Last updated on December 29th, 2021

You’re looking for a globally diversified ETF to invest in. However, there are so many choices!

Some of the popular ETFs include IWDA and VT.

So how exactly are they different? Here’s what we’re going to find out:

Contents

The difference between IWDA and VT

IWDA and VT are both globally diversified ETFs. However, VT invests in emerging markets which IWDA does not. These ETFs are also managed by different fund managers (iShares and Vanguard). The 2 main differences between these ETFs are the dividend withholding taxes and how they distribute their dividends.

Here is an in-depth comparison between these 2 ETFs:

They track different indexes

IWDA tracks the MSCI World Index. Meanwhile, VT tracks the FTSE Global All Cap Index. Even though both are globally diversified indexes, their holdings are slightly different.

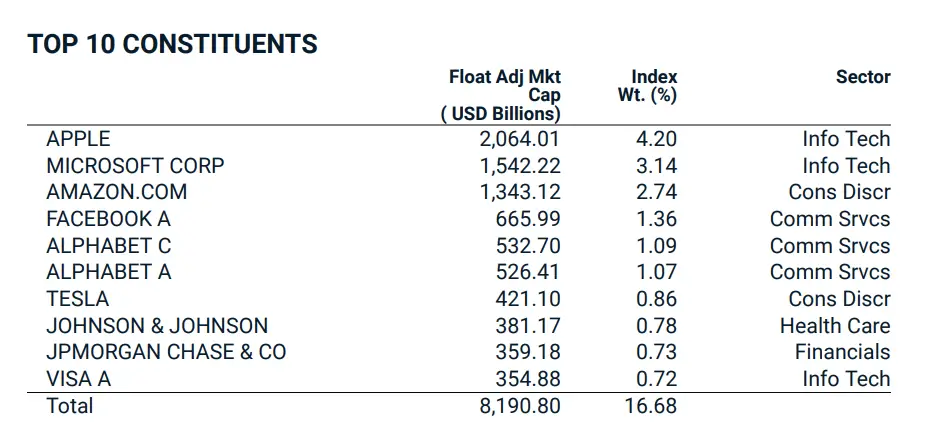

MSCI World Index has 1,600 constituents

The MSCI World Index tracks stocks across 23 developed market countries. The main countries for this index include:

- United States

- Japan

- United Kingdom

- France

The index has around 1,600 constituents. Here are the top 10 holdings from this index:

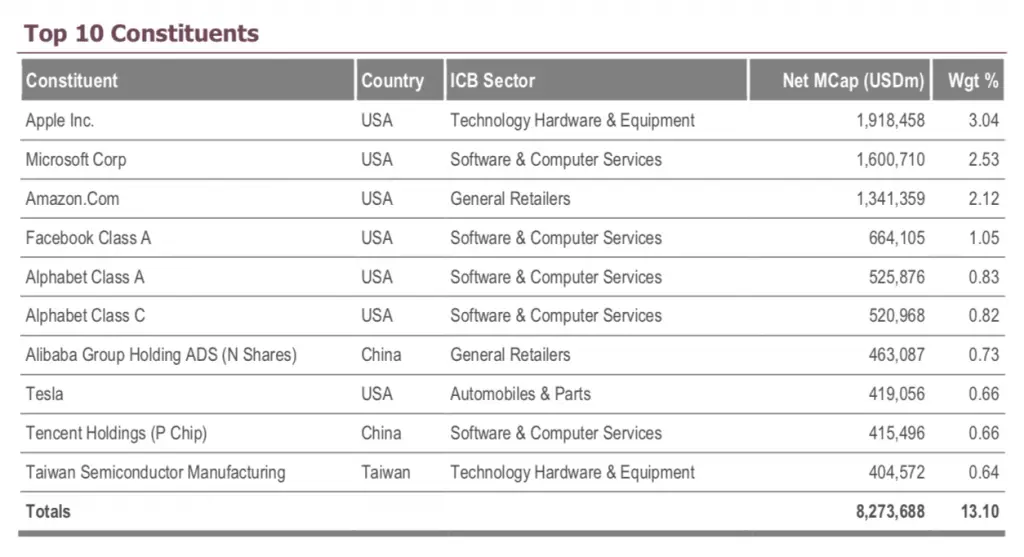

FTSE Global All Cap has 8,000 constituents

This index is more diversified as it covers both developed and emerging markets. It also contains a lot more stocks, almost 6,400 more of them!

Here are the top 10 holdings which are slightly different from the MSCI World Index:

Fund manager

IWDA is managed by iShares, while VT is managed by Vanguard.

You may be wondering why IWDA appears as SWDA on iShare’s website. You can read my comparison between IWDA and SWDA to see what are the differences between them.

Vanguard launched VT slightly earlier in 2008, compared to IWDA in 2009. Even though IWDA was launched 1 year later, they have a larger asset under management.

| ETF | Assets Under Management (AUM) |

|---|---|

| IWDA | 27 billion |

| VT | 22.7 billion |

They are listed on different exchanges

IWDA is listed on the LSE, while VT is listed on the NYSE. There may be certain differences if you wish to trade on these 2 exchanges.

Not all brokers allow you to trade on both exchanges

Some brokers do not allow you to trade on the London Stock Exchange. In contrast, the NYSE is being offered by many brokers.

| Broker | LSE | NYSE |

|---|---|---|

| FSMOne | ✕ | ✓ |

| Interactive Brokers | ✓ | ✓ |

| Saxo Markets | ✓ | ✓ |

| Standard Chartered | ✓ | ✓ |

| Maybank Kim Eng | ✓ | ✓ |

| KGI Securities | ✓ | ✓ |

| OCBC Securities | ✓ | ✓ |

| Tiger Brokers | ✕ | ✓ |

| POEMS | ✓ | ✓ |

| TD Ameritrade | ✕ | ✓ |

| DBS Vickers | ✕ | ✓ |

To invest in the LSE, you may need to find a specific broker to do so. You can view my guide to see what are the best ways to buy LSE ETFs from Singapore.

You can also view my comparison between Tiger Brokers and FSMOne to see which broker is better for you.

Commissions charged may be different

When you are trading in different exchanges, you may incur different costs. For example, here are some of the commissions when you trade in both markets:

| Broker | US | LSE |

|---|---|---|

| Interactive Brokers | 1% of trade value Minimum USD 0.35 | 0.05% * trade value Minimum GBP 1 |

| OCBC Securities | 0.3% of trade value Minimum USD20 | 0.7% of trade value Minimum GBP55 |

When you are choosing a broker, you should choose one that will incur the least costs for your investment amount.

You can also consider Tiger Brokers which offers you a minimum of USD1.99/trade in US markets.

They handle their dividends differently

Both ETFs will receive dividends from the stocks they invest in. However, the way that they handle their dividends are quite different.

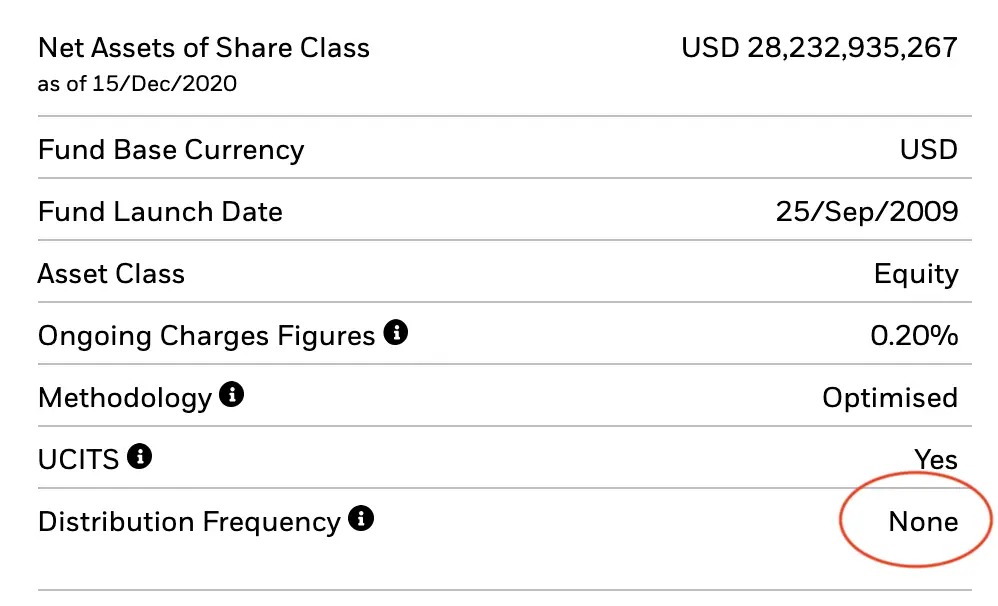

IWDA is an accumulating ETF

You will notice that IWDA does not have any dividend distributions.

This is because IWDA is an accumulating ETF. Instead of distributing the dividends to you, the fund manager reinvests your dividends instead.

The fund manager will use the dividends to buy stocks found in the MSCI World Index.

If you choose to invest in an accumulating ETF, your dividends will automatically be reinvested.

This saves you some transaction fees if you’ve already intended to reinvest your dividends!

VT is a distributing ETF

Meanwhile, VT is a distributing ETF. This means that any dividends received by the fund manager will be distributed to you.

Vanguard will distribute the dividends on a quarterly basis.

VT has a dividend yield of around 1.94%. This will be good if you intend to receive some passive income from this ETF!

You can view my comparison between accumulating and distributing ETFs to find out which one is better for you.

You will pay different dividend withholding taxes

If you are a non-resident alien of the USA, you are required to pay a dividend withholding tax. However, the amount of tax you’ll need to pay for the 2 ETFs will be different!

This is because these 2 ETFs are domiciled in different countries.

| ETF | Fund Domicile |

|---|---|

| IWDA | Ireland |

| VT | USA |

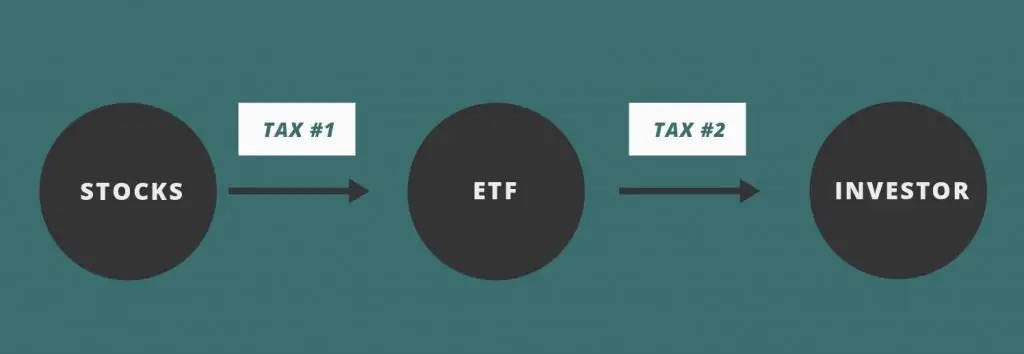

There are 2 layers of dividend withholding taxes you’ll need to pay

For any ETF, the fund manager buys the stocks based on the index they are tracking. The dividends that they distribute are collected from the stocks in their fund.

As such, there are 2 layers where you may incur some taxes:

- From stock to ETF

- From ETF to you, the investor

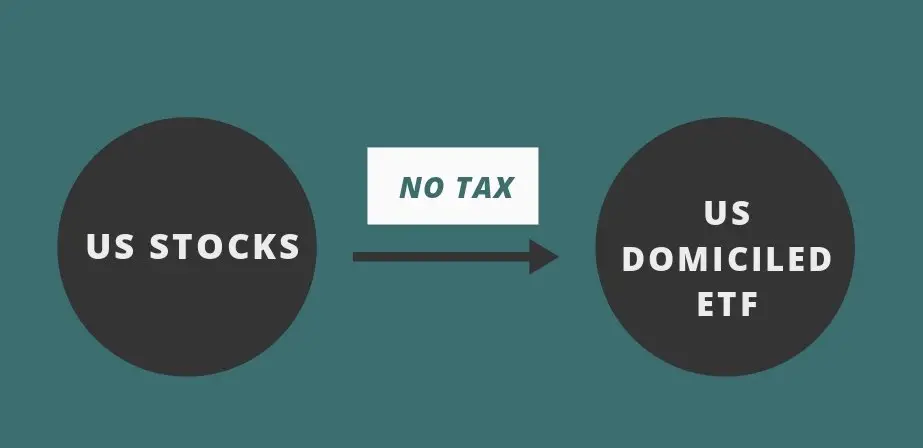

VT incurs dividend withholding tax on the second layer

When the stock distributes its dividend to the ETF, no tax is incurred. This is because the dividend is distributed from a US stock to a US-domiciled ETF.

However when the dividends are distributed to you, they will incur the 30% tax. This is because you are a non-resident alien.

IWDA incurs dividend withholding tax on the first layer

For IWDA, the dividends from the US stocks are distributed to an Irish-domiciled ETF. As such, the 15% withholding tax applies on the first layer.

Ireland does not charge you any dividend taxes. You will only incur the 15% tax from the first layer.

This also means that even though you invest in an accumulating ETF, you will still incur this tax. This is because the tax has already been deducted in the first layer!

Since IWDA is an Irish-domiciled ETF, you will not incur any US estate taxes when you invest in it.

If you wish to track your dividends with the taxes accounted for, you can consider trying out StocksCafe’s platform.

Their expense ratios are different

On top of the trading commissions you’ll need to pay the broker, you will have to pay an expense ratio to the fund manager as well.

This expense ratio is usually deducted at the end of each year.

Here are the expense ratios for these 2 funds:

| IWDA | VT | |

|---|---|---|

| Expense ratio | 0.20% | 0.08% |

Even though VT has a lower Asset Under Management (AUM), it is still able to charge a lower expense ratio.

When it comes to cost, there seems to be a trade-off that you’ll have to make between:

- Dividend withholding tax

- Expense ratio

| IWDA | VT | |

|---|---|---|

| Dividend Withholding Tax | 15% | 30% |

| Expense Ratio | 0.20% | 0.08% |

Liquidity

If you are looking to frequently trade this ETF, you may want to look at an ETF’s liquidity. One of the main parameters to look at is the average trading volume.

Here are the average trading volumes for these 2 ETFs:

| IWDA | VT | |

|---|---|---|

| Average Trading Volume | 232,600 | 1,444,500 |

Since VT is on the NYSE, it has a much higher trading volume compared to IWDA.

However, IWDA still has a rather decent trading volume. This means that you should still be able to buy or sell your units at your intended price.

Verdict

Here is a comparison between these 2 ETFs:

| IWDA | VT | |

|---|---|---|

| Fund Manager | iShares | Vanguard |

| Index Tracked | MSCI World Index | FTSE Global All Cap Index |

| Exchange | LSE | NYSE |

| Minimum Units To Invest | 1 | 1 |

| Currency | USD | USD |

| Dividend Distribution | Accumulating | Distributing |

| Dividend Withholding Tax | 15% | 30% |

| Expense Ratio | 0.20% | 0.08% |

| Liquidity | 232,600 | 1,444,500 |

So which ETF should you be investing in?

Choose IWDA if you have a longer time horizon

IWDA is an accumulating ETF, which helps to automatically reinvest your dividends. This is great if you have a long time horizon and are looking to accumulate your wealth.

By automatically reinvesting your dividends, this saves you on the transaction fees!

However, IWDA is listed on the LSE. Some brokers don’t allow you to invest in ETFs listed on this exchange. Moreover, those that do may charge you high transaction fees.

Even though IWDA has a lower dividend withholding tax, it may still be more costly when you factor in other costs!

Choose VT if you want greater diversification

VT may not be so tax efficient due to the higher dividend withholding taxes.

However, it does offer a broader diversification across a lot more stocks.

It also contains stocks from emerging markets, which is not included in IWDA.

If you prefer to spread your risk out even more, VT will be the better choice for you.

Conclusion

Both ETFs offer you the opportunity to invest in a globally diversified index. This helps you to spread out your risk even more!

There are also many indexes and ETFs that you can invest in, such as the S&P 500 and the ARKK ETF.

Moreover, Vanguard has another ETF (VTI), and you can view how it differs from both IWDA and VT.

When deciding between the 2, here are 4 considerations you might have:

- Do I want to invest in emerging markets?

- Do I want to invest in an accumulating or distributing ETF?

- Do I want a lower dividend withholding tax or a lower expense ratio?

- Am I able to find a broker that gives me affordable commissions? (Especially for IWDA)

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?