Last updated on October 29th, 2021

Welcome to this cozy corner of the internet, where you can pick up little nuggets of financial knowledge to improve your personal wealth.

Although I am sure we have all heard of the CPF Special Account (SA), we do not usually pay much attention to it as there are limited ways to use our savings there.

To save you the trouble of having to navigate through the CPF website, here are 15 answers to questions that you may have about your SA. Sit tight and enjoy!

Contents

Limits in your CPF SA

Before making that top up to your SA, you may want to be aware of the limitations involved in doing so. Here is an explanation of some of them.

1. Is there a limit on how much I can keep in your SA?

There is no limit on the amount of funds that you can keep in your SA. This is different from your MediSave Account (MA), where the limit is up till the Basic Healthcare Sum (BHS).

Coupled with the predictable (read: almost risk free) returns of the SA, it is no wonder that more Singaporeans are turning to CPF top ups to save up for their retirement.

One formidable retirement goal out there that emphasises accumulating in your CPF SA is the 1M65 movement pioneered by Loo Cheng Chuan.

Using some math and the power of compound interest, Loo proposes that if you and your spouse each save $130,000 in your CPF SA and MA at age 30, both of you will have a combined CPF balance of $1 million at age 65!

As $130,000 in your SA savings is definitely unattainable from your salary alone, you will need to perform top ups to reach this amount.

2. What happens when my CPF SA reaches FRS?

When your CPF SA reaches the Full Retirement Sum (FRS), you will no longer be able to make further top-ups to your SA via the Retirement Sum Topping-Up (RSTU) scheme. Furthermore, only funds from your SA will be used to form your RA at 55.

You may have managed to save up the FRS for the current year with your SA savings alone before the age of 55. Having reached this goal, you may be wondering if there will be any changes to your SA.

First of all, congratulations for attaining this monumental milestone in your retirement journey with CPF!

From this point onward, there are 2 things that will happen to your SA:

You will not be able to top up your SA under RSTU

Firstly, you will not be able to make further top ups to your SA through the Retirement Sum Topping-Up (RSTU) Scheme. The only way to top up your SA is through Voluntary Contributions (VCs).

However, you will need to top up all your 3 CPF accounts (OA, SA and MA) at once.

Similarly, VCs are the only option if you intend to top up your OA.

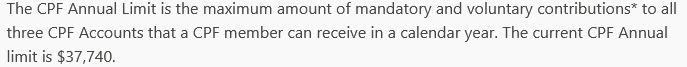

If you wish to top up your SA through a VC, you may want to note that on top of the mandatory CPF Contributions from your employment, you can only top up to the CPF Annual Limit each year, which currently stands at $37,740.

Only your SA funds will be used to form your RA at 55

If you are turning 55 on this or next year, you will be able to know the FRS that you need to save in your Retirement Account (RA). After your RA is created on your 55th birthday, your SA funds will be withdrawn first to form your FRS, followed by those in your OA.

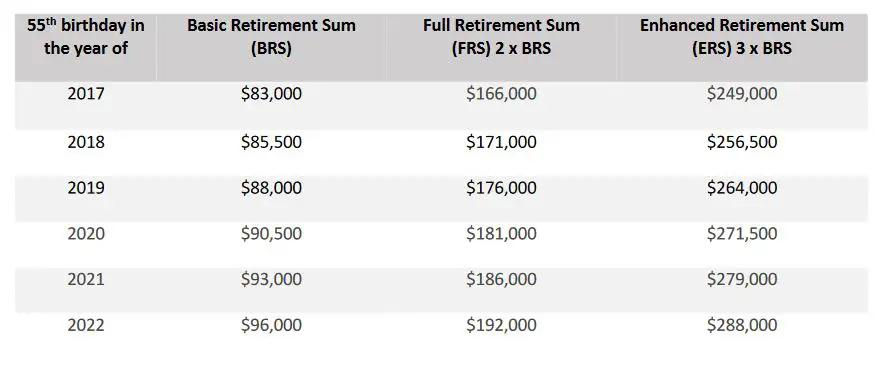

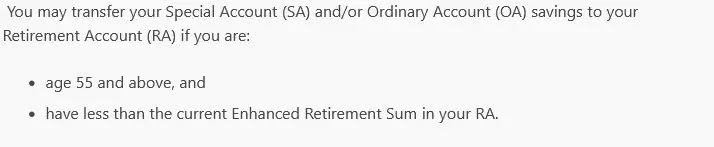

Along with the FRS, CPF also displays the Basic Retirement Sum (BRS) and the Enhanced Retirement Sum (ERS) that you need to save according to your age.

Since you had saved the FRS in your SA by then, only the monies in your SA will be channeled to your RA. This leaves the monies in your OA free for other uses, such as paying for your home mortgage.

3. Will my SA flow to my OA once it reaches FRS?

Any excess amount that you have saved in your SA above the FRS will continue to accumulate in your SA. If you are still working, you will continue to make your mandatory and voluntary contributions to your SA under the prevailing CPF allocation rate for your age group.

Therefore, any SA funds above your FRS will not flow to your OA, or any other CPF account.

This concept is not the same as that in the Basic Healthcare Sum (BHS), which serves as the maximum amount you can save in your Medisave Account (MA).

Any excess amount saved above your BHS will flow to your SA (if you are below 55) or your RA (if you are 55 and above).

4. Will my SA be closed after 55?

Although your RA is created at 55 to fulfill your retirement needs, your SA will still remain open. Furthermore, you will also continue to make contributions to your SA based on the prevailing CPF allocation rate if you are still working.

The following table shows the CPF allocation rate as of 2021 for ages above 55, which is inclusive of both employee and employer contributions:

| Age | Ordinary Account (% of wage) | Special Account (% of wage) | MediSave Account (% of wage) |

|---|---|---|---|

| 56 – 60 | 12 | 3.5 | 10.5 |

| 61 – 65 | 3.5 | 2.5 | 10.5 |

| Above 65 | 1 | 1 | 10.5 |

As we can see, the only a small portion of your contribution goes to your SA after you hit the magic age of 55.

Instead, most of your CPF contributions after age 55 will be made to your Medisave Account. This is done in anticipation of our increased healthcare needs during our golden years.

5. Can my SA be used for housing?

The main purpose of your SA is to help you to save up for your retirement. As such, you are unable to use the funds in your SA for housing expenses. This is in contrast to your OA, where one of its functions is to help you with financing your home.

Your CPF has 3 main accounts, and all of them have a very specific purpose:

| CPF OA | Housing and Education |

| CPF MA | Medical Expenses |

| CPF SA | Retirement |

The funds in your CPF SA are meant to build up your savings when you eventually retire. This is different from your CPF OA, which can be used for housing.

As such, only your CPF OA can be used for housing expenses (such as your mortgage), and not your CPF SA!

Topping up your CPF SA

Topping up your SA is a risk-free way of growing your spare savings, with your funds enjoying a fixed 4 – 5 % interest per year! However, here are some things you’ll need to know before topping up your SA.

6. Is there a limit on how much I can top up my SA?

Your SA top up limit is dependent on what scheme you are utilising. The Retirement Sum Topping-Up Scheme (RTSU) has a limit up till your prevailing FRS, while you can top up via a Voluntary Contribution (VC) up till the CPF Annual Limit ($37,740).

There are 2 ways to top up your SA, each with its own top up limit. Lets find out more about each of them:

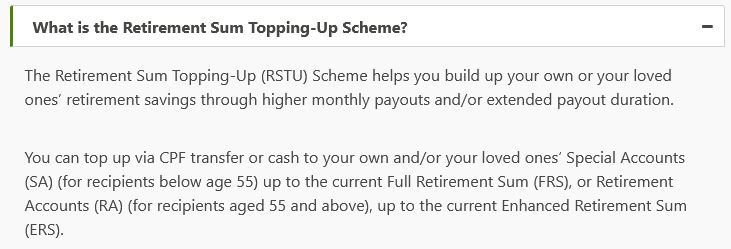

Retirement Sum Topping-Up Scheme

If you are under the age of 55, you can top up your SA through the RSTU Scheme using either cash or your CPF OA funds. The RSTU Scheme aims to boost the retirement sum for you and your loved ones through voluntary top ups.

Unfortunately, the RSTU scheme only allows you to top up your RA if you are 55 or above. In this way, the Voluntary Contributions will become the sole way that you can top up your SA.

Apart from your current balance, the top up limit to your SA through the RSTU Scheme depends on 2 factors:

- The FRS of the current year

- Savings withdrawn from SA under the CPF Investment Scheme (CPFIS)

Therefore, this is the maximum amount you can top up through the RSTU Scheme:

Max SA Top Up = FRS – SA Balance – Investments from SA

For example, Ravi (aged 42) wants to top up his own SA under the RSTU scheme. Apart from the balance in his SA, he also has some of his SA funds invested under CPFIA.

This is the profile of his SA:

| Amount | ||

|---|---|---|

| (a) | Current FRS (As of 2021) | $186,000 |

| (b) | SA balance | $151,000 |

| (c) | CPFIA funds withdrawn from SA | $30,000 |

| (d) | Amount that Ravi can top up: (a) – (b) – (c) | $5,000 |

From the above table, we can see that Ravi is only able to top up a maximum of $5,000 through the RSTU Scheme in 2021.

The FRS is continually revised upward every year. Thus, if you have already saved the FRS in your SA, you will need to wait till the revision next year to make further top ups!

Voluntary Contributions

On top of your monthly CPF contributions from both yourself and your employer, you can make Voluntary Contributions to your OA, SA and MA up to the CPF Annual Limit each year using cash.

The proportion in which each account is topped up is based on your CPF allocation rate of your age group.

As of 2021, the CPF Annual Limit stands at $37,740

The following table shows the CPF allocation rate as of 2021, which is inclusive of both employee and employer contributions:

| Age | Ordinary Account (% of wage) | Special Account (% of wage) | MediSave Account (% of wage) |

|---|---|---|---|

| 35 and below | 23 | 6 | 8 |

| 36 – 45 | 21 | 7 | 9 |

| 46 – 50 | 19 | 8 | 10 |

| 51 – 55 | 15 | 11.5 | 10.5 |

| 56 – 60 | 12 | 3.5 | 10.5 |

| 61 – 65 | 3.5 | 2.5 | 10.5 |

| Above 65 | 1 | 1 | 10.5 |

You may also want to note that there is another type of VC that involves only topping up your MA. However, this will not be discussed in this article.

7. How much does it cost to top up my CPF SA?

There are no transaction fees incurred when you top up your CPF SA using either the Retirement Sum Topping-Up Scheme (RTSU), or via a voluntary contribution.

Investments out there cost money. This may come in the form of broker fees when stock trading, management fees in unit trusts or commissions to your financial advisor in Investment-linked Policies (ILPs).

The good thing about topping up your SA? It does not cost you anything!

Under certain conditions, you will even be rewarded for topping up your SA in the form of tax reliefs!

You can claim up to $7,000 in tax reliefs under the RSTU Scheme, while generally VCs are only tax deductible for self employed people.

Before you get all excited to make that SA top up, this is a trade off that you need to consider:

Your CPF top ups are irreversible!

That’s right, you cannot withdraw any top ups made into your SA.

To prevent yourself from over-contributing, it is important to only set aside savings for your SA only after covering your essential expenses in the foreseeable future and setting up your emergency fund.

Another way to save up for your retirement while enjoying tax reliefs is your SRS. You can read about the pros and cons of topping up your CPF SA and SRS here.

8. Can I top up my CPF SA after 55?

If you are still working after the age of 55, you will continue to make mandatory contributions to your CPF SA account according to the CPF Allocation Rate. However, the proportion that goes to your SA is comparatively much lower, at 3.5% or below of your wage.

| Age | Ordinary Account (% of wage) | Special Account (% of wage) | MediSave Account (% of wage) |

|---|---|---|---|

| 56 – 60 | 12 | 3.5 | 10.5 |

| 61 – 65 | 3.5 | 2.5 | 10.5 |

| Above 65 | 1 | 1 | 10.5 |

Furthermore, you can also top up your SA through Voluntary Contributions (VCs) if you are aged 55 years or above. On top of your mandatory contributions from your employment, the top up limit to all your 3 CPF accounts is $37,740 each year.

One other CPF account you can consider topping up instead of your SA is your Retirement Account (RA).

Not only does the RA have a higher top up limit (up to the prevailing Enhanced Retirement Sum), you will receive higher monthly payouts after age 65 under CPF LFE.

With a higher monthly payout, you can afford to live a more comfortable life during your retirement years.

Transfers and Withdrawals

Thinking of transferring funds to your SA, or withdrawing funds from your account? Here are some things to consider:

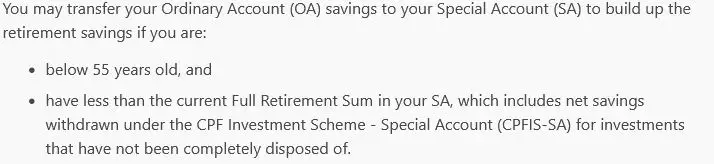

9. Can I transfer from my OA to SA after 55?

You are unable to top up your SA using your OA after 55. In fact, the only CPF Account that you can top up your SA with is your Retirement Account (RA).

Before you turn 55, the reason for topping up your SA is to build up your retirement savings.

However, your RA takes over the function of your retirement savings after you turn 55, so henceforth you can only transfer your OA funds to your RA to save for your retirement.

To continue saving up for your retirement, you can transfer your OA and SA funds to your RA.

The caveat here is that your SA funds will be transferred first, followed by your OA. As such, you can only transfer your OA funds to your RA after your SA is depleted.

10. Can I transfer from my SA to RA?

You are able to transfer from your SA to your RA under the Retirement Sum Topping-Up (RSTU) Scheme. Like other CPF account top ups, there is also a top up limit to your RA, which in this case is the Enhanced Retirement Sum (ERS).

The ERS is 1.5 times of the Full Retirement Sum (FRS), and 3 times of the Basic Retirement Sum (BRS).

You may wonder: I have so little funds in my CPF SA. What’s the point of transferring to my RA?

The idea behind this transfer is to build up your retirement savings under CPF LIFE.

As most of your retirement savings are contributed to your SA before age 55, your RA top ups can be seen as the last lap to your retirement savings journey. At the end of this journey, you will receive monthly payouts under CPF LIFE for the rest of your retirement.

You can choose your CPF LIFE payouts to begin anytime from age 65 – 70.

11. Can I withdraw my SA funds after 55?

After setting aside your Full Retirement Sum (FRS) in your CPF Retirement Account (RA) at age 55, you can withdraw the balance amount in your SA anytime. This will be done in the form of cash and your funds can be transferred to you either through Interbank GIRO or PayNow.

You must withdraw your SA savings first, followed by your OA.

If you have not set aside your FRS, you will be unable to withdraw your accumulated SA funds.

Now some of you may be wondering: I have saved in the CPF for so many years, and I cannot withdraw a single cent?

Here is the good news if you are a property owner: If you choose to pledge your property (which can last you until you are 95) or have a CPF charge that covers your RA to the FRS when you sell your property, you can save half the FRS, also known as the Basic Retirement Sum (BRS), in your RA!

A CPF Charge is created when you purchase your property using your CPF monies. Its value consists of the amount of CPF monies used plus accrued interest.

With a sufficient property charge/pledge, you can withdraw the amount in excess of your BRS from your RA. However, the trade-off here would be a lower CPF LIFE monthly payout.

Before proceeding to withdraw more from your RA, you will have to first decide if you can live with a lower CPF LIFE payout in your golden years.

Investing with your CPF SA

While you can leave your SA funds to enjoy fuss-free interest, you can also invest your them to further enhance your returns. These are some pointers on how you can do so:

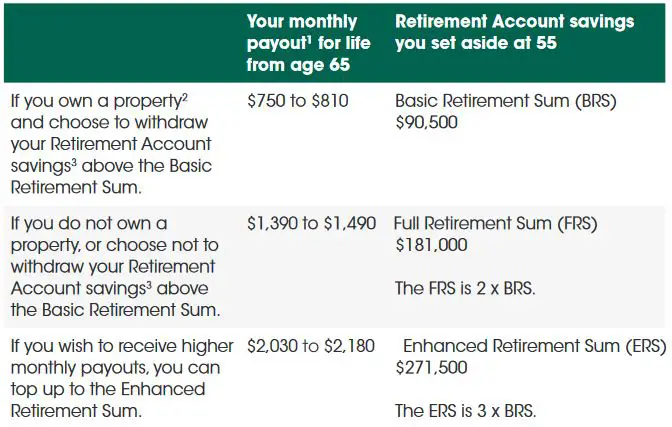

12. Can my SA funds be used for investment?

Under the CPF Investment Scheme (CPFIS), you can invest in a variety of investment products using your CPF SA. However, products which are approved for CPF SA investments tend to fall into lower risk categories as compared to investing using your CPF OA.

By only allowing investments in products with lower risk, the chances that you’ll have inadequate savings for your retirement is reduced.

Here is a list of investment products that you can invest in using your SA funds:

- Unit Trusts and ILPs (Higher risk products not included)

- Annuities

- Endowment Policies

- Singapore Government Bonds

- Treasury Bills

Unlike saving in your SA, you will also need to consider the impact of fees when you invest in certain products.

Excessive fees may eat into your returns, making the investment less worthwhile to make!

Here is a quick breakdown of the fees you can expect to pay for the various products available:

| Investment Product | Estimated fees (% p.a.) |

|---|---|

| Higher-risk Unit Trusts/ILPs | 0.75% – 2.5% |

| Lower-risk Unit Trusts | 0.6% – 1.25% |

| ETFs | 0.0945% – 0.7% |

| Treasury Bills, SSBs | 0 % |

In addition, some products (such as endowment plans and annuities) are labelled as ‘Savings Plans’. These also come with fees that are payable to the advisor and company managing your funds!

If the projected net return of your investment after accounting for fees is less than 4 % p.a., you may want to consider contributing to your SA instead.

Interested to know more on how you can invest using your CPF funds under CPFIS? You may find this guide useful.

13. Should I invest my CPF SA funds?

When you invest your CPF SA funds, you will need to be confident that your investment is able to beat the guaranteed 4 – 5 % p.a. interest of your Special Account. At first glance, it may quite hard to find an alternative investment that beats this return,hence many of us prefer to retain our funds inside our SA to continue earning the 4 – 5 % p.a. interest.

However, is it possible to beat the SA’s interest rate through investing our SA funds? Let’s delve deeper on whether and how we can do so.

The infographic below shows the potential returns (and risk) you can expect from the various investments available under the CPFIS. You can also see how returns of the CPF OA and SA compare to these investments.

If we limit ourselves to products investible with our SA, that leaves us with only Unit Trusts and ILPs as possible ways to beat the SA’s interest rate.

A quick example here: Let’s have a look at how the returns of SA-approved Unit Trusts fare versus the SA itself.

You can view the whole list of Unit Trusts approved for investment under the SA here.

To start our little test, we shall look at the past performance of SA-approved funds in FSMOne.

As of Sep 2021, you can invest in all but one of the SA-approved funds in FSMOne.

Next up, the funds will be arranged starting from the best 10-year annualised performance.

This simulates the long time horizon of investing for our retirement.

I think the data shows it all: Only 2 funds managed to beat the SA on a long term basis.

(This is literally the cheat sheet of SA-approved Unit Trusts: Only the Schroder Multi Asset Revolution and First Sentier Bridge Funds are worth your attention.)

With a long term return of more than 7% per year, the funds have clearly beaten the CPF SA’s interest rate of 4 – 5 % over this time period.

You may also want to note that the annualised performances shown here have already factored in management expenses, and that FSMOne does not charge platform fees for CPFIS Funds.

While past performance does not equate to future returns, what we can conclude from this little test is that only a small fraction of funds can beat the CPF SA’s interest rate.

14. How much of my CPF SA can I invest?

After setting aside $40,000 in your SA, you are able to invest the remainder of your SA funds. Some investment products that you can invest in under the CPFIS include annuities, endowment policies and selected Unit Trusts/ ILPs.

For most people who wish to invest using their SA funds, this restriction may seem like a high barrier of entry.

However, we also need to consider the purpose of the SA, which is to provide enough savings for your retirement needs.

With this mindset, we can treat this $40,000 as a buffer, where you savings can compound safely at 4 – 5 % p.a.

You can also consider to invest using your CPF OA or SRS, which have lower entry barriers.

15. Can I use CPF SA to buy shares?

Under the CPFIS, you are unable to use your Special Account funds to purchase single shares. This is in contrast to your Ordinary Account, where you are able to use up to 35% of your investible savings to purchase eligible shares that are listed on the SGX.

Why can’t we use our SA funds to buy shares? If I were to make a guess, this is because investing in shares are regarded by the government as too risky to invest your retirement savings in.

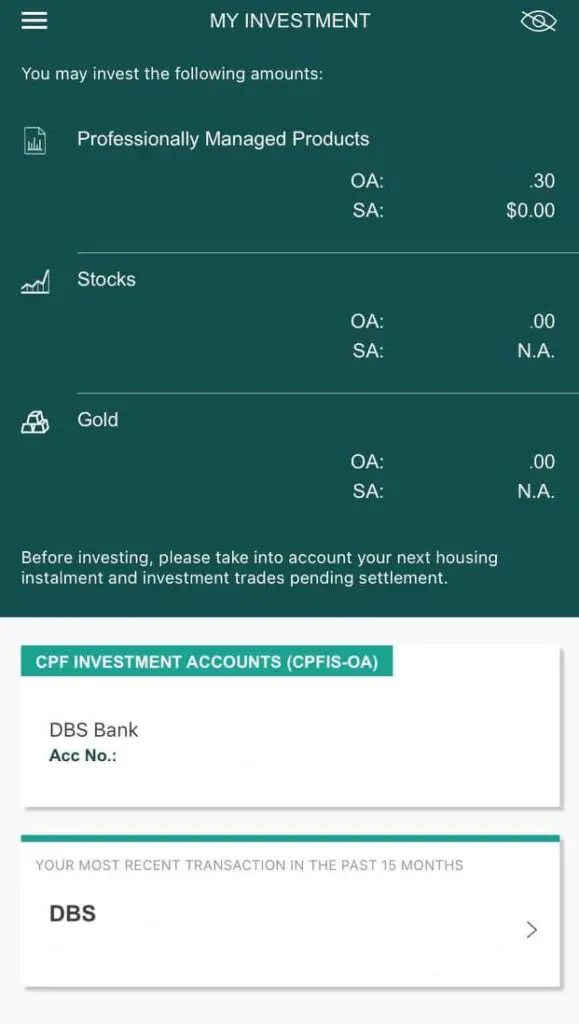

From the myCPF App, we can see that investing in stocks and gold are off-limits for your SA funds.

Being an investment product of high risk, the value of shares may rise or fall over short periods of time.

While there are many success stories of people ‘beating the stock market’, there are also many others who lost their fortunes from shares too.

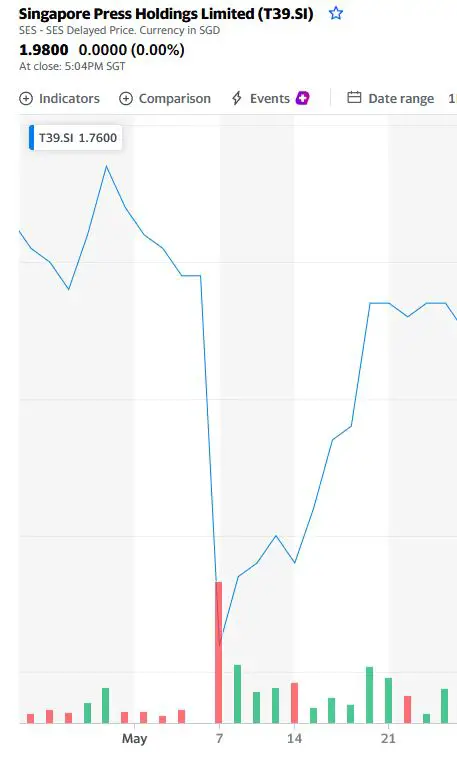

Take the recent example of SPH, whose shares fell by 15% in one day after the company announced plans to restructure its business on 7 May 2021.

Such a large drop would have been disastrous for someone who had invested his life savings in SPH shares.

Conclusion

Although CPF contributions are mandatory for all Singaporeans, the many rules and regulations behind this scheme can be intimidating to some.

Within the CPF accounts, I find that the Special Account is the least well known of them, as there are not many ways to use the funds inside apart from saving them for your retirement.

Therefore, I hope this guide helps to tackle some of the more important questions that we may have with our CPF SA. Do check out this page for more guides to other topics about your CPF!

Do you like the content on this blog?

To receive the latest updates, you can follow us on our Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?