Last updated on June 6th, 2021

Investing is never easy, especially if you are young and don’t know where to start. Moreover, you may want to perform trading instead of investing in regular savings plans like the OCBC BCIP or Invest Saver.

Wouldn’t it be great if you could get some advice and guidance to get you started?

Here’s how OCBC’s Young Investor Programme (YIP) can kickstart your investment journey:

Contents

What is the Young Investor Programme?

OCBC’s Young Investor Programme is a 2-year programme that teaches you the basics of trading. You will receive a guided approach to help you get started on your investment journey.

Who is eligible for the Young Investor Programme?

To be eligible for this programme, you will just need to be between 18-29 years old.

Moreover, you need to be a new customer at OCBC Securities. You will only be eligible if you have not opened a trading account with OCBC Securities before.

How can I apply for this programme?

There are 3 ways that you can apply for the Young Investor Programme:

#1 Apply at a FRANK store

You can choose to apply for this programme at any FRANK store.

During this COVID-19 period, only the Orchard Gateway store is open.

The other branches at NUS, NTU and SMU have been temporarily closed.

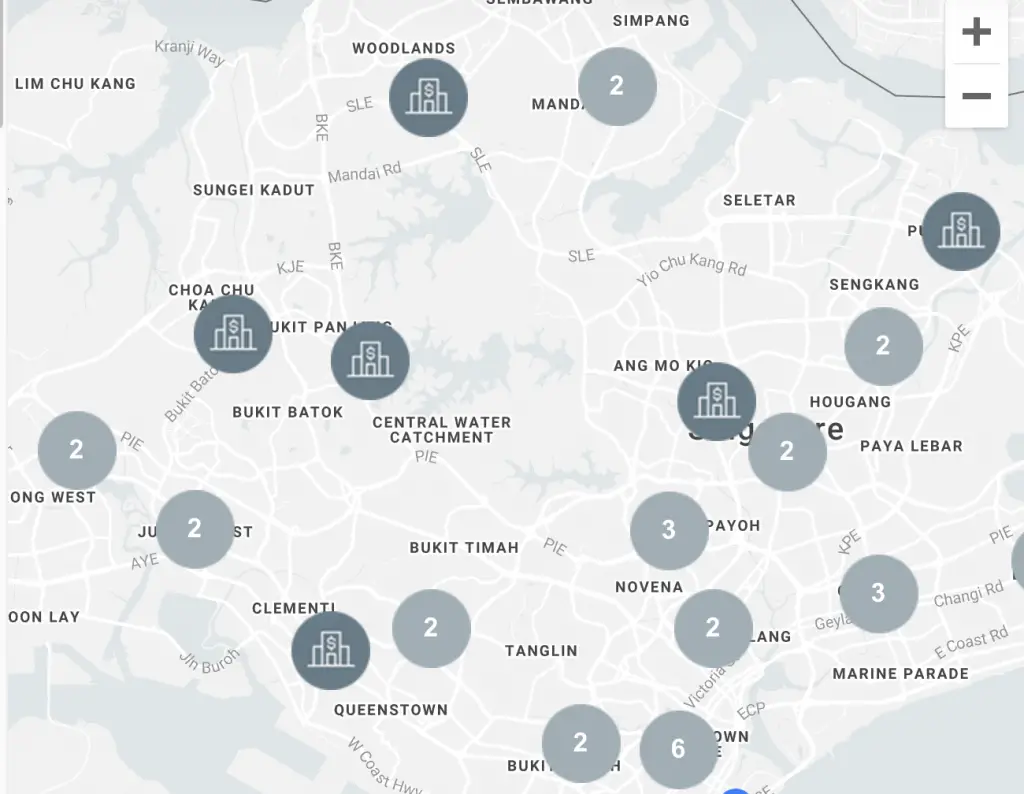

#2 Apply at an OCBC branch

You can choose to apply at an OCBC branch as well.

Here are some documents that you’ll need to bring along:

- Your ID / Passport

- A bank statement that shows your name and address

Do remember to inform your customer service officer to write ‘YIP’ / ‘YIP-FRANK’ on your account opening form! This will allow you to earn special benefits as a youth investor.

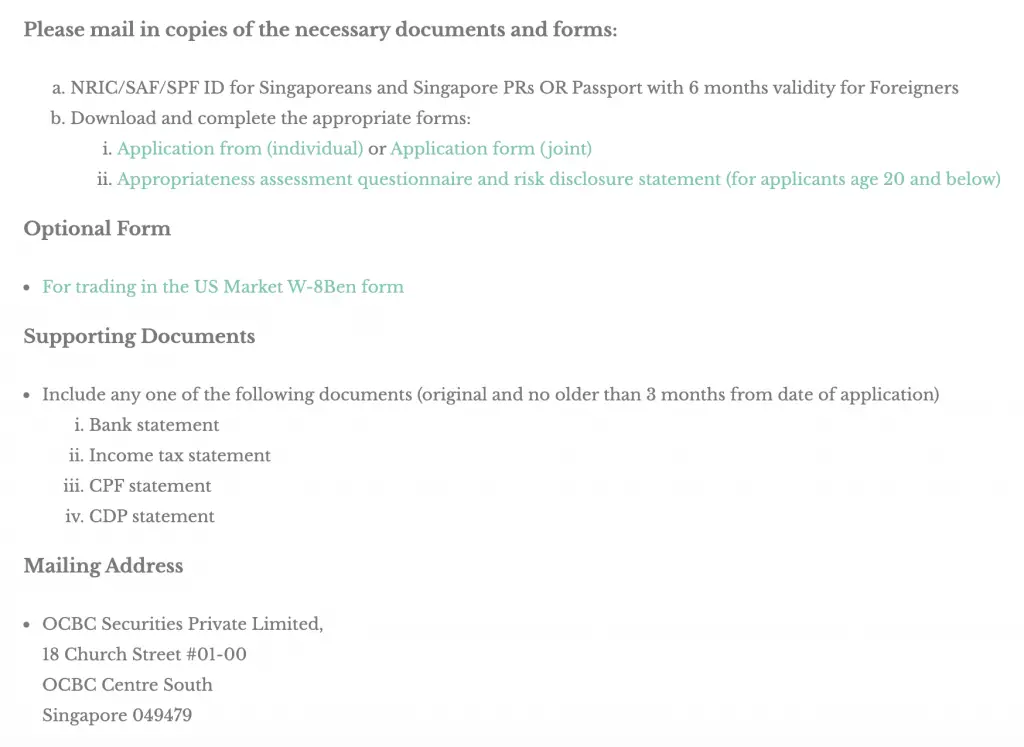

#3 By mail

You can mail your application to OCBC instead. Here are the required documents for your application:

What are the components of the Young Investor Programme?

Here are 3 main components of this 2-year programme:

#1 Set up your trading account

When you start this programme, you will need to open your trading account. If you have an existing OCBC FRANK account, you can link your trading account to it via GIRO.

When you make any trades, the money will be deducted directly from you GIRO account.

This will give you special rebates and commission rates when you make a trade!

At the end of the 2-year programme, your trading account will be converted into a Basic Trading (Cash) Account. This allows you to enjoy higher trading limits, allowing you to make more trades.

If you are between 18-20 years old, the 2 year countdown will only start when you’re 21. This means that you will only receive the Basic Trading Account when you’re 23.

#2 Learn about trading at seminars

As part of the Youth Investor Programme, you are able to attend seminars that are organised by SGX Academy and OCBC Securities.

You will be to learn skills required to trade from this seminars. OCBC also states that you’ll receive guidance from:

- Trading representatives

- Seasoned industry experts

#3 Start your investment journey

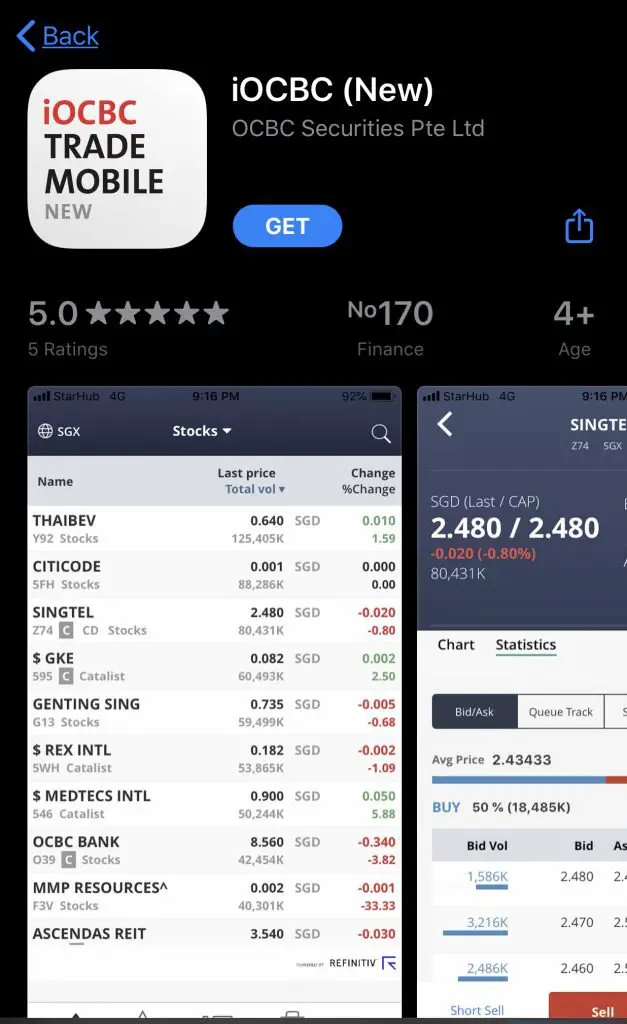

You will be creating your trading account with OCBC Securities. This allows you to make your trades through OCBC’s platform.

You are able to access the trading platform on either your desktop or mobile.

With OCBC Securities, you are able to make trades across 15 global markets. This includes:

- Singapore

- US

- UK

- Australia

- China

- Hong Kong

- Japan

What are the benefits of the Young Investor Programme?

Here are some benefits that the YIP provides:

Exclusive YIP rebates

You are able to receive exclusive rebates when you trade as a Young Investor.

1. Criteria for rebates

Here are the criteria that you’ll need to fulfil first:

- You must have a FRANK account and debit card before opening your trading account

- Your trading account must be linked to your FRANK account

- You must clearly indicate in your application forms that you wish to apply for the YIP

As such, it is very important to inform the staff that you wish to apply for this programme! If they do not indicate this, you will not be able to enjoy these rebates.

If you are mailing your application, do remember to indicate ‘YIP-FRANK’ at the top right hand corner of your form.

2. What rebates will I receive?

When you trade using OCBC’s platform, the minimum commission is usually $25. However when you make online trades from your FRANK account, your commission is reduced to $15.

Here are the usual commissions that you’ll need to pay with OCBC Securities:

| Trading Amount | Commissions |

|---|---|

| ≤ $50k | 0.275% |

| > $50k and ≤ $100k | 0.22% |

| > $100k | 0.18% |

| Minimum | $25 |

This means that you’ll be able to get slightly more affordable rates!

However, there are certain terms and conditions for this rebate:

- The rebates are only applicable for trades that you make in the Singapore market

- You will still have to pay the $25 minimum fee, but will receive the rebate eventually

- The rebate you receive will be the difference between $25 and the higher of $15 and the actual brokerage charge

If you make a larger trade, you may not receive the full $10 rebate.

For example, you may buy 2000 shares costing $3 each. The commission that you will pay is $16.50 (0.275% * $6000).

This means that you’ll only receive a rebate of $8.50 instead of $10.

If you intend to trade in large volumes, you may not receive the full benefit of this rebate. Moreover, this rebate is only limited to trades in the Singapore market.

You will still need to pay the original commissions if you trade in other markets!

Educational content

You will receive a lot of educational content throughout these 2 years. This includes:

#1 YIP Seminars

You will be able to attend seminars that are organised by OCBC Securities and SGX. These seminars will help you to learn all the basics on investing.

#2 Dedicated Trading Representative

You will be able to receive guidance from a trading representative. If you ever need help with making a trade, you can always seek help from your representative!

You are also able to receive regular market updates. This might provide you with certain investing opportunities that will benefit you in the future.

#3 Access to YIP Pocket Book

You will have access to this pocket book, which is a unique investment guide. This was written by other young investors, so the guide will definitely be more relatable to you.

Verdict

So is the Young Investor Programme worth signing up for? Here are some key points:

#1 Educational content will be really helpful

If you are lost about how to start your investment journey, the content from this programme will be really helpful. You can receive a lot of personalised guidance as well!

#2 Rebates are not that attractive

The minimum commission of $15 is not really that attractive. There are other online brokerages with more affordable commissions.

For example, Tiger Brokers only charges a minimum commission of SGD$2.88!

One of the most important things to consider when investing is the fees that you’ll incur. If you are able to invest in the same product but at a lower cost, you should definitely choose that option instead.

Only go for the educational content

I believe that OCBC is using this programme to introduce young investors to their trading platform. It is hoped that you’ll be more familiar with this platform and continue to trade with them.

However, there are definitely cheaper brokerages that offer more attractive rates. I would suggest that you only go for the educational content. It will definitely be useful to help you start your investment journey!

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?