Last updated on June 8th, 2022

Stablecoins are important as they bridge the world of real money to crypto. You are able to lock in gains without having to convert to cash, avoiding price fluctuations.

2 of these stablecoins include USDC and GUSD, and here’s how these two are different:

Contents

The difference between USDC and GUSD

Both GUSD and USDC are stablecoins. However, USDC has a higher market cap, more trading pairs and higher availability of lending platforms compared to GUSD, which may result in greater use cases for USDC.

Here is a further comparison between these 2 stablecoins:

Reserves Liquidity and Market Capitalisation

One of the most important aspects of a stablecoin is its reserves. This is how a stablecoin can maintain a constant price despite the changes in the cryptocurrency market.

USDC – Reserves and Liquidity

In an ‘attestation’ that was done by Grant Thornton in 2021, the findings showed that only 60% of USDC reserves are made of cash.

Meanwhile, the remaining 40% of the reserves were backed by debt securities and bonds.

A debt security is a debt instrument that can be bought or sold between two parties and has basic terms defined, such as the notional amount (the amount borrowed), interest rate, and maturity and renewal date.

Investopedia

Their assets are less liquid and less accessible compared to cash. Furthermore, it takes time to retrieve those assets. If the other party is unable to pay the loan, then the money is essentially gone.

If there is a big crash in the crypto market and everyone wants to cash out USDC for USD at the same time, you may not be able to do so!

USDC – Market Capitalisation

USDC has the second-largest market cap of all stablecoins, with the largest being USDT.

This shows the faith that investors have in this stablecoin.

GUSD – Reserves and Liquidity

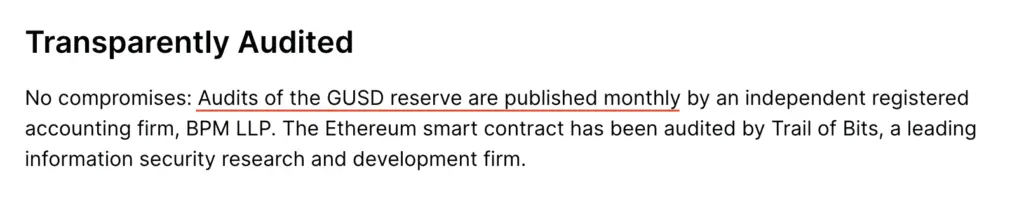

On the other hand, Gemini conducts a monthly audit for the reserves of GUSD.

This ensures that GUSD’s reserves are fully backed 1:1 with USD, and you are able to exchange GUSD for USD at any time.

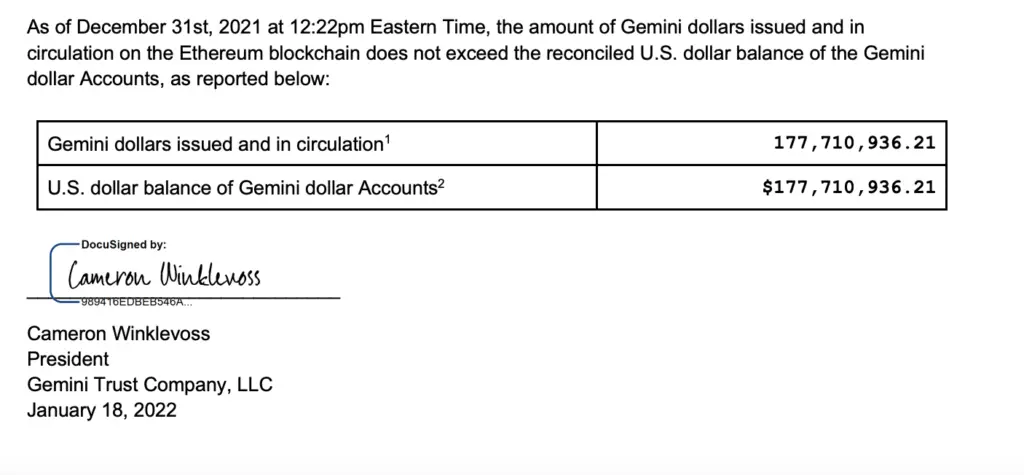

In the audit done in December 2021, it was found that the US dollar balance is equal to the amount of GUSD that is issued and in circulation.

As such, this helps to ensure that GUSD has one of the more trusted reserves for a stablecoin. This also makes it more trustworthy compared to USDC’s reserves.

GUSD – Market Capitalisation

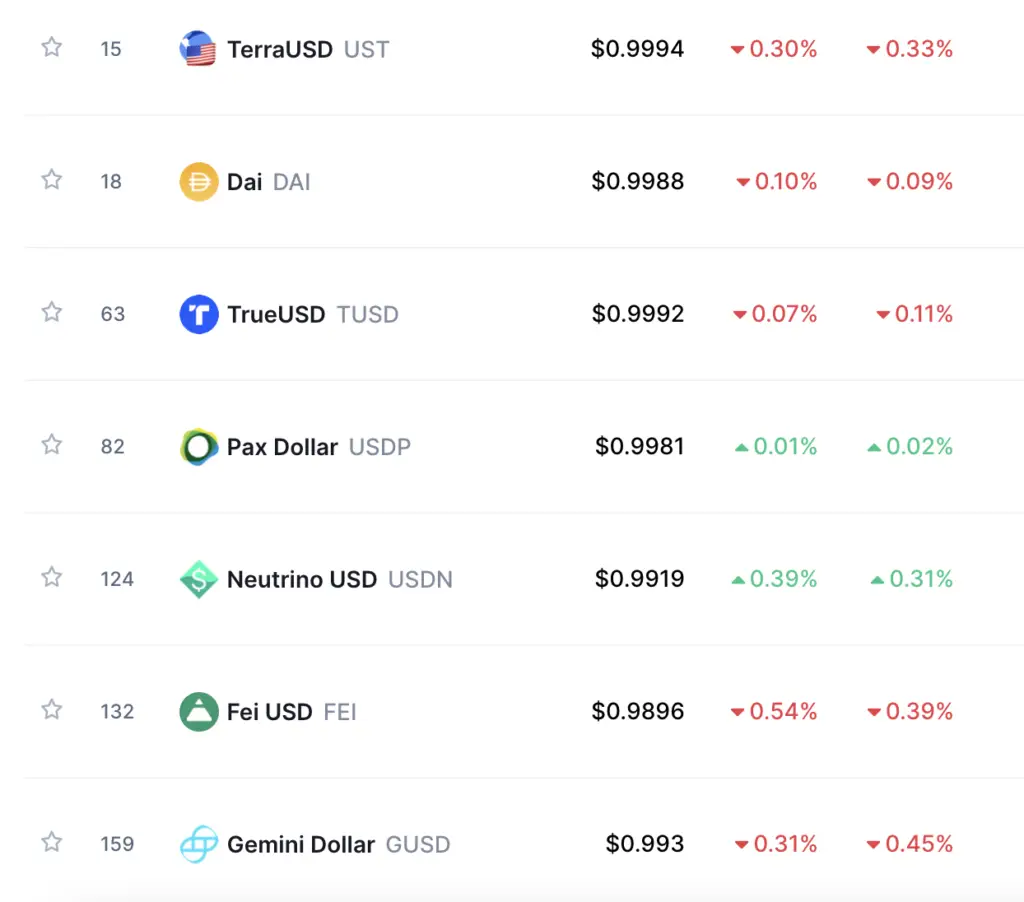

When compared to other stablecoins, GUSD has a much lower market cap.

In fact, GUSD is the 10th ranked stablecoin, behind other currencies like TUSD, UST and DAI.

Its current market cap is around $290 million, which pales in comparison to USDC’s market cap of $52 billion.

Availability of Trading Pairs on Platforms

The main purpose of stablecoins is to convert volatile coins into a more stable currency.

For stablecoins to be useful, we have to be able to exchange any crypto coins of our choice into stablecoin.

A trading pair is where assets that can be traded for each other on an exchange

Definition of trading pairs by Gemini

The more trading pairs a coin has, the more useful a coin is.

An example of a trading pair is Bitcoin/Ethereum (BTC/ETH), which is the exchange between Bitcoin and Ethereum.

If you are exchanging Bitcoin for Tether (USDT), you are using the trading pair of BTC/USDT.

Let’s look at the number of trading pairs each of the coins has:

USDC – Trading Pairs

As the second-highest stablecoin in terms of market cap, USDC has quite an extensive number of trading pairs on different platforms, such as:

Most of these platforms allow you to trade various cryptocurrencies for USDC, including:

- XRP

- ADA

- BNB

GUSD – Trading Pairs

GUSD is not listed on many platforms as compared to USDC.

Apart from it’s parent platform on Gemini, it is also listed on other decentralised finance (DeFi) platforms such as:

- Uniswap

- Curve Finance

However, most of the popular cryptocurrency exchanges do not list GUSD on their platform.

Interest Rates on Staking Platforms

Other than trading with stablecoins, you can also earn interest with your stablecoins on various staking platforms.

The prices of stablecoins remain constant, unlike other cryptocurrencies such as Bitcoin. This makes holding stablecoins a great way to avoid market volatility.

On top of that, the interest rates for stablecoins are usually higher than normal coins. Even though stablecoins can be considered as similar to USD, the interest rates for stablecoins are much higher compared to those offered by the banks!

Your stablecoins gain interest, while having stable prices.

This is a great way to earn passive income.

Let’s compare the interest rates across the different platforms:

USDC – Interest Rates

Here are some of the places where you can lend or ‘stake’ USDC:

| Platform | Minimum Deposit | Lock-In Period |

|---|---|---|

| Celsius | None | Flexible |

| Nexo | None | Flexible |

| Crypto.com | 250 USDC | Flexible, 1 / 3 months |

| Binance | 1 USDC | Flexible |

| AAX | 10 – 100 USDC | Flexible, 7 / 14 / 30 days |

| Blockfi | None | None |

| Hodlnaut | None | None |

| Midas | None | None |

You can find out more about these platforms with this guide on ‘staking’ USDC.

GUSD – Interest Rates

There are fewer platforms where you can lend out GUSD to earn interest:

| Platform | Minimum Deposit | Lock-In Period |

|---|---|---|

| Celsius | None | Flexible |

| Blockfi | None | None |

| Gemini Earn | None | None |

Companies behind GUSD and USDC

To look at the value of a cryptocurrency, it will be good for you to consider their management team.

The company that is in charge of a stablecoin have a vision for the coin, which in turn sets the direction of the coin.

In the case of stablecoins, they have to be trustworthy as they essentially work as a central bank that prints and distributes money.

Let’s look at the companies behind these coins:

USDC – Centre and Circle

USDC is backed by the Centre consortium, which was founded by both Circle and Coinbase.

All of these companies are well established in the cryptocurrency space, and you are able to have some assurance when using USDC as a form of exchange.

GUSD – Gemini

True to its name, GUSD is run by Gemini, which is regulated in the US by the New York State Department of Financial Services.

This does hold quite a lot of credibility for GUSD.

Furthermore, all of the US dollars in Gemini’s reserves are held in an FDIC-insured bank account and money market funds.

Both stablecoins are centralised stablecoins

Both USDC and GUSD are centralised stablecoins, where a central entity issues the stablecoin.

This poses the risk of the stablecoin being in control of governments. For example, 3 Ethereum addresses were frozen in January 2022 which contained USDT upon requests from law enforcement.

Since these stablecoins are not fully decentralised like UST, there is a risk of governments still having control of your funds.

If you are using cryptocurrency because of decentralisation and freedom from the government, you may want to consider decentralised stablecoins instead.

Final Verdict

Here is a summary of both stablecoins:

| USDC | GUSD | |

|---|---|---|

| Liquidity and reserves | 60% cash and 40% backed by bonds and debt securities | 100% in USD |

| Market capitalisation | Second-highest market cap | 10th ranked stablecoin (based on market cap) |

| Trading pairs availability | More | Fewer |

| Staking interest rates | More platforms available | Less platforms available |

| Owners of the coins | Circle, Centre and Coinbase | Gemini |

So which stablecoin is more suitable for you?

Choose USDC if you prefer convenience

In terms of convenience and availability of trading options, USDC is the better option.

However, if you hold USDC, you have to tolerate the risk of Circle only having a small portion of cash reserves.

Having cash reserves is also an important factor in evaluating stablecoins.

Choose GUSD if you prefer trusted reserves

In terms of regulations, GUSD is the better option.

Due to its monthly audits, it adds much more credibility to the reserves of GUSD.

In this way, you will have lesser worries when exchanging 1 GUSD for 1 USD.

However, GUSD is not as well established a stablecoin, which limits the use cases for this stablecoin. As such, you won’t be able to use it on as many platforms compared to USDC!

Are you passionate about personal finance and want to earn some flexible income?