Last updated on January 19th, 2022

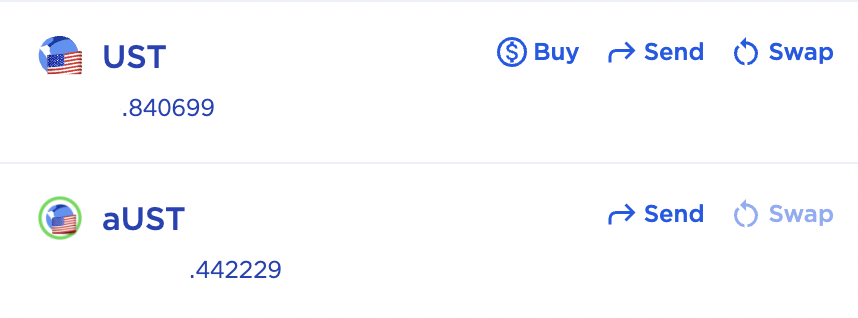

If you’ve deposited UST into the Anchor Protocol, you may have noticed that your UST balance has disappeared from your Terra Station wallet!

In its place, you will notice that you now own aUST.

Moreover, the amount of aUST you own may be lower than the amount of UST that you’ve initially deposited into Anchor.

What’s the difference between these 2 cryptocurrencies, and should you be worried?

Here’s what you need to know:

Contents

What is aUST on the Terra Station wallet?

When you deposit UST into the Anchor Protocol, you will receive aUST in return. This is a yield-bearing asset that increases in value, depending on the aTerra exchange rate between aUST and UST.

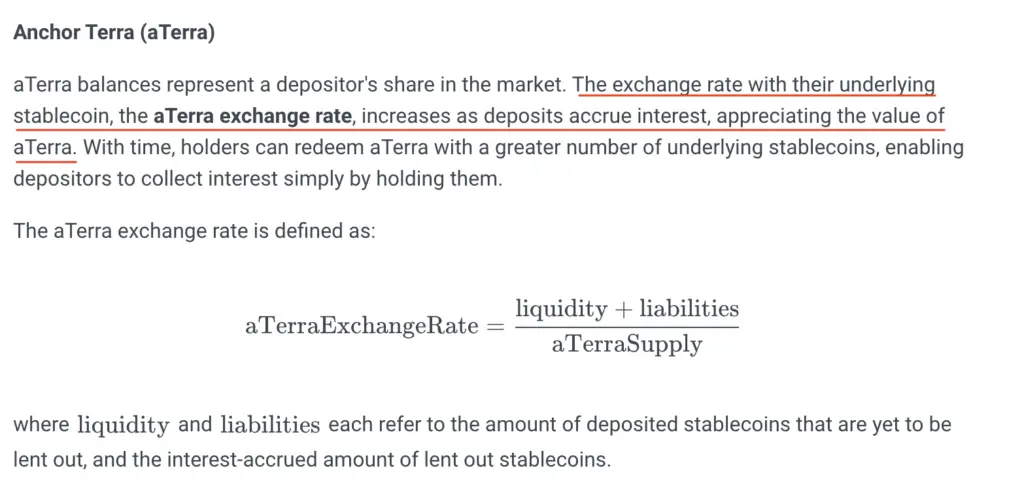

Here’s what was mentioned in the documentation of the Anchor Protocol:

What this means is that the value of aUST will increase over time, based on the current interest rate that Anchor Protocol is providing for UST.

When the Anchor Protocol was first launched, the exchange rate between aUST and UST was 1:1.

However, over time, the exchange rate will increase. In a theoretical situation where the interest rate was consistently 20% for a year, the exchange rate between aUST and UST will now be 1:1.2.

Let’s say that you’ve deposited $1,000 UST one year ago when the exchange rate was 1:1. When you withdraw your funds when the exchange rate is 1:1.2 one year later, you will now receive $1,200 UST (20% interest rate).

Things may not be that straightforward, as the interest rate on the Anchor Protocol has been fluctuating between 19.4% to 20%.

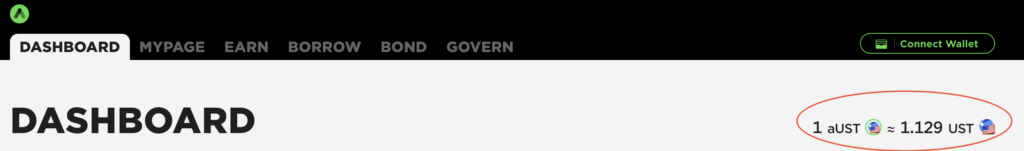

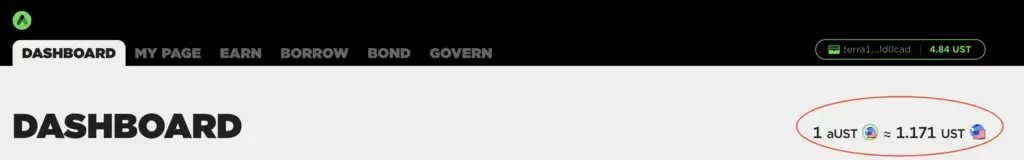

You are able to check the latest exchange rate between aUST and UST on the Anchor Protocol dashboard.

On 4th November 2021, the exchange rate between aUST and UST was 1:1.129.

When I checked it again on 12 January 2022, the exchange rate has now increased to 1:1.171.

As such, the exchange rate between aUST and UST will continue to increase based on the interest rate on Anchor Protocol. This is independent of the price of aUST and UST.

Is aUST the same as UST?

aUST represents a yield-bearing asset, while UST represents a stablecoin that is backed to the US dollar. Based on the interest rate that is issued by the Anchor Protocol, the exchange rate between aUST and UST will increase over time. As a result, the amount of UST that you withdraw from the Anchor Protocol will be higher than the amount that you’ve deposited.

The amount of aUST that you own represents a share of the total UST that is deposited into the Anchor Protocol at that point in time.

This is somewhat similar to depositing 2 tokens into a liquidity pool, and you will receive liquidity pool (LP) tokens in return. These LP tokens represent your share of the entire liquidity pool.

For example, let’s say you deposit $1,000 UST into the Anchor Protocol when the exchange rate between aUST and UST is 1:1.125.

This means that you will receive 888.88 aUST tokens based on this exchange rate.

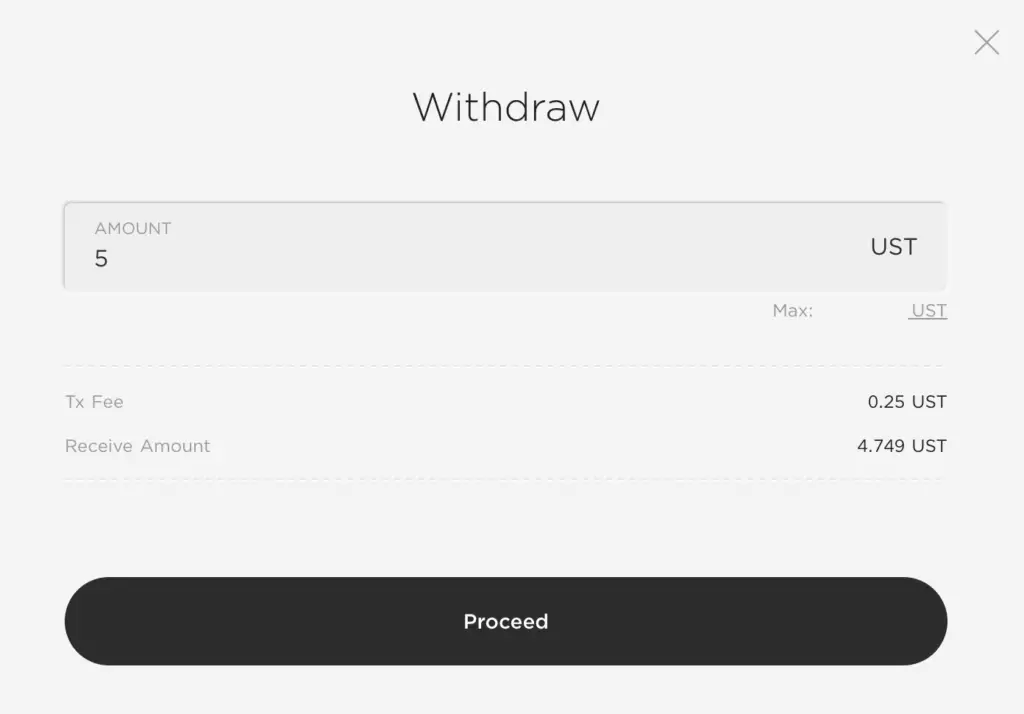

If you decide to withdraw the tokens immediately, you should receive back $1,000 UST. However, don’t forget that you will incur transaction fees when depositing and withdrawing from the Anchor Protocol!

If you let these 888.88 aUST tokens stay in the Anchor Protocol, you will continue to earn interest and the exchange rate will increase too.

Let’s say the exchange rate now increases to 1:1.3. When you withdraw your UST back to your Terra Station wallet, you will receive $1,155.54 UST.

Even though your aUST did not increase in price, the amount of UST you receive will increase due to the increase in the exchange rate.

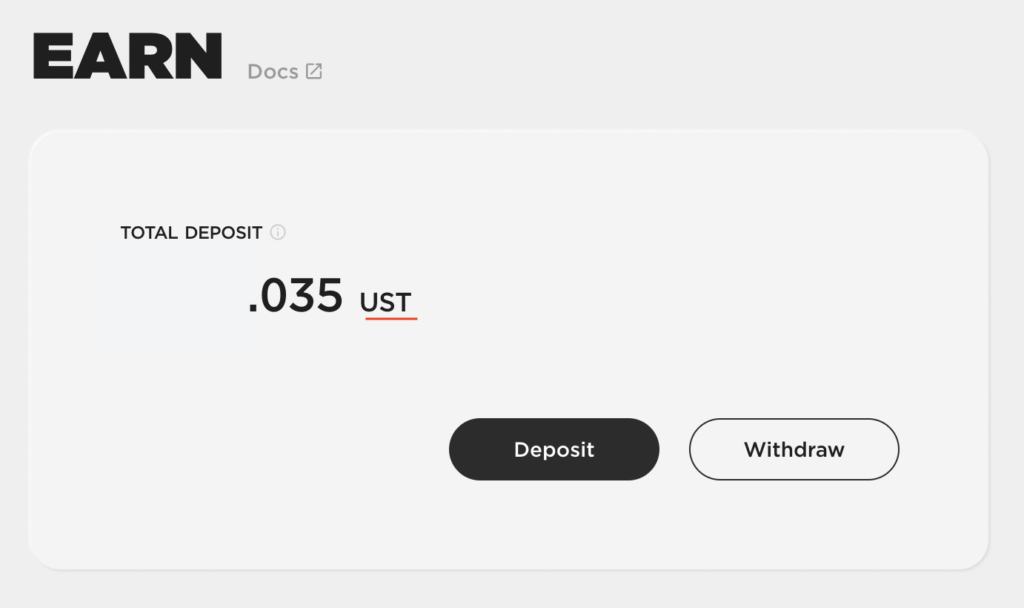

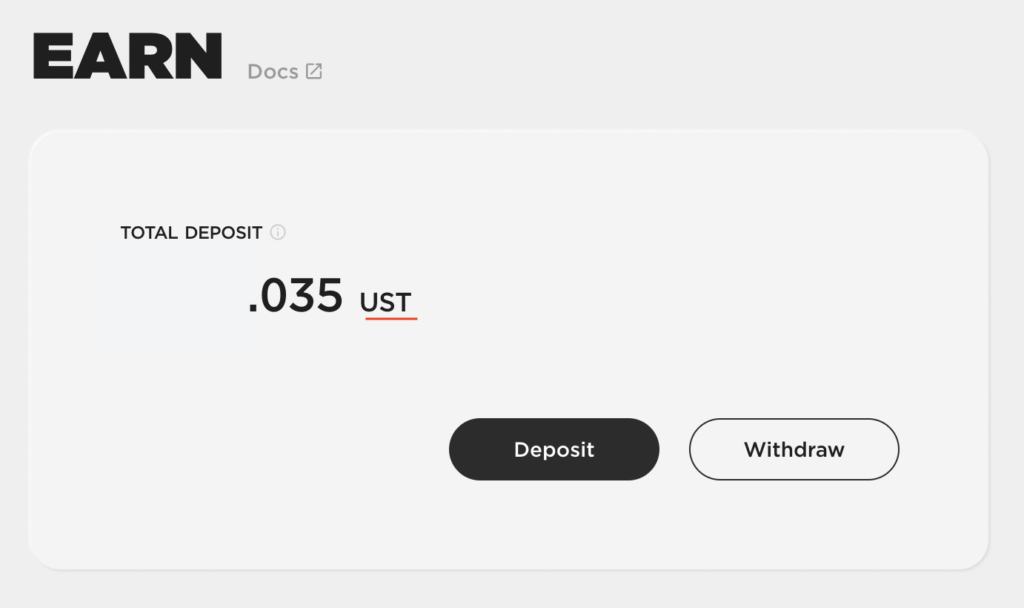

You may also want to note that the value shown on the Anchor Protocol ‘Earn‘ dashboard is in UST, and not aUST.

As such, this value should increase as the exchange rate between aUST and UST increases over time!

How do I convert aUST back to UST?

To convert aUST back to UST, you will need to initiate a withdrawal from the Anchor Protocol which will result in you receiving UST. The amount of UST that you receive will be based on the current exchange rate between aUST and UST.

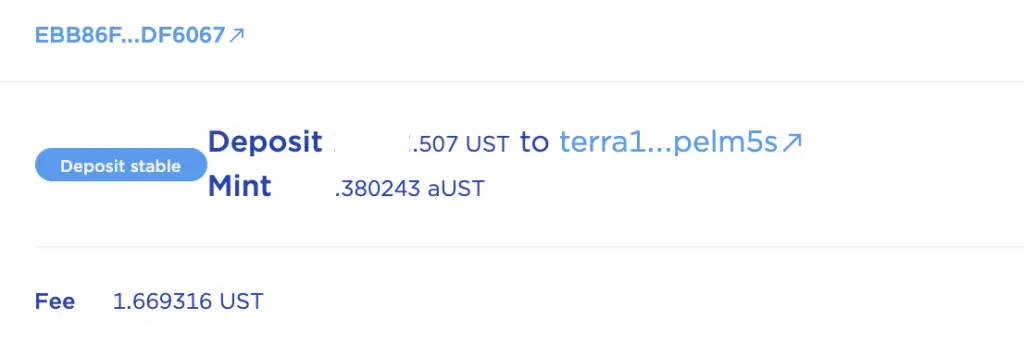

You are able to check the amount of aUST that you’ve obtained from the Anchor Protocol, based on the amount of UST that you’ve deposited.

You can check this on the ‘History‘ tab of your Terra Station wallet.

The amount of aUST you receive will be based on the current exchange rate between aUST and UST.

When you withdraw aUST back to UST, you will receive the amount of UST based on the new and increased exchange rate between aUST and UST.

Conclusion

The amount of aUST that you receive after depositing UST into Anchor Protocol may be less than your initial deposit in UST.

If you’re wondering how you can use the Anchor Protocol from Singapore, you can view my step-by-step guide here.

However, you do not need to worry as the exchange rate between aUST and UST is not 1:1. The amount of aUST that you receive in your Terra Station wallet depends on the current exchange rate when you made the deposit.

Over time, the exchange rate between aUST and UST will continue to increase, based on the prevailing interest rate issued by the Anchor Protocol.

When you withdraw UST from Anchor Protocol, the value of aUST will be higher relative to UST. This means that the amount of UST that you receive from the withdrawal should be higher than the amount that you’ve deposited.

As such, you do not need to be worried about the amount of aUST that you receive. Ultimately, you still are able to track the amount of UST that you currently have in the Anchor Protocol from the dashboard.

Since the interest is earned in real-time, you may notice that your total deposit will increase over time!

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?