Last updated on February 24th, 2022

We have heard of crazy fluctuations in the crypto market. 10% drops in a day or a 20% increase in price in an hour are common in cryptocurrencies.

However, there is a class of cryptocurrencies that are stable in prices, regardless of the ups and downs of the market. These coins are called stablecoins.

A stablecoin is a digital currency that is pegged to a “stable” reserve asset like the U.S. dollar or gold. Stablecoins are designed to reduce volatility relative to unpegged cryptocurrencies like Bitcoin.

Definition of a stablecoin by Coinbase

Stablecoins are important as they bridge the world of real money to crypto. You are able to lock in gains without having to convert to cash, avoiding price fluctuations.

There are different ways where stablecoins can be created. The stablecoins can choose to have reserves in:

- fiat, which is real-world dollars

- cryptocurrencies,

- or have no reserves at all.

Let’s discuss two fiat-based, USDT and BUSD, and their differences.

Contents

The Difference Between BUSD and USDT

Both BUSD and USDT are fiat-based stablecoins. In terms of market capitalisation among the stablecoins, USDT is ranked highest while BUSD is in third place. USDT is widely used on almost all platforms, but it has problems with its unclear reserves. BUSD is regulated and has reserves in cash, but it is available only on selected platforms.

Reserves, Liquidity and Market Capitalisation

One of the most important aspects of a stablecoin is its reserves. This is how a stablecoin can maintain a constant price despite the changes in the cryptocurrency market.

USDT – Reserves and Liquidity

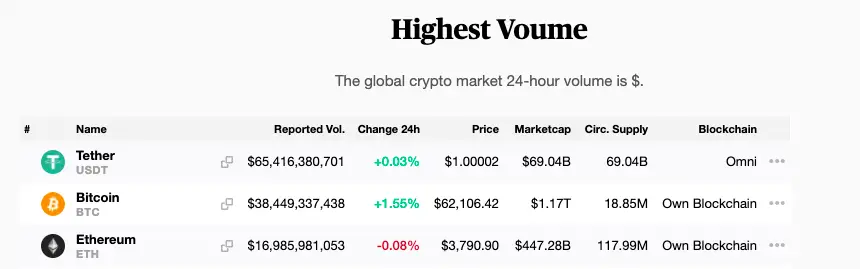

USDT has been the most well-known stablecoin and is widely used in crypto exchanges.

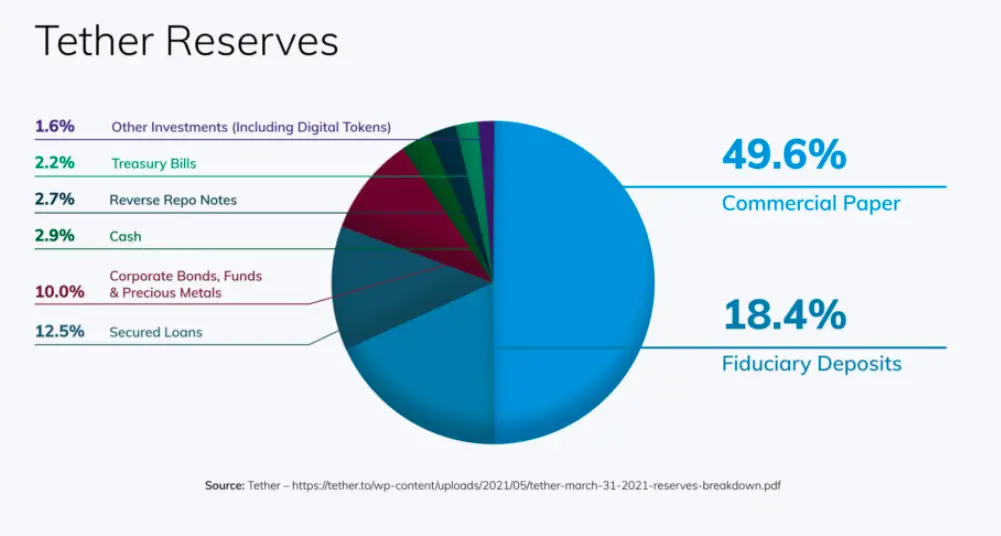

Let’s dive into the breakdown of Tether’s reserves:

This pie chart shows that Tether only holds 2.9% in cash and 2.2% in treasury bills.

The other parts of the reserve include commercial paper and secured loans.

Commercial paper is a form of unsecured, short-term debt commonly issued by companies to finance their payrolls, payables, inventories, and other short-term liabilities.

Definition of a commercial paper by Investopedia

Their assets are less liquid and less accessible compared to cash. Furthermore, it takes time to retrieve those assets. If the other party is unable to pay the loan, then the money is essentially gone.

For example, if there is a big crash in the crypto market, you may not be able to withdraw your USDT for USD in cash. As a holder of USDT, you may lose your capital.

USDT – Liquidity

When talking about Tether liquidity, we have to mention their issue with their reserves.

Back in 2019, Tether claimed that for every USDT coin on the blockchain, there is one USD in cash, held by the company.

However, the company did not hold enough reserves to back 100% of the USDT issued. This also means that USDT has limited liquidity in its funds. The users found out and soon, the authorities stepped in.

Tether (the company) was fined 41 million USD by the Commodity Futures Trading Commission (CFTC) in the US. This was due to Tether’s untrue claims that its USDT Stablecoins is fully backed by fiat money in the real world.

According to CFTC’s findings, Tether’s reserves included “unsecured receivables and non-fiat assets”.

This means that they do not have the full cash on hand, and some of their funds are not backed by any type of asset!

Not only that, Tether only had enough reserves for 27.6% of the days in a 26-month period. However, they claimed that they have “100% reserves at all times”.

Essentially, for every USDT that was created on the blockchain, there are not enough cash in their reserve to back it.

This is different from what Tether claimed.

Today, Tether has released more details about the structure of their reserves, without specifying that they only have 2.9% of their reserves held in cash.

For now, Tether remains stable despite the previous downturns in crypto markets.

However, if you are investing in this coin, it is important to keep in mind that there is a certain risk in USDT in regards to its reserves and liquidity.

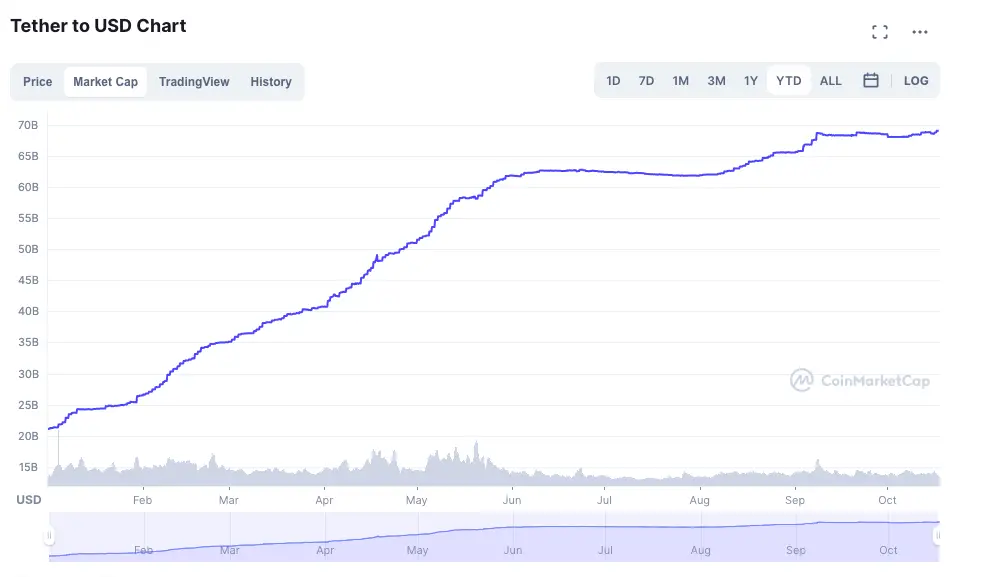

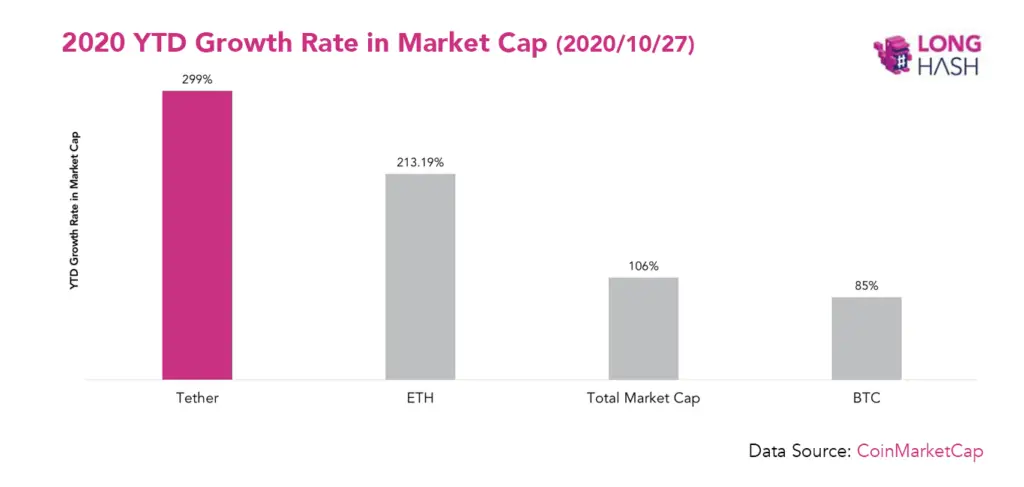

USDT – Market Capitalisation

Nonetheless, USDT is still the stablecoin with the highest market capitalisation. It also remains popular among cryptocurrency traders.

Source: CoinMarketCap

With a market capitalization of almost 70 million USD, USDT holds 58% of the stablecoin market share. Tether is also often used as a way to hold money on exchanges when traders feel the market is extremely volatile.

Source: Long Hash

USDT is widely accepted in most exchanges. Trading on exchanges has also become the main source of demand for USDT.

About 62% of the USDT issued by the Tether treasury flowed directly to exchanges, based on its 180-day average.

According to Chainalysis, last updated in Nov 2021

Increasingly, USDT is being issued or minted on several blockchains.

Since USDT is hosted on the Ethereum chain, the main blockchain that issue USDT had been the Ethereum chain. However, other chains, such as TRON, OMNI and OMG, have recently been issuing USDT as well.

Tron is now one of the main issuers of USDT with 37 billion USDT minted. This means that it increases the quantity of USDT in the market, which in turn, increases the market capitalisation of USDT.

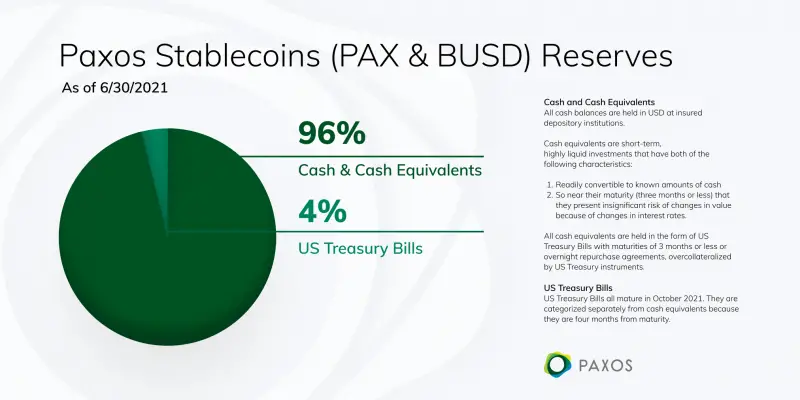

BUSD – Reserves and Liquidity

On the other hand, BUSD is regulated and their physical dollars are being stored in FDIC-insured US banks.

The biggest difference between BUSD and other stablecoin is that it is backed by cash (by fiat). Other stablecoins, such as DAI, are also backed by other cryptocurrencies.

The reserves of BUSD is cash in the bank, while other stablecoins have reserves in cryptocurrency.

Thus, the other stablecoins are not actually pegged to physical cash in the real world, making it riskier.

Paxos and BUSD are approved and regulated by the New York State Department of Financial Services, ensuring the utmost of consumer protections.

Paxos official website

As of 30 June 2021, some 96% of the reserves were held in cash and cash equivalent. The other 4% were invested in U.S. Treasury bills. In contrast to USDT, this is a huge amount of cash being kept in the reserves.

Source: Paxos

This means that for every one BUSD on the blockchain, there is one USD directly stored under Paxos in cash or Treasury Bills.

Because of this, BUSD has more reliable reserves than USDT. This means that they are more financially stable and the coin becomes less risky to hold in the long term.

If all BUSD holders would like to exchange BUSD for cash, there should be enough reserves from Paxos to exchange every BUSD for one USD in cash.

BUSD is just one of the cryptocurrencies that were created by Binance, with the other being BNB. You can find out more about the differences between BNB and BUSD in this comparison article.

BUSD – Market Capitalisation

By market capitalisation, BUSD is the third-largest stablecoin, with 11.37 billion BUSD in supply.

Source: CoinMarketCap

In third place, BUSD accounts for 10.8% market share in the stablecoin market. This means that there is a healthy circulation of this coin. As such, these coins can then be used to buy, sell or stake on various platforms.

Availability of Trading Pairs on Platforms

The main purpose of stablecoins is to convert volatile coins into a more stable currency.

For stablecoins to be useful, we have to be able to exchange any crypto coins of our choice into stablecoin.

A trading pair is where assets that can be traded for each other on an exchange

Definition of trading pairs by Gemini

The more trading pairs a coin has, the more useful a coin is.

An example of a trading pair is Bitcoin/Ethereum (BTC/ETH), which is the exchange between Bitcoin and Ethereum.

If you are exchanging Bitcoin for Tether (USDT), you are using the trading pair of BTC/USDT.

Let’s look at the number of trading pairs each of the coins has:

USDT – Trading Pairs

By far, USDT is still the most widely used on most exchange platforms. This also explains why they have the highest market capitalisation for stablecoins at the moment.

Source: cryptoslate

Compared to every other cryptocurrency, it usually has the highest 24-hour trading volume. With higher trading volume, this means that there is more activity. USDT is constantly being used to exchange with other cryptocurrencies.

Moreover, USDT is listed on almost every exchange. Most of the coins on these exchanges will have a trading pair with USDT.

Source: consider

There are almost 300 USDT pairs on Binance.com, and close to 1000 pairs on Gate.io.

USDT remains useful as it is widely used as the stablecoin across multiple exchanges, despite having issues with its reserves.

If you are trading with different coins, and particularly those rare coins, USDT may be the better stablecoin for you.

BUSD – Trading Pairs

Since BUSD was started by Binance.com, it has the most trading pairs on the platform. On other platforms, they are less likely to list BUSD if they are not in collaboration with Binance.

Source: Binance

While BUSD is available on these platforms, there are fewer platforms that offer this stablecoin compared to USDT, which is listed on almost all exchanges.

If you are only using Binance, BUSD is a great choice, since most of the coins on Binance have a trading pair with BUSD.

However. if you often transfer your stablecoins across platforms, it would be more convenient to use USDT.

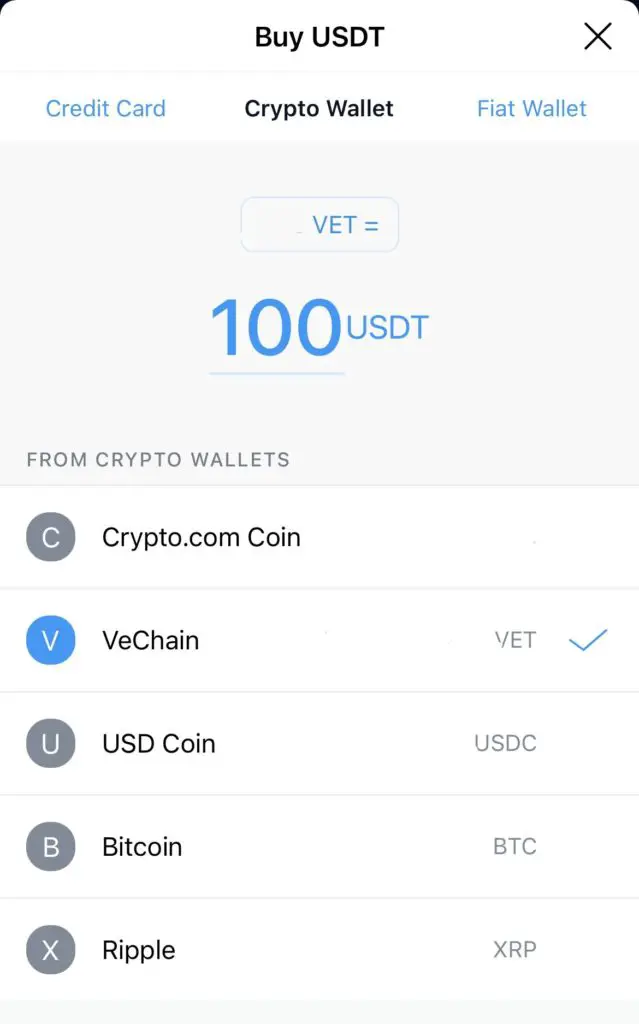

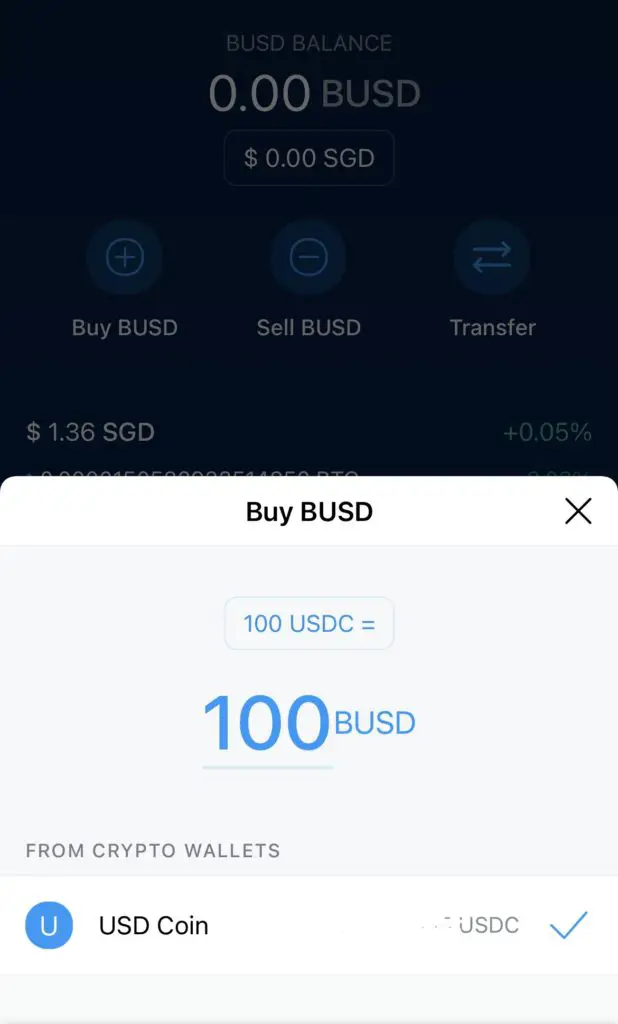

Comparison of trading pair availability on Crypto.com

To show you the difference in trading pairs available on a platform that is not Binance, let’s compare the trading pairs available on Crypto.com for both USDT and BUSD.

There are far more trading pairs for USDT on Crypto.com, on their exchange.

What about the trading pairs on their app?

Note: This is a non-exhaustive list of coins that can be exchanged with BUSD. It is to demonstrate that with the same group of coins available, only a few coins can be exchanged into BUSD. More coins can be exchanged directly into USDT.

From these screenshots, you can see that there is a wider range of coins that can be exchanged into USDT, compared to BUSD.

The Crypto.com App and Exchange are 2 separate platforms, and you can view an in-depth comparison here.

Interest rates on staking platform

Other than trading with stablecoins, you can also earn interest with your stablecoins on various staking platforms.

The prices of stablecoins remain constant, unlike other cryptocurrencies such as Bitcoin. This makes holding stablecoins a great way to avoid market volatility.

On top of that, the interest rates for stablecoins are usually higher than normal coins. Even though stablecoins can be considered similar to USD, the interest rates for stablecoins are much higher compared to those offered by the banks!

Your stablecoins gain interest, while having stable prices.

This is a great way to earn passive income.

Let’s compare the interest rates across the different platforms:

USDT – Interest Rates

Here are the crypto exchanges and platforms that offer staking for USDT:

| Platform | Interest rate (per year) |

|---|---|

| Nexo | 10% for the basic tier up to 12% for more advanced tiers |

| BlockFi | 8.25% for the first 40,000 USDT 7% after the first 40,000 USDT |

| Cake DeFi | 7% |

| Crypto.com | 6% – 12% depending on the duration of stake and staked CRO amount |

| Binance | 1.2% for flexible 4.24% for 7 days locked savings |

The interest rates for USDT is relatively high, compared to volatile coins such as Bitcoin and Ethereum.

These interest rates may vary depending on conditions set by the platforms, such as the duration or the amount of your stake.

For example, if you stake the coins for 3 months, you are unable to withdraw your coins for 3 months. Usually, you get higher interest rates when you stake your coins for a longer period.

USDT is offered on almost all platforms, and so there are more platforms that offer USDT staking. Let’s compare that to BUSD.

BUSD – Interest Rates

Here are the crypto exchanges and platforms that offer staking for BUSD:

| Platform | Interest rate (per year) |

|---|---|

| Binance | 1.2% for flexible 4.24% for 7 days locked savings |

| BlockFi | 8.25% for the first 40,000 BUSD 7% after the first 40,000 BUSD |

| Cake DeFi | None |

| Crypto.com | None |

| Nexo | None |

Compared to USDT, there are fewer platforms that offer you interest rates for BUSD.

Binance is the company behind BUSD, thus they offer a staking option for their in-house coin. BlockFi is in collaboration with Paxos, the issuing company of BUSD. As such, they offer staking for BUSD as well.

Other exchanges and platforms do not offer interest rates for BUSD, although they have staking for USDT. These platforms most likely do not offer BUSD on their exchange.

Comparing both coins, USDT has more options on the platforms and also has a higher interest rate for holding.

Companies behind BUSD and USDT

To look at the value of a cryptocurrency, it will be good for you to consider their management team.

The company that is in charge of a stablecoin have a vision for the coin, which in turn sets the direction of the coin.

In the case of stablecoins, they have to be trustworthy as they essentially work as a central bank that prints and distributes money.

Let’s look at the companies behind these coins:

USDT – Tether and Bitfinex

USDT was launched as RealCoin in July 2014, much earlier than the other stablecoins in the market currently. It is considered the first successful stablecoin and remains the biggest stablecoin till today.

So who is managing this coin?

USDT is directly managed by Tether, while Tether is managed by Bitfinex. Moreover, the parent company of both companies is iFinex.

This causes some issues:

- Since Tether has many parent companies, it is difficult to track accountability when there is an issue. The parent company can simply shut down Tether and move on to another company.

- Since the company and coin are not regulated, the coin may be at risk when governments decide to enforce rules on these coins. When the company crashes, you lose access to the coins and so lose your capital.

Nonetheless, Tether still maintains its dominance in the stablecoin market. This is because it has the advantage of being first in the market and also its widespread use across platforms, making it easy for users to adopt it.

BUSD – Paxos and Binance

Binance collaborated with Paxos, a New York-regulated financial institution to create BUSD. With BUSD, trading in Binance would be much easier.

Despite the name of BUSD being Binance USD, Paxos is the issuing company of BUSD. This means that Paxos holds reserves of BUSD, which are all the US dollars that back up the BUSD.

As the coin is regulated by institutions, it is less likely to be shut down due to regulations.

When Binance USD (BUSD) was created in September 2019, in collaboration with Paxos, we set out to provide a stablecoin that would work as a trusted stablecoin within the Binance ecosystem.

Binance.com, commenting on their stablecoin

Since BUSD is native to Binance, Binance can offer lower fees when users are trading with BUSD. Occasionally, Binance also offers discounts for trading with BUSD.

However, since BUSD is controlled by Paxos, they have the right to freeze your accounts anytime. If regulators think you are involved with illegal activity, Paxos can take over your account.

We may freeze, temporarily or permanently, your use of, and access to

BUSD or the US dollars backing your BUSD, with or without advance notice,

if we are required to do so by law, including by court order or other legal process.

– Terms and conditions of BUSD by Paxos

If you are using cryptocurrency because of decentralisation and freedom from the government, then you may want to consider another stablecoin that is not BUSD.

Final Verdict

| USD Tether (USDT) | Binance USD (BUSD) | |

|---|---|---|

| Liquidity and Reserves | Includes – cash – cash equivalents – receivables from loans – other assets | Includes – 96% Cash and cash equivalents – 4% US Treasury Bills |

| Market Capitalisation | #1 among stablecoins | #3 among stablecoins |

| Availability of Trading Pairs | Close to 1000 pairs | Close to 250 pairs |

| Interest Rates for Staking | Highest interest rate: up to 12% per year on Nexo | Highest interest rate: 8.25% per year on BlockFi |

| Staking Platform Options | More platform options such as Cake Defi, Crypto.com, Nexo, Binance and BlockFi | Staking platforms only include Binance and BlockFi |

| Owners of the Coins | Tether, Bitfinex | Binance, Paxos |

| Year of Establishment | 2014 | 2019 |

| Regulations | Fined by Commodity Futures Trading Commission (CFTC) in the US | Regulated by the New York State Department of Financial Services |

So which stablecoin is more suitable for you?

Choose USDT if you prefer convenience

In terms of convenience and availability of trading options, USDT is the best for a beginner. If you trade with lesser-known altcoins, you most likely have the option to buy it with USDT, since it is more widely used.

However, if you hold USDT, you have to tolerate the risk of Tether only having a small portion of cash reserves.

Having cash reserves is also an important factor in evaluating stablecoins.

Choose BUSD if you prefer trusted reserves

In terms of regulations, BUSD is the better option. If you are using Binance for your crypto activities, you benefit even more as BUSD is already part of the Binance ecosystem.

Since it is regulated, there is less risk involved, especially if governments are putting more restrictions on stablecoins.

However, if you often trade across platforms and buy less known coins, BUSD may not be available. Most platforms do not offer it, apart from the bigger exchanges.

Also, if you would like to have full control of your coins without facing government regulations, then BUSD is not ideal for you.

Conclusion

Stablecoins are essential to the crypto ecosystem.

Stablecoins may all serve the same purpose, but they are not created equal.

USDT and BUSD are the top stablecoins in the market at the moment and are both useful in their own ways.

To decide which stablecoin to use, you should consider your needs, such as:

- the types of coins you buy

- the platforms you use

- the level of risk you are willing to take

- whether you want full control of your coins

From there, you can better determine which stablecoin is most suitable for you!

Do you like the content on this blog?

To receive the latest updates, you can follow us on our Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?