Last updated on August 14th, 2021

You’ve decided to invest in the SGX. You may just want to buy 1 share of a certain stock. However, you realise that you can’t actually do that!

This is because SGX has a minimum lot size for all of its listings.

So what are the minimum lot sizes that you can purchase a stock?

Contents

- 1 What is the minimum lot size for the SGX?

- 2 The minimum lot size for stocks on the SGX is 100

- 3 How much is 1 lot of shares in Singapore?

- 4 How much is 1 lot of Singtel shares?

- 5 The minimum lot size for ETFs can range from 5-100

- 6 Fixed income instruments can be traded in lot sizes between 10-1,000

- 7 American Depository Receipts can be traded in lot sizes of 10

- 8 You can trade odd lots on the SGX via the Unit Share Market

- 9 You will have to consider the trading commissions you’ll incur

- 10 Can I buy 1 share in Singapore?

- 11 Conclusion

- 12 👉🏻 Referral Deals

What is the minimum lot size for the SGX?

The standard lot size for Stocks, REITS and Business Trusts that are listed on the SGX is 100. This means you’ll have to purchase these securities in multiples of 100 for each trade you make.

However, the lot size for other products listed on the SGX may vary. For example, the American Depository Receipts (ADRs) are listed in lot sizes of 10 units.

Here is a table that shows the different lot sizes for other products on the SGX:

| Product | Board Lot Size |

|---|---|

| Exchange Traded Funds (ETFs) | 5 / 10 / 100 |

| American Depository Receipts (ADRs) | 10 |

| Fixed Income Instruments | 10 / 100 / 1,000 |

The minimum number of units that you can purchase depends on the product you’re purchasing.

Here is an in-depth explanation of the lot sizes found on the SGX:

The minimum lot size for stocks on the SGX is 100

For all Stocks, REITs or Business Trusts listed on the SGX, the minimum board lot size is 100. This is irregardless of the unit price of the stock.

There are around 705 stocks that are listed on the SGX.

The price of stocks listed on the SGX can just cost a few cents

There are a few stocks listed on the SGX that only cost a few cents. These include:

| Stock Name | Stock Ticker | Estimated Unit Price |

|---|---|---|

| Mermaid Maritime | DU4 | 0.071 |

| CFM | 5EB | 0.042 |

| No Signboard | 1G6 | 0.035 |

| Tritech | 5G9 | 0.017 |

| Citicode | 5FH | 0.001 |

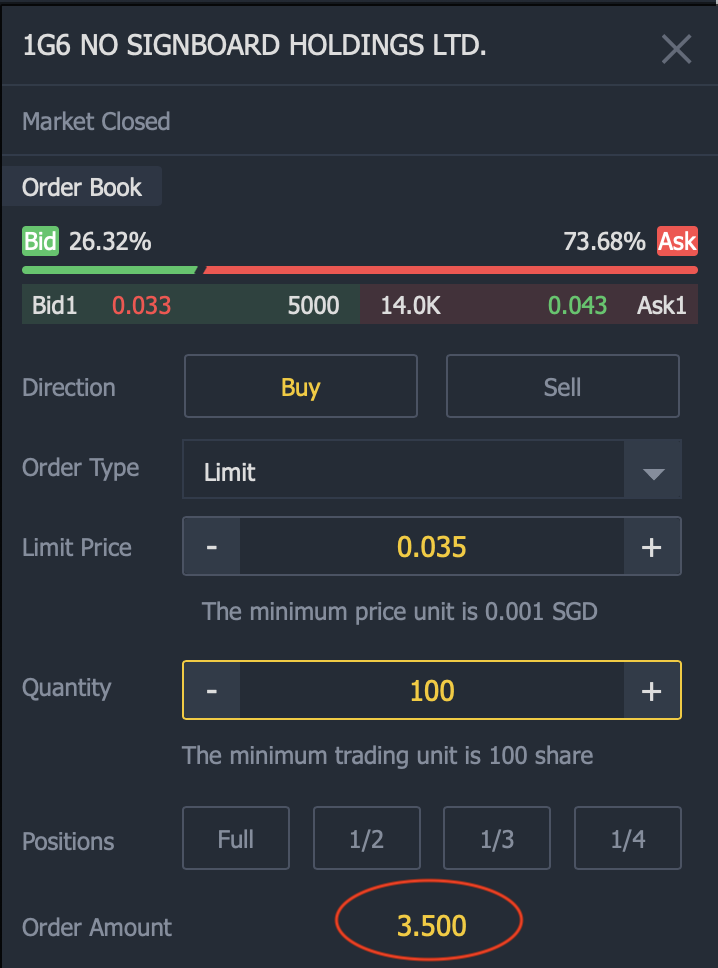

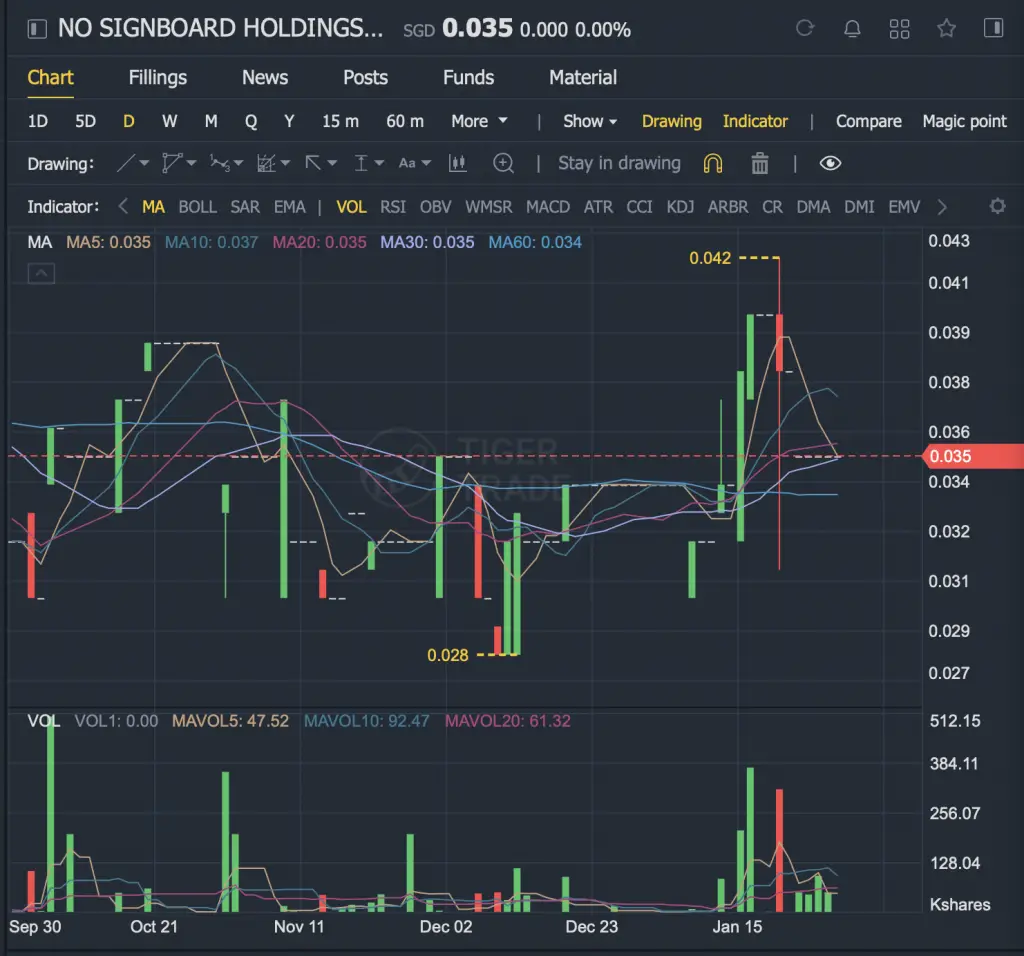

Investing in No Signboard Holdings (1G6) may seem very attractive. The minimum amount that you need to purchase the stock is just $3.50!

However, you’ll need to consider the trading volume of the stock as well. Even though you place a buy bid, you can’t buy the stock if no one is selling it!

Here is the volume chart for 1G6.

You can see that the trading volume is very irregular. There are some days when the stock has a high volume of trading (like in late September 2020).

However, there are days when the trading volume is only a few thousands.

As such, this is something else you’ll need to consider when investing in stocks with low unit prices!

You can view my guide on how to read the volume bars to understand trading volume better.

Some stocks on the SGX can be much more expensive

On the other hand, there can be stocks that are very expensive as well. Here are the unit prices for some of the more expensive stocks on the SGX:

| Stock Name | Stock Ticker | Unit Price |

|---|---|---|

| JMH USD | J36 | USD$57 |

| JSH USD | J37 | USD$25 |

| DBS | D05 | SGD$25 |

| UOB | U11 | SGD$23 |

| Jardine C&C | C07 | SGD$21 |

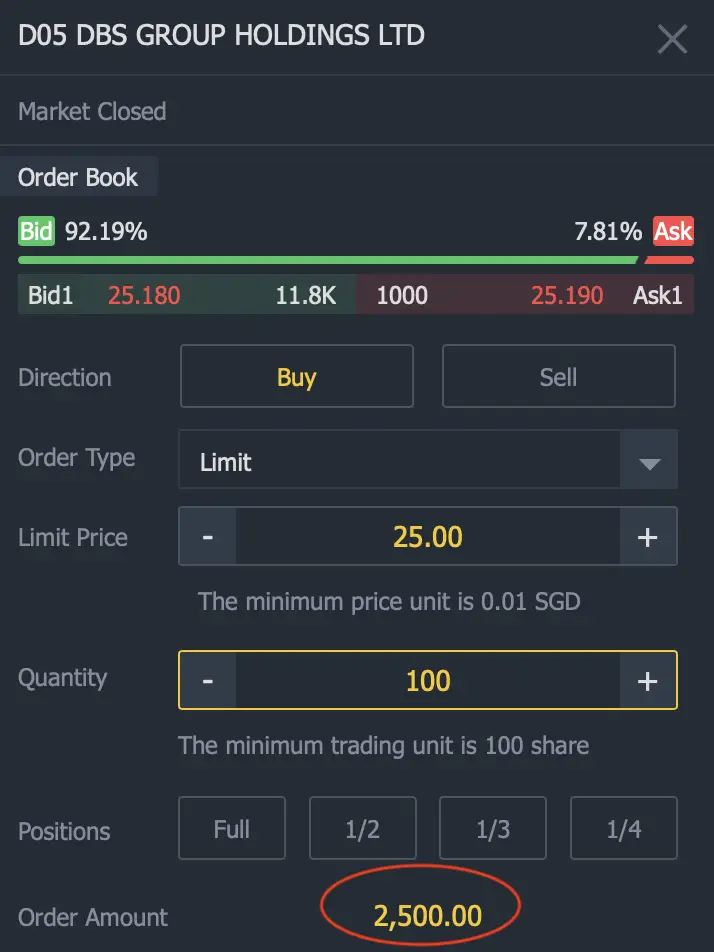

If you want to buy 1 lot size for one of these stocks, the minimum initial investment can be quite costly.

For example, 1 lot of DBS will cost around $2.5k!

If you only have a small initial sum to invest, you can consider regular savings plans like OCBC BCIP or POEMS Shares Builder Plan.

These savings plans allow you to buy odd lots of certain stocks listed on the SGX. This makes investing in these stocks with high unit prices much more accessible!

The minimum lot size has been reduced from 1,000 to 100

The minimum lot size for SGX actually used to be 1,000. However, it has since been reduced to 100 in 2015.

This was a great move as it makes investing much more accessible for the retail investor. The minimum amount you need to invest has been decreased by 10 times!

Moreover, the reduction of the board lot size was shown to increase the trading activity in the SGX.

This is good news as lower lot sizes also give you greater flexibility. In the past, you could only invest in multiples of 1,000 units.

Now, you can do so in just multiples of 100 units!

The minimum lot size for shares in Singapore is 100. This applies for any shares listed on the SGX, including SIA or DBS.

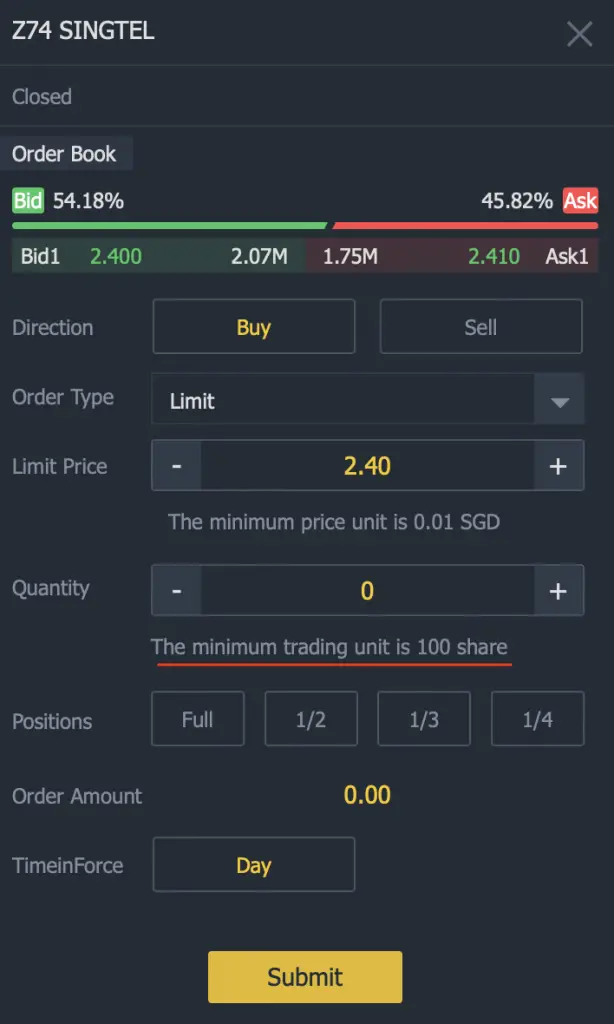

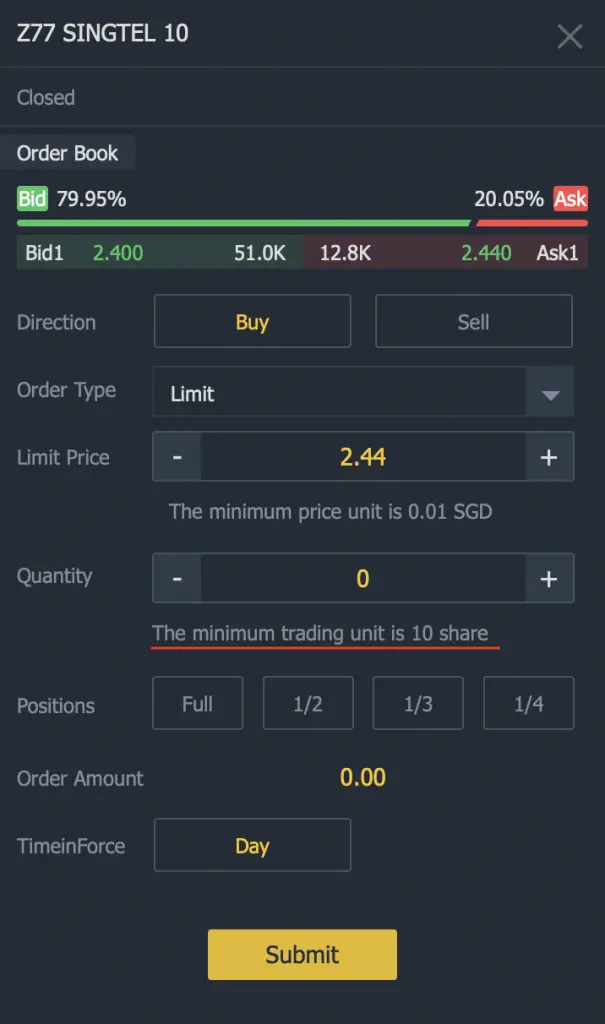

1 lot of Singtel shares can either be 10 or 100. This depends on which stock ticker (Z77 or Z74) you choose to purchase on the SGX.

If you wish to buy Singtel shares, you may buy the standard stock (Z74) which require you to purchase in multiples of 100 shares.

However, Singtel actually has a ‘Singtel 10’ stock (Z77) which allows you to buy Singtel shares in lots of 10 units!

This makes Singtel shares more accessible if you do not have a large amount of money! You can view my comparison between Singtel and Singtel 10 to see which stock is better for you.

The minimum lot size for ETFs can range from 5-100

There are a total of 43 ETFs that are listed on the SGX. However, the minimum lot size for each ETF may vary between 5-100 units.

Here are some of the ETFs sorted based on their minimum lot size:

| Minimum Lot Size | ETF(s) |

|---|---|

| 5 | SPDR Gold ETF (O87) |

| 10 | STI ETF (ES3) Lion-OCBC Hang Seng Tech ETF (HST) Nikko AM STI ETF (G3B) Nikko AM-STC Asia REIT ETF (CFA) ICBC CSOP CGB ETF (CYC) Nikko AM ABF SG Bond ETF (A35) Nikko AM SGD IGBond ETF (MBH) SPDR S&P 500 ETF Trust (S27) |

| 100 | iShares Barclays USD Asia High Yield Bond ETF (O9P) Lion-Phillip S-REIT ETF (CLR) Phillip SING Income ETF (OVQ) |

Based on this list, it seems that most ETFs have a minimum lot size of 10.

There also does not seem to be a correlation between the lot size and the unit price.

For example, CYC costs around $14 and has a minimum lot size of 10. Most of the other stocks with a minimum lot size of 10 have a unit price of around $1.

Meanwhile, OVQ has a unit price of around $1 as well, but the minimum lot size is 100!

As such, you may want to find out the minimum lot size of the ETF first before you invest in it.

Fixed income instruments can be traded in lot sizes between 10-1,000

SGX also lists fixed income instruments on their exchange.

The lot size of each bond can range from 10 units all the way to 1,000 units.

There are many bonds that are listed on the SGX. However, you can’t get access to them via most brokers.

One platform that allows you to trade bonds is FSMOne.

American Depository Receipts can be traded in lot sizes of 10

For American Depositary Receipts (ADRs), there is a fixed lot size of 10 units.

ADRs are a US security which represents the ownership of shares in a foreign company.

These ADRs can be traded freely just like any other stock.

MoneySense

There are 16 ADRs that are found on the SGX. Most of them come from Chinese companies, such as Baidu and HSBC.

SGX only allows you to trade in multiples of between 5 to 1,000 units. However, there may be times when you receive an odd lot!

An odd lot is an order amount for a security that is less than the normal unit of trading for that particular asset.

Investopedia

One of the most common cases where you’ll own odd lots is when a company issues a share dividend.

Instead of issuing you a dividend in cash, they will issue you additional shares of the company.

SGX offers a Unit Share Market option that allows you to trade these odd lots. This market allows you to trade any odd lots that are less than the usual lot size on the SGX.

Some of the brokers that provide this feature include:

You can find out more about selling odd lot shares from my step-by-step guide.

You will have to consider the trading commissions you’ll incur

Some stocks may seem very cheap as you only need a small sum to invest.

For example, the Lion-OCBC Hang Seng Tech ETF costs around $1. With its minimum lot size of 10, all you need is around $10 to be invested in this ETF!

However, you will need to consider the trading commissions you’ll incur too. This commission is charged by the brokerage platform that you use.

Some of these brokerages charge you a minimum fee for each trade that you make. Here are some of the fees that they will charge (based on the cash upfront rates):

| Broker | Commission | Minimum (SGD) |

|---|---|---|

| CGS-CIMB | 0.18% | $18 |

| OCBC Securities | 0.18%-0.275% | $25 |

| FSMOne | 0.08% | $10 |

| DBS Vickers | 0.18%-0.28% | $25 |

| Lim and Tan | 0.18%-0.28% | $25 |

| KGI Securities | 0.18%-0.275% | $25 |

| MayBank Kim Eng | 0.18%-0.275% | $25 |

| POEMS | 0.18%-0.28% | $25 |

| Utrade | 0.18% | $18 |

| Tiger Brokers | 0.08% | None (Until 31 Dec 2021) |

| moomoo (powered by FUTU SG) | 0.03% | $2.49 |

Most of the brokers in Singapore charge a minimum of between $18-$25. If you just invest in 10 units of the Hang Seng Tech ETF, your investment amount is less than the commissions you’re paying!

As such, it’s important to consider the minimum fees charged by each broker before you invest with them.

You may want to consider investing in Tiger Brokers which does not charge a minimum for SGX trades until 31 Dec 2021.

If you are investing in stocks in Singapore, the minimum number of shares you can buy is 100, as this is the minimum lot size on the SGX.

Conclusion

The minimum lot size for products listed on the SGX can range from anywhere from 5 to 1,000. This depends on which product you wish to purchase.

However, most products (especially stocks) will have a minimum lot size of 100.

The reduction of the board lot size has been a welcome one for most investors. This is because we are now able to buy stocks that have a higher unit price with a lower initial sum.

However, the minimum lot size is still much larger compared to the US markets or the London Stock Exchange. Both of these exchanges only require you to purchase a minimum of 1 unit!

As such, there is a long way more to go before the SGX can be truly accessible for most retail investors.

👉🏻 Referral Deals

If you are interested in signing up for any of the products mentioned above, you can check them out below!

moomoo Referral ($200 Stock Cash Coupon Bundle, AAPL Shares and Commission Free Trades for 180 Days)

If you are interested in signing up for a moomoo (powered by FUTU SG) account, you can use my referral link.

Here are some of the rewards you can receive (From 2 Oct 2021):

- Commission-free trading for 180 days (SGX, HKEX and US markets)

- $200 or $2,000 Stock Cash Coupon Bundle (First Deposit Reward)

- Apple share and iPhone 13 (First Transfer-In Rewards)

To receive these bonuses, here are the steps you’ll need to do:

#1 Sign up for a Moomoo account

You’ll need to use my referral link to sign up for a moomoo (powered by FUTU SG) account.

Once you have successfully opened a FUTU SG Securities Account, you will receive:

- 180 days unlimited commission-free trading for the US, HK & SG stock market (to be activated within 90 days)

- Lvl 2 US stock Market Data

- Lvl 1 SG stock Market Data

- Lvl 1 China A-Shares Market Data

First Deposit Reward

You will be able to receive a Stock Cash Coupon Bundle, depending on the amount that you deposit for your very first deposit:

| S$ 2,700 – S$ 199,999 | $200 Stock Cash Coupon Bundle |

| ≥ S$ 200,000 | $2,000 Stock Cash Coupon Bundle |

First Transfer-In Reward (US & HK stocks only)

If you transfer your US or HK stocks from another brokerage account to moomoo, you will be able to receive some rewards:

| SGD 50,000 – SGD 99,999 | 1 Free Apple (AAPL) share |

| SGD 100,000 – SGD 199,999 | 2 Free Apple (AAPL) shares |

| ≥ SGD 200,000** | 1 iPhone 13 (256GB; first 50 sets) OR 3 Free Apple (AAPL) shares |

To learn more, you can view more about this promotion on the FUTU SG website.

Tiger Brokers Referral (Free AAPL Share and 60 Commission-Free Trades)

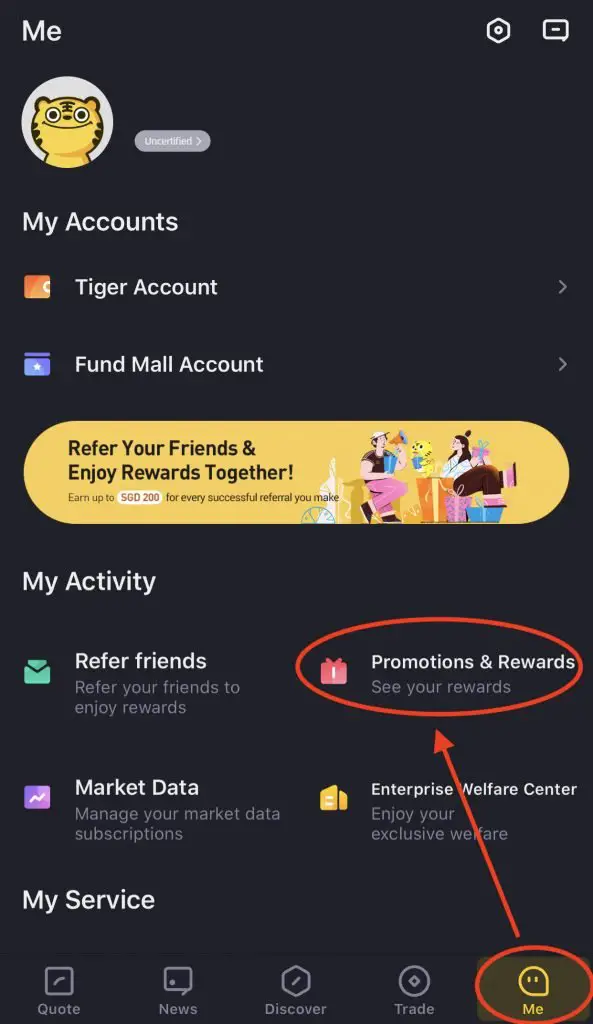

If you sign up for a Tiger Brokers account using my referral link, you will be eligible for some rewards. You can view and claim your rewards by going to ‘Me → Promotions & Rewards‘.

Here are 3 bonuses that you can receive:

#1 Registration Reward

When you register for a Tiger Brokers Account, you will receive 500 Tiger Coins.

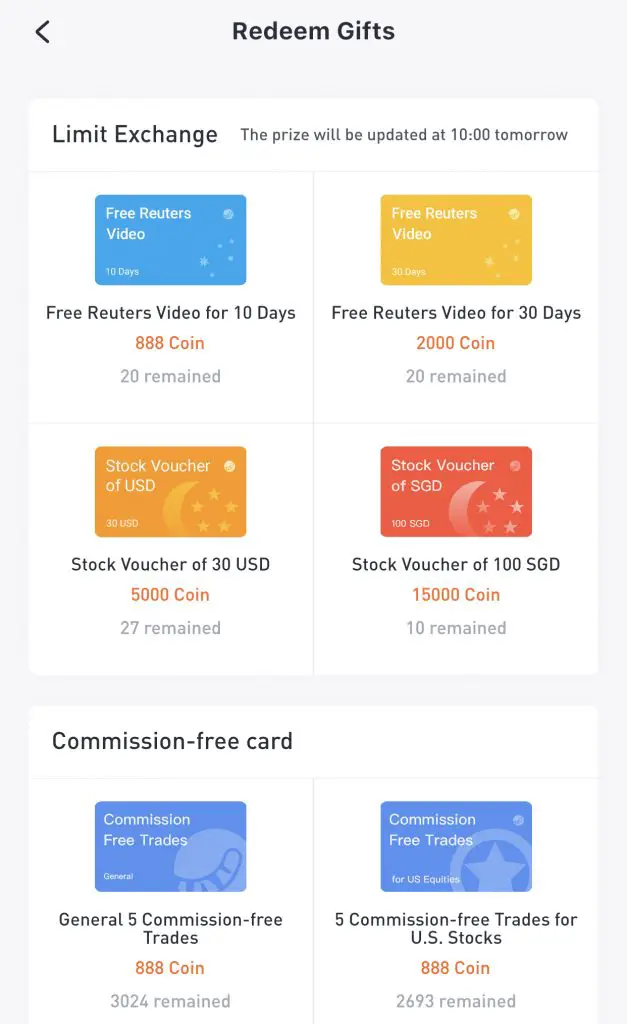

These Tiger Coins can be used to redeem a variety of rewards, such as:

- Stock vouchers

- Commission-free trades

- Reuters videos

#2 Account Opening Reward

After successfully opening your account, you will receive 60 commission-free trades that you need to use within 180 days.

These commission free trades can be used for:

- US stocks

- HK stocks

- Singapore stocks

- Australia stocks

On top of that, you will receive 5 commission-free trades for futures within 30 days.

You will still need to pay the commission first. The commission should be refunded to you on the next working day.

#3 Funding Reward

If you fund at least $2,000 SGD into your Tiger Brokers account for your very first deposit, you will receive a free Apple (AAPL) share.

The shares will be added into your account within 10 working days.

On top of that, you will receive a stock voucher (SGD5) for SGX stocks only.

You can view the terms and conditions of this promotion on Tiger Brokers’ website.

POEMS Referral (Free US trades for 1 month)

If you are interested in signing up for a POEMS account, you can use my referral link. You will be able to receive free US trades for one month after you deposit SGD $3,000 into POEMS!

Here’s what you need to do:

- Sign up for a POEMS Cash Plus Account

- Deposit ≥ SGD $3,000 into your Cash Plus Account within 1 week of opening your account

- Enjoy 1 month worth of free US trades

FSMOne Referral

If you would like to create an FSMOne account, you can enter my account number ‘P0381515‘ into the referral code field.

I will receive 1,000 reward points for referring you. Although you do not receive any benefits, I would appreciate your support!

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?