Last updated on June 6th, 2021

When deciding to start your investment journey, you may have heard of 2 popular platforms: Funding Societies and StashAway.

How are they different and which one should you be using to invest?

Contents

Funding Societies vs StashAway

Funding Societies is a P2P lending platform that allows you to earn interest when you lend your money to a SME. Meanwhile, StashAway is a robo-advisor that invests your money into a globally diversified portfolio that includes stocks, bonds and commodities. Both forms of investments are risky. However, lending your money via Funding Societies may be riskier as there is a risk that the SME may default on the loan.

Here’s an in-depth comparison of what these 2 investing platforms can offer you:

Type of Investment

Both platforms offer very different types of investment products:

Funding Societies allows you to conduct P2P lending

When you use Funding Societies, you are lending your capital to SMEs via peer-to-peer (P2P) lending. Usually, it is hard for small SMEs to get loans from banks.

This is because banks are more afraid that these SMEs may not be able to pay back the loan in the future.

As such, these SMEs may turn to these P2P lending platforms instead. These platforms help to connect these SMEs to interested investors, and crowdsource the funds. Due to the risk of these loans, you will usually receive a higher interest rate than your bank account.

How does Funding Societies work?

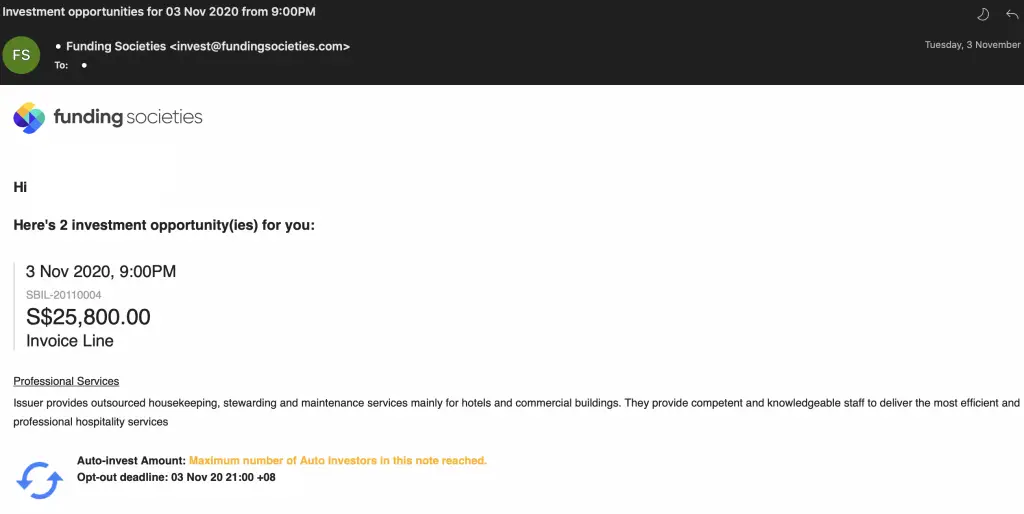

You will need to first deposit funds into your Funding Societies account. From time to time, a SME may apply for a loan and you will be notified.

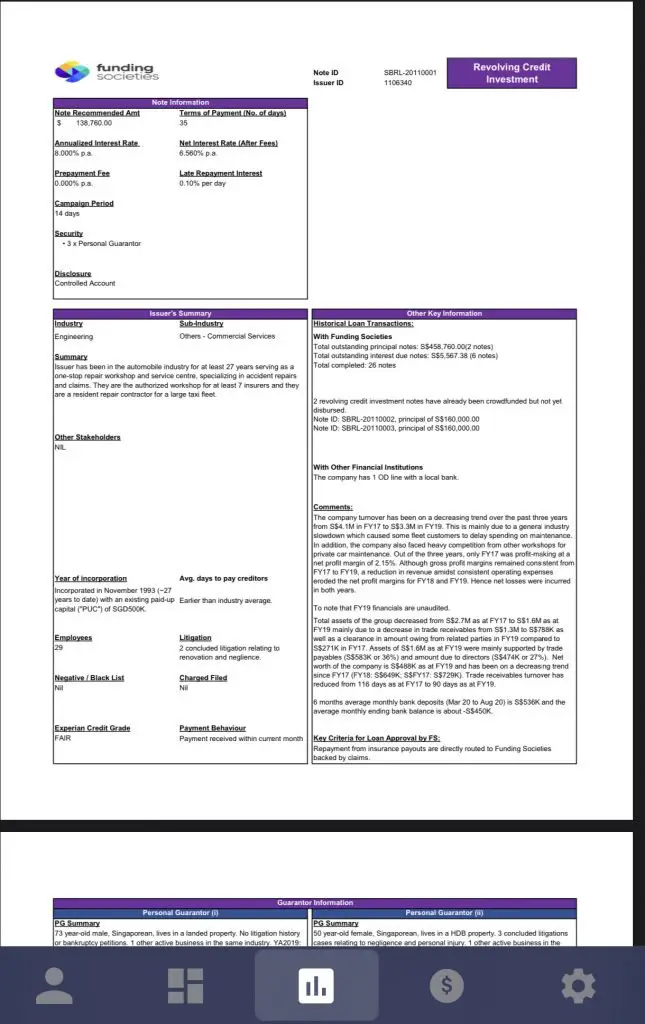

You are able to view the factsheet of the company and the loan.

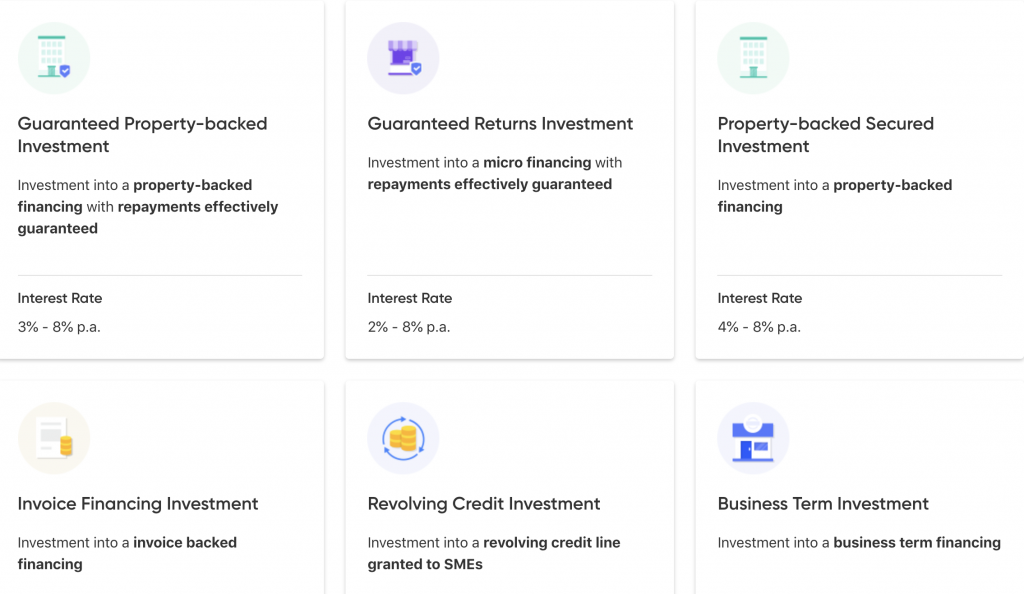

There are 5 different types of loans that you can participate in:

- Guaranteed Property-backed Investment

- Guaranteed Returns Investment

- Property-backed Secured Investment

- Invoice Financing Investment

- Revolving Credit Investment

- Business Term Investment

Here are the projected interest rates that you will earn:

| Type of Investment | Interest Rate |

|---|---|

| Guaranteed Property-backed Investment | 3-8% |

| Guaranteed Returns Investment | 2-8% |

| Property-backed Secured Investment | 4-8% |

| Invoice Financing Investment | 8-18% |

| Revolving Credit Investment | 8-18% |

| Business Term Investment | 8-18% |

Typically, the higher interest rate is to compensate you with a higher risk of that loan. If you are receiving a higher interest rate, it means that there is a higher chance that the loan may default.

As such, you should only invest in SMEs that you’re comfortable with!

You can find out more about the different types of loans from Funding Societies’ YouTube channel.

If you are a business owner that is looking for more ways to obtain credit, you may want to consider InstaREM’s BizPay as well.

StashAway invests your money into a globally diversified portfolio

StashAway is a robo-advisor that invests your money into a globally diversified portfolio. StashAway focuses on asset allocation, using their Economic Regime-based Asset Allocation (ERAA) Framework.

What this means is that StashAway focuses on the asset classes that you are investing in. Some examples include stocks, bonds or commodities like gold. They are less focused on choosing a particular stock or bond that you should invest in.

The portfolio that you have depends on your risk profile

StashAway offers a wide variety of portfolios, which is based on your risk appetite. They have an indicator which is called the StashAway Risk Index.

The StashAway Risk Index ranges from 6.5-36%. This means that there is a 99% probability that you would lose more than 6.5-36% of your original capital each year.

As such the more risk you’re willing to take, the higher the StashAway Risk Index you’ll have. Usually, the higher Risk Index portfolios should perform better.

Here is an example of the 36% StashAway Portfolio.

The riskier the profile, the higher your allocation will be towards stocks.

StashAway invests in US ETFs

StashAway invests your funds into US exchange traded funds (ETFs). They have chosen their ETFs based on the following criteria:

- Credibility of fund manager

- Underlying assets worth at least half a billion USD

- Cost-efficient

- Low tracking error

Different ways of earning returns

Both platforms offer you very different types of investments. As such, you will have different ways of obtaining your returns.

You will earn interest on your loans with Funding Societies

When you participate in a loan with Funding Societies, your interest will be credited to you when the loan is repaid.

Each loan will come with its interest rate per annum.

There are 2 things you’ll need to note about the interest rate:

- The interest rates shown are always per annum

- The interest rate is simple interest and not compounded

So for the above example, you will only earn approximately 0.77% interest on your loaned amount.

35 / 365 * 8% = 0.77%

All of Funding Societies’ loans are up to 1 year. As such, these are very short term investments that you’ll be making.

The interest can either be paid to you in full or in partial amounts. If the SME pays you after the deadline, you may get some late repayment as well.

You may not get to invest in loans all the time

While the interest rates seem attractive, you may not get to loan out your funds all the time. This is because:

- The number of loans available depends on the SMEs

- The loans you wish to invest in may be fully subscribed

As such, there may be times when your cash is lying uninvested in your Funding Societies account.

You will not have to have this worry if you invest with StashAway. This is because your funds will remain invested and continue to reap the returns.

You will earn returns on your investments with StashAway

When you invest in the various portfolios by StashAway, you are investing in ETFs that should increase in value.

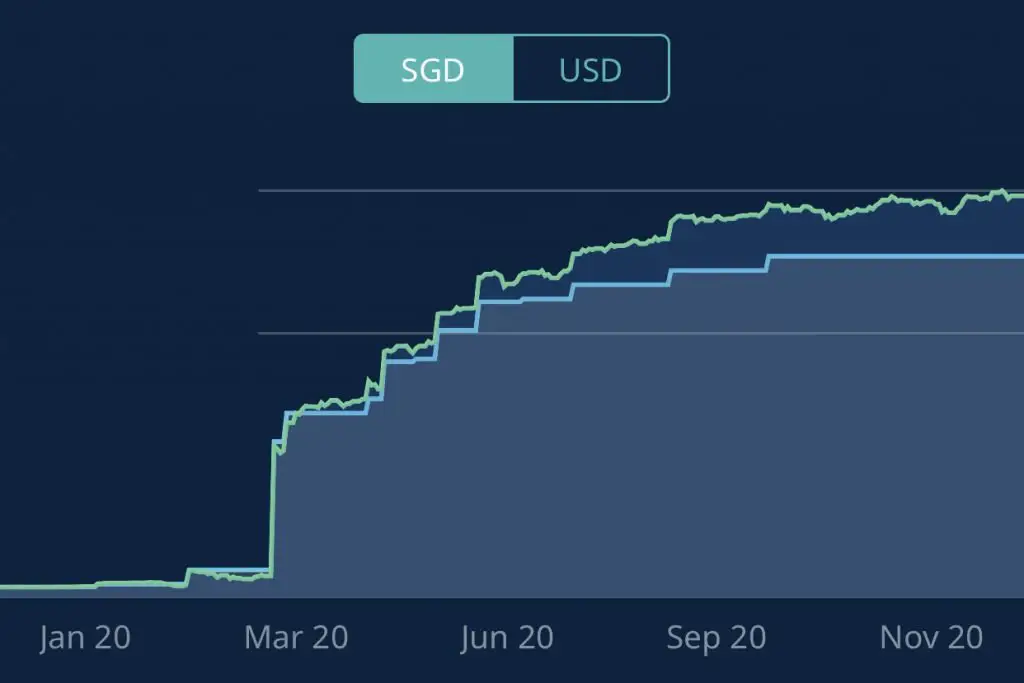

However, these ETFs can be traded on the market. As you can see from the picture above, your portfolio’s value will fluctuate each day.

There may be times when your portfolio may be negative and in the red!

Compared to Funding Societies, investing with StashAway is more long-term. The markets will always go up, but only in the long run.

As such, it is best to leave your money in StashAway for at least 3 years to be able to see some returns!

Minimum amount

Both platforms have a different minimum amount to invest in:

Funding Societies has 2 minimum investment requirements

Here are the minimum amounts that you’ll need to start investing with Funding Societies:

#1 Minimum initial deposit of $100

Funding Societies requires you to make an initial deposit of $100.

When I first signed up for my Funding Societies account in early 2020, the initial deposit was $500. I’m glad that the deposit has now been lowered.

This makes P2P lending more accessible even if you only have a small initial capital!

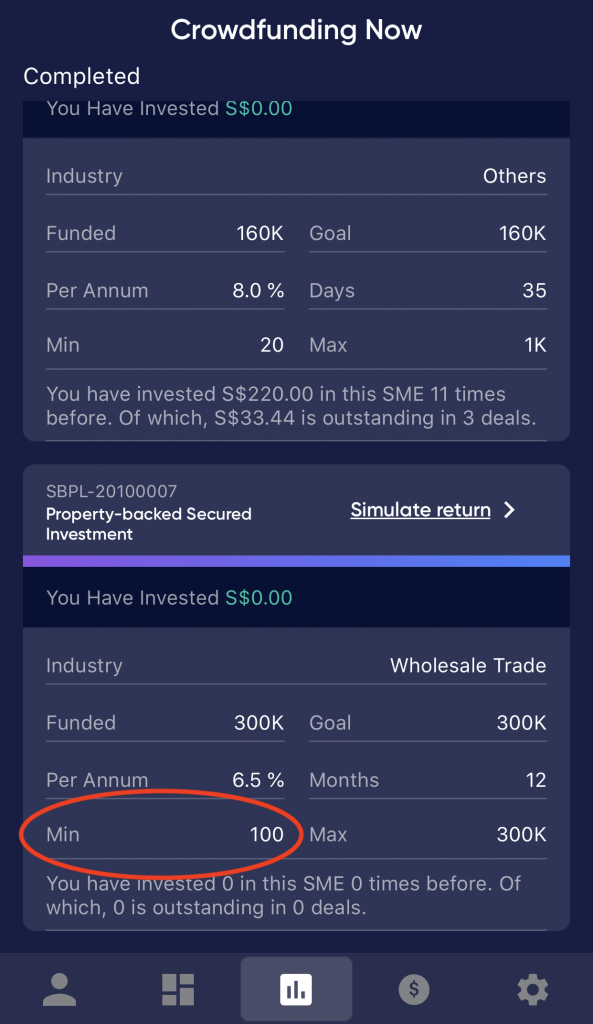

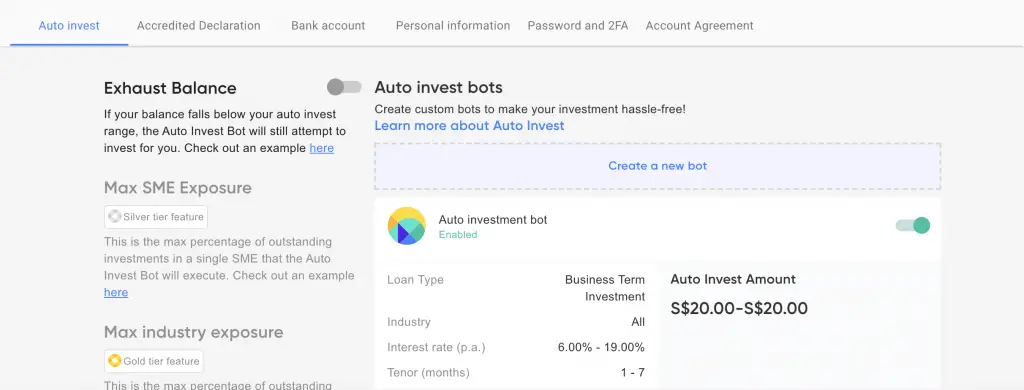

#2 Minimum investment of $20 for each loan

Funding Societies has a minimum investment of $20 for each loan you wish to participate in.

This means that you can start your P2P lending journey with a very small initial amount. Your risks are also reduced as you can spread your investment amount across many loans.

Even if a certain loan defaults, it will not be that painful as you would have at most lost $20.

However, there are some SMEs that require you to invest a larger amount. Usually, these SMEs would require you to invest a minimum of $100.

StashAway has no minimum investment amount

In contrast, StashAway does not have any minimum amount to invest if you are depositing in SGD.

Essentially, you can start investing with just $1! This makes investing with StashAway extremely flexible. However, there will be a minimum deposit if you wish to deposit in USD (minimum $10,000 USD).

Moreover, you are required to maintain a minimum balance of SGD$10,000 if you invest in StashAway’s Income Portfolio.

Fees

The pricing structure for both platforms are slightly different:

Funding Societies charges a 18% fee for each loan

Funding Societies charges you a one-off fee for each loan. You will be charged 18% of the interest that you earn for each loan.

For example, you’ve invested $1000 into a one-month loan that offers 12% p.a.

You are supposed to receive $10 in interest. However, Funding Societies will charge you 18% of the interest you’ve earned.

In the end, you will only receive $8.20.

Funding Societies does not charge you for other things, such as:

- Setting up your account

- Depositing or withdrawing your funds

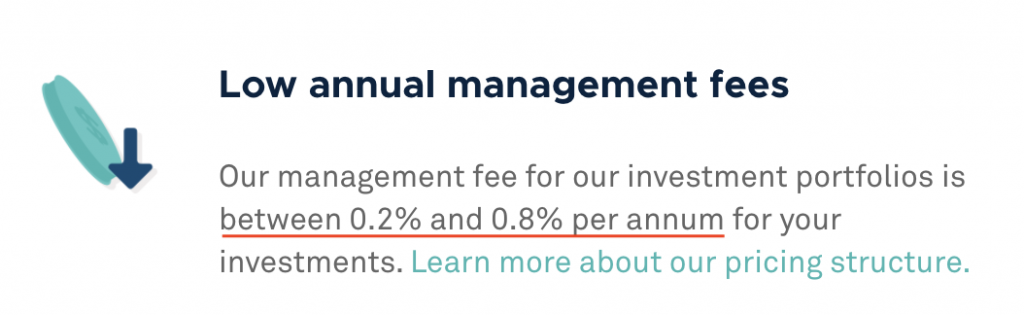

StashAway charges a 0.8% p.a. management fee for your first $25k

StashAway charges you an annual management fee. For your first $25k, you will be charged a 0.8% fee.

This means that you’ll only be charged $20 each year if you’ve invested $25k.

It may seem like a small amount at the start since you’re probably only paying a few dollars each year. However as the amount in your portfolio increases, so does your fees.

Here are the fees that you’ll need to pay, according to StashAway’s pricing structure:

| Total Amount | Management Fee |

|---|---|

| First $25k | 0.80% |

| Next $25k | 0.70% |

| Next $50k | 0.60% |

| Next $150k | 0.50% |

| Next $250k | 0.40% |

| Next $500k | 0.30% |

If you have $1 million invested in StashAway, you will need to pay $3925 in fees each year! As such the fees can be very hefty especially when your portfolio amount increases.

You will need to pay for the expense ratio of the ETFs too

Another type of fee that you’ll need to pay is the expense ratio. This is a fee paid to fund managers for each ETF. The average expense ratio that you’ll need to pay for each portfolio is roughly 0.4%.

This is on top of the management fees that you’ll have to pay. Eventually, this means that you’ll roughly pay around 1.2% in fees each year!

The fees does eat into your returns and it will eventually add up. It is very important for you to consider the amount of fees that you’re paying.

It may be more cost effective to invest with Funding Societies. However due to its high risks, I would not suggest investing all of your funds into P2P lending.

How safe are these platforms?

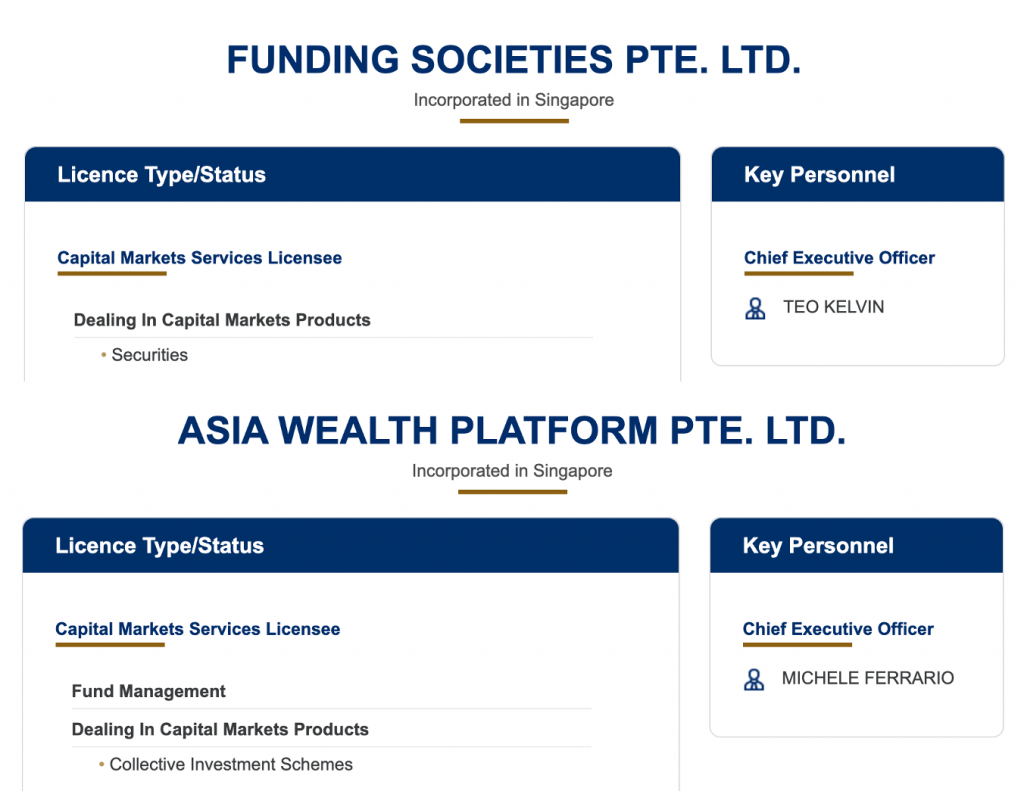

You may be concerned about the safety of your assets when you are using both platforms. However, both firms managed to acquire the Capital Markets Services License from MAS.

This license requires the company to have very strict requirements of separating your money from the company’s funds. In the unfortunate event that either firm closes down, your assets are still safe and the company can’t touch them.

Here are the different custodians that the 2 companies use:

| Funding Societies | StashAway |

|---|---|

| Vistra | Cash: DBS Investments: Saxo or Lion Global |

Funding Societies has a low default rate (1.45%)

Funding Societies has a low default rate of 1.45%. This means that out of the 3.275 million loans that have been issued so far, around 47.5k loans have defaulted.

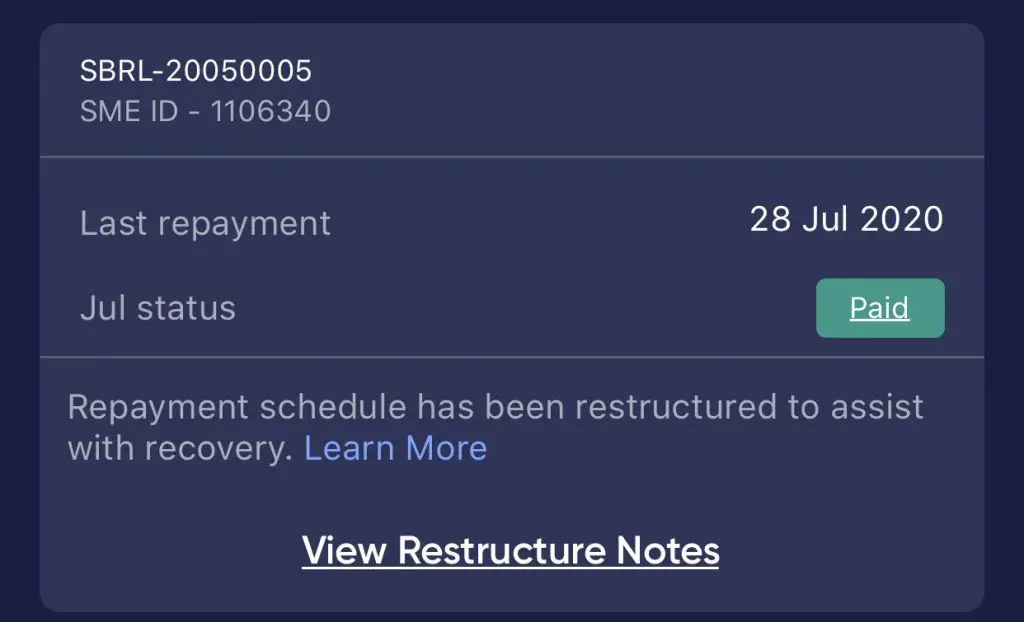

Funding Societies has some measures to reduce the chance of a company defaulting. They will try to work with the SME to pay the loan back to you with interest.

For example, they may help to restructure the loan to ensure that the SME can return you your money.

I would think that the default rate is rather low. Moreover out of the 85 loans that I have so far, none of them had defaulted.

P2P lending does have its risks, but I believe that Funding Societies is trying its best to reduce these risks.

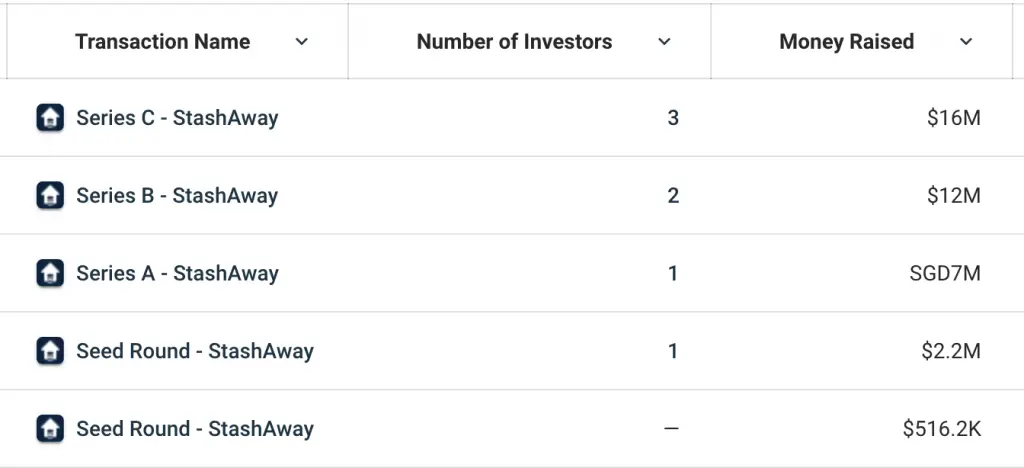

StashAway has received considerable funding

StashAway has managed to raise a lot of capital during its Series A, B and C rounds.

Moreover, they have expanded from Singapore to Malaysia and Dubai. It is safe to say that StashAway has a rather solid business model.

If you have any concerns about StashAway closing down like Smartly, this should help to put your mind at ease.

Verdict

Here’s a head-to-head comparison of these 2 platforms:

| Funding Societies | StashAway | |

|---|---|---|

| Type of Investment | P2P Lending | ETFs that invest in stocks, bonds and commodities |

| How to Earn Returns | Simple Interest | Increase in value of underlying assets |

| Minimum investment amount | $100 initial deposit $20 minimum investment for each loan | No minimum sum |

| Fees | 18% on any interest you earn | 0.4-0.8% management fee (depending on your investment amount) |

| Safety of platforms | CMS License Low default rate (1.45%) | CMS License Considerable funding Expanded to Malaysia and Dubai |

So which platform should you be choosing?

Choose StashAway for long-term investing

StashAway offers you a globally diversified portfolio. The returns that you receive will be pretty steady in the long run. Moreover, there is no minimum sum to start investing with StashAway. This makes it really accessible if you have a small capital!

You are recommended to leave your funds with StashAway for at least 3 years. This will give it enough time for your portfolio to provide good returns to you.

However, you will need to consider the management fees that you’ll need to pay. It may seem little at first. However once your capital in StashAway builds up, the management fees can be quite hefty.

You may eventually want to consider DIY investing via low-cost brokers like Tiger Brokers.

Choose Funding Societies for riskier short-term investing

The loans that are available on Funding Societies have a maximum duration of 1 year. As such, these investments that you make are very short term.

The interest rate that you earn can be higher than your investments’ returns. However, this means that such investments are very risky. You can even lose your entire capital!

With the shorter term loans in Funding Societies, it requires you to be more active in selecting your loans. It is possible for you to choose the Auto Invest function.

However, there may be times when there are not enough loans. As such, some of your capital may remain uninvested!

I believe that a small part of your portfolio can be allocated towards P2P lending. However, I do not think that it may be wise for your entire investment portfolio to be allocated towards P2P.

Conclusion

Both platforms offer very different investment opportunities for you. Some factors you may want to consider when deciding on the platform include:

- The riskiness of the investment

- The returns you wish to receive

- The amount you wish to deposit into the platform

👉🏻 Referral Deals

If you are interested in signing up for any of the products mentioned above, you can check them out below!

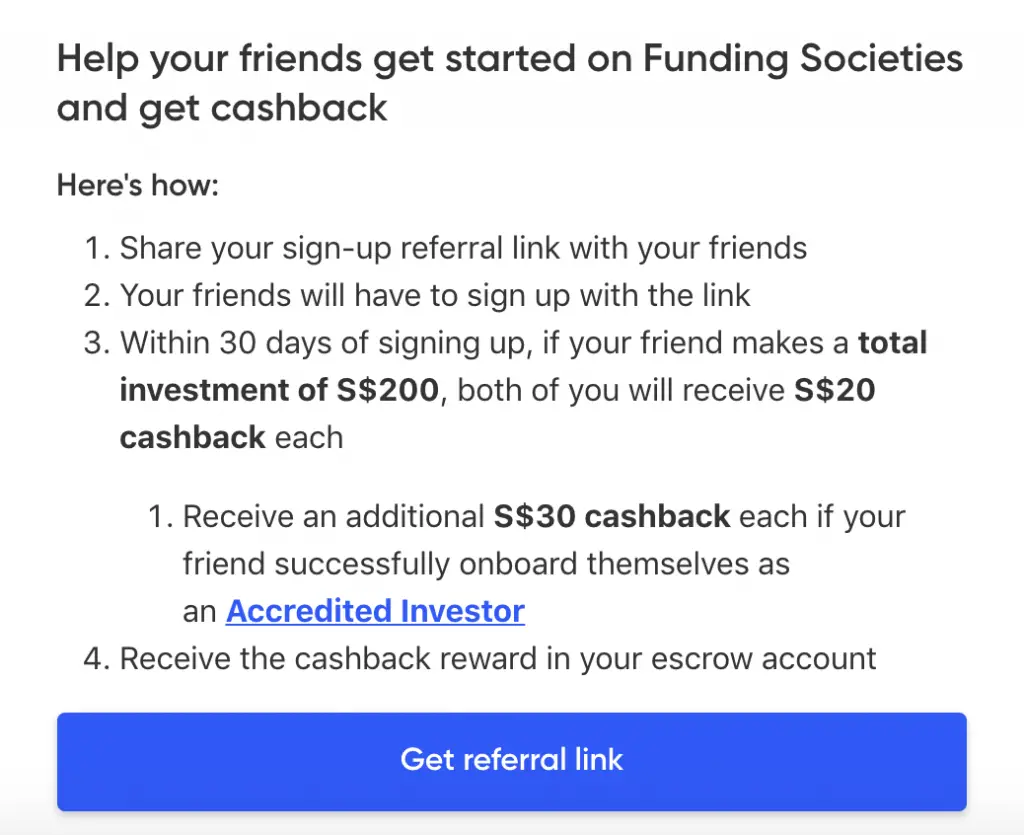

Funding Societies Referral (Get $20 cashback)

If you would like to sign up for Funding Societies, you can sign up using my referral link.

Here’s what you’ll need to do to receive the $20 cashback:

- Sign up for a Funding Societies account via my referral link

- Make a total investment of $200 within 30 days of signing up

StashAway Referral (Up to $40,000 SGD managed for free for 6 months)

If you are interested in signing up for StashAway, you can use my referral link to sign up.

Here’s what you’ll need to do:

- Sign up for a StashAway account

- Make a deposit of ≥ $10k within 4 weeks of signing up

- Receive a fee waiver for 6 months (up to $40k)

You can find out more about this program on SingSaver.

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?