Last updated on January 2nd, 2022

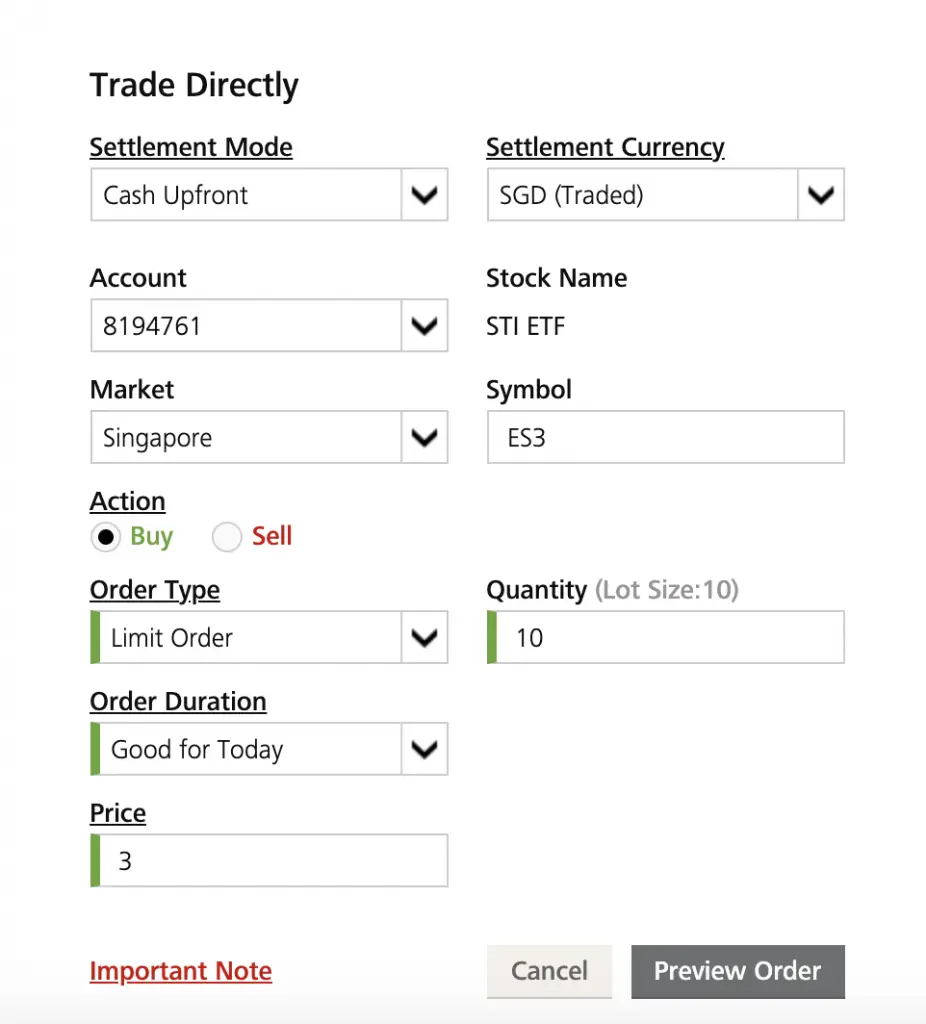

You may want to make a stock purchase on DBS Vickers (such as buying the STI ETF). However, you noticed that there are 2 ways you can make the settlement.

So what’s the difference between them? Here’s what you need to know:

Contents

What is DBS Vickers Cash Upfront?

Your Cash Upfront account with DBS Vickers requires you to have sufficient cash in your account before making a trade. This is because your trade amount will be immediately deducted from your account.

This is similar to other pre-funded brokerage accounts like Tiger Brokers.

Here are the things that you’ll need to trade with DBS Vickers Cash Upfront:

- A POSB or DBS iBanking account

- An individual DBS Vickers Online Account

It is possible for you to trade using your DBS Vickers account from the DBS or POSB iBanking. You will need to link your Vickers and iBanking accounts together.

When this happens, your funds will be immediately deducted from your DBS or POSB account when you make a trade.

How do I use my DBS Vickers Cash Upfront Account?

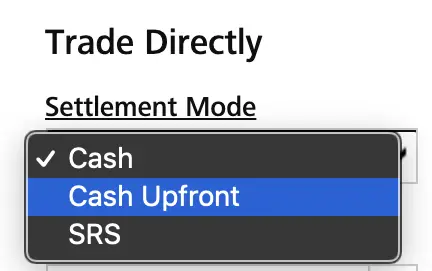

When you make a trade, the settlement mode is defaulted to your Cash Account. You will need to change the ‘Settlement Mode‘ to Cash Upfront to use this account.

You will have to do this on the ‘Order Details‘ page.

This is only applicable to buy orders!

The difference between Cash and Cash Upfront

DBS Vicker’s Cash Upfront account will immediately deduct the money from your account when you make a buy order. Meanwhile, the Cash Account allows you to make a buy order without placing any cash deposits.

The commissions for Cash Upfront is lower than the Cash Account. However, Cash Upfront is only available for buy trades!

Here are the 5 main differences between these 2 accounts:

#1 Type of settlement

Here is how the trade settlement will differ from the different types of accounts:

Cash Upfront deducts your money immediately

The Cash Upfront account deducts the trade value immediately from your bank account.

This is why you will need to have a linked POSB or DBS account!

This is similar to how a debit card works. The transaction can only go through if you have enough money in your account.

Cash Account gives you 2 days to make the settlement

For the Cash Account, you are given up to 2 days after the transaction date to deposit your funds.

This T+2 settlement date is applicable to the different markets that you can trade using DBS Vickers:

- Hong Kong

- Singapore

- Canada

- US

- UK

- Australia

- Japan

When you are using the Cash Account, it is somewhat similar to a credit card. You are able to make the trade first, but deposit the funds up to 2 days later!

However, it does not mean that you have to wait till 2 days after your transaction to make a settlement. You can still pay funds upfront as well!

If you wish to make a short term trade and keep the profit, then the Cash Account is more suitable for you.

#2 Commissions charged

Here are the commissions charged if you want to use both of these accounts for the SGX:

| Cash Account | Cash Upfront | |

|---|---|---|

| Commission | 0.28% (min $25) | 0.12% (min $12) |

When you make a trade using your Cash Upfront account, the commissions that you pay are much cheaper.

The commissions are reduced by more than half!

This could be because your trade amount is deducted immediately from your account, compared to the Cash account.

For the Cash account, you have up to 2 days after the transaction date to settle your amount.

#3 Type of orders

If you want to use your Cash Upfront account, you can only do so for buy orders.

When you want to sell your shares that you bought with your Cash Upfront account, you can only use your Cash account.

This means that the sell commissions will be much higher!

In contrast, you can use your Cash Account for both buy and sell trades.

You may want to use another broker which allows you to sell your CDP shares for a cheaper rate, such as FSMOne!

#4 Type of markets

You can use the Cash Account for all of the markets that are available on DBS Vickers:

- Singapore

- Hong Kong

- US

- Canada

- UK

- Australia

- Japan

The Cash Upfront Account is mainly available for trades in the SGX.

However, it is possible to do Cash Upfront trades for overseas stocks as well! The main requirement is that you’ll need to have a Multi-Currency Account (MCA).

The 2 MCAs that DBS has are:

By using your Cash Upfront account for your overseas trades, you will be charged a lower commission too!

| Cash | Cash Upfront | |

|---|---|---|

| HK | 0.18% (Min HKD100 / USD15) | 0.15% (Min HKD80 / USD12) |

| US | 0.18% (Min USD25) | 0.15% (Min USD18) |

| Canada | 0.50% (Min CAD28) | 0.25% (Min CAD20) |

| UK | 0.35% (Min GBP25 / USD36 / EUR33) | 0.25% (Min GBP 20 / USD 28 / EUR 26) |

| Australia | 0.35% (Min AUD30) | 0.25% (Min AUD20) |

| Japan | 0.35% (Min JPY3,000) | 0.25% (Min JPY2,000) |

The Cash Upfront is also only available for buy orders. Moreover, you may need to pay lots of other fees when you trade in overseas stocks!

#5 Contra trading

You are able to perform contra trading with your Cash account.

This is because of the way the Cash account works. You are able to settle your trades 2 days after the transaction date.

As such, you are able to perform a contra trade!

In contrast, you cannot perform a contra trade with your Cash Upfront Account.

Since your cash is immediately deducted, you can’t perform any contra trading!

Is Cash Upfront CDP or custodian?

Cash Upfront is a CDP account. This means that you are in full ownership of your shares. This is in contrast to other brokerage firms in Singapore which use custodian accounts if you perform a pre-funded trade.

According to this FAQ on DBS Vickers, it mentions that you require to open a Central Depository Account (CDP) to be able to trade on the SGX.

As such, you’ll need a CDP account to use both the Cash and Cash Upfront accounts to trading on the SGX!

This is unlike other brokerages where they are the custodian for your Cash Upfront trades.

For example, CGS-CIMB holds the custody of your SGX shares. Your shares will be under a CDP Sub-Account with CGS CIMB.

This is probably why DBS Vickers only allows you to place buy orders with your Cash Upfront account. Your shares are under your full custody in your CDP account.

For other brokerages, they have custody of your shares when you use their Cash Upfront accounts. As such, they allow you to place both buy and sell orders with your Cash Upfront account!

As such, if you are looking to trade SGX stocks without a CDP account, you should not be using DBS Vickers.

What are the sell commissions when using DBS Vickers Cash Upfront?

DBS Vickers Cash Upfront does not support sell orders. You can only use Cash Upfront for buy trades.

As such, you can only use your Cash Account when you want to sell your shares!

Verdict

Here is a breakdown between both of these accounts:

| Cash Account | Cash Upfront | |

|---|---|---|

| Settlement Period | T+2 | Immediate |

| Commission (SGX) | 0.28% (min $25) | 0.12% (min $12) |

| Type of Orders | Buy and Sell | Sell |

| Type of Markets | All markets | Only SGX Others markets are possible (if you have an MCA account) |

| Contra Trading | Allowed | Not allowed |

| Custodian or CDP? | CDP | CDP |

So which account should you choose?

Choose Cash Account if you want to do short term trading

The Cash Account is great if you are a short term trader. You do not need to put a deposit, so it gives you greater flexibility!

You are able to do contra trades on the SGX as well. If you sell the stock at a higher price than your buying price, you are able to make a profit!

However, you will need to consider the fees involved in the transaction as well!

Choose Cash Upfront for cheaper commissions

Cash Upfront provides you with cheaper commissions compared to the Cash Account. If you are a long term investor, this will be more preferable!

However, the only problem with Cash Upfront is that you cannot use it for any sell orders. Instead, you will have to use your Cash Account. This will mean you will pay higher commissions!

One workaround you can use is to sell your stocks with another broker with lower sell commissions. Since your stocks are held in your CDP account, you can use any broker that is linked to your CDP!

For example, you can use FSMOne to sell your CDP shares at a lower commission rate!

Conclusion

The Cash and Cash Upfront Accounts present different ways for you to make a settlement for your trades.

The Cash Upfront gives you cheaper commissions when you make a trade. However, there are 2 things that you’ll need to note:

- The money is immediately deducted from your account

- This is only applicable to buy trades and not sell ones

The Cash Account has higher commissions, but your trade amount is not deducted immediately. Instead, you are given 2 days from your transaction date to settle the order.

This may be more useful if you wish to do short-term trading!

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?