Last updated on March 5th, 2022

Stablecoins are important as they bridge the world of real money to crypto. You are able to lock in gains without having to convert to cash, avoiding price fluctuations.

2 of these stablecoins include BUSD and DAI, and here’s how these two are different:

Contents

The difference between BUSD and DAI

BUSD is a fiat-based stablecoin that has a higher market capitalisation and wider availability of trading pairs compared to DAI, which is over-collateralised with a variety of crypto assets. As such, DAI is a decentralised stablecoin, while BUSD is controlled by a central entity.

Here’s a further comparison of these 2 stablecoins:

Reserves Liquidity and Market Capitalisation

One of the most important aspects of a stablecoin is its reserves. This is how a stablecoin can maintain a constant price despite the changes in the cryptocurrency market.

BUSD – Reserves and Liquidity

BUSD is regulated and their physical dollars are being stored in FDIC-insured US banks.

The biggest difference between BUSD and other stablecoin is that it is backed by cash (by fiat). Other stablecoins, such as DAI, are also backed by other cryptocurrencies.

The reserves of BUSD is cash in the bank, while other stablecoins have reserves in cryptocurrency.

Thus, the other stablecoins are not actually pegged to physical cash in the real world, making it riskier.

Paxos and BUSD are approved and regulated by the New York State Department of Financial Services, ensuring the utmost of consumer protections.

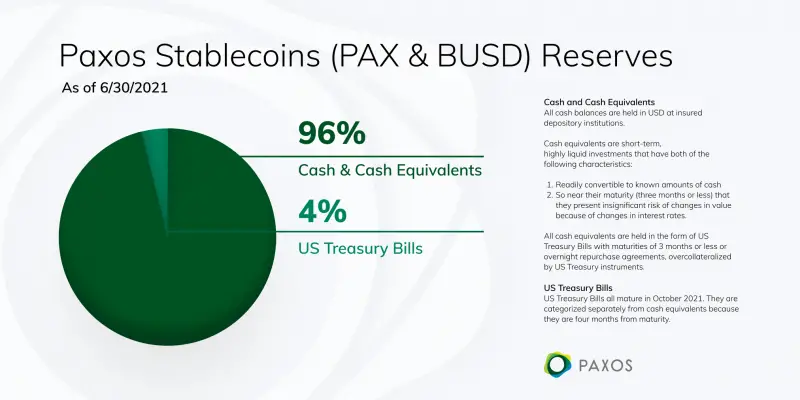

Paxos official website

As of 30 June 2021, some 96% of the reserves were held in cash and cash equivalent. The other 4% were invested in U.S. Treasury bills. In contrast to USDT, this is a huge amount of cash being kept in the reserves.

Source: Paxos

This means that for every one BUSD on the blockchain, there is one USD directly stored under Paxos in cash or Treasury Bills.

Because of this, BUSD has more reliable reserves than USDT. This means that they are more financially stable and the coin becomes less risky to hold in the long term.

If all BUSD holders would like to exchange BUSD for cash, there should be enough reserves from Paxos to exchange every BUSD for one USD in cash.

BUSD is just one of the cryptocurrencies that were created by Binance, with the other being BNB. You can find out more about the differences between BNB and BUSD in this comparison article.

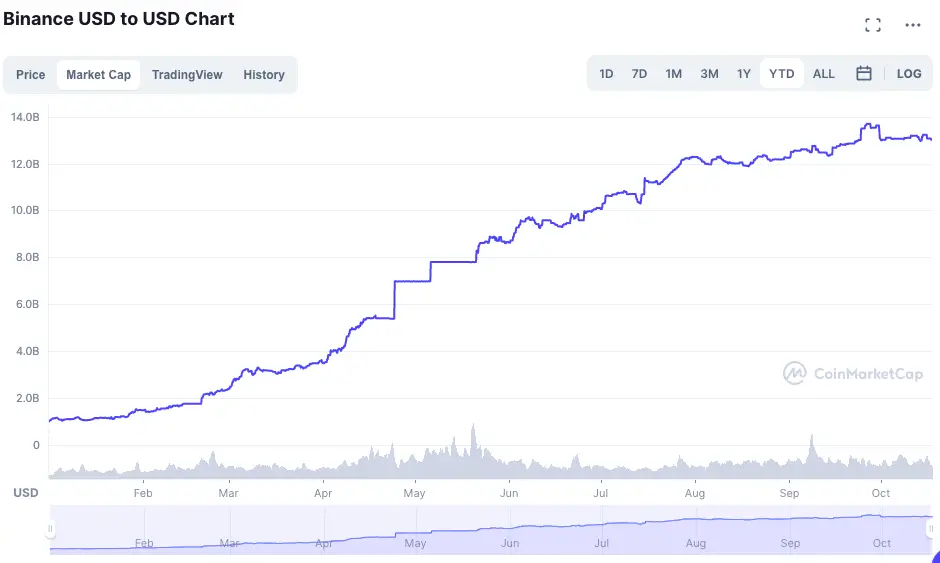

BUSD – Market Capitalisation

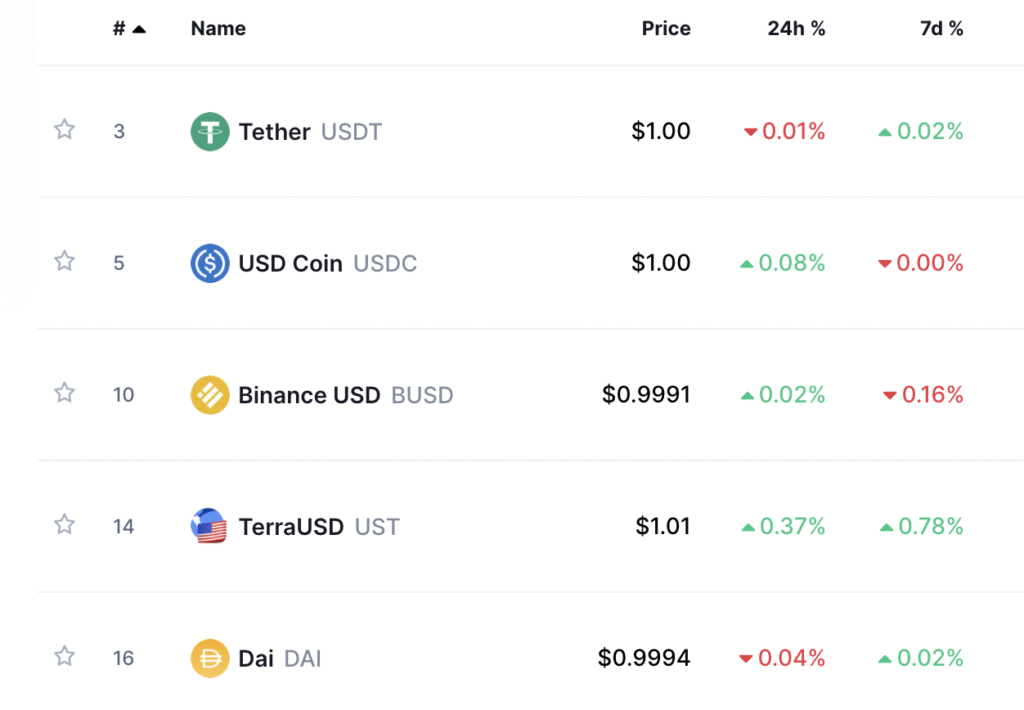

By market capitalisation, BUSD is the third-largest stablecoin, with 11.37 billion BUSD in supply.

Source: CoinMarketCap

In third place, BUSD accounts for 10.8% market share in the stablecoin market. This means that there is a healthy circulation of this coin. As such, these coins can then be used to buy, sell or stake on various platforms.

DAI – Reserves and Liquidity

The situation of collateral with DAI is a bit different and relatively more complicated. DAI tokens are actually over-collateralised in the sense that for every DAI coin in existence, there’s 150% of crypto assets backing it.

Compared to other stablecoins which are backed by USD, DAI is backed by collateral on the Maker platform.

The collateral is deposited with MakerDAO, which accepts a wide variety of coins, including:

- ETH

- BAT

- USDC

The price of DAI is maintained through smart contracts, instead of having a central organisation to keep the price steady.

This makes DAI a decentralised stablecoin, where it is not being controlled by a central entity.

However, there are risks when the assets that back DAI have a huge decrease in price. With a huge drop in the price of ETH in March 2020, MakerDAO considered shutting down DAI, which shows the risks of being backed by other assets instead of USD.

DAI – Market Capitalisation

When comparing the market capitalisation of DAI, it has the 5th highest market cap, just behind UST and BUSD.

Availability of Trading Pairs on Platforms

The main purpose of stablecoins is to convert volatile coins into a more stable currency.

For stablecoins to be useful, we have to be able to exchange any crypto coins of our choice into stablecoin.

A trading pair is where assets that can be traded for each other on an exchange

Definition of trading pairs by Gemini

The more trading pairs a coin has, the more useful a coin is.

An example of a trading pair is Bitcoin/Ethereum (BTC/ETH), which is the exchange between Bitcoin and Ethereum.

If you are exchanging Bitcoin for Tether (USDT), you are using the trading pair of BTC/USDT.

Let’s look at the number of trading pairs each of the coins has:

BUSD – Trading Pairs

Since BUSD was started by Binance.com, it has the most trading pairs on the platform. On other platforms, they are less likely to list BUSD if they are not in collaboration with Binance.

Source: Binance

While BUSD is available on these platforms, there are platforms that offer more stablecoin trading pairs, such as USDC or USDT.

If you are only using Binance, BUSD is a great choice, since most of the coins on Binance have a trading pair with BUSD.

DAI – Trading Pairs

In comparison with BUSD, DAI has much fewer trading pairs. Most of these trading pairs are limited to either:

- BTC

- ETH

- Other stablecoins

- Fiat currencies

You won’t be able to buy altcoins with DAI on most trading platforms!

As such, the variety of trading pairs that you can use the buy with DAI is much less limited.

Interest rates on staking platform

Other than trading with stablecoins, you can also earn interest with your stablecoins on various staking platforms.

The prices of stablecoins remain constant, unlike other cryptocurrencies such as Bitcoin. This makes holding stablecoins a great way to avoid market volatility.

On top of that, the interest rates for stablecoins are usually higher than normal coins. Even though stablecoins can be considered similar to USD, the interest rates for stablecoins are much higher compared to those offered by the banks!

Your stablecoins gain interest, while having stable prices.

This is a great way to earn passive income.

Let’s compare the interest rates across the different platforms:

BUSD – Interest Rates

Here are the crypto exchanges and platforms that offer staking for BUSD:

| Platform | Interest rate (per year) |

|---|---|

| Binance | 1.2% for flexible 4.24% for 7 days locked savings |

| BlockFi | 8.75% for the first 20,000 DAI 7.75% after the first 20,000 DAI |

| Crypto.com | None |

| Nexo | None |

DAI – Interest Rates

Here are the crypto exchanges and platforms that offer staking for DAI:

| Platform | Interest rate (per year) |

|---|---|

| Binance | 2.2% for flexible |

| BlockFi | 8.75% for the first 20,000 DAI 7.75% after the first 20,000 DAI |

| Crypto.com | Up to 12% |

| Nexo | Up to 12% |

There are more platforms that allow you to earn interest on DAI, compared to BUSD.

Companies behind BUSD and DAI

To look at the value of a cryptocurrency, it will be good for you to consider their management team.

The company that is in charge of a stablecoin have a vision for the coin, which in turn sets the direction of the coin.

In the case of stablecoins, they have to be trustworthy as they essentially work as a central bank that prints and distributes money.

Let’s look at the companies behind these coins:

BUSD – Paxos and Binance

Binance collaborated with Paxos, a New York-regulated financial institution to create BUSD. With BUSD, trading in Binance would be much easier.

Despite the name of BUSD being Binance USD, Paxos is the issuing company of BUSD. This means that Paxos holds reserves of BUSD, which are all the US dollars that back up the BUSD.

As the coin is regulated by institutions, it is less likely to be shut down due to regulations.

When Binance USD (BUSD) was created in September 2019, in collaboration with Paxos, we set out to provide a stablecoin that would work as a trusted stablecoin within the Binance ecosystem.

Binance.com, commenting on their stablecoin

Since BUSD is native to Binance, Binance can offer lower fees when users are trading with BUSD. Occasionally, Binance also offers discounts for trading with BUSD.

However, since BUSD is controlled by Paxos, they have the right to freeze your accounts anytime. If regulators think you are involved with illegal activity, Paxos can take over your account.

We may freeze, temporarily or permanently, your use of, and access to

BUSD or the US dollars backing your BUSD, with or without advance notice,

if we are required to do so by law, including by court order or other legal process.

– Terms and conditions of BUSD by Paxos

If you are using cryptocurrency because of decentralisation and freedom from the government, then you may want to consider another stablecoin.

DAI – MakerDAO

MakerDAO was founded by Rune Christensen, where the value of the stablecoin is achieved by regulating it through this Decentralised Autonomous Organisation (DAO).

Due to this decentralised design of DAI, you are able to use it without being regulated by a central entity.

Verdict

Here’s a summary of the comparison between these 2 stablecoins:

| BUSD | DAI | |

|---|---|---|

| Liquidity and Reserves | Includes – 96% Cash and cash equivalents – 4% US Treasury Bills | Over-collateralised with a variety of coins (ETH, BAT, USDC) |

| Market Capitalisation | #3 among stablecoins | #5 among stablecoins |

| Availability of Trading Pairs | Close to 250 pairs | Lesser options for trading pairs |

| Staking Platform Options | Staking platforms only include Binance and BlockFi | More options than BUSD |

| Owners of the Coins | Binance, Paxos | MakerDAO |

| Year of Establishment | 2019 | 2014 |

| Regulations | Regulated by the New York State Department of Financial Services | None |

So which stablecoin is more suitable for you?

Choose BUSD if you prefer trusted reserves

In terms of regulations, BUSD is the better option. If you are using Binance for your crypto activities, you benefit even more as BUSD is already part of the Binance ecosystem.

Since it is regulated, there is less risk involved, especially if governments are putting more restrictions on stablecoins.

However, if you often trade across platforms and buy less known coins, BUSD may not be available. Most platforms do not offer it, apart from the bigger exchanges.

Also, if you would like to have full control of your coins without facing government regulations, then BUSD is not ideal for you.

Choose DAI if you are looking for a decentralised stablecoin

DAI is unique as it is not backed by any fiat currencies, but instead by a variety of cryptocurrencies.

Since there is no central entity that controls the reserves, the stablecoin can be considered to be decentralised, and governments may not be able to regulate it as much as BUSD!

However, DAI has lower availability of trading pairs compared to BUSD, so it may limit its use cases for trading with other cryptocurrencies.

Conclusion

Stablecoins are essential to the crypto ecosystem.

Stablecoins may all serve the same purpose, but they are not created equal.

BUSD and DAI are the top stablecoins in the market at the moment and are both useful in their own ways.

To decide which stablecoin to use, you should consider your needs, such as:

- the types of coins you buy

- the platforms you use

- the level of risk you are willing to take

- whether you want full control of your coins

From there, you can better determine which stablecoin is most suitable for you!

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?