Last updated on June 8th, 2021

Are you looking for an alternative way to buy crypto in Singapore, apart from Coinhako?

There are many crypto exchanges out there that you can consider.

So how many are there, and which should you choose?

Here’s what you need to know.

Contents

Alternatives to Coinhako

Here are 12 alternatives to Coinhako that you can consider using to trade crypto:

- Gemini

- Luno

- Zipmex

- Crypto.com

- Liquid

- Tokenize

- Coinut

- AAX

- Binance Singapore

- Binance

- Kraken

- Coinbase

Here is each alternative explained in-depth:

Gemini

Gemini can also be found in 50+ countries!

This is a summary of Gemini’s features:

| Number of Currencies | 34 |

| Funding Methods | Xfers |

| Methods of Buying | Instant Buy (Exchange) Trading (Active Trader) |

| Withdrawal of Funds | Xfers |

| Deposit Fees | None |

| Withdrawal Fees | None |

| Trading Fees | From 1.49% (Exchange) and up to 0.35% (Active Trader) |

| Sending Fees | Free for first 10 withdrawals |

| Minimum Per Trade | Depends on currency |

| Extra Features | Gemini Earn |

| Security | Cold storage + hot wallet |

| Verdict | Lower fees with more currencies than Coinhako |

Here is Gemini explained in-depth:

Number of currencies

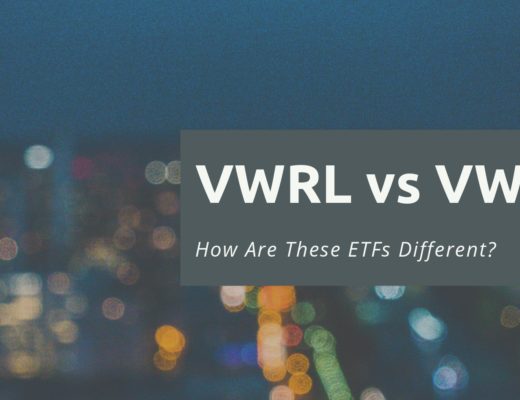

Gemini allows you to buy 34 currencies on their platform. Here are some of the currencies can buy:

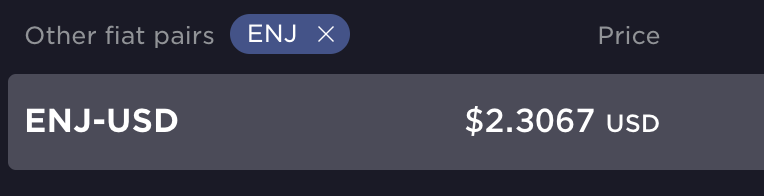

You are also able to buy other currencies like ENJ on their platform too.

Gemini has quite a unique variety of cryptocurrencies on their platform!

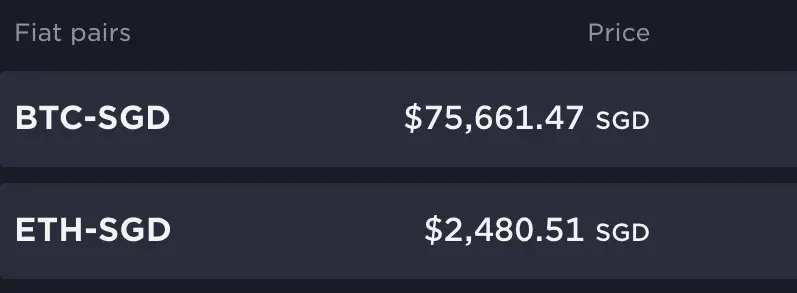

Methods of funding account

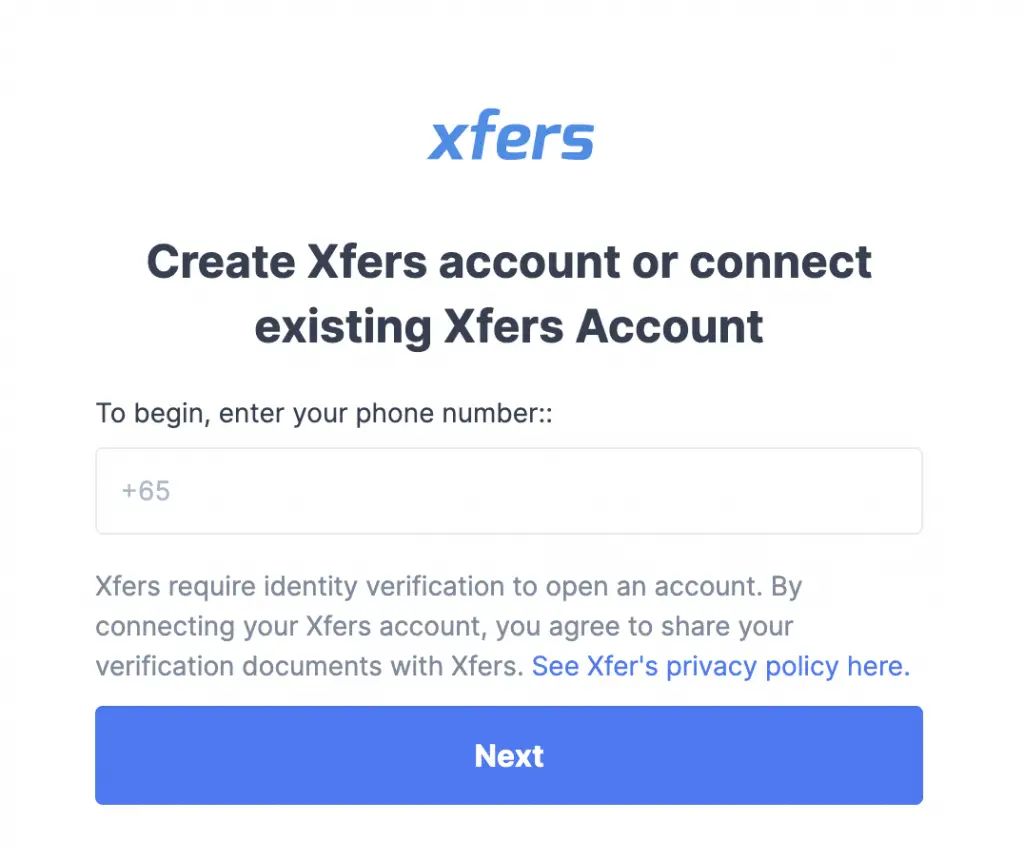

You can deposit funds into Gemini by transferring them to your Xfers wallet.

After receiving the funds, it will be directly credited into your Gemini account.

You can check out my guide on how to deposit funds into Gemini to find out more.

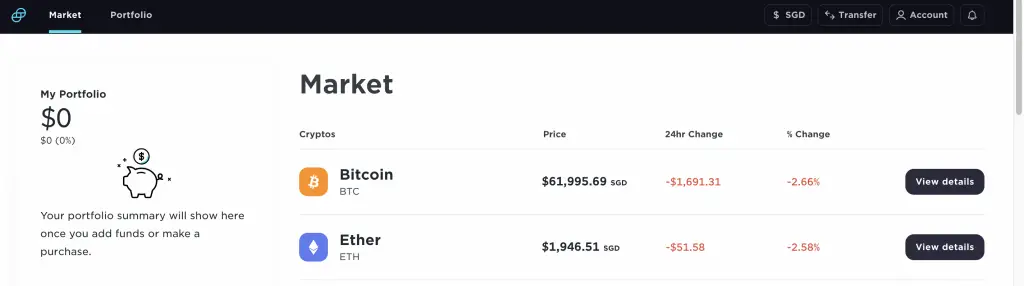

Methods of buying

Gemini allows you to buy crypto on their platform using 2 methods:

- Gemini Exchange

- Gemini Active Trader

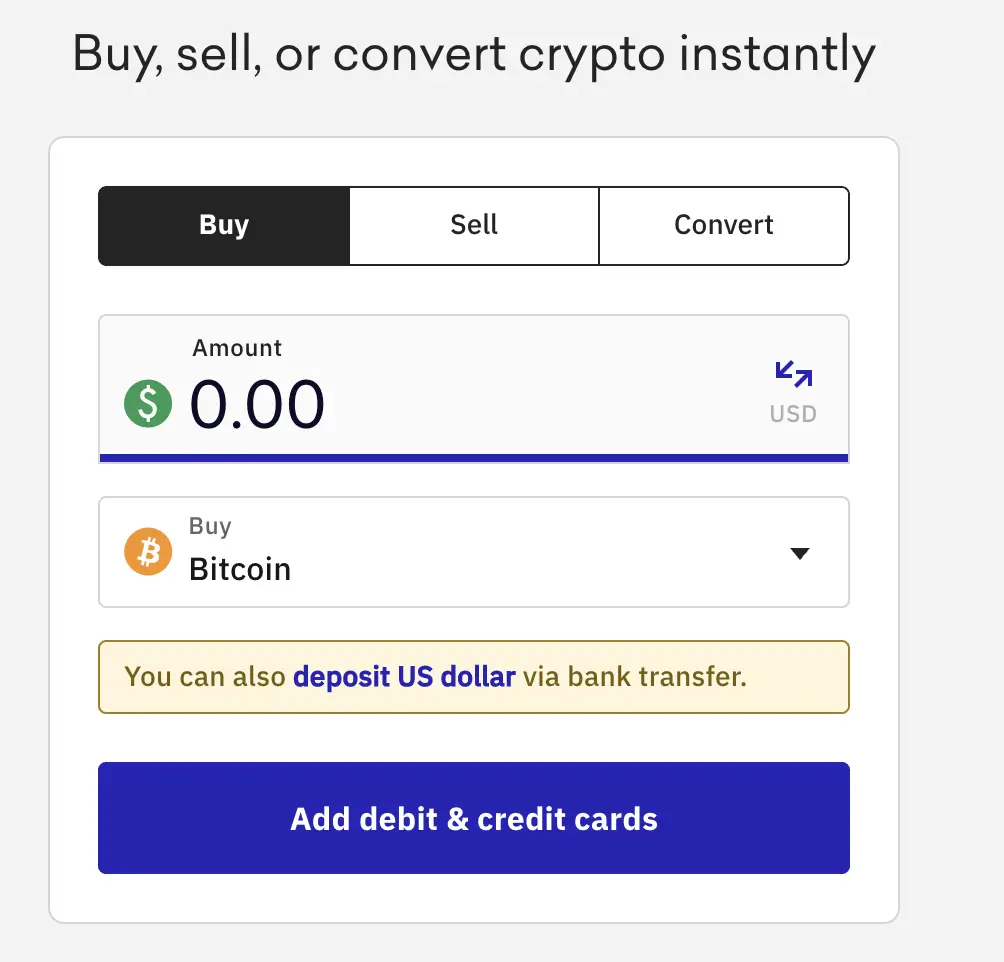

Gemini Exchange is an Instant Buy feature, which is similar to Coinhako.

You will buy your crypto at the prevailing market rate that is set by Gemini.

The fees may be quite high too!

Alternatively, you can consider using Gemini’s Active Trader platform instead.

The fees for Active Trader are much lower!

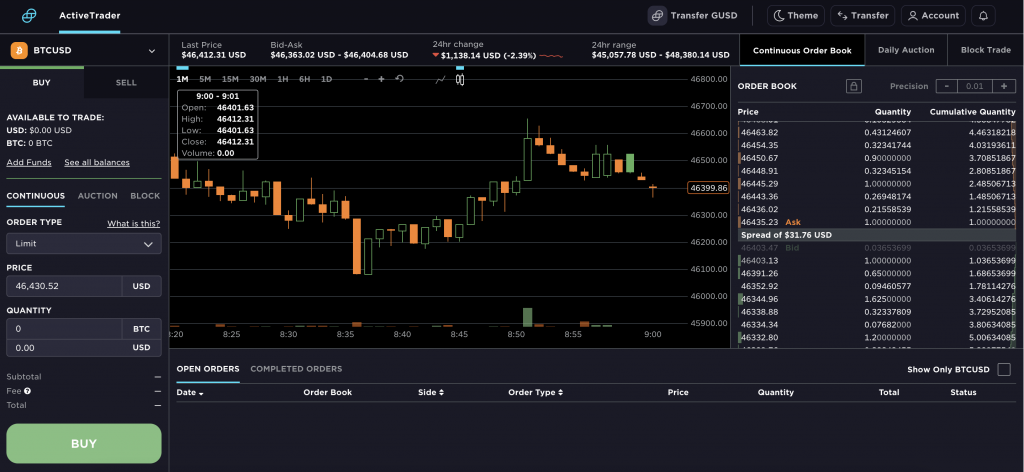

However, the only issue is that Active Trader only has a SGD trading pair with either BTC or ETH.

If you want to buy other currencies like LINK or UNI, you’ll have to make at least 2 trades.

For example, if you want to buy UNI, these are the trades you need to make:

- SGD to BTC

- BTC to UNI

In the end, the fees may still be cheaper compared to buying UNI via Gemini Exchange!

Withdrawal of funds

When you withdraw your funds from Gemini, it will be sent to Xfers.

Your funds should be credited back into your account within one business day.

This means that you’ll still need to go to Xfers and withdraw the funds back into your bank account.

This is may be slightly more troublesome compared to Coinhako, which directly credits SGD to your bank account.

Minimum trade amount

If you want to trade on Gemini’s Active Trader platform, the trading minimum depends on your currency.

For Gemini Exchange, you can make a purchase with less than $15. However, the fees that you’re charged are really high!

Fees

Here are the fees that you’ll incur when trading with Gemini:

| Fee | Amount |

|---|---|

| Deposit Fees | None |

| Withdrawal Fees | None |

| Trading Fees | From 1.49% (Exchange) and up to 0.35% (Active Trader) |

| Sending Fees | Free for first 10 withdrawals |

The trading fees for Gemini Exchange are really high:

| Trade Amount (SGD) | Trading Fee (SGD) |

|---|---|

| ≤ $15.00 | $1.50 |

| > $15.00 but ≤ $35.00 | $2.00 |

| > $35.00 but ≤ $70.00 | $2.75 |

| > $70.00 but ≤ $250.00 | $4.00 |

| > $250.00 | 1.49% of your Web Order value |

It is definitely not worth trading anything less than $250!

As such, you may want to consider using Active Trader, which only costs up to 0.35%.

Even if you make multiple trades, it will still be cheaper compared to buying on Gemini’s Exchange!

Another feature of Gemini is that it offers you 10 free withdrawals each month. This is really useful if you want to send your crypto to another platform.

Some currencies may charge a very high fee when sending on their networks!

Extra features

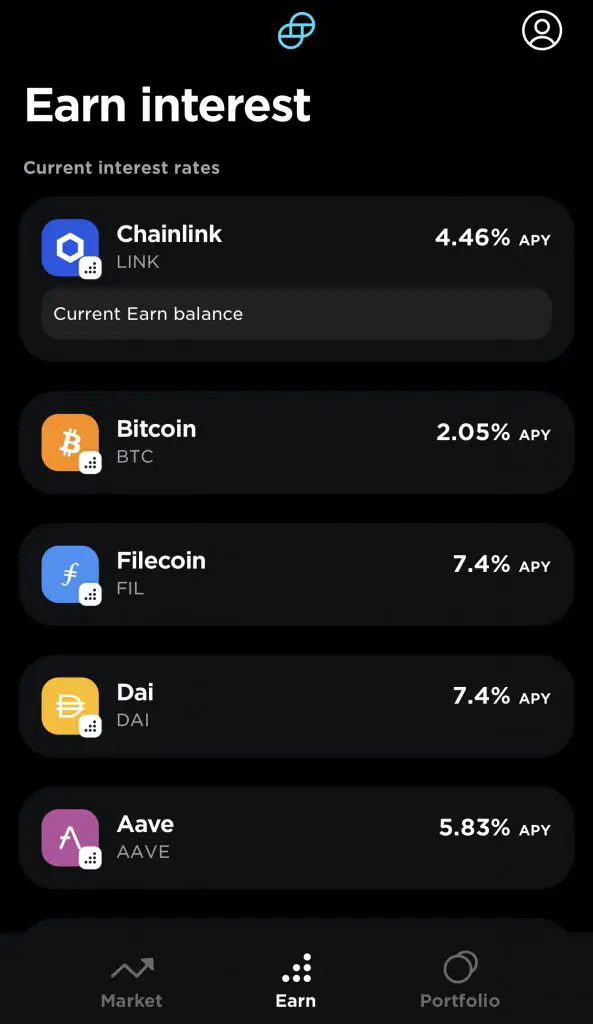

Gemini also has an Earn feature, which allows you to earn interest on your crypto.

Gemini lends out your currencies to their approved partners. So far, Genesis is their only approved partner.

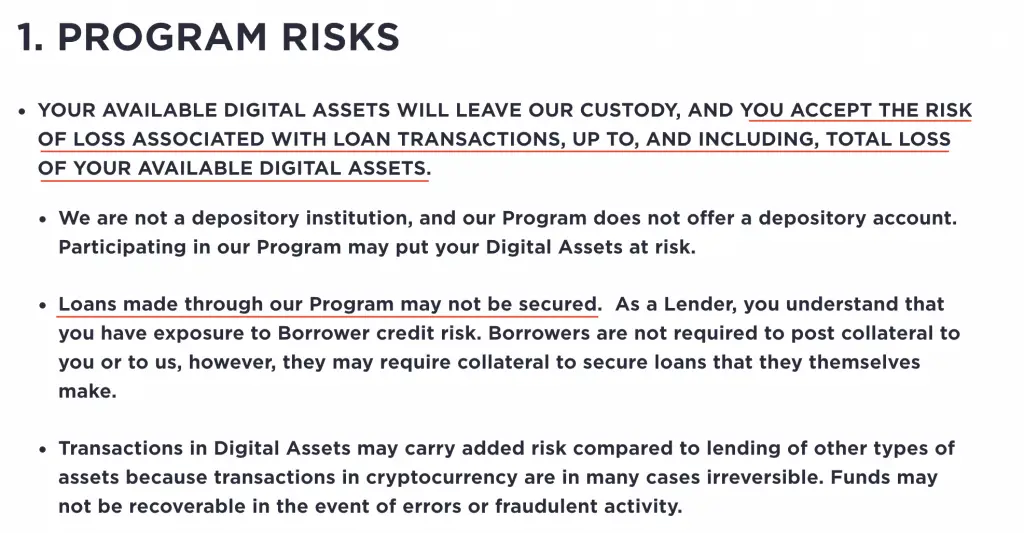

However, Gemini may not secure your loan with collateral. Furthermore, they will not take responsibility if your borrower defaults!

This may be riskier compared to lending out your currencies with Celsius or Blockfi.

Security

Gemini claims it is one of the most secure crypto exchanges.

Majority of the assets on the exchange are stored in an offline cold wallet.

Moreover, the remaining funds in the hot wallet is insured.

Our policy insures against the theft of Digital Assets from our Hot Wallet that results from a security breach or hack, a fraudulent transfer, or employee theft.

Gemini

It seems that Gemini’s owners are quite confident about the security of their platform!

Verdict (Comparison with Coinhako)

Here are Gemini’s pros and cons compared to Coinhako:

| Pros | Cons |

|---|---|

| Low trading fees for Active Trader (Up to 0.35%) | Active trader only has 2 SGD trading pairs (BTC and ETH) |

| More currencies available | Buying via Gemini Exchange is more costly (≥ 1.49%) |

| No deposit or withdrawal fees | Does not have popular currencies like ADA or DOT |

| Earn feature present |

If you intend to do a lot of trading, Gemini may be the better option compared to Coinhako.

However, there are certain currencies like ENJ or AAVE, where Gemini only has a USD trading pair on the Active Trader.

If you want to buy ENJ from SGD, Coinhako is the better option compared to Gemini.

As such, it really depends on the currencies that you want to buy.

You should choose Gemini if your currency has a BTC / ETH trading pair on Active Trader. If not, Coinhako may be the better option!

Luno

Luno is based in London and was founded in 2012.

They have expanded to a few countries like UK, Australia and Singapore.

Here is a summary of their features:

| Number of Currencies | 6 |

| Funding Methods | Xfers |

| Methods of Buying | Instant Buy (App) Trading (Exchange) |

| Withdrawal of Funds | Xfers |

| Deposit Fees | None |

| Withdrawal Fees | None |

| Trading Fees | 1% (Instant Buy) and up to 0.1% (Exchange) |

| Sending Fees | Dynamic |

| Minimum Per Trade | Depends on currency |

| Extra Features | Luno Savings Wallet |

| Security | Cold storage + hot wallet |

| Verdict | Cheapest way of buying BTC from Exchange |

Number of currencies

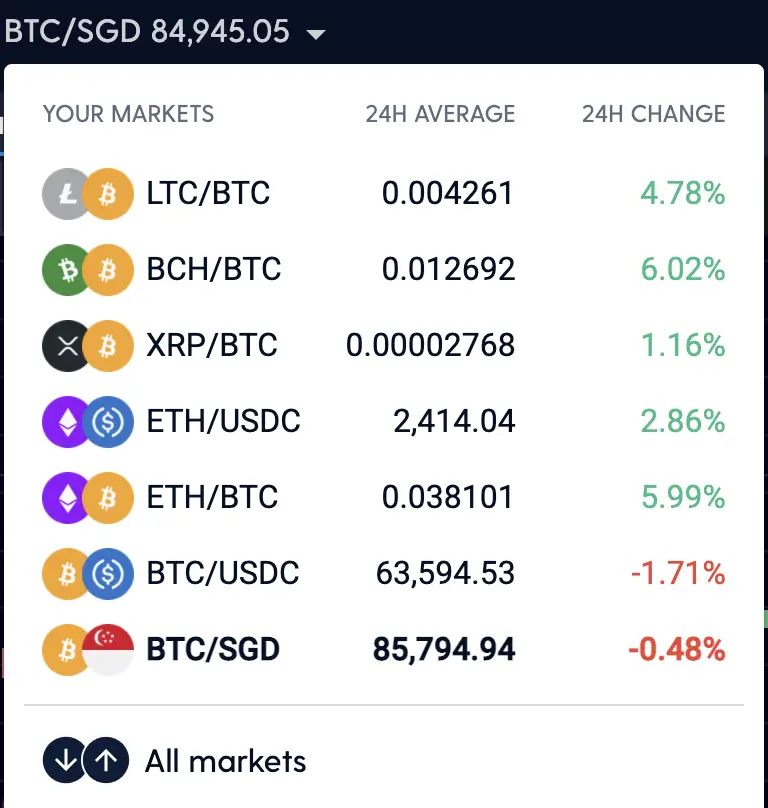

Luno only offers you 6 currencies on their platform:

Luno’s offering is much lower compared to Coinhako!

Methods of funding account

Luno allows you to deposit your funds via Xfers.

This makes it rather convenient to transfer your funds between platforms.

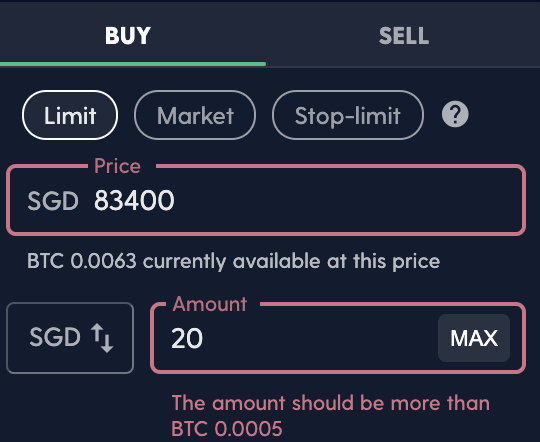

Methods of buying

Similar to Gemini, Luno has 2 methods of buying crypto on their platform:

- Instant Buy

- Exchange

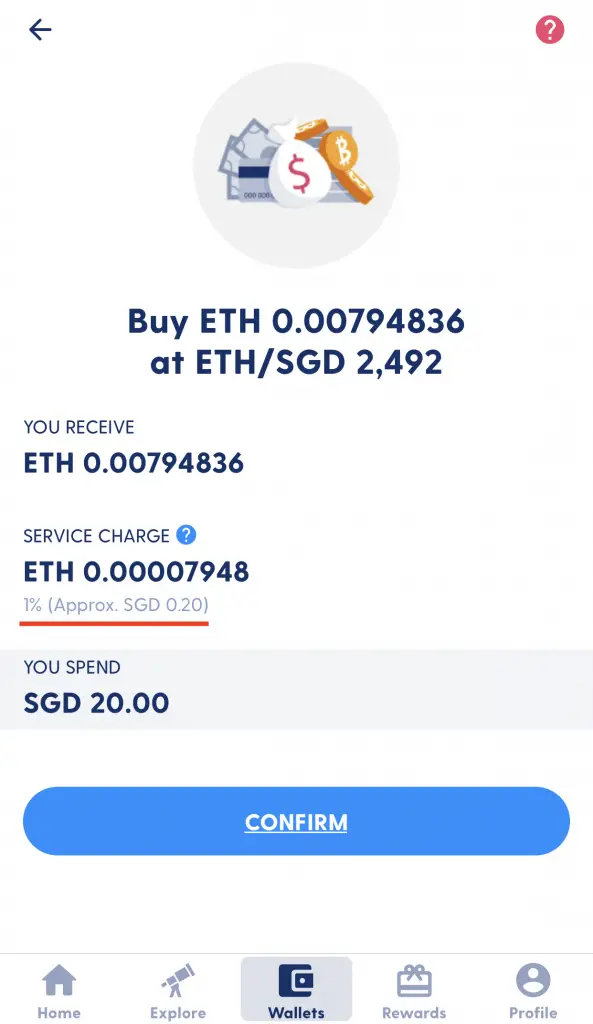

For Instant Buy, you will buy crypto at Luno’s prevailing market rate.

However, the fees are rather expensive at 1%.

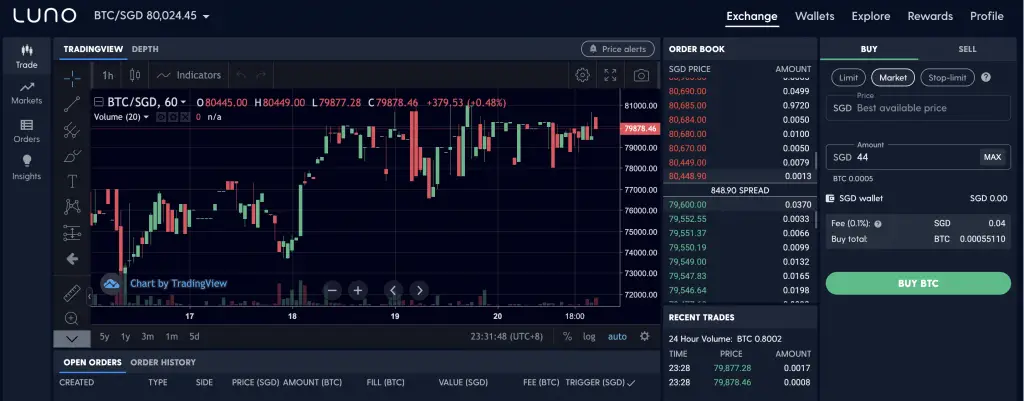

You can also trade your crypto on the Luno Exchange.

However, you can only buy BTC from SGD, and not other currencies. This is because the only SGD trading pair available is BTC/SGD.

If you want to buy the other 5 currencies on Luno, you’ll have to make at least 2 trades.

Withdrawal of funds

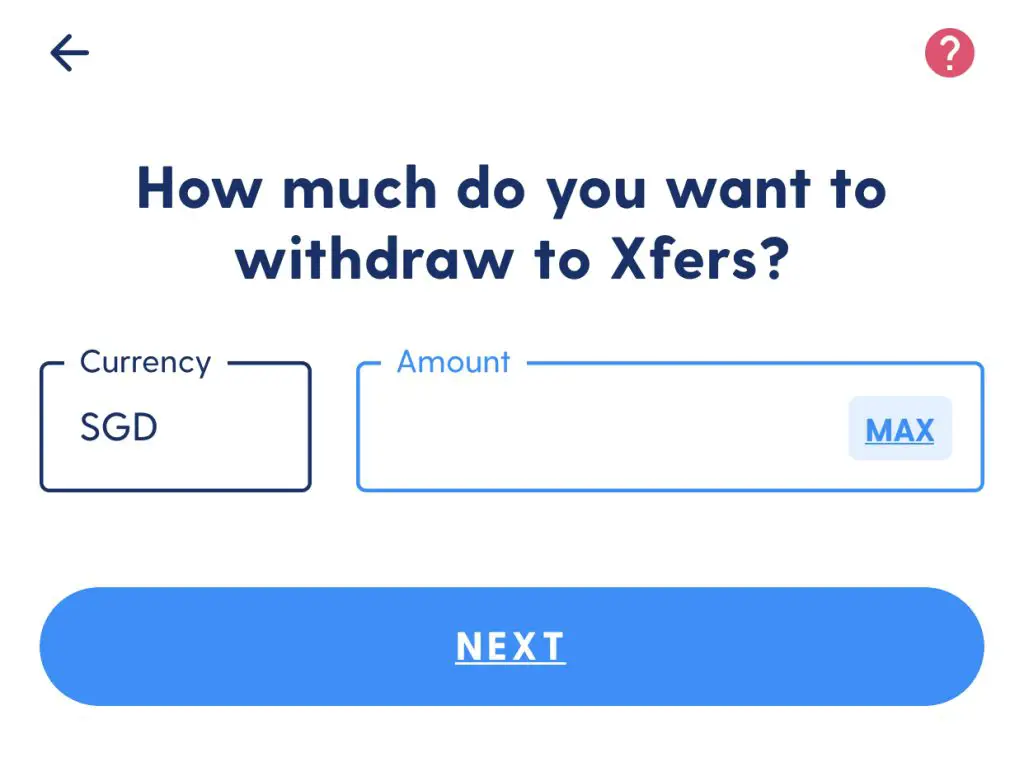

When you withdraw your funds from Luno, they will be transferred to your Xfers wallet.

Again, you’ll need to transfer the funds from Xfers back to your bank account. This may be slightly more troublesome.

Minimum trade amount

When you are buying crypto on Instant Buy, the minimum is $20.

If you are buying BTC on the Luno Exchange, the minimum amount is 0.0005 BTC.

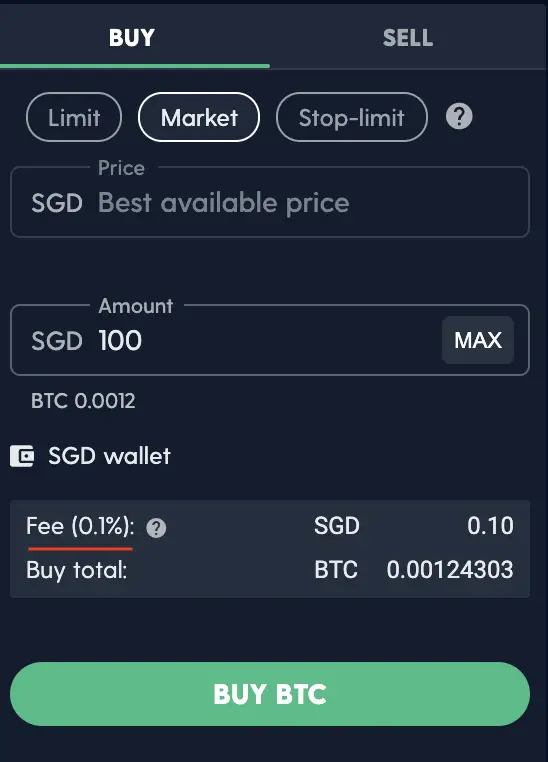

Fees

If you use Luno’s Instant Buy, you will incur a 1% fee.

Meanwhile, Luno Exchange charges you up to 0.1% per trade.

Luno’s Exchange charges one of the lowest fees when it comes to trading with SGD!

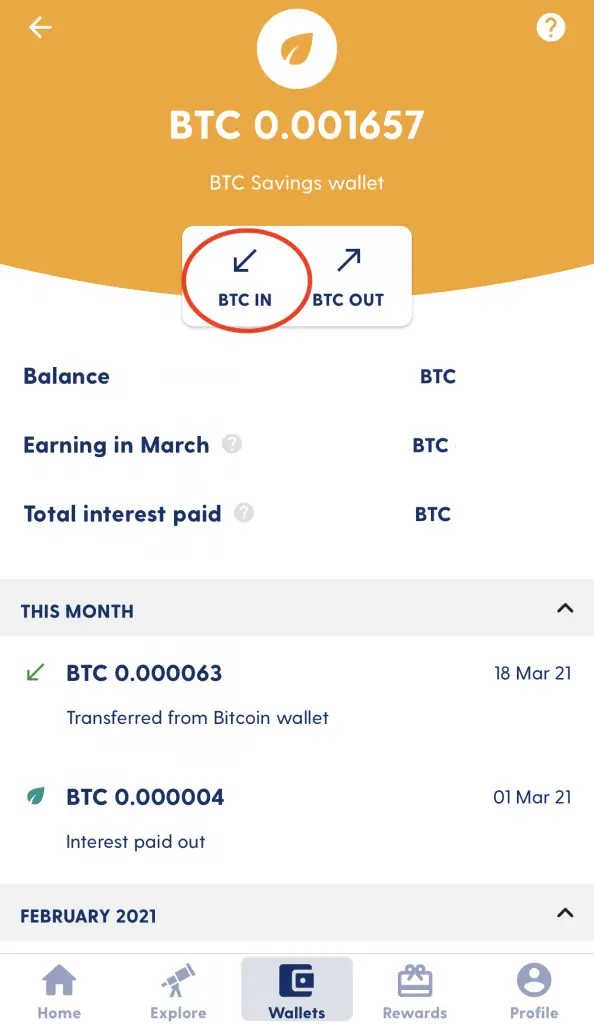

Extra features

Luno also offers you a way to earn interest on your crypto via the Luno Savings Wallet.

You are able to earn interest on your BTC and ETH. Luno expects to give you up to 4% interest for your crypto that you loan out with them.

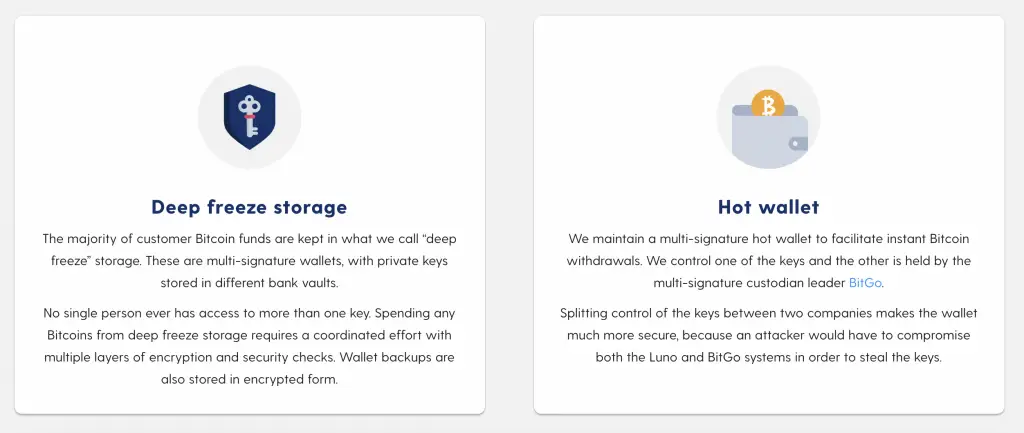

Security

Luno also uses 2 places to store your crypto:

- Deep freeze storage

- Hot wallet

This approach is quite similar to what Coinhako does. Most of your funds are stored in the cold wallet.

However, some of your funds are in their hot wallet, in case you want to quickly withdraw them.

In the hot wallet, another set of keys are held with BitGo. They are considered to be a secure custodian of your crypto.

Once again, your crypto stored with Luno should be rather secure.

Luno provides 2FA to either your email or mobile phone whenever you login to your account.

Verdict (Comparison with Coinhako)

Here are the pros and cons of using Luno compared to Coinhako:

| Pros | Cons |

|---|---|

| Lower trading fees for Luno Exchange (Up to 0.1%) | Significantly lesser cryptocurrencies available |

| Luno Savings Wallet present | |

| No deposit or withdrawal fees |

Luno offers one of the cheapest trading fees when buying from SGD. However, you can only buy BTC directly from SGD.

Furthermore, Luno only gives you access to 6 different currencies. This is much lower than Coinhako’s 31 currencies.

If you are looking to buy altcoins, then Coinhako seems to be the better option.

However, if you are just looking for exposure into Bitcoin, then Luno will be the suitable choice for you.

Zipmex

Zipmex is an exchange that was founded in Thailand.

Here is a summary of their features:

| Number of Currencies | 17 |

| Funding Methods | Xfers Direct |

| Methods of Buying | Instant Buy Trading |

| Withdrawal of Funds | Bank Account |

| Deposit Fees | None |

| Withdrawal Fees | $5 per withdrawal |

| Trading Fees | 0.2% |

| Sending Fees | Depends on currency |

| Minimum Per Trade | Depends on currency (but quite low) |

| Extra Features | Zipmex Earn |

| Security | Uses BitGo’s technology |

| Verdict | Low trading fees, but high SGD withdrawal fees |

Number of currencies

Zipmex supports 17 different currencies, which you are able to directly buy from SGD.

This includes:

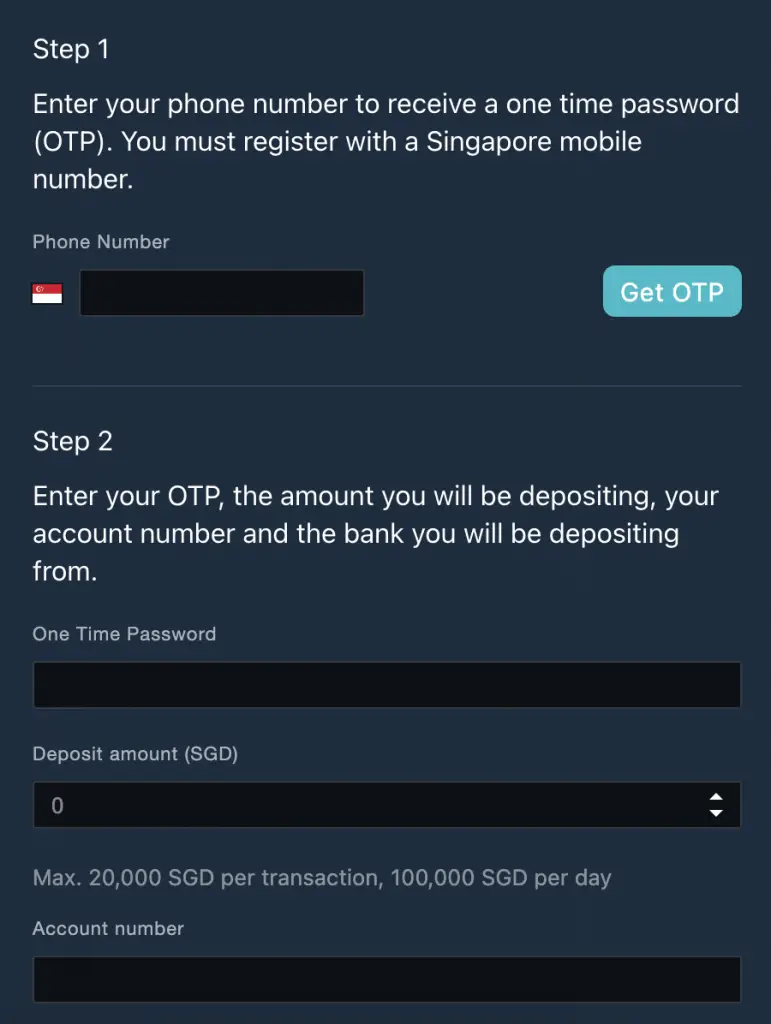

Methods of funding account

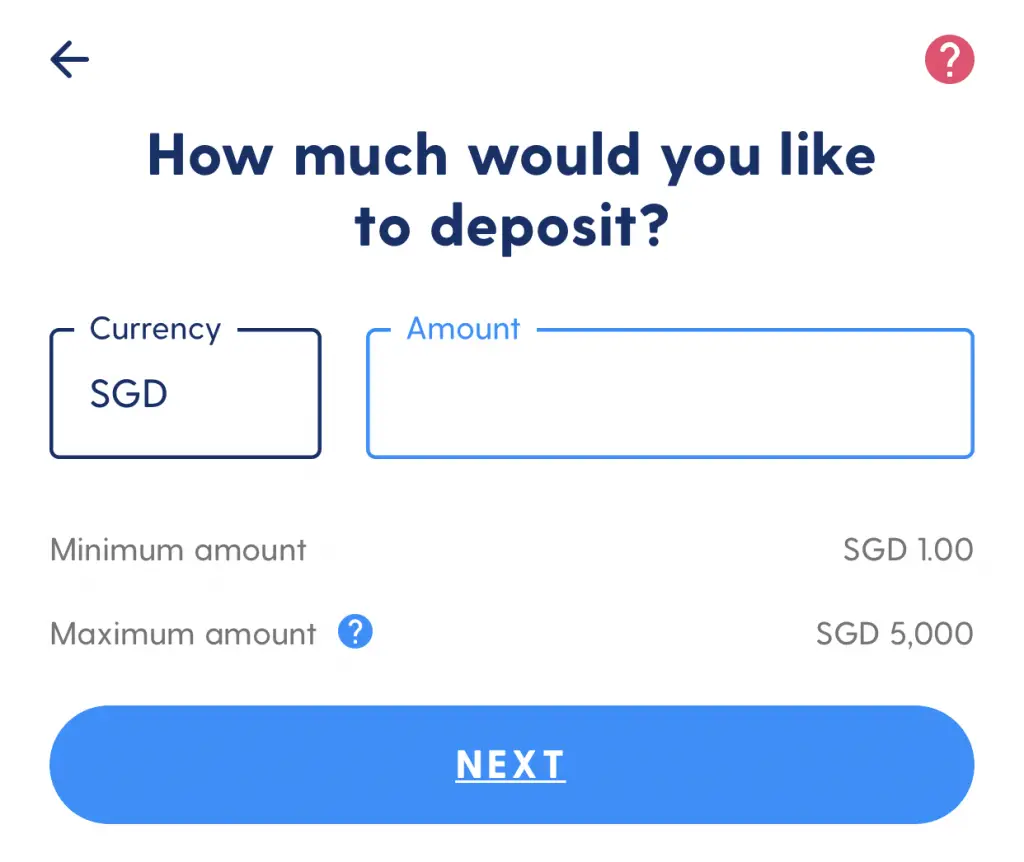

If you would like to fund your account, you can deposit your funds via a bank transfer. This will be done via Xfers Direct.

You are required to enter some details so that Zipmex can process your deposit.

This includes:

- Deposit amount

- Account number

- The bank you’re depositing from

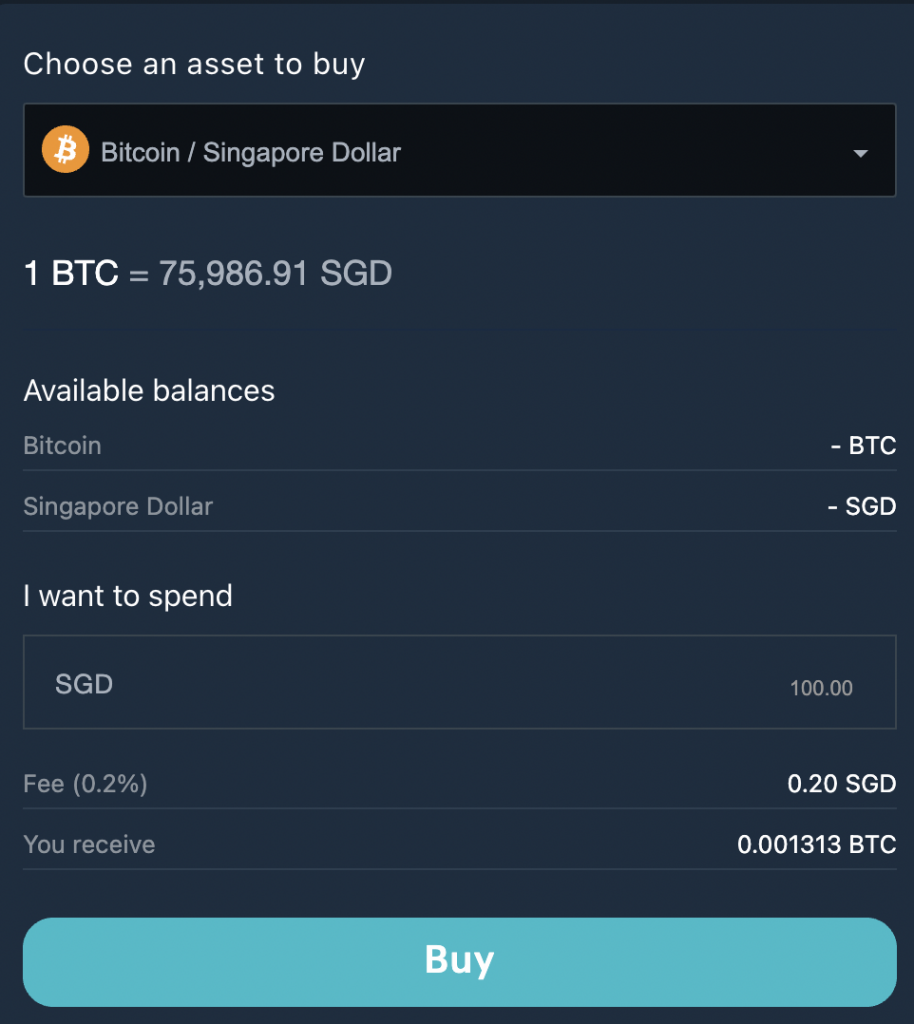

Methods of buying

There are 2 ways of buying crypto on Zipmex:

- Instant Buy

- Trading

You are able to instantly buy your crypto on Zipmex, which is based on the prevailing market rate.

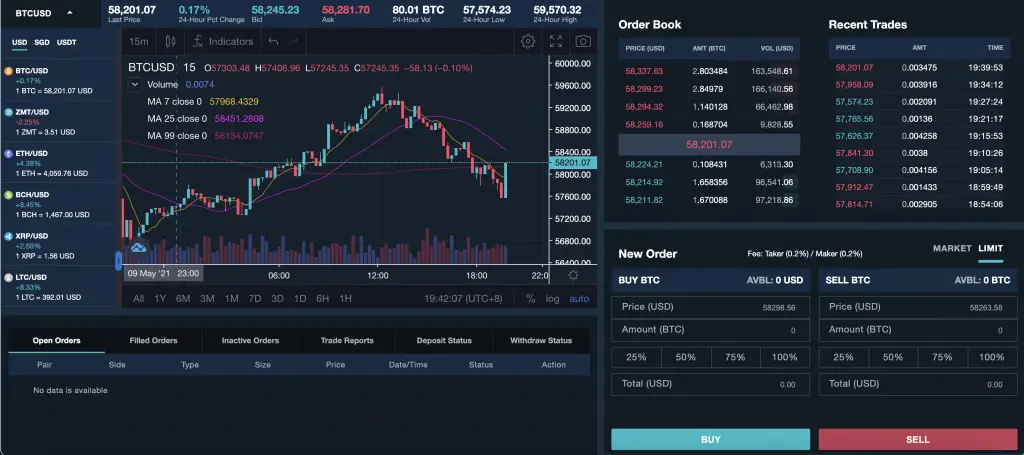

You are also able to trade your crypto on the trading platform.

This allows you to set the price that you’d like to buy your crypto with.

Withdrawal of funds

If you wish to withdraw SGD from Zipmex, you can withdraw it to your bank account via bank transfer too.

Minimum trade amount

The minimum amount that you need for each trade depends on each currency.

Most of these minimums are very low, and they usually cost less than $1 SGD!

You will also need to withdraw a minimum of $10 SGD for each withdrawal you make.

Fees

Here are some of the fees that Zipmex charges you:

| Fee | Amount |

|---|---|

| Deposit Fees | None |

| Withdrawal Fees | $5 per withdrawal |

| Trading Fees | 0.2% |

| Sending Fees | Depends on currency |

The trading fees that you incur on Zipmex are really low!

However, the withdrawal fees are quite high at $5 for each withdrawal.

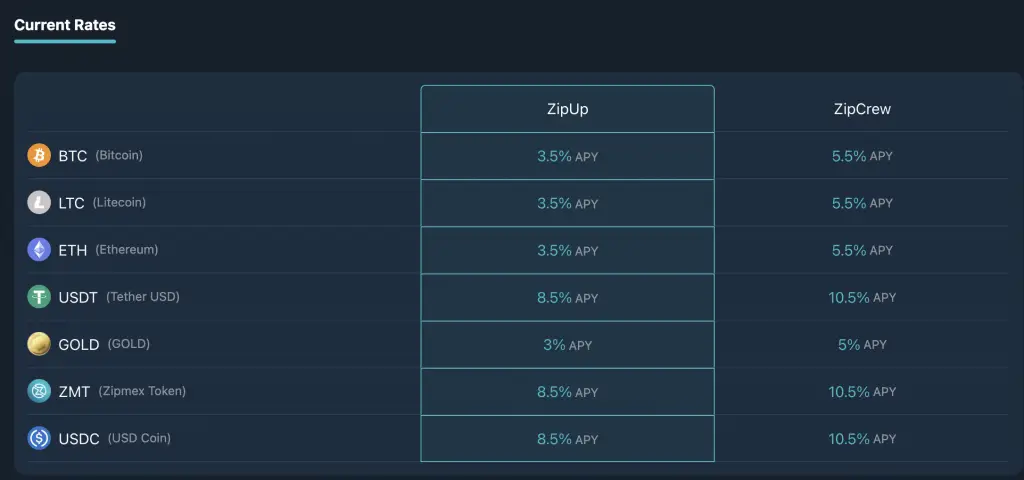

Extra features

Zipmex also has an Earn feature (ZipUp) that allows you to earn interest on your crypto.

The interest rates are lower compared to other platforms that allow you to loan out your crypto.

Security

Zipmex uses BitGo’s infrastructure to secure their platform.

Most of your funds will be stored in a wallet that is offline, so hackers won’t be able to access them.

Zipmex did talk about what would happen if they cease operations. However, they mentioned about the laws in Thailand, and did not mention anything in Singapore.

You may want to be a bit cautious and not put all of your funds into Zipmex!

Verdict

Here is a comparison between Zipmex and Coinhako:

| Pros | Cons |

|---|---|

| Lower trading fees (0.2%) | Higher withdrawal fee ($5) vs Coinhako |

| Has Earn feature for some currencies | Lower number of currencies on platform |

| Able to buy USDT and send for a reasonable fee |

The main pro of Zipmex is that you are able to trade at much lower fees compared to Coinhako.

If you are a frequent trader, this will help to significantly reduce the fees that you incur!

Furthermore, Zipmex also has an Earn feature which allows you to earn interest on some cryptocurrencies you own.

The main issue with Zipmex is that it has a much higher withdrawal fee at $5 (compared to Coinhako’s $2).

However, if you make a lot of trades, you may still incur less fees compared to trading with Coinhako.

Crypto.com

Crypto.com was founded in June 2016. They are based in Hong Kong, and serves over 10 million customers!

Here is a summary of Crypto.com’s features:

| Number of Currencies | 100+ (8 from SGD) |

| Funding Methods | Xfers Credit card |

| Methods of Buying | Instant Buy |

| Withdrawal of Funds | Xfers |

| Deposit Fees | None |

| Withdrawal Fees | 0.4% (Xfers) |

| Trading Fees | None |

| Sending Fees | Depends on currency |

| Minimum Per Trade | USD $1 |

| Extra Features | Crypto Earn Supercharger |

| Security | 100% cold storage |

| Verdict | Good if you have the Visa card and want to use Crypto.com’s other features |

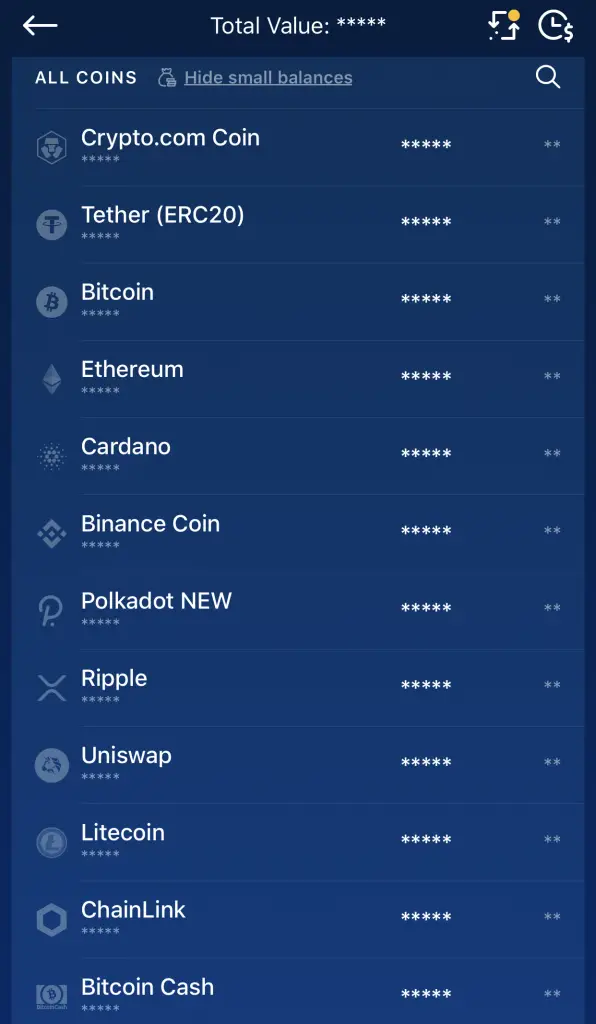

Number of currencies

Crypto.com offers a wide variety of currencies on their platform.

However, there are only 8 currencies that you can buy directly from SGD:

For the other currencies on Crypto.com, you’ll need to make at least 2 trades to buy them.

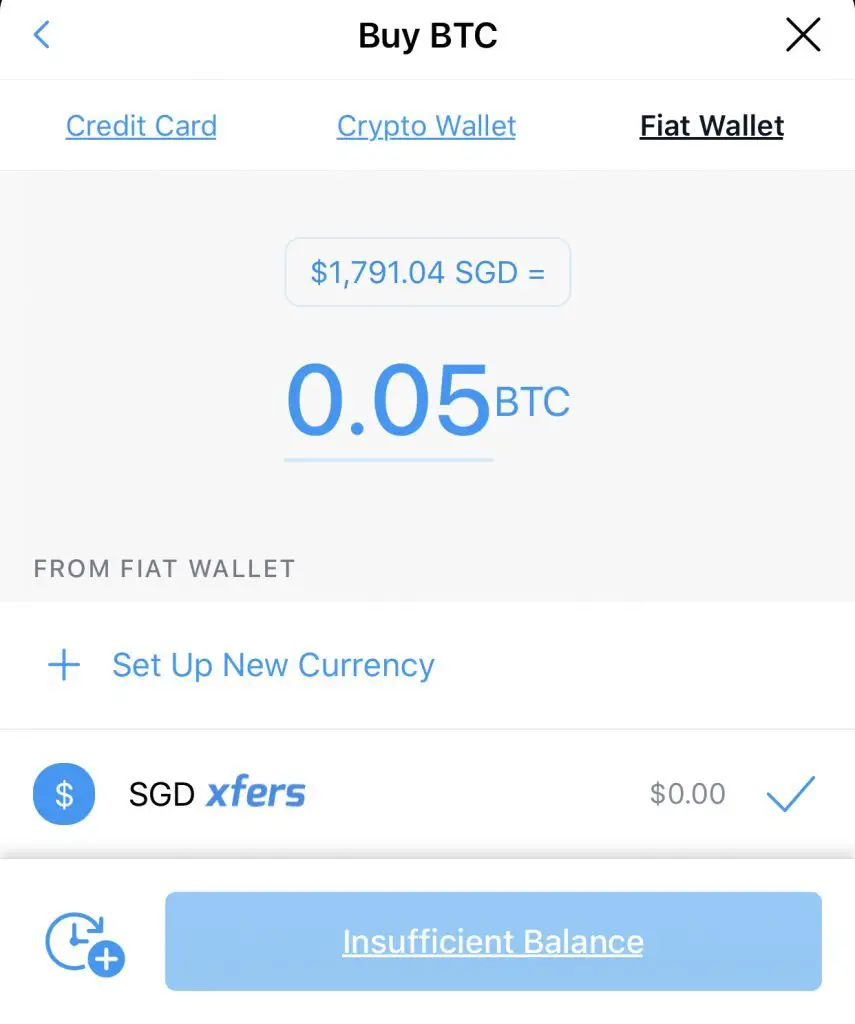

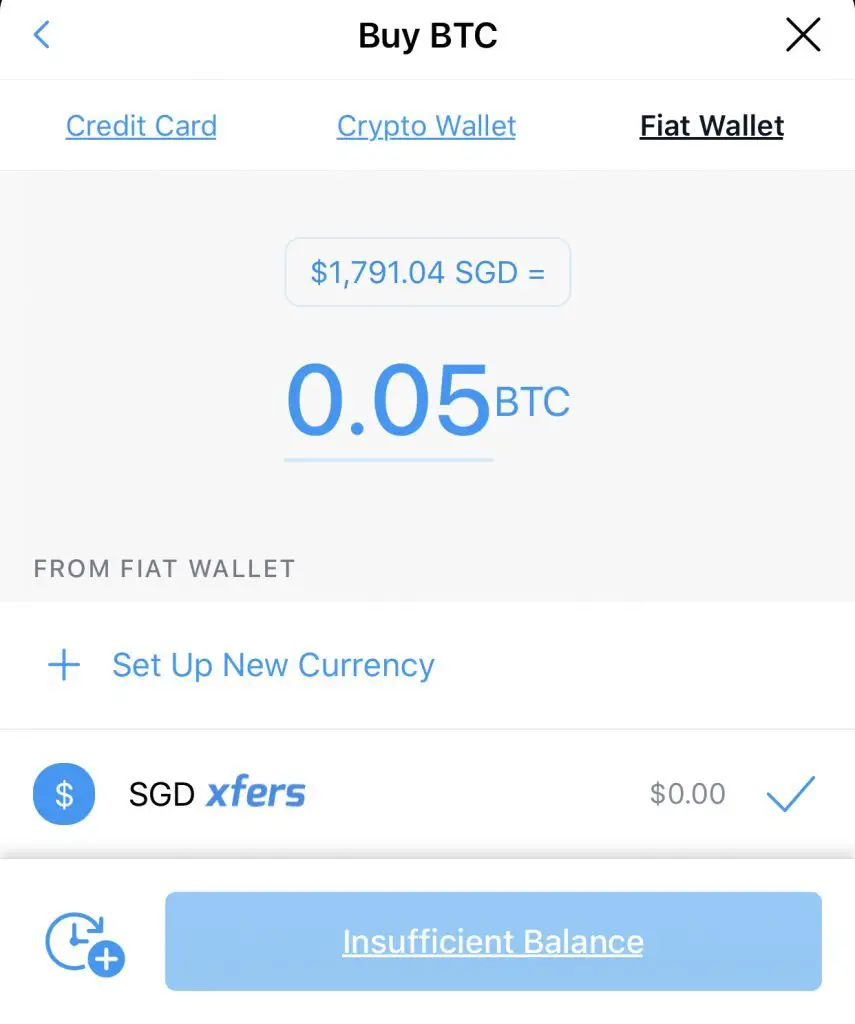

Methods of funding account

Crypto.com has a fiat wallet that you’ll need to connect with your Xfers account.

Once you’ve transferred your funds to your Xfers account, you can buy crypto using the Crypto.com app.

Methods of buying

To buy crypto on Crypto.com, you can use 3 methods:

- Credit card

- Instant buy (fiat wallet)

- Trading from another cryptocurrency

If you’re just starting out trading on Crypto.com, you can choose to buy crypto using a credit card,

as well as directly from Xfers.

However, the fees that you incur when paying with credit card will be quite high!

For both methods, you are buying crypto at Crypto.com’s prevailing market rate.

This may be higher or lower compared to the actual market rate.

Withdrawal of funds

When you want to withdraw your funds, you would need to withdraw it to Xfers.

You can only sell off the 8 currencies for SGD back into Xfers! These are the same 8 currencies that you can only buy with SGD too.

You will incur a withdrawal fee of 0.4% as well.

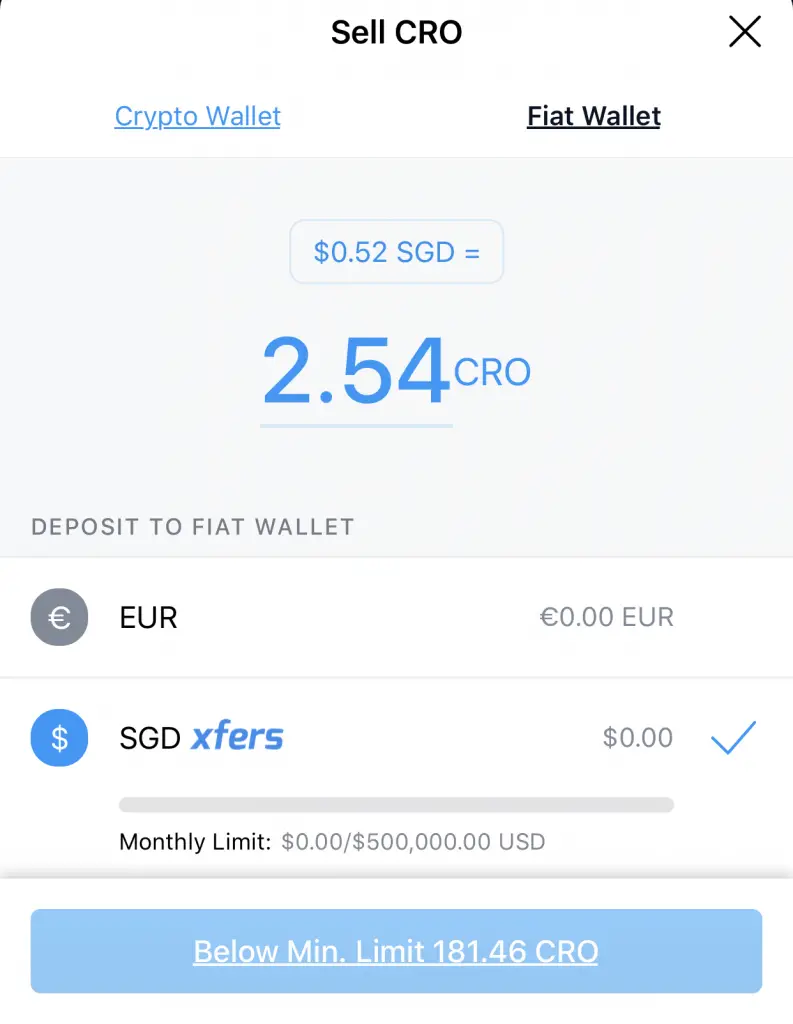

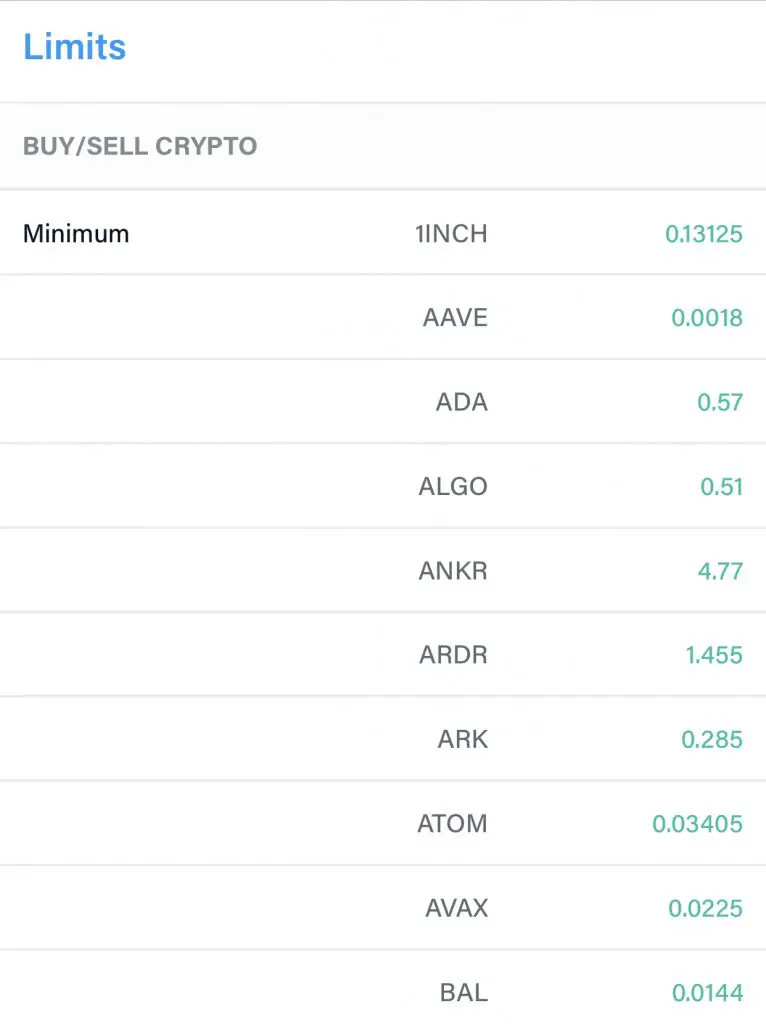

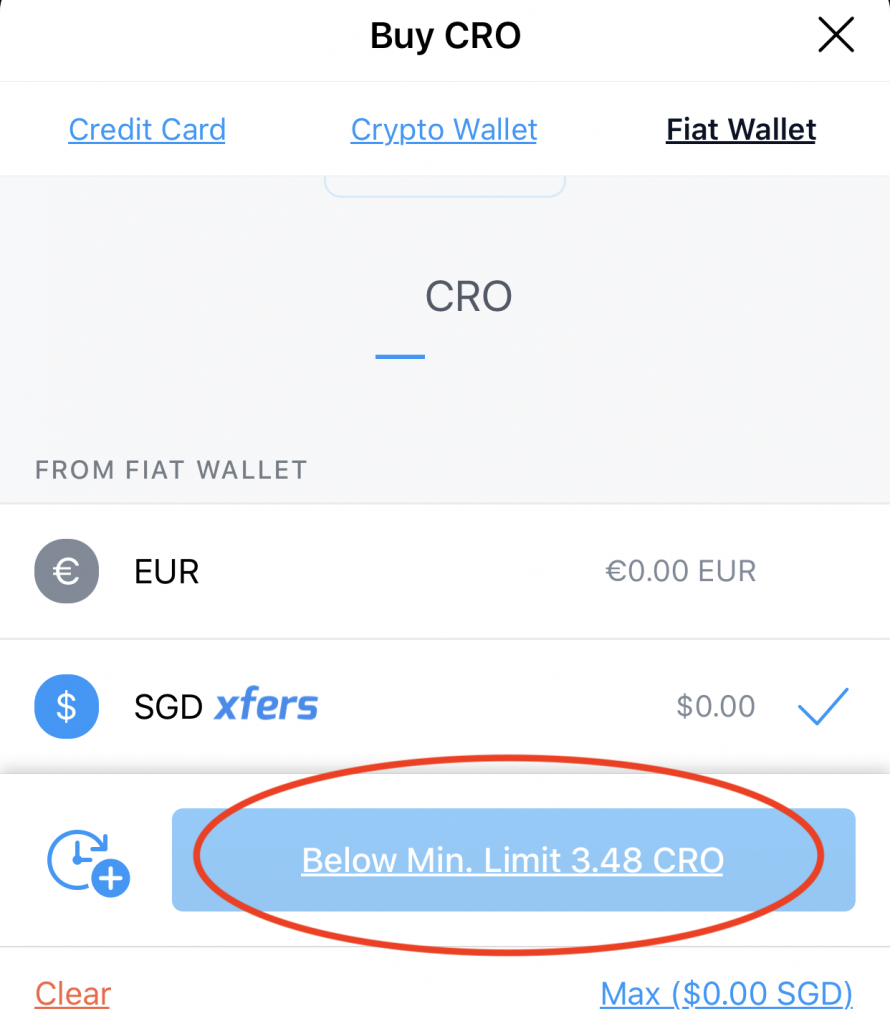

Minimum trade amount

The minimum trade amount depends on each currency.

You can see the minimum amount required for each currency in the ‘Fees / Limits‘ tab.

Most of these minimum trading amounts are equivalent to around $1 USD!

For example, you will require to buy a minimum of 3.48 CRO for each trade.

3.48 CRO is around the equivalent of $1 SGD.

The minimum trade amount is much lower compared to other exchanges! As such, this will make buying crypto much more accessible for you.

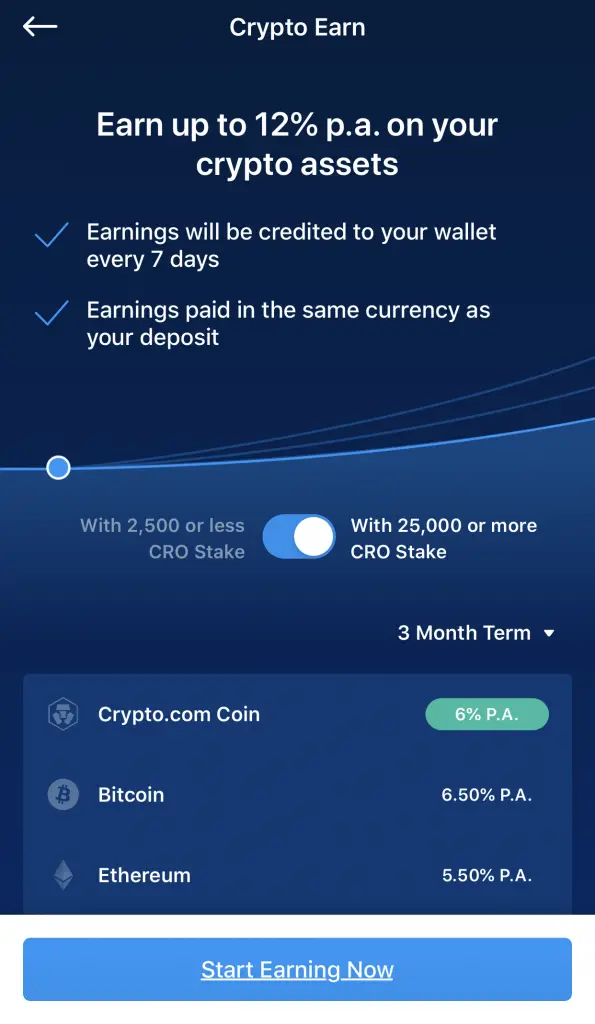

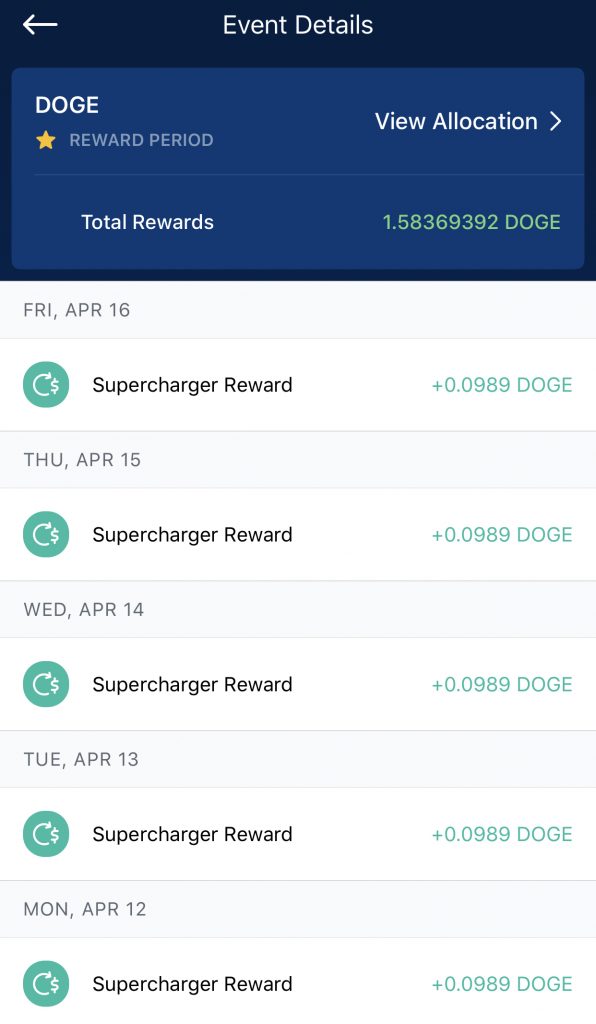

Extra features

The Crypto.com app has lots of other features as well!

You are able to earn interest on your crypto with Crypto.com Earn,

as well as mine DeFi tokens with Supercharger.

There are quite a few features that can help you to earn even more returns with your crypto!

Fees

Here are the fees that you’ll incur when buying crypto on Crypto.com:

| Fee | Amount |

|---|---|

| Deposit Fees | None |

| Trading Fees | None |

| Withdrawal Fees | 0.4% (Xfers) |

You do not incur any fees when converting one cryptocurrency to the other.

However, you’ll need to take note of the spreads.

In this way, you may be buying your crypto at a less favourable rate.

If you are constantly trading crypto, you may want to use Crypto.com’s Exchange instead.

Moreover, you will incur a 0.4% fee when you sell your crypto back to SGD with Xfers.

This withdrawal fee is still pretty reasonable compared to other platforms.

Security

Crypto.com stores 100% of your assets in cold storage.

This means that even if Crypto.com gets hacked, the hackers will not be able to gain access to your coins!

Crypto.com has partnered with Ledger Vault to ensure that your crypto is secure.

As such, your assets should be rather safe with Crypto.com.

Verdict (Comparison vs Coinhako)

Here is a comparison between Crypto.com and Coinhako:

| Pros | Cons |

|---|---|

| No trading fees on app (but spread may be high) | Only 8 currencies available directly from SGD |

| Visa Card allows you to earn cashback | 0.4% withdrawal fee may be more expensive than $2 |

| More currencies on their platform | |

| No deposit fees |

While Crypto.com has many more cryptocurrencies on their platform, you can only buy 8 directly from SGD.

If you want to buy other currencies like DOGE or VET, then you’ll need to make at least 2 trades.

Furthermore, the 0.4% withdrawal fee can be rather expensive when you’re selling your crypto back to SGD. It may cost even more than Coinhako’s $2 withdrawal fee!

Crypto.com may be a better platform if you want to own more currencies. However, I personally prefer trading on the exchange, rather than the app, due to the lower costs.

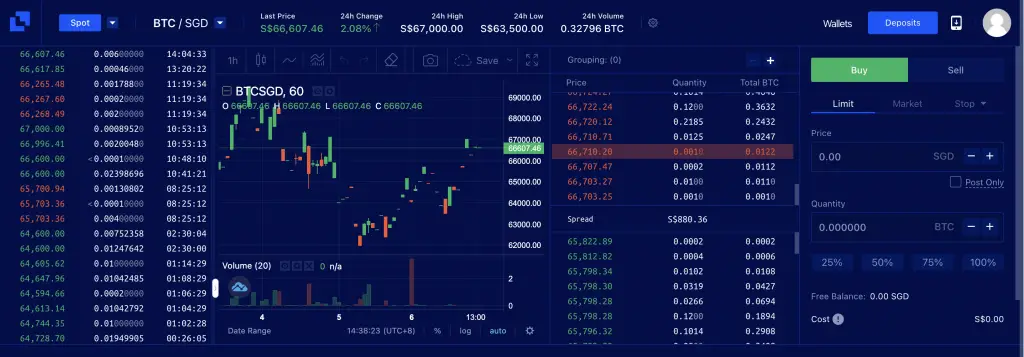

Liquid

Liquid is a crypto exchange that is based in Japan. It was founded in 2014, and has offices in Japan, Singapore and Vietnam.

Here is a summary of Liquid’s features:

| Number of Currencies | 100+ (9 from SGD) |

| Funding Methods | Bank Transfer |

| Methods of Buying | Trading |

| Withdrawal of Funds | Bank Transfer |

| Deposit Fees | Depends on bank |

| Withdrawal Fees | $15 SGD + $30 USD minimum |

| Trading Fees | Up to 0.30% |

| Sending Fees | Depends on currency |

| Minimum Per Trade | NA |

| Security | Cold storage + hot wallet |

| Verdict | Good for extremely rare altcoins not found on other platforms |

Here is a look into this platform:

Number of currencies

Liquid supports a lot of currencies on their platform. However, there are only a limited number of cryptocurrencies that you can trade directly from SGD.

Some of them include:

If you want to buy other currencies like LINK or DOT, you will need to make at least 2 trades.

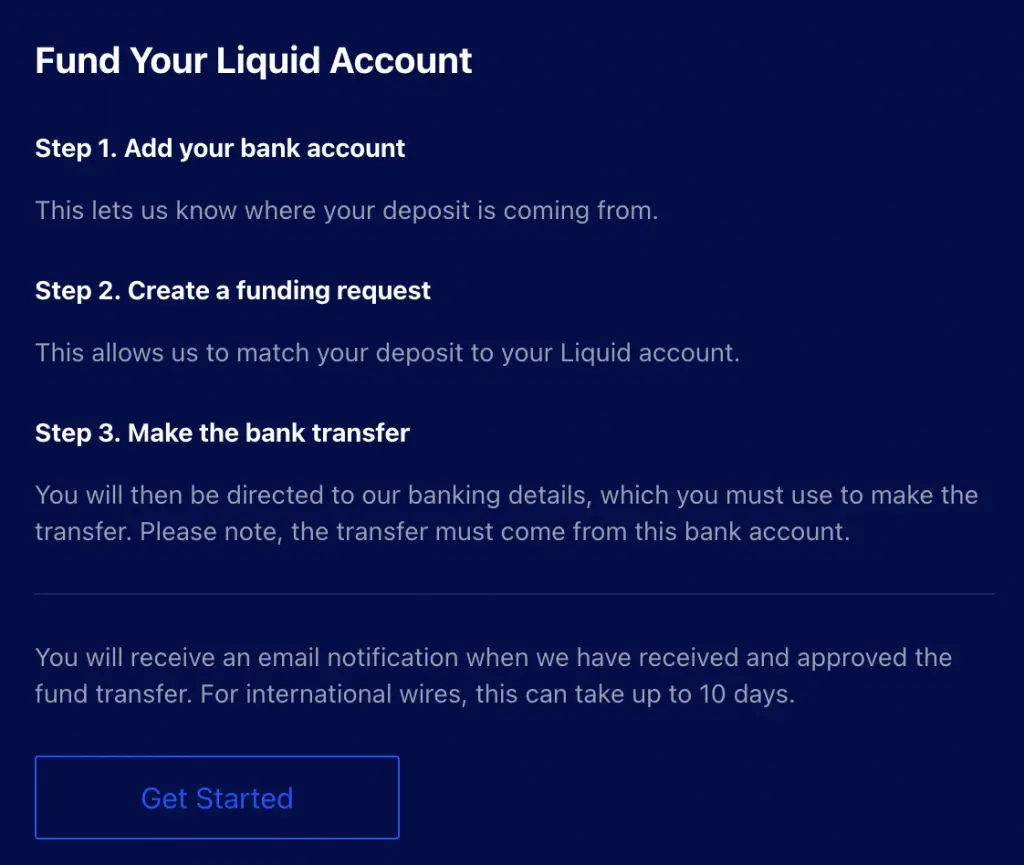

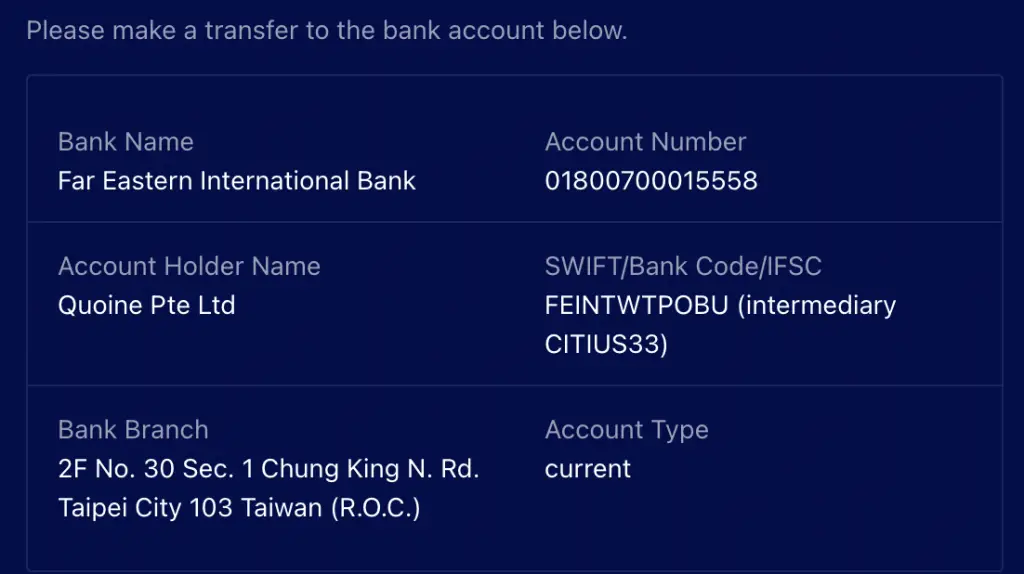

Methods of funding account

Liquid allows you to deposit your SGD via bank transfer.

You will need to transfer your funds from an account under your own name.

When you are transferring money to Liquid, you will be transferred to their account with Far Eastern International Bank.

As such, you may incur some bank fees for this transfer. This depends on the fee structure of your bank.

Methods of buying

Liquid is a trading platform, so you can only perform trades on this platform.

Withdrawal of funds

Liquid allows you to withdraw your SGD back to your bank account.

However, the withdrawal fees for Liquid can be pretty high!

Minimum trade amount

Liquid does not seem to have a minimum trade, which can help you to trade small amounts.

Fees

Here are the fees that you’ll incur when trading with Liquid:

| Type | Amount |

|---|---|

| Trading fees | Up to 0.30% |

| SGD Withdrawal Fees (StraitsX) | 0.55% (Min $4, Max $30) |

| Withdrawal Fees (Bank Transfer) | $15 SGD + $30 USD |

The trading fee is pretty competitive, and slightly lower than Gemini.

However, the withdrawal fees for SGD are really high!

You may want to consider trading on Liquid first. Afterwards, you can send your crypto to another platform like Gemini to sell them for SGD.

This is because Gemini does not charge for any SGD withdrawals that you make.

Security

Liquid stores around 98% of all of their assets in cold storage.

Meanwhile, the remaining 2% of crypto is stored in warm wallets, which is powered by Unbound Tech.

Liquid was previously hacked on 13 Nov 2020, where the hackers tried to gain access to login and 2FA data.

However, no assets were stolen from their platform.

Verdict (Compared to Coinhako)

Here is a comparison of Liquid’s pros and cons compared to Coinhako:

| Pros | Cons |

|---|---|

| Lower trading fees (Up to 0.3%) | Less currencies that you can buy directly from SGD |

| Wider variety of currencies on the platform | Withdrawal fees are much more expensive |

Liquid is a good exchange that you may want to consider, if you want to hold rather ‘rare’ altcoins, such as:

These are very rare altcoins that you can’t find elsewhere. You’ll need to make 2 trades to buy these currencies from SGD!

Liquid’s main drawback is their hefty withdrawal fees. It is really expensive if you want to withdraw a fiat currency from their platform!

As such, you may want to consider trading your currency to BTC, and then send it to another exchange like Luno or Gemini to sell it for SGD.

Tokenize

Tokenize is another exchange from Singapore that was launched in early 2018.

Here is a summary of its features:

| Number of Currencies | 34 |

| Funding Methods | Xfers Direct Charge FAST |

| Methods of Buying | Trading |

| Withdrawal of Funds | FAST |

| Deposit Fees | None |

| Withdrawal Fees | 0.55% |

| Trading Fees | 0.80% – 1%, minimum $1 |

| Sending Fees | Depends on currency |

| Minimum Per Trade | NA |

| Security | Not disclosed |

| Verdict | Good for buying rare altcoins like SUSHI and 1INCH |

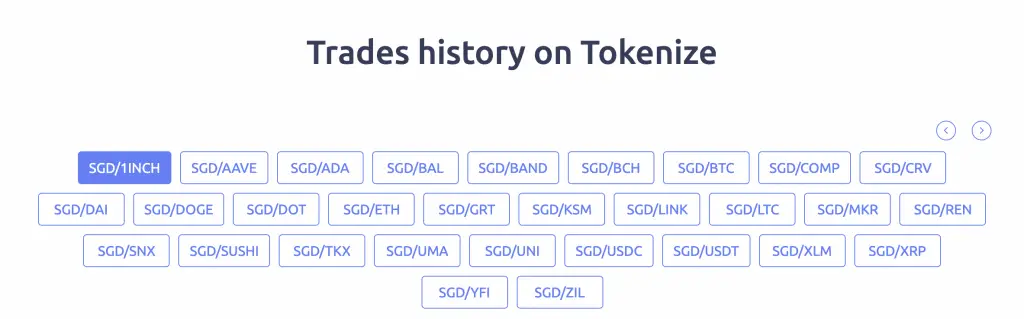

Number of currencies

Similar to Coinhako, Tokenize allows you to trade quite a wide variety of currencies from SGD.

They allow you to buy ‘rarer’ altcoins like:

Tokenize provides you with a lot of currencies that you can buy directly from SGD.

Methods of funding account

Tokenize allows you to deposit your SGD via 2 ways:

- Xfers Direct Charge

- Bank transfer

However, you can only use the bank transfer option if you’re a Premium or Platinum member.

Similar to Coinhako, you will need to pay a 0.55% fee if you decide do use Xfers Direct Charge.

Methods of buying

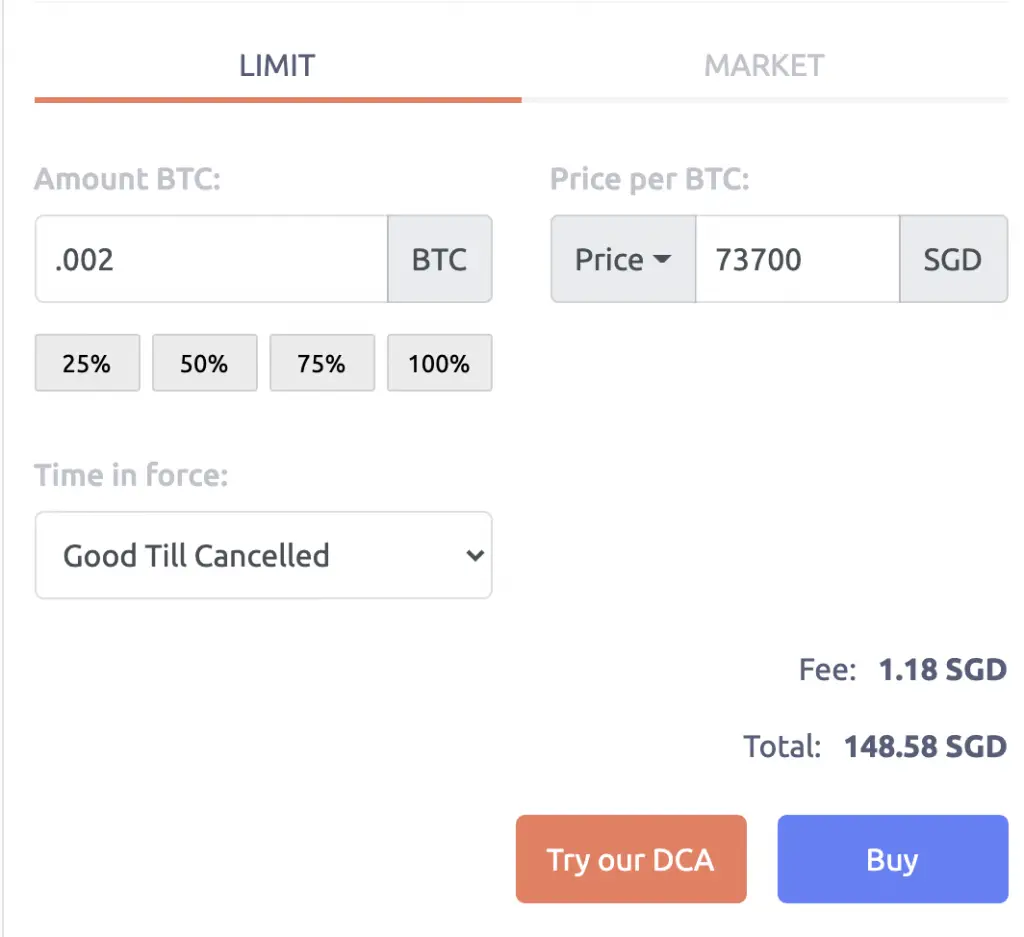

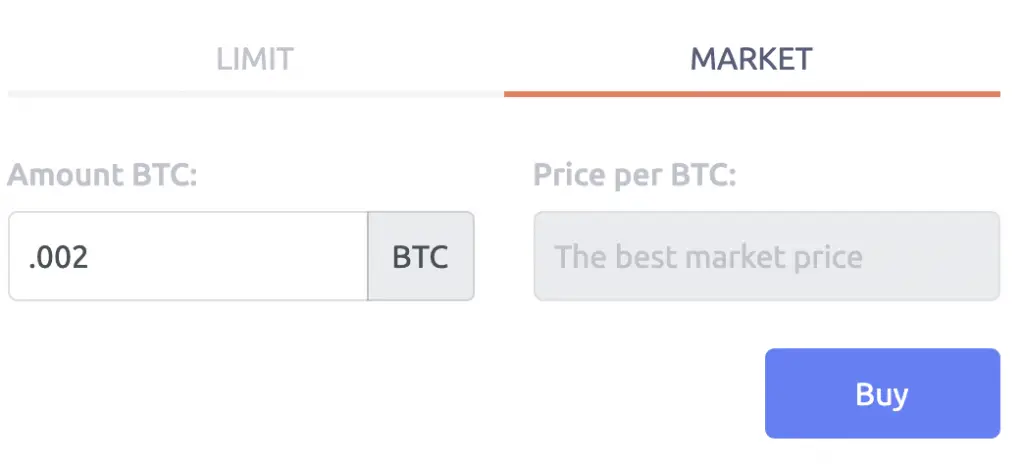

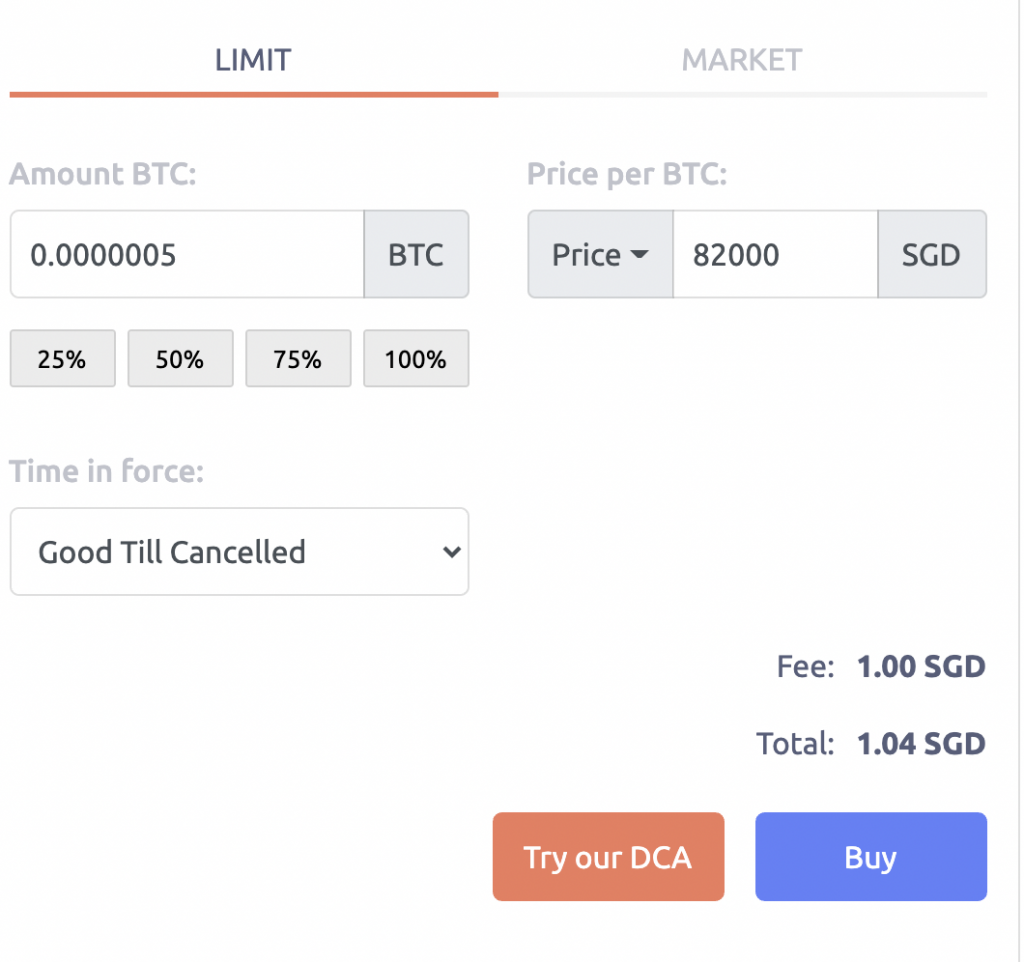

When you want to buy on Tokenize, you can only do so via the trading platform.

This is similar to Luno’s Exchange too.

There are 2 types of orders you can make with Tokenize:

- Limit

- Market

Limit orders will allow you to determine the price of the crypto that you wish to pay.

This gives you more control over the price that you want to pay.

Meanwhile, market orders will purchase your crypto at the current market price.

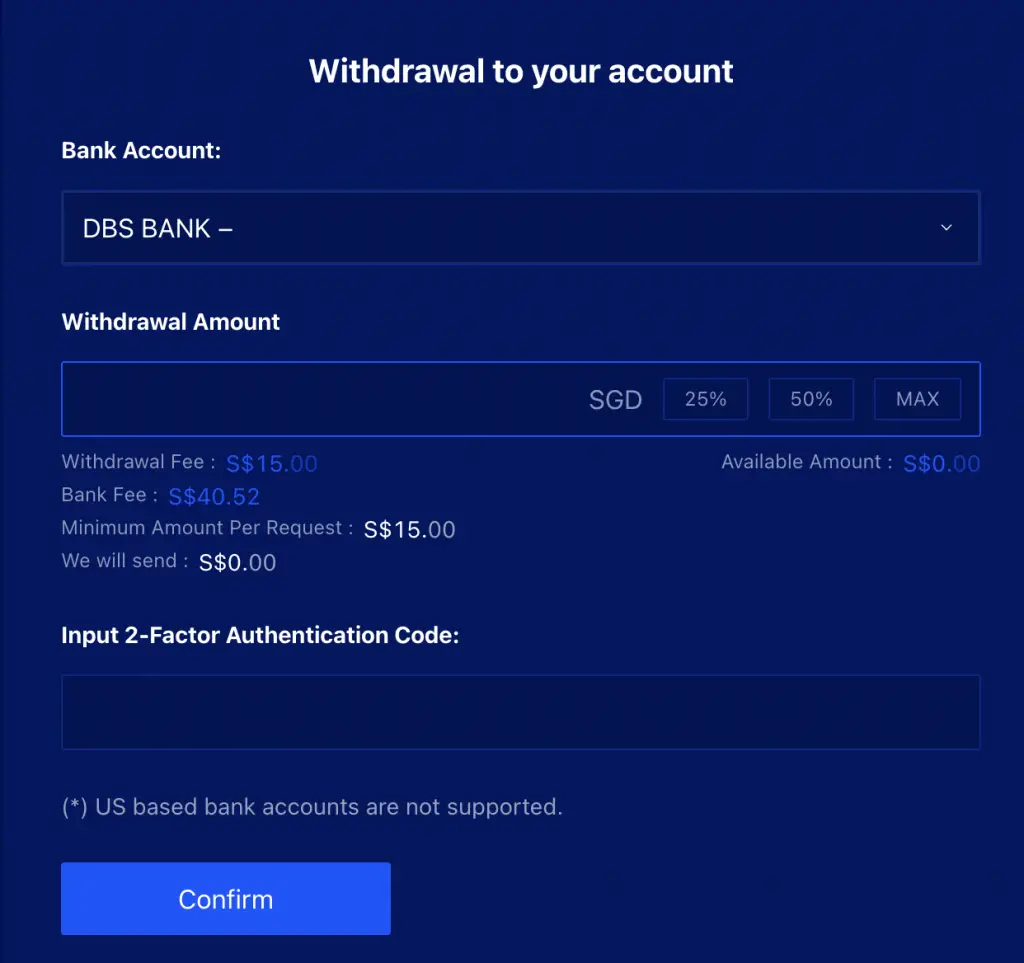

Withdrawal of funds

Tokenize only allows you to withdraw your funds via Xfers Direct Charge.

This will incur additional withdrawal fees for you as you are also charged 0.55%.

Minimum trade amount

Tokenize does not have a minimum trade amount, which is good if you want to trade small amounts.

However, they charge a minimum trading fee of $1. This will eat into your funds if you only trade small amounts!

Fees

Here are the fees that you’ll incur when trading on Tokenize:

| Fee | Amount |

|---|---|

| Deposit Fees | 0.55% |

| Trading Fees | 0.80% – 1% (Minimum $1) |

| Withdrawal Fees (SGD) | 0.55% |

| Withdrawal Fees (Crypto) | Depends on currency |

Even though Tokenize states that their fee is only at 0.80%, I have seen them charging 1% for coins like DOGE or ADA.

The fees are rather comparable compared to Coinhako.

Security

Tokenize is less transparent regarding their security protocols.

On their website, they mentioned their security measures rather briefly.

This may be slightly worrying if you are very concerned about the security of the platform!

Verdict (vs Coinhako)

Here are Tokenize’s pros and cons compared to Coinhako:

| Pros | Cons |

|---|---|

| Currencies like KSM and SUSHI are not found on Coinhako | 0.55% withdrawal may be more expensive than $2 fee for Coinhako |

| Trading instead of buying at prevailing market rate | |

| No minimum trade amount |

Tokenize is a good option that you may want to consider when buying ‘rarer’ altcoins, like:

- KSM

- 1INCH

- SUSHI

The one advantage that they have over Coinhako is that you can trade your currencies. In contrast, you can only buy currencies on Coinhako at the prevailing market rate.

You may be able to buy your coins at a more favourable rate.

However, the trading and withdrawal fees are quite high too. These are some costs you’ll need to consider if you want to buy these altcoins.

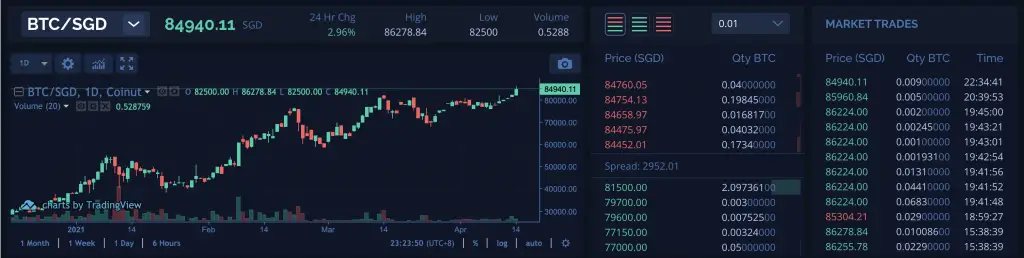

Coinut

Coinut is another exchange that is founded in Singapore in 2013.

However, it is not as well known as other exchanges.

Here is a summary of Coinut’s features:

| Number of Currencies | 7 |

| Funding Methods | FAST |

| Methods of Buying | Trading |

| Withdrawal of Funds | FAST |

| Deposit Fees | 0.55% (min $1) |

| Withdrawal Fees | 0.55% (min $1) |

| Trading Fees | Up to 0.50% |

| Sending Fees | USDT 12 for USDT |

| Minimum Per Trade | NA |

| Security | Information stored offline |

| MAS Regulation | Intends to comply |

| Verdict | Good for buying stablecoins like USDT or DAI |

Number of currencies

Coinut allows you to trade 7 currencies:

- BTC

- LTC

- ETH

- ETC

- DAI

- USDT

- XSGD

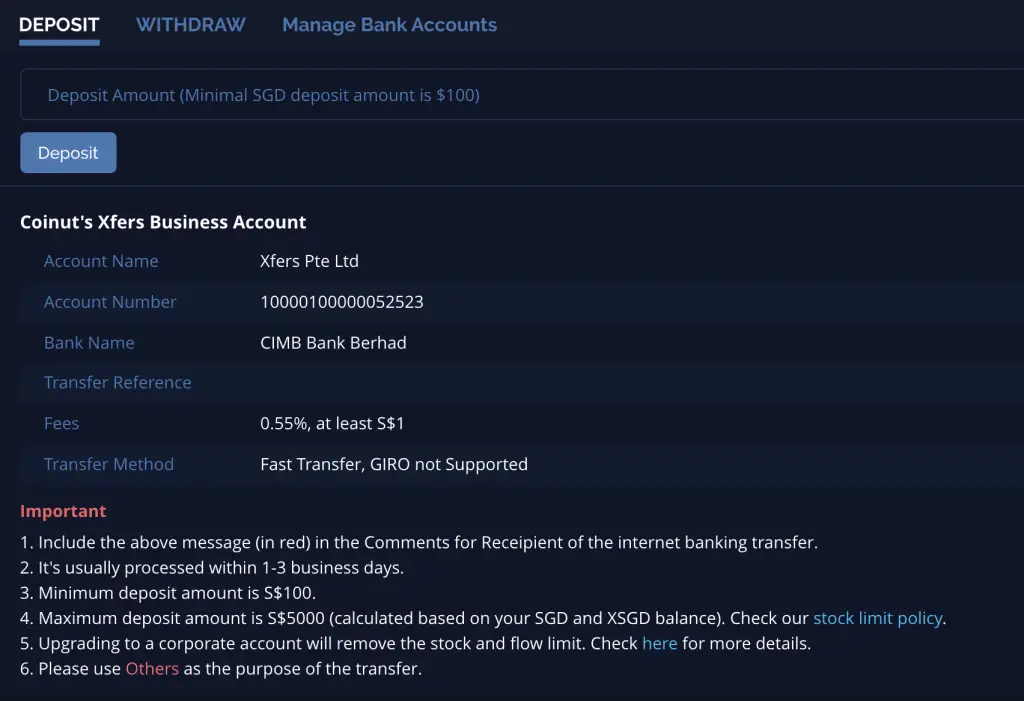

Methods of funding account

To deposit SGD into Coinut, you’ll need to send your funds via Xfers Direct.

You’ll need to make a minimum deposit of at least $100.

Methods of buying

Coinut is a trading platform.

This allows you to set both market or limit orders.

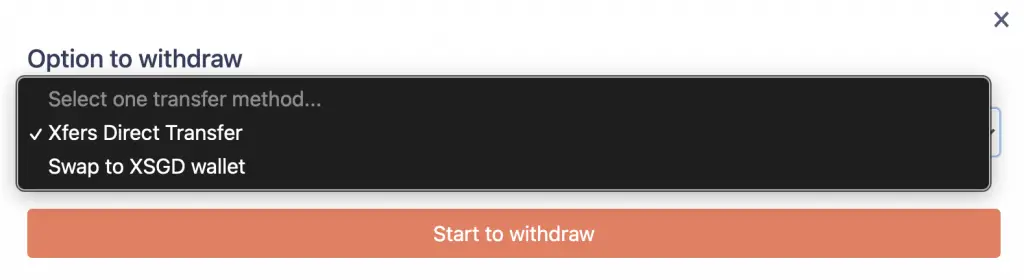

Withdrawal of funds

You are able to withdraw your SGD via FAST as well. The minimum withdrawal is $51, which is rather high.

Furthermore, the withdrawal fees on Coinut are quite expensive too!

Minimum trade amount

Coinut does not have any minimum trade amount as well.

This means that you can start buying crypto with as little money as possible.

However, you’ll need to consider the minimum deposit of $100 too.

Fees

Here are the fees and minimum amounts for Coinut:

| Type | Amount |

|---|---|

| Deposit Fee | 0.55% Minimum $1 SGD |

| Trading Fee | Up to 0.50% |

| Minimum Deposit | $100 |

| Withdrawal Fee | 0.55% Minimum $1 SGD |

The trading fees on Coinut are pretty reasonable compared to the other platforms.

However, the withdrawal fee can be pretty high!

Security

Coinut states that they are a rather secure platform, as they have a high ICO rating in 2018.

Coinut stores their data online using encryption technology. Meanwhile, important data regarding your cryptocurrencies are stored offline.

It would be quite hard for hackers to access any information from Coinut.

Coinut also tracks your transactions semi-manually. This may occur when your account has a sudden increase in transactions.

Coinut may require you to authenticate each transaction, before they process them.

As such, they can be a rather secure platform.

Verdict (Comparison with Coinhako)

Here is a comparison of Coinut’s pros and cons with Coinhako:

| Pros | Cons |

|---|---|

| Lower trading fees (Up to 0.5%) | Lesser number of currencies |

| Able to buy USDT | Higher withdrawal fee (min. $10 SGD) |

Coinut offers lower fees compared to Coinhako. You are able to buy USDT too, which can has many trading pairs on other exchanges like Binance or Huobi.

Furthermore, their withdrawal fees for USDT are pretty low, at USDT 12.

However, Coinut has a lower variety of cryptocurrencies, compared to Coinhako.

Coinut may be a good place to buy USDT. If you are looking for a wider variety of currencies, then Coinhako is the better choice!

AAX

Atom Asset Exchange (AAX) was founded in 2018, and is based in Hong Kong.

They are the first cryptocurrency exchange to be powered by LSEG Technology. Moreover, they have also joined the London Stock Exchange’s partner platform.

Here is a summary of AAX’s features:

| Number of Currencies | 32 (only 2 from SGD) |

| Funding Methods | Bank transfer |

| Methods of Buying | Instant Buy and Trading |

| Withdrawal of Funds | Bank transfer |

| Deposit Fees | $35 (none if deposit ≥ $1.5k) |

| Withdrawal Fees | 0.3% minimum $10 |

| Trading Fees | Up to 0.1% |

| Sending Fees | Depends on currency |

| Minimum Per Trade | $10 for fiat to crypto |

| Security | Cold storage |

| Verdict | A good option if you intend to trade large sums of crypto |

Number of currencies

AAX allows you to trade quite a large number of currencies on their platform.

However, you can’t buy all of them directly from SGD!

You can only buy BTC or USDT from SGD using AAX’s Exchange feature.

AAX does not charge you any fees for using this service.

However, the market rate that you buy BTC at from AAX may be higher than the actual rate.

Similar to Crypto.com, you may lose some money based on the spread.

Methods of funding account

When you want to transfer your SGD to AAX, you will need to do so via bank transfer.

You can deposit a minimum of $50. However, you may incur quite a hefty deposit fee for small amounts!

Methods of buying

When you want to buy BTC or USDT from SGD, you can only do so via the Exchange.

Once you’ve exchanged your SGD for either currency, you can start to make trades on AAX’s spot market.

Withdrawal of funds

When you wish to withdraw your SGD back to your bank account, you’ll need to do a wire transfer too.

You will need to withdraw a minimum of $150.

Minimum trade amount

When you are converting your SGD to BTC or USDT, you’ll need to convert a minimum of $10.

When you are trading on the Spot platform, the minimum trade amount depends on the currency.

Fees and minimums

Here are the fees and minimums when you’re trading on AAX:

| Deposit Minimum | $50 |

| Deposit Fees | $35 if deposit < $1500, none if deposit ≥ $1500 |

| Trading Fees | Up to 0.1% |

| Withdrawal Minimum | $150 |

| Withdrawal Fees | 0.3% (Minimum $10) |

| Sending Fees | Depends on currency |

If you want to save on the deposit fees, you’ll have to deposit at least $1.5k into your AAX account each time!

The trading fees are as competitive as Binance (up to 0.1%). However, AAX has the added advantage of supporting fiat currencies like SGD.

I would think that AAX is more suitable if you intend to trade a large amount of crypto. This is due to the deposit and withdrawal minimums that AAX has.

Security

AAX also stores majority of your cryptocurrency in an offline wallet. It also aims to comply with the Cryptocurrency Security Standard (CCSS), which ensures that it is extra secure.

So far, AAX has not been hacked yet, which should give you an ease of mind.

Verdict (Compared to Coinhako)

Here are the pros and cons of AAX compared to Coinhako:

| Pros | Cons |

|---|---|

| Lower fees (up to 0.1%) | Can only buy BTC or USDT directly from SGD |

| Slightly more currencies (35) | High deposit fees (if you deposit < $1.5k) |

| Higher withdrawal fees (min. $10) |

AAX offers slightly more currencies compared to Coinhako.

However, you’ll need to make at least 2 trades to buy most currencies. This is because you can only buy BTC or USDT from your SGD!

Moreover, you’ll need deposit a huge amount (≥ $1.5k) to avoid the deposit fee ($35).

Due to its many restrictions, AAX would be a suitable platform only if you trade a large amount of crypto.

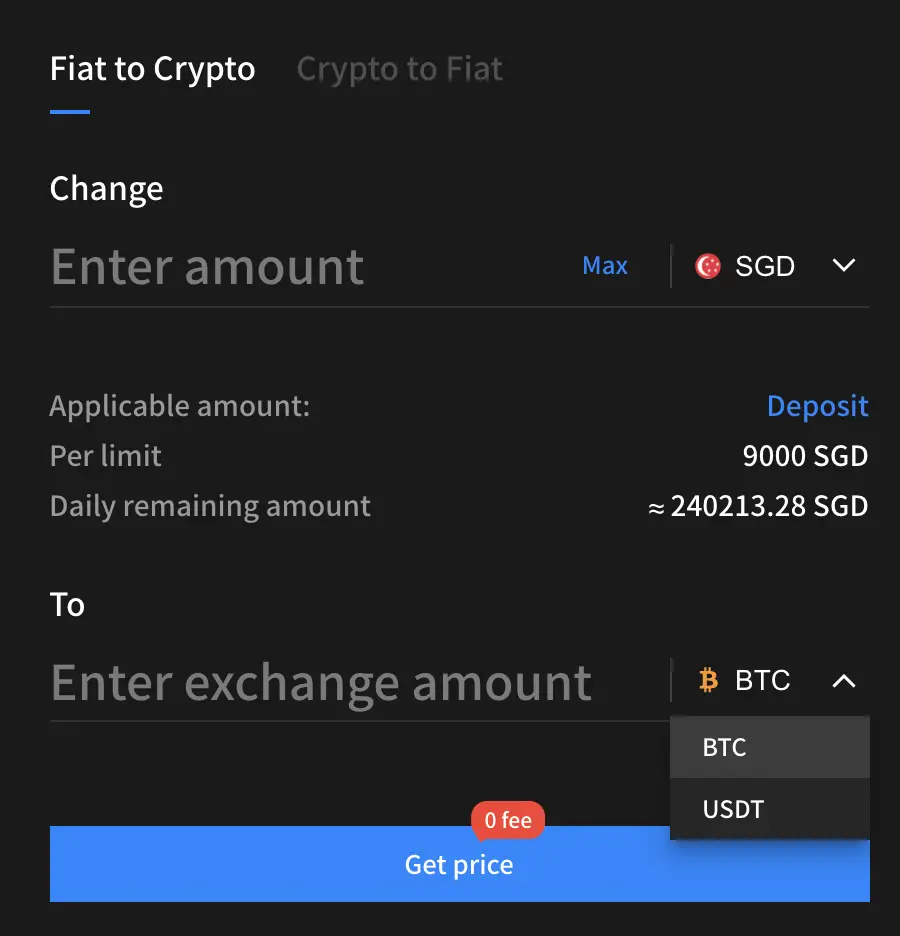

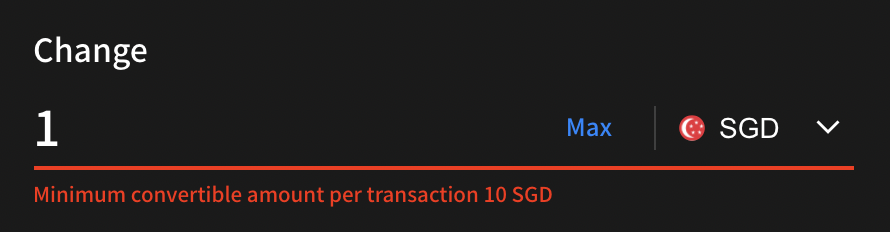

Binance Singapore

Binance Singapore was launched in 2019. It is actually a separate exchange from Binance.com!

Here is a summary of Binance Singapore’s features:

| Number of Currencies | 8 |

| Funding Methods | Xfers |

| Methods of Buying | Instant Buy |

| Withdrawal of Funds | Xfers |

| Deposit Fees | None |

| Withdrawal Fees | None |

| Trading Fees | 0.6% |

| Sending Fees | Depends on currency |

| Minimum Per Trade | $20 |

| Security | Not disclosed |

| Verdict | Cheaper way to buy NEO from SGD, compared to Coinhako |

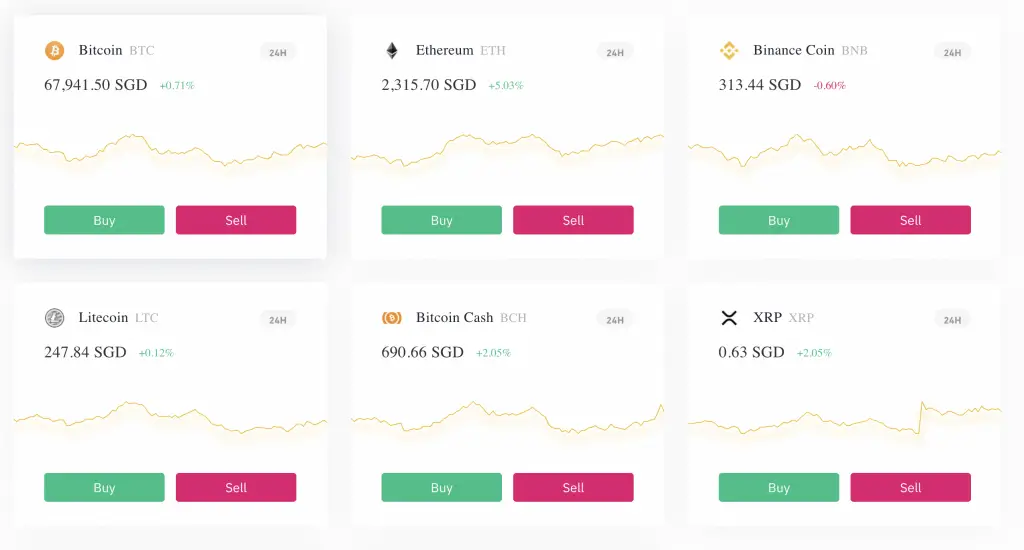

Number of currencies

Binance Singapore allows you to trade in 8 cryptocurrencies.

This includes:

Methods of funding account

Binance Singapore allows you to send SGD using your Xfers account.

Xfers is directly connected to your Binance Singapore account. As such, you don’t need to transfer your SGD between both platforms.

This saves you the hassle of making one extra transfer!

Methods of buying

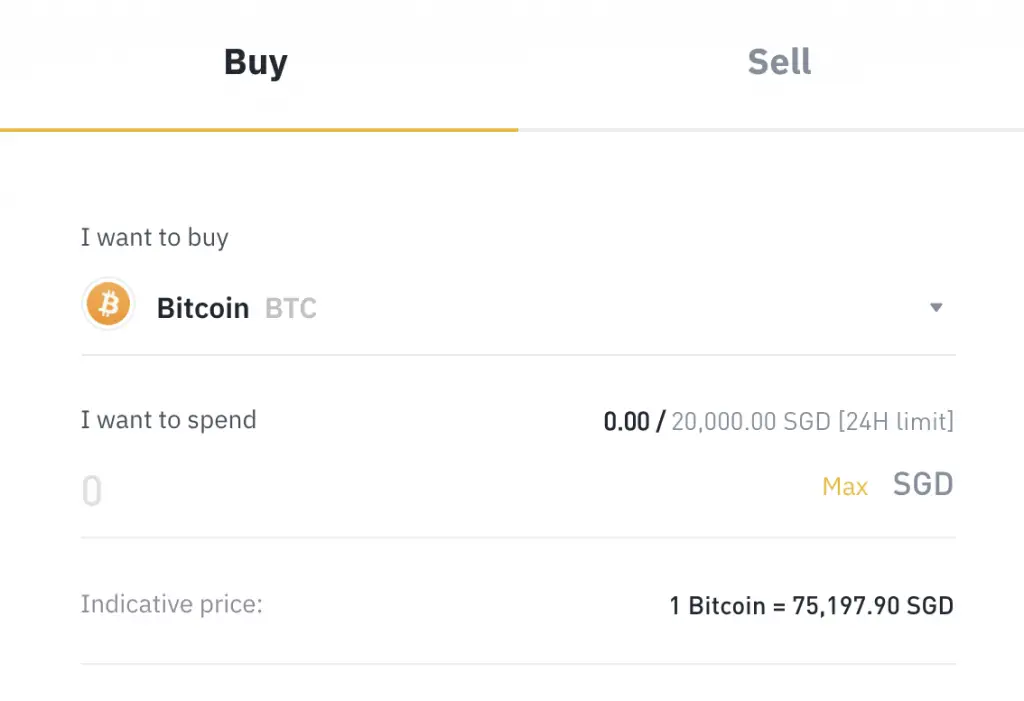

Similar to Coinhako, Binance Singapore allows you to buy crypto via Instant Buy.

You can only buy the crypto at the prevailing market rate, which you can see on the ‘Buy’ page.

If you check the current price on sites like CoinMarketCap, it may be slightly different from what you see on either platform.

Withdrawal of funds

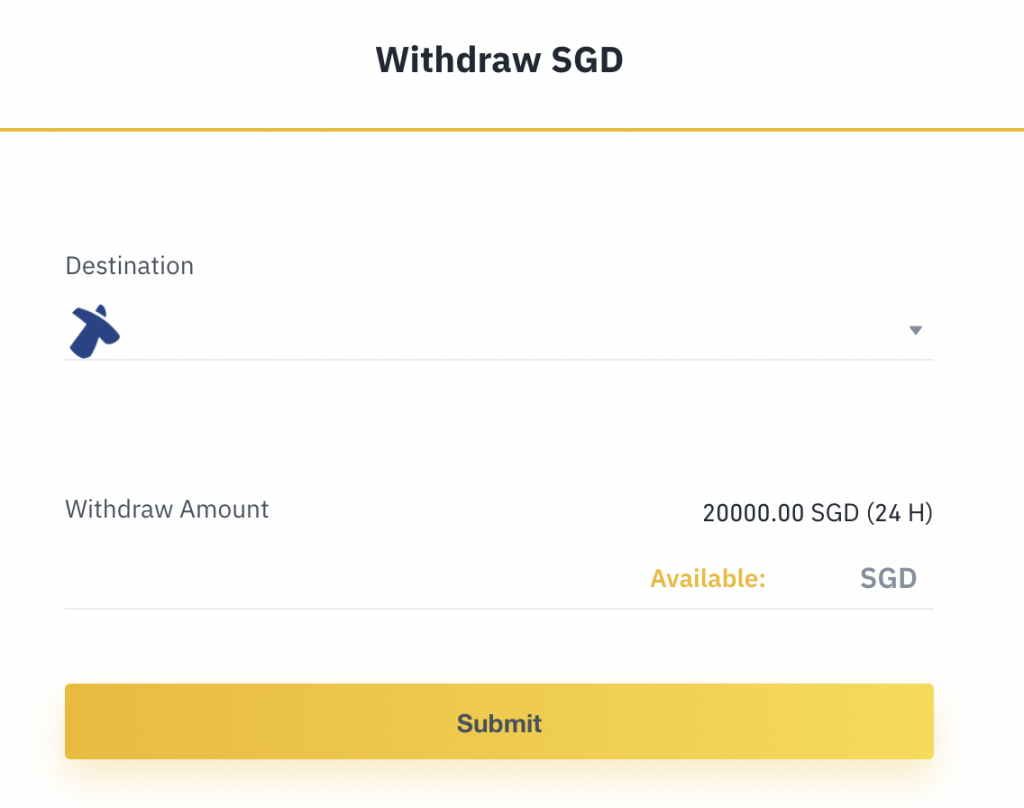

Binance Singapore only allows you to withdraw to your Xfers wallet.

This is slightly more troublesome as you’ll have to go to Xfers and withdraw your funds to your bank account.

Fees

Here are the fees and minimum trading amounts that you’ll need to pay with Binance Singapore:

| Type | Amount |

|---|---|

| Minimum Trading Amount | $20 |

| Trading fees | 0.60% |

| Withdrawal fees | None |

Overall, Binance Singapore has quite a high trading fee compared to other platforms.

However, it does allow you to buy NEO at a cheaper fee compared to Coinhako (0.80% – 1%).

Security

Binance Singapore does not disclose the security measures they have put in place. This may be slightly worrying if you are very concerned about security.

Binance.com faced a security breach in 2019. However, Binance Singapore declared that the breach did not affect their exchange.

Although the platform is quite new, Binance Singapore has not been hacked so far.

Verdict (Comparison with Coinhako)

Here are the pros and cons of Binance Singapore compared to Coinhako:

| Pros | Cons |

|---|---|

| Lower trading fees (0.6%) | Lesser number of currencies available |

| No deposit or withdrawal fees | |

| Lower minimum per trade ($20) |

In terms of the fees that you incur, Binance Singapore is the more cost effective way to invest in cryptocurrency.

However, the currencies that you can buy on Binance Singapore are much more limited!

As such, it really depends on which currency that you want to buy.

Binance (International)

Binance is possibly one of the most well established trading platforms that you can buy cryptocurrency on.

While it offers a huge amount of trading pairs, the ways that you can buy crypto from SGD are rather limited.

Here is a breakdown of this platform:

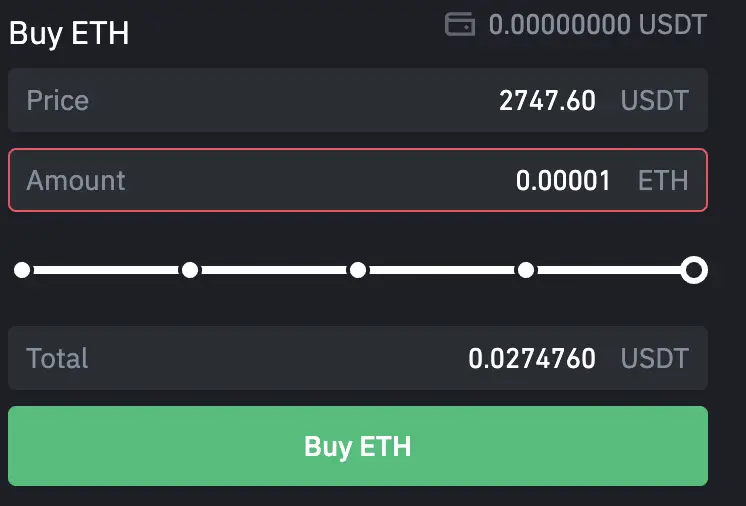

| Number of Currencies | 200+ |

| Funding Methods | Fiat or Crypto |

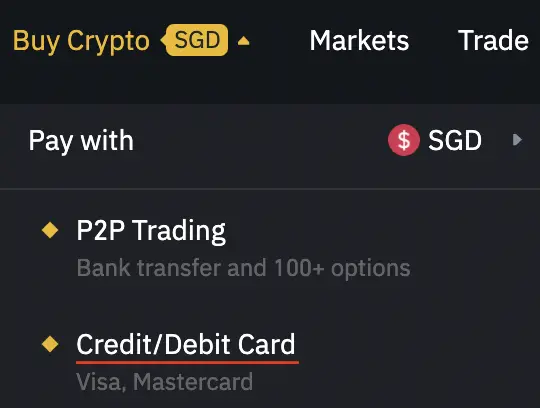

| Methods of Buying | P2P Credit / Debit Card Trading |

| Withdrawal of Funds | Crypto or Fiat (But not SGD) |

| Deposit Fees | None |

| Trading Fees | Up to 0.1% |

| Sending Fees | Free for first 10 withdrawals |

| Minimum Per Trade | Depends on currency |

| Extra Features | Staking Loans |

| Security | Cold storage + hot wallet |

| Verdict | Cheaper fees and many more currencies, but poor SGD support |

Number of currencies

If you are looking to buy a rare altcoin, it will most likely be on Binance.

The variety of currencies that are on Binance is just staggering.

Most coins should have a trading pair with either BTC or USDT.

If you are looking to buy one altcoin from another, you may have to make 2 trades.

For example, you may want to buy 1INCH from AAVE. In this case, the 2 trades you’ll need to make are:

- 1INCH to BTC or USDT

- BTC or USDT to AAVE

The same process can be repeated for any 2 altcoins you wish to trade.

Funding methods

You can send your fiat currencies or crypto to Binance.

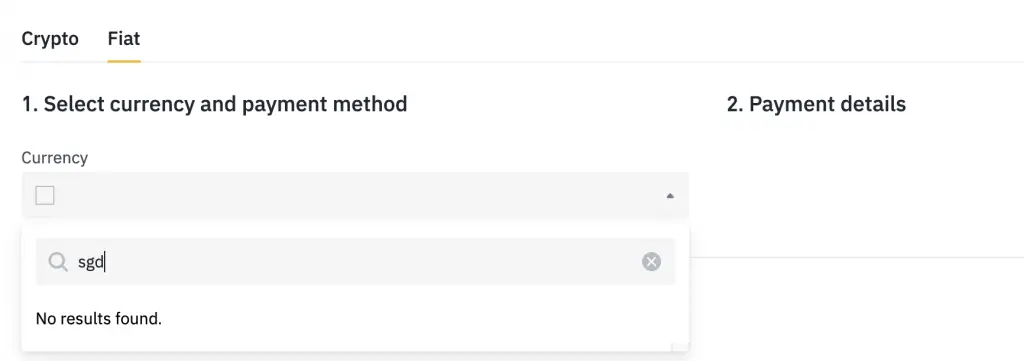

However, Binance does not support SGD in their Spot Wallet.

Unlike all of the previous options, you can’t buy cryptocurrency directly from SGD!

Instead, you are able to deposit other fiat currencies, like USD, HKD, or EUR.

It is possible to send USD to Binance via a remittance service. However, the fees may be rather costly.

Methods of buying

There are a few ways that you can buy cryptocurrency on Binance’s platform:

- P2P Trading

- Credit Card / Debit Card

- Trading

#1 P2P Trading

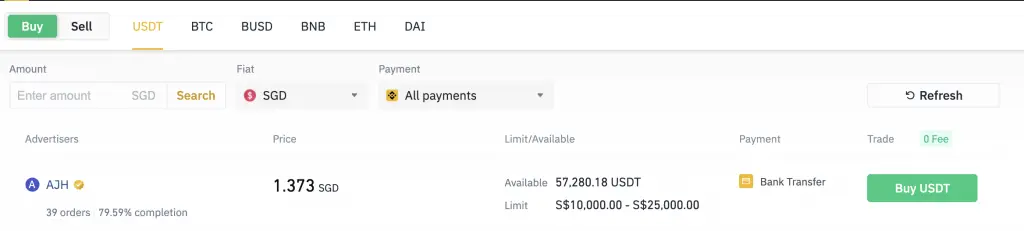

Binance has a P2P trading platform which allows you to buy 6 currencies from SGD.

This includes:

- USDT

- BTC

- BUSD

- BNB

- ETH

- DAI

P2P trading can be very convenient, as Binance does not charge any fees.

However, it can be really risky too!

Binance has tried to introduce measures to reduce scams. However, there is still a possibility that scammers may still be lurking on the platform!

I would suggest that you only trade small amounts each time, to reduce the risk of you losing your entire capital.

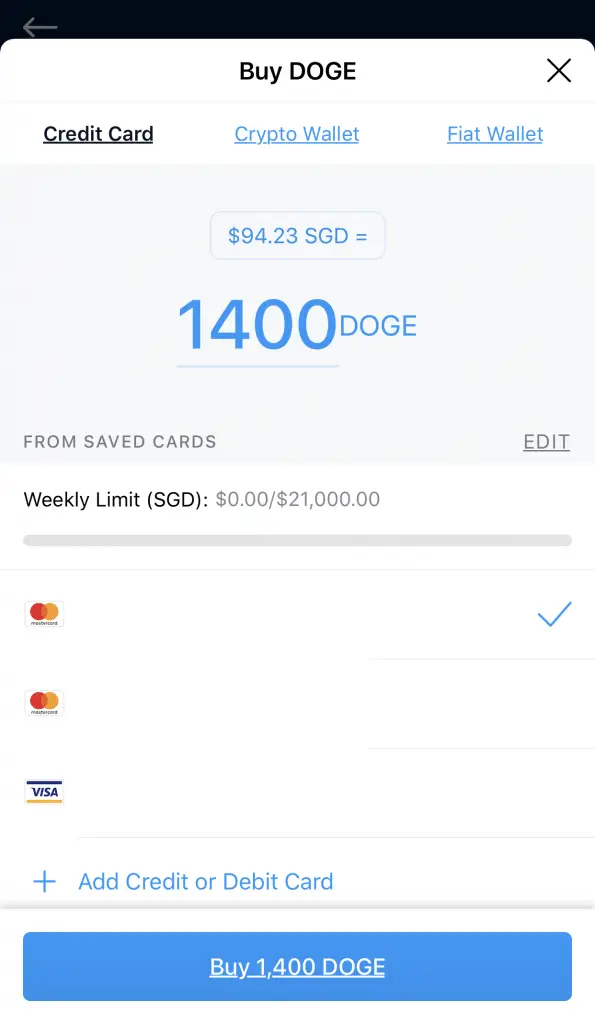

#2 Credit / Debit Card

You are able to buy crypto via a credit / debit card. This allows you to buy crypto directly from SGD.

However, you can only buy a certain number of crypto from SGD:

However, buying crypto from a credit card will incur high fees. As such, I would not recommend using this method.

#3 Trading

You are able to use Binance’s trading platform to trade a variety of currencies.

However, Binance’s platform does not allow you to trade crypto with fiat.

As such, you are only able to trade between 2 cryptocurrencies!

To use Binance’s trading platform, you’ll need to first have a cryptocurrency that you own.

This means that you’ll either need to:

- Buy BTC or USDT using one of the previous methods

- Send your cryptocurrency from a platform to Binance

In the end, the fees can really add up!

Withdrawal of funds

You are able to withdraw your funds from Binance. However, it does not have SGD support!

If you intend to send USD from Binance to your bank account, you may incur some remittance fees along the way.

Fees

Here are the fees that you’ll incur when trading on Binance:

| Fee | Amount |

|---|---|

| Trading fees | Up to 0.1% |

| Sending fees | Depends on currency |

The fees that you incur on Binance are really cheap!

The trading fees are extremely low, and you will not incur significant costs.

Minimum per trade

The minimum per trade depends on the currency that you want to buy.

You can go to Binance’s platform to view the minimum amount that you can trade for each currency.

Unlike traditional brokers, Binance does not have a minimum trading fee. This allows you to trade as little amount as possible, without incurring high fees!

Extra features

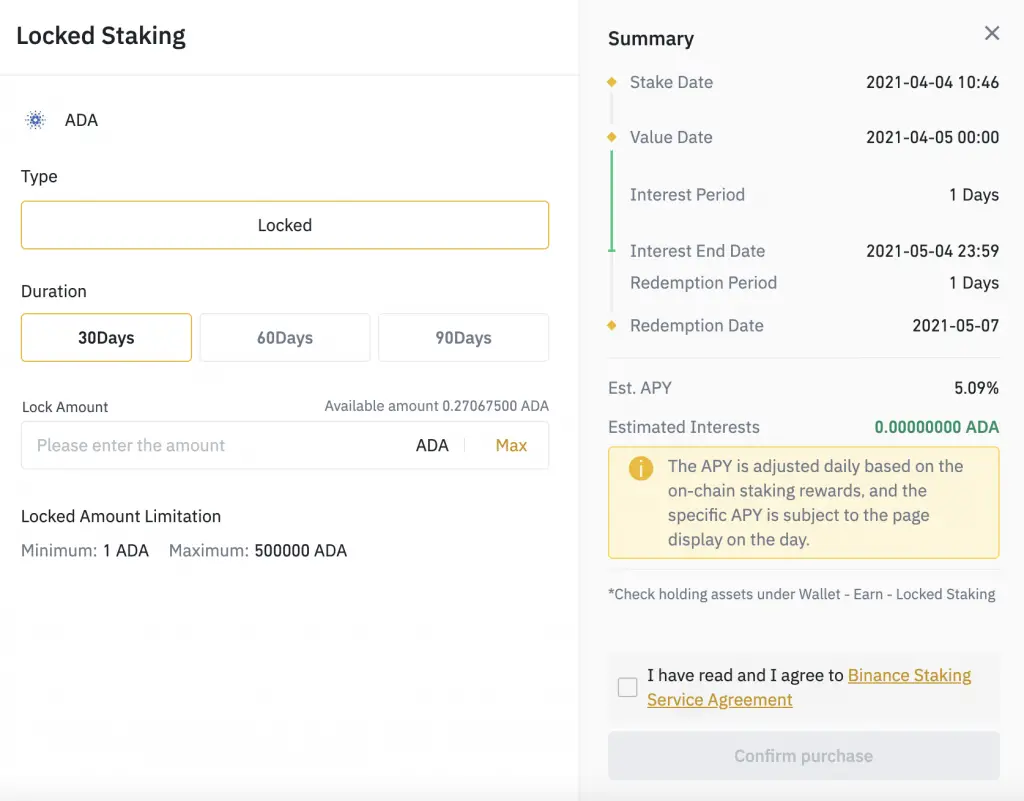

In terms of extra features, Binance has a whole ton of them.

This includes:

- Staking

- Lending

- Trading Derivatives

Apart from trading crypto, Binance provides you with many features to grow your crypto portfolio.

Security

Binance listed down some security measures that they have. Most of them involves artificial intelligence.

Due to the sheer number of transactions that they have on their platform, the AI will help to monitor for any unusual activity.

However, Binance has been hacked before in 2019. Over $40 million worth of assets were stolen from the exchange!

Although the security measures have definitely been ramped up, there is still a risk that the platform can be hacked again.

As such, you may want to consider only placing a small amount in Binance, instead of your entire crypto portfolio!

Verdict (comparison with Coinhako)

Here are the pros and cons of Binance (International) compared to Coinhako:

| Pros | Cons |

|---|---|

| Many more currencies supported | Unable to deposit SGD into Binance |

| Low trading fees (Up to 0.1%) | P2P trading with SGD can be risky |

| Extra features (e.g. staking) |

Binance has many advantages over Coinhako, such as more currencies and cheaper fees.

However, their main drawback is that you can’t deposit SGD into Binance.

You are able to deposit USD, but the remittance fees may be rather expensive.

As such, the easiest way to start trading on Binance is to deposit a cryptocurrency from another platform. You are even able to transfer your crypto from Coinhako to Binance!

You may want to transfer XRP over to Binance from Coinhako since you are charged really low fees.

Kraken

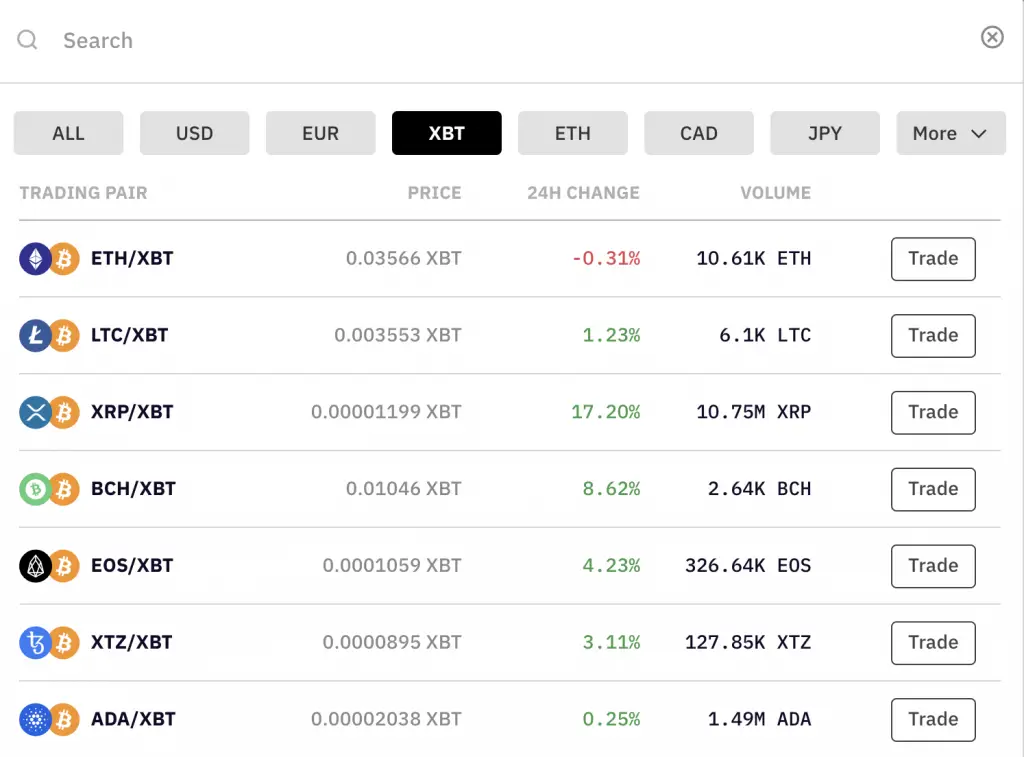

Kraken is another platform that is rather well established.

However, they don’t have much SGD support too. This makes it quite difficult for you to buy crypto on their platform from Singapore.

Here is a breakdown of this platform:

| Number of Currencies | 50+ |

| Funding Methods | Bank transfer (but does not support SGD) |

| Methods of Buying | Credit / Debit Card Trading Platform |

| Withdrawal of Funds | Bank transfer (but does not support SGD) |

| Deposit Fees | Depends on currency |

| Trading Fees | Up to 0.26% |

| Sending Fees | Depends on Currency |

| Minimum Per Trade | Depends on currency |

| Extra Features | Staking |

| Security | Cold storage + hot wallet |

| Verdict | Cheaper fees and many more currencies, but poor SGD support |

Number of currencies

Compared to Coinhako, Kraken has much more currencies that are available on their platform!

This includes common currencies like ETH or LTC, as well as ‘rarer’ altcoins like ADA or DOGE.

Funding methods

You are able to deposit your fiat currencies onto their platform.

However, you can’t deposit SGD into Kraken!

You can deposit other fiat currencies, like:

- USD

- EUR

- JPY

This makes Kraken rather limited as it does not allow you to buy crypto directly from SGD.

Methods of buying

You can use a credit card to buy crypto on Kraken.

However, you can’t use SGD to buy crypto on Kraken! As such, you may incur a foreign currency conversion fee.

Kraken is mainly a trading platform, so you can trade between fiat and crypto on this exchange.

However, Kraken does not support SGD. You are able to trade crypto from fiat currencies like USD or EUR, but not SGD!

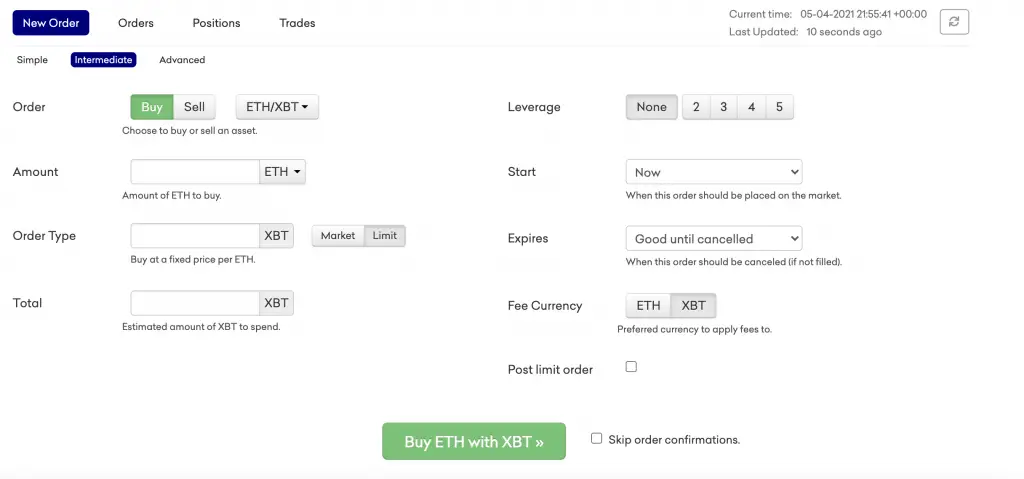

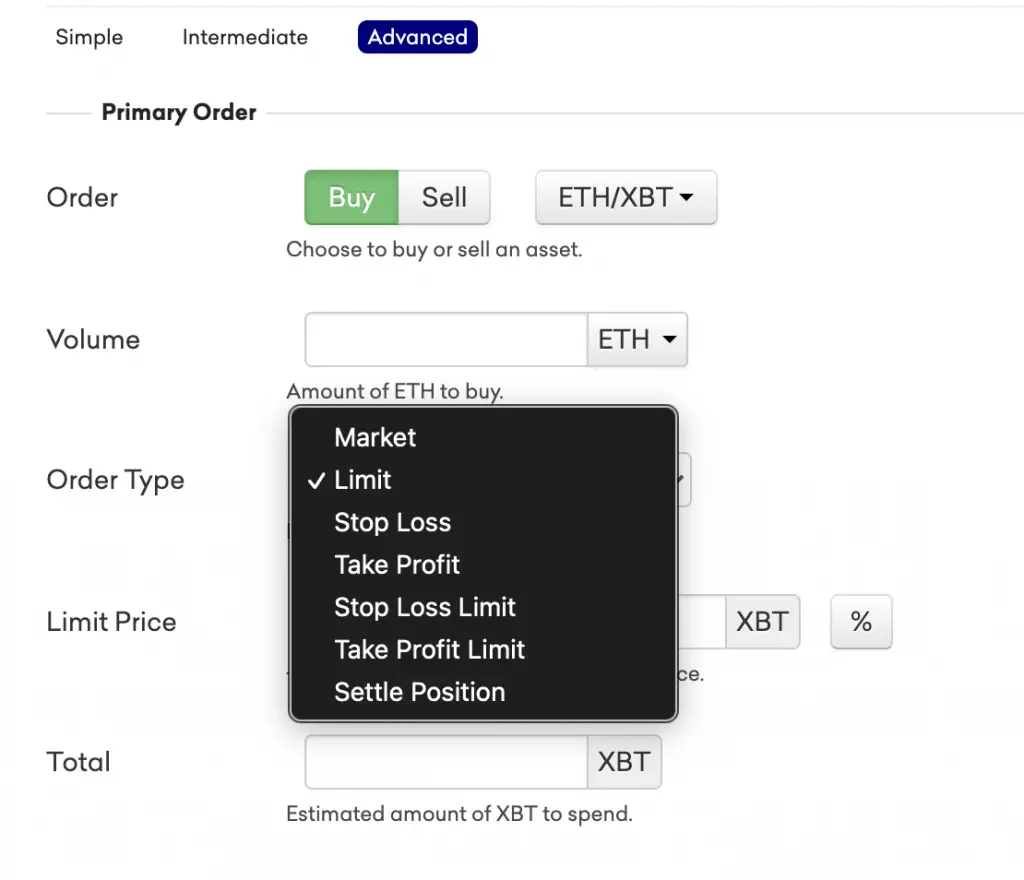

There are 2 types of orders you can make with Kraken:

- Limit

- Market

Limit orders will allow you to determine the price of the crypto that you wish to pay.

Meanwhile, market orders will purchase your crypto at the current market price.

You can make even more types of orders on Kraken’s Advanced platform.

Instead of using the Instant Buy feature, you are able to set the price that you wish to buy your crypto at!

Withdrawal of funds

You are able to withdraw your fiat currencies to your bank account.

However, you are unable to withdraw any SGD!

Fees

Here are the fees that you will incur when using Kraken:

| Fee | Amount |

|---|---|

| Trading Fee | Up to 0.26% |

| Sending Crypto Fee | Depends on currency |

The fees when using Kraken are much cheaper than Coinhako’s!

Minimum per trade

The minimum trade amounts for Kraken depends on the currency. You may want to check the minimum amount of the crypto you want to buy, before funding your Kraken account!

Extra features

Kraken also allows you to stake some of your crypto.

You can stake 7 different currencies on Kraken:

- DOT

- KSM

- KAVA

- ATOM

- XTZ

- FLOW

- ETH

If you want to earn some rewards by staking your crypto, then Kraken may be a better platform for you!

Security

Kraken stores 95% of all of its assets in cold storage too. Even if hackers gain access to their platform, they will not have access to all of your assets.

So far, Kraken has not been hacked, which is rather promising.

This is because other large crypto platforms like Binance or Coinmama have been hacked before.

As such, Kraken’s platform seems pretty secure!

Verdict (comparison with Coinhako)

Here are the pros and cons of Kraken when compared with Coinhako:

| Pros | Cons |

|---|---|

| Many more currencies supported | Unable to deposit SGD into Kraken |

| Low trading fees (Up to 0.26%) | |

| Extra features provided (e.g. staking) |

The pros and cons of Kraken are very similar to Binance. While Kraken has more currencies and cheaper fees, they don’t have SGD support.

This means that you may incur some fees when sending another fiat currency (like USD) over to Kraken!

If you are looking to stake your cryptocurrencies like DOT or ETH, you may want to consider sending them over to Kraken from Coinhako.

Coinbase

Coinbase is a rather well established cryptocurrency exchange.

However, SGD is not really supported on their platform too!

Here is a breakdown of their platform:

| Number of Currencies | 42 |

| Funding Methods | NA |

| Methods of Buying | Credit / Debit Card Only |

| Withdrawal of Funds | NA |

| Deposit Fees | NA |

| Withdrawal Fees | NA |

| Trading Fees | 3.99% (Credit / Debit Card) |

| Sending Fees | Dynamic |

| Minimum Per Trade | SGD $2 |

| Extra Features | Coinbase Earn |

| Security | Cold storage + hot wallet |

Number of currencies

Coinbase is a much larger exchange, so it provides a lot more options.

You can trade 42 different cryptocurrencies on their exchange from Singapore!

However, the options for certain currencies may be slightly more limited.

There are 4 tiers of currencies that you can have on Coinbase:

| Tier | Definition |

|---|---|

| Tier 1 | Buy, Sell, Send and Receive |

| Tier 2 | Buy, Send and Receive |

| Tier 3 | Send and Receive |

| Tier 4 | Receive only |

Here are some examples of the currencies that you can have on the different tiers:

It is quite interesting to see that you can’t sell most of the popular cryptocurrencies like Bitcoin!

However, this only applies to Singapore, and not the US, EU or UK.

Methods of buying

Coinbase, does not offer any SGD wallets to store your funds.

Instead, you can only use the credit / debit card method to purchase crypto.

You will need to make sure that your debit or credit card is a 3D secured card before you can use it to buy crypto!

As such, Coinbase is slightly more inflexible in their payment methods compared to Coinhako.

Withdrawal of funds

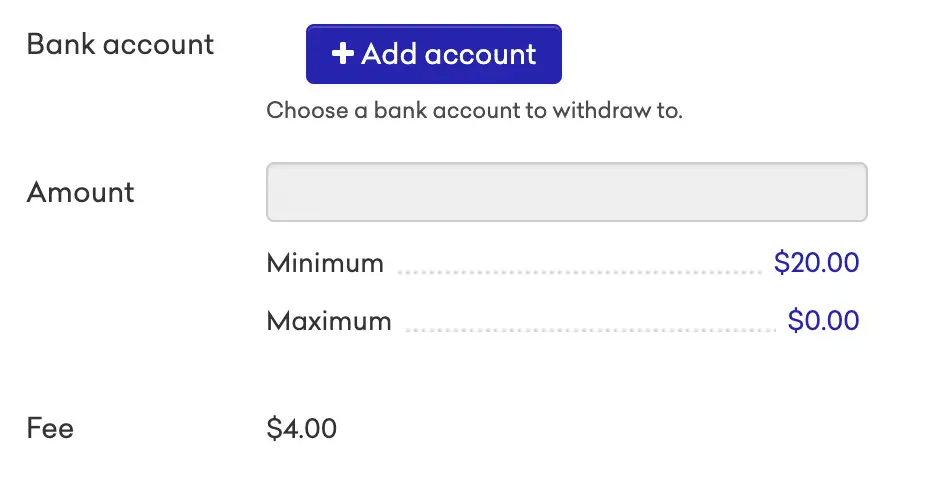

Coinbase stopped their partnership with Xfers, which means you can no longer withdraw your funds on Coinbase into SGD.

The only way you can do so is to send your cryptocurrency to another crypto exchange that has SGD support, and then sell it for SGD.

This makes it really inconvenient for you if you want to cash out your profits!

Fees

Here are the fees that you’ll incur when using Coinbase:

| Fee | Amount |

|---|---|

| Credit Card Fee | 3.99% |

| Sending Crypto Fee | Dynamic |

Since you can only use a credit card to buy crypto on Coinbase, it can be really hefty!

The 3.99% fee that you incur is possibly one of the most expensive fees for buying crypto with a credit card.

As such, it is really not worth buying cryptocurrency on Coinbase!

Minimum per trade

Coinbase only requires a minimum of $2 per trade. However, the fees that you incur when making these small purchases will be quite high too.

Extra features

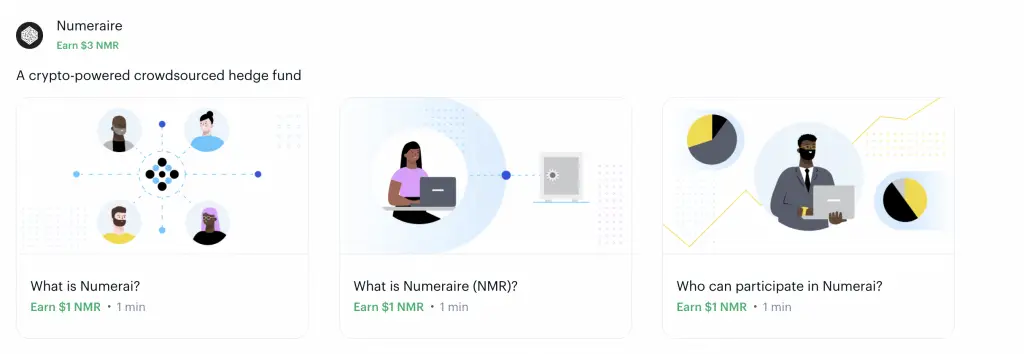

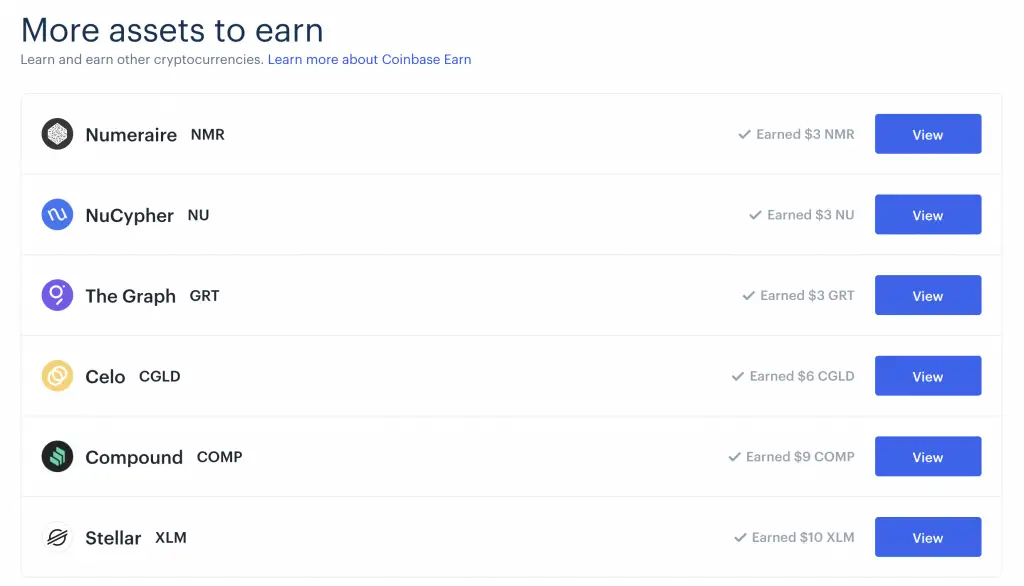

Coinbase has an Earn program which allows you to earn crypto after watching videos that educate you about the currency.

In my opinion, this is the only reason why you should be creating a Coinbase account in Singapore.

However, you may be on the waitlist for quite a while. It took me almost a year before I was finally allowed to earn crypto with my account.

If you’re willing to wait to get approved, then Coinbase Earn may be a program that you can consider to earn some free crypto.

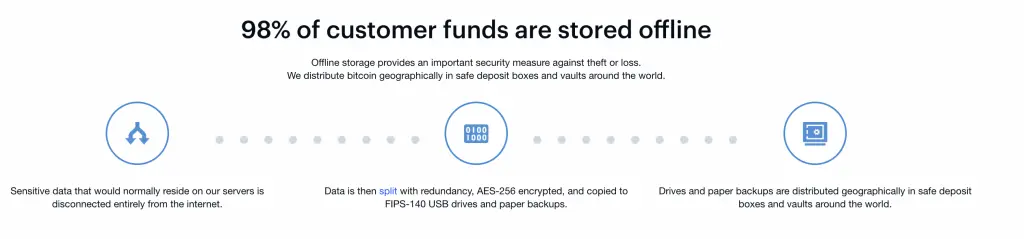

Security

Coinbase stores 98% of all the crypto on their exchange offline.

Even if they get hacked, your funds should still be secure!

Coinbase also uses the Authy app for 2FA verification.

Verdict (comparison with Coinhako)

Here are the pros and cons of Coinbase when compared with Coinhako:

| Pros | Cons |

|---|---|

| Earn program | More expensive fees (3.99%) |

| More cryptocurrencies supported | Unable to withdraw to Xfers |

Coinbase is similar to Coinhako, where both are platforms that let you instantly buy crypto.

You can choose the rates that you can buy crypto at. Rather, you can only buy them at the prevailing market rate on the platform.

In this case, Coinbase is just way too costly to buy crypto on, due to their high fees. As such, Coinhako seems to be the better choice.

If you are looking to sell off the cryptocurrency you’ve bought in Coinbase, it is possible for you to transfer it to Coinhako too.

The only reason I feel that you should be creating a Coinbase account is to take part in their Earn program!

Conclusion

There are many different options that you can use to buy crypto apart from Coinhako! Each platform also has their strengths and weaknesses.

As such, here are some things you may want to consider when choosing an alternative to Coinhako:

- The currency that you want to buy

- The ability for you to buy your preferred currency directly from SGD

- The fees you’ll incur when buying crypto

- The safety of the platform

- The features you want to use, apart from buying crypto (e.g. staking and lending)

- The minimum required for each trade

👉🏻 Referral Deals

If you are interested in signing up for any of the products mentioned above, you can check them out below!

Gemini Referral (Earn $10 USD in BTC)

If you are interested in signing up for a Gemini account, you can use my referral link.

You will be able to receive $10 USD in BTC!

Here’s what you need to do:

- Register for a Gemini account

- Trade ≥ USD $100 or equivalent on Gemini’s platform

- Receive USD $10 worth of BTC in your account

Luno Referral (Earn SGD $30 in Bitcoin)

If you are interested in signing up for a Luno account, you can use the referral code ‘T5N74J‘ or my referral link to sign up for an account.

You’ll be able to earn SGD $30 worth in Bitcoin!

Here’s what you need to do:

- Sign up for a Luno Account

- Deposit and buy ≥ SGD $200 of BTC via Instant Buy

- Receive SGD $30 in Bitcoin

You will need to purchase BTC using the Instant Buy function. The fees that you incur will be 0.75%.

It would be best to buy only $200 SGD worth of BTC, which only incurs you a $1.50 fee. The $30 SGD bonus will be able to offset the fee!

Crypto.com Referral (Get up to $25 USD worth of CRO)

If you are interested in signing up for Crypto.com, you can use my referral link and enter the code ‘x2kfzusxq6‘.

We will both receive $25 USD worth of CRO in our Crypto Wallet.

Here’s what you’ll need to do:

- Sign up for a Crypto.com account

- Enter my referral code: ‘x2kfzusxq6‘

- Stake enough CRO to unlock a Ruby Steel card or higher

The amount of CRO that you need to stake depends on the card you wish to get, and the currency you are staking in.

You can read more about the referral program on Crypto.com’s website.

Tokenize Referral (Get 5 TKX worth ~ $25 SGD)

If you are interested in signing up for a Tokenize account, you can use my referral link.

You will be able to receive 5 TKX in your account (worth ~$25 SGD)!

Here’s what you need to do:

- Sign up for a Tokenize account

- Trade at least $1000 USD worth of crypto

- Receive 5 TKX in your Tokenize wallet

You can view details of this referral program on Tokenize’s website.

Receive a further SGD $50 worth of TKX when you upgrade to Premium

You are able to receive another SGD $50 worth of TKX if you upgrade to the Premium or Platinum membership of Tokenize.

You will need to pay 160 TKX to upgrade your membership to the Premium tier.

Once you have upgraded your membership tier, you will receive the TKX bonus!

You can view more information about this promotion on Tokenize’s website as well.

Binance Referral (Receive 5% off your trading fees)

If you are interested in signing up for a Binance account, you can use my referral link.

You will be able to receive 5% off all of your trading fees on Binance!

Coinbase Referral (Receive USD $10 worth of BTC)

If you are interested in signing up for Coinbase, you can use my referral link.

You are able to earn USD $10 worth of BTC in your wallet!

Here’s what you need to do to earn this reward:

- Create an account on Coinbase using my referral link

- Trade at least USD $100 worth of cryptocurrency within 180 days of opening your account

- Receive USD $10 worth of BTC

You can view the details of the Coinbase referral program to find out more.

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?