Last updated on June 6th, 2021

Do you find it hard talking to others about money?

I’ve had this problem many times. Money can be an extremely sensitive topic to some. Others may feel they do not have the adequate knowledge to discuss about it.

I feel that this boils down to financial literacy.

Being financially literate allows us to:

- Understand how money works

- Develop a positive relationship with money

There have been programmes implemented to improve literacy levels in Singapore. However, I agree with the viewpoint that much more can be done.

Read on to find out more about what financial literacy means to you and why you should strive to obtain this skill!

Contents

What is Financial Literacy?

Many countries are becoming concerned about the financial literacy levels of their citizens, especially young adults.

But what exactly is financial literacy?

Financial literacy is the ability to understand and properly apply financial management skills.

Investopedia

Basically, financial literacy encompasses everything and anything about money.

If you understand how money works, you should be able to make better financial decisions.

You’ll have greater confidence in managing your money. This allows you to achieve the financial goals you’ve set out.

Why is Financial Literacy important in Singapore?

Being financially literate helps you to make smart decisions with your money. You are able to spend your money wisely, while growing your wealth at the same time.

In a report released by OECD in 2020, it lists down some benefits of being financially literate:

- You can understand complex financial products, allowing you to distinguish between beneficial products and scams

- You can take into account the extra costs of hidden fees or in-app purchases, which can add up in the long run

- You can be financially secure, even in times of crisis

- Being financially literate may reduce the income and wealth inequalities in society

The last point is really interesting. It has been observed that lower income families are usually financially illiterate, even in Singapore. Moreover, there are not enough programmes in Singapore that focus on financial education.

Parents are usually the one to teach their children about managing finances. However, lower income families will continue to be left behind, as they do not possess this knowledge.

By improving financial literacy levels across the board, we may improve financial inclusion as well!

Also, here are some implications if you’re financially illiterate:

- If you do not understand how loans work, your debt will accumulate over time

- If you do not plan well for retirement, you may be unprepared when you’re forced to retire

- You are not taking advantage of compound interest to grow your wealth

Based on data from the World Bank, Singaporeans are saving 43% of our GDP. Apart from China and Qatar, most of the other countries above us are less developed countries.

However, we do not understand the concept of compound interest.

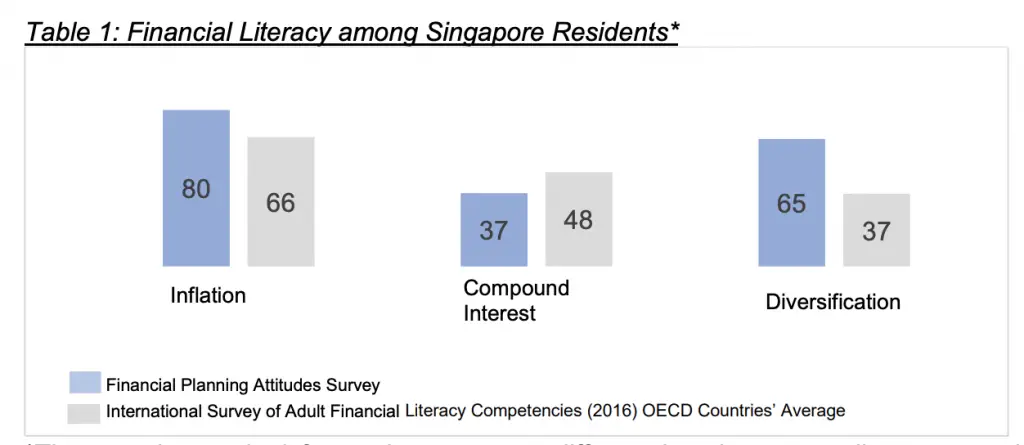

In the 2017 Financial Planning Attitudes Survey conducted by the MAS, Singaporeans were tested on basic financial literacy concepts. Their performance was benchmarked against a similar study done by the OECD.

Singaporeans fared better in understanding inflation and diversification compared to other countries. However, they fared poorly when it came to compound interest.

This possibly shows that while we are saving a lot, we are not investing our savings.

As such, most of us are losing out on a great opportunity to grow our wealth!

Financial literacy covers many different aspects, and it can seem really overwhelming.

However, I hope you can see how important this skill is, and be motivated to pick it up!

What are the key components of Financial Literacy?

In this study, they defined the aspects of financial literacy they were interested in. These came in 3 tiers:

#1 Basic Money Management

These are the fundamentals of being financially literate. Some of these aspects include:

1. Savings patterns

There are 2 main ways of saving:

- Spending all your money on your required expenses, then saving the rest

- Saving a fixed amount of your income each month, before using the rest to pay for your expenses

Ideally, you should be saving via the 2nd method.

By setting budgets and saving goals, it allows you to manage your finances better. Having budgets force you to work within these limits. This will help you to consider the opportunity costs when you wish to buy something.

By developing good saving habits, you can achieve your financial goals faster!

After building up your savings, you’ll have to decide on a saving account to place your savings in.

Most saving accounts have a base rate of 0.05% interest, which is pretty pathetic. However, some may provide higher rates, based on certain conditions you need to fulfill.

By understanding the different products out there, you can find one that best suits your needs!

I’ve reviewed some of the possible places to park your savings, such as:

2. Amount of emergency funds

Emergency funds are an important safety net for any financial plan. The amount of emergency funds you should have heavily depends on your financial situation.

It can range anywhere from 3-24 months worth of your monthly expenses!

It’s highly recommended to have certain sum of money to fall back on, as you can’t predict what will happen to you in the future.

If you want to find out more, I’ve written an article on emergency funds too.

3. Spending patterns

Cash has been the main form of transactions for a long time.

However, the government is pushing Singapore towards a cashless society. Cash may soon be a thing of the past!

There has been an increase in the number of payment options you can use. Credit cards have been around all along, and every company wants to have their own e-wallet now.

Google Pay was recently released in 2020. They are offering a $3 referral bonus for new users. You can find out more in my review on Google Pay.

Some of these payment methods gives you rewards for certain transactions you make! By understanding your spending patterns, you can maximise these benefits.

Some of these include:

- Debit and credit cards

- Cashback programmes like ShopBack

Cash may no longer be the best way to make a purchase. Making use of certain benefits will help you to get more bang for your buck!

3. Expense tracking

To understand your spending patterns, you’ll need to track your expenses first.

This is probably one of the most dreaded part of financial literacy, as:

- It is just so tedious to carry out

- You may be scared of what you’ll find, so you choose to ignore your expenses

If you wish to find out about spending patterns, you’ll have to track your expenses. There is just no way around it.

There are many apps out there that can help to make this process easier.

Also, you may find out really interesting things about your spending habits as well!

I strongly encourage you to track your expenses, at least for a month. You may be surprised at what you find!

If you wish to improve on tracking your expenses, here are 8 great tips to make it easier.

4. Loans

There may be times when you do not have the money at hand to make a large purchase. You may require to take a loan from the bank to finance it.

Repaying your loans is another ball game as well.

Knowing the different repayment methods allows you to decide the best method that suits you needs.

If you have multiple loans, there are strategies that help you prioritise which loan you should pay off first.

Loans can help you achieve certain goals you have, but only if you manage them properly. If you become mired in debt, it can greatly hinder your progress towards certain goals.

#2 Financial and Retirement Planning

Have you started on your financial plan? By setting out goals you wish to attain, it will be easier to work towards them.

One such milestone that everyone should plan for is retirement. It is one of the most significant landmarks in your life.

When you retire, you should not have to worry about having an income. Ideally, your expenses should be covered by either your savings or investments.

Here are some essential things to consider when starting your financial plan:

1. When to start to planning for your future financial needs

The best time to start was yesterday, the next best time is now.

The MAS study found that those who have not started financial planning yet tended to be:

- Students

- Unemployed

- Retirees

- Those with low income

The 2 main reasons for why this group did not start financial planning were:

- Not enough money

- It is still early

In a Financial Planning Attitudes Survey conducted by MAS in 2017, most people thought that ‘a lot of spare cash was required for financial planning‘.

This may not always be the case!

With a plan in place, you can set budgets and savings goals. This makes you more conscious about your spending habits, and you may push yourself to spend less.

You may not have a lot of spare cash now. However, if you have a plan in place and stick to it, you will eventually build up a healthy amount of cash!

In the same Financial Planning Attitudes Survey, half of the surveyed working adults (17-29 years old) did not start financial planning. Most of them thought that it was too early to start.

Retirement and financial planning may seem so far away, especially for students. In fact, this is the best time to start planning!

By doing up a comprehensive plan now, you will not have to worry much about your finances when you start work.

Just think about it: do you think you’ll have the time to plan for your finances when you’ve just started work?

Also, since you are young, you have a longer time horizon before retiring. This allows you to take advantage of the power of compounding to grow your wealth even more!

The inertia is can be really great. It is important that you take this giant step forward to kickstart your personal finance journey.

2. Whether to hire a financial advisor

A financial advisor is a professional who provides financial services to you. This can range from insurance to investments.

Having a financial advisor is great as you have a professional to manage your finances.

However, there are some things you’ll need to consider:

- Does the advisor understand your needs and can offer the best products that suits your needs?

- Can you truly trust this person? (You’ll be sharing everything about your financial life with your advisor).

- Are you able to approach them anytime and they are willing to help you out with your requests?

A survey in 2018 showed that only 10% of Singaporeans believe their financial advisor puts their interests first.

Having someone to manage your finances is a huge responsibility. You need to be sure that you can absolutely trust that person.

Moreover, a financial advisor may charge pretty hefty fees for their services.

It is very important to determine if the advisor suits your needs, before entrusting them with your finances!

3. Types of insurance plans you should have

Insurance is the wealth protection component of your financial plan. By having insurance, you are transferring your risk to an insurance company to manage it for you.

There are many insurance plans out there, each covering a specific aspect of your life.

Most of them are good to have, but it is important to only buy what you need!

Again, it boils down to opportunity cost. You may be paying for an insurance plan that you may not really need. The cost incurred is that you could use this money elsewhere, such as investing.

4. Source and amount of retirement funds you need

How much should you save for retirement? There is no arbitrary number, as it depends on your financial situation.

The best case scenario is if you can cover your monthly expenses with your savings.

It is even better if you have a passive income source that can cover your expenses!

Moreover, it would be good to have a few sources to help fund your retirement too.

Your retirement funds should follow the principle of diversification too. This ensures that no matter the scenario next time, you’ll still have enough funds to supplement your daily expenses.

Here are some possible sources for your retirement fund:

- Investments

- Savings

- Annuity Plans

- CPF

#3 Investment Know-How

Investing is an important part of growing your wealth. By making your money work harder for you, it’ll allow you to achieve your goals faster.

Here are some things you should know about investing:

1. Knowing how to invest

There are many types of instruments you can choose to invest in, and not just stocks!

If you understand how your investments work, and what platforms you should use, this can help to decide on the instruments you can invest in.

2. Factors to consider when investing

There are many different factors to consider when you start to invest.

Here are the 3 main factors I think you should consider:

- The investment’s returns allow you to reach your financial goals

- The time horizon required to reach your goal

- The investment’s risk matches your risk profile

3. Monitoring an investment’s performance

The next step you’ll need to do is to monitor your investment’s performance.

It will determine if your investments are on track to help you achieve your financial goals.

Some ways you can monitor the performance include:

- The stock’s price and valuation

- Financial statement of the company

- Reading financial news

4. Diversification

Don’t put all your eggs in one basket.

Diversification is something that can be applied to anything in life.

Essentially, you are spreading out the risk to different components, rather than relying on just one component.

Robo-advisors are a great way for beginner to start investing. They offer you diversified portfolios that are customised to your risk profile. You can check out my answers to 13 questions you may have about robo-advisors.

Even if one component fails, others may perform better which helps to balance the losses you face.

You may get a lower performance overall, but your risk is better managed. There is always the risk that the one component you rely on will horribly fail.

Unless you are absolutely sure about what you’re doing, it would be best to diversify your investments.

If you’d like to know more about how to start investing, you can find out more in my Investing Starter Guide.

Knowledge vs Action

You may have all the financial know-how to start a plan and execute it. However, are you actively applying this knowledge you have?

Learning the theory in financial literacy is not enough. Everyone has a different financial situation. There are many different factors you’ll need to consider too.

It is best to come up with a financial plan, either by yourself or with the help of a financial advisor. This tailor-made plan allows you to reach your goals, according to your needs.

How can I tell if I’m Financially Literate?

Here are 2 tests you can attempt to see if you are financially literate.

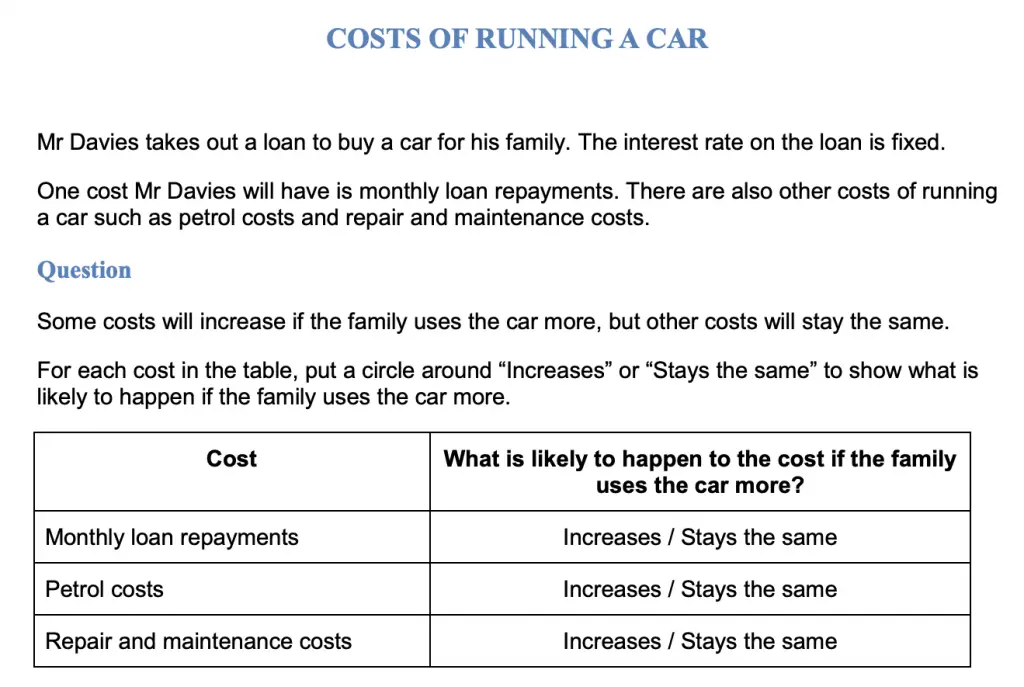

OECD PISA Financial Literacy Test

The PISA test was conducted by the OECD in 2018. Part of the test’s aim was to determine the financial literacy of 15-year-old students in participating countries.

Here are some sample questions that you can try.

It’s worth a try to see if you’re able to answer all of the questions!

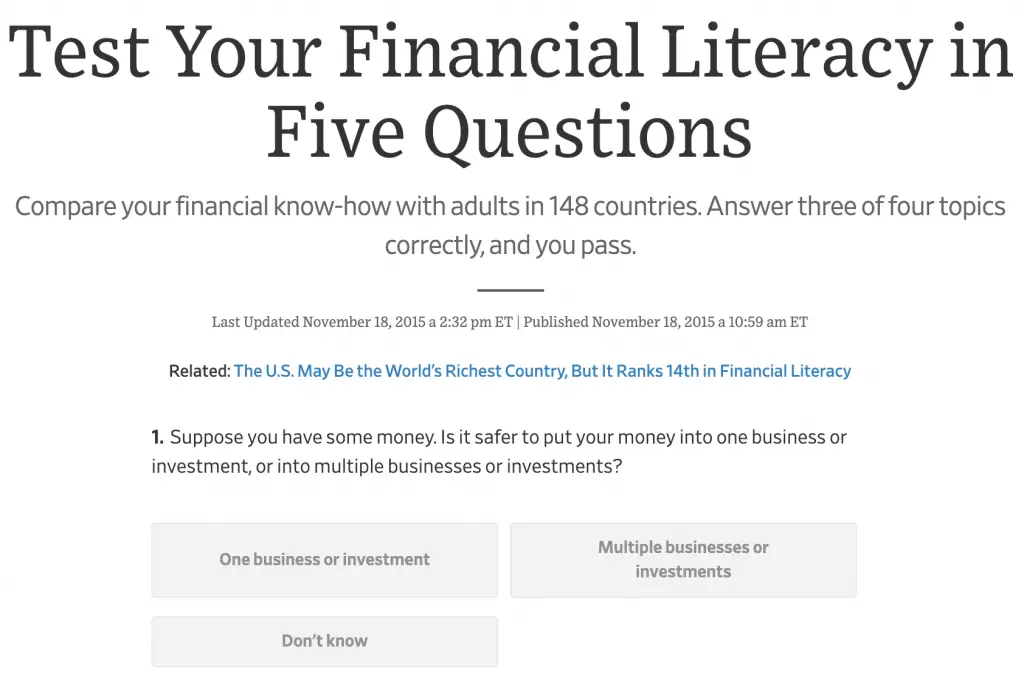

S&P’s Ratings Services Global Financial Literacy Survey

If you’d like to try a shorter test, you can try out 5 sample questions from the S&P’s Ratings Services Global Financial Literacy Survey.

The questions may be slightly easier than the PISA test. However, it’s a great indicator to see if you have a good grasp of the fundamentals!

Why is Financial Literacy not taught in schools?

We were not taught financial literacy in school.

It takes a lot of work and time to change your thinking and to become financially literate.

Robert Kiyosaki

If financial literacy is so important, then why isn’t it being taught in schools?

Here are some reasons why I think why this is the case:

- The skills taught in school are not explicitly linked to financial literacy

- Not enough qualified teachers

- Financial literacy does not really benefit the economy

- Every person has their unique financial situation

#1 The skills taught in school are not explicitly linked to financial literacy

You may have learnt about compound interest in secondary schools. If you studied economics, you’ll be familiar with the concept of inflation.

However, these are just concepts that we learn separately. They are not taught in a way that links it to personal finance. Without this links, we may not understand how such concepts can be applied in our daily lives.

I learnt about the Rule of 72 in a General Education module I took in NUS. However, I did not realise how this rule could help me grow my money until much later. If only I had invested earlier!

#2 Not enough qualified teachers

Are there enough teachers qualified to teach us about financial literacy?

The Financial Literacy Hub for Teachers was started in 2007. This program hoped to encourage teachers to integrate financial literacy into the subjects they taught.

In 2015, NIE partnered with SGX to introduce an eight-module course. This course taught teachers on the key concepts of financial literacy.

It was hoped that after learning these skills, they would be able to teach their students the importance of financial literacy.

However, would teachers be confident in teaching their students about something that they’ve just learnt?

Furthermore, the educator needs to be unbiased. Children can be easily influenced by what they are exposed to.

It is extremely important that the educator provides an impartial view on financial literacy, without promoting a specific product.

It is hard to find people who are qualified in this area. This makes it tough to conduct large-scale educational programmes for students.

#3 Financial literacy does not really benefit the economy

Does being financially literate benefit the economy? Apart from having less debt, I don’t see how else it will improve the economy.

In fact, banks may earn less since they would profit from the interest rates of the loan!

If all of us decided to adopt the FIRE (Financial Independence, Retire Early) movement, there may be less people in the workforce too.

As such, teaching financial literacy may not be the highest priority in an education system.

Instead, skills such as Science, Maths and Humanities are taught. Students are able to apply these skills in their jobs. These greatly benefits the economy, hence they will have a much higher priority.

School teaches you to be an employee.

If you want to be rich, don’t count on school.

Robert Kiyosaki’s Rich Dad

Going to school teaches you the skills to be a good employee. There are many other skills not taught in schools that are important too, such as financial literacy!

#4 Every person has their unique financial situation

This is the reason why I think financial literacy is so complex.

You may have the knowledge on personal finance, but you may not be able to apply them to your daily life.

Everyone has their unique financial situation. There is no ‘one size fits all’ answer that can be taught in schools.

This could be a reason why financial literacy is not being taught. For such courses to be truly effective, they may have to be tailor-made for each individual.

However, I still feel that the fundamentals should still be taught. If we learn to save and budget at a young age, it could really us to develop good habits that benefit us in the future.

What has the government already done to improve financial literacy?

There are 2 main ways the government has tried to improve the financial literacy of Singaporeans:

#1 Institute of Financial Literacy

The Institute of Financial Literacy (IFL) was established in 2012. There are many different workshops being offered on their site.

These free courses are usually 3 hours long, which are great for you to learn this huge topic in small chunks.

I am glad that the government sees the importance of financial literacy and is trying to teach us these skills through workshops.

However, I feel that greater promotion should be done, so that more people will be able to benefit from these workshops.

#2 Compulsory grade-free module for polytechnic and ITE students

Since 2019, all Year 1 polytechnic and ITE students are required to take a grade-free financial literacy module. These programs are conducted by MoneySense, Singapore’s national financial program.

This is a commendable effort to improve financial literacy levels in Singapore.

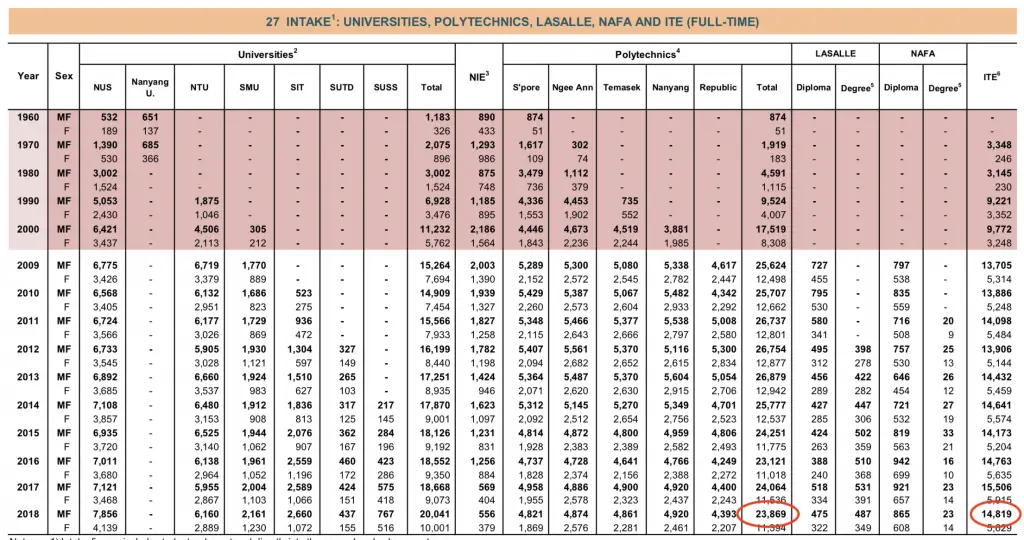

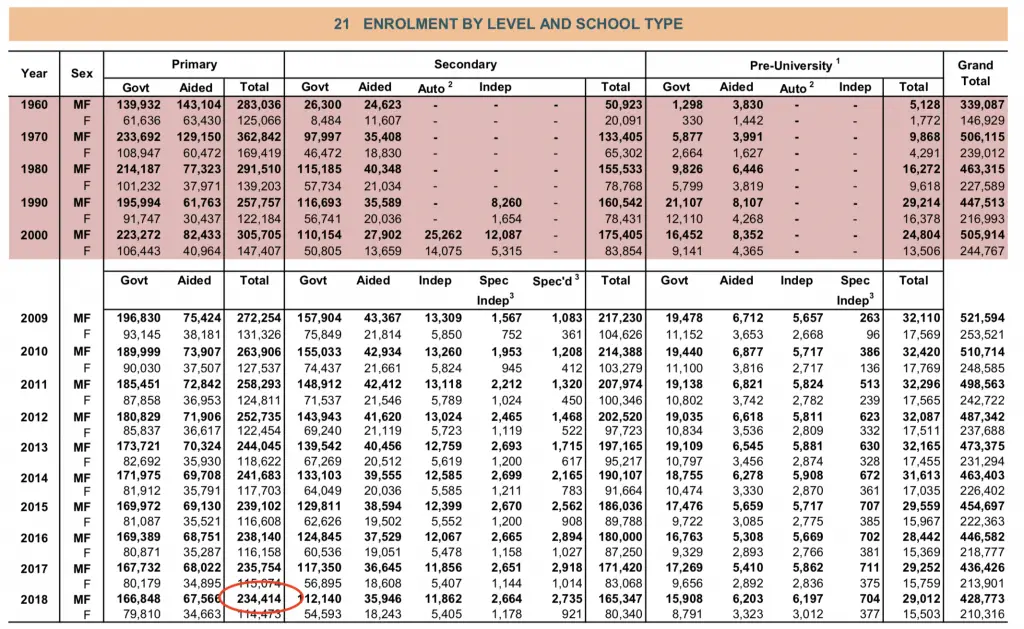

However, only a subset of students that can benefit from this program. Based on the Education Statistics Digest by the Ministry of Education (MOE) in 2019, around 40,000 students were enrolled in Polytechnic and ITE.

Meanwhile, there were 234,000 students who were enrolled into primary schools!

To have a greater impact, I strongly believe that these financial literacy programmes should be conducted at an earlier stage of our education lives. We are able to cultivate good money habits from young that will greatly benefit us in the future.

#3 Inclusion of SGFinDex

The MAS released SGFinDex in 2020 to help us to get a clearer picture of our finances. This allows us to view certain accounts all in one platform, including:

- Bank accounts from 6 different banks

- CPF, HDB and IRAS

While this is a good start, a lot more can be done to make it better. The loading of information takes a while, especially since you require SingPass to share all of your information.

I do hope that we will be able to have brokerages and insurance plans included in the platform as well. This will really make it a one-stop place to view all of your finances!

How can I improve my Financial Literacy?

The government has tried to improve financial literacy levels, but much more needs to be done.

If we truly want to improve our financial literacy, we would have to be motivated to learn it by ourselves.

There are many resources you can refer to. (Some of these resources may not be in the Singapore context, but the fundamentals still remain the same!)

Such resources include:

- Books

- Blogs

- Podcasts

- YouTube Channels

- Webinars

- Courses

- News Sites

- Online Tools

- Apps

Will so many different ways to learn, there should be one method that suits your needs!

Conclusion

Being financially literate has many advantages. This is especially so for millennials, where the future is so uncertain.

Events such as the COVID-19 pandemic may strike as at any time. These can greatly impact both our finances and employment. If we can come up with a robust financial plan, we will be more secure when faced with such situations.

It is impossible for us to learn everything about financial literacy. However, it is important to have a growth mindset and be willing to learn more.

I hope you will realise the need for you to pick up this skill. Being financially literate will benefit both yourself, as well as future generations to come!

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?

Rachel

June 8, 2020 at 1:10 pmOoooooft this is an amazing list of resources! Thanks for sharing! Already, your blog is an amazing resource in itself HAHAHA keep it up!

FI Pharmacist

June 8, 2020 at 1:21 pmThank you so much for the kind words!

Looking forward to learning from you too!

Carl

August 24, 2020 at 8:39 pmI believe numeracy and its application to financial matters can be taught to some extent in schools. I agree on the general lack of financial literacy in our education system for a long time and the problem extends beyond Gen Z to Gen Y and even Gen X – meaning the teachers themselves in Gen Y and Gen X are often clueless themselves.

Take an example, how many people truly understands the workings of CPF and all its schemes to properly evaluate their choices when it comes to their property purchase or retirement needs.

Anyway I am very heartened at least in one of our youth that he has taken the effort to understand the issues at hand and to point out available resources as solutions to it. There is some hope for our collective future after all 🙂