When you are looking to earn interest with your cryptocurrencies, 2 platforms that come to your mind include Nexo and Gemini Earn.

How do they differ from each other, and which should you choose?

Here’s what you need to know:

Contents

- 1 The difference between Nexo and Gemini Earn

- 2 Founder

- 3 Number of cryptocurrencies

- 4 Buying cryptocurrency

- 5 Exchanging cryptocurrencies

- 6 Interest rates

- 7 Nexo has a loyalty program

- 8 How you earn your rewards

- 9 Borrowers of both platforms

- 10 Deposits

- 11 No lock-in period

- 12 Withdrawal fees

- 13 Taking loans

- 14 Platform

- 15 Security

- 16 Verdict

- 17 Conclusion

- 18 👉🏻 Referral Deals

The difference between Nexo and Gemini Earn

Gemini Earn allows you to earn interest with 42 different cryptocurrencies, while Nexo offers fewer currencies at 21. For the cryptocurrencies that are common between the 2 platforms, Nexo offers higher interest rates for most currencies compared to Gemini Earn.

Here are these 2 platforms compared in-depth:

Founder

Gemini was founded in New York in 2014.

Gemini is a regulated cryptocurrency exchange that is found in 50+ countries!

Meanwhile, Nexo was founded in 2018 and its headquarters is in London.

Number of cryptocurrencies

Here are the different cryptocurrencies that you can earn with either platform:

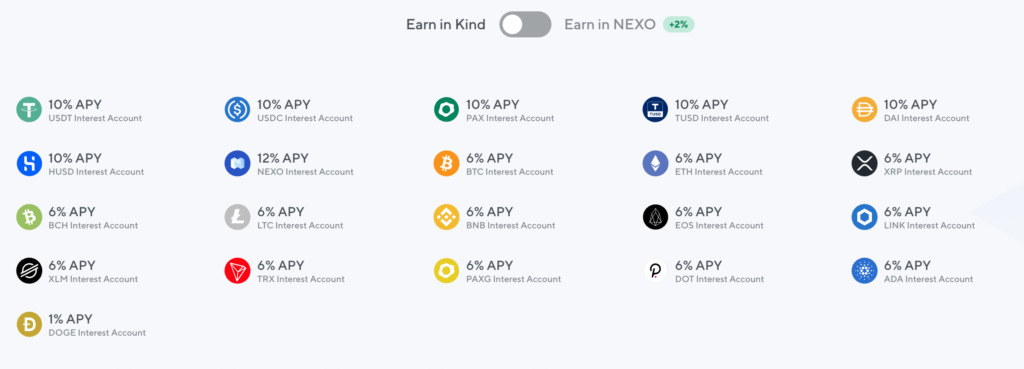

Nexo allows you to earn on 21 cryptocurrencies

You can earn interest on Nexo with 21 different currencies:

This gives you slightly more variety on the currencies compared to Gemini Earn, including:

Nexo allows you to earn interest on BNB, which is similar to Celsius.

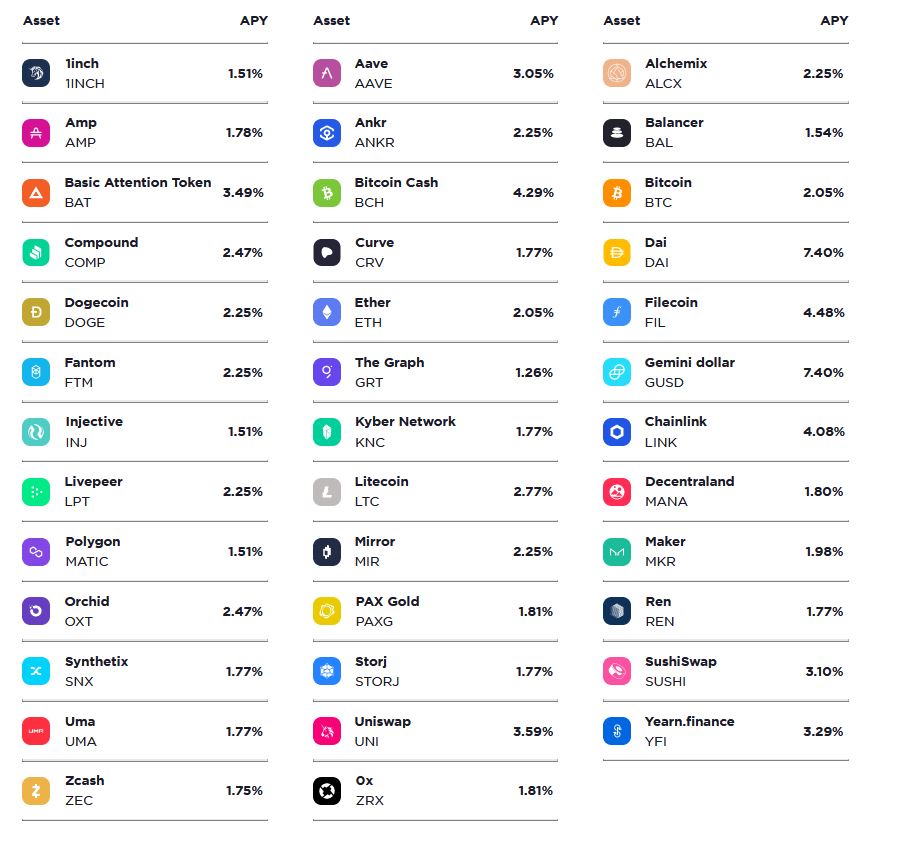

Gemini Earn allows you to deposit 42 different currencies

With Gemini Earn, you are able to earn interest in a wider variety of cryptocurrencies.

This includes:

You can earn interest on altcoins such as AXS and LUNA too.

However, the only stablecoins that you can earn interest on is DAI and TUSD.

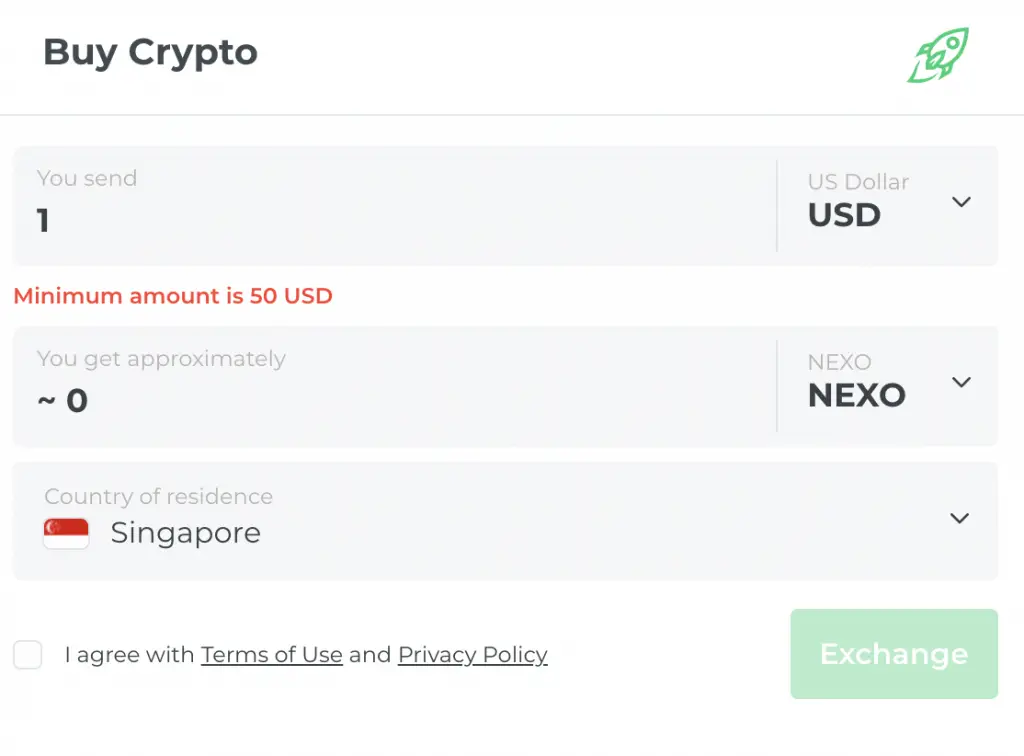

Buying cryptocurrency

If you are looking to buy cryptocurrency on Nexo, it is possible to do so. However, the only crypto that you can buy is NEXO, which is Nexo’s native token.

You are able to buy NEXO via a variety of currencies, both fiat or crypto. However, there are some currencies like SGD which are not supported.

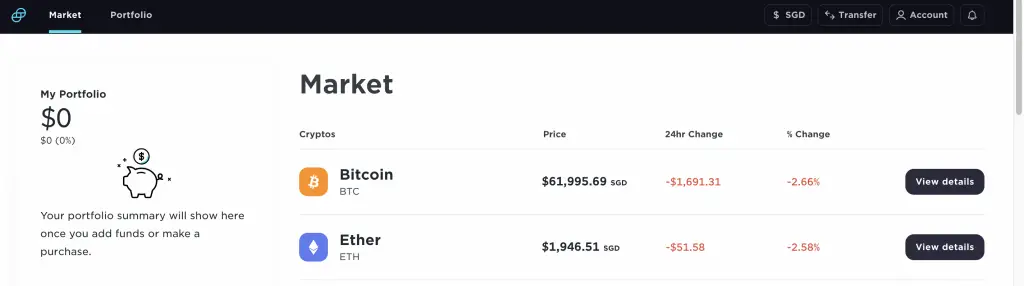

Gemini also has a whole ecosystem of crypto services that they can offer you. Apart from their Earn feature, they also allow you to buy crypto on their platform.

There are 2 ways that you can buy crypto on Gemini:

- Gemini Exchange (i.e. Instant Buy)

- Gemini Active Trader

Gemini Exchange allows you to buy crypto instantly with some fiat currencies.

However, their fees are extremely high. For every trade that you make, the fees that you’ll be charged start from 1.49%!

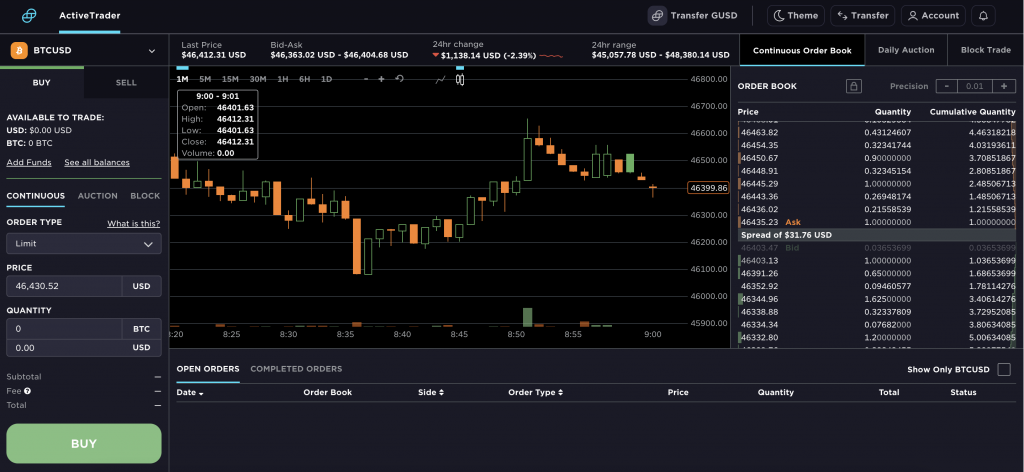

You can use Gemini’s Active Trader to lower your fees

If you are looking to lower your fees, you can consider using Gemini’s Active Trader platform instead.

The trading fees you’ll incur will be up to 0.35%, which is more than 4 times lower than the exchange!

The only drawback is that you can’t buy a variety of currencies from these 3 fiat currencies:

- SGD

- GBP

- EUR

You can only buy BTC or ETH with these currencies.

If you want to own other currencies, you’ll need to make at least 2 trades.

For example, you may want to buy LINK. You’ll have to make 2 trades from your SGD:

- SGD to BTC

- BTC to LINK

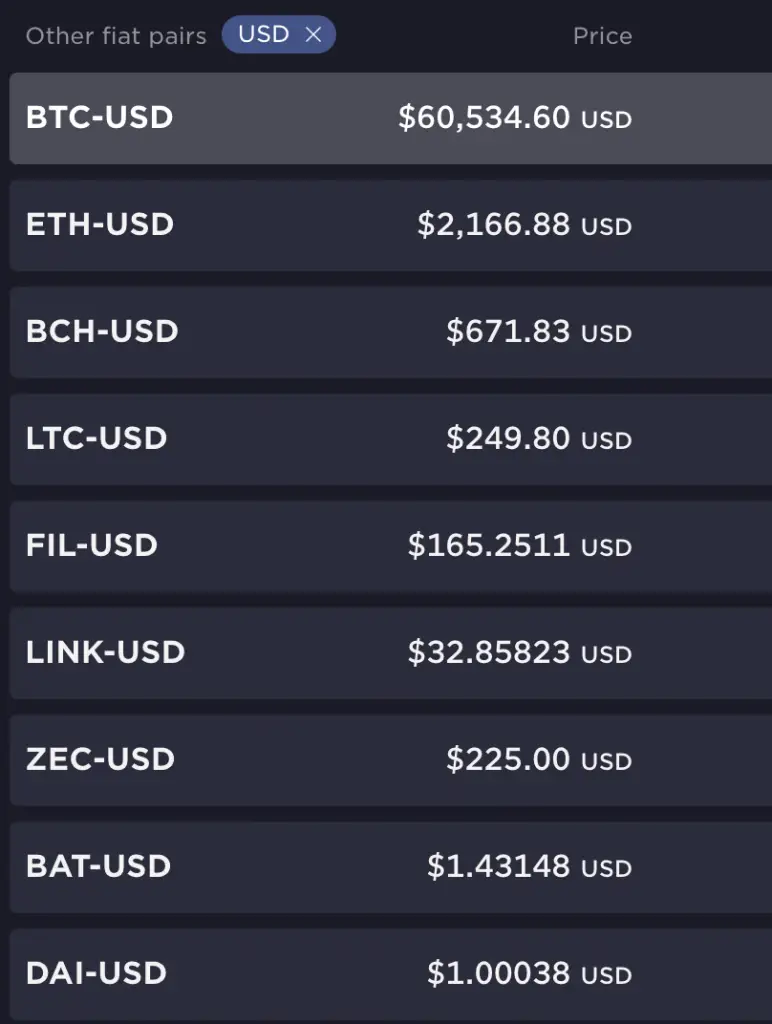

Meanwhile, you can use USD to buy a large variety of currencies.

Exchanging cryptocurrencies

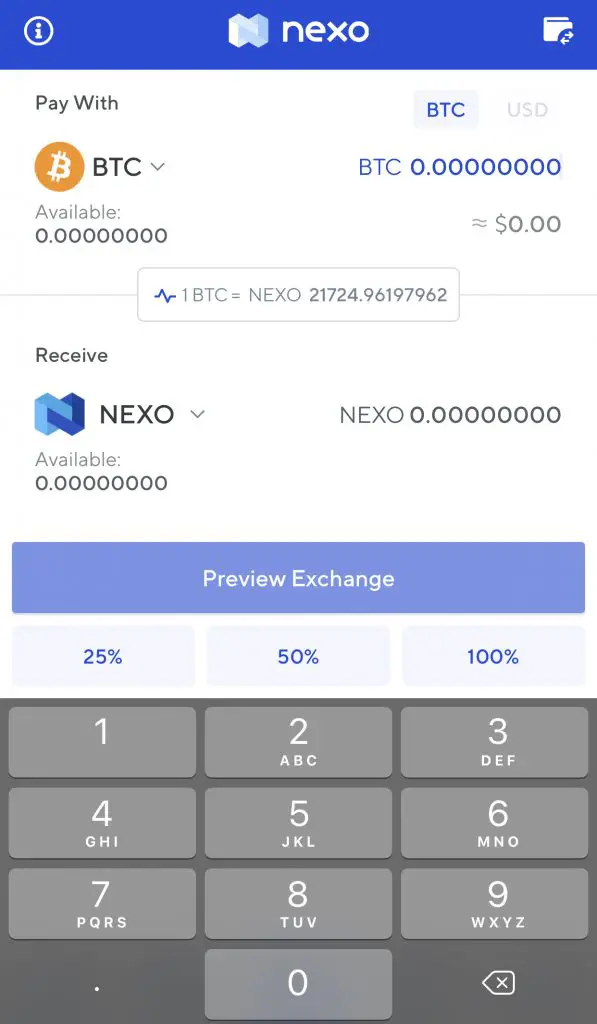

Once you’ve transferred cryptocurrencies to Nexo, you can use their exchange to trade them for other currencies.

This can be done on Nexo’s app.

For Gemini, you can swap using the app, or by Gemini Active Trader.

Active Trader would be a better place to exchange your currencies as it charges cheaper trading fees.

Interest rates

The main thing you’ll be interested in is the interest rates that either account offers you.

Gemini Earn allows you to earn your interest in-kind. Meanwhile, Nexo allows you to earn interest in 2 ways:

- In-Kind (i.e. the token that you’ve deposited)

- Earning in Nexo’s native token (NEXO)

If you choose to earn in NEXO, you are able to earn an extra 2% interest. Here are the rates of the common currencies on the platform:

| Nexo APY (In-Kind) | Nexo APY (NEXO) | Gemini Earn | |

|---|---|---|---|

| BTC | 6.0% | 8.0% | 1.49% |

| ETH | 6.0% | 8.0% | 2.05% |

| DAI | 10.0% | 12.0% | 7.55% |

| DOGE | 1% | 2% | 3.78% |

| TUSD | 10% | 12% | 6.88% |

| LTC | 6% | 8% | 2.77% |

Across the board, Nexo provides higher interest rates for most cryptocurrencies, apart from DOGE.

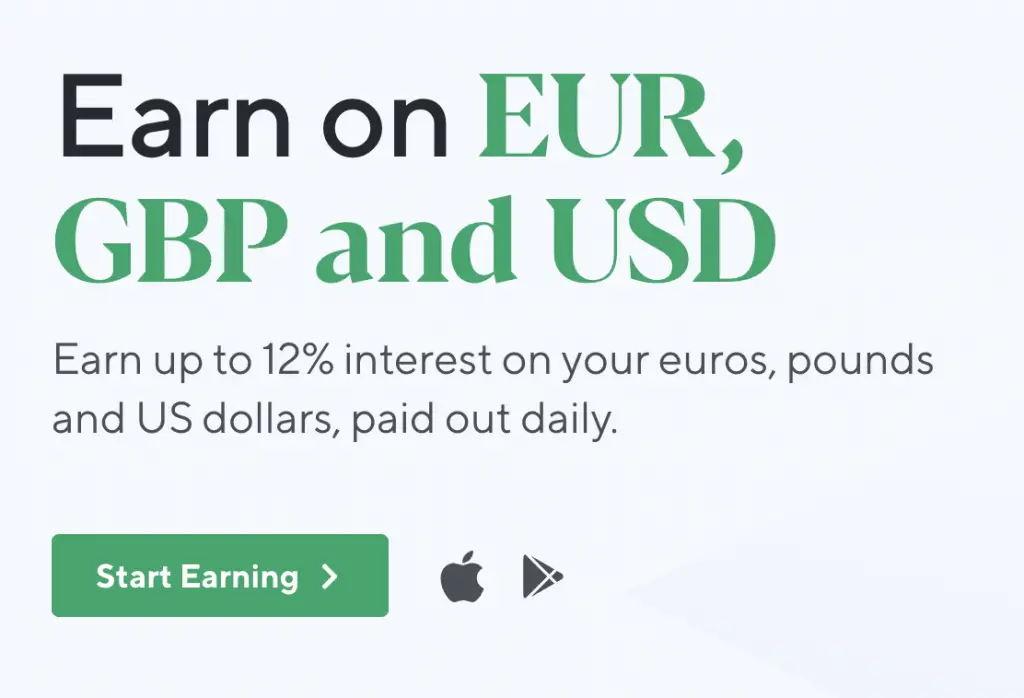

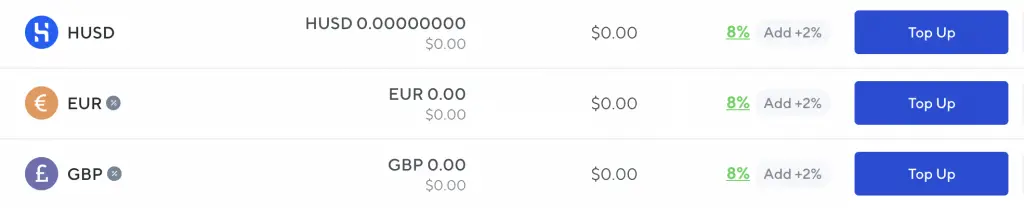

Nexo also allows you to earn interest on fiat currencies

Apart from crypto, Nexo also allows you to earn interest on your fiat currencies.

You are able to earn up to 12% APY! However, you would have to earn your interest in the form of NEXO to receive this high interest rate.

If you wish to earn in-kind, you will still get a 10% interest rate. This is still really high!

There are 3 currencies that you can earn from:

- USD

- GBP

- EUR

However, I can’t find the USD option in my account. I only have the option to deposit either GBP or EUR.

This could be because I am from Singapore.

High interest rates means high risks

While the high interest rate seems really attractive for your fiat currency, I would suggest against leaving all of your money with Nexo.

This is because the reason why Nexo can offer such a high interest rate is due to the people whom they are lending to.

You are able to take a loan from Nexo without having much requirements. The only thing that you need to provide is collateral, in case you default.

As such, there is a higher chance that a lender may default from their payment! This is why Nexo offers such high interest rates on your money.

If you are aware of the risks involved, then you can place some of your money inside Nexo.

However, I strongly recommend not to treat Nexo like a savings account and leave all of your money inside!

Nexo has a loyalty program

Nexo has a loyalty program, which gives you perks depending on the amount of NEXO that you own.

How you earn your rewards

For Gemini Earn, your interest is calculated and compounded daily. With this daily compounding effect, you are able to receive even higher returns!

However, the interest will only be credited to you at the start of each month.

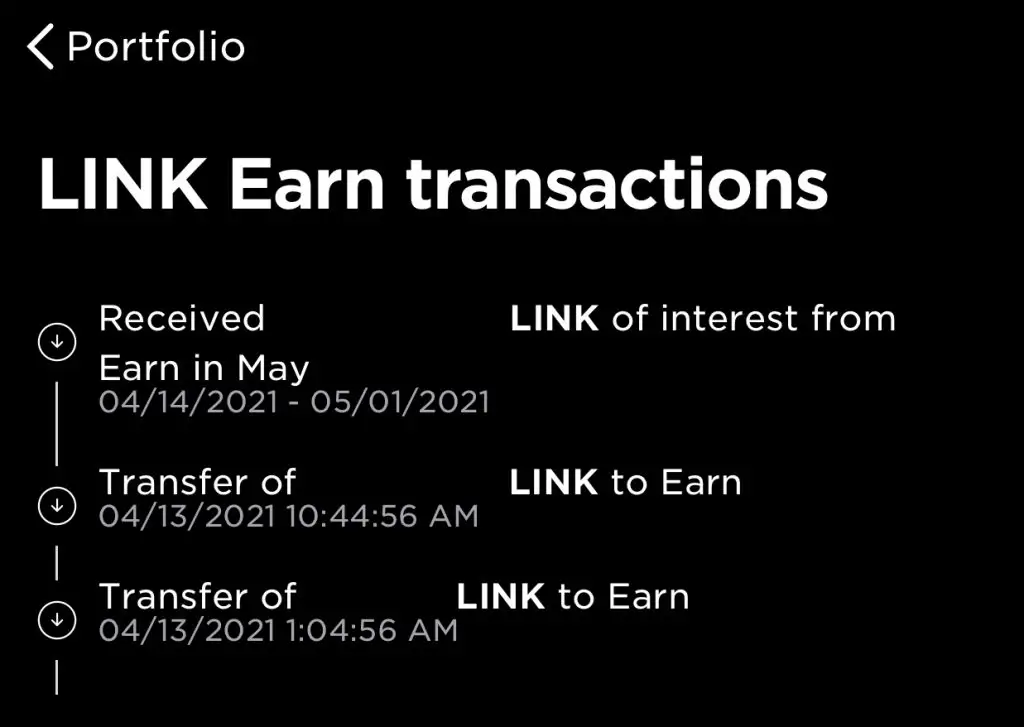

For Nexo, your interest is paid out daily. You will need to hold your assets for at least 24 hours first, before the payout is issued to you.

Borrowers of both platforms

How can both of these platforms afford to pay you such a high interest rate on your crypto?

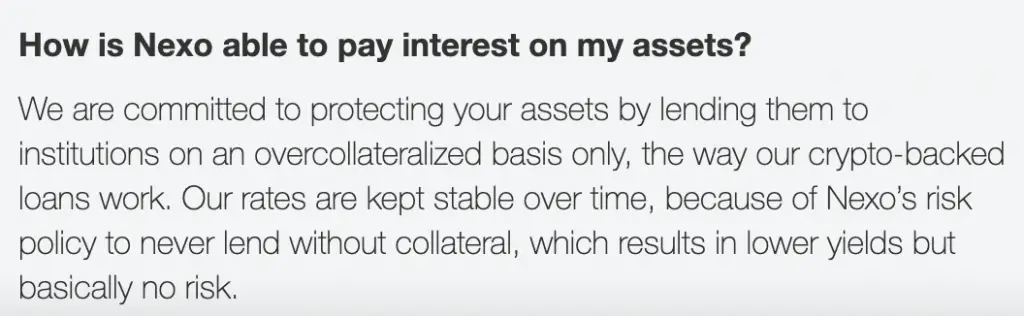

Nexo loans out your crypto to institutions on an overcollaterised basis.

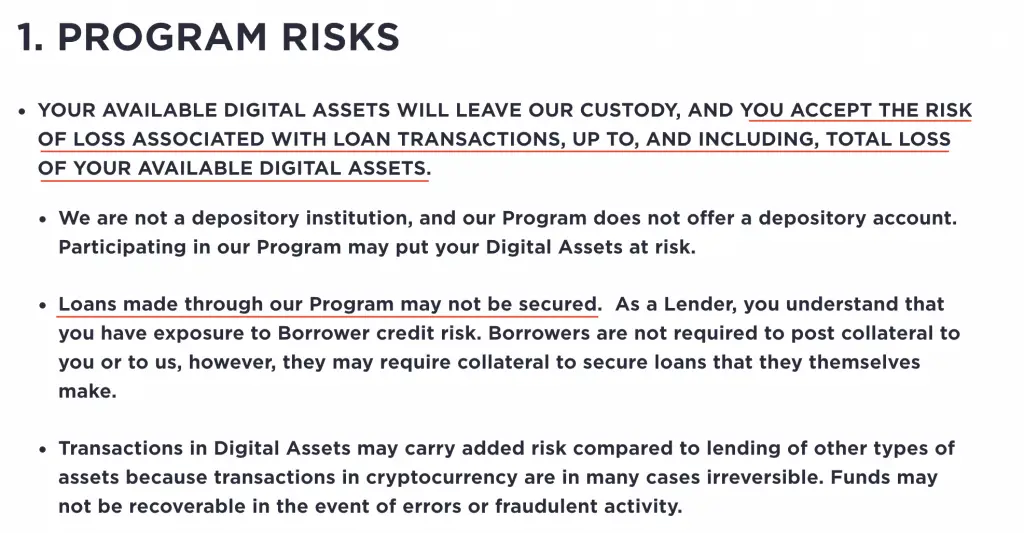

Lending your cryptocurrencies via Gemini Earn may be riskier

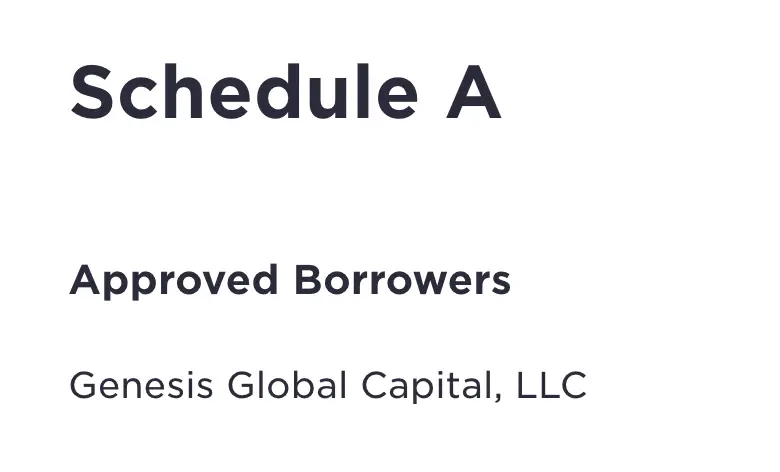

Gemini loans out your funds to their approved borrowers. So far, Gemini’s only approved borrower is Genesis Global Capital.

You may want to take extra caution when placing your funds with Gemini Earn. This is because of this clause in their Terms of Service.

In the event that a borrower defaults with your cryptocurrency, you may not be able to get back your funds!

Moreover, Gemini does not require borrowers to post collateral when they take a loan.

This may mean that your loans may be much riskier. The borrower does not have much penalties if they decide to default on the loan.

As such, you’ll need to consider if it’s worth taking this risk when lending out your crypto with Gemini Earn!

Deposits

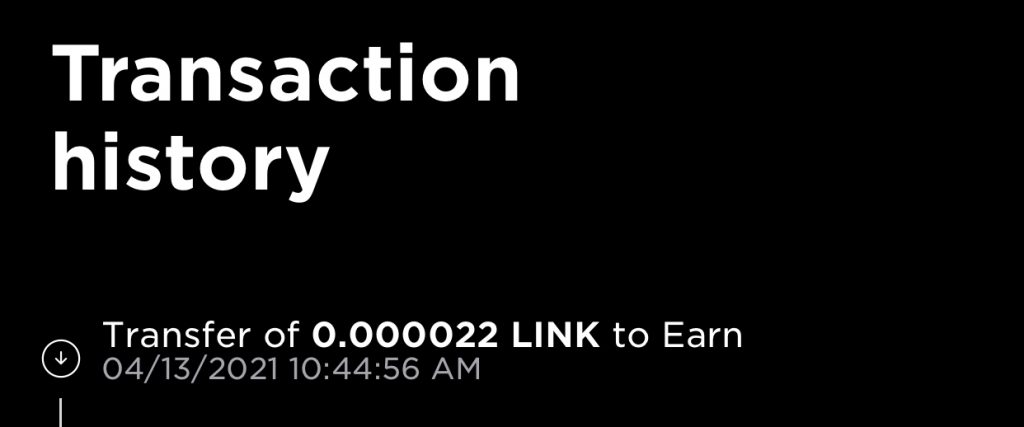

For Gemini Earn, there is no minimum deposit required. You can deposit any amount of crypto that you earn immediately!

I managed to send 0.000022 LINK into my Gemini Earn account, even though it is worth less than a few cents.

However for Nexo, you are required to have a minimum deposit to start earning the high interest rates:

| Currency | Minimum Deposit |

|---|---|

| BTC | 0.001 |

| ETH | 0.01 |

| XRP | 5.00 |

| BCH, LTC | 0.01 |

| EOS | 0.50 |

| XLM | 20 |

| LINK | 0.3 |

| TRX | 150 |

| PAXG | 0.001 |

| BNB | 0.05 |

| Stablecoins | 1 |

The minimum amounts are not too high, but it may affect how much you need to transfer to your account!

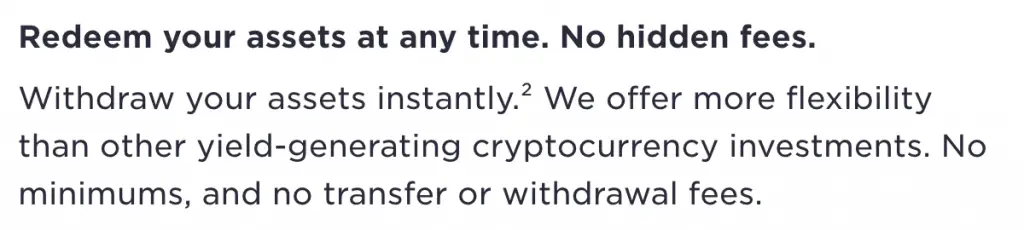

No lock-in period

Both Nexo and Gemini Earn do not have any lock-in periods. This means that you are able to freely withdraw your crypto any time you wish!

For Gemini Earn, you should be able to receive your funds almost instantly.

However, there may be certain instances where it’ll take up to 5 business days before you are able to withdraw your funds from the account.

Withdrawal fees

Gemini Earn does not charge you any withdrawal fees when you withdraw from their platform.

Furthermore, Gemini does not charge you any withdrawal fees for your first 10 withdrawals from the platform each month.

Nexo does provide you with some free withdrawals. However, this depends on your loyalty tier:

| Tier | Number of Free Withdrawals |

|---|---|

| Base | 1 free withdrawal |

| Silver | 2 free withdrawals |

| Gold | 3 free withdrawals |

| Platinum | 5 free withdrawals |

The withdrawal fee that you are charged depends on the gas fees that are being charged by the network!

If you are looking to make frequent withdrawals, then lending with Gemini Earn may be the better option.

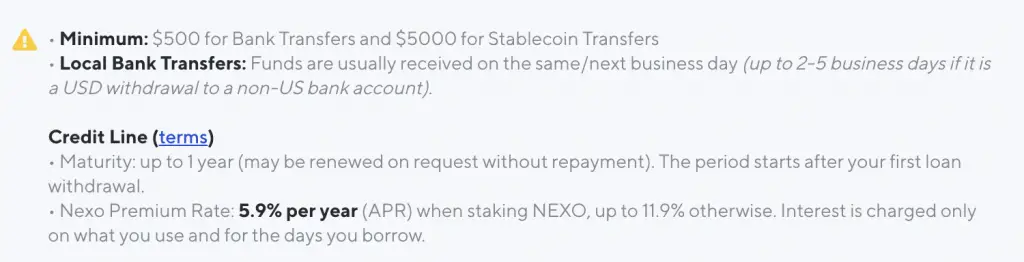

Taking loans

You can start taking a loan from Nexo starting from 5.9% APR.

You will need collateral as well, which is:

- $500 USD for bank transfers

- $5,000 for stablecoin transfers

Here are some of the currencies you can borrow in:

| Type of Currency | Currencies Available |

|---|---|

| Fiat Currencies | 40+ (EUR, GBP, USD) |

| Stablecoins | USDT, USDC |

Meanwhile, you are unable to take a loan on Gemini’s platform.

Platform

Both Nexo and Gemini Earn have an app as well as a web platform.

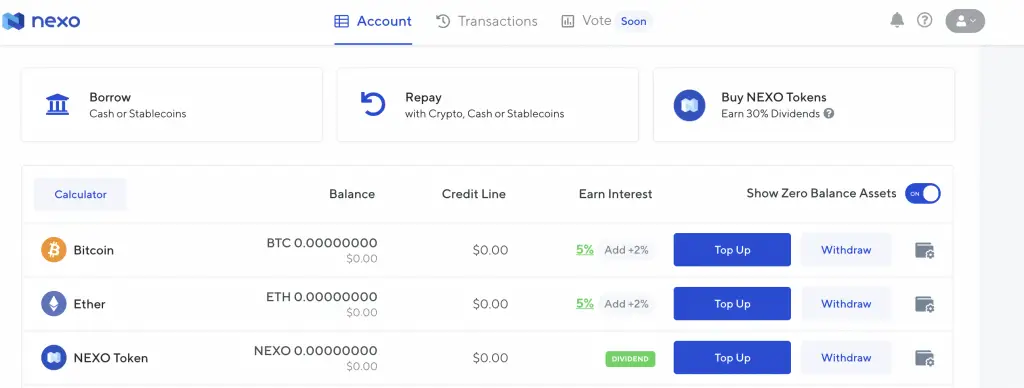

Here is Nexo’s web platform,

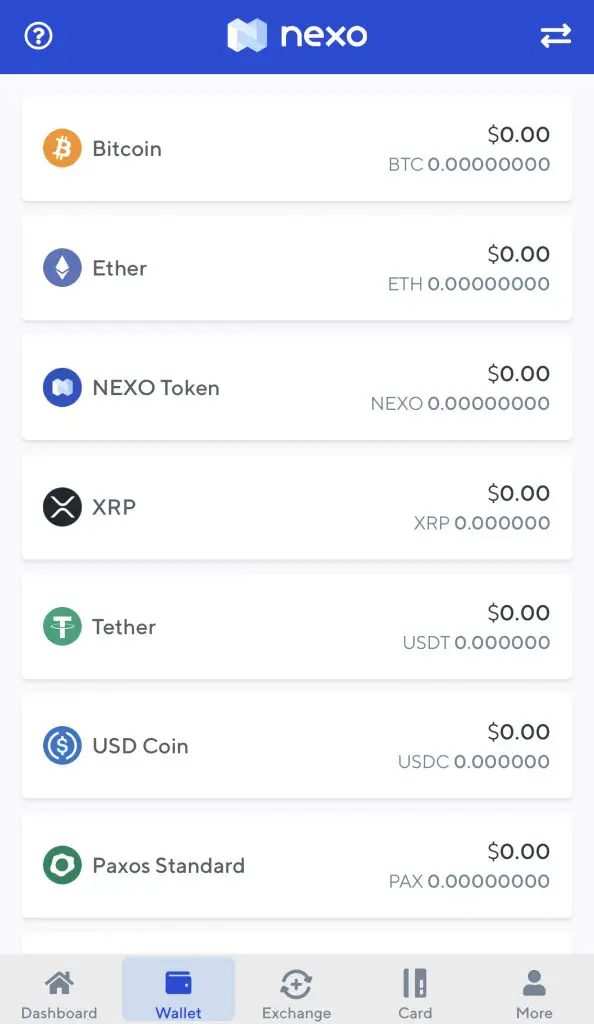

and their mobile app.

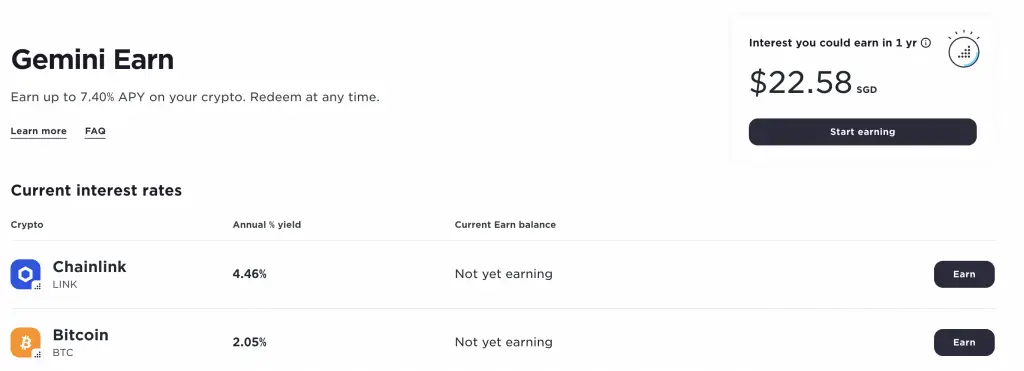

Meanwhile, this is Gemini’s web platform,

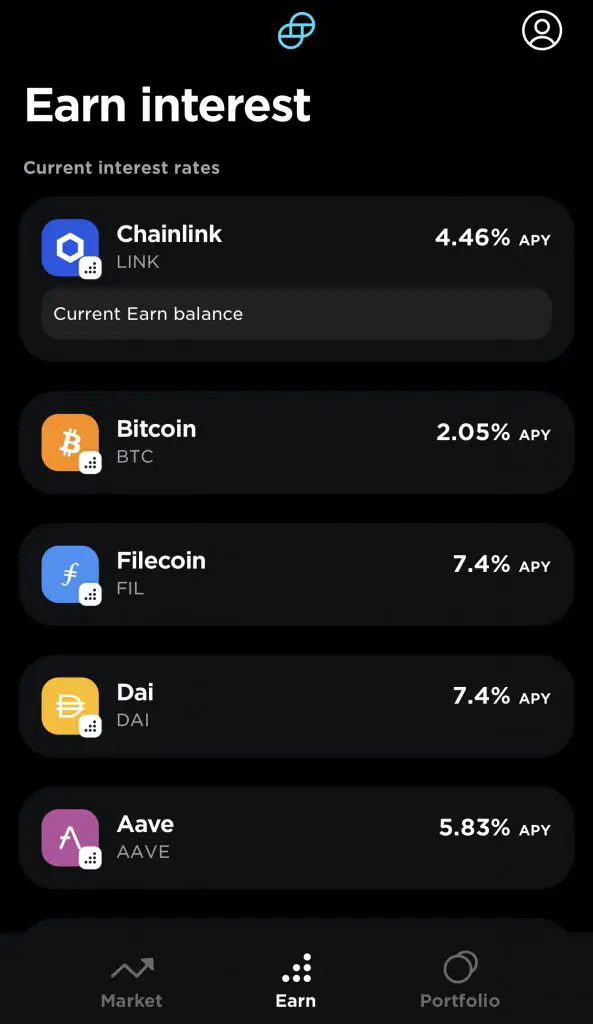

and their mobile app.

Security

If you intend to leave your funds with either account, you will be more at ease if they are secure.

So what measures do both of these accounts have?

Nexo has a rather secure platform

Nexo has partnered with BitGo and Ledger Vault as their security partners.

BitGo is the main custodian of your crypto assets and has a pretty strong track record.

Nexo also has $375 million worth of assets being insured by both partners!

Moreover, Nexo only loans your assets to credit lines that are overcollateralised between 200-500%.

This should help to reduce the risk of the institution defaulting from the loan!

Gemini stores the majority of your currencies in a cold storage

Gemini claims it is one of the most secure crypto exchanges.

Majority of the assets on the exchange are stored in an offline cold wallet.

Moreover, the remaining funds in the hot wallet is insured.

Our policy insures against the theft of Digital Assets from our Hot Wallet that results from a security breach or hack, a fraudulent transfer, or employee theft.

Gemini

It seems that Gemini’s owners are quite confident about the security of their platform!

Crypto lending is risky

The reason why both platforms are offering such high interest rates on your crypto is because this is quite a risky business.

Cryptocurrency is very volatile, and it may fluctuate in price by a lot!

The amount of crypto that you have in your portfolio really depends on your risk profile.

As such, you should decide if you are willing to take the risks when it comes to investing in any cryptocurrency!

Verdict

Here is a summary of the comparison between these 2 platforms:

| Nexo | Gemini Earn | |

|---|---|---|

| Year Founded | 2018 | 2014 |

| HQ | London | New York |

| Number of Currencies | 21 | 42 |

| Buying Cryptocurrency | Present | Present (via Exchange or Active Trader) |

| Interest Rates | In-Kind NEXO (higher interest) | In-Kind only |

| Accrual of Interest | Daily | Compounded daily |

| Borrowers | Institutions | Genesis |

| Type of loans | Overcollaterised | Unsecured |

| Deposit Fees | None | None |

| Minimum Deposit | Yes | None |

| Lock-in Period | None | None |

| Withdrawal Fees | Depends on loyalty tier and gas fees | None to Gemini platform 1st 10 withdrawals from Gemini are free |

| Loans | Present | Absent |

| Platform | Web and mobile platforms | Web and mobile platforms |

| Security | Insured up to $375 million | Cold storage + hot wallet |

So which platform should you choose?

Choose Nexo for higher interest rates

Apart from DOGE, Nexo offers higher interest rates for the common assets with Gemini Earn. If you are looking to maximise the yields that you receive, then you can consider earning interest in NEXO too.

This will help to give you an extra 2% interest!

Choose Gemini Earn for more free withdrawals and more cryptocurrencies

Gemini Earn offers a wider variety of cryptocurrencies from which you can earn interest from. Most of them are altcoins that do not have many options when you are looking to loan them out.

It can be quite hard to find a platform that offers you interest on AXS or SNX!

Furthermore, Gemini Earn has 10 free withdrawals, compared to the 1 free withdrawal that you have with Nexo.

This gives you much more freedom to make withdrawals from Gemini Earn, compared to Nexo.

Conclusion

Both platforms offer an alternative way of earning rewards on your crypto compared to staking.

In the end, the platform that you choose may depend on these few factors:

- The currency you wish to earn interest on

- The interest rate that you’ll receive

- The number of free withdrawals that you’ll need per month

👉🏻 Referral Deals

If you are interested in signing up for any of the products mentioned above, you can check them out below!

Nexo Referral (Earn USD$25 in BTC)

If you are interested in signing up for a Nexo account, you can use my referral link. You will receive USD$25 in BTC after holding $100 or more in assets for the next 30 days.

Here’s what you need to do:

- Sign up for a Nexo account

- Complete the Advanced Verification on Nexo

- Transfer ≥ $100 worth of assets into Nexo

- Hold these assets for at least 30 days

You will receive your BTC reward in the next 30 days!

You can view more information about this promotion on Nexo’s website.

Gemini Referral (Earn $10 USD in BTC)

If you are interested in signing up for a Gemini account, you can use my referral link.

You will be able to receive $10 USD in BTC!

Here’s what you need to do:

- Register for a Gemini account

- Trade ≥ USD $100 or equivalent on Gemini’s platform

- Receive USD $10 worth of BTC in your account