Last updated on June 7th, 2021

You may be looking for a savings account to put your money in. You may also have a problem with maintaining a savings habit!

Here’s how the DBS POSB eMySavings Account may help you.

Contents

eMySavings Account Review

The eMySavings Account is a good way to develop a savings habit as you are required to make a monthly contribution. However, the interest rate is quite low and you will be penalised for making any withdrawals.

Here is an in-depth review of the eMySavings Account.

What is the eMySavings Account?

The eMySavings Account is offered by both DBS and POSB. It is an account that rewards you with bonus interest if you make a monthly contribution.

You may be wondering why it is being offered by both DBS and POSB. In fact, they are actually the same bank!

What is the interest rate?

This account is great if you want to cultivate a good saving habit. By crediting a certain sum of money each month, you may receive additional interest!

Here are some conditions to be met:

- The amount you save each month ranges from $50-$3,000 (in multiples of $10)

- A crediting date between the 1st -25th day of each month

- A debiting account that the money will be deducted from

This is similar to how the POSB Save As You Serve account works too.

Here are the interest rates based on the monthly contribution you make:

| Monthly Contribution | Interest Rate |

|---|---|

| $50 – $290 | 0.05% |

| $300 – $790 | 0.2% |

| $800 – $1,490 | 0.25% |

| $1,500 – $3,000 | 0.25% |

| Other scenarios | 0.05% |

To earn a 0.25% interest rate on your savings, you are required to contribute at least $800 a month.

You may only earn a 0.05% interest rate if you meet these conditions

Here are the 3 conditions that will cause you to only earn 0.05%:

- Failed crediting of monthly contribution

- Withdrawal from the bank account

- Account closure during the month

A failed crediting will usually occur if you do not have enough funds in your debiting account. As such, don’t forget to ensure you have the required funds in your account at least one day before the deduction!

The good thing is that you will only forfeit the bonus interest for that particular month. You are still able to enjoy the bonus interest for the other months.

Withdrawing your money will forfeit your interest

If you make any withdrawals from this account, you will only earn a 0.05% interest.

I believe that this is not a good place to store your emergency funds. If you need to withdraw money for an emergency, your bonus interest will be lost!

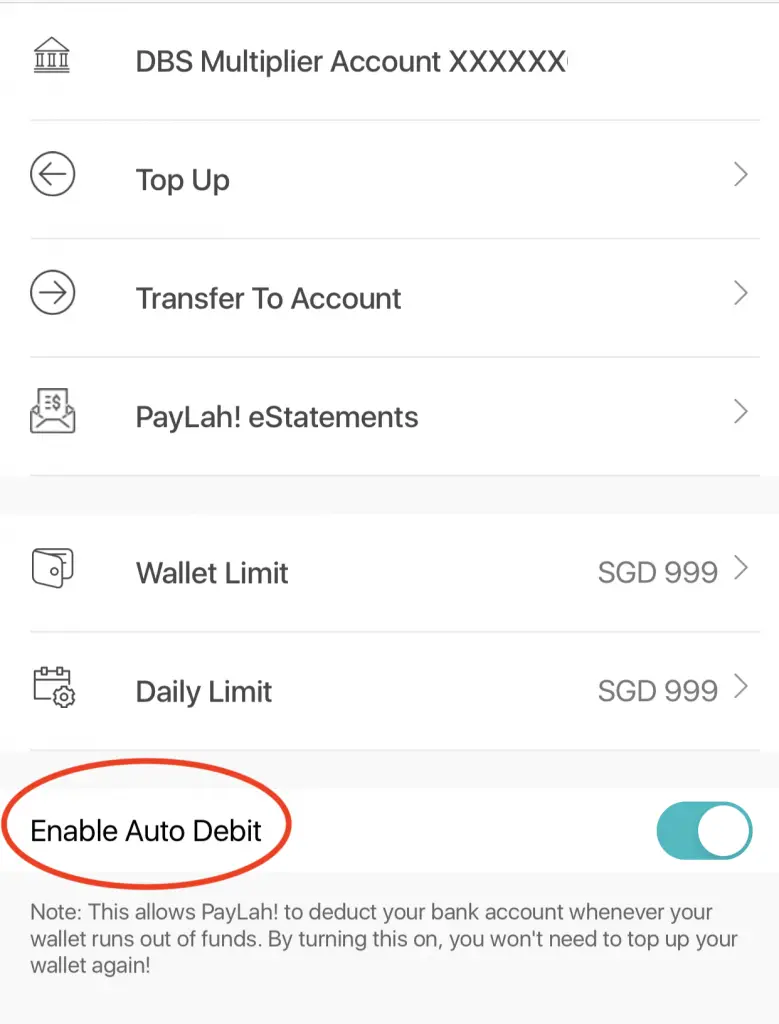

It is also recommended that you do not link your eMySavings account with your PayLah! mobile wallet. If you turn on the auto-debit function, you will make a withdrawal from your account.

As such, your bonus interest rate will also be forfeited!

You can change your crediting date via iBanking

You are able to change the crediting date or the monthly contribution anytime via the POSB or DBS digibank app.

This makes it rather flexible for you to change the monthly contribution to suit your needs.

You can calculate the interest that you can earn

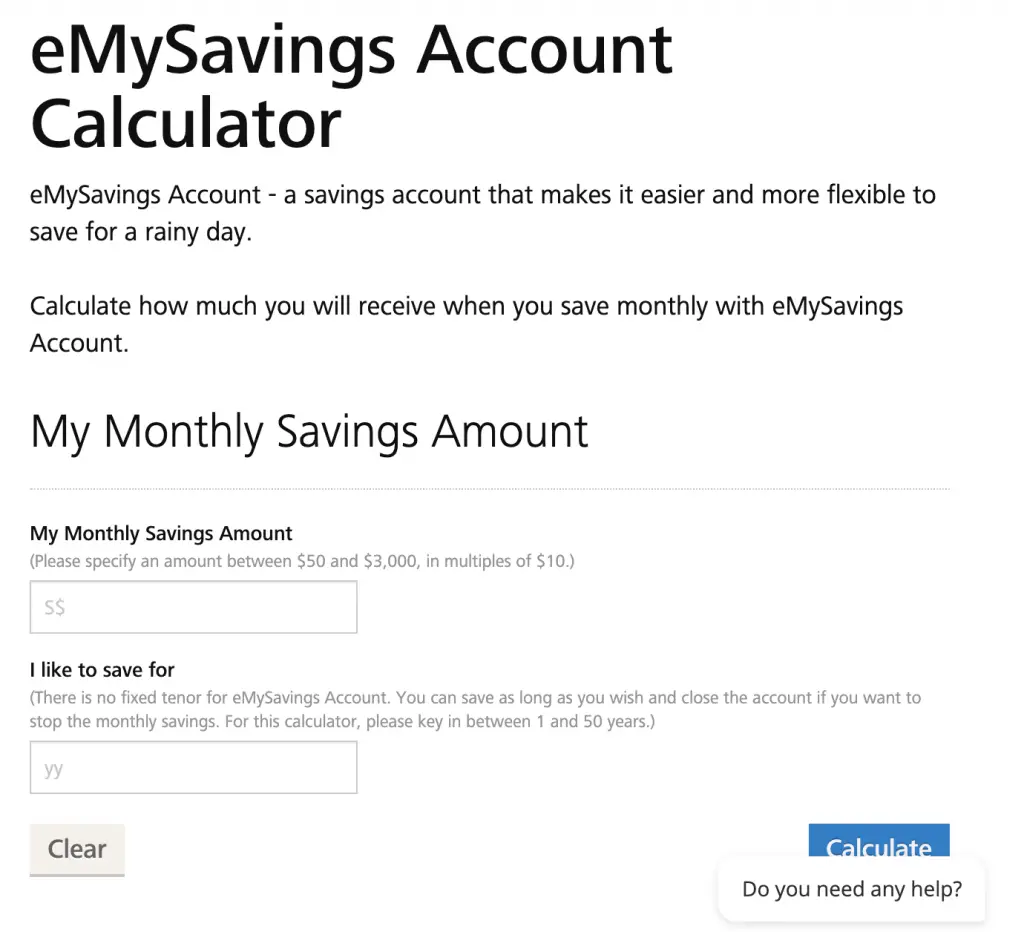

POSB also provides an eMySavings interest calculator.

This allows you to calculate the interest you can earn over a period of 1-50 years.

However, this takes into consideration that:

- Your savings amount is the same

- You do not forfeit the bonus interest

The interest rate is less attractive compared to other bank accounts

The eMySavings Account’s 0.25% interest rate is quite low. There are many bank accounts that provide a better interest rate.

Furthermore, these accounts allow you to withdraw your funds without being penalised too!

Here are some other accounts that you can consider:

| Savings Account | Interest Rate |

|---|---|

| OCBC Frank | 0.05% – 0.3% |

| CIMB FastSaver | 0.3% – 0.15% |

| Standard Chartered JumpStart | 0.1% – 0.4% |

| Vivid Savings Account | 1.05% -1.3% |

Furthermore, there are other insurance savings plans that offer a higher interest rate.

| Plan | Crediting Rate |

|---|---|

| SingLife Account | 2% for first $10k, 1% for next $90k |

| GIGANTIQ | 1.8% for first $10k, 1% for any amount above $10k |

The eMySavings Account’s interest rate really pales in comparison compared to these other accounts.

What are the requirements for this account?

Here are some of the requirements for this account:

#1 No initial deposit

The eMySavings Account does not require you to make an initial deposit. You can apply to create this account online via digibank and it’ll be created immediately!

#2 You need to be at least 16 years old with a DBS or POSB account

The minimum age of 16 years old is lower compared to some savings accounts. Moreover, you will need to have another DBS or POSB account.

This account will be your debiting account where your monthly contributions come from.

#3 No minimum balance and fall below fee

There is no minimum balance you are required to maintain for the eMySavings Account.

As such, you will not incur a fall below fee as well.

With such few requirements, you can consider the eMySavings account if you want an account without a fall below fee.

However, you will be penalised if you make a withdrawal!

Verdict

Here are the pros and cons of this savings account.

| Pros | Cons |

|---|---|

| No initial deposit | Monthly contributions of $50 – $3000 to earn bonus interest |

| No minimum balance and fall below fee | Bonus interest will be penalised if you make any withdrawals |

| Monthly contributions force you to save | Interest rates are not that attractive |

Besides the no initial deposit and minimum balance, there isn’t anything really enticing about this savings account.

Conclusion

The eMySavings Account is something you can consider if you are looking for an account without a fall below fee. Moreover, it is a great account to force you to save if you have trouble doing so.

However, the low interest rate and the penalty for withdrawing money makes it really unattractive.

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?