Last updated on February 19th, 2022

While looking to apply for a cashback credit card, chances are you may have heard of the Amex True Cashback card.

If you’re still on the fence about whether you should use this card or not, here’s my experience with this card:

Contents

- 1 What are the benefits of the Amex True Cashback card?

- 2 What are the exclusions for the Amex True Cashback card?

- 3 Can I use the Amex True Cashback card to top up my GrabPay wallet?

- 4 Is there a cap to the cashback on the Amex True Cashback card?

- 5 Does the Amex True Cashback card charge any foreign transaction fees?

- 6 Am I able to get an annual fee waiver for the Amex True Cashback card?

- 7 Conclusion

- 8 👉🏻 Credit Card Deals

What are the benefits of the Amex True Cashback card?

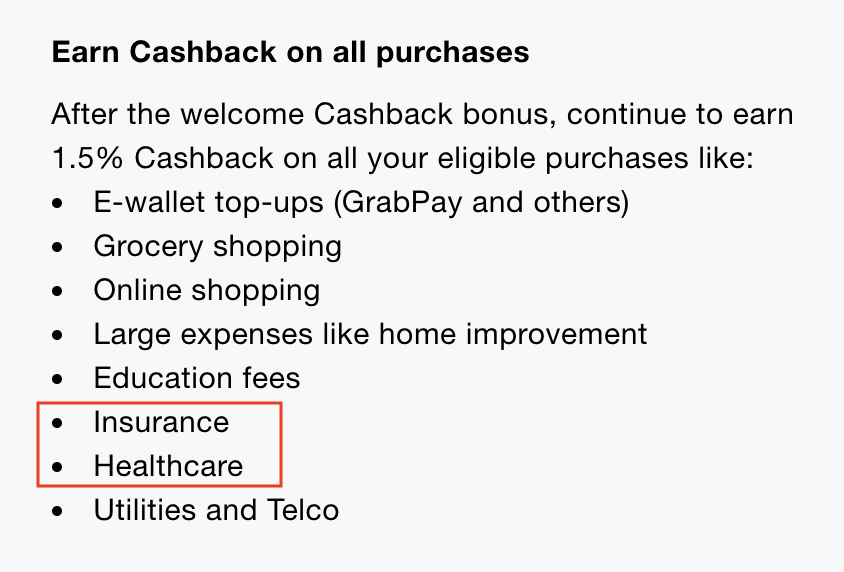

The Amex True Cashback card offers a flat 1.5% cashback for almost all transactions that you make with the card.

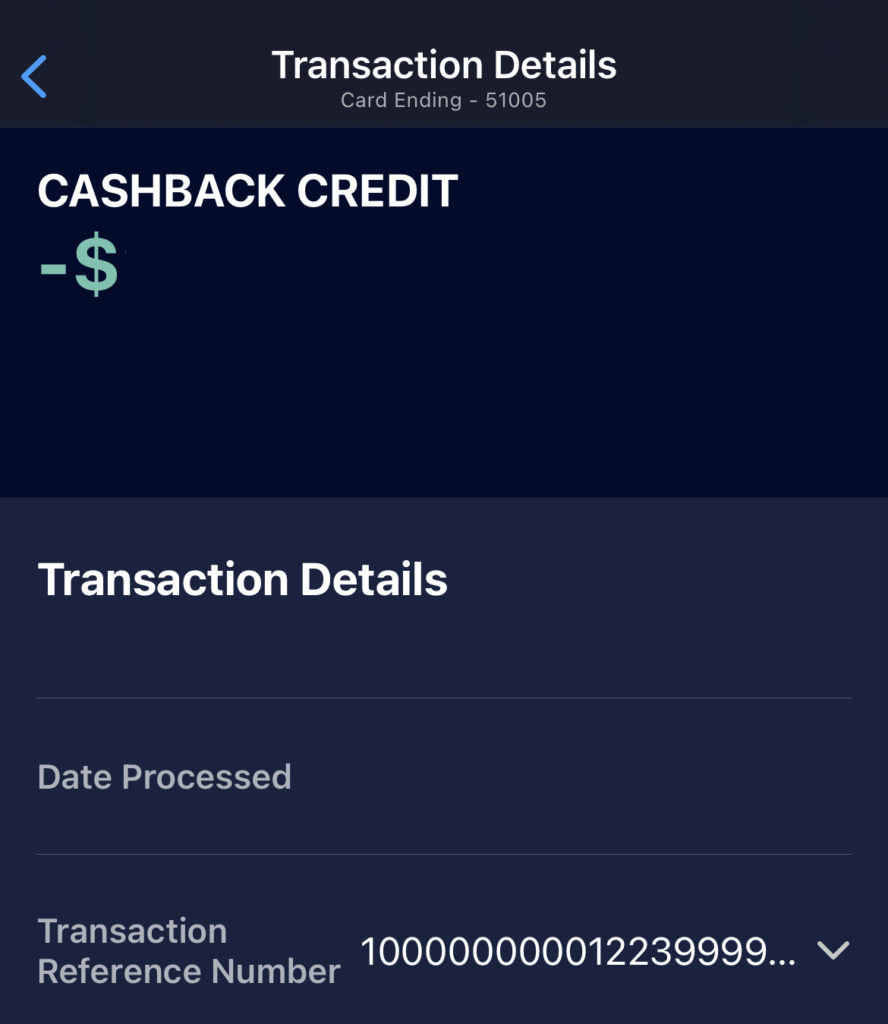

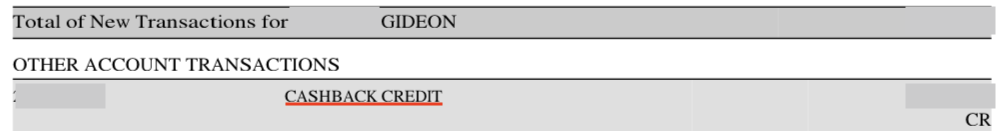

One of the advantages of this credit card is that you are able to receive the cashback bonus in the same month, which will then offset the bill that you need to pay for the month.

This is different from other credit cards, where the cashback will offset your bill for the next month.

If you are looking to pay for your Amex bills using different banking platforms, you can check out my guides for DBS and OCBC.

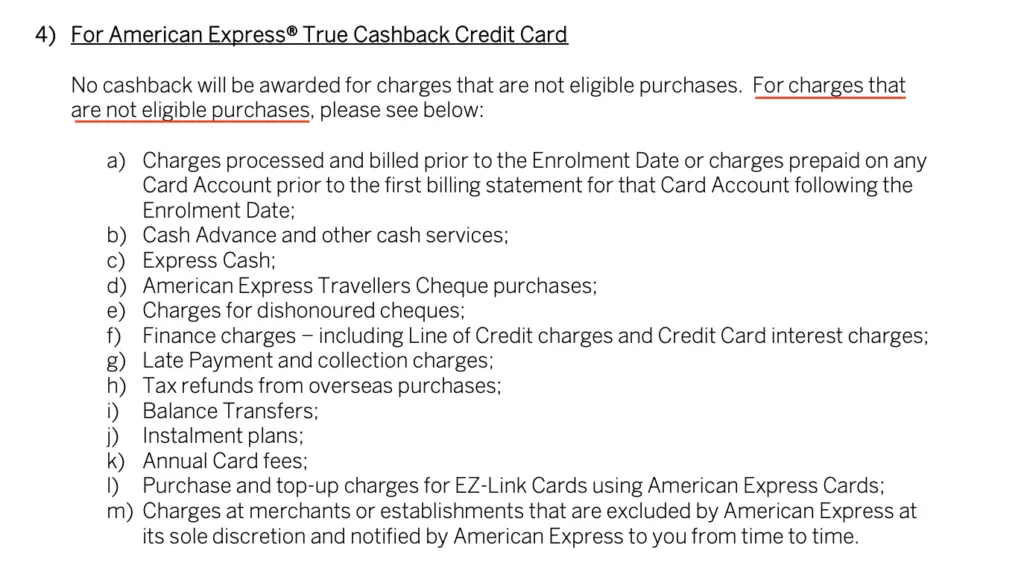

What are the exclusions for the Amex True Cashback card?

Some of the exclusions for the Amex True Cashback card include cash advance payments, instalment plans, annual card fees and the purchase and topping up of EZ-Link cards.

You can view the full exclusion list for the Amex True Cashback card from this list:

Most of these exclusions are financing charges and various administrative charges. This exclusion list does not have any transactions that you make during a day-to-day basis.

As such, you are able to use your Amex True Cashback card for most retail transactions, and still enjoy the 1.5% cashback!

Can the Amex True Cashback card be used for insurance premiums and hospital bills?

You are able to use your Amex True Cashback card to pay for transactions such as insurance payments or hospital bills, provided that your insurance company or healthcare institution accepts payments via Amex credit cards.

On the Amex website, it mentions that you are able to use your Amex True Cashback card to pay for both insurance premiums and hospital bills.

However, you may want to double-check with your insurance company or healthcare institution whether they accept Amex credit cards when you are making your payment.

Some companies may accept credit card payments, but this may only be restricted to either Visa or Mastercard payments!

Can the Amex True Cashback card be used for AXS payments?

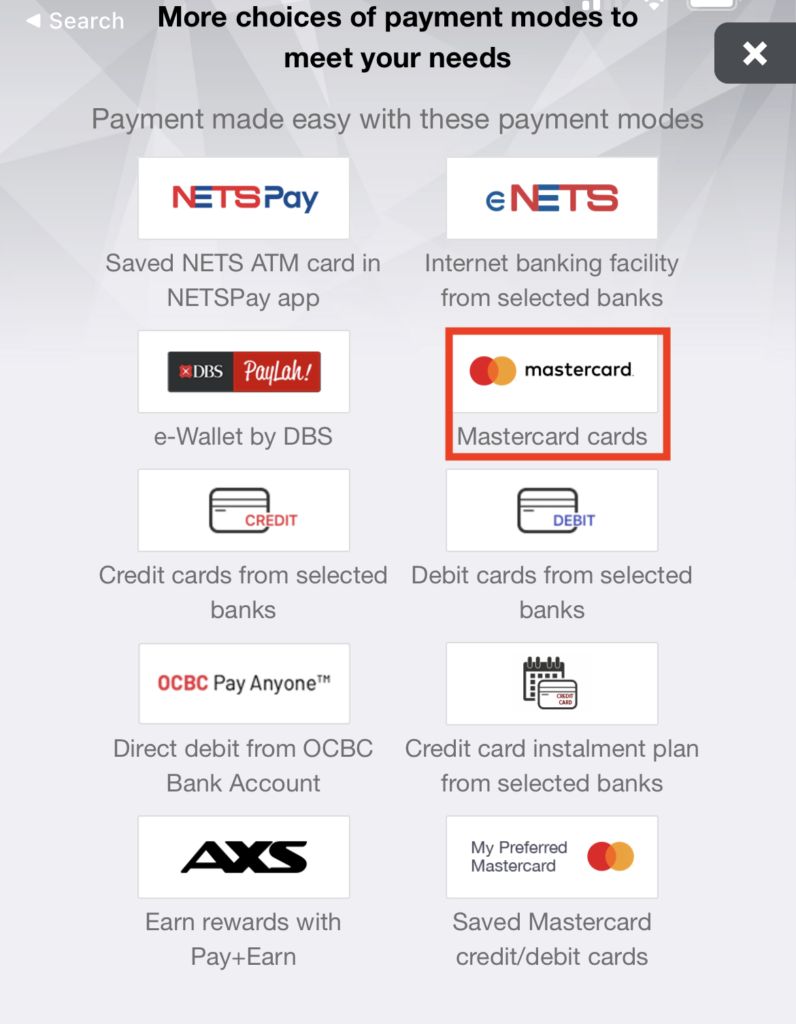

You are unable to use your Amex True Cashback card for AXS payments, as AXS only accept credit card payments via Mastercard.

If you would like to make payments on the AXS app via a credit card, you are only able to do so via a Mastercard credit card.

As such, you won’t be able to make AXS payments with your Amex True Cashback card.

However, it is possible for you to make an AXS payment using the GrabPay Mastercard, which can be topped up by the Amex True Cashback card. This allows you to receive cashback when paying your bills!

Can the Amex True Cashback card be as an EZ-Link card?

You Amex True Cashback card is unable to be added to Simplygo and as such, you are unable to use it to pay for your bus and MRT rides.

If you are looking to use your credit or debit card to pay for MRT, you will need to use add it to your Simplygo account. However, you are only able to add Visa or Mastercard debit or credit cards to your Simplygo account.

Even though you are able to add the Amex True Cashback card to Apple Pay, you may not be able to use this card with Simplygo.

As such, you are unable to use your Amex True Cashback card to pay for your MRT and bus rides. Again, you are able to use your GrabPay Mastercard to pay for public transport rides.

Can I use the Amex True Cashback card to top up my GrabPay wallet?

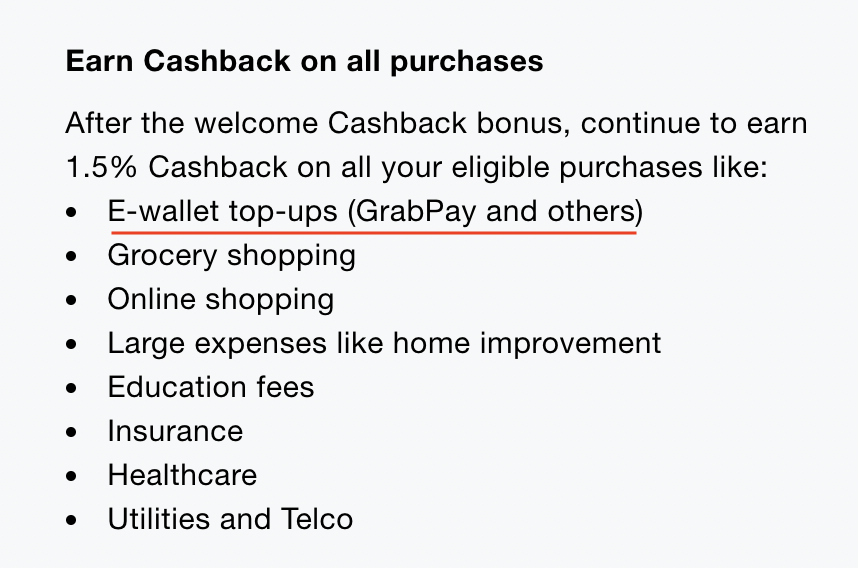

You are able to use your Amex True Cashback card to top up your GrabPay wallet, and receive the 1.5% cashback reward.

This is a huge advantage of the Amex True Cashback card, as you are able to still receive the cashback reward on wallet top-ups, such as GrabPay!

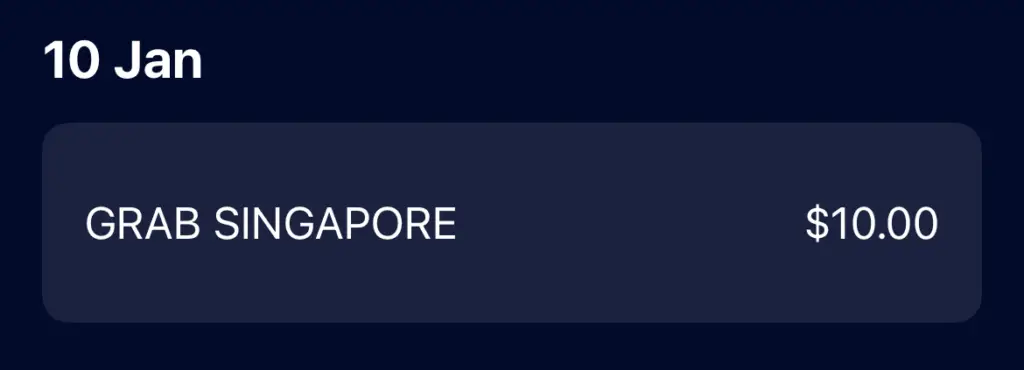

I have been using my Amex True Cashback card to top up my GrabPay wallet,

and it will be counted into the transactions that are eligible for the cashback reward.

Another advantage is that you will not incur any fees when topping up your GrabPay wallet with your Amex True Cashback card.

This is in contrast to GrabPay top-ups that you make using a Visa credit card, where a $1 fee will be charged for top ups < $400.

However, you may want to note that you won’t be able to withdraw the amount that you’ve topped up using a credit card from your GrabPay wallet balance!

This is really advantageous, because:

- You are able to receive the 1.5% cashback from your Amex True Cashback card

- You are able to earn GrabRewards points

I have been using this method to maximise the amount of rewards that I receive for each transaction.

Furthermore, I am able to use GrabPay at neighbourhood stalls that do not accept credit cards. This helps me to earn cashback at these places, even though I am not using a credit card to make my payment!

The GrabPay Mastercard can be used at places which don’t accept Amex

There may still be some merchants that do not accept Amex credit cards, but they may accept Mastercard cards.

One such example is making payments for your bus and MRT rides.

In this case, it is possible for you to top up your GrabPay wallet with your Amex True Cashback card, and then use your GrabPay Mastercard to make the payment.

This helps to avoid the problem of the merchant not accepting Amex payments!

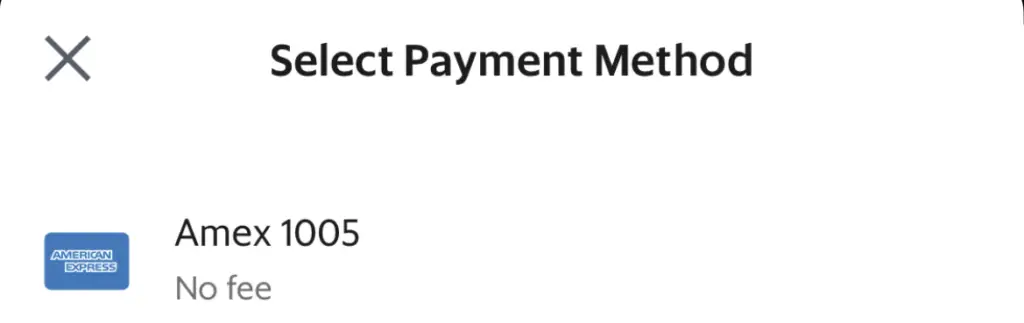

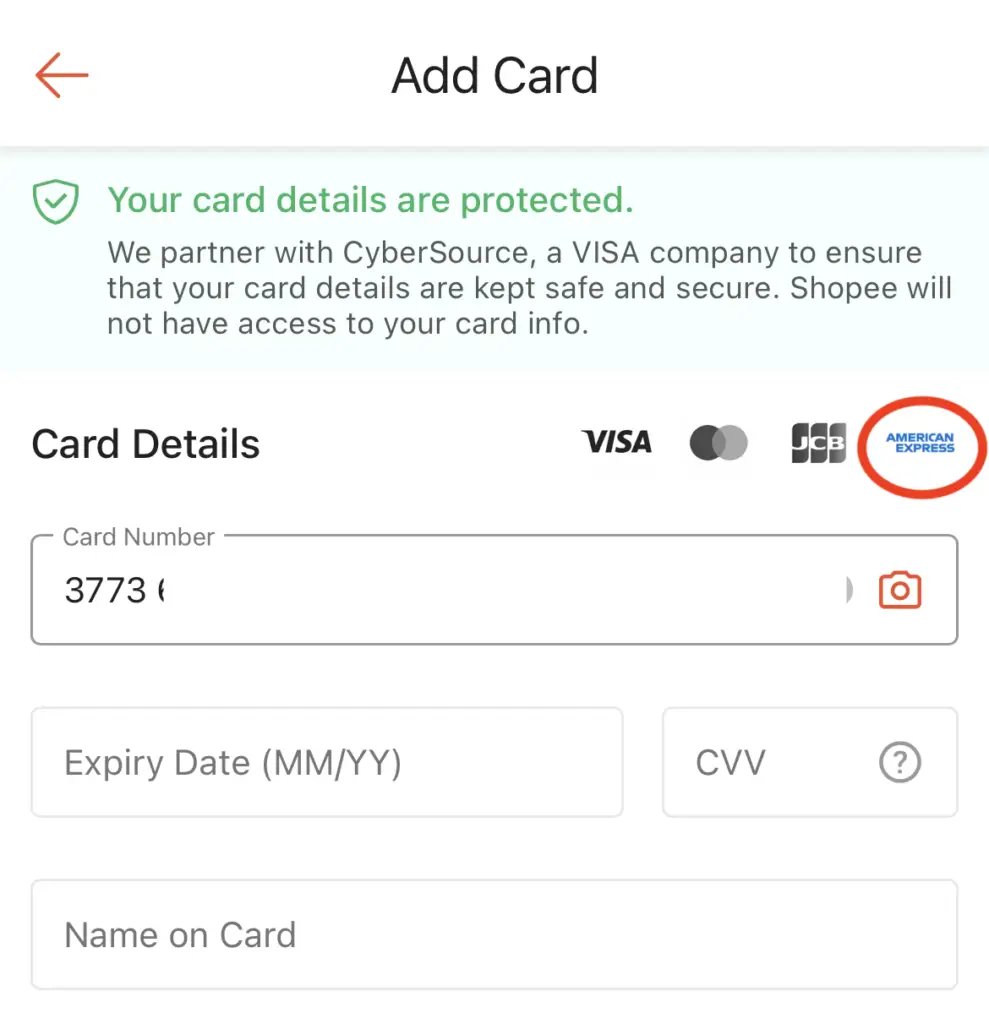

Can I use the Amex True Cashback card to top up Shopee Pay?

Shopee Pay accepts Amex credit cards, so you are able to add your Amex True Cashback card to top up your Shopee wallet.

Shopee allows you to make top ups to your Shopee Pay wallet using Amex cards.

If you enter the credit card number of your Amex True Cashback card, it should automatically detect that it is an Amex card.

This will allow you to top up your Shopee Pay wallet, and still earn cashback from this e-wallet top-up!

Is there a cap to the cashback on the Amex True Cashback card?

There is no cap on the cashback that you can earn with the Amex True Cashback card, as well as no minimum spend.

What I really like about this card is that you are able to receive cashback on almost any transaction that you make. Even if you only spend a few dollars on this card, you will still be eligible for the cashback!

You are able to track all of your spending on the Amex mobile app.

You can view the transaction statement for each month as a PDF file, where you can view your total spending, as well as the cashback that you receive.

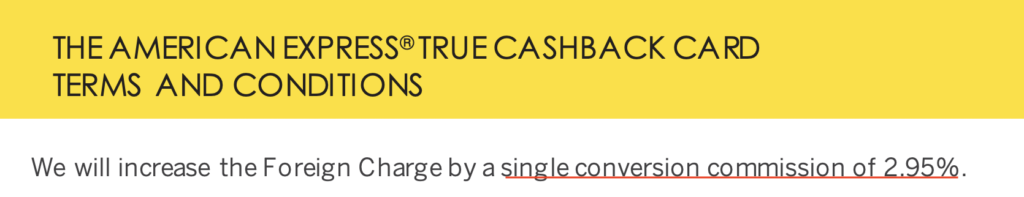

Does the Amex True Cashback card charge any foreign transaction fees?

The Amex True Cashback card charges a foreign currency fee of 2.95%.

Here is what is mentioned in the Amex True Cashback card’s terms and conditions:

You will be able to get a 1.5% cashback on any foreign transactions that you make, which may help to reduce the fees you incur. However, it is still quite expensive to pay for foreign transactions with your Amex True Cashback card!

Instead, you may want to consider getting a multi-currency card, such as BigPay or Revolut, where you do not incur any foreign transaction fees.

Am I able to get an annual fee waiver for the Amex True Cashback card?

Your Amex True Cashback card will receive an annual fee waiver for the first year. If you wish to waive your fee for the subsequent years, you may need to contact the customer service staff at Amex to request for a waiver.

Conclusion

The Amex True Cashback card is a versatile card that you are able to use for most transactions and receive cashback too.

This card is similar to the UOB Absolute Cashback card, which also does not have many exclusions for the cashback reward.

One of its main advantages is that you are still able to receive cashback even for topping up your GrabPay wallet. This allows you to use your GrabPay Mastercard at places that do not accept Amex payments, and still receive the 1.5% cashback!

If you wish to have a credit card that offers higher cashback rates with a minimum spend requirement, there are other cards that you can consider, including:

👉🏻 Credit Card Deals

Are you interested in signing up for a credit card? Check out some of the deals below!

Amex True Cashback Card

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?