You may have taken a tuition fee loan with OCBC to fund your NUS or NTU tuition fees.

The best part is that the loan is interest free during your university course!

However, once your course is over, you may be wondering how you should go about paying it.

Here is my experience with repaying my tuition fee loan with OCBC.

Contents

How to repay OCBC student loan

Here are 4 steps you’ll need to repay your OCBC student loan:

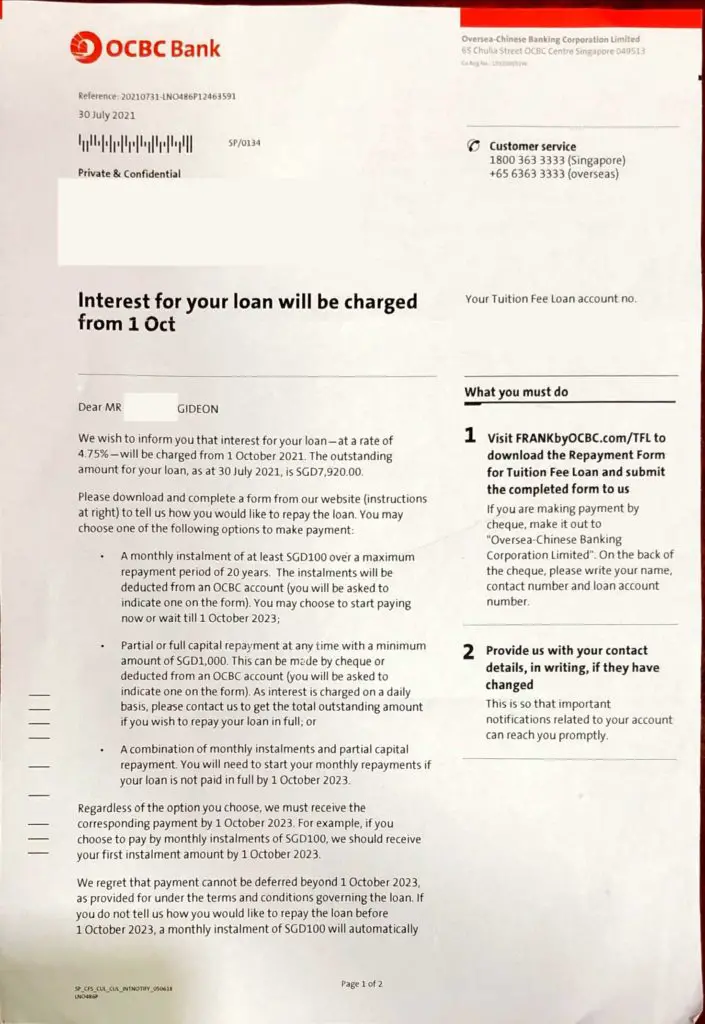

- Receive a letter from OCBC 2 months before your student loan is due

- Select the method of repayment for your student loan

- Fill up the loan repayment form and mail it to OCBC

- Start the repayment

#1 Receive a letter from OCBC 2 months before your student loan is due

I previously went to OCBC to enquire about my student loan. The staff at the bank mentioned that a letter would be sent to your house to inform you about the repayment.

True enough, this letter came to me 2 months before my tuition fee loan was due.

My tuition fee loan was only due on September, because MOE had further deferred the payment of loans in 2021.

In most cases, your loan should be due when the school term ends (around May-June).

Apart from this letter, I did not receive other notifications regarding my loan being due. As such, you may want to make sure that your mailing address is up to date on OCBC’s records!

#2 Select the method of repayment for your student loan

There are 3 ways that you can choose to repay your student loan:

- Monthly instalments

- Full or partial repayment

- Monthly instalments + partial capital repayment

There are pros and cons to choosing one repayment method over the other.

The best way to repay your loan would be to make a full repayment, just before your interest-free period ends. This is because you’ll incur a 4.75% interest rate on your funds, which can be quite hefty!

Another way would be to pay as much as you can as the initial repayment. You can then pay the remainder through monthly instalments.

This helps to reduce the amount of interest that you owe the bank, which can compound really fast.

#3 Fill up the loan repayment form and mail it to OCBC

After deciding on your method of repayment, you will need to fill up the loan repayment form on OCBC’s website.

You will need to mail this form to OCBC’s Consumer Loan Operations office in Tampines.

#4 Start the repayment

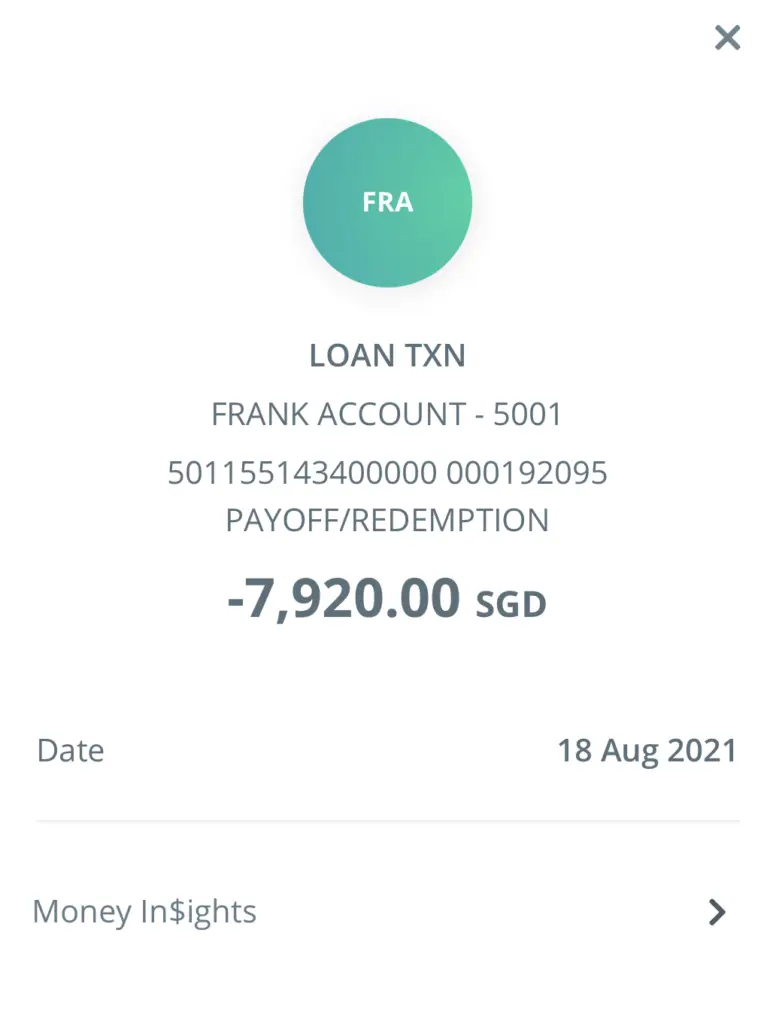

When OCBC receives your form, they will start to process the loan.

I opted for the full repayment, and within 3 working days, the funds were deducted from my bank account.

This was rather fast, and I do regret sending in the application so early. I had been placing my funds in a cash management account to continue earning some interest on my capital.

My main concern was that I did not want to incur any interest to the bank, so I withdrew my funds much earlier. However, I could have earned slightly more interest on my funds.

Hopefully, this will help you to plan your withdrawals better, if you are using the same strategy as me.

Where can I place my savings to pay back my student loan?

The best part about the student loan is that it is interest free during the course of your study. Even if you have the capital to pay your uni fees upfront, I would still recommend you to take the student loan.

This is because you are able to have this extra cash on hand to place it in products that can help you to generate some short term returns. This is similar to some of the places I’ve recommended to store your emergency funds.

There are cash management accounts that are offered by some robo-advisors and brokers:

| Account | Projected Yield | Withdrawal Time |

|---|---|---|

| Endowus Cash Smart | Core: ~ 0.8% – 1% Enhanced: ~ 1.2% – 1.5% Ultra: ~1.8% – 2% | 6 (Cash) and 10 (SRS) business days |

| Syfe Cash+ | ~ 1.5% | 4-5 business days |

| StashAway Simple | ~ 1.2% | 3-4 business days |

| MoneyOwl WiseSaver | ~ 0.43% | 1-2 business days |

| FSMOne Auto-Sweep | ~ 0.6% | T+3 business days |

Most of these accounts invest in rather similar funds. While some of them have a higher projected yield, the liquidity may be lower.

It may take a longer time for you to receive your funds after withdrawing them.

Since you can estimate when you’ll need to repay your loan, you may even opt for short-term endowment plans which lock up your funds for 3 years!

An example of such a plan is Gro Capital Ease by NTUC Income.

Should I invest or pay back my student loan first?

If you are thinking of investing, I would suggest that you prioritise paying back your tuition fee loan first. This is because the interest rate is rather high, and you may not be able to beat this amount.

I would only recommend that you start investing if you are confident of consistently beating the 4.75% interest you owe the bank. It may be possible if you choose to invest in the S&P 500, which has an average return of 10%.

However, this is only the average return. You may not be receiving 10% returns every year.

There may be some years where you may receive negative returns too!

To get consistent returns above 4.75% may be something that’s quite hard to achieve. This would mean that your debt grows larger than your wealth, so you may still have a negative net worth.

As such, it may be a better choice for you to aim to be as close to debt free as possible before starting to invest!

Conclusion

Your student loan may be the largest expense you incur once after your graduation.

I would recommend trying to pay back your loan as soon as possible. This ensures that the interest does not compound to become a huge sum that you’ll owe the bank.

It is possible to start investing, but I would only recommend doing so if you’re confident of consistently beating the 4.75% interest rate that you’ll incur with the loan.

👉🏻 Referral Deals

If you are interested in signing up for any of the products mentioned above, you can check them out below!

Endowus Referral (Receive a $20 Access Fee Credit)

If you are interested in signing up for Endowus, you can use my referral link to create your account.

You will receive a $20 access fee credit, irregardless of the amount that you start investing with Endowus.

The access fee does not have any expiry date. As such, you can invest at any pace that you wish, and still get $20 off your fees!

Syfe Referral (Up to $30,000 SGD managed for free for 3 months)

If you are interested in signing up for Syfe, you can use the referral code ‘FIPHARM‘ when you are creating your account. You will have your first $30,000 invested with Syfe managed for free for your first 3 months.

You will be able to save up to $75 worth of fees!

This applies only to the money that you’ve invested in Syfe’s 3 portfolios. If you are using only Syfe Cash+, you will not be charged any fees by Syfe!

You can view more information about this referral program on Syfe’s website.

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?