Last updated on June 6th, 2021

You may have heard about IWDA being one of the ‘best ETFs’ to invest in. However, it is listed on the London Stock Exchange (LSE), instead of the US exchanges.

One of the ways that you can buy stocks on the LSE is by using Standard Chartered’s Online Trading Platform.

But how do you go about using this broker?

Here’s what you need to know:

Contents

- 1 How to buy IWDA using Standard Chartered

- 2 #1 Create a bank account with Standard Chartered

- 3 #2 Sign up for an Online Trading Account

- 4 #3 Transfer money to your USD Securities Settlement Account

- 5 #4 Fill up your Customer Account Review (CAR) Declaration form

- 6 #5 Search for IWDA.LSE on the trading platform

- 7 #6 Enter your trade details

- 8 #7 Confirm your trade

- 9 #8 Settle the trade amount

- 10 Conclusion

How to buy IWDA using Standard Chartered

Here are the 8 steps you’ll need to take to buy the IWDA ETF on Standard Chartered:

- Create a bank account with Standard Chartered

- Sign up for an Online Trading Account

- Transfer money to your USD Securities Settlement Account

- Fill up your Customer Account Review (CAR) Declaration form

- Search for IWDA.LSE on the trading platform

- Enter your trade details

- Confirm your trade

- Settle the trade amount

#1 Create a bank account with Standard Chartered

The first step you’ll need to do is to create a bank account with Standard Chartered if you haven’t done so yet.

There are 3 main accounts that you can create:

This account allows you to transfer your money easily into your Securities Settlement Accounts.

I would suggest creating a JumpStart account if you are between 18-26 years old. It has a decent interest rate, and you get a JumpStart debit account too!

#2 Sign up for an Online Trading Account

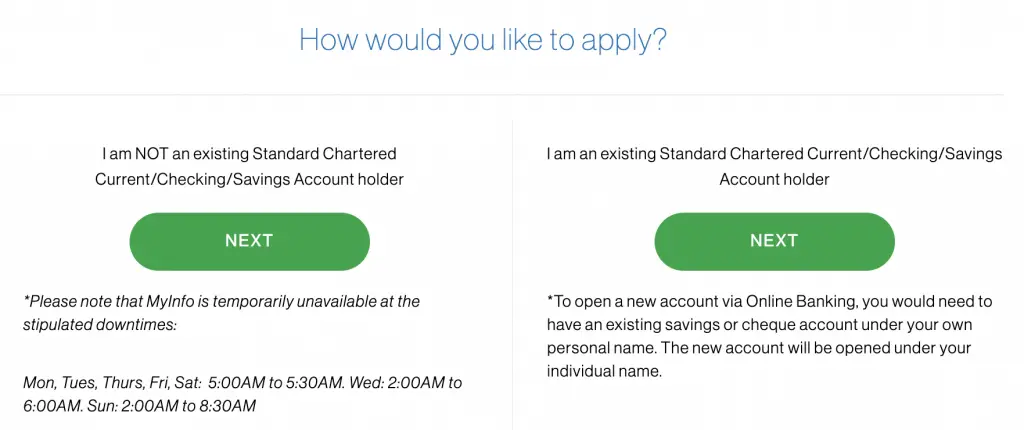

You can apply for a Standard Chartered Trading account directly from Standard Chartered’s website.

You are still able to sign up for an online account without a Standard Chartered bank account. However, it may be much more troublesome to do so!

When you are filling up the sign-up form, you will be asked to create a Securities Settlement Account.

These accounts are where your trade amounts will be deducted from. They are also denominated in different currencies, including:

- USD

- GBP

- EUR

- AUD

If you want to buy the IWDA ETF, make sure you create a USD Securities Settlement Account!

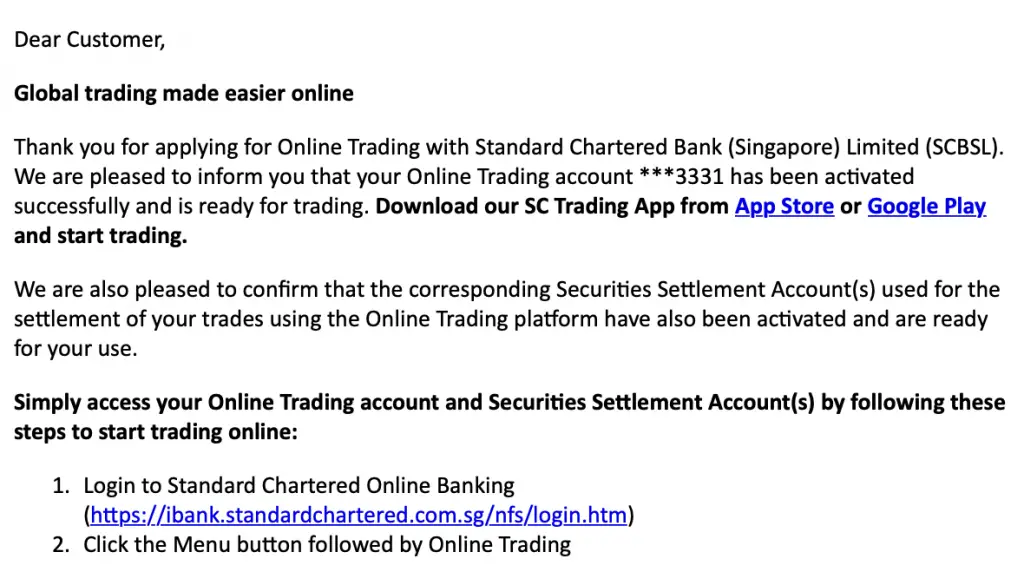

Once you finish the application, it will take around a week for your account to be activated.

You will now have 2 new types of accounts with Standard Chartered:

- Online Trading Account

- Securities Settlement Account

Your online trading account is where all of your stocks or ETFs will be held.

Meanwhile, your Securities Settlement Account is where you keep your funds to purchase the stocks or ETFs.

#3 Transfer money to your USD Securities Settlement Account

After you’ve created your accounts, you will need to fund your USD Securities Settlement Account.

This is because Standard Chartered Online Trading is like a pre-funded account. You will need to have your funds in your account first before you can make a trade.

The way Standard Chartered works is similar to the DBS Vickers’ Cash Upfront Account and Tiger Brokers.

To decide how much you should be exchanging, here’s what you need to consider:

- The current unit price of IWDA

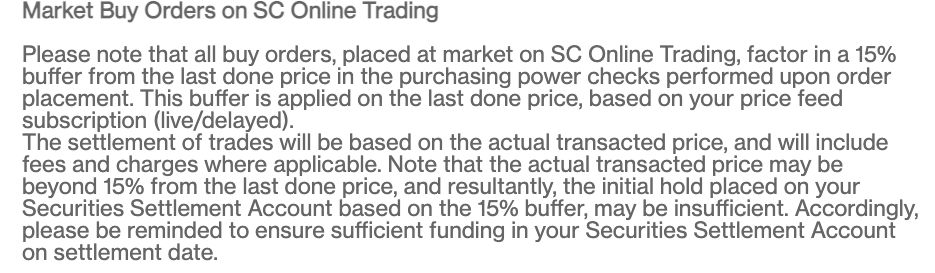

- A 15% buffer in your Securities Settlement Account

You can get the current price of IWDA on Google or Yahoo Finance. This helps to give you a gauge of the market price at this point in time.

You will also need around 15% of buffer in your Securities Settlement Account.

Due to Standard Chartered’s pre-funded nature, you can only buy the stock or ETF if you have enough money in your Securities Settlement Account.

IWDA’s price may fluctuate from time to time. To ensure that you’ll still be able to purchase it, you may need to have some buffer in your account!

This ensures that you can still buy IWDA even though the price has increased.

Here are 2 ways that you can convert your SGD into USD with Standard Chartered:

1. Transfer directly to your Securities Settlement Account

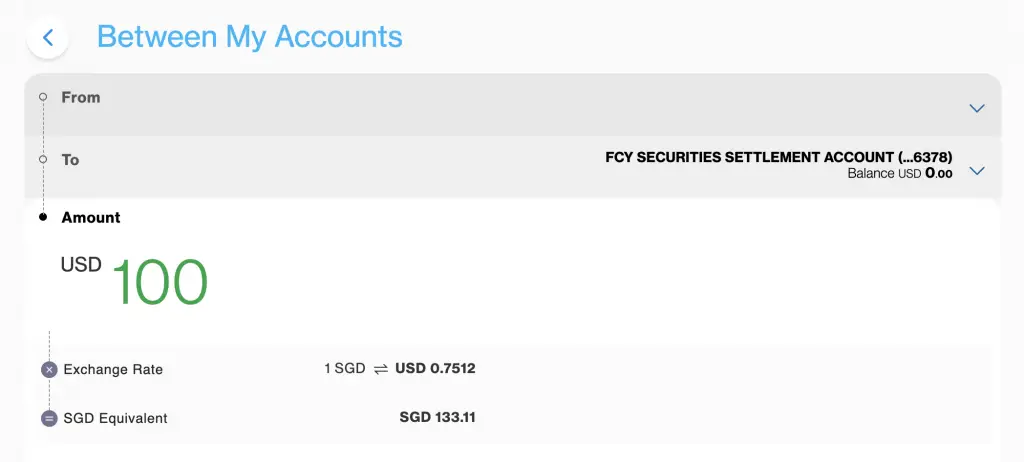

You can use the ‘Transfer Between My Accounts‘ function. This allows you to transfer from your bank account to the Securities Settlement Account.

You can choose the amount of USD you wish to have in your Securities Settlement Account.

You will be shown the exchange rate as well as the equivalent amount you’ll exchange from SGD.

The spread can be pretty high from this trade!

For example, I was trading at a rate of 1 SGD = 0.7512 USD.

When I looked at the current rate on XE, it was 1 SGD = 0.754420 USD!

This FX spread will affect how much SGD you’ll need to convert into USD!

This method of exchanging your currency is very convenient. However, it may increase the costs that you incur!

2. Using the LiveFX platform

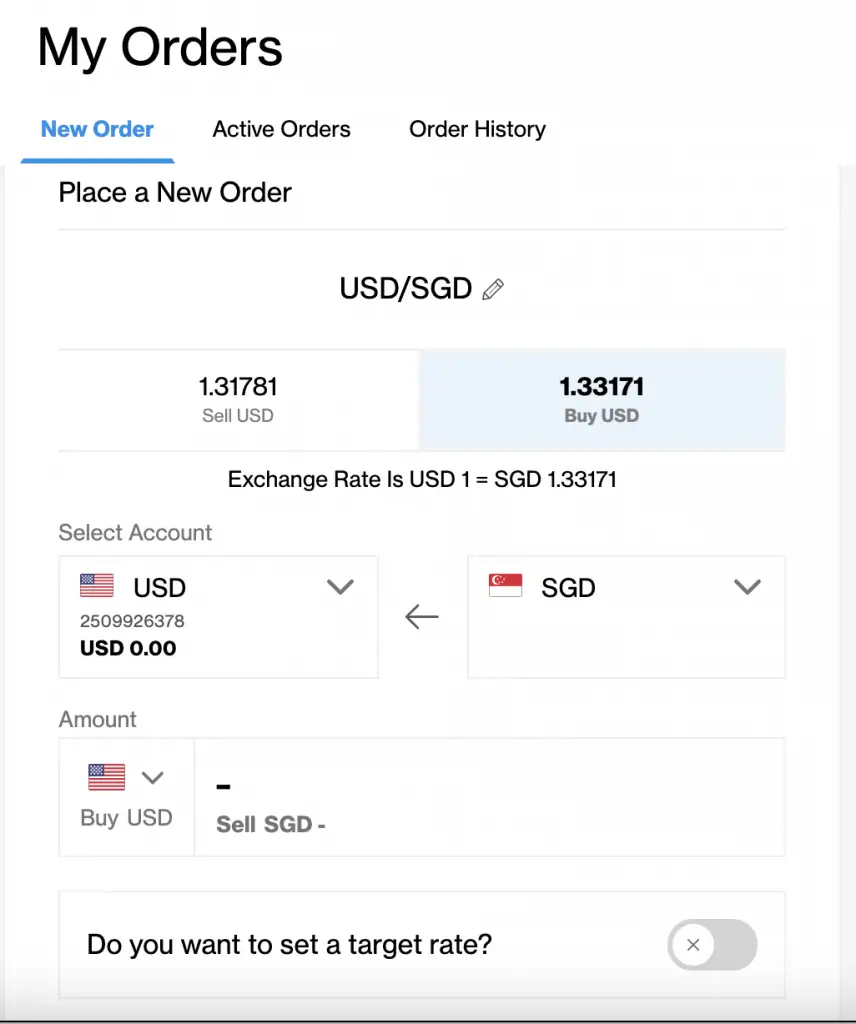

Another way that you can exchange your SGD to USD is using the LiveFX platform.

This works quite similar to a stock broker. However, you’re trading currencies instead of stocks!

You can place a buy order to convert your SGD to USD.

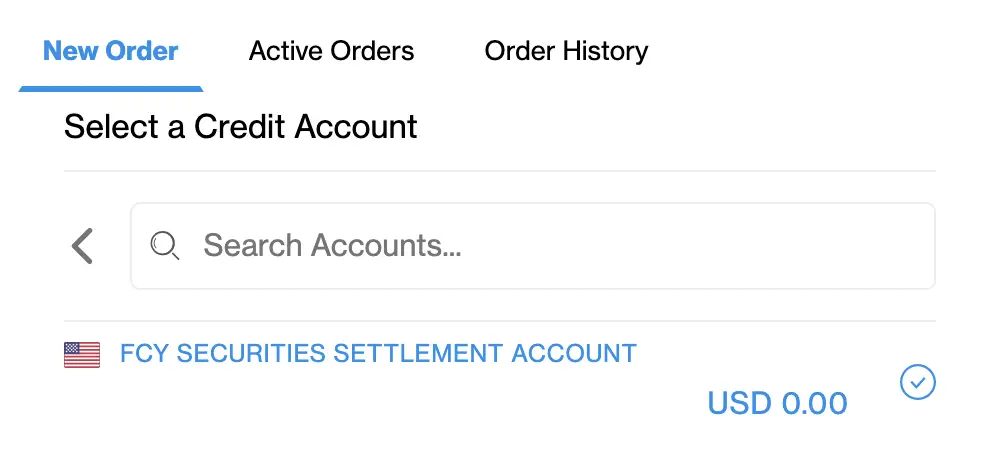

Don’t forget to choose your destination to be the USD Securities Settlement Account!

The spread is still quite high. However, you are able to trade and choose a price that you’d like to either buy or sell.

As such, you may be able to obtain a slightly more favourable exchange rate!

Once you’ve converted your SGD to USD, you will be able to start buying IWDA!

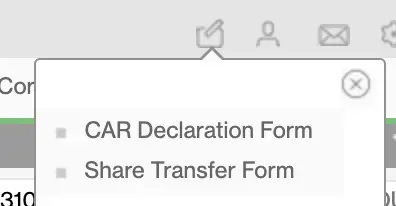

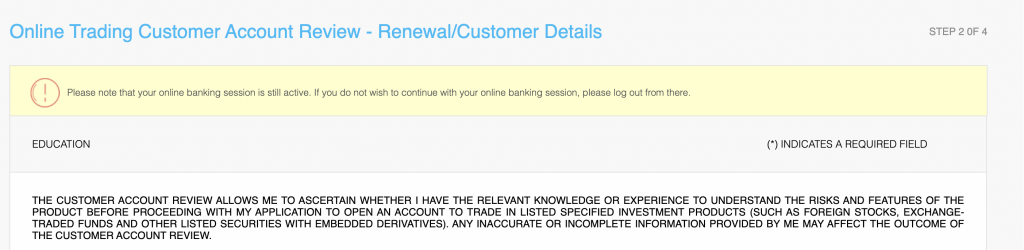

#4 Fill up your Customer Account Review (CAR) Declaration form

Before you can trade with IWDA, you’ll need to complete a Customer Account Review (CAR) Declaration form.

This will be prompted when you first launch the Online Trading platform.

However, you can also fill it up at this icon:

You will be asked certain questions to determine if you’re able to trade in overseas equities!

Once you’re done, you can finally start to buy IWDA!

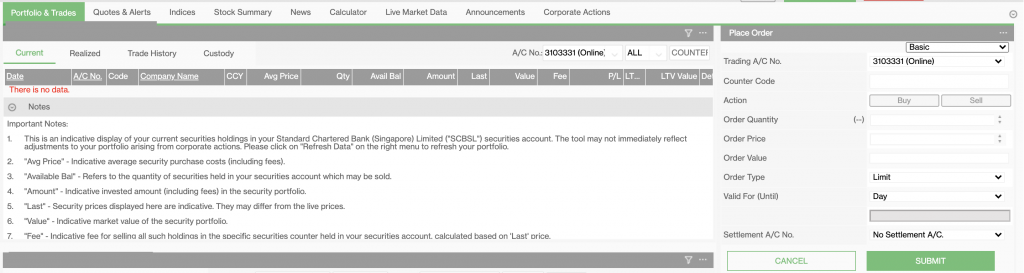

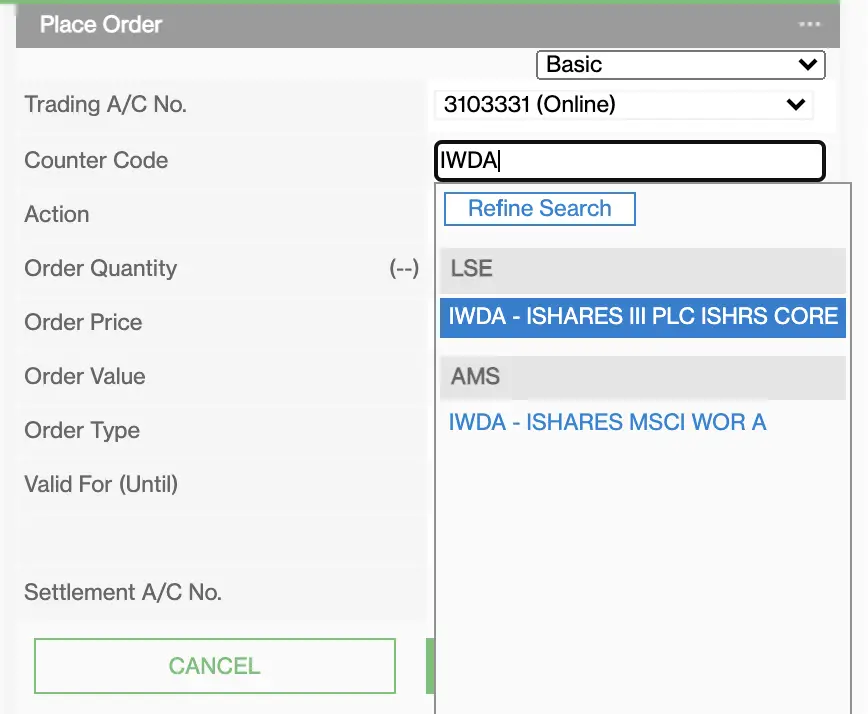

#5 Search for IWDA.LSE on the trading platform

The ‘Place Order‘ box is on the right hand side of the trading platform.

You can directly search for IWDA from the ‘Counter Code‘ box.

You may notice that there are actually 2 IWDA ETFs available on Standard Chartered.

The one that you should be looking for is the ETF that is listed on the London Stock Exchange (LSE).

The ETF listed on the Amsterdam Stock Exchange (AMS) is denominated in EUR instead of USD!

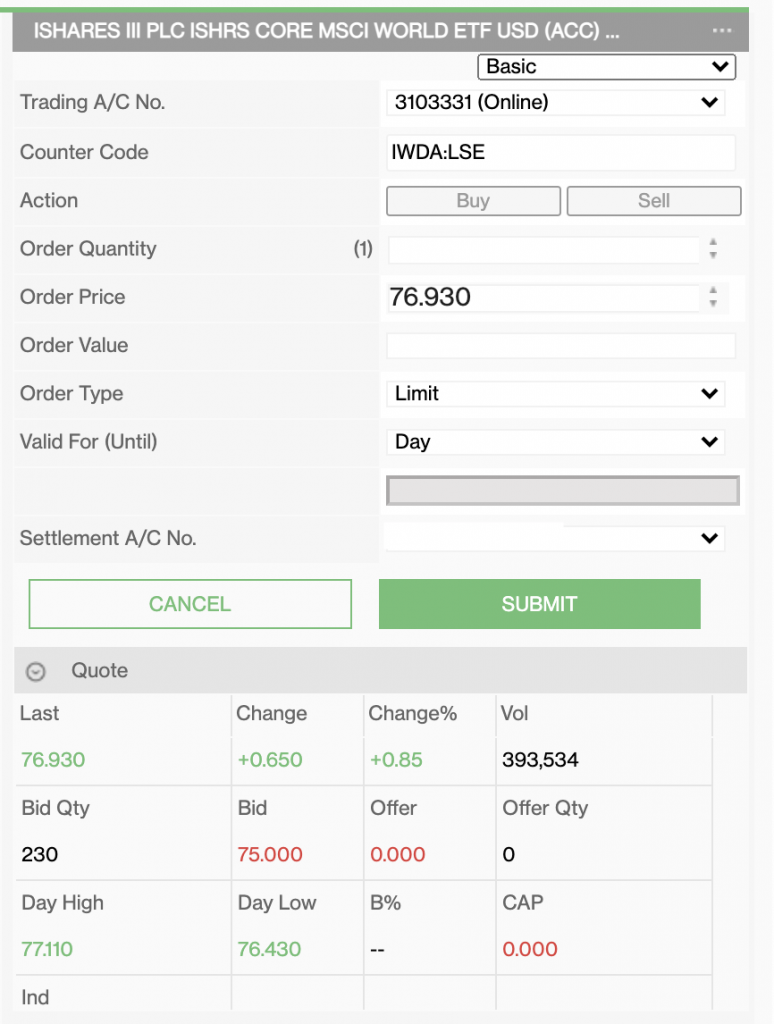

#6 Enter your trade details

Once you’ve selected IWDA on the LSE, you’ll need to enter some details to make your trade:

- Buy or sell

- Order quantity

- Order price

The order value will be automatically filled when you enter your order quantity.

The minimum lot size for the LSE is 1 unit. This makes investing in IWDA extremely accessible!

However, Standard Chartered has a minimum commission of USD $10 for each trade. It may not be worth paying such a high commission if you are just buying one unit each time!

You can check out my guide on investing in LSE stocks from Singapore to find out more options you can choose from.

The price that Standard Chartered shows on their platform may have some delays. As such, you should always check the live price either from Google or Yahoo Finance!

This helps to make your order closer to the current market price.

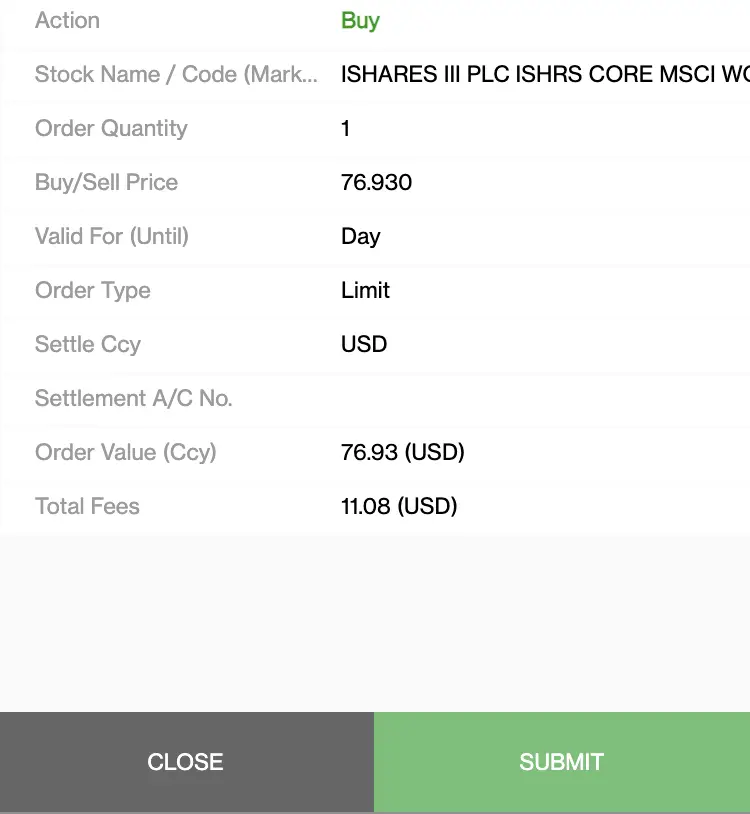

#7 Confirm your trade

You will be shown the details of your trade, as well as your trading commission.

You may see that the total fees you pay is around 11.08 USD! This includes the 1% stamp duty that is charged by the LSE.

However, the LSE does not charge any stamp duty on ETFs.

This is just a minor bug on Standard Chartered’s end.

When you actually settle the amount, you will only be charged the trading commission.

However, do remember that you’ll be charged GST on your trading commission too!

#8 Settle the trade amount

After confirming the trade details, your buy order will be queued. Once your order is matched with a seller, it will go through!

The IWDA units will be transferred to your Online Trading Account.

Meanwhile, the investment value will be deducted from your USD Securities Settlement Account.

After this is done, you’ve finally bought the IWDA ETF using Standard Chartered!

Conclusion

IWDA is a globally diversified ETF that is a great addition to your portfolio.

Standard Chartered is one of the more suitable platforms to buy IWDA. This is especially so if you are doing a lump sum investment.

If you prefer to do monthly dollar cost averaging, Interactive Brokers may be the better choice!

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?