Last updated on June 6th, 2021

You’ve decided to invest in the STI ETF. However, there are many options you can go about to purchase it!

One such way is to buy it through a broker, like DBS Vickers.

So how exactly do you go about doing it?

Contents

How to buy the STI ETF on DBS Vickers

Here are the 5 main steps you’ll need to do in order to purchase the STI ETF on DBS Vickers:

- Sign up for a DBS Vickers account

- Go to ‘Trade → Place Order’

- Search for the STI ETF

- Enter your order details

- Confirm your order

Here is an in-depth explanation for each step:

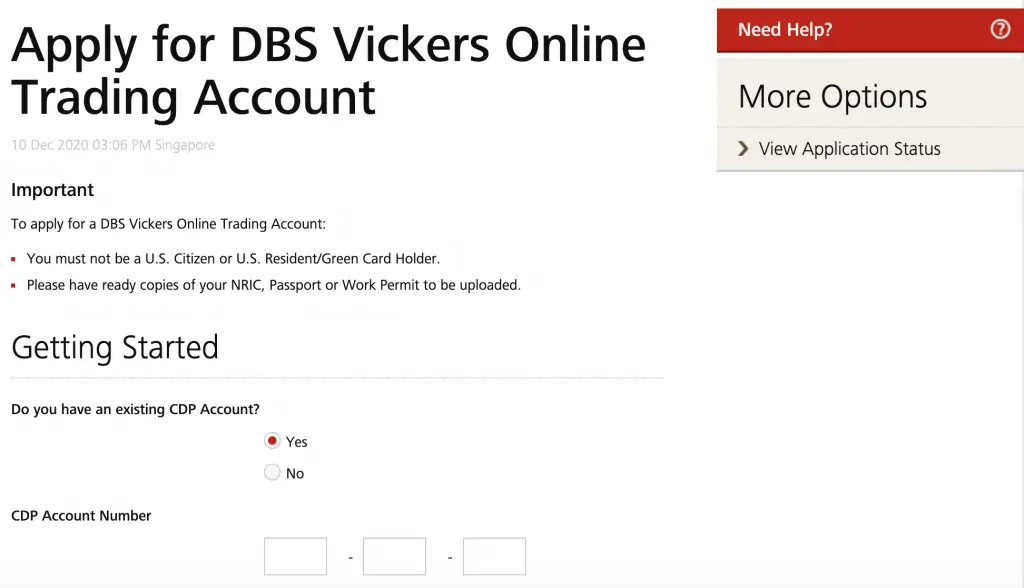

Sign up for a DBS Vickers account

You can easily apply for a DBS Vickers account if you already have a DBS or POSB bank account.

You can link your CDP account if you’ve previously created one. Otherwise, you will need to create a new account.

The sign-up process is pretty fast and your account should be able to be created in a few days.

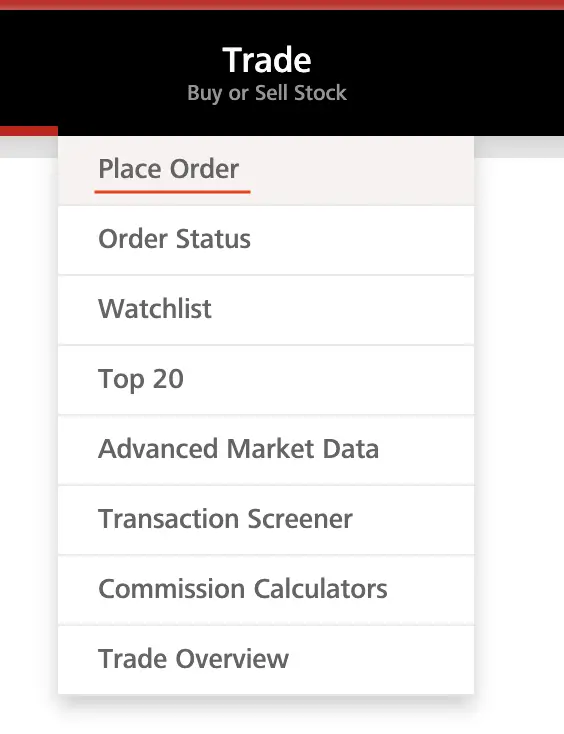

Go to ‘Trade → Place Order’

Once you’ve created your DBS Vickers account, you can start making trades in the SGX!

You’ll need to go to the ‘Trade‘ sidebar and click ‘Place Order’.

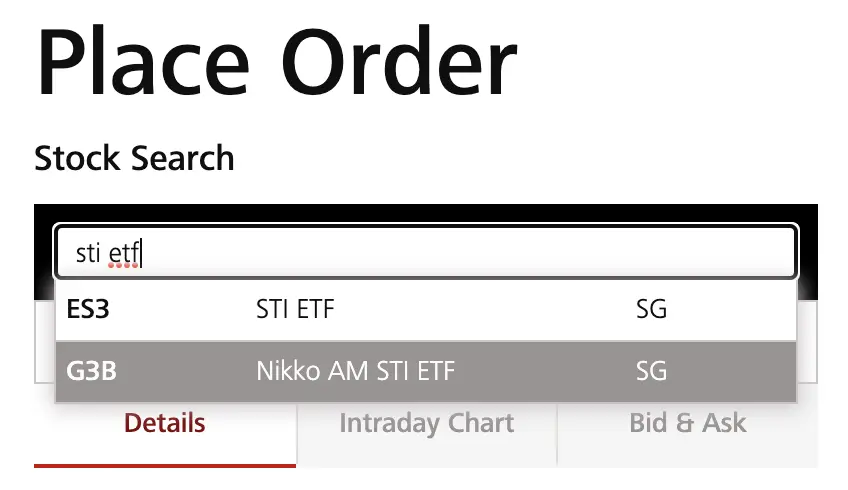

Search for the STI ETF

Once you’ve reached the ‘Place Order’ page, you can search for the STI ETF.

There are actually 2 different STI ETFs listed on the SGX! ES3 is managed by SSGA, while G3B is managed by Nikko AM.

You can view my comparison between ES3 and G3B to see if there is any difference!

Enter your order details

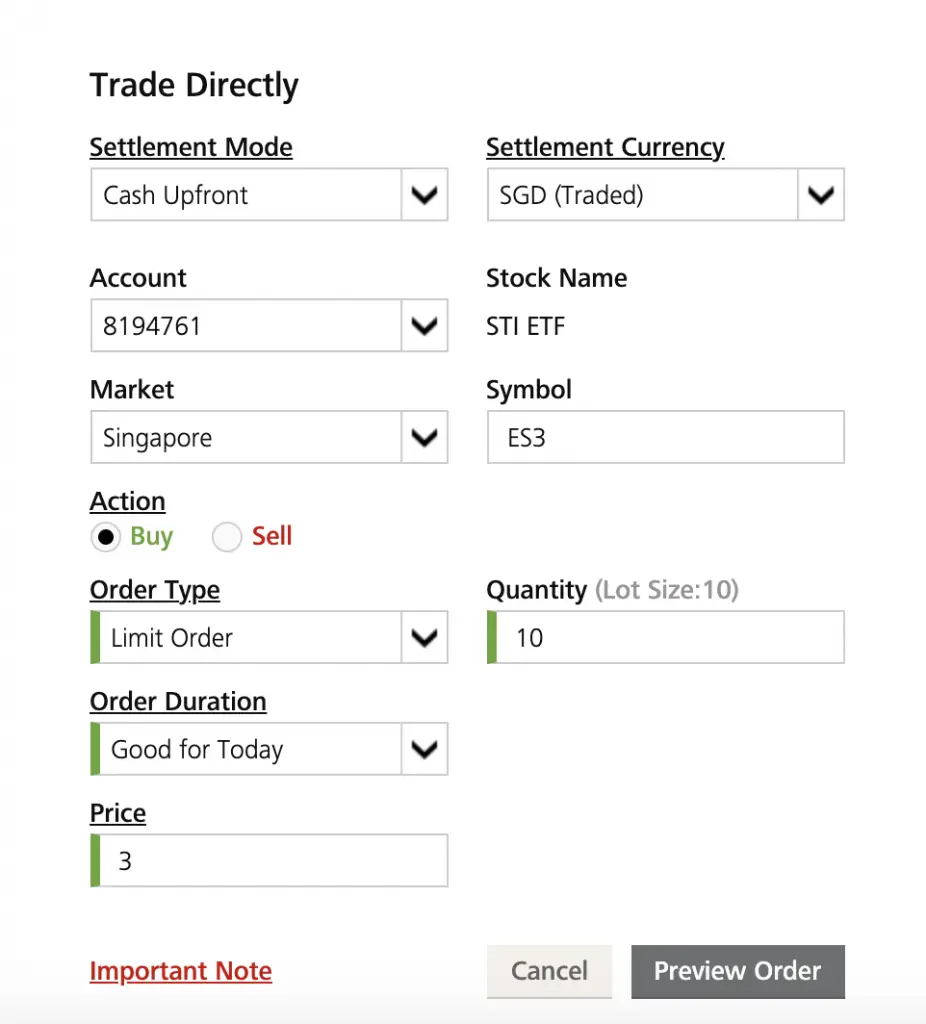

Once you’ve selected the STI ETF to invest in, there are some details you’ll need to fill up.

Here are some of the important details you’ll need to take note of:

#1 Settlement Mode

This option determines how your purchase will be made. There are 3 different types of settlement modes:

| Type of Account | Explanation |

|---|---|

| Cash | You can buy the stock first, and can pay for the stock up to 3 days (T+3) after the transaction date |

| Cash Upfront | Your funds will be automatically deducted from your DBS or POSB bank account (i.e. you need make the deposit first) |

| SRS | You can use your SRS funds to make the purchase |

The commissions you pay for Cash Upfront is lower compared to your Cash account!

#2 Order type

Here are the 2 types of orders that you can place:

| Type of Order | Description |

|---|---|

| Market Order | Your order is made at the best bid or ask price available (at the current market price) |

| Limit Order | You are stating the price which you wish to buy or sell the stock (you are limiting the price) |

When you are placing a market order, you are guaranteed an order. However, you can’t control the price since you will just receive the market price at that point in time.

When you place a limit order, you are controlling the price. However, you may not be guaranteed the order! This is because there may not be any bids to buy or sell the ETF at your intended price.

#3 Quantity

You will need to decide the number of units that you need to purchase this ETF.

For both ES3 and G3B, the minimum lot size on the SGX is 10. As such, you can purchase them in multiples of 10 units each.

It may seem quite ‘cheap’ to purchase the ETF, since you only need around $30 to buy 10 units of either ETF!

However, you’ll need to consider the commissions that you’ll incur.

DBS Vickers has a minimum of $10 (Cash Upfront) or $25 (Cash) per trade. As such, the commissions that you pay may be almost the same as your investment amount!

DBS Vickers does not allow you to trade odd lots via the online platform. Instead, you’ll need to go through a phone broker to purchase these odd lots.

#4 Order duration

There are 6 different orders that you can make when you are buying the STI ETF:

| Order Type | Description |

|---|---|

| All or None (AON) | The entire order must be filled at the same time, if not the order will not be filled |

| Good for Day | A limit order that is only good for that business day (it will expire at the end of the day if it is not filled) |

| Good till Date | A limit order that is only good till the date of expiry |

| Good till Max | A limit order that is only good for the next 30 calendar days |

| Fill or Kill (FOK) | The entire quantity must be matched in full, or the order will be cancelled |

| Fill and Kill (FAK) | Any portion of a market FAK order will be matched as soon as the order is placed and the remaining order will be cancelled |

AON orders are only available if the quantity you wish to order is above 100 units.

#5 Price

The last thing you’ll need to enter is the price that you wish to place the order. However, if you are placing a market order, you would not need to worry about the price.

Both ES3 and G3B cost more than $1 on the SGX. As such, the minimum bid size for both ETFs is $0.01.

Once you’ve filled in all of these options, you can press the ‘Preview Order‘ button.

Confirm your order

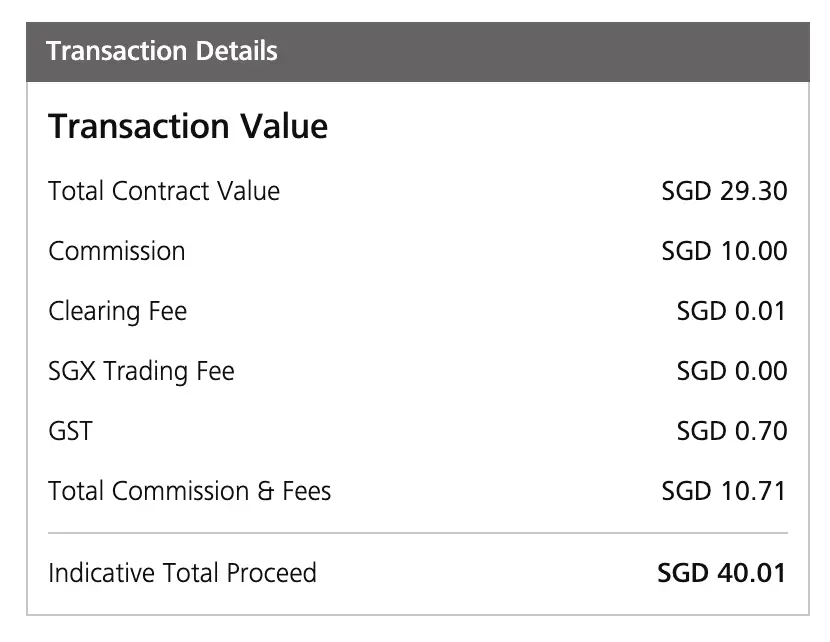

When you’re brought to the ‘Preview Order’ page, you can view 2 things:

#1 The amount you’ll pay for the trade

You can view the full breakdown of the amount that you’ll need to pay for the trade.

The minimum commission for a Cash Upfront trade is $10. This is much cheaper compared to the Cash account, which is $25!

Moreover, GST will be charged on the commission that you need to pay to DBS Vickers.

This will give you a very clear indication of the fees that you’ll need to pay. If you are only investing a small sum, it may not be worth the fees.

You may want to consider Tiger Brokers instead which does not charge a minimum fee until 31 April 2021.

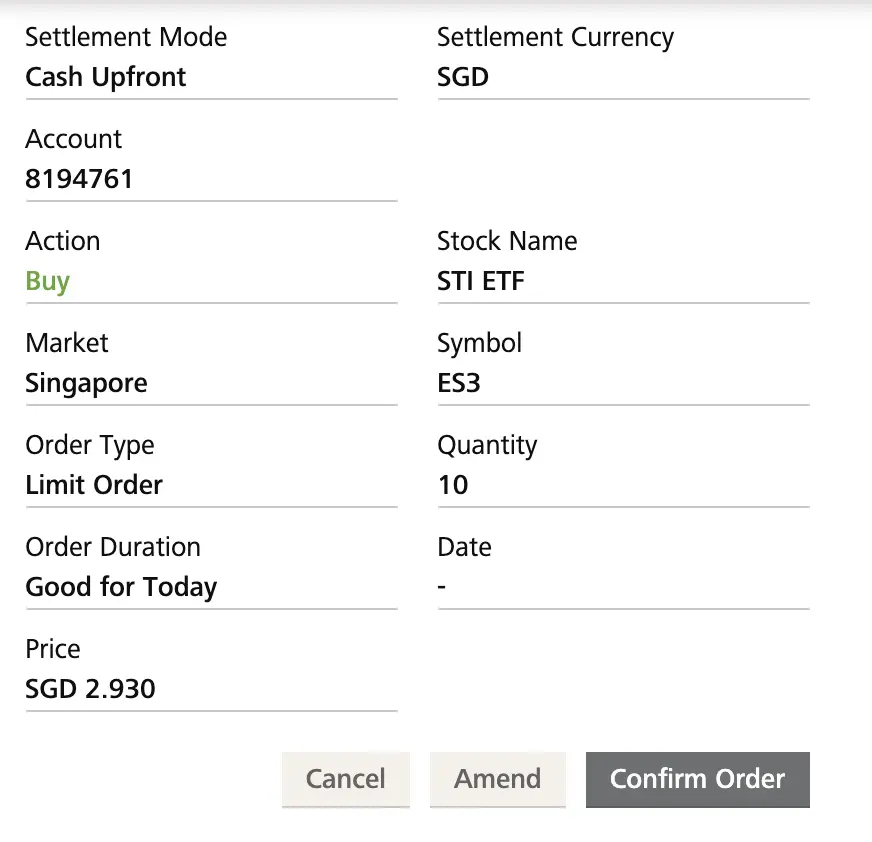

#2 The final order

You can view the final order that you make.

If you’re happy with the order, you can proceed to confirm it.

Once the order has been filled, the STI ETF will be added to your holdings.

Conclusion

The process of buying the STI ETF with DBS Vickers is rather straightforward.

However, you’ll need to consider the fees that you incur when you make the trade. The minimum fees will be too costly if you’re only buying a few units of the ETF!

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?