, the poor liquidity may not really be a problem. However if you are a trader that wishes to profit off gold, then you may want to invest in GLD instead!

Investment options

You are able to invest in both GLD and O87 using different methods:

Invest in GLD via brokers or robo-advisors

If you wish to invest in GLD, you can only use cash to invest. You can purchase GLD with any brokerage that offers access to the US markets.

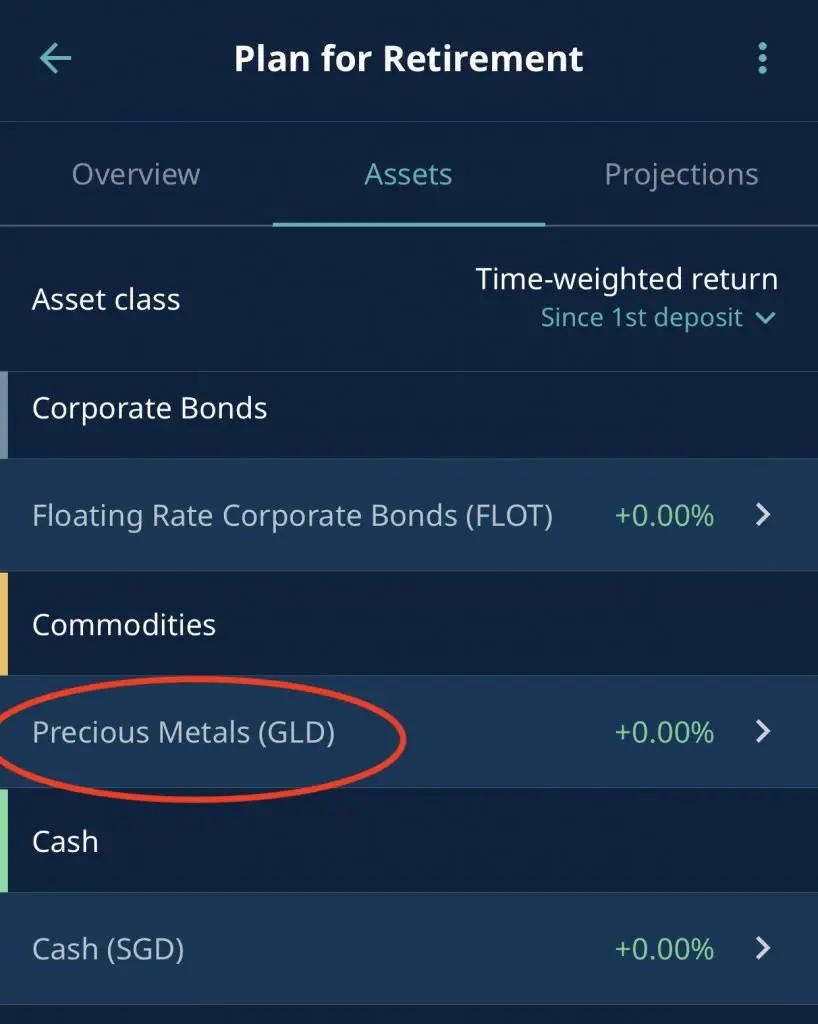

Moreover, some robo-advisor portfolios include the GLD ETF. For example, StashAway’s general investing portfolios will invest your funds in GLD.

However, StashAway will not invest in GLD if you choose to invest in the Income Portfolio.

You can invest in O87 using both CPF and SRS

Besides cash, you can invest in O87 using your CPF or SRS. This is great if you want to hedge your CPF-OA or SRS funds against gold instead of leaving it in your account.

For SRS, you will need to use any brokers that allow SRS investing. Some of these brokers include:

O87 is the only Gold ETF that you can purchase with your CPF funds. You will need to find a broker that allows you to invest your CPF funds as well.

You may want to note that you can only invest up to 10% of your investible savings in gold. The types of gold you can invest in include:

- Gold ETFs

- Other gold products (gold certificates, gold savings account, physical gold)

Verdict

Here’s a comparison between these 2 ETFs:

| GLD | O87 | |

|---|---|---|

| Fund Manager | SPDR | SPDR |

| Exchange Listed On | NYSE | SGX |

| Currency | USD | USD |

| Minimum Unit | 1 | 5 |

| Performance | Same | Same |

| Dividends | None Issued | None Issued |

| Expense Ratio | 0.40% | 0.40% |

| Average Trading Volume | 12,000,000 | 27,000 |

| Investment Options | Cash | Cash CPF SRS |

Since both of them are so similar, which gold ETF should you choose?

GLD is the preferred option

GLD offers the better option as:

- The minimum units per purchase is lower

- It is much more liquid

Invest in O87 only if you wish to invest your CPF or SRS

If you want to invest your CPF or SRS funds, then investing in O87 is the only option. However, you may experience some problems in terms of liquidity!

Conclusion

GLD and O87 are exactly the same ETF, but they are listed on different exchanges. Both do have their advantages, and the choice of ETF depends on which funds you wish to use to invest.

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?