Last updated on June 6th, 2021

There are many different S&P 500 ETFs for you to choose from.

So how exactly does the UCITS ETF (VUSD) differ from the US-listed VOO?

Contents

The difference between VUSD and VOO

VUSD is listed on the London Stock Exchange while VOO is listed on the NYSE. While they both track the same S&P 500 index, they will differ mainly in terms of their expense ratio, dividend withholding tax and trading volume.

Here’s an in-depth comparison between these 2 ETFs:

Index tracked

Both ETFs track the S&P 500 index. As such, they should have almost the same performance in the stock market.

This is because both funds will have the same holdings in the same proportion.

You can find out more about investing with the S&P 500 in Singapore with my guide.

The fund manager is the same

Both VUSD and VOO are managed by Vanguard.

VUSD was started in May 2012, while VOO started in July 2010. With that extra 2 years and being listed on the US exchange, VOO has a much larger assets under management (AUM).

| VUSD | VOO | |

|---|---|---|

| AUM | 27,624 million | 177,931 million |

They are listed on different exchanges

VUSD is listed on the London Stock Exchange (LSE), while VOO is listed on the NYSE. This does have certain implications on how you can buy these ETFs.

Both have the same minimum unit number of 1

The minimum units that you can purchase on either the NYSE and LSE is 1. Compared to the SGX which has a minimum lot size of 10 units, this makes it really accessible for you to purchase either ETF.

Not all brokers allow you to trade on both exchanges

Some brokers do not allow you to trade on the London Stock Exchange. In contrast, the NYSE is being offered by many brokers.

| Broker | LSE | NYSE |

|---|---|---|

| FSMOne | ✕ | ✓ |

| Interactive Brokers | ✓ | ✓ |

| Saxo Markets | ✓ | ✓ |

| Standard Chartered | ✓ | ✓ |

| Maybank Kim Eng | ✓ | ✓ |

| KGI Securities | ✓ | ✓ |

| OCBC Securities | ✓ | ✓ |

| Tiger Brokers | ✕ | ✓ |

| POEMS | ✓ | ✓ |

| TD Ameritrade | ✕ | ✓ |

| DBS Vickers | ✕ | ✓ |

To invest in the LSE, you may need to find a specific broker to do so. You can view my guide to see what are the best ways to buy LSE ETFs from Singapore.

You can also view my comparison between Tiger Brokers and FSMOne to see which broker is better for you.

Commissions charged may be different

When you are trading in different exchanges, you may incur different costs. For example, here are some of the commissions when you trade in both markets:

| Broker | US | LSE |

|---|---|---|

| Interactive Brokers | 1% of trade value Minimum USD 0.35 | 0.05% * trade value Minimum GBP 1 |

| OCBC Securities | 0.3% of trade value Minimum USD20 | 0.7% of trade value Minimum GBP55 |

You can also consider Tiger Brokers which offers you a minimum of USD1.99/trade.

Interactive Brokers’ commissions may seem attractive. However, they will charge you a custodian fee of $10 per month if your total amount is below $10k!

As such, you should try to find the lowest brokerage fees so that they won’t eat into your returns!

Unit Price

The unit price of each ETF is the price you’ll need to pay for 1 unit. Both VUSD and VOO have rather different unit prices.

| VUSD | VOO | |

|---|---|---|

| Estimated Unit Prices | $70 USD | $350 USD |

If you only have a small sum of less than $300 USD to invest, VUSD may be a better option for you.

This is because you are still able to purchase some units of VUSD with your small investment amount.

Dividend withholding taxes

VUSD is domiciled in Ireland while VOO is domiciled in the US. You will incur a lower dividend withholding tax when you invest in Irish-domiciled ETFs.

| VUSD | VOO | |

|---|---|---|

| Dividend Withholding Tax | 15% | 30% |

If you are a non-resident alien to the US, you will incur the 30% dividend withholding tax.

However there is a tax treaty between Ireland and US. Any dividends issued from US stocks will only incur a 15% withholding tax.

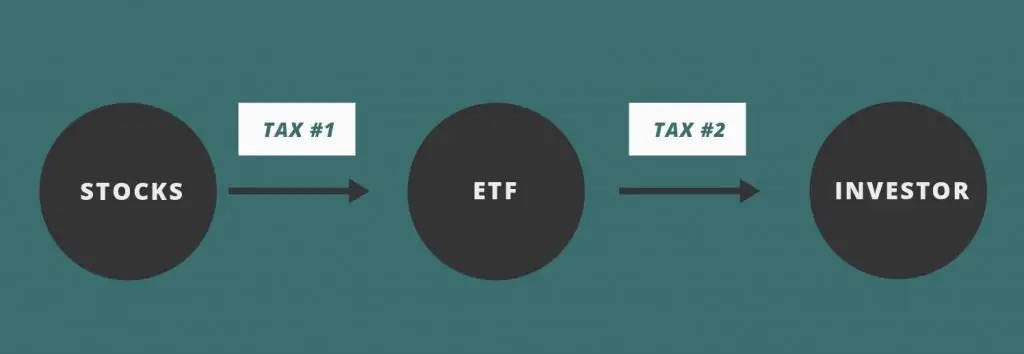

2 layers of taxes

For any ETF, the fund manager buys the stocks based on the index they are tracking. The dividends that they distribute are collected from the stocks in their fund.

As such, there are 2 layers where you may incur some taxes:

- From stock to ETF

- From ETF to you, the investor

VUSD incurs the tax on the first layer

For VUSD, the dividends from the US stocks are distributed to an Irish-domiciled ETF. As such, the 15% withholding tax applies on the first layer.

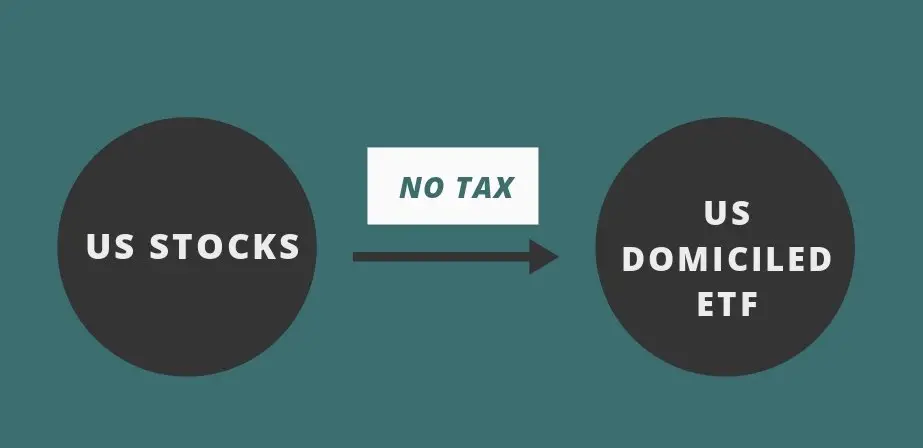

VOO incurs the tax on the second layer

When the stock distributes its dividend to the ETF, no tax is incurred. This is because it is from a US stock to a US-domiciled ETF.

However when the dividends are distributed to you, they will incur the 30% tax. This is because you are a non-resident alien.

If you wish to track your dividends with the taxes accounted for, you can consider trying out StocksCafe’s platform.

Dividend distribution

Both VUSD and VOO are distributing ETFs. This means that they will issue a dividend to you each quarter.

However, you would still need to factor in the withholding tax! The taxes will eat into your returns, especially if you invest in VOO.

You can read my comparison between accumulating and distributing ETFs to see how they are different.

Expense ratio

On top of the trading commissions you’ll need to pay the broker, you will have to pay an expense ratio to the fund manager as well.

This expense ratio is usually deducted at the end of each year.

Here are the expense ratios for these 2 funds:

| VUSD | VOO | |

|---|---|---|

| Expense Ratio | 0.07% | 0.03% |

The expense ratio for VUSD is more than twice that of VOO’s. While this difference may seem small, it will affect you in the long run!

If you are a US investor, VOO will be a much better choice due to the lower fees you’ll need to pay.

Liquidity

If you are looking to actively trade using these ETFs, you may want to look at their liquidity. One of the indicators you may want to look at is the ETF’s trading volume.

| VUSD | VOO | |

|---|---|---|

| Liquidity | 72,000 | 3,152,000 |

VOO has a much higher trading volume than VUSD due to it being listed on the NYSE.

If you are a frequent trader, VOO will be a better ETF to invest in. This is because you will be able to buy or sell the ETF at your intended price.

Verdict

Here is the complete breakdown between VUSD and VOO:

| VUSD | VOO | |

|---|---|---|

| Index Tracked | S&P 500 | S&P 500 |

| Fund Manager | Vanguard | Vanguard |

| AUM | 27,624 million | 177,931 million |

| Exchange | LSE | NYSE |

| Estimated Unit Prices | $70 USD | $350 USD |

| Dividend Withholding Tax | 15% | 30% |

| Dividend Distribution | Distributing | Distributing |

| Estate Tax | No | Yes |

| Expense Ratio | 0.07% | 0.03% |

| Liquidity | 72,000 | 3,152,000 |

So which ETF should you choose?

Choose VUSD if you want a lower dividend withholding tax

If you are a non-US investor, VUSD seems to be the more tax-efficient ETF to invest in.

You will receive a much lower dividend withholding tax. However, the expense ratio is slightly higher!

As such, you’ll need to consider the total costs of investing in an ETF, rather than just the withholding tax that you’ll incur.

The lower unit price makes VUSD more accessible

If you can only invest a small amount each time, then VUSD may be better for you. This is because you can buy each unit of the ETF with around $70 USD.

However, you’ll need to see if the trading fees are worth it for this small amount!

Choose VOO if you want an ETF with a higher liquidity and lower expense ratio

If you are a US investor, VOO is a no-brainer for you. However, the dividend withholding tax may deter you if you’re a non-US investor.

What you get in return for the higher taxes is a higher trading volume and lower expense ratio. The higher trading volume is more applicable to you if you’re a frequent trader.

Moreover, most brokers may provide a cheaper trading commission when trading on US exchanges compared to the LSE. As such, you may actually be saving more when you invest with VOO!

The only thing that you’ll need to really take note of is your estate tax. This becomes very significant when your assets in US become larger than $60k!

Conclusion

Both ETFs track the same index, so their performances should be very similar. The ETF that you choose depends on a few things:

- The amount of taxes that you wish to incur

- The exchange that you want to trade in

- The expense ratio you’re willing to pay

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?