Last updated on June 6th, 2021

You’ve decided to purchase an ETF that tracks the S&P 500 Growth Index.

However, there are quite a few different ETFs that track this index, such as IVW and VOOG.

So which one should you choose?

Contents

The difference between IVW and VOOG

Both IVW and VOOG track the S&P 500 Growth Index. These ETFs mainly differ in their fund manager (BlackRock vs Vanguard), their expense ratio and trading volume.

Here is an in-depth comparison between these 2 ETFs:

Index tracked

Both IVW and VOOG track the S&P 500 Growth Index.

The S&P 500 Growth Index consists of large-capitalization U.S. equities that exhibit growth characteristics

BlackRock

There are 3 main factors which the S&P 500 Growth Index uses to measure these growth stocks include:

- Sales growth

- Ratio of earnings change to price

- Momentum

Compared to the S&P 500, the S&P 500 Growth Index only has 232 holdings!

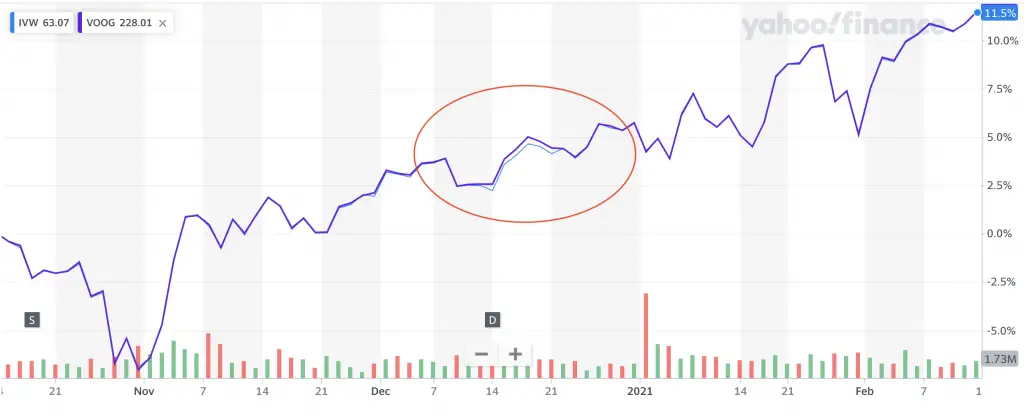

Since both ETFs track the same index, they should roughly have the same performance.

You can see this from their stock price charts.

You can read my guide to find out what do the red and green bars mean in a stock chart.

Apart from very minor changes in price, they essentially give you the same performance!

The main difference in their performance will be due to tracking error. However, this should not make much of a difference, especially if you are investing for the long term!

They are managed by different fund managers

IVW is managed by BlackRock, under the iShares family of ETFs. Meanwhile, VOOG is managed by Vanguard.

IVW was started in May 2000, which is 10 years earlier than VOOG (September 2010). This could be a reason why IVW has a much larger assets under management (AUM)!

| IVW | VOOG | |

|---|---|---|

| AUM | 33 billion | 4.88 billion |

They are listed on the same exchange

Both IVW and VOOG are listed on the New York Stock Exchange (NYSE). As such, here are some things you’ll need to consider when trading on the NYSE:

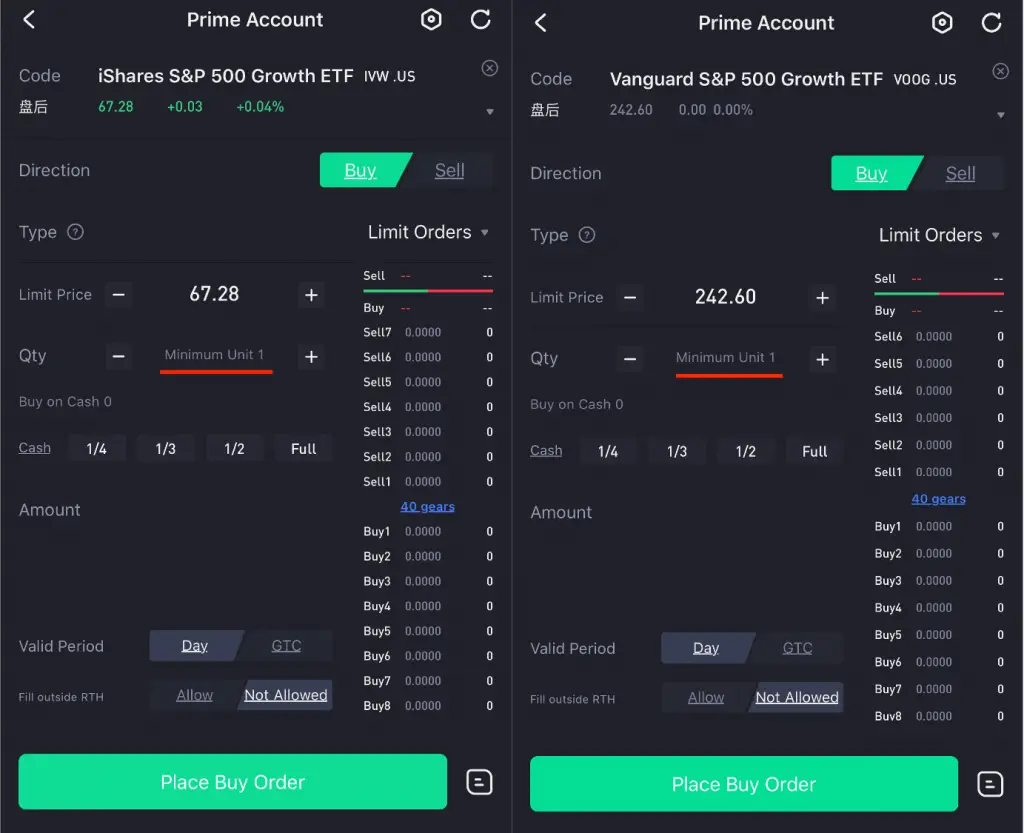

Minimum units to invest

You are required to only invest a minimum of 1 unit for each ETF.

This is similar to the LSE. Moreover, it has better accessibility compared to the SGX, which requires you to purchase in lot sizes of 100 units!

Commissions charged

When you purchase an ETF through a broker, you will be charged a certain commission for each trade you make.

As such, you’ll need to find a broker that gives you the best deal for the amount you intend to invest in!

You can consider Tiger Brokers, which charges a minimum of 1.99 USD for each trade you make.

Unit Price

The unit price of each ETF is the price you’ll need to pay for 1 unit. Both IVW and VOOG have quite similar unit prices.

| IVW | VOOG | |

|---|---|---|

| Estimated Unit Prices | USD$60 | USD$240 |

IVW seems to be slightly more accessible due to the lower unit price!

If you have a smaller investment amount, it may make sense to invest in IVW.

This is because the lower unit price gives you more flexibility in your investment amount! You can purchase IVW in multiples of around $60, while you can only purchase VOOG in multiples of around $240.

However, you’ll need to consider your broker’s commission rates to see if it’s worth investing a smaller amount!

You should not worry about the difference in the unit price. This is because both ETFs are tracking the same index. As such, their performance will be very similar!

Dividend withholding taxes

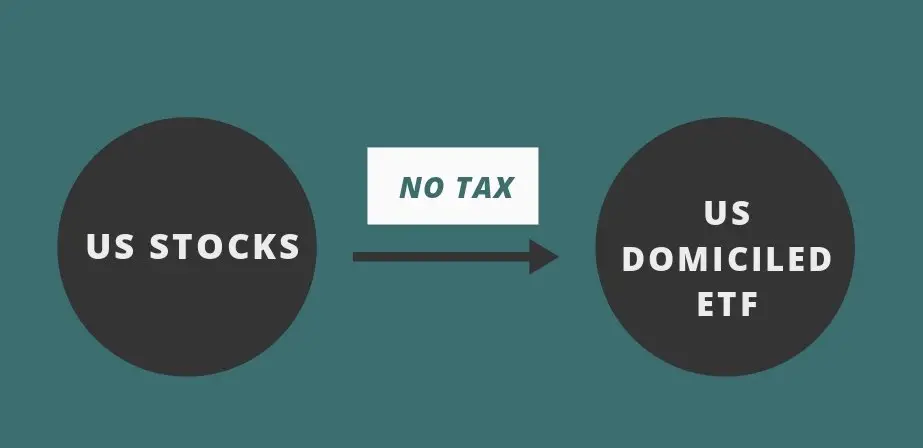

Both IVW and VOOG are domiciled in the US.

If you are a non-resident alien to the US, you will incur a 30% dividend withholding tax.

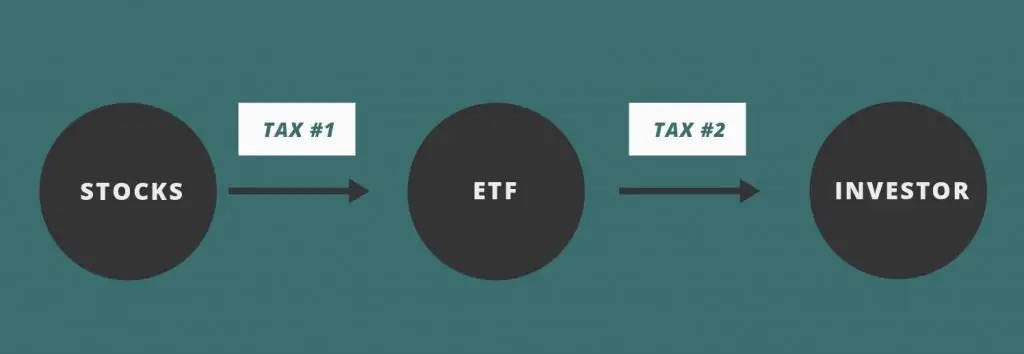

2 layers of taxes

For any ETF, the fund manager buys the stocks based on the index they are tracking. The dividends that they distribute are collected from the stocks in their fund.

As such, there are 2 layers where you may incur some taxes:

- From stock to ETF

- From ETF to you, the investor

When the stock distributes its dividend to the ETF, no tax is incurred. This is because it is from a US stock to a US-domiciled ETF.

However when the dividends are distributed to you, they will incur the 30% tax. This is because you are a non-resident alien!

If you wish to track your dividends with the taxes accounted for, you can consider trying out StocksCafe’s platform.

Dividend distribution

Both IVW and VOOG are distributing ETFs. This means that they will issue a dividend to you each quarter.

Don’t forget to factor in the withholding tax when calculating the dividends you receive!

You can read my comparison between accumulating and distributing ETFs to see how they differ.

Estate tax

Another significant cost of investing in US-related assets is the estate tax. This can go from 18% all the way to 26%!

An estate tax is a tax on the right for you to transfer your assets after you have passed on.

The estate tax is really hefty if you are a non-resident alien of the US.

Since both ETFs are domiciled in the US, they will be included in your taxable estate.

If you wish to leave behind a legacy for your loved ones, you may want to reconsider investing in these ETFs!

Expense ratio

On top of the trading commissions you’ll need to pay the broker, you will have to pay an expense ratio to the fund manager as well.

The expense ratio is charged by the fund manager to cover the costs of running the fund.

Based on the value of your assets in the fund, you will be charged an annual fee.

Here are the expense ratios for these 2 funds:

| IVW | VOOG | |

|---|---|---|

| Expense Ratio | 0.18% | 0.10% |

It is interesting that even though IVW has the larger assets under management, it is almost 2 times more expensive than VOOG!

You may think that IVW may be cheaper due to the larger economies of scale. However, this does not seem to be the case!

This difference may seem little, but it will affect you in the long run!

Liquidity

If you are looking to actively trade using these ETFs, you may want to look at their liquidity. One of the indicators you may want to look at is the ETF’s trading volume.

| IVW | VOOG | |

|---|---|---|

| Liquidity | 1.8 million | 118,000 |

IVW seems to have a much higher liquidity compared to VOOG!

Since it is more frequently traded, you should be able to buy or sell IVW at your intended price.

Verdict

Here is the complete breakdown between IVW and VOOG:

| IVW | VOOG | |

|---|---|---|

| Index Tracked | S&P 500 Growth | S&P 500 Growth |

| Fund Manager | BlackRock | Vanguard |

| AUM | 33 billion | 4.88 billion |

| Exchange | NYSE | NYSE |

| Currency | USD | USD |

| Estimated Unit Prices | $60 | $240 |

| Dividend Withholding Tax | 30% | 30% |

| Dividend Distribution | Distributing | Distributing |

| Estate Tax | Yes | Yes |

| Expense Ratio | 0.18% | 0.10% |

| Average Trading Volume | 1.8 million | 118,000 |

Both ETFs look really similar, so which one should you choose?

I am leaning more towards VOOG, mainly due to the lower expense ratio. The only drawback with VOOG is the much lower trading volume.

There is a chance that you may not be able to buy or sell at your intended price!

However, I still think that the lower trading volume is a reasonable tradeoff for a lower expense ratio.

Conclusion

Both ETFs track the same index, so their performances should be very similar.

However, I believe the VOOG is the better option. The much lower expense ratio will definitely improve your return in the long run!

Ultimately, I still think that SPYG is the best S&P 500 Growth ETF to invest in, mainly due to its even lower expense ratio!

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?