Last updated on June 6th, 2021

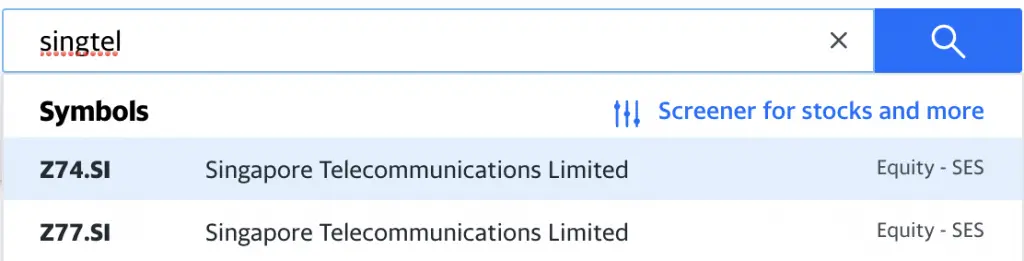

You’ve decided to buy a Singtel stock. However when you search it up on Yahoo Finance, you realise that there are 2 different Singtel stocks!

Is there any reason why there are 2 shares of the same kind?

Contents

The difference between Singtel (Z74) and Singtel 10 (Z77)

The minimum lot size to buy Singtel (Z74) is 100, while the lot size for Singtel 10 (Z77) is in multiples of 10. Besides the lot size, they mainly differ in terms of trading volume and the closing price.

Here’s what you need to know about these 2 stocks in detail:

Both Z74 and Z77 are Singtel shares. When you buy either one of these stocks, you are still buying into Singtel as a company!

However, they mainly differ in their lot sizes.

Minimum lot size

On the SGX, the minimum lot size is 100 for any stock, REIT or business trust.

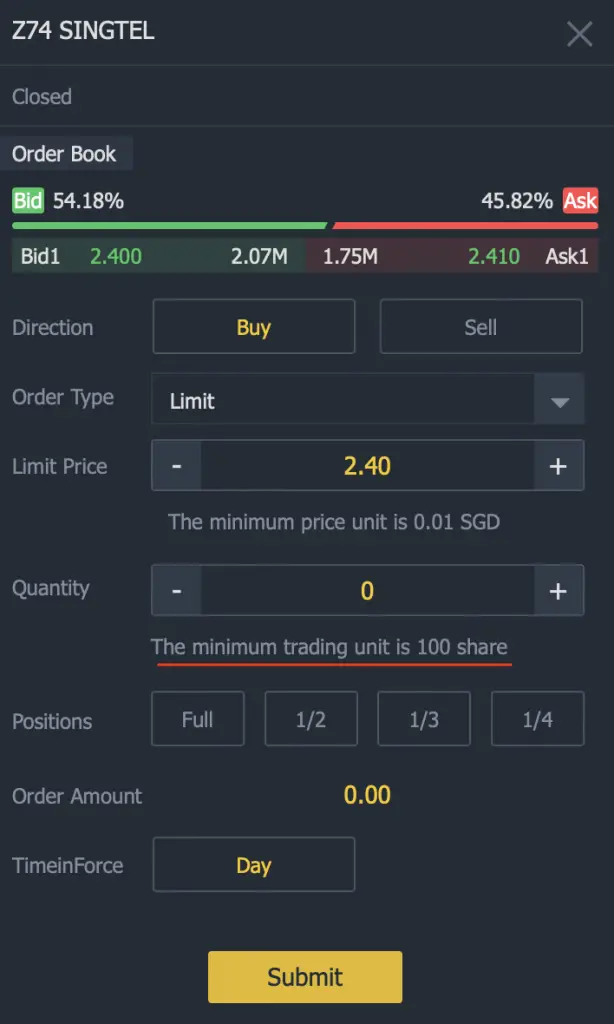

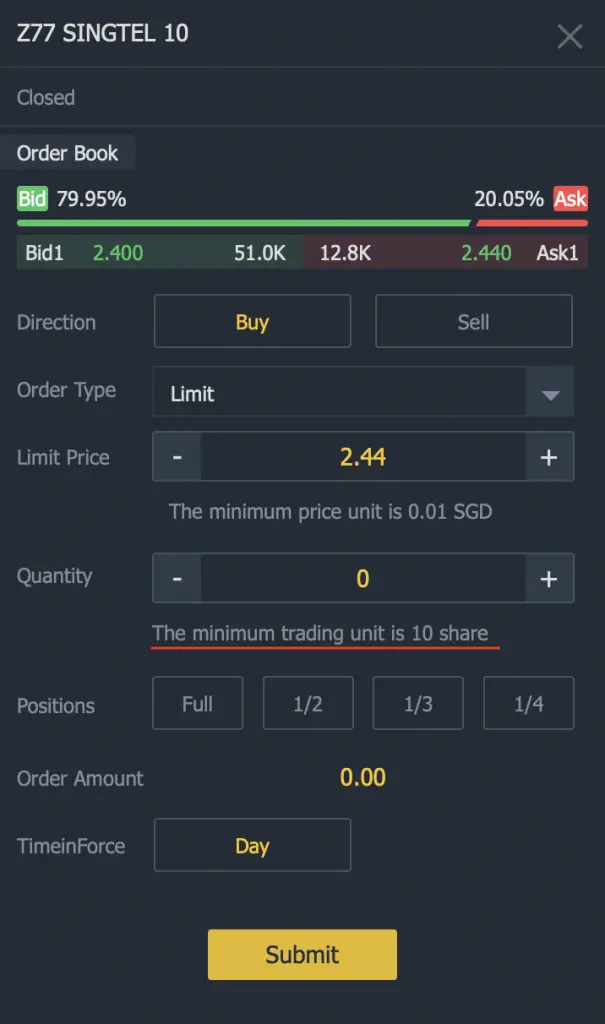

For the Singtel stock (Z74), it is the same as well. You can only buy Z74 in multiples of 100.

You can view the minimum number of units you can trade on trading apps like Tiger Brokers.

Meanwhile, the minimum lot size for Singtel 10 (Z77) is 10!

One reason why they are listed in 2 separate stocks is due to the lot size requirement. This is in contrast to other exchanges like the NYSE or the LSE where the minimum lot size is 1!

This makes it a bit more flexible when you want to invest in Singtel shares. Let’s take the price of a Singtel share to be $2.40.

If you buy Z74, you can only buy Singtel shares in multiples of $240. In contrast, you can buy Z77 in multiples of $24!

When you have a smaller sum to invest, Z77 may be a better choice for you!

Some brokerages may charge a minimum commission

Buying Singtel 10 seems cheap since you only need $24! However, most brokerage firms have a minimum commission that you’ll need to pay for each trade.

For example, OCBC Securities charges a minimum commission of $25. The commissions you pay may be even more expensive than your trade value!

As such, you will have to consider if your investment amount is worth the fees that you pay!

You may want to consider trading with Tiger Brokers, which does not charge a minimum commission until 31 April 2021!

Trading volume

Even though both stocks give you shares of the same company, they are traded under separate tickers.

As such, these stocks may have different liquidity! One of the ways liquidity is measured is by using the trading volume of the stock.

The average trading volume for both stocks are really different:

| Z74 | Z77 | |

|---|---|---|

| Average Trading Volume | 36 million | 81,000 |

The trading volume for Z74 is more than 400x greater than that of Z77!

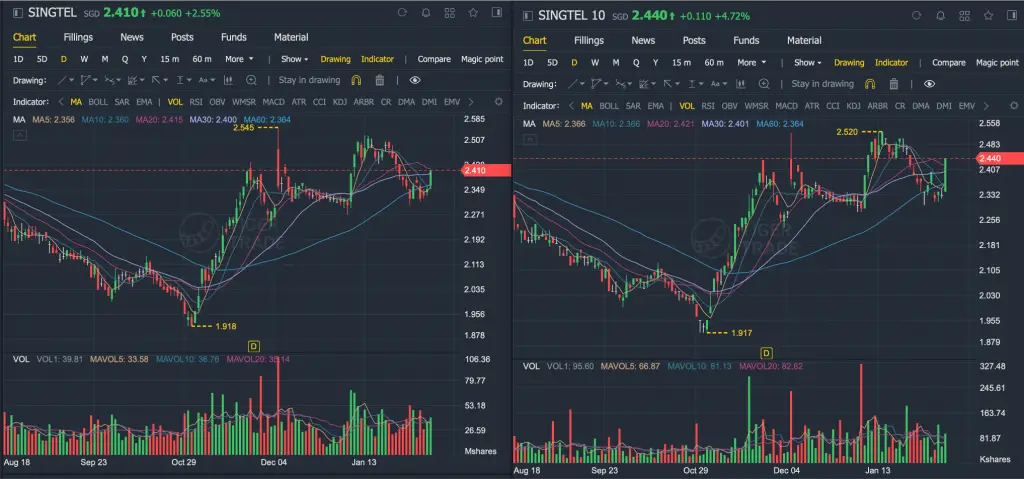

Judging from the volume bars, Z74 has a more stable frequency of trading throughout the day.

Due to the much lower liquidity, you may have problems buying or selling Z77 at your intended price. This is because the demand for the Z77 stock pales in comparison to Z74!

Closing price

Since both stocks are traded separately, they may have different closing prices as well.

This is because they are treated as 2 different stocks, even though they are shares of the same company!

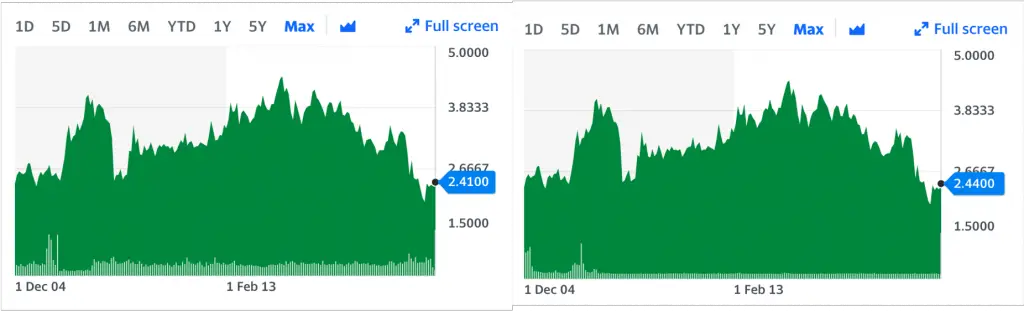

Due to the trading volume and the bid and ask prices, the closing prices of Z74 and Z77 differ slightly.

However, both stocks have a similar trend in their price over time.

The price of Z74 is on the left, while that of Z77 is on the right. If I did not tell you which was which, you may not have been able to tell the difference!

The way both stock prices move is according to the market forces. It is interesting to see that both stocks have a very similar trend!

Dividends received

When Singtel issues a dividend, it is usually announced as the amount of dividend per share.

Since both Z74 and Z77 are Singtel shares, you will receive the same amount of dividend per share.

The only difference is the amount of shares you own. Each time you buy Z74, you will get 100 shares. Meanwhile, you will buy 10 shares for each transaction you make with Z77.

In the end, you will still receive the same dividend. However, the dividend yield may be slightly different since the closing prices are slightly different!

Appearance in CDP account

Both Z74 and Z77 just represent different lot sizes for the same company (Singtel). If you trade using a CDP account, your Singtel shares will all be consolidated together.

They will reflect as Singtel under your CDP statement, so it does not matter which stock you buy!

If you have Singtel shares in multiples in 10 but can’t make them to multiples of 100, you’ll need to sell them via Z77. If you can make them into multiples of 100, you can sell your Singtel shares using Z74!

However, if you receive any shares as part of a scrip dividend, you may need to sell them in the Odd Lot Market instead.

Conclusion

The Singtel 10 (Z77) stock makes investing in Singtel slightly more accessible for you. This is because the minimum lot size is 10, compared to the lot size of 100 for Z74.

However, the trading volume for Z77 is much lower. You may not be able to transact your Singtel shares at your intended price.

You’ll also need to consider the commissions that you’ll incur for each trade. Even though the number of units is less for Z77, the minimum commissions for some brokers will still be the same!

As such, you’ll need to consider if trading smaller lots of Singtel shares is worth the fees!

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?