Last updated on January 2nd, 2022

You may want to diversify your portfolio into some Taiwanese companies.

However, there are no Taiwanese stocks that are available in the Singapore Exchange (SGX)!

So how exactly do you go about buying these Taiwanese stocks in Singapore?

Contents

How to buy Taiwanese stocks in Singapore

Here are the 2 ways you can buy Taiwanese stocks as a Singaporean investor:

- Buying stocks directly from the TWSE

- Buying Taiwan ETFs listed on the NYSE

Buying stocks directly from the TWSE

You can choose to purchase Taiwanese stocks directly from the Taiwan Stock Exchange (TWSE).

In Singapore, only 5 brokers give you access to the TWSE:

Other brokers like Tiger Brokers do not have this access.

Moreover, some of them only allow you to trade via a trading representative. This means that you can’t trade on their online platforms.

Instead, you’ll need to place an order with your designated trading representative!

| Online Platform | Trading Representative |

|---|---|

| Lim & Tan | OCBC Securities Maybank Kim Eng POEMS UOB Kay Hian |

Lim & Tan Securities is the only platform that allows you to trade online. All the other 4 firms require you to make a trade via your trading representative.

Trading in the TWSE

Here are some things you’ll need to take note when you want to trade in the TWSE:

Commissions charged by broker

Here are the commissions that you’ll need to pay the broker for each trade you make:

| Broker | Commission | Minimum |

|---|---|---|

| OCBC Securities | 0.80% | TWD 1,700 |

| POEMS | 0.4% | TWD 1,000 + TWD 250 trading fee |

| UOB Kay Hian | Negotiable | Negotiable |

| Maybank Kim Eng | 0.50% | TWD 1,200 |

| Lim & Tan | 0.80% | SGD$100 (with remittance charge of TWD 800 and transaction fee of TWD 1,500) |

UOB Kay Hian did not mention their rates for trading in the TWSE.

Some of the brokers may charge GST on their commission as well! As such, it can be really costly to trade Taiwanese stocks.

Custodian charges may be charged by brokers

When you trade with these brokers in foreign stocks, you may need to pay a custodian charge. This differs between the different brokers:

| Broker | Custodian Charge |

|---|---|

| OCBC Securities | $2 per counter per month (max $150) |

| Maybank Kim Eng | $2 per counter per month (max $150) + 0.12% custodian agent Fee |

| POEMS | 0.01% on month end portfolio value |

| Lim & Tan | (0.1%/12) of month end portfolio value |

| UOB Kay Hian | Unknown |

Again, UOB Kay Hian did not mention what are the fees they will charge for the custody of Taiwan stocks.

$2 custody fee can be waived

However, the $2 custodian charge can be waived if you make a certain number of trades, either:

- 2 trades in the same calendar month

- 6 trades in the same calendar quarter

However, Maybank Kim Eng also has an additional Custodian Agent Fee that you’ll need to pay. This is charged at 0.12% of your entire TWSE portfolio.

Even if you are able to waive the custody fee, you are still subject to this fee!

POEMS and Lim & Tan do not have any waivers

For both POEMS and Lim & Tan, you are unable to waive the custody fees that they charge you.

It seems that OCBC Securities seem to offer the cheapest custodian fees. However, this is provided that you are able to waive the fees!

Sales tax

You will incur a sales tax of 0.3% of any sales proceeds you receive.

This is only applicable to any sale orders that you make.

Minimum lot size

For most stocks or ETFs, the minimum unit size will be 1,000 shares. As such, you will need to buy each stock or ETF on the TWSE in multiples of 1,000s.

This is similar to purchasing lots of 100 shares in the SGX.

Trading hours

The trading hours on the TWSE is rather short, between 0900-1330 (GMT+8).

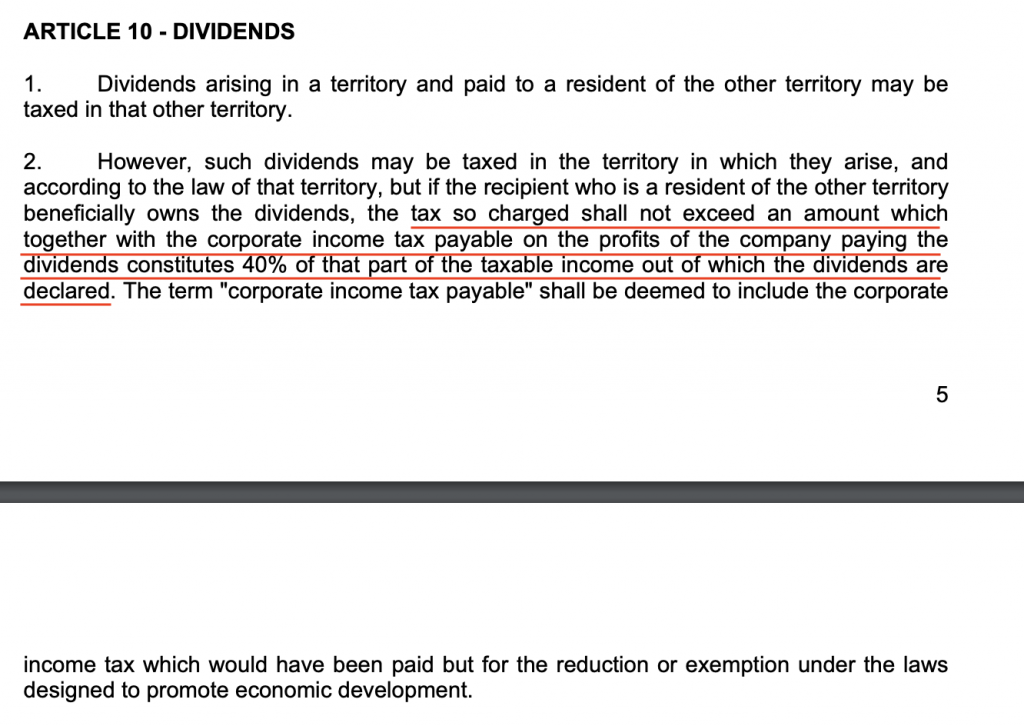

Dividend withholding tax

Singapore has a tax treaty with Taiwan. However, the actual dividend withholding tax that you’ll incur is still quite unclear.

In Deloitte’s website, it only mentions this:

The total tax burden of CIT and dividends tax is not to exceed 40% of the total profits of the company.

In the treaty agreement between Singapore and Taiwan, the same statement appears as well.

It would be best for you to discuss this with your tax consultant before you proceed with buying Taiwan stocks!

Buying Taiwan ETFs listed on the NYSE

If you do not want to pick a specific Taiwanese stock to invest in, why not buy the entire Taiwan market instead?

There are 2 ETFs listed on the NYSE that track an index of Taiwan stocks:

However, both of ETFs track different indexes:

| EWT | FLTW | |

|---|---|---|

| Index Tracked | MSCI Taiwan 25/50 Index | FTSE Taiwan Capped Index |

These indexes are similar to the S&P 500, which represents the top 500 companies in the USA.

Even though they track different indexes, their top 5 holdings are the same:

| Stock Name | Stock Ticker |

|---|---|

| Taiwan Semiconductor Manufacturing | 2330 |

| Mediatek INC | 2454 |

| Hon Hai Precision Industry LTD | 2317 |

| United Micro Electronics Corp | 2303 |

| Delta Electronics INC | 2308 |

Both ETFs have a very high weightage towards the TSMC stock. However, EWT has a slightly higher weightage towards TSMX compared to FLTW!

When you buy either ETF, you will gain exposure to the Taiwan market as a whole.

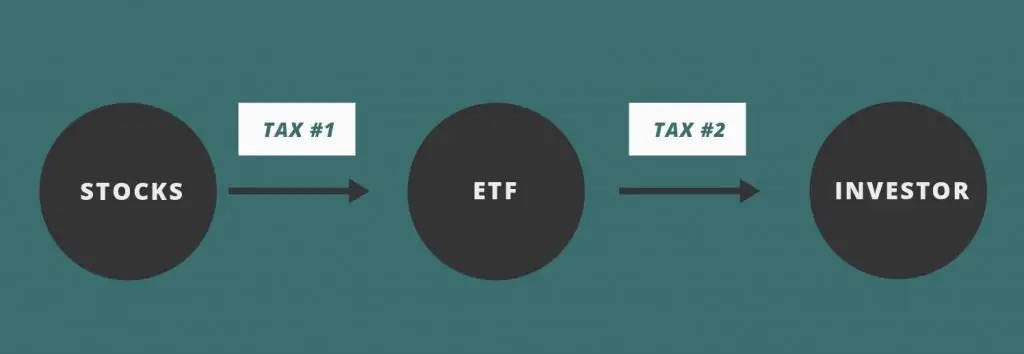

Tax implications of buying a US-listed ETF that contains Taiwanese stocks

There are extra tax considerations you’ll need to take note of if you want to invest in either of these ETFs from Singapore.

This is because both ETFs are domiciled in the US.

#1 Higher dividend withholding tax

For any ETF, the fund manager buys the stocks based on the index they are tracking.

The dividends that they distribute are collected from the stocks in their fund.

As such, there are 2 layers where you may incur some taxes:

- From stock to ETF

- From ETF to you, the investor

Taiwan does not seem to have a dividend withholding tax when distributing the dividends to the US-listed ETFs.

You may want to double check this with a qualified tax consultant.

However when the US-listed ETFs issues the dividend to you, you will be subject to the second layer of tax of 30%.

If the Taiwanese stocks issue a dividend to you, you will not receive the full amount!

#2 US estate tax

On top of the dividend withholding tax, you will be subject to the US estate tax as well. This can range from 18-26%, depending on the amount of US assets that you have!

This tax will only come into play when you pass on. The estate tax will be taxed on your total assets, regardless of whether you intend to pass it on to someone or not.

If you wish to leave your assets for your loved ones, you may not want to invest in US-listed ETFs!

Conclusion

Similar to Korean stocks, the ways that you can invest in Taiwanese stocks is rather limited for a Singaporean investor. This is because:

- Not many Singaporean brokers offer trading in the TWSE

- Trading on the TWSE via these brokers are quite expensive

- US-listed Taiwanese ETFs are quite tax inefficient

However, you do not need a CDP account to trade them as a CDP account is only used for SGX stocks.

As such, you’ll really need to consider if investing in these Taiwanese stocks are worth the hassle!

👉🏻 Referral Deals

If you are interested in signing up for any of the products mentioned above, you can check them out below!

POEMS Referral (Free US trades for 1 month)

If you are interested in signing up for a POEMS account, you can use my referral link. You will be able to receive free US trades for one month after you deposit SGD $3,000 into POEMS!

Here’s what you need to do:

- Sign up for a POEMS Cash Plus Account

- Deposit ≥ SGD $3,000 into your Cash Plus Account within 1 week of opening your account

- Enjoy 1 month worth of free US trades

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?