Last updated on June 8th, 2021

There are many different multi currency cards out there, so which one should be choosing?

Here’s a comparison between YouTrip and BigPay:

Contents

- 1 The difference between YouTrip and BigPay

- 2 Type of multi-currency wallet

- 3 Topping up card

- 4 Local spending

- 5 Overseas spending

- 6 Currency conversion rates

- 7 Number of currencies

- 8 Storing other currencies

- 9 Withdrawal to bank account

- 10 Sending money

- 11 ATM withdrawal

- 12 Rewards

- 13 Security

- 14 Verdict

- 15 Conclusion

- 16 👉🏻 Referral Deals

The difference between YouTrip and BigPay

Both YouTrip and BigPay are multi-currency cards with no conversion fees. YouTrip’s main selling point is that you can store multiple currencies in this wallet. Meanwhile, BigPay allows you to transfer money out of your wallet, apart from using the money to make purchases.

Here’s an in-depth comparison between these 2 cards:

Type of multi-currency wallet

Both YouTrip and BigPay are mobile wallets that come with a stored value card. This means that they are not linked to any bank accounts. Instead, you’ll need to use a debit or credit card to top up these cards.

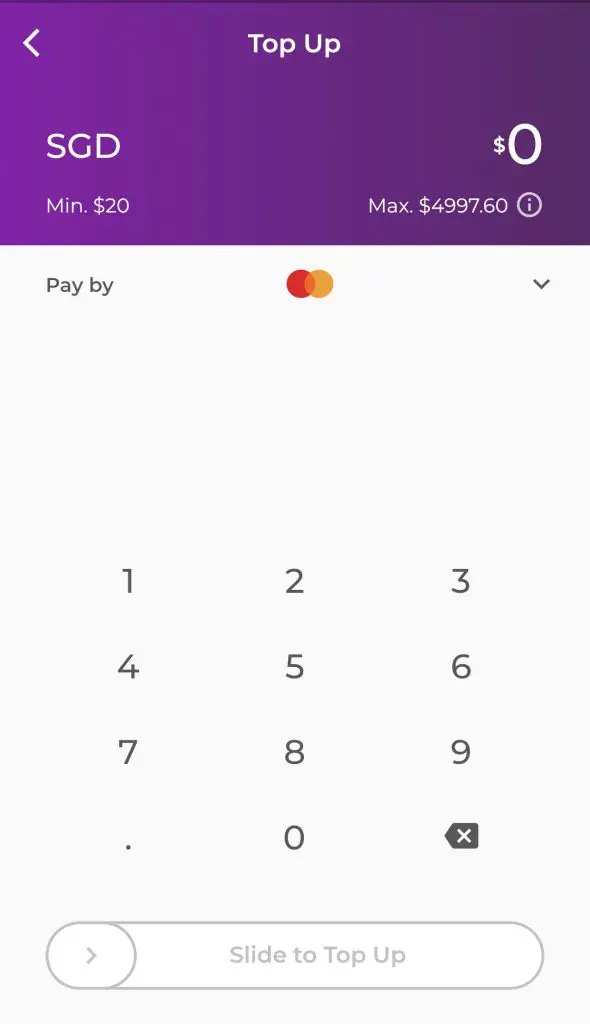

Topping up card

Both cards do allow you to top up in decimals. This really helps you to fully utilise all the funds in your card.

This is unlike GrabPay and Singtel Dash which do not allow you to top up in decimals to your mobile wallet.

YouTrip has a minimum top up amount of $20.

However, there is no minimum top up for BigPay. I even managed to top up $1 into my BigPay wallet!

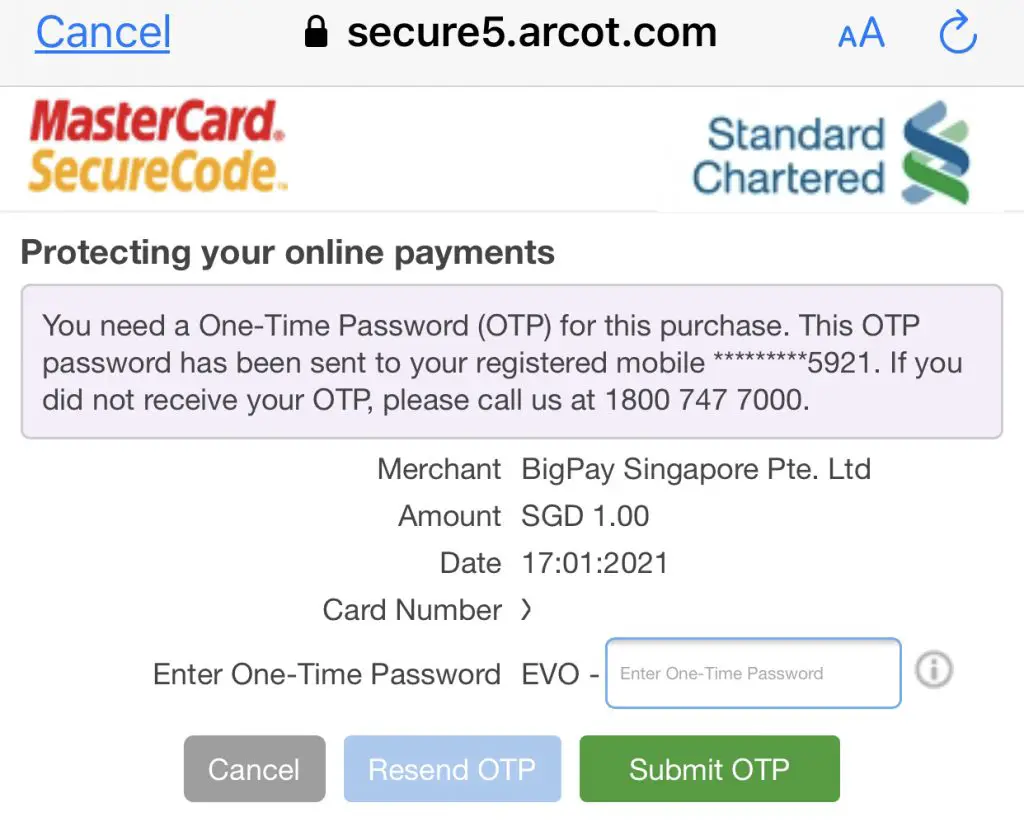

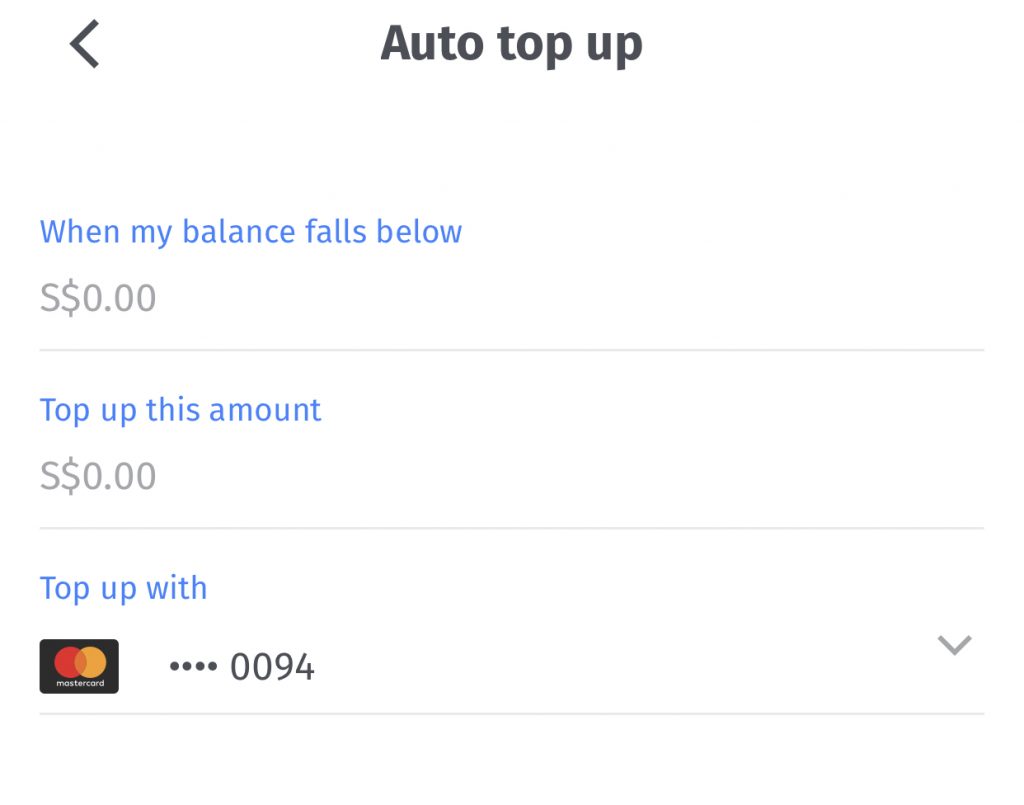

You are also able to set an Auto Top-Up for BigPay.

Your debit or credit card will be automatically charged when your BigPay wallet falls below a certain amount.

Local spending

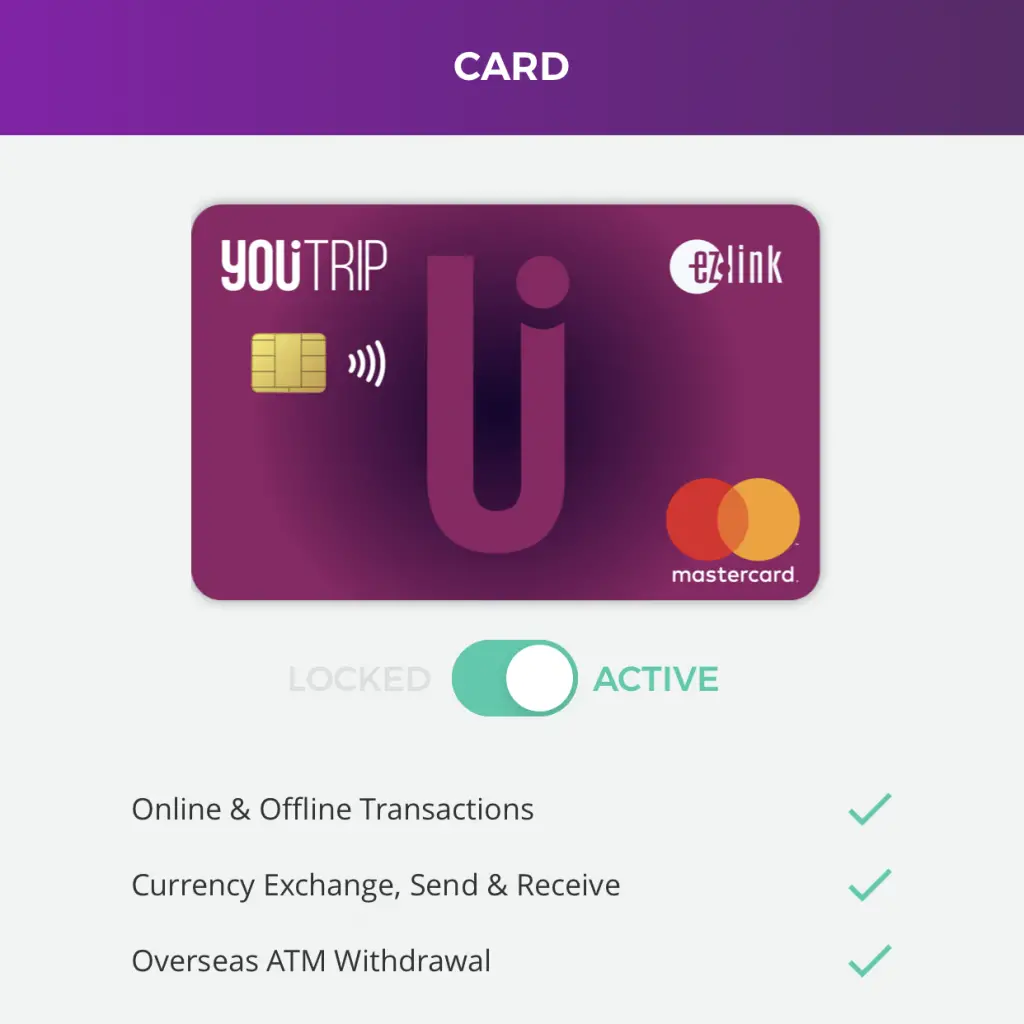

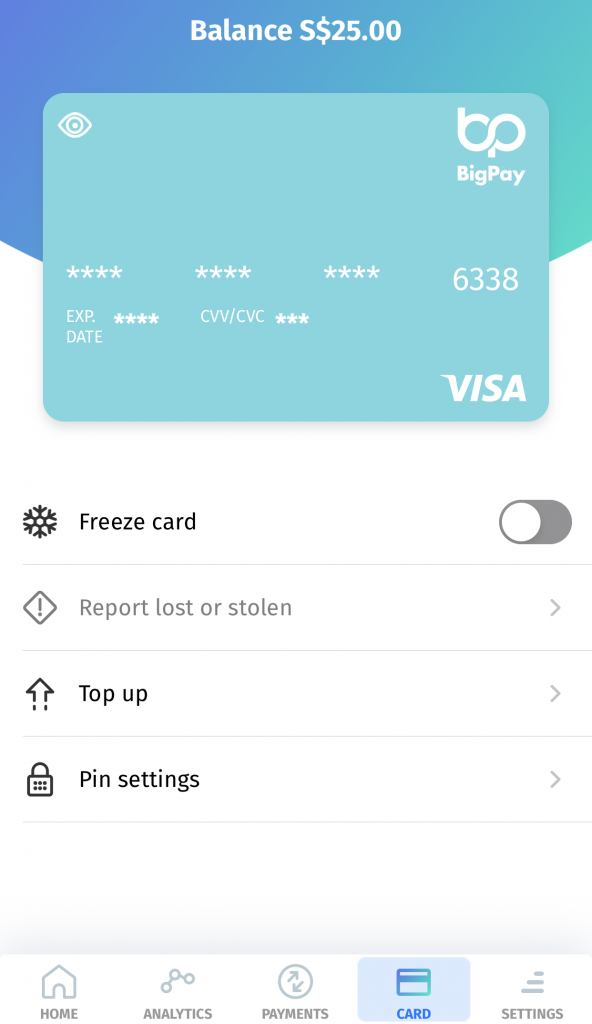

BigPay is a Visa debit card,

while YouTrip is a Mastercard.

As such, you can use either card at terminals that accept Visa payWave or Mastercard contactless.

Overseas spending

You are able to use either card overseas, so long as the merchant accepts contactless payments as well.

The only exception is that BigPay does not allow you to make any transactions in North Korea or Israel.

Currency conversion rates

What makes both multi-currency cards attractive is that they do not charge any currency conversion fees.

Another card that does not have any foreign currency exchange fees is the SingLife debit card.

As such, you will only pay at the prevailing exchange rate when you make a transaction.

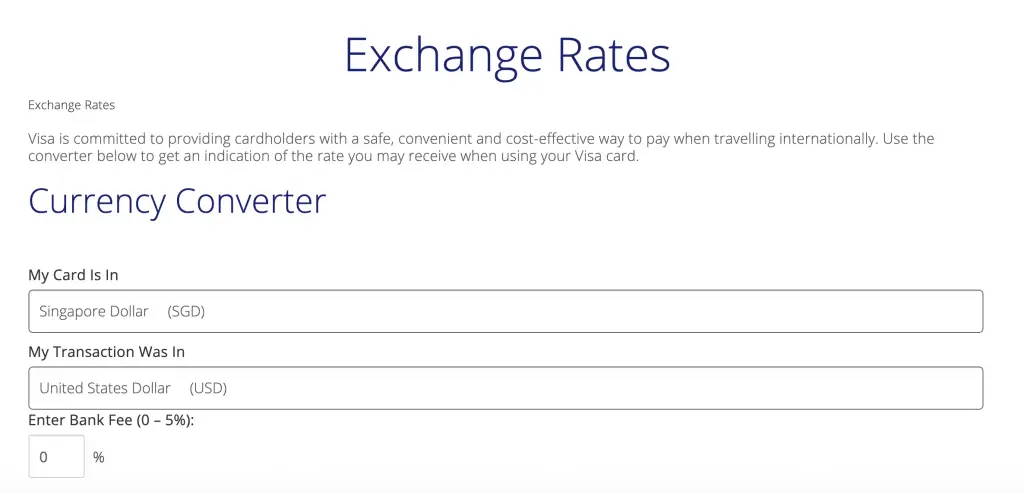

BigPay uses the prevailing exchange rates from Visa

When you want to make any payments in a foreign currency, BigPay dynamically converts your local currency into the required amount.

You can check the exchange rate for any currency with the Visa Currency Converter.

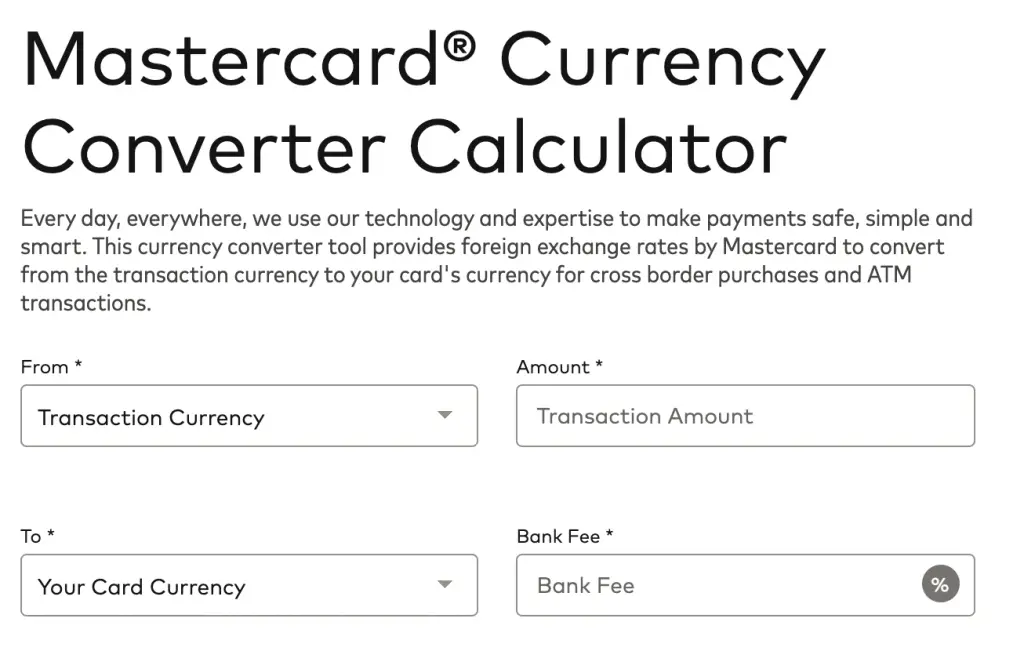

YouTrip uses the wholesale exchange rates

Similar to BigPay, YouTrip also uses wholesale exchange rates. They follow the Mastercard Currency Converter Calculator to calculate the exchange rate you’ll use.

Your exchange rate is only confirmed when the merchant confirms the transaction

Your exchange rate is only locked in when the merchant confirms the transaction. However, this may take 1-2 (maximum 8) days before the merchant completes it.

Due to short term fluctuations, you may pay at an exchange rate slightly higher or lower compared to the amount that you initially paid!

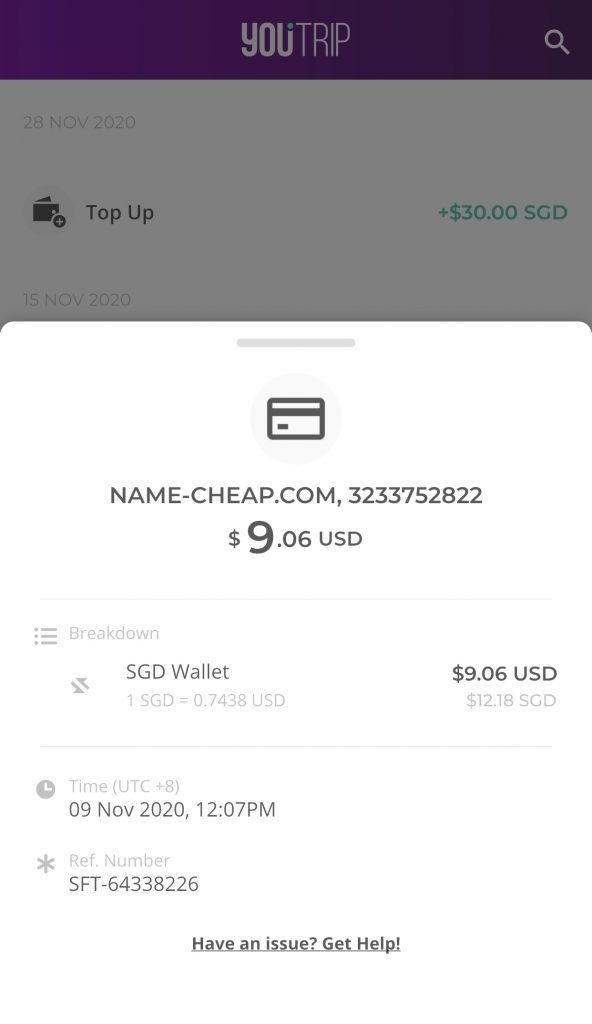

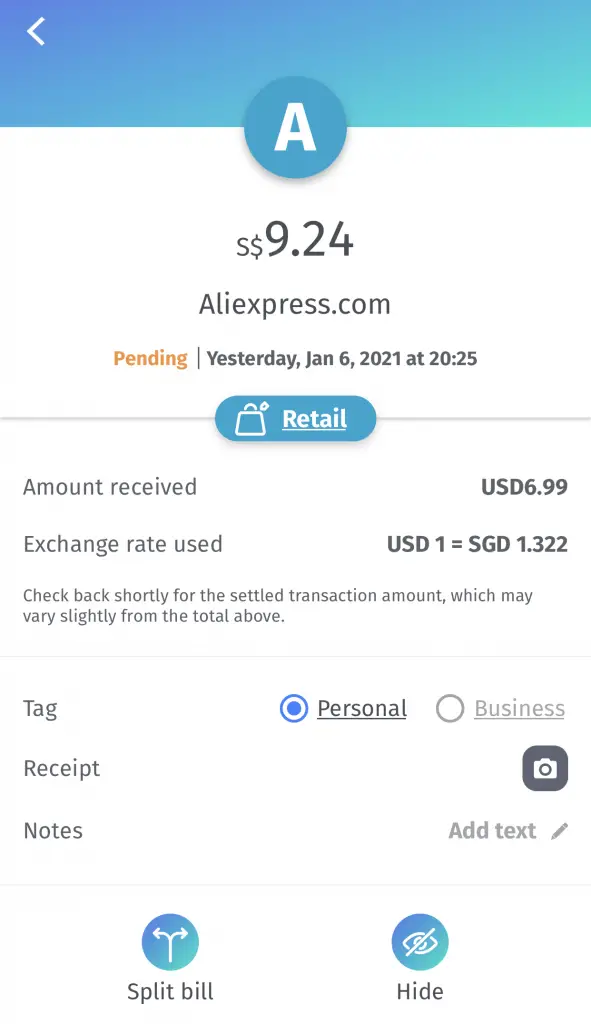

Both cards provide a breakdown of the exchange rate used

What I really like is that both cards show you the exchange rate they used when you make the transaction.

You can see this on YouTrip,

as well as BigPay.

This is something that the MCO Visa card lacks, so you’ll have to manually calculate the exchange rate!

Number of currencies

YouTrip allows you to make payments in over 150 currencies in the world. This makes it a really versatile multi-currency card!

BigPay did not mention how many currencies it supports. However, you should be able to make purchases in most of the common currencies available in the world.

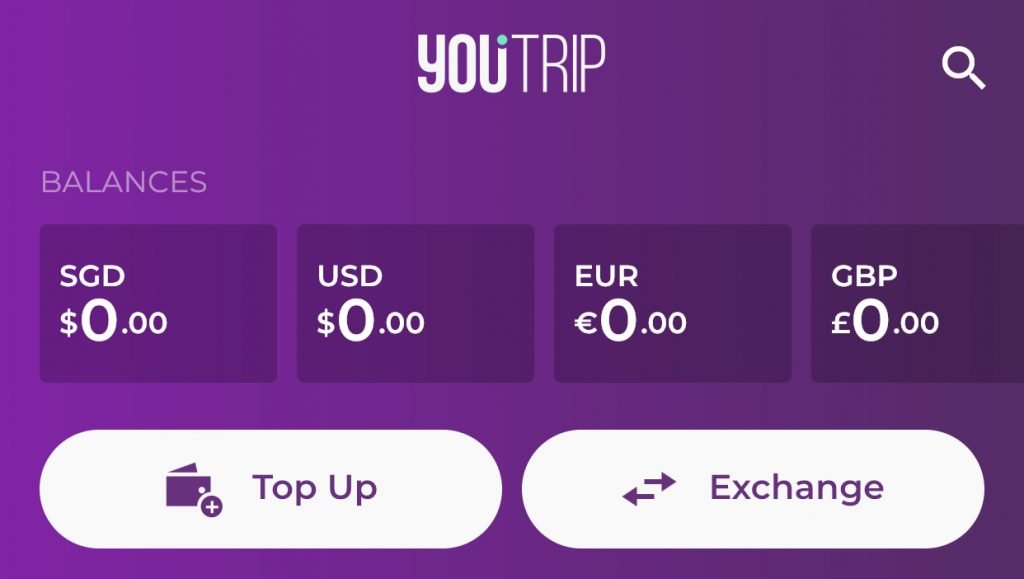

Storing other currencies

YouTrip has a special feature where it allows you to store other currencies in your mobile wallet.

Here are the 10 currencies that you can store in the mobile wallet:

- SGD

- USD

- EUR

- GBP

- JPY

- HKD

- AUD

- NZD

- CHF

- SEK

This allows you to lock in a good exchange rate for a certain currency!

BigPay does not have this feature

BigPay does not allow you to store any other currencies in your mobile wallet besides SGD.

As such, your money will only be dynamically converted when the merchant completes the transaction.

Withdrawal to bank account

YouTrip does not provide you with an option to withdraw your money from the mobile wallet. Once you’ve topped up your YouTrip wallet, the only way that you can use the money is to spend it!

This is similar to other mobile wallets like Razer Pay which lock up your money too.

The only way that you can receive the money from your mobile wallet is by closing your YouTrip account. However, you will need to pay a $10 processing fee!

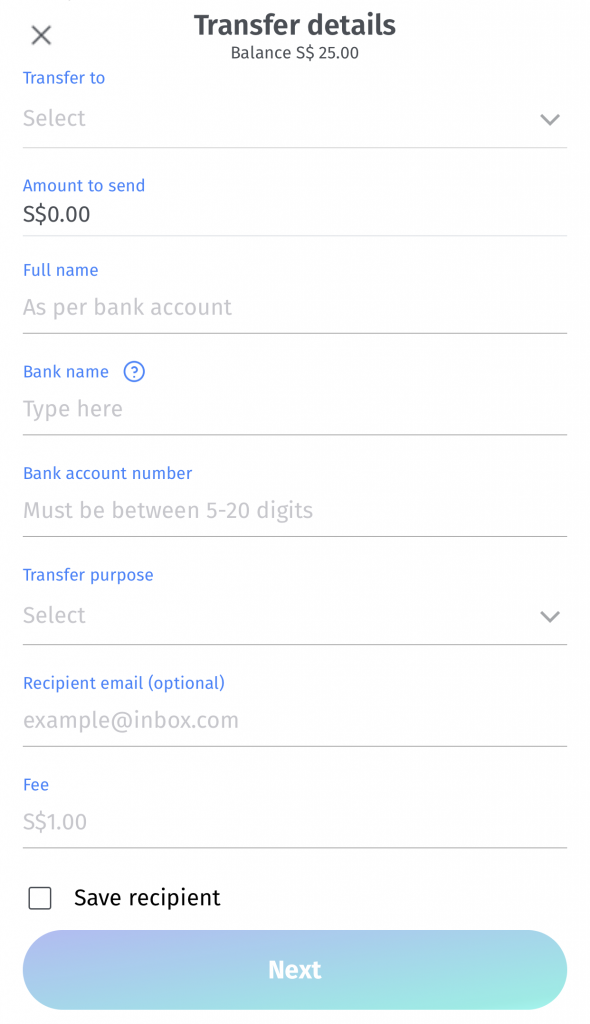

BigPay allows withdrawals to bank account for a $1 fee

You can send the money in your BigPay wallet to a local bank account.

However, you will be charged a $1 fee for any transfer!

Despite this fee, you are still given that option to withdraw your funds. As such, this makes BigPay slightly more flexible.

Sending money

YouTrip does not have any features that allows you to send money to other accounts.

However, BigPay does have certain features:

#1 Send to friends or split a bill

You are able to send money to your friends or split a bill with them.

However, your friends will need to have a BigPay wallet too for this function to work.

This is different from Google Pay which allows you to send money to your friends, even if they are not using Google Pay!

Google Pay will send your money to your friend’s bank account that is linked via PayNow.

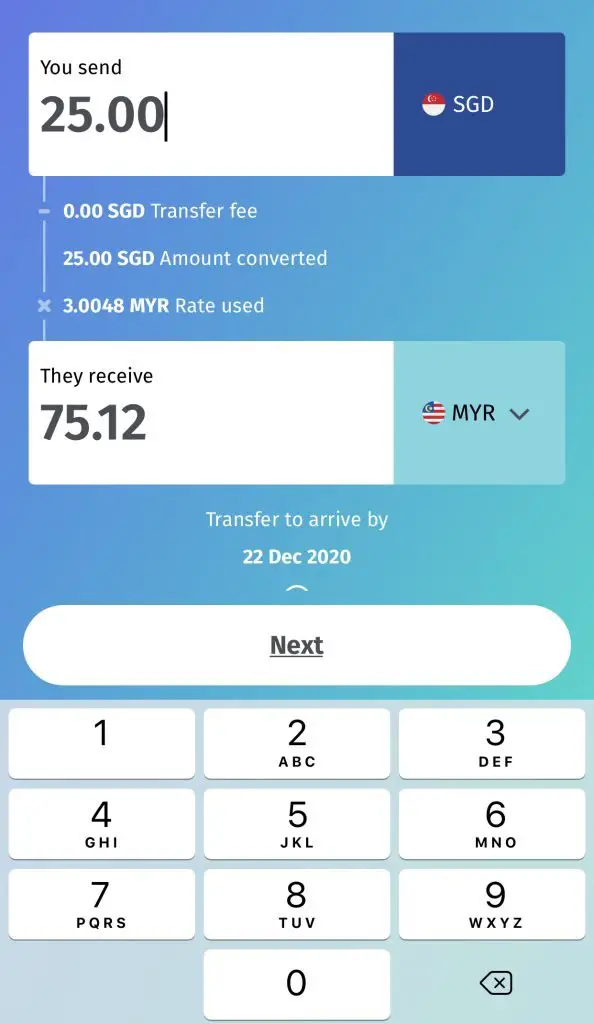

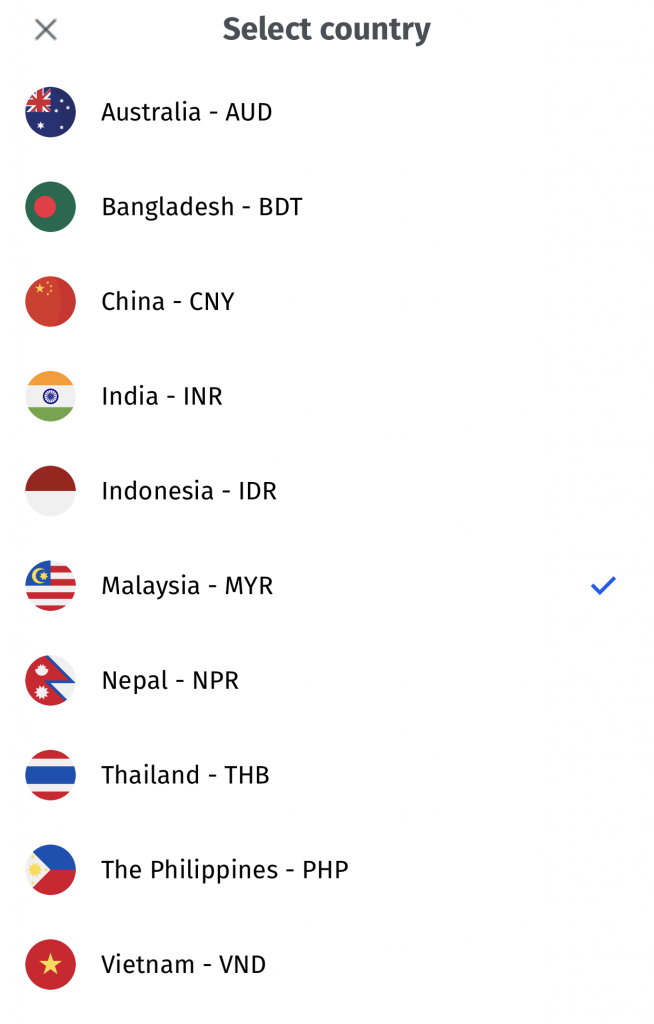

#2 International bank transfer

You are also be able to make an international bank transfer with BigPay. You can see the exchange rate and fees that BigPay will charge you.

There are 10 different countries where you can make a transfer to:

- Australia (AUD)

- Bangladesh (BDT)

- China (CNY)

- India (INR)

- Indonesia (IDR)

- Malaysia (MYR)

- Nepal (NPR)

- Thailand (THB)

- The Philippines (PHP)

- Vietnam (VND)

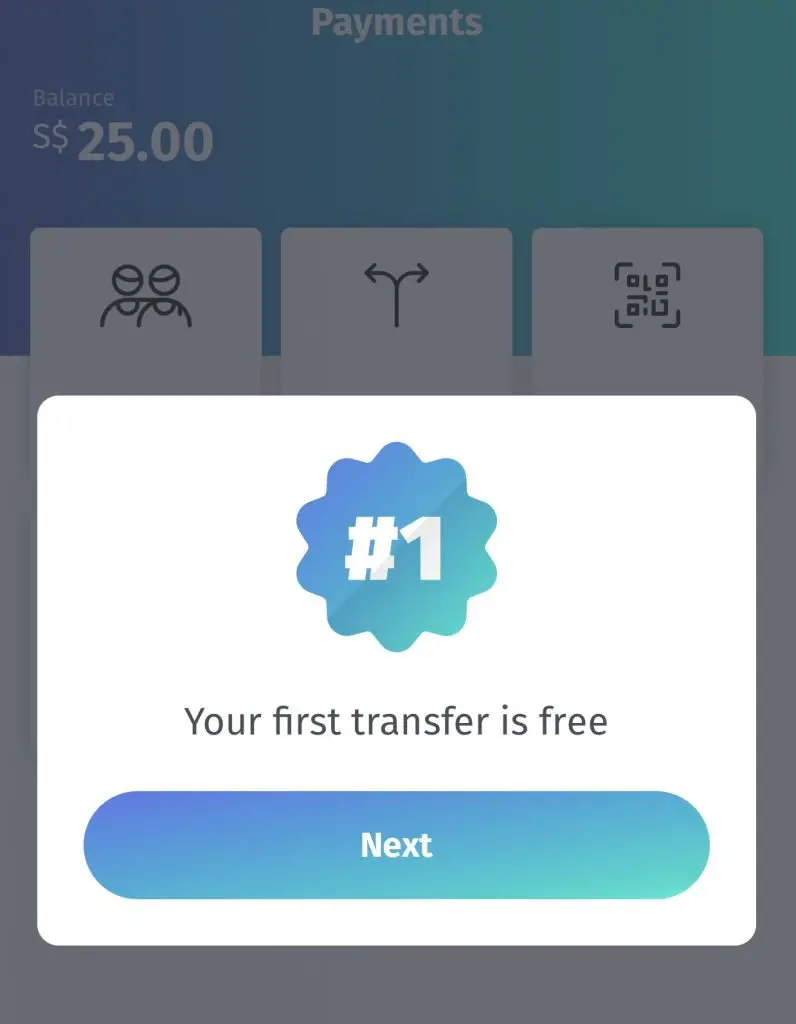

For your very first international bank transfer, you will not be charged any fees.

For any subsequent remittances, you will be charged a fee based on the country that you remit to.

| Country | Remittance Fee |

|---|---|

| Malaysia | SGD$1 |

| Indonesia Nepal India Bangladesh | SGD$3 |

| Vietnam | SGD$4 |

| Thailand | SGD$5 |

| Australia | SGD$6 |

| China | SGD$8 |

These remittances fees are a flat fee instead of other services that charge you a percentage. As such, the higher the amount that you remit, the more worth it the remittance fee will be.

ATM withdrawal

Both cards do not allow you to withdraw your money from Singapore ATMs. However, you are able to withdraw your money from overseas ATMs!

Here are the withdrawal fees and limits for these 2 cards:

| YouTrip | BigPay | |

|---|---|---|

| ATM Withdrawal Fee | SGD$5 or equivalent | 2% transaction fee, free for first withdrawal |

| ATM Withdrawal Limit | SGD$5,000 | SGD$2,500 |

Rewards

Both cards do not really give you that enticing rewards to use them:

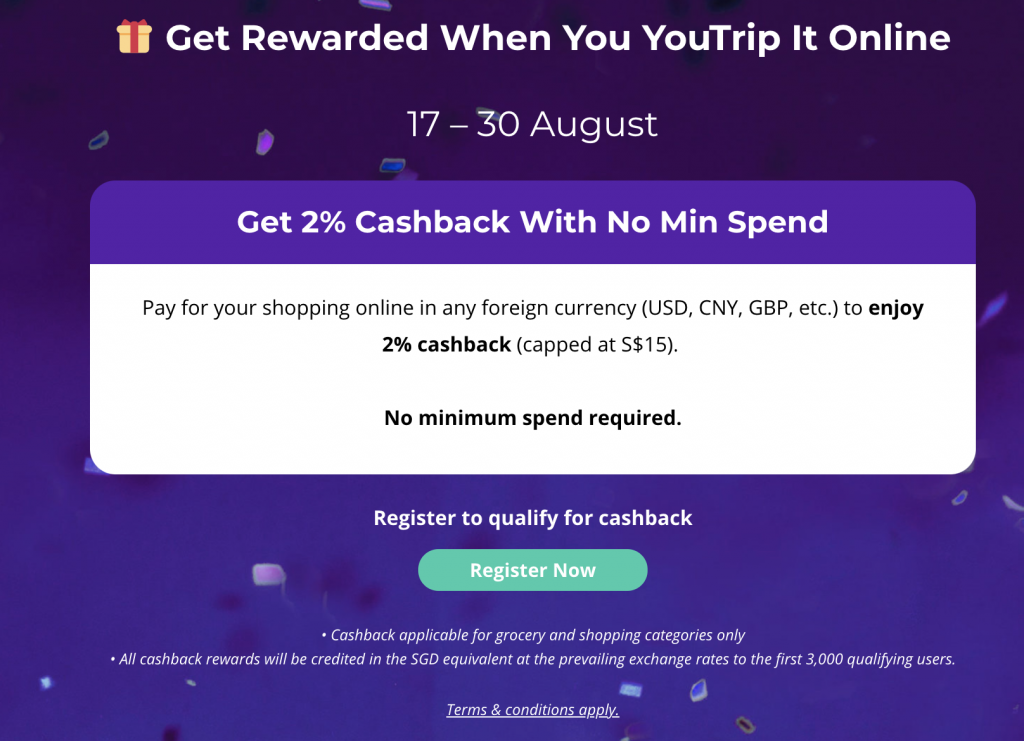

YouTrip has rather limited cashback deals

YouTrip does provide some cashback deals. However, these promotions are rather limited. The latest promotion was done in August.

Moreover, this promotion was only limited to grocery and shopping categories only.

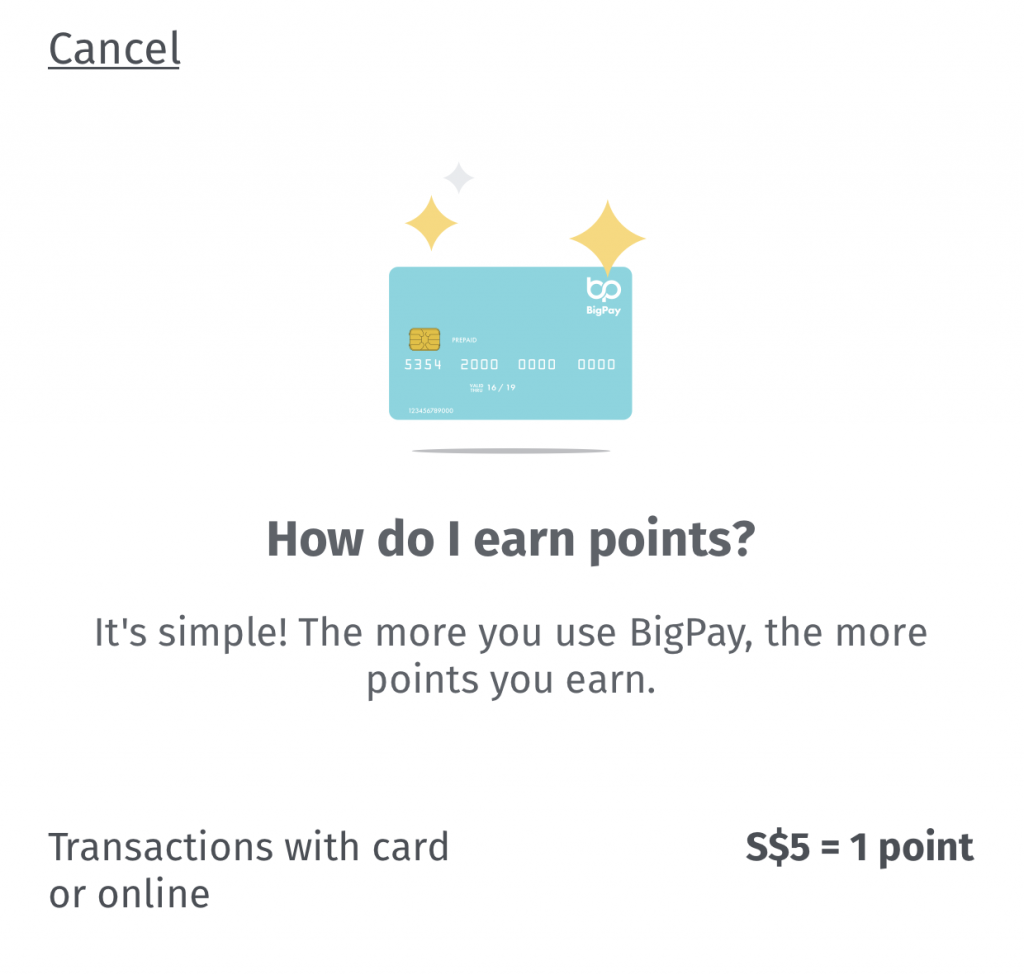

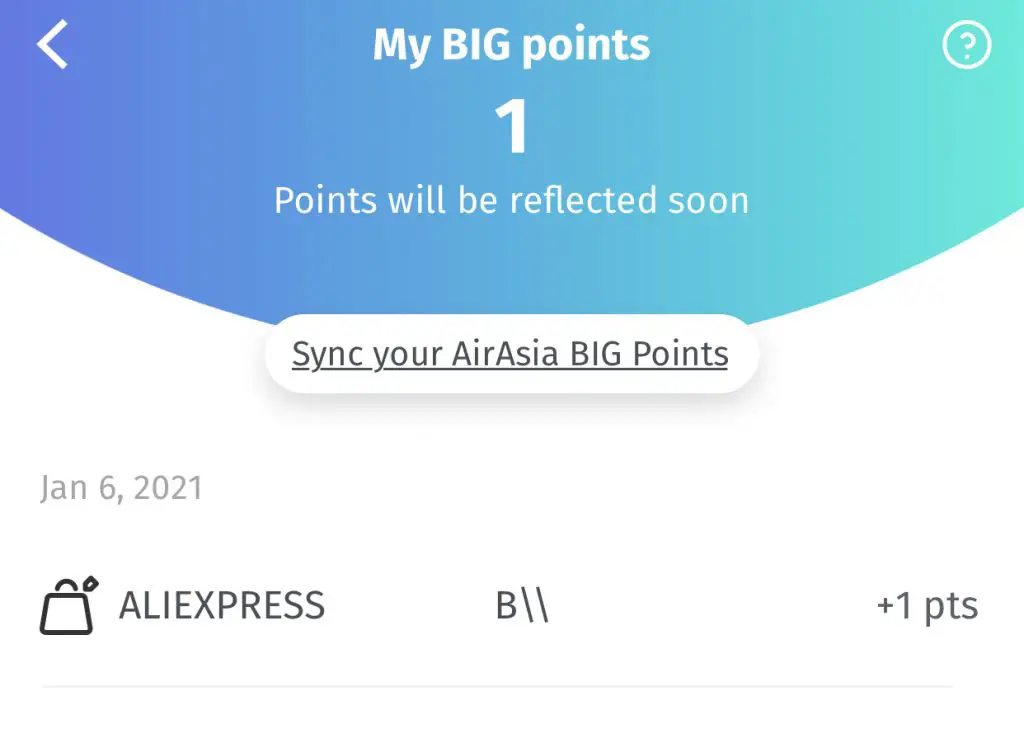

Earn AirAsia BIG points when you spend

BigPay is part of AirAsia. As such, you are able to earn BIG points when you spend using your BigPay card.

For every $5 that you spend, you will receive 1 BIG point.

Your points will be credited to your account within 5-7 working days.

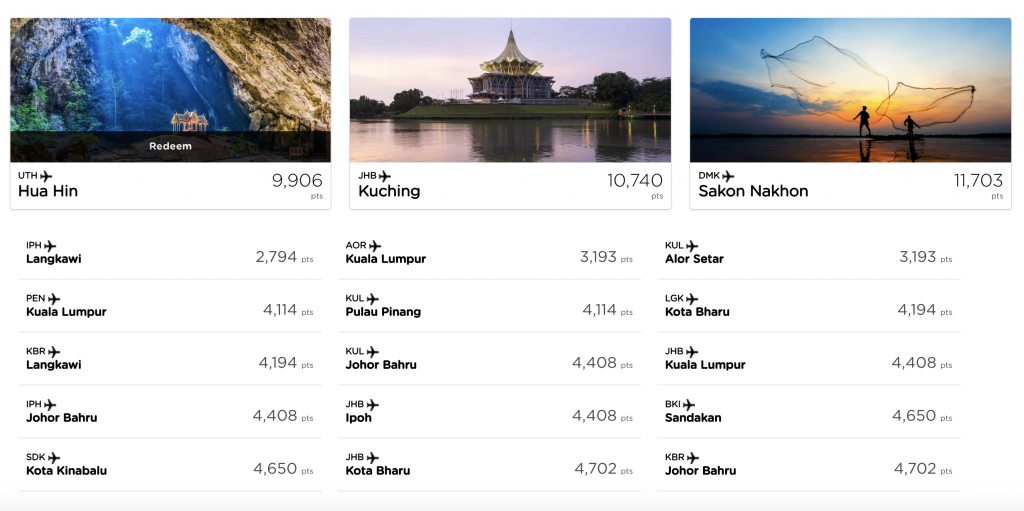

These BIG points can then be redeemed for flights to certain destinations.

The exchange rate for the BIG points is pretty low. Moreover, your points will expire within 24 months!

The good thing is that you can stack the BIG points with other rewards points you can earn, such as:

- Google Pay

- ShopBack

- Mall rewards e.g. Lendlease Plus

You can also link your BigPay Visa card to SNACK by Income to trigger micro-insurance policies.

If you already have a pre-existing BIG account, you can link it to your BigPay mobile wallet.

Receive benefits when using BigPay on AirAsia

You can receive some additional benefits when you use BigPay to book your AirAsia flights:

- Zero processing fees when you buy AirAsia flights

- Discounts on pre-booked check-in luggage and meals

- Exclusive access to AirAsia sales

Security

Both multi-currency cards have rather similar security features.

You can choose to scan your fingerprint or face to unlock the wallets. You are also required to set a PIN to open the app.

In case you lose your card, you are still able to lock your card on YouTrip,

as well as BigPay.

Verdict

Here’s a breakdown of YouTrip vs BigPay:

| YouTrip | BigPay | |

|---|---|---|

| Type of Card | Multi-currency card + mobile wallet | Multi-currency card + mobile wallet |

| Minimum Top Up | $20 | $1 |

| Local spending | Any merchant accepting contactless payments | Any merchant accepting contactless payments |

| Overseas Spending | Any merchant accepting contactless payments | Any merchant accepting contactless payments except for North Korea and Israel |

| Currency Conversion Rates | Mastercard Currency Converter | Visa Currency Converter |

| Number of Currencies | 150+ | Unknown |

| Storing Other Currencies | Yes | No |

| Withdrawal to Bank Account | No | Yes ($1 fee) |

| Sending Money | No | To friends with BigPay wallet or overseas bank account (including fees) |

| ATM Withdrawal Fee | SGD$5 or equivalent | 2% transaction fee, free for first withdrawal |

| ATM Withdrawal Limit | SGD$5,000 | SGD$2,500 |

| Rewards | Limited cashback | BIG Points |

| Security Features | Card lock | Card lock |

Since they are so similar, which multi-currency card should you choose?

Choose YouTrip if you want to store other currencies in your mobile wallet

YouTrip’s main feature that is not found in BigPay is the ability to store other currencies in the mobile wallet.

If you are constantly monitoring the exchange rates, then you are able to lock in the exchange rate when it is favourable for you!

Besides that, there is not much differences between these 2 multi-currency cards.

Choose BigPay if you want some rewards and the ability to withdraw to your bank account

BigPay has 2 main advantages over YouTrip:

- You can earn some rewards via BIG points

- You can withdraw money to your bank account for a $1 fee

Although the BIG points conversion rate is rather low, it still gives you some rewards. This may be useful especially if you want to travel via AirAsia.

Moreover, you are able to withdraw money from your BigPay mobile wallet. Although you will incur a $1 fee, it may be worth it if you are withdrawing a large amount of money.

As such, I believe that BigPay may be the more useful card compared to YouTrip!

Conclusion

With the rise of multi-currency cards, you no longer need to pay hefty fees when making overseas transactions.

Both YouTrip and BigPay are useful cards to have around. However, I believe that BigPay has the edge due to the withdrawal function.

👉🏻 Referral Deals

If you are interested in signing up for any of the products mentioned above, you can check them out below!

YouTrip Referral (Receive $5 when you sign up)

If you are interested in signing up for a YouTrip account, you can use my referral link.

You will receive $5 in your YouTrip account after making your first top-up to the account.

You can view more details of this referral program on YouTrip’s website.

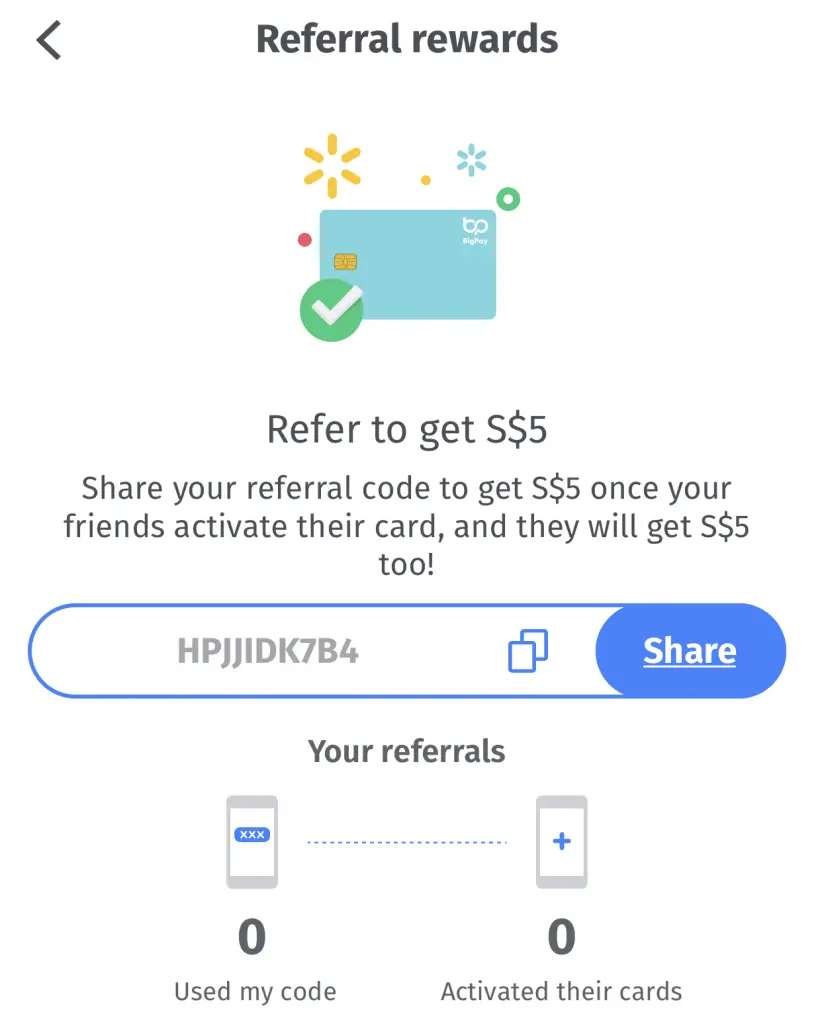

BigPay referral code (Get $5 credited to your BigPay account)

If you are interested in signing up for the BigPay card, you can use the promo code ‘HPJJIDK7B4‘ when you sign up. You will receive $5 in your BigPay wallet after you’ve activated your card!

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?