Last updated on November 16th, 2021

You have heard of the 3 retirement sums, namely the BRS, FRS and ERS under the CPF Retirement Sum Scheme. However, you still have questions on what are they about, or how to go about saving towards it.

Therefore, this article will help to cover these burning queries by collating and answering the most important questions that you may have. Sit tight and enjoy!

Contents

Retirement Sums

Within the CPF Retirement Sum Scheme, there are 3 retirement sums, namely the Basic, Full and Enhanced Retirement Sums (or BRS, FRS and ERS in short).

Saving the BRS in your CPF Retirement Account at age 55 gives you a monthly payout that supports a basic standard of living under CPF LIFE (from age 65 onwards), while the FRS and ERS are set at 2 times and 3 times of the BRS respectively.

How do the CPF Retirement Sum Scheme work?

The CPF Retirement Sum Scheme (RSS) encourages Singaporeans to save up for their retirement by setting aside a retirement sum in their CPF Retirement Account (RA). From age 65, this retirement sum will be used to distribute monthly payouts for life under an annuity plan known as CPF LIFE.

To understand more about the RSS, we first have to understand how it links to your payouts in the CPF LIFE Scheme.

CPF LIFE is an annuity scheme that provides monthly payouts for life

Like other annuities out there, there are 2 parts to CPF LIFE:

- Premiums

- Payouts

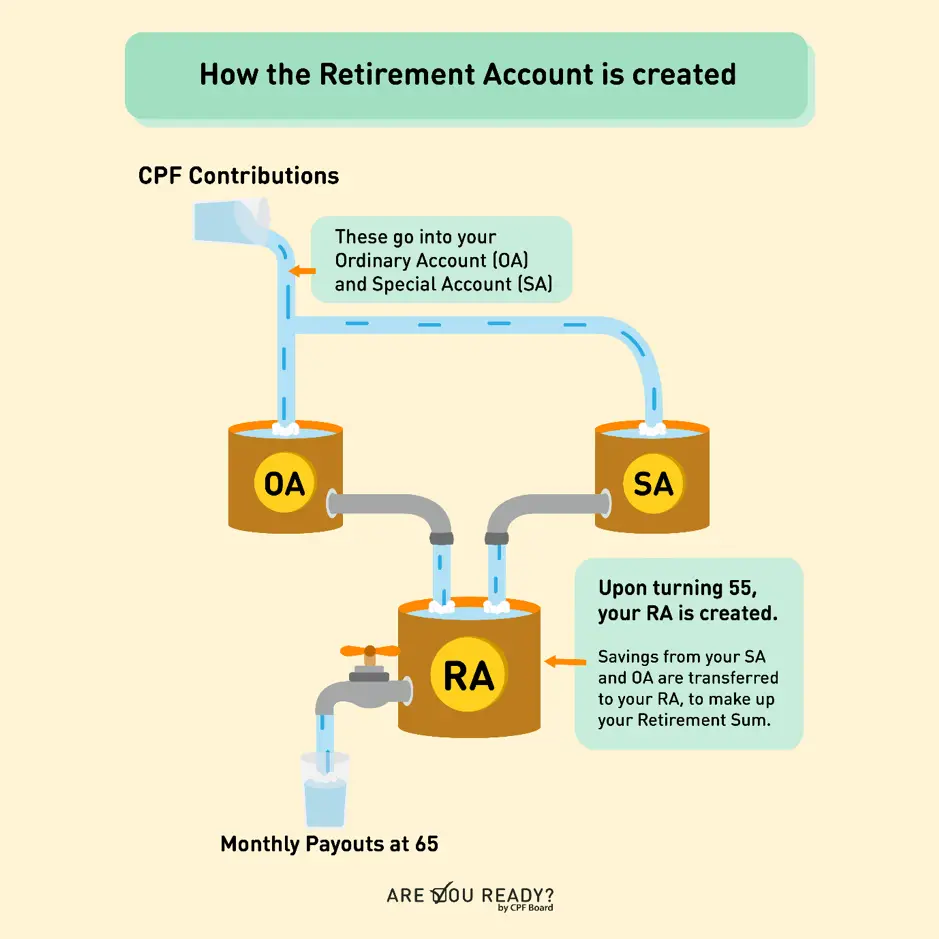

When you reach the age of 55, your CPF Ordinary Account (OA) and Special Account (SA) funds will be used to form the Full Retirement Sum (or Basic Retirement Sum if you pledge your property) in your Retirement Account (RA). Your RA funds will then continue to grow with interest (at 4 – 6 % p.a.).

Once you reach 65, your retirement sum (along with the accumulated interest) will act as a one-time payment.

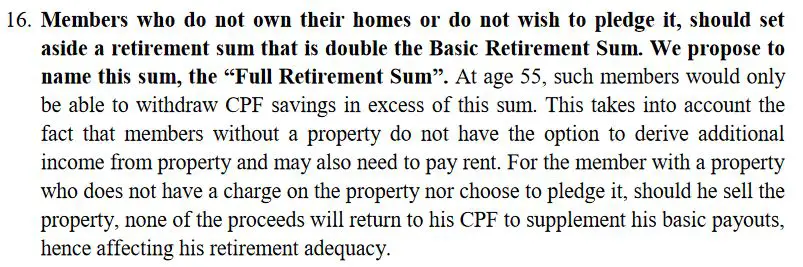

This is also known as the premium, which is commonly found in other annuity plans.

After paying this premium, you will be able to receive monthly payouts under CPF Life.

The best part is that you will continue to receive these payments for life!

Despite the announcement of the 3 retirement sums, you can enter CPF LIFE with any retirement sum in your Retirement Account. From age 65, you will then receive your monthly payouts according to the amount of retirement sum that you have saved.

The higher the retirement sum saved, the larger your monthly payouts will be, and vice versa.

How does CPF LIFE compare to other annuities?

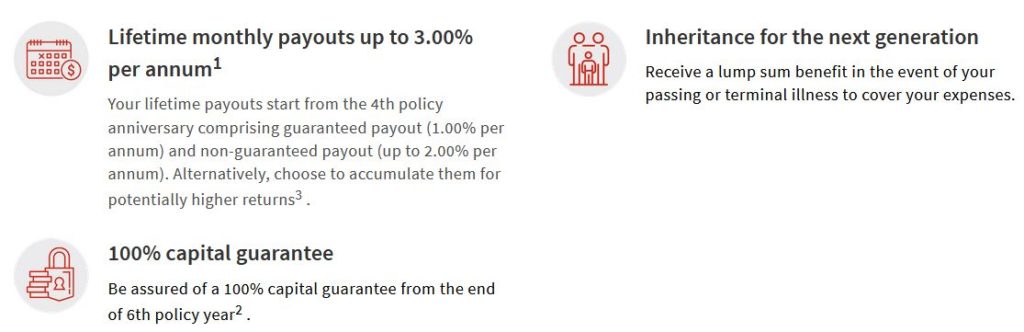

As an annuity, CPF LIFE has a much simpler structure to cater for general retirement needs. This is in contrast to other products in the market, which may contain more complex features.

Although most Singaporeans are automatically subscribed to CPF LIFE, there are many annuity plans in the market that target Singaporeans who prefer larger payouts during retirement or insurance benefits.

You may be thinking: How similar is CPF LIFE to these annuities?

Without delving into the specifics, let’s see how CPF LIFE compares to some annuities out there.

Through examining their features, we can notice some similarities of these annuities with CPF LIFE:

- You will need to pay premiums at the start of the policy

- Payouts of these annuities are for life

Beyond them, the features and benefits of these plans start to differ significantly. Some of them include:

- Multiple premiums

- Payout frequency (Yearly vs monthly payouts)

- Fixed / Variable payouts

- Insurance protection

Some commercial annuities employ variable payouts which are dependent on the performance of the underlying investment the annuity is invested in.

Furthermore, you can expect to pay higher premiums for annuities that provide insurance protection (such as death / critical illness benefits). This is because a part of your payments will go into the insurance component of the annuity.

In contrast, CPF LIFE does not provide any insurance benefits to its investors.

While these features can be tweaked to suit a variety of needs, they may not be easily understood by retirees.

The complexities may only serve to confuse and discourage you to plan for your retirement!

Therefore, CPF LIFE serves to solve this issue by serving as a universal annuity scheme for Singaporeans. Its stable payouts give certainty to its investors, and the single premium feature makes the plan easier to understand.

How do I check my CPF Retirement Sums?

If you are turning 55 in the upcoming year, CPF will publish the retirement sums you are required to save on their website. You are also able to check your estimated payout levels using the CPF LIFE Estimator if you are aged 55 or above.

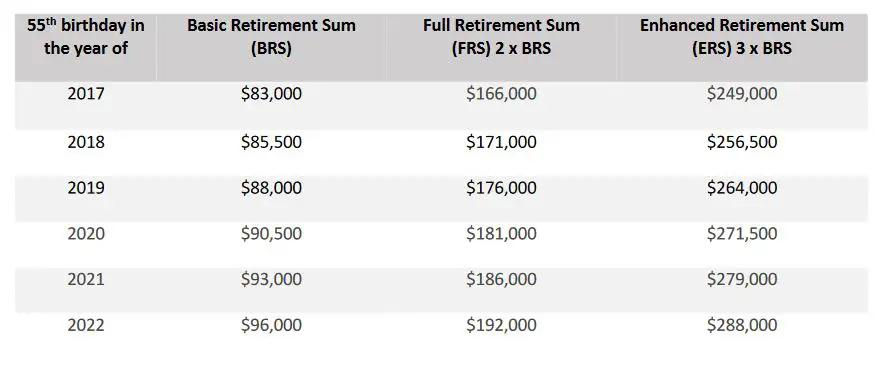

However, there is no way to confirm your retirement sums if you are not reaching 55 anytime yet. To get around this, we can approximate the growth rate of the Basic Retirement Sum at 3%:

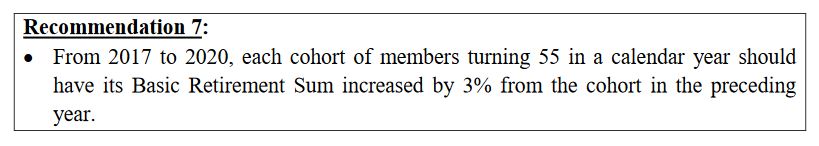

How did I arrive at this figure? Basically, the 3% growth was set out by the CPF Advisory Panel in 2015 based on the long term inflation rate in Singapore.

In simple terms, this growth accounts for the general price increases from now till the year your retirement sums are announced.

Although we cannot predict for sure whether this growth rate will be fixed, we can use it to estimate the retirement sum we need for our retirement.

Basic Retirement Sum (BRS)

The smallest of the retirement sums, the Basic Retirement Sum (BRS) comprises the amount that you need to save to cover the basic living aspects during retirement. Notably, rental expenses are not factored in the BRS, as homeowners are deemed to be able to raise extra income through rentals or selling their property.

How is the BRS calculated?

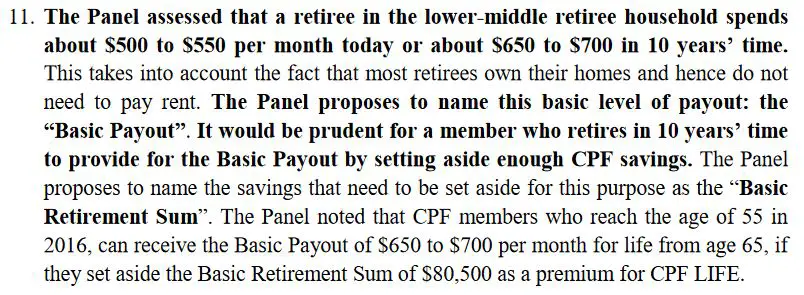

The BRS is back-calculated from what a retiree will need to spend for their basic retirement expenses in future. It can be seen as a balance between an adequate monthly payout and affordability.

To start calculating the BRS, we need to understand that the basis of CPF LIFE is used to cover retirement expenses in Singapore. From here, the next question is:

What is the minimum amount that a retiree needs to survive adequately?

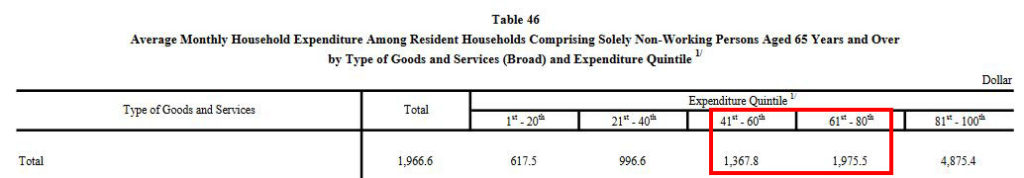

When the current version of retirement sums was first conceptualised in 2015, the CPF Advisory Panel assigned the spending of a retiree in a lower-middle retiree household as a benchmark for what a retiree needs to adequately survive.

This method allows payouts to be accurately set based on the real-time needs of retirees, reducing the possibility of Singaporeans over or under-saving for their retirement.

To protect Singaporeans from rising costs of inflation, the Panel then compounded this spending 10 years into the future (when Singaporeans start receiving their payouts at 65).

This inflated figure is then set as the ‘Basic Payout’, which is then used to calculate the Basic Retirement Sum.

By taking reference from the lower-middle level of a retiree’s spending, payouts from the BRS can be seen to provide the basic necessities for retirement.

Will I get payouts under CPF LIFE if I have not saved up the BRS?

Even though you did not manage to save up for the BRS by age 55, you are still eligible for payouts under CPF LIFE. However, you may want to note these payouts may not be enough to cover all your basic needs during your retirement.

As the BRS provides a payout that is meant to cover all your basic necessities, you may need to readjust your lifestyle to live on a lower payout.

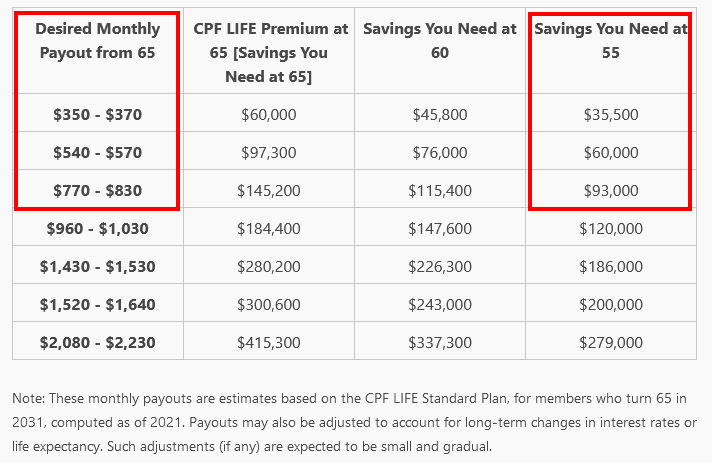

To illustrate the difference in payouts you will receive had you not saved up for the BRS, here is a comparison of the payouts received through the Standard Payout option:

As of 2021, the BRS is $93,000. By saving for the BRS at age 55, you will be able to receive a monthly payout of $770 – $830. However, had you saved a lower retirement sum of $60,000 or $35,500, you will receive a monthly payout of $540 – $570 and $350 – $370 respectively.

On a side note, you will also be able to withdraw up to $5,000 from your OA and SA after you reached 55 even if you have not saved up for the BRS. The remaining amount will then be transferred to your RA to form your retirement sum.

Can I opt to just save for the BRS in my RA?

The BRS serves as the ‘minimum sum’ in your RA if you pledge your property before 55 or have a CPF charge that covers your RA to the FRS when you sell your property. With your rental expenses covered by owning a property, saving for the BRS will help to cover the rest of your retirement needs.

A CPF Charge is created when you purchase your property using your CPF monies. Its value consists of the amount of CPF monies used plus accrued interest.

However, if you are financially able to, it may be a better idea to go the extra mile and save for FRS instead.

Why is saving up for the FRS so important?

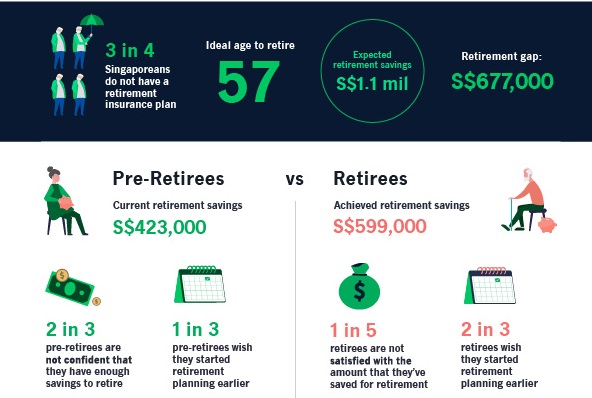

Singaporeans want to retire sooner, but they do not have sufficient funds to do so. According to a survey conducted by Manulife in 2021, 72% of retirees regretted not saving up sooner.

Similarly, a survey by AIA Singapore in 2020 revealed that more than half of Singaporeans were 14 years short in planning for an adequate retirement when assuming an average life expectancy of 84 years.

This means a large proportion of Singaporeans will see themselves running out of money by age 70!

Aside from the doom and gloom of having to survive in a society with rising living costs, we can help mitigate this issue better by planning to save enough for our retirement.

While it is easier to save for our BRS in your CPF for our retirement, its monthly payouts only cover our most basic needs.

This may mean saying goodbye to meals at fancy restaurants and overseas trips!

Hence, to reduce the chances of overspending on your CPF payout, it may be a better idea to save up towards the FRS instead.

Full Retirement Sum (FRS)

Being the middle of the three retirement sums, the Full Retirement Sum (FRS) in your CPF is calculated as 2 times the Basic Retirement Sum (BRS). This sum corresponds to a payout that covers all aspects of retirement expenses, including housing.

As such, the FRS serves a top-up limit for the Special Account, representing the retirement savings benchmark for Singaporeans below the age of 55.

How can I save up to the FRS more quickly?

You can save up to the FRS more quickly by increasing your CPF savings through top-ups or making your CPF monies work harder for you (through OA to SA transfers or investing your CPF funds). By saving up to your FRS more quickly, you can free up your income for other financial goals.

#1 Topping up your CPF using cash

This is the most direct way to boost your retirement savings: Increasing the amount of savings you have. If you have just started working and have a low CPF balance, topping up your CPF through cash is the most effective way to boost your CPF savings.

This is because you do not have enough savings to generate tangible returns from your interest.

For Singaporeans below the age of 55, you can top up your SA through the Retirement Sum Topping- Up (RSTU) Scheme. Apart from giving a boost to your CPF savings, you can also enjoy tax relief for the first $7,000 of your top-up within a year!

Another way to save up for your retirement while enjoying tax reliefs is your SRS. You can read about the pros and cons of topping up your CPF SA and SRS here.

If you are self-employed and/or aged 55 and above, you can also consider topping up all 3 CPF accounts (OA, SA and MA) through a Voluntary Contribution (VC) to boost your CPF.

However, you may want to note that you can only top up to the CPF Annual Limit each year, which is on top of your mandatory contributions!

As of 2021, the CPF Annual Limit stands at $37,740

Mandatory contributions refer to contributions made to your:

- MA if you are self-employed, or

- Your 3 CPF accounts (OA, SA and MA) if you are employed by a company

Are you intending to top up your CPF OA? Here’s what you need to know.

#2 Transfer from your CPF OA to SA

While the CPF OA is a safe haven to save up for your retirement with its stable interest rate, its 2.5% – 3.5% interest per annum leaves more to be desired when investing for long term goals such as your retirement.

One way to make your excess OA funds work harder for you is to transfer them to your SA, which generates a higher interest of 4 – 5 % per annum.

Excess OA monies refer to your remaining funds after setting aside necessary spending needs such as housing.

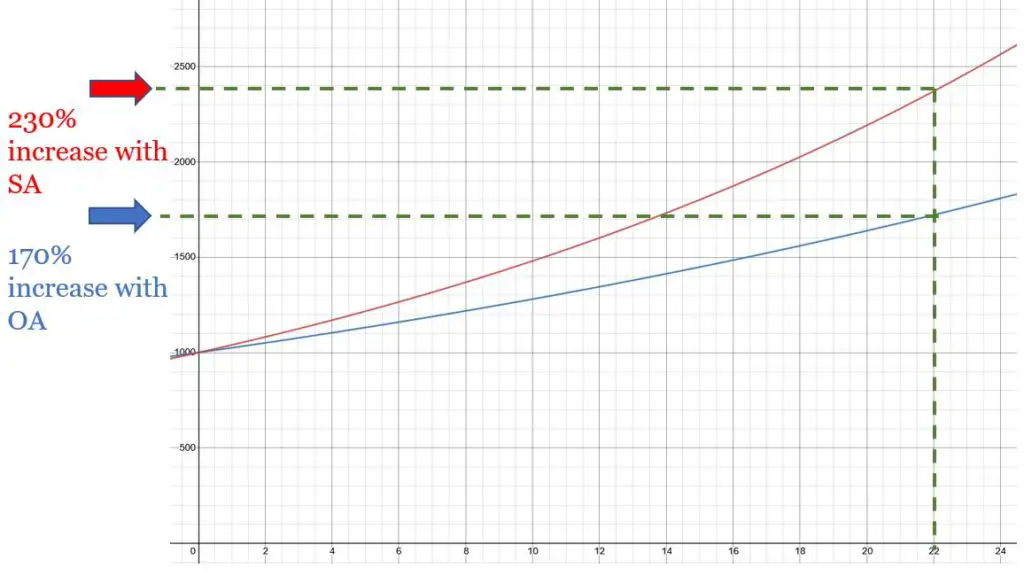

Right now, you may wonder: The difference in interest rate is only 1.5%. How much more can I earn in my SA?

To illustrate the effect of a 1.5% difference in returns over time, here is a graph showing the final balance if you had saved the same amount in your OA and SA for 22 years.

By just switching your funds from your OA to your SA, you would have seen a 60% increase in your returns! When comparing the final amounts between both accounts, the SA has 35% more than the OA.

A 1.5% increase in returns may not look much at first, but it can compound to a much greater difference in the long run.

#3 Invest your CPF OA funds via CPFIS

Another way to make your OA monies work harder for you is to invest them. However, you will need to spend the effort to research the various investment options available.

This is because investments do not give fixed returns, which is different from our CPF. In some products, you may even lose money if you withdraw your investments at the wrong time!

However, by investing within our risk tolerances, we can take advantage of the long time horizon to achieve greater returns compared to the OA’s interest rate.

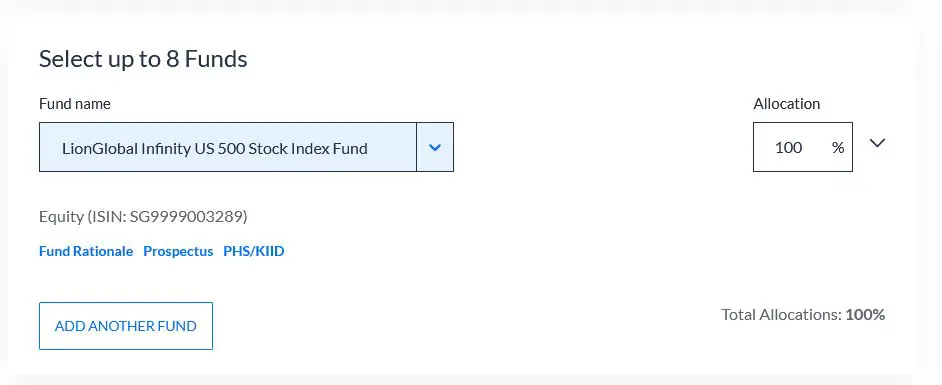

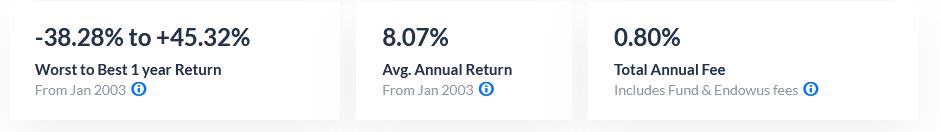

For example, we take the example of investing our OA funds in the S&P 500 through the LionGlobal Infinity US 500 Stock Index Fund, which tracks the S&P 500’s performance through the Vanguard® U.S. 500 Stock Index Fund.

You can invest in the LionGlobal Infinity US 500 Fund through Endowus.

After accounting for fees, this fund has yielded an average of about 7.2% per annum over the past 18 years. Using the power of compound interest, an investment in this fund would have returned much more than leaving them in your OA!

Although this figure does not conclusively predict the future returns of this fund, we can still conclude that investing your OA funds gives you a very good chance of beating the OA interest rates in the long term.

With your increased returns, you get a strong advantage to top up your RA from age 55 to save up to your FRS or even your ERS.

After covering your retirement sum, you can sit back and relax as you receive your lifelong payouts under CPF LIFE once you hit the payout eligibility age of 65 years old.

Other than investing your OA monies, you can also consider investing your SA or SRS funds!

What happens when you saved the FRS in your CPF OA and SA?

When you have managed to save the Full Retirement Sum (FRS) in your combined OA and SA savings, you can opt not to pledge your property before withdrawing your excess CPF savings.

Without pledging your property, you do not need to return anything to your CPF RA when you sell your house in future.

When choosing whether to pledge your property or not, you will need to weigh the trade-offs between having enough savings for your current expenses vs your future payouts from CPF LIFE.

If you are turning 55 either this or next year, you will be also able to know the FRS that you need to save in your Retirement Account (RA). After your RA is created on your 55th birthday, your SA funds will be withdrawn first to form your FRS, followed by those in your OA.

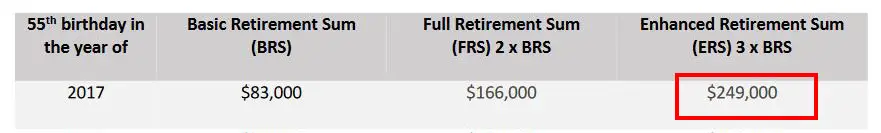

Enhanced Retirement Sum (ERS)

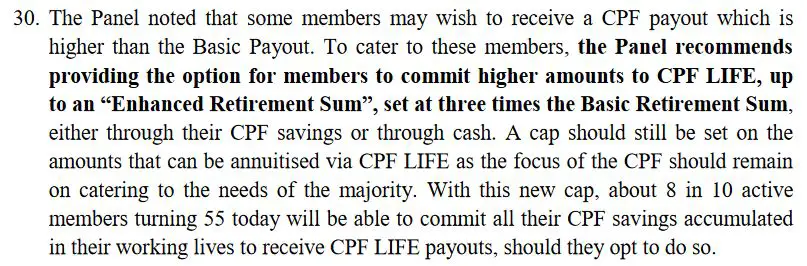

The Enhanced Retirement Sum (ERS) is the largest of all the 3 retirement sums, and is calculated as 3 times the Basic Retirement Sum (BRS). This sum represents the cap that you can save in the Retirement Account (RA) to receive higher payouts.

Should I top up to my ERS to retire comfortably?

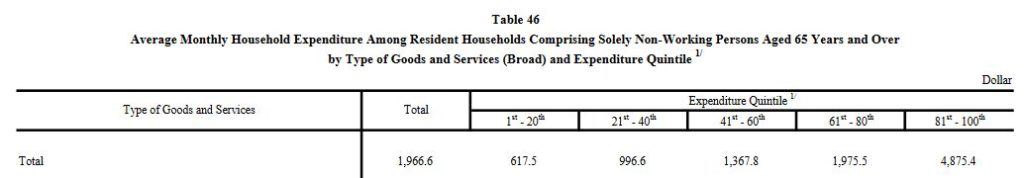

From data in the Household Expenditure Survey of 2017/18, topping your RA up to the ERS at age 55 may only allow you to live an average lifestyle in Singapore. Therefore, you may want to consider supplementing your CPF payouts with other sources of income, even if you have topped up to your ERS.

Everyone around us has a different idea of what ‘retiring comfortably’ is. For some, it consists of daily cafe hopping and frequent round the world trips. Meanwhile, others may be content with just eating coffee shop food and knitting at home.

To answer this question from the perspective of the Singaporean society as a whole, we shall turn to the Household Expenditure Survey to look at the expenditures of retiree households (above age 65). These expenditures will then be inflation-adjusted and used to compare with the estimated payouts from the ERS.

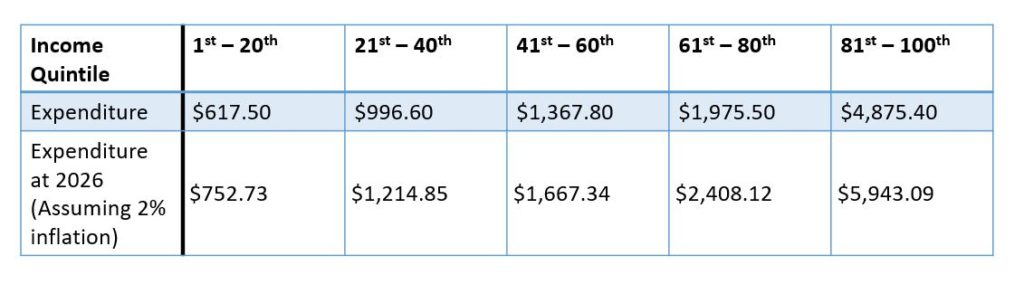

As of the last date of writing this article, the latest Household Expenditure Survey falls back to 2017. The data we are interested in here is the retiree household expenditure by quintile.

This gives us an idea of where the payout from the ERS will fall within the current spending of all Singaporean retirees.

Unfortunately, Singaporeans do not receive their CPF LIFE payouts for another 10 years. Therefore, the expenditures would need to be compounded to account for inflation.

A 2% inflation rate was used based on the long term inflation rate determined by the CPF Advisory Panel.

In the same year when the survey was conducted, the ERS of Singaporeans who turned 55 was $249,000.

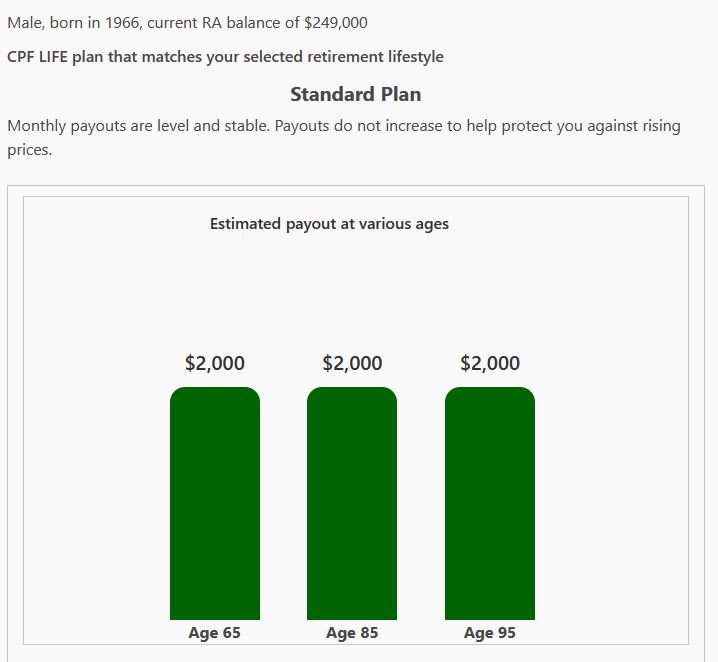

Using the value of ERS from that year, the approximate payout for both a male and female member was calculated using the CPF LIFE Estimator. As a reference, the Standard Payout option was selected.

The payouts for saving the ERS at age 55 in 2017 is about $1,860 – $2,000 a month.

Referring back to the table of inflated expenditures, the ERS payout will be able to cover the expenditures up to about the 60th percentile of all retirees.

While more than half of Singaporeans can easily survive on this amount, a significant portion of Singaporeans will find the ERS payout insufficient for their retirement lifestyle.

Therefore, to be able to maintain a higher lifestyle level, you may want to consider supplementing your CPF payouts with other forms of income, such as investments or annuities.

Can I top up my CPF RA above the ERS?

As the ERS represents the upper limit of what you can save in your Retirement Account, you cannot top up your RA above the ERS for your age. However, you are able to take advantage of the 4 – 6 % interest in your RA to boost your funds, which will greatly increase your payouts.

The earlier you save to your ERS, the more you are able to take advantage of this additional interest.

Conclusion

At first glance, it can be confusing to see 3 retirement sums in the CPF RSS, which makes us wonder what is an appropriate amount to save for our retirement. A good start to examine these sums is the BRS, which can be seen as a payout for basic survival.

The FRS is then introduced to protect Singaporeans who are not homeowners, as the additional payout ensures that retirees are able to pay rental expenses. However, if you are financially able to, it would be worthwhile to minimally save up to the FRS to guarantee a better standard of living.

Finally, the ERS depicts the maximum amount you can save in your RA. Despite this, payouts from your ERS may not give you a lavish lifestyle, and it is recommended you diversify to other investment products to further boost your retirement income!

Do check out this page for more guides to other topics about your CPF!

Do you like the content on this blog?

To receive the latest updates, you can follow us on our Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?