Last updated on June 6th, 2021

I started investing at one of the worst times ever.

My investment journey began on Feb 2020, a few weeks before the COVID-19 market crash.

The prices kept plunging and I was hooked. I checked my stocks’ performance around 4 times an hour!

However, was that really necessary? The answer is an overwhelming NO.

So how often should you be checking your investments instead?

Contents

Should you check your stocks everyday?

There is no need to check your stocks everyday, especially if you are a long-term investor. You will need to trust that the markets will do their job and go up in the long run. Checking your stocks everyday will cause you to be affected by short term volatilities.

This will ultimately lead you to make emotional investment decisions. Such decisions don’t always end up well!

Technology has made it really easy to check your stocks

In the past, it was hard to get information about the assets that you invested in. Any news that you received was by mail.

By the time you received that mail, the information would most likely be outdated too.

Technology changed all of that.

Sites like Yahoo Finance and StocksCafe emerged over time. These sites allow you to receive live updates about the stocks that you’ve invested in.

There are many news sites out there that keep track on the markets too, such as the Financial Times.

Now, there is just an abundance of information!

With technology, you are able to check your stocks’ performance as often as you wish. This is just like refreshing your Instagram feed!

Why you shouldn’t check your stocks

Checking your stocks too often may do you more harm than good. Here are 3 reasons why:

#1 Emotions may influence your investment decisions

You are given 2 choices:

- You will get $100 up front

- You will get $200, but will lose $100

Which scenario would you choose?

I’m sure most of you would have chosen the first choice. Even though both choices gave you $100 in the end, the first option seemed more appealing.

Most people would prefer receiving everything up front, rather than to make a loss, no matter how small.

The loss aversion theory was formulated by Amos Tversky and Daniel Kahneman.

Losses loom larger than corresponding gains.

Amos Tversky and Daniel Kahneman

Tversky and Kahneman proposed that people are swayed by potential losses, rather than potential gains. This leads us to avoid losses at all costs.

Loss aversion may be the reason why some people do not invest. They may not willing to make any losses at all!

In relation to the stock market, this may make you do 2 things:

- Selling your stocks when they increase in price to lock in the profits

- Not selling your stocks when they drop in price with the hopes that it will increase in the future

The prospect of making losses can have a huge emotional impact on you.

By checking your stocks regularly, you risk being swayed by these emotions. Stock prices fluctuate all the time. You may make the wrong decisions if you’re influenced by these changes.

#2 You are giving yourself unnecessary stress

Being exposed to market news all the time can be overwhelming.

There’s so many things happening around the world at the same time. All of these events will affect the prices of stocks and other investments.

If you are making your investment decisions based on market sentiment, it may be stressful for you.

One moment, the market might be telling you to buy. The next moment, it might tell you to sell!

You may incur extra fees

If you buy and sell frequently, you may incur unnecessary transaction fees too. The sum of money that you’re putting in or taking out may not be worth the fees you’re paying.

You can make a loss by paying these fees, even though your stocks increased in value!

Would you feel stressed in this situation? All of this could be avoided if you didn’t check your stocks and the market news that frequently.

#3 Your time is precious

Every second you spend monitoring the markets could have been better spent elsewhere.

Your time is precious. There are many things you could be doing instead of stressing over your stocks’ performance.

It would be better to come up with an investment plan and stick to it. Once in a while, you can check in on your stocks.

Having this plan is important. It saves you a lot of time from unnecessarily checking your stocks’ prices.

You can then use this extra time that you have to do other things that you enjoy!

Why you should check your stocks

That being said, you should not just invest in something and forget about it.

It is still important to keep track of your stocks periodically, and here are 2 reasons why:

#1 Ensure you are on track to attaining your financial goal

It is still important to check your stocks’ performance every once in a while.

If your portfolio consists of only a few stocks, you have to check your investments regularly. Anything can happen to the companies that you’ve invested in.

The best way would be to decide on how often you wish to check your investments before starting to invest. After you’ve decided on the frequency, all you need to do is to stick to it.

By checking your investments’ performances frequently, you can determine if you’re able to achieve your financial goal.

Imagine if you didn’t check your stocks at all. When it’s time to withdraw your money, you may realise that your investments didn’t give you the returns you expected!

Surely you wouldn’t want this to happen, right?

#2 Constant exposure may make you more comfortable with volatility

Contrary to what most people think, Grant Sabatier believes that you should be checking your stocks daily!

As a self-made millionaire, Grant believes that “the more time you spend with your money, the more comfortable you get with it”.

Grant recommends you to review your portfolio daily. By constantly exposing yourself to the volatility, you will eventually become desensitised to it.

Based on my experience, this was something that happened to me too. I used to constantly check my stocks’ performance. Eventually, I’ve become emotionally detached from how they perform. In fact, I’m not affected even though the value of my investments may start to drop!

People are showing signs of desensitisation to the number of COVID-19 cases in Singapore over time. In the same way, constant exposure to your stocks may detach your emotions from investing.

However, this strategy may not work for you. Some reasons include:

- You do not have the investment know-how or the experience to not be swayed by market sentiment

- You may still be driven by your emotions before you get desensitised

As such, you should consider this advice carefully. You may want to consider a gradual increase in the frequency that you check your stocks instead (i.e. from months to weeks to days).

How often should you check your stocks?

Depending on the type of investor you are, here’s how often I believe you should be checking your stocks:

#1 Long-term investor

Most of us are investing for the long-term.

When we invest, we are usually accumulating money for a goal in the next 10 years or more.

Such long-term goals include:

- Your retirement

- Your child’s education fees

You have to remind yourself that you are in for the long run. If you have made a financial plan, all you need to do is to stick to it.

Most people fail because they can’t stick to their plans.

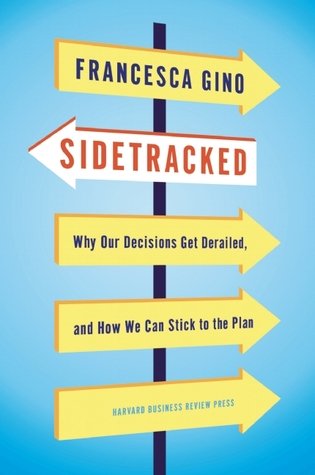

In the book “Sidetracked“, Francesca Gino highlights 3 key factors that distract us from our plans:

- Internal distractions (e.g. emotions)

- Social connections (e.g. peer pressure)

- Our external environment (e.g. news)

If you’d like to find out more about “Sidetracked”, you can check out more information on Amazon.

Small fluctuations in price should not affect your plan

Are you going to ruin your retirement plan, just because of something in the news, or something your friend said?

Such small fluctuations are not going to affect you. Instead, you should be focusing on the long-term returns of investing.

As such, you shouldn’t check your stocks daily!

If you are a long term investor, you can check your stocks monthly, quarterly or once every 6 months.

This is mainly to ensure that you’re on track to achieve your financial goals.

#2 Investing for a short-term goal

A short-term goal is one that you wish to attain within the next 3-5 years. You have a much shorter time horizon, so the chances of you losing money is much higher.

It is therefore not recommended to invest the money that you’re saving up for a short term goal.

You should check your stocks more regularly

However, if you decide to invest your money, you may need to monitor your investments more frequently.

You might want to check your stocks weekly, or even daily.

You have less time in the market for a short term goal. As such, the weekly or daily return is important to help you to assess if this investment is right for you.

I would strongly recommend against investing the money you need for short term goals. There is too much risk and you’ll most likely be swayed by emotions.

How can you stop checking your stocks?

You may have an addiction to watching the stock market, just like me. However, all hope is not lost!

Here are 5 methods you can use to avoid checking your stocks too frequently:

#1 Don’t invest money you can’t afford to lose

Investing is risky, and you may lose your entire capital if you make the wrong decisions.

If you’ve set up your emergency fund and start to invest a fixed amount each month, you will be more secure.

However, if you’re investing the money needed for your studies, the whole game has changed.

The stakes are much higher. You will have a higher tendency to be swayed by emotions as well.

As such, you should only invest money that you are willing to lose!

#2 Reassess your plan

If you are checking your stocks too frequently, it could mean that you do not trust that stock to give you a good return.

The stock you invested in may not suit your risk profile.

As such, it’s time to reassess your plan!

If you are investing in risky stocks, you can consider investing in blue-chip stocks. These are usually companies that are well established and relatively stable.

Some may provide a dividend as well!

The returns may not as good as growth stocks. However, they may be able to provide returns that are more consistent.

With greater risk, comes greater rewards. However, this comes with greater losses as well!

If it is too risky for you to invest in stocks, you can consider buying into an index fund instead.

These funds track a stock index. These funds will purchase a group of stocks that the index is tracking.

As such, your returns are diversified across a few stocks, rather than one stock.

Here are some examples of index funds and the indexes they track:

| Index Tracked | Funds |

|---|---|

| Straits Time Index | Nikko AM STI ETF (G3B) SPDR STI ETF (ES3) |

| S&P 500 | Vanguard S&P500 ETF (VOO) iShares S&P500 ETF (IVV) SPDR S&P500 ETF (SPY) |

When you invest in individual stocks, you should be confident that it’ll beat the index.

If you can’t find the stock to beat the index, why not follow the index instead?

Your returns may be less, but it’s definitely higher compared to leaving your money in the bank!

If you are interested in investing in the S&P 500, you can check out my detailed guide to do so.

#3 Automate your investments

You may be thinking about finding the best time to invest. Why not do it via a dollar-cost averaging (DCA) approach instead?

In a DCA strategy, you are putting the same amount of money into an investment. This is regardless of whether the stock is performing well or poorly.

The best part of a DCA strategy? This allows you to automate your investments!

Here are 2 ways that allow you to automate:

These 2 strategies are a great way for you to adopt a “set and forget” approach.

All you need to do is to set up a standing instruction with your bank. Your bank will send funds from your account to the robo-advisor or RSP.

Your money will then be automatically invested. Once everything’s set up, you don’t need to monitor your investments that frequently!

The fees may be rather expensive

While this seems like a great strategy, one thing that you should look out for are the fees.

Regular Savings Plans (RSPs) such as the OCBC BCIP or Invest Saver will charge a transaction fee. These fees are usually quite high.

The POEMS Share Builders Plan has very exorbitant monthly handling fees as well!

Robo-advisors have different fees that are associated with them. All these fees may add up to be pretty substantial in the end.

As such, it’s still important to periodically review your investments. This helps you to see if the fees that you’re paying are still worth it.

Even though you can “set and forget”, this doesn’t mean that you should totally forget about your investments!

If you are still torn between the 2, you can read my comparison between robo-advisors and regular savings plans.

#4 Busy yourself

You may be checking on your stocks because it’s something that you’ve prioritised. However, I’m sure that you have better things to do!

You should try to find other things that have a higher priority, or something that you enjoy doing. When you keep your mind occupied, you will spend less time thinking about your stocks.

This will greatly reduce the number of times you check your stocks!

#5 Self-discipline

Self-discipline is key to making sure your plan works.

Before investing, you should decide on how often you intend to check your stocks. Once you’ve made that decision, you should stick to it.

It will be hard not to look at your stocks.

I had this problem at the start, and was constantly obsessing over the stock prices.

However once you become more disciplined, this will be less of an issue.

You can start by removing all the noise that distracts you. These include:

- Deleting investment apps on your phone

- Unsubscribing from news alerts for the stocks you own

Removing distractions ensures that you remain on track for your investing plan!

Conclusion

Checking your stocks frequently can be really exciting. The prices continue to fluctuate, and you can see how much you’ve gained or lost each second.

However, I soon realised that there’s no point in checking your stocks frequently. Who cares if you received a $1 gain in an hour, when you’re investing for the next 40 years or so?

Can you control your emotions?

An important thing to consider is your emotions when checking your stocks. If you aren’t affected by the news and the markets, it’s possible to check your investments more frequently.

However for the rest of us, sticking to a fixed frequency may be the wiser choice.

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?

James

September 6, 2020 at 10:23 pmGreat article!

Gonna put my phone away and not check my portfolio every morning anymore 😛