Last updated on March 23rd, 2022

If you are a frequent user of Grab, you may have noticed that they are offering the GrabPay Mastercard.

You may already have many other debit or credit cards already, so is it really worth getting another one?

Here’s what you need to know:

Contents

- 1 Is the GrabPay card a debit card or a credit card?

- 2 What’s the difference between the GrabPay card and the GrabPay wallet?

- 3 How do I find my GrabPay card number?

- 4 What is the GrabPay virtual Mastercard?

- 5 What are the rewards for using the GrabPay card?

- 6 Are there any exclusions for the GrabPay card?

- 7 Can the GrabPay card be used for insurance?

- 8 Can the GrabPay card be used on AXS?

- 9 Can the GrabPay card be used overseas?

- 10 Can the GrabPay card be used to pay for bus and MRT?

- 11 Can the GrabPay card be added to Apple Pay or Google Pay?

- 12 Are there any annual fees for the GrabPay card?

- 13 Is the GrabPay card worth it?

Is the GrabPay card a debit card or a credit card?

The GrabPay Mastercard is a prepaid debit card that will deduct the balance from your GrabPay wallet. You will need to ensure that your GrabPay wallet has enough funds for the transaction to go through.

Similar to other cards such as the Crypto.com Visa Card, or the BigPay card, the GrabPay Mastercard is a prepaid debit card.

This means that you will have to top up your GrabPay wallet first before you can make a payment.

If you own either the Amex True Cashback or UOB Absolute Cashback card, you will be able to earn cashback even when you are topping up your GrabPay wallet.

This is something you may want to take note of when you are making a recurring transaction with your GrabPay Mastercard, such as paying for your mobile plan like Circles Life.

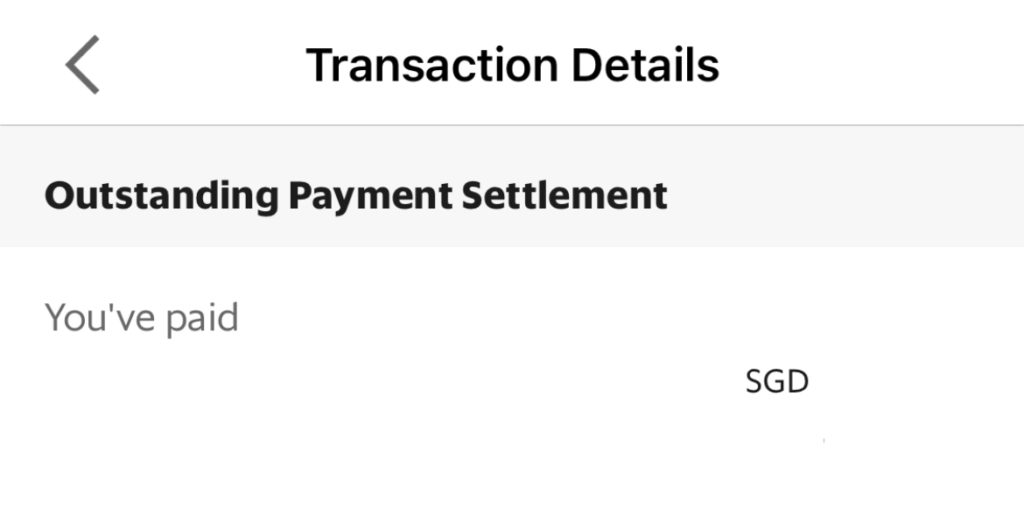

If that happens, you will need to settle the outstanding payment for that transaction.

Can I use the GrabPay card for PayWave?

The GrabPay Mastercard can be used at places that accept Mastercard contactless transfers. Since both Visa and Mastercard are the widely used payment networks in Singapore, you should be able to use your GrabPay Mastercard at any store that allows PayWave transactions.

Can I use the GrabPay card for NETS?

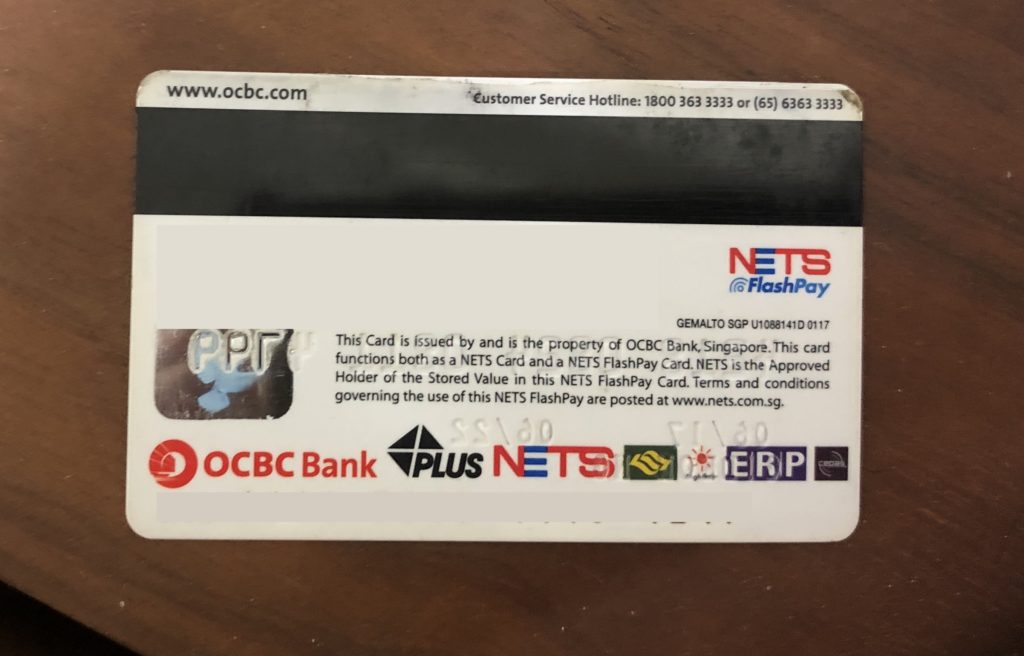

The GrabPay Mastercard does not support transactions made via the NETS payment network.

For some debit cards like Standard Chartered JumpStart or the FRANK Debit Card, you may see the NETS logo at the back of your card.

However, this is not the case for the GrabPay Mastercard, which does not have the NETS logo on its back.

As such, you will only be able to make payments via the Mastercard network.

If you’re wondering what’s the difference between NETS FlashPay and the NETS CashCard, you can view my comparison here.

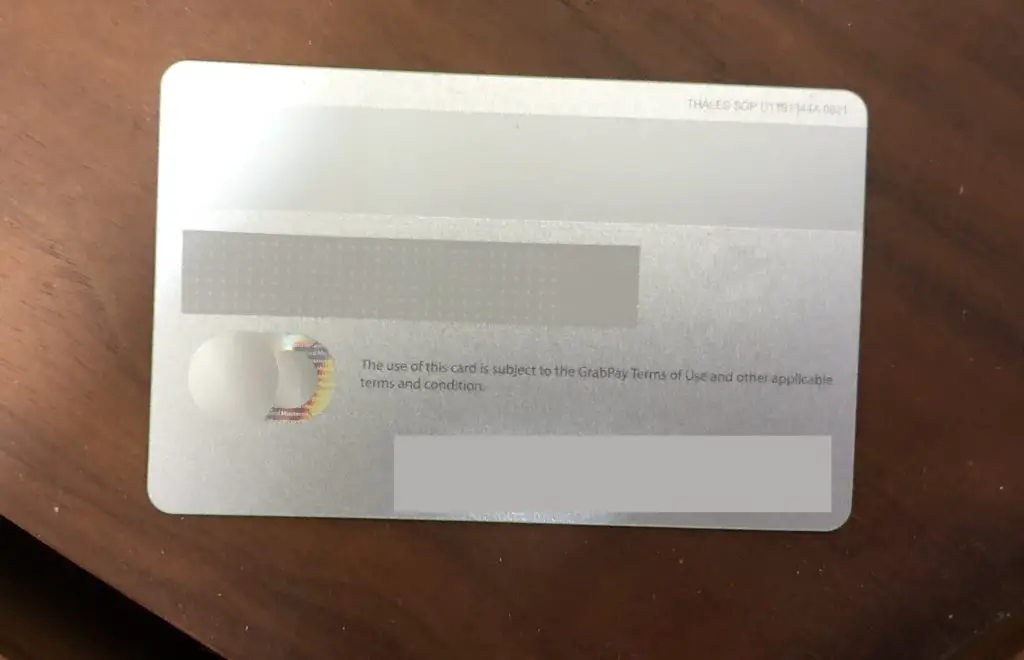

Is the GrabPay card a metal card?

The GrabPay Mastercard is a plastic card, and not a metal card.

Although the GrabPay Mastercard may give a metallic feel due to its silver colour,

it is actually a plastic card!

What’s the difference between the GrabPay card and the GrabPay wallet?

The GrabPay Mastercard allows you to make purchases at stores that accept Mastercard transactions by deducting funds from your GrabPay Wallet. However, the GrabPay Mastercard is just one of the ways to make payments with your GrabPay Wallet.

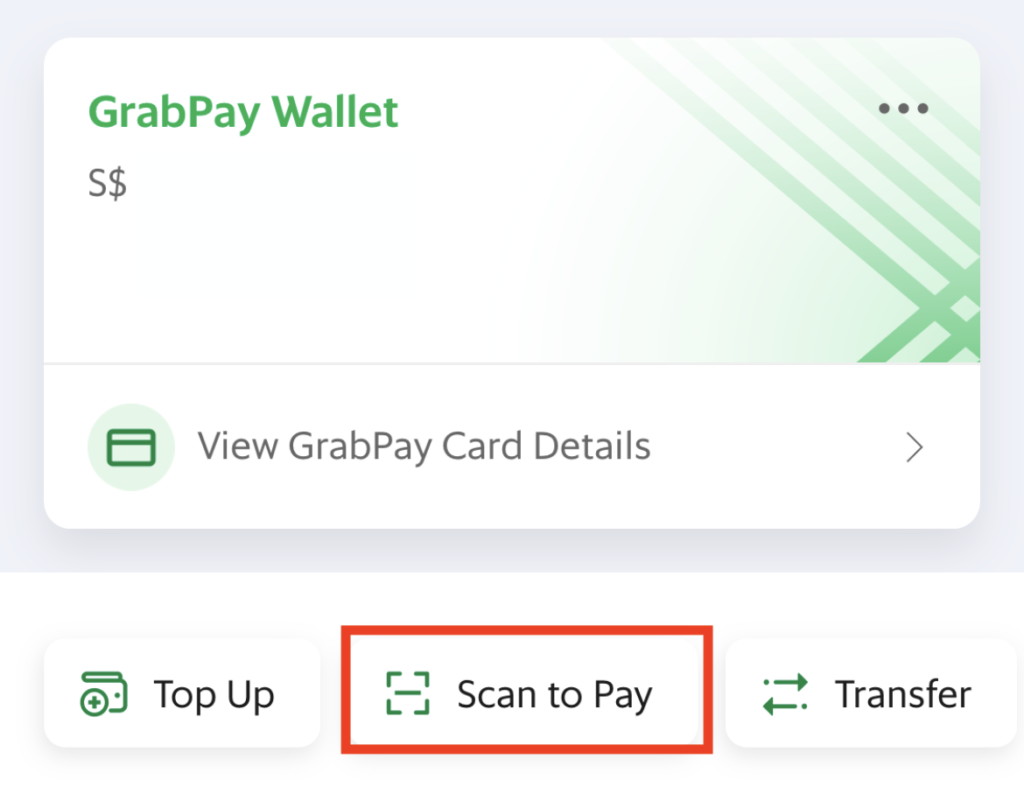

Apart from using the GrabPay Mastercard to make payments from your GrabPay wallet, you are able to scan a GrabPay QR code to make payments too.

This is especially advantageous if a store accepts payment via GrabPay, but not via Mastercard transactions. As such, you will still be able to earn rewards at these stores.

If you top up your GrabPay wallet with the 2 cashback cards (Amex True Cashback and UOB Absolute Cashback), you will be able to receive cashback as well.

How do I find my GrabPay card number?

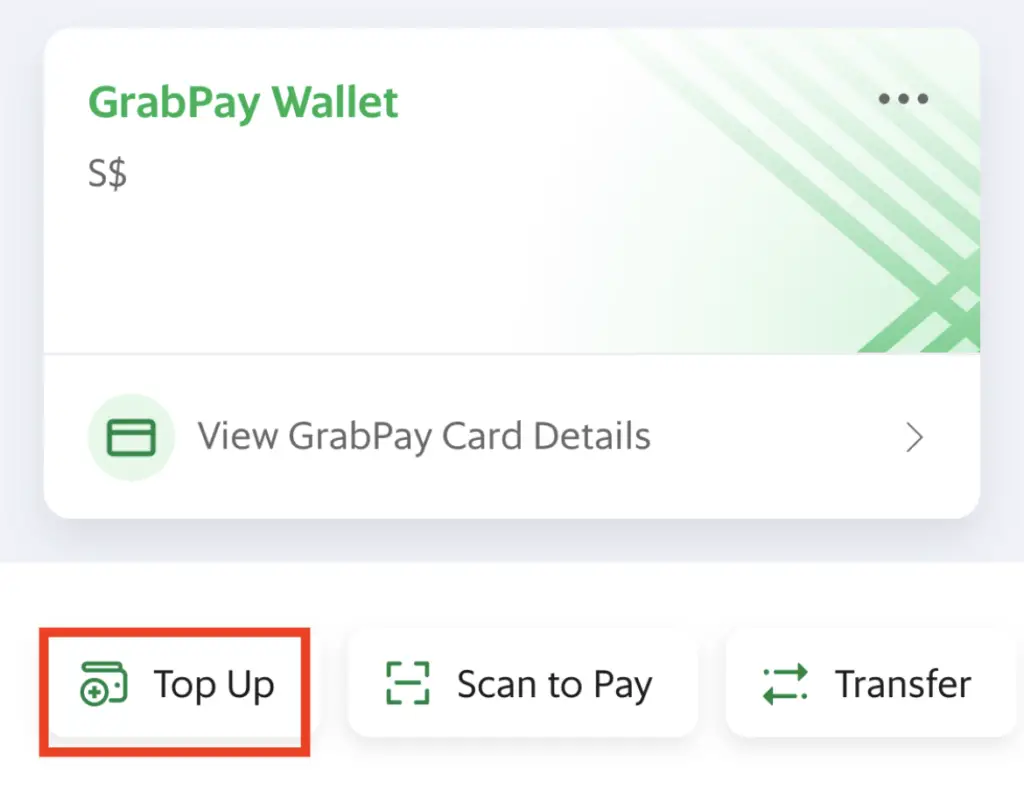

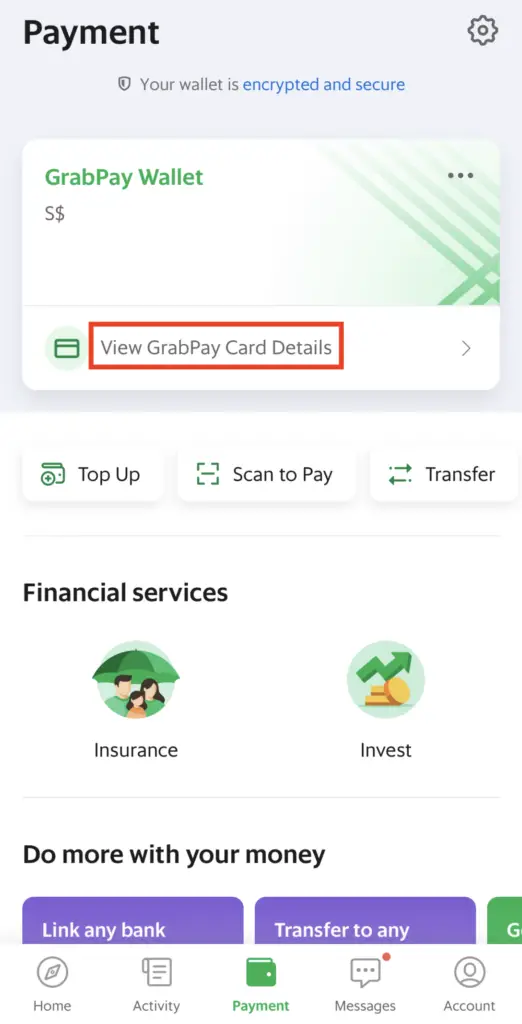

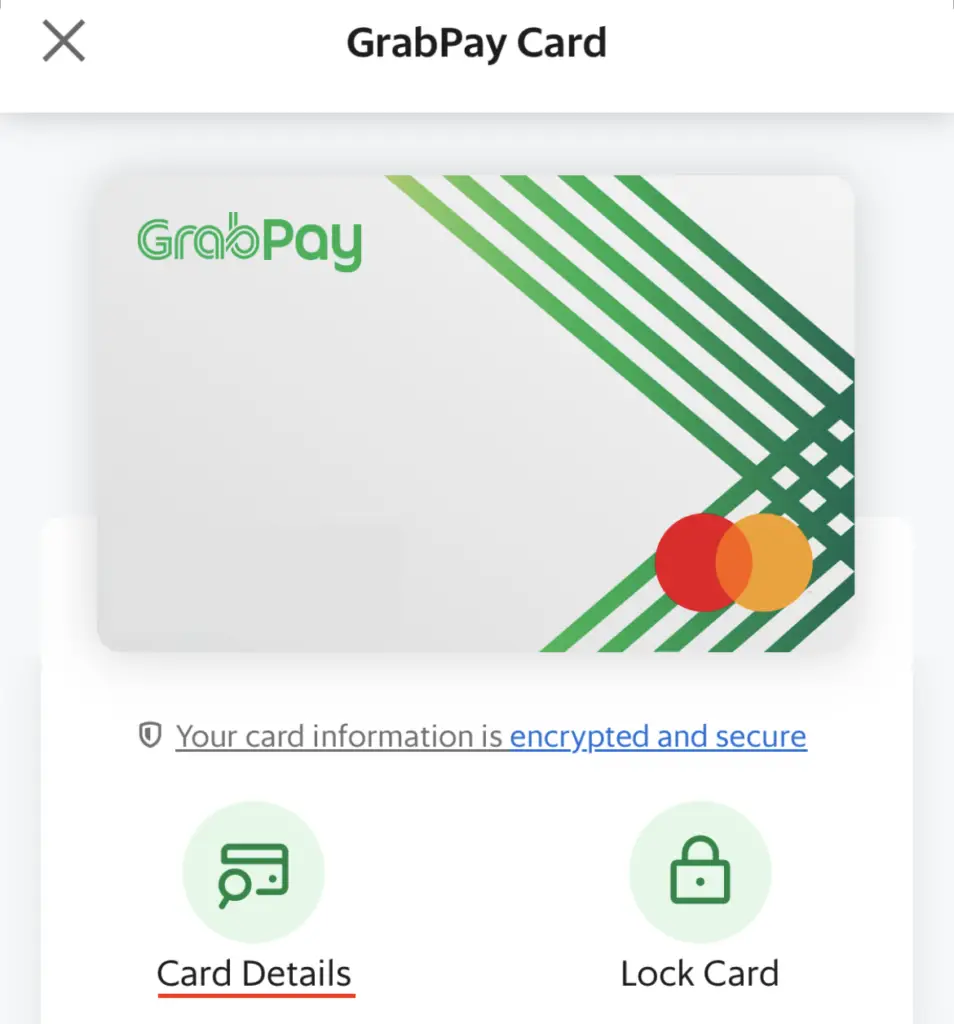

To find your GrabPay Mastercard number, you will need to go to the ‘Payment‘ tab under your Grab app, and select ‘View GrabPay card details‘.

After tapping on this,

you will be able to see your Card Details.

This includes your Card Number, CVV and ‘Valid Through’ date.

What is the GrabPay virtual Mastercard?

The GrabPay virtual Mastercard will only allow you to make payments via the GrabPay Mastercard via online purchases only. You are unable to make any contactless transactions at merchants unless you have a physical card.

What are the rewards for using the GrabPay card?

Depending on your GrabRewards tier (Member, Silver, Gold, Platinum), you will be able to receive 3 – 6 points for every $1 that you spend.

Here are the GrabReward points that you’ll receive when you spend $1 on the GrabPay Mastercard:

| GrabRewards Tier | Number of Points |

|---|---|

| Member | 3 points |

| Silver | 3 points |

| Gold | 4.5 points |

| Platinum | 6 points |

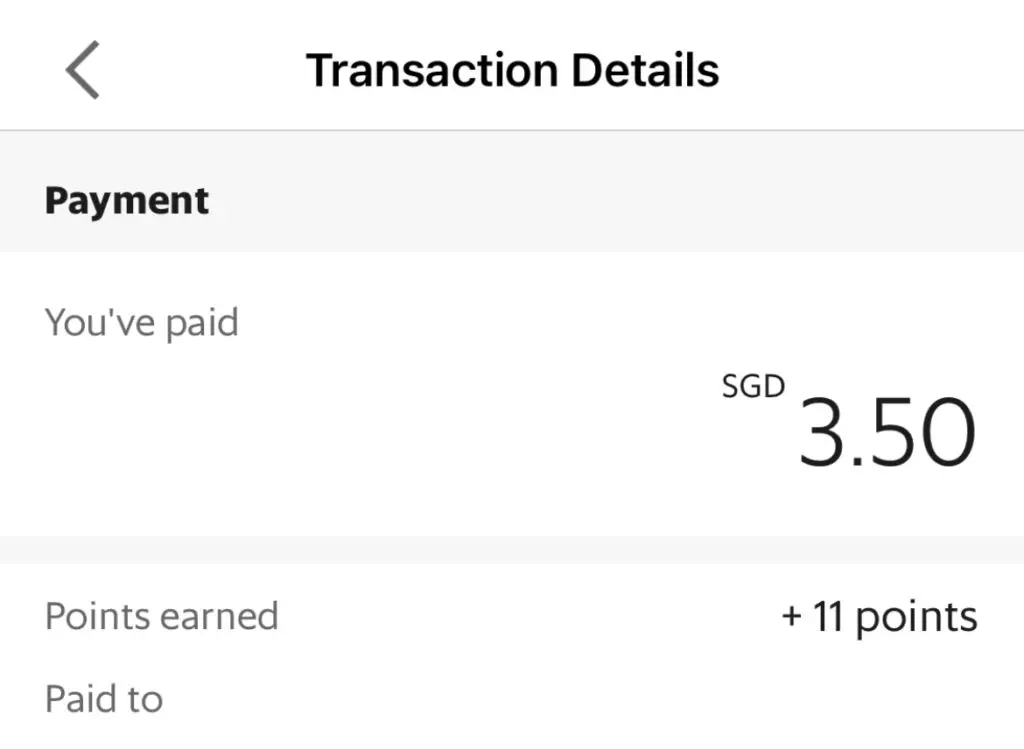

However, you may want to note that the rewards points are proportional to every dollar that you spend. If you spend $3.50, you should receive 11 points as a Silver member.

This means that for every 33 cents that you spend, you will get 1 point as a Silver member.

Am I able to earn cashback by using the GrabPay card?

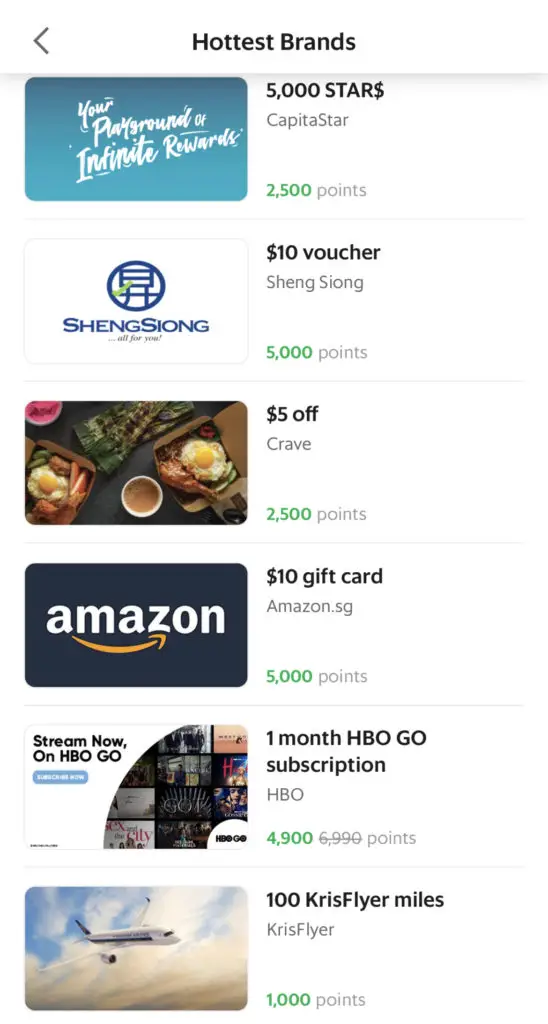

You are able to earn cashback from the GrabPay Mastercard in the form of vouchers such as CapitaStar, Sheng Shiong, or Starbucks. These vouchers can be claimed via your GrabRewards points that you’ve accumulated while spending using the GrabPay Mastercard.

You won’t be able to earn your rewards directly as cashback. Instead, you will accumulate GrabRewards points for every purchase that you make.

These GrabRewards points can be claimed for vouchers, including:

- Sheng Siong

- CapitaStar

- Crave

- FairPrice Online

You are able to convert them to KrisFlyer miles as well.

How much ‘cashback’ can I earn with the GrabPay Mastercard?

You will be able to receive between 0.6% – 1.2% cashback with the GrabPay Mastercard, depending on your GrabRewards tier.

To obtain a $10 voucher, here’s the amount that you’ll need to spend to earn 5,000 points:

| Tier | Amount Spent To Reach 5,000 Points | Equivalent Cashback |

|---|---|---|

| Member / Silver | $1,666.67 | 0.6% |

| Gold | $1,111.11 | 0.9% |

| Platinum | $833.33 | 1.2% |

The maximum cashback that you can obtain from the GrabPay Mastercard is 1.2%, provided that you are a Platinum tier member.

If you are looking for other cashback credit cards, you can consider some of them below:

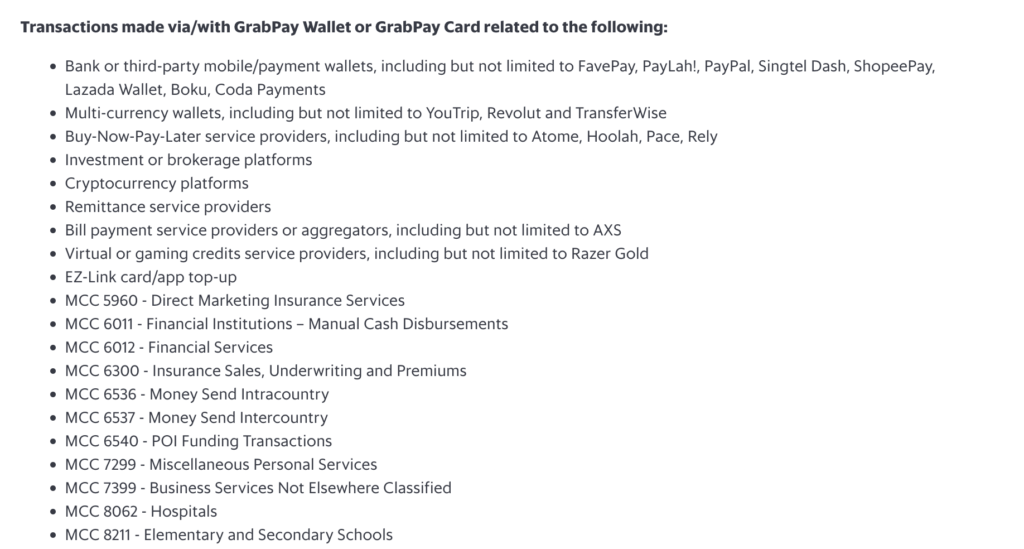

Are there any exclusions for the GrabPay card?

There are numerous MCC codes that are excluded from earning GrabRewards points, including Charities (8398) and Financial Services (6012). Top-ups to third party mobile or payment wallets are excluded from earning GrabRewards points as well.

Grab has a rather extensive list of transactions that do not qualify for GrabRewards points.

Some of the significant exclusions include:

- Financial services

- Hospital bill payments

- Insurance payments

- School fees

- EZ-Link card top-ups

- Mobile wallet top-ups

If you are using the GrabPay Mastercard for your everyday expenditure, it will be a good way to accumulate the GrabRewards points.

However, for larger expenses like insurance or school fees, you will not be able to earn any GrabRewards points.

Can the GrabPay card be used for insurance?

The GrabPay Mastercard can be used for insurance payments. However, you will be unable to earn any GrabRewards points from this transaction, as it is one of the exclusions for GrabRewards points.

Can the GrabPay card be used on AXS?

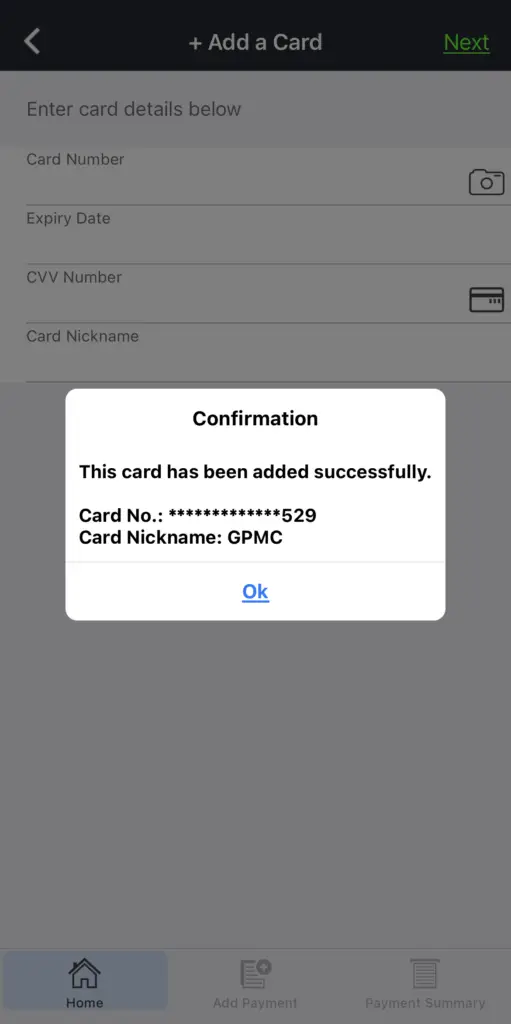

Your GrabPay Mastercard can be used at AXS stations and the AXS app by adding this card as a payment option on your app. However, you will be unable to earn any GrabRewards points for any transactions on AXS.

It is possible for you to add the GrabPay Mastercard to your AXS app as one of your payment options.

However, you are unable to earn any GrabRewards points from any transactions on AXS, as they are within the exclusion list.

Nevertheless, this still gives you an opportunity to earn either a 1.5% or 1.7% cashback when you top up your GrabPay wallet with the Amex True Cashback or UOB Absolute Cashback card.

This is one way to earn cashback for transactions that may not give you any other types of credit card rewards!

Can the GrabPay card be used overseas?

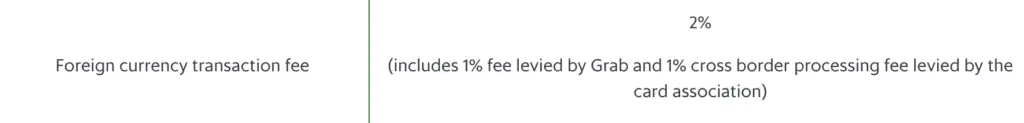

You are able to use your GrabPay Mastercard for overseas transactions at any merchant that accepts Mastercard transactions. Your SGD balance will be converted to a foreign currency based on the prevailing Mastercard Currency Conversion rates, and you will be subject to an additional 2% foreign currency conversion fee.

For each foreign transaction that you make, you will be subject to a 2% foreign currency conversion fee.

While you can use the GrabPay Mastercard for overseas transactions, it may not be the best way to do so due to the fees.

If you are looking to use a multicurrency card, there are other options you can use without incurring the foreign currency conversion fees, such as BigPay, YouTrip or Revolut.

Can the GrabPay card be used to pay for bus and MRT?

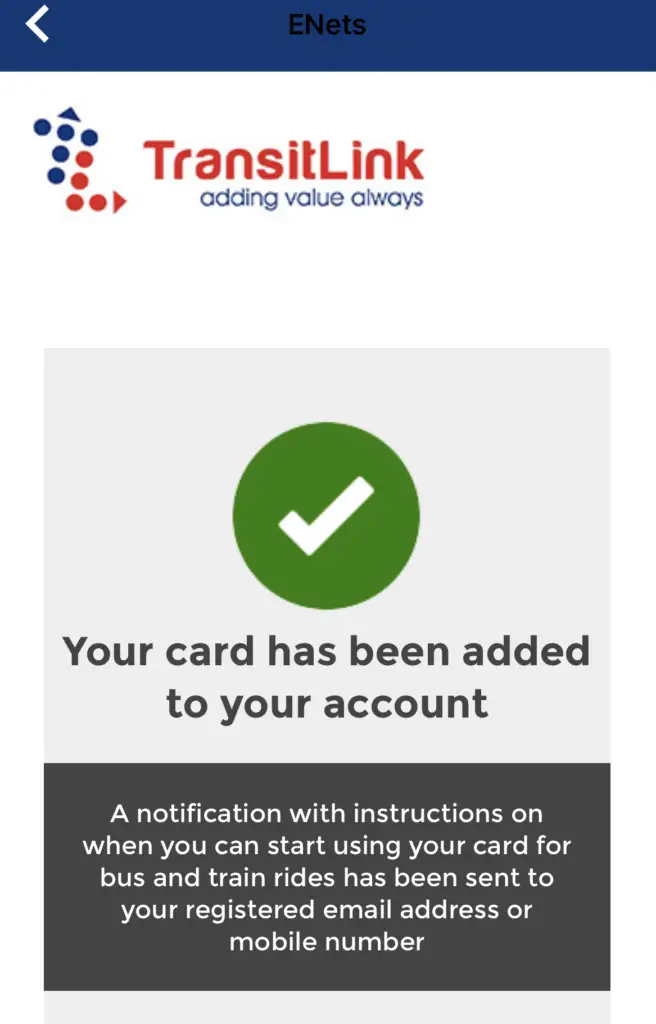

The GrabPay Mastercard can be used to make payments for public transport such as bus or MRT rides. You will need to add your card to your SimplyGo account to be able to make these payments.

You can check out my guide on adding cards to SimplyGo for more information.

Once you have added your GrabPay Mastercard to your SimplyGo account,

you will be able to use your GrabPay Mastercard for bus and MRT rides.

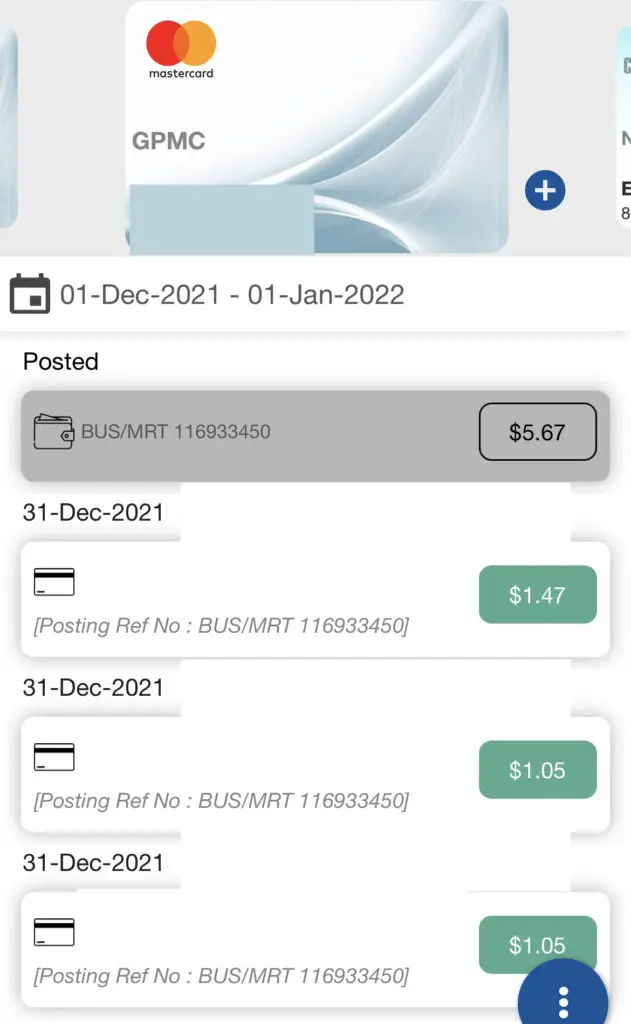

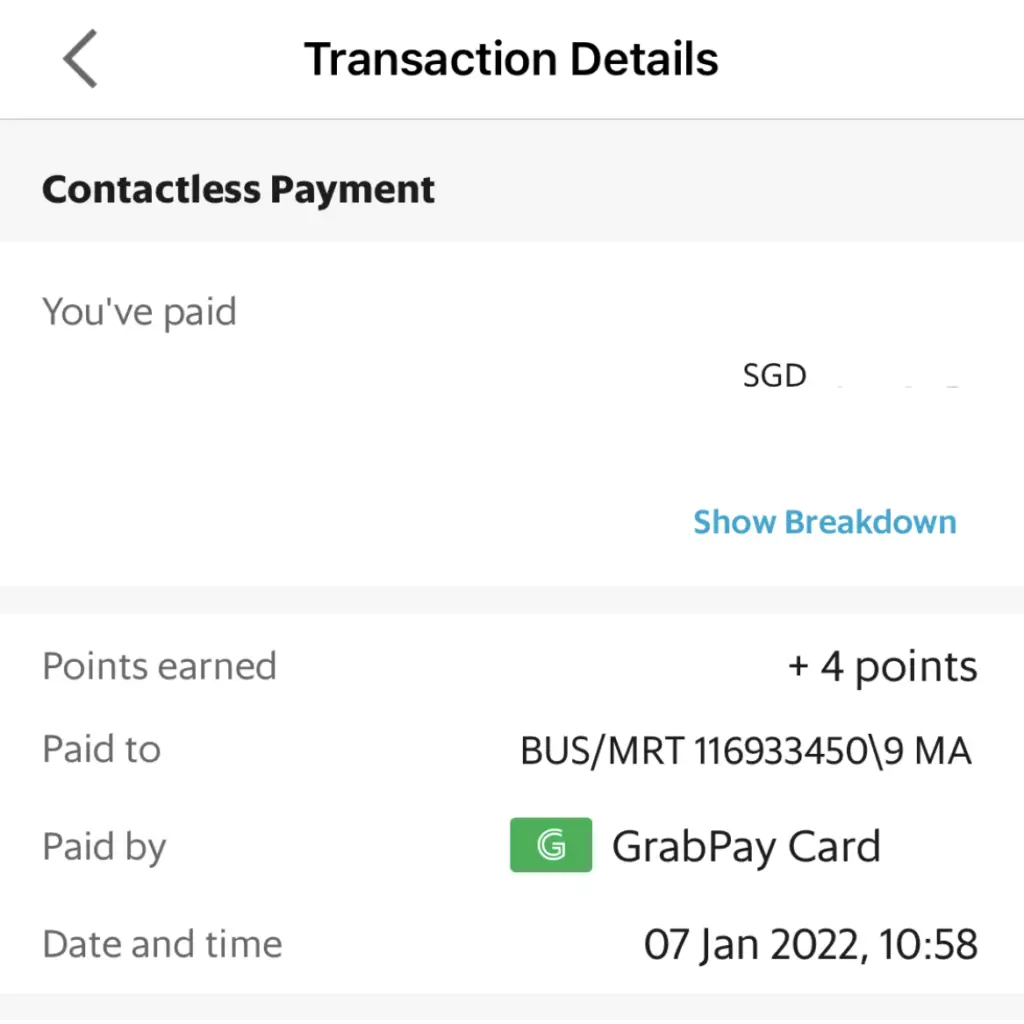

However, you may want to note that it takes a while before the funds get deducted from your card. For example, I used my card on 31st December 2021.

Meanwhile, I was only charged the amount on 7th Jan 2022.

As such, don’t forget to ensure that you have enough funds in your GrabPay wallet to make this transaction.

The process of deducting your fare for your MRT or bus ride is different from an EZ-Link card, as the EZ-Link card immediately deducts the fee, while the GrabPay Mastercard will only deduct the fee after a certain number of days.

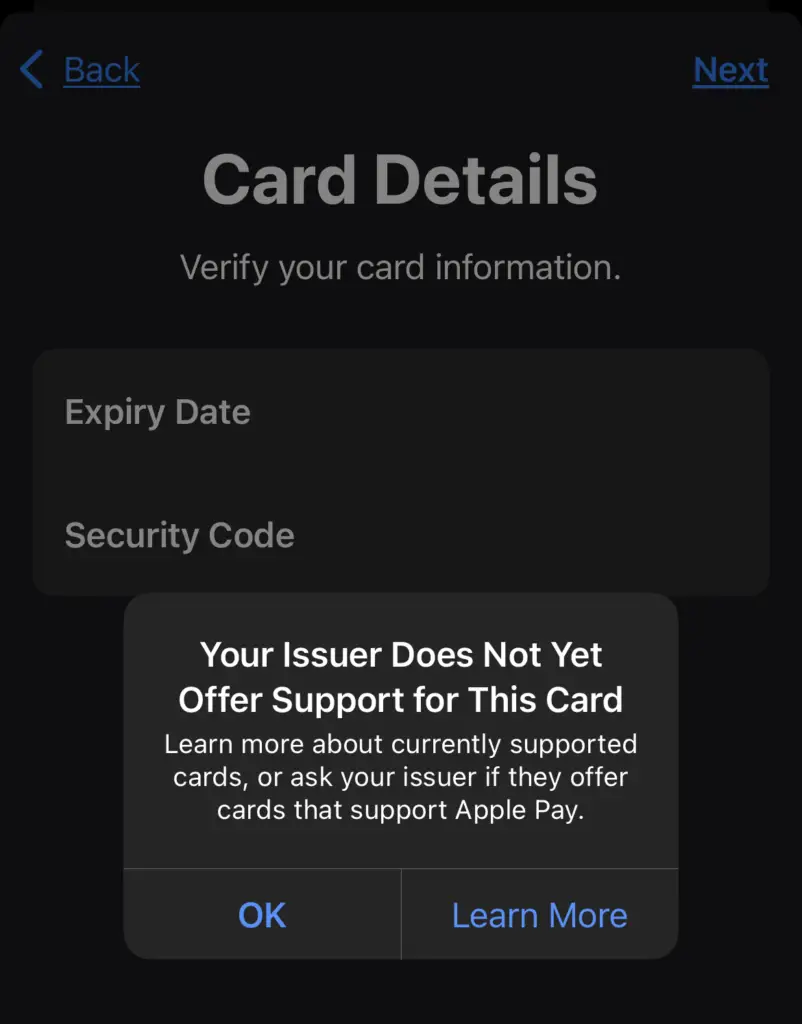

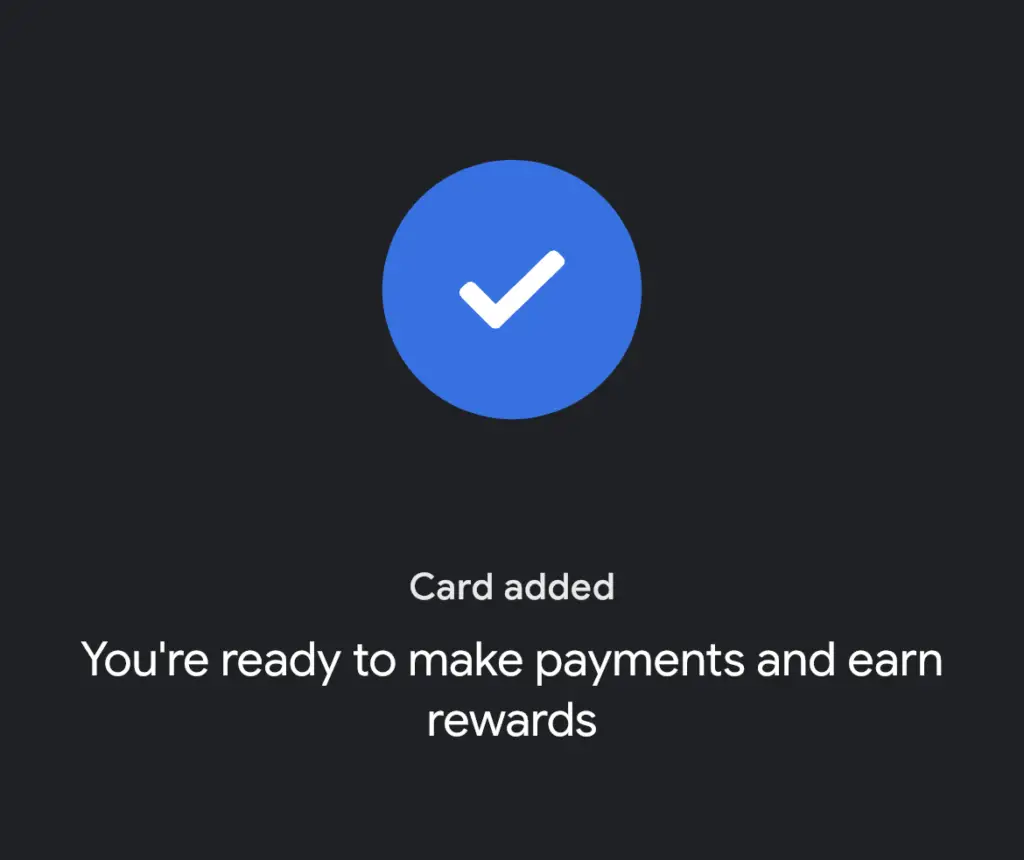

Can the GrabPay card be added to Apple Pay or Google Pay?

The GrabPay Mastercard can be added to your Google Pay account, but not to Apple Pay.

When I tried to add the GrabPay Mastercard to Apple Pay, I was given this error.

This was similar to when I tried to add my Crypto.com Visa Card to Apple Pay.

However, when I tried to add the GrabPay Mastercard to Google Pay, there were no issues.

Are there any annual fees for the GrabPay card?

There are no annual fees charged for using the GrabPay Mastercard. You can refer to the fee schedule for a full breakdown of all the possible fees that are associated with the GrabPay Mastercard.

Is the GrabPay card worth it?

The GrabPay Mastercard is a good way for you to accumulate GrabRewards points via contactless transactions when a merchant does not have a GrabPay QR code. However, when comparing the rewards that you earn with Grab with other credit cards, the 0.6% – 1.2% ‘cashback’ that you receive from Grab pales in comparison to other cards.

If a merchant does not accept either Visa or Mastercard, you can consider using GrabPay to still earn some rewards when making a transaction.

However, if you are able to use your GrabPay Mastercard to make payments, there may be other credit cards that offer better rewards.

Nevertheless, there are still some transactions where it is advantageous to use the GrabPay Mastercard, such as AXS transactions. However, you’ll need to use either the UOB Absolute Cashback or the Amex True Cashback card to earn that extra cashback!

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?