Last updated on June 8th, 2022

With both Binance and Huobi getting banned in Singapore, you may be looking at alternatives to buy cryptocurrencies in Singapore.

One of these options that you can consider is FTX, which allows you to deposit fiat currencies onto their platform!

FTX supports both SGD and USD on their platform. However, which currency should you deposit?

Here’s what you need to know:

Contents

How to deposit USD to FTX from Singapore

Here are 9 steps you’ll need to deposit USD to FTX:

- Go to ‘Wallet’ tab on the FTX dashboard

- Find USD and click on ‘Deposit’

- Click on ‘Deposit via Wire’ and take note of the details

- Go to DBS iBanking and click on ‘DBS Remit and Overseas Transfer’

- Go to ‘Overseas Receipient’ and select ‘New Recipient’

- Enter the necessary details as stated on FTX

- Select the bank account as your recipient

- Enter the amount you wish to transfer and your account identifier

- Receive USD in your FTX account

This method uses DBS Remit as the way to transfer USD to your account, so it would be good to have a DBS Multiplier or My Account.

This is because DBS Remit does not charge any fees if you make a USD wire transfer to a bank account in the US.

You can view a video guide here,

or you can read on to find out more:

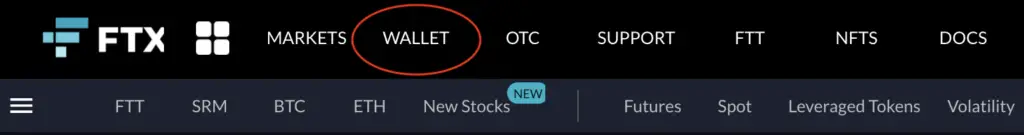

Go to ‘Wallet’ tab on the FTX dashboard

First, you’ll need to go to the ‘Wallet‘ tab on FTX.

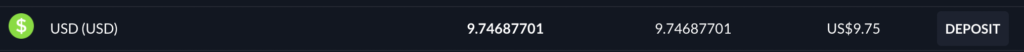

Find USD and click on ‘Deposit’

You’ll need to find USD as the currency that you wish to deposit.

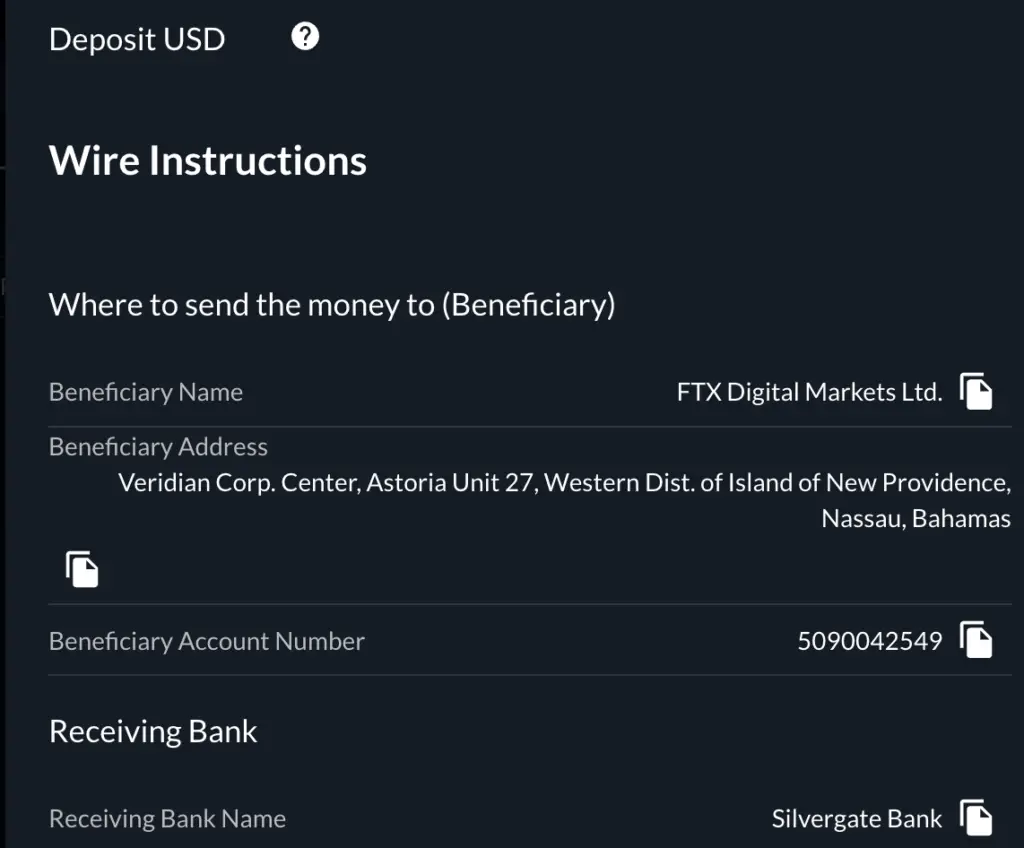

Click on ‘Deposit via Wire’ and take note of the details

This will give you a variety of ways that you can deposit USD onto FTX.

If you want to deposit USD via DBS Remit, you will need to click on ‘Deposit via Wire‘.

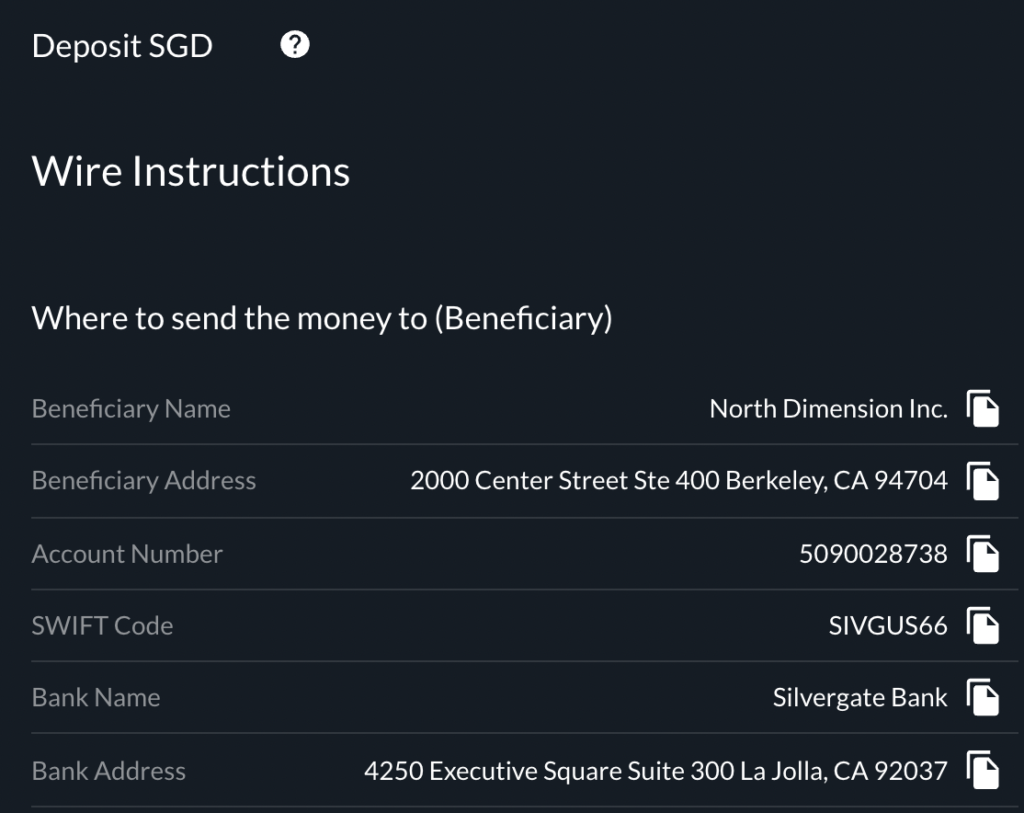

After clicking this, you will be given the details to wire your money.

Beneficiary details vs receiving bank details

There are 2 main details that are found on this page:

- Beneficiary

- Receiving Bank

The beneficiary details are the details that you should be sending your USD to. This is the bank account that is under FTX that will be receiving your funds, and then crediting them to your FTX account.

The second set of details is that of the receiving bank. This is the bank that FTX has created their account with.

This is similar to the bank details of DBS or OCBC!

As such, the details that you should add as the recipient of the funds would be from the beneficiary details. We will be going through this in detail later.

The only detail that you’ll need from the Receiving bank is the SWIFT code.

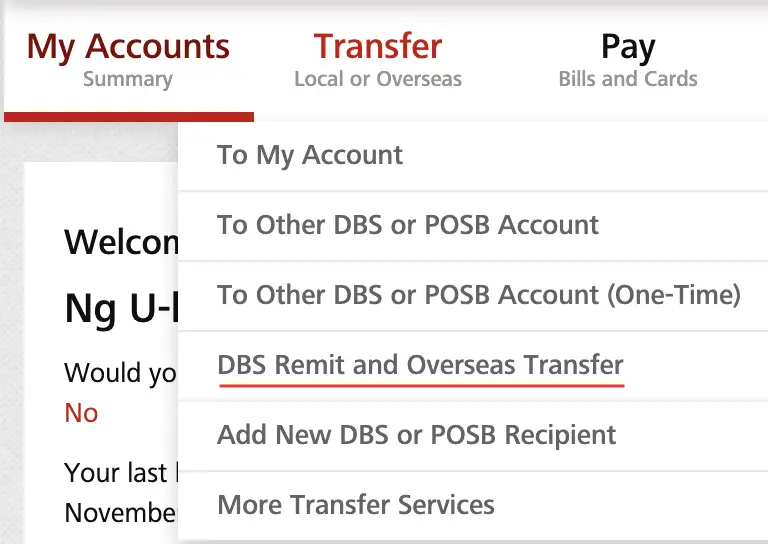

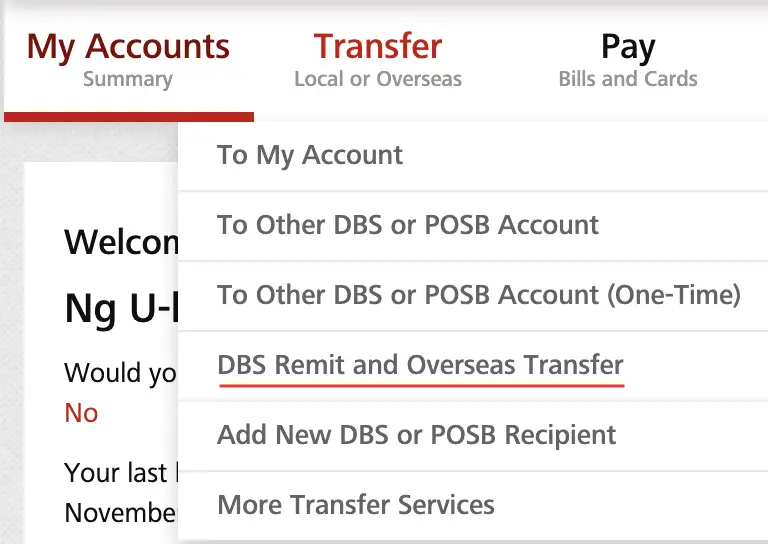

Go to DBS iBanking and click on ‘DBS Remit and Overseas Transfer’

Now that you have the details of the bank account that you will be transferring to, you can log into your DBS iBanking account.

To go to DBS Remit, you will need to select ‘Transfer‘ and go to ‘DBS Remit and Overseas Transfer‘.

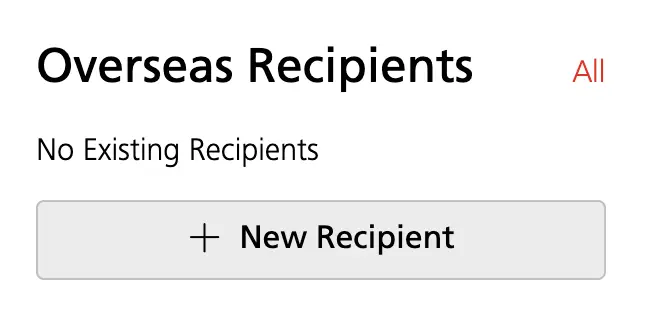

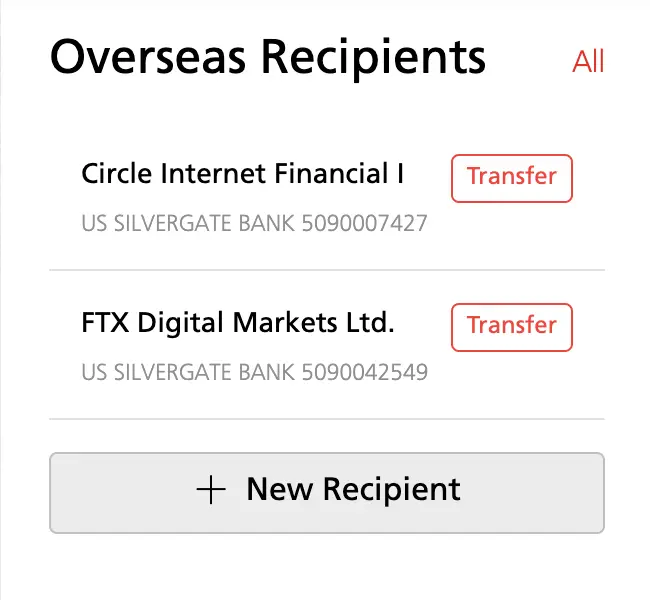

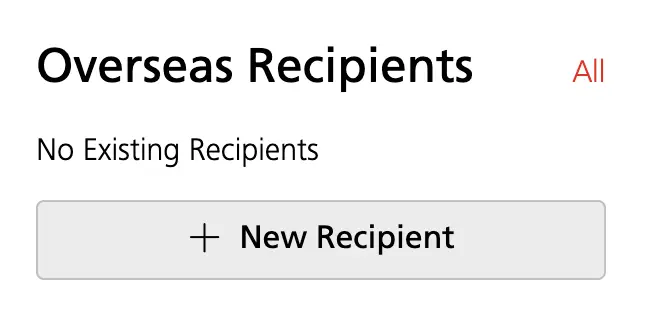

Go to ‘Overseas Recipient’ and select ‘New Recipient’

You will be brought to the DBS Remit page, and you’ll need to navigate to ‘Overseas Recipient‘ and select ‘New Recipient‘.

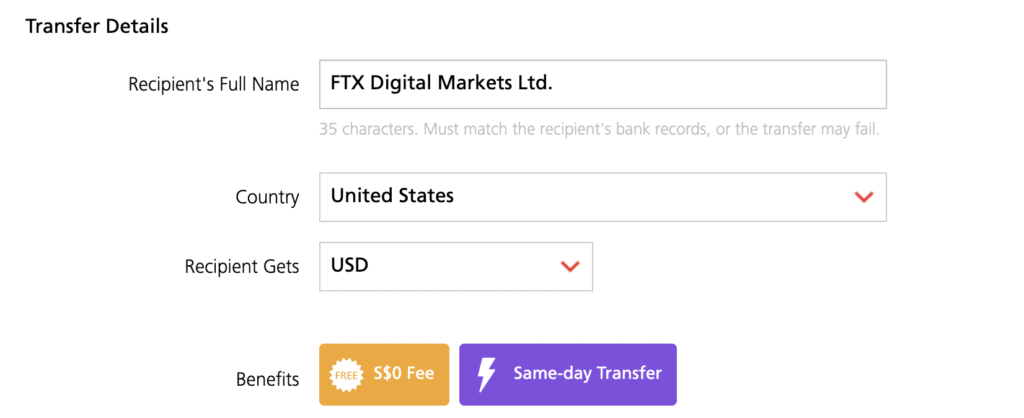

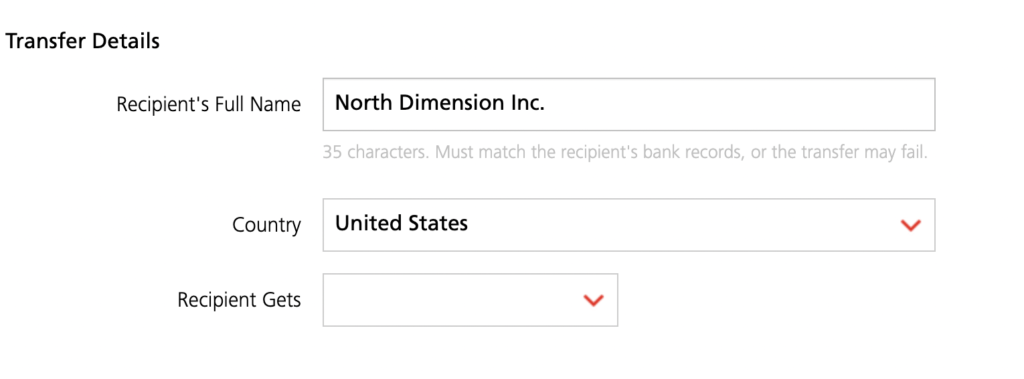

Enter the necessary details as stated on FTX

Now, you will need to add the beneficiary details that was previously stated on FTX.

The first part will be to enter the name of the beneficiary under the ‘Recipient’s Full Name‘.

Although the Beneficiary Address is in Nassau, the bank is still situated in the United States, and you will need to select United States here.

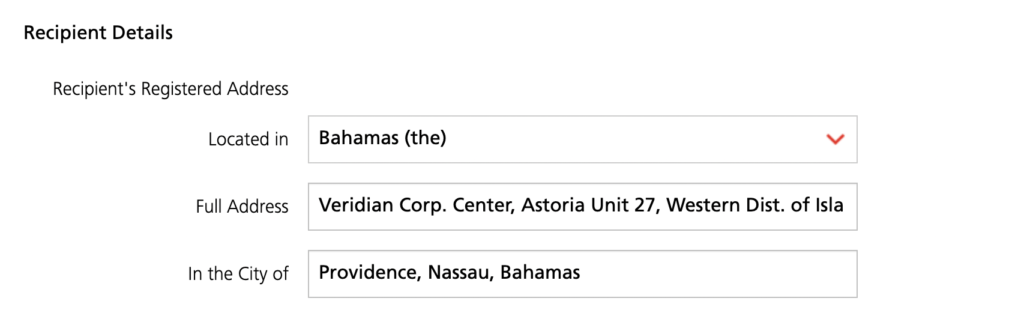

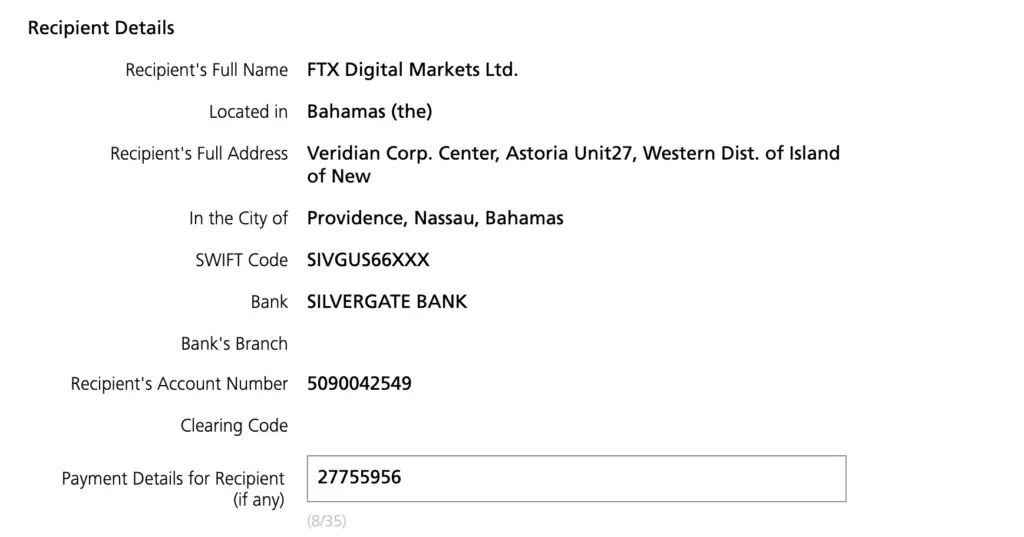

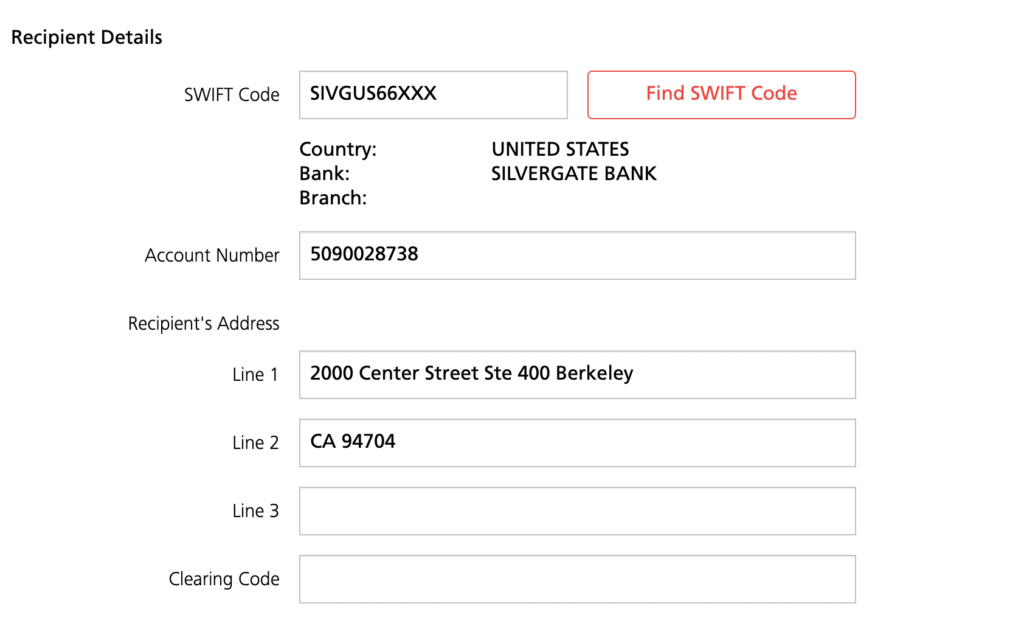

Under the Recipient Details, you will need to enter these details as shown:

- Located in the Bahamas

- Full address (copied from FTX)

- In the City of Nassau

You should be adding these from the Beneficiary Details, and not the details of the Receiving Bank!

There is a character limit under ‘Full Address’, and you will need to spill over to the second line.

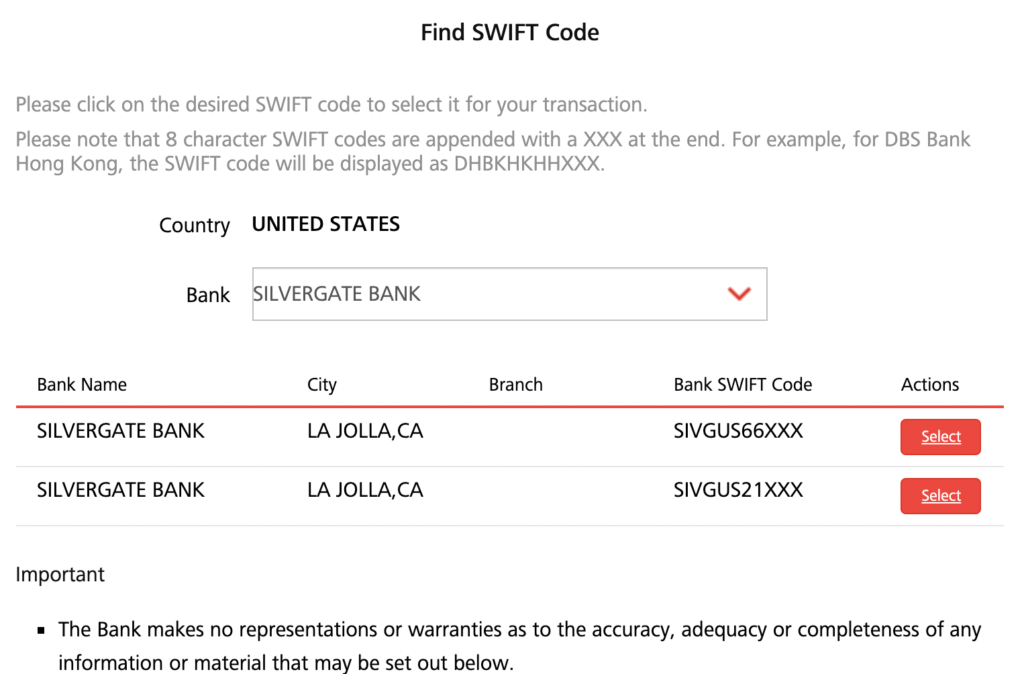

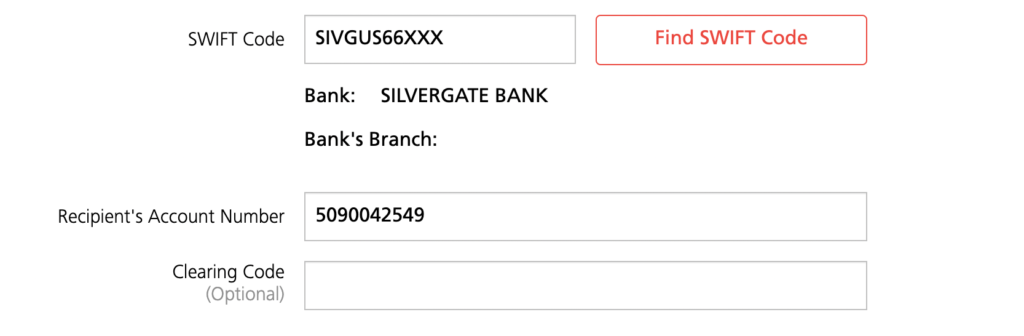

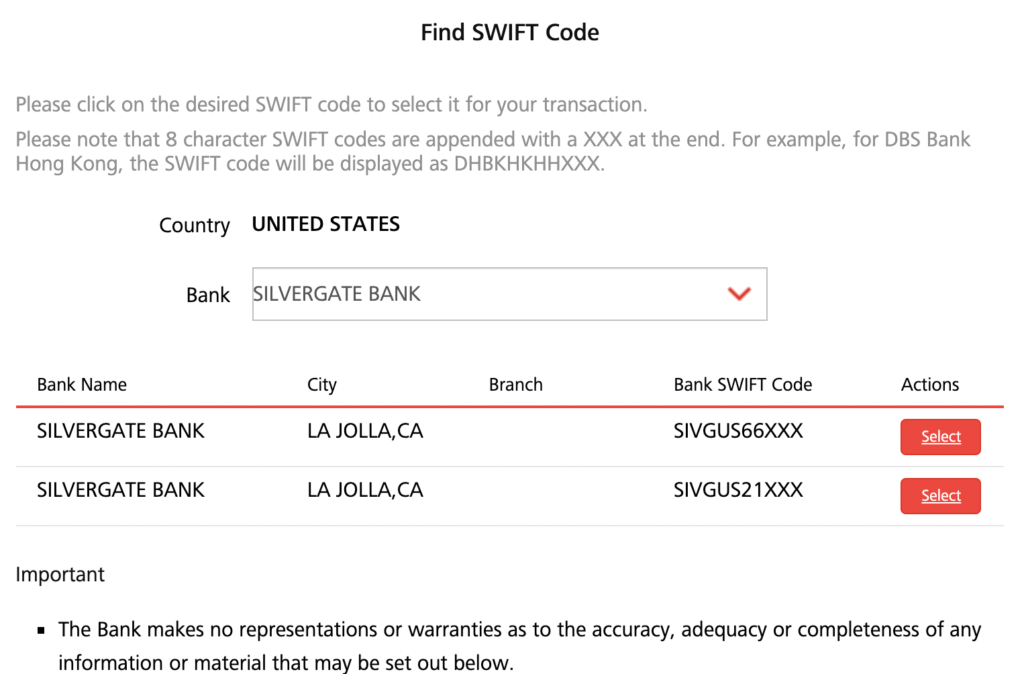

The next part will be to add the SWIFT code that is found in the ‘Receiving Bank‘ details on FTX. In this case, you should be adding the SWIFT code for Silvergate Bank.

Do make sure that you are sending to the SWIFT code that starts with ‘SIVGUS66’, and not the other one!

After that, you will need to add the Recipient’s Account Number.

The clearing code is optional, and you do not need to add anything there.

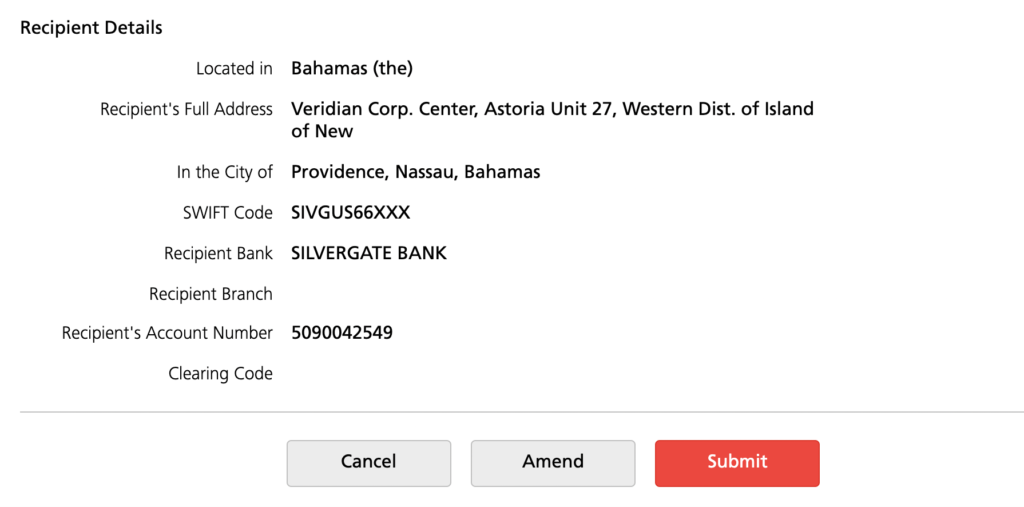

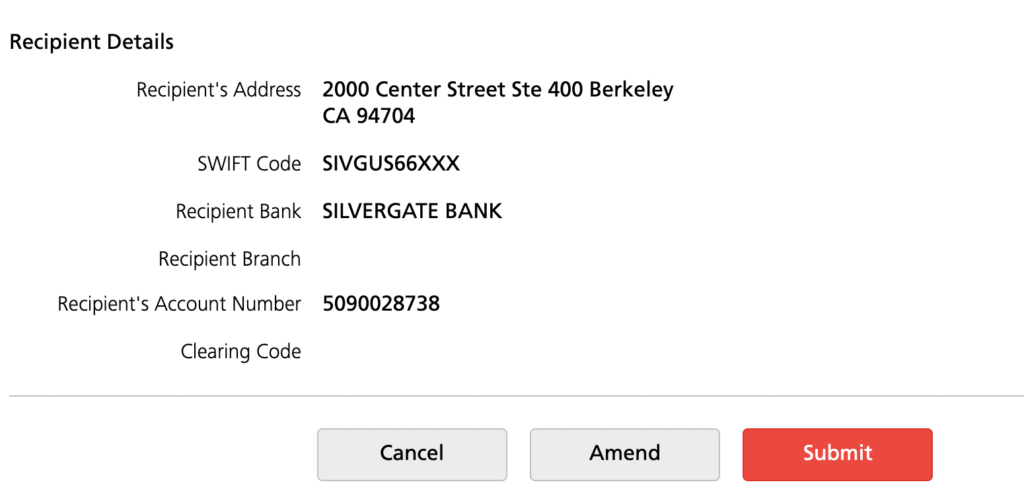

Afterwards, you will be given a confirmation regarding the details that you’ll be sending your funds to.

This will be a good time to double-check that all the details that you’ve entered are correct.

Select the bank account as your recipient

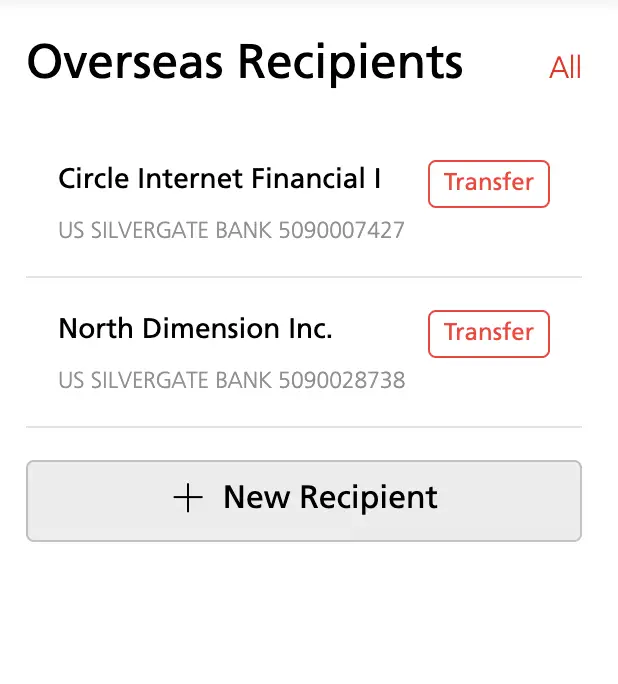

After adding FTX’s bank account to DBS Remit, you can select this account as your recipient.

The other recipient that I have here is to deposit USD to Crypto.com. In return, Crypto.com will credit the same amount that you’ve deposited as USDC into your Crypto.com App.

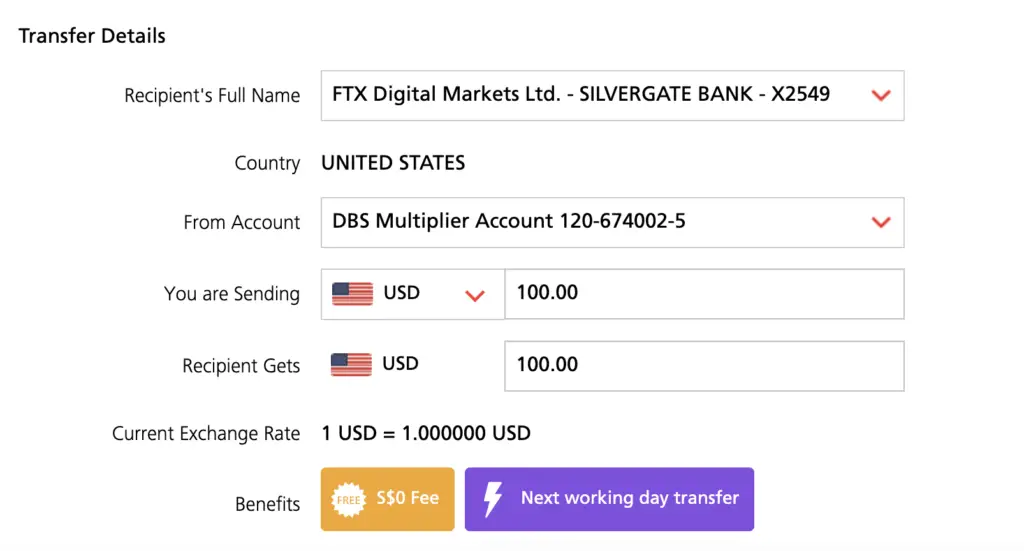

Enter the amount you wish to transfer and your account identifier

If you already have USD in your account, you can use that to transfer to FTX’s bank account.

In this case, you will need to select ‘USD‘ as the currency that you are sending.

If you do not have any USD in your Multiplier Account, it is possible to send SGD from your savings account which will be converted to USD. However, the exchange rate that DBS offers you may not be that favourable.

If you’re wondering what’s the difference between DBS and POSB, you can find out more here.

To save on the FX spread, one way you can consider would be to convert your SGD to USD using either Tiger Brokers or moomoo (powered by FUTU SG).

However, this does take some time to process, so it may not be the best method if you are looking to quickly transfer USD.

Here are some articles that you can read to know more about this process:

- Exchange SGD to USD on Tiger Brokers

- Withdraw USD from Tiger Brokers to your DBS Account

- Withdraw USD from moomoo to your DBS Account

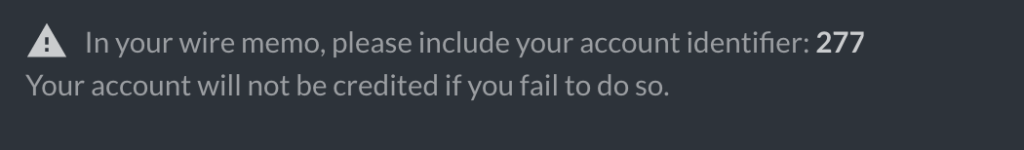

Once you have decided the amount that you want to send, the last thing you’ll need to do is to enter your account identifier from FTX.

This should be added under the payment details of this transaction.

Receive USD in your FTX account

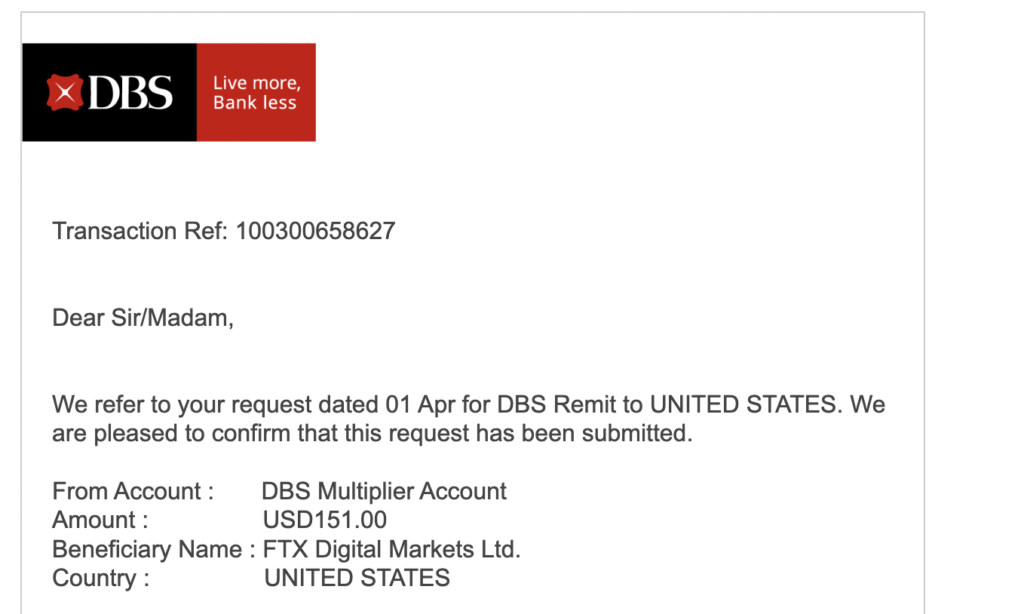

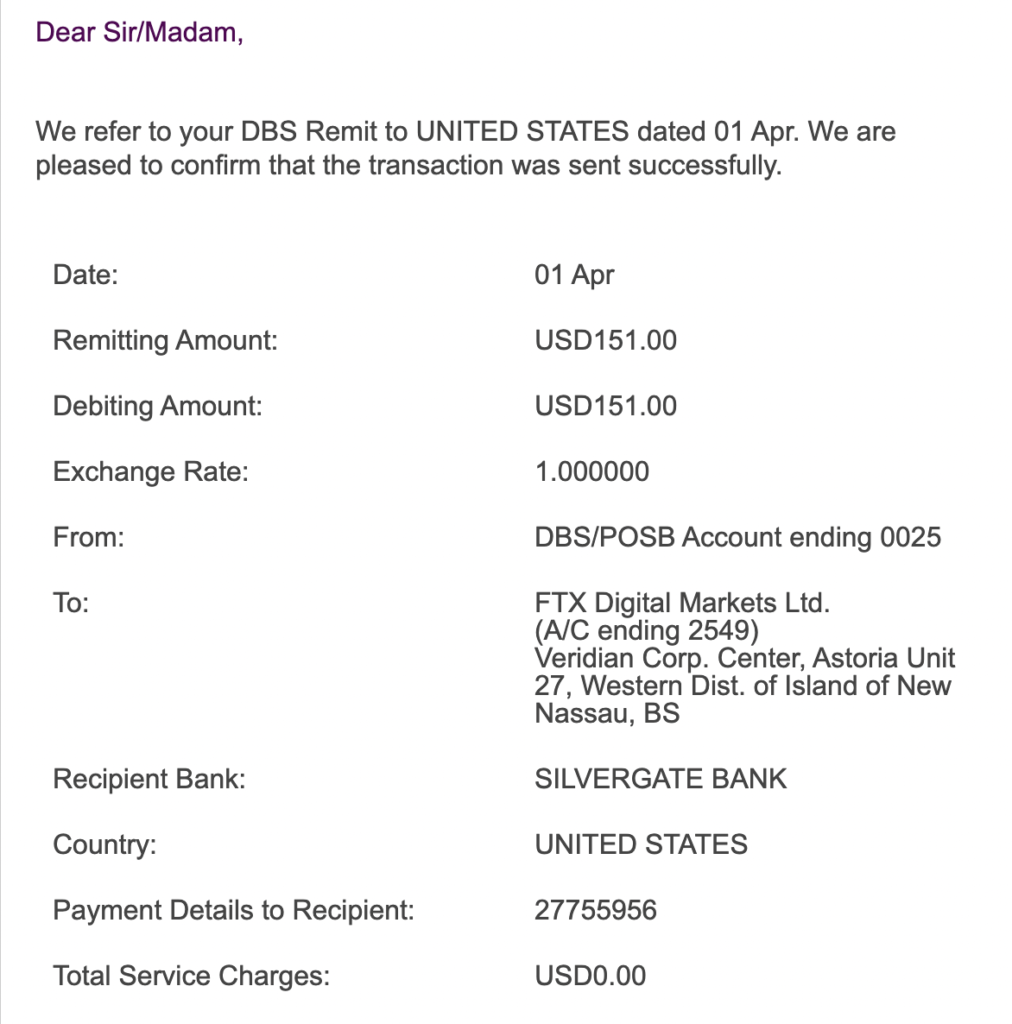

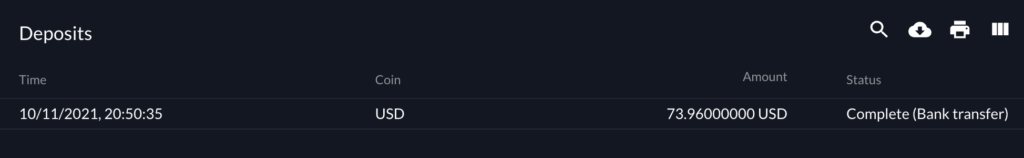

After confirming the details of the transaction, you should receive a confirmation from DBS that your transaction request was submitted.

You will receive another email to inform you that your funds were sent.

I sent my funds around 3pm in Singapore time. However, Silvergate will only process your deposits when their bank opens in US time.

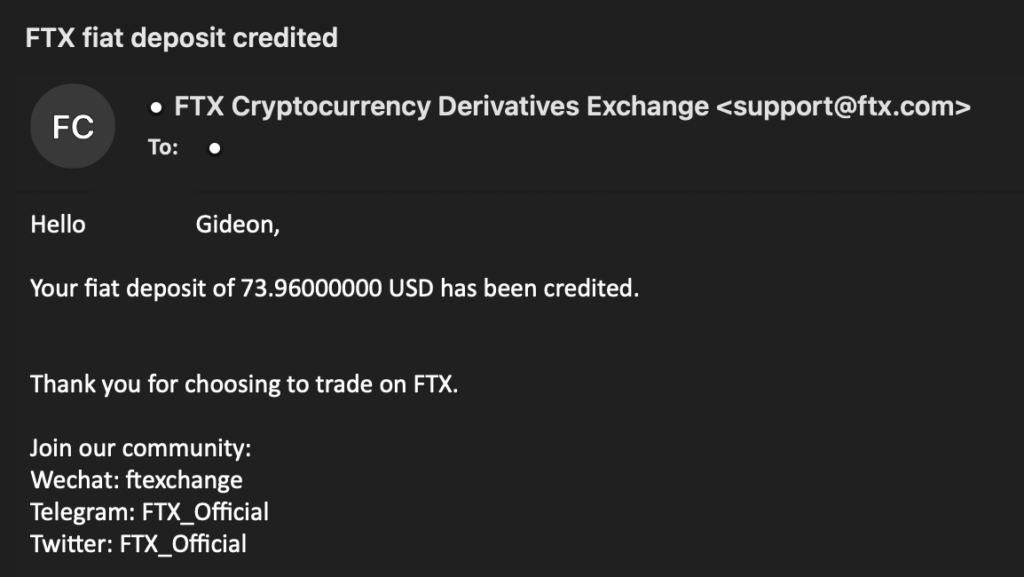

As such, your deposits will only be processed at night. I received this email around 9pm in Singapore time.

When I checked my FTX account, the funds were deposited as USD too!

What are the fees when I deposit USD from Singapore to FTX?

If you are using DBS Remit via your DBS Multi-Currency Account to send USD to FTX, you will not incur any fees for the transaction.

Other banks may charge a fee when you send USD to a bank account. So far, I have only used a DBS account to send funds over, and I was not charged any fee.

If you want to use another bank’s remittance service, you may want to take note of the fees!

How to deposit SGD to FTX from Singapore

The process of depositing SGD to FTX is similar. However, you will be depositing SGD to a Silvergate bank account.

DBS Remit only offers free remittance of USD to a US bank account, and not for SGD. As such, you will be charged a fee if you are making this transaction!

Here are the steps you’ll need to take to deposit SGD to FTX:

- Go to ‘Wallet’ tab on the FTX dashboard

- Find SGD and click on ‘Deposit’

- Click on ‘Deposit’ and take note of the details

- Go to DBS iBanking and click on ‘DBS Remit and Overseas Transfer’

- Go to ‘Overseas Receipient’ and select ‘New Recipient’

- Enter the necessary details as stated on FTX

- Select the bank account as your recipient

- Enter the amount you wish to transfer and your account identifier

Go to ‘Wallet’ tab on the FTX dashboard

First, you’ll need to go to the ‘Wallet‘ tab on FTX.

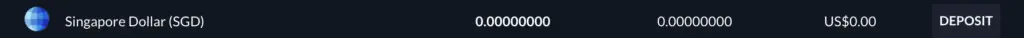

Find SGD and click on ‘Deposit’

You’ll need to find SGD as the currency that you wish to deposit.

Click on ‘Deposit’ and take note of the details

After clicking on deposit, you will be given the same bank details as the account that you’ll deposit USD to.

Similar to the USD method, do take note of the difference between the Beneficiary details and the bank details!

Go to DBS iBanking and click on ‘DBS Remit and Overseas Transfer’

If you have already added the Silvergate bank account, you can skip the next few steps.

Now that you have the details of the bank account that you will be transferring to, you can log into your DBS iBanking account.

To go to DBS Remit, you will need to select ‘Transfer‘ and go to ‘DBS Remit and Overseas Transfer‘.

Go to ‘Overseas Recipient’ and select ‘New Recipient’

You will be brought to the DBS Remit page, and you’ll need to navigate to ‘Overseas Recipient‘ and select ‘New Recipient‘.

Enter the necessary details as stated on FTX

Now, you will need to add the beneficiary details that was previously stated on FTX.

The first part will be to enter the name of the beneficiary under the ‘Recipient’s Full Name‘.

The next part will be to add the SWIFT code that is found in the ‘Receiving Bank‘ details on FTX. In this case, you should be adding the SWIFT code for Silvergate Bank.

After that, you will need to add the Recipient’s Account Number and Address.

You should be adding these from the Beneficiary Details, and not the details of the Receiving Bank!

Afterwards, you will be given a confirmation regarding the details that you’ll be sending your funds to.

This will be a good time to double-check that all the details that you’ve entered are correct.

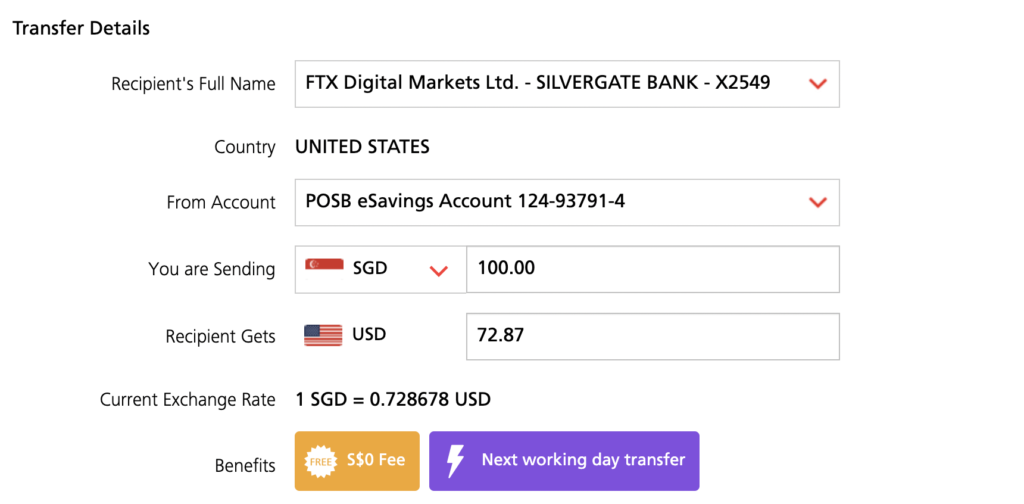

Select the bank account as your recipient

After adding FTX’s bank account to DBS Remit, you can select this account as your recipient.

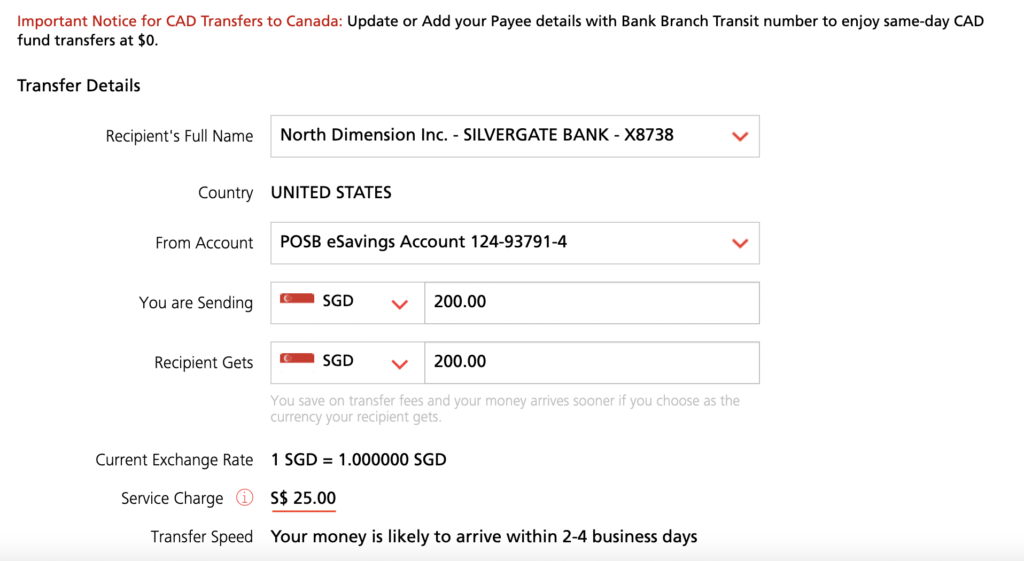

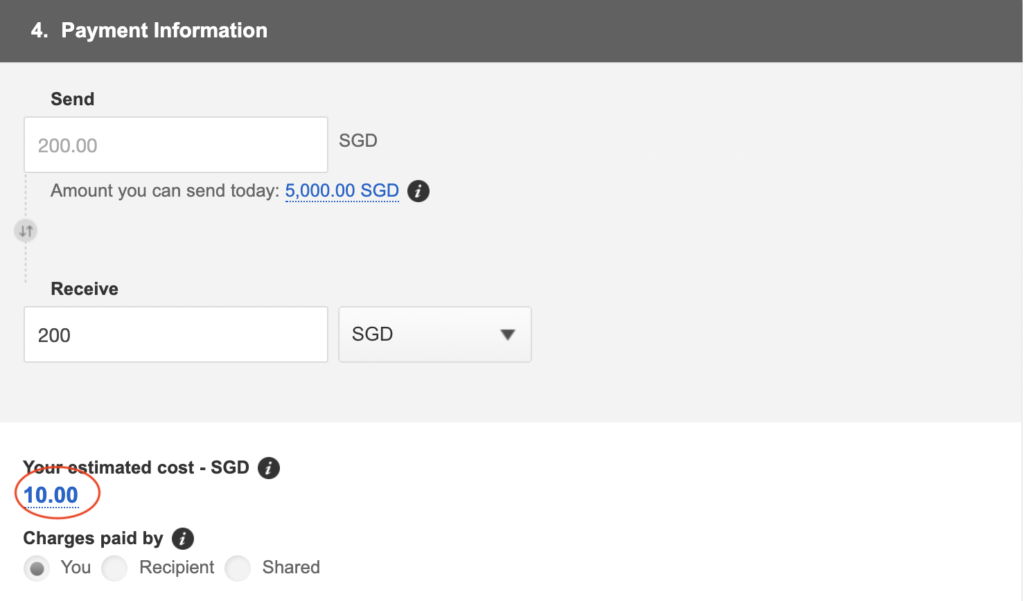

For the ‘You Are Sending’ field, do remember to select SGD and not USD. However, you will be charged a $25 fee for depositing SGD to this bank account!

As such, it is not advisable to transfer SGD since you’ll incur such high fees.

Enter the amount you wish to transfer and your account identifier

Similar to the above, don’t forget to add your account identifier before confirming your transaction!

What are the fees for depositing SGD to FTX from Singapore?

Most banks in Singapore will charge you a service fee when depositing SGD into a US bank account, ranging from $10 to $25.

I tried sending SGD to my FTX account using OCBC instead. The fees were slightly cheaper at $10.

Nevertheless, this is an unnecessary fee that you’ll incur, so I strongly encourage you to wire USD instead!

FTX used to have a DBS account that you can send funds to

For a while, FTX had a DBS account where you could directly transfer SGD to them. However, the process must have taken quite a while, which could be why they switched back to using their Silvergate bank for the deposits.

In the future, if FTX does allow you to transfer SGD to a DBS bank account, you should not incur any transfer fees.

This will be the only scenario when it makes sense to transfer SGD to FTX!

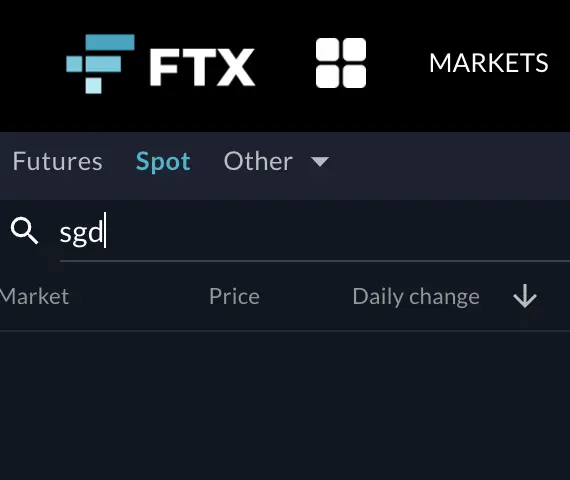

FTX does not provide any SGD trading pairs

You may want to note that FTX does not offer any direct SGD trading pairs on their platform.

As such, you can’t buy cryptocurrencies directly from SGD on FTX.

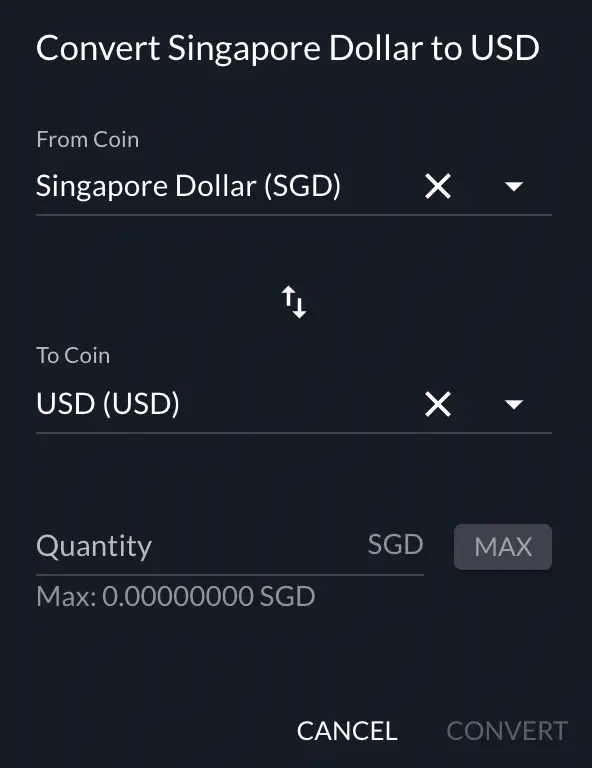

You will still need to make an extra step where you convert SGD to USD. This is because FTX has a lot of USD trading pairs with the different cryptocurrencies.

You’ll need to go to ‘Convert‘,

and then select the amount that you want to convert.

However, the exchange rate that FTX offers may not be that favourable to you too! This means that you may get less USD for the amount of SGD that you are exchanging.

Even if you can deposit SGD for free to FTX, it may still be more cost-effective to deposit USD to FTX.

Conclusion

FTX is one of the ways that you can deposit fiat currencies onto a crypto exchange from Singapore. The best way would be to transfer USD to FTX, since it has the most number of trading pairs.

This will allow you to immediately buy SOL or SHIB directly from USD.

You may be considering transferring SGD to FTX instead. However, you may incur some extra costs, including:

- Transfer fee when transferring from a local bank to FTX’s US bank account

- Spread when converting SGD to USD

You can’t buy any cryptocurrencies with SGD, so the only way will be to convert your SGD funds to USD.

If you don’t have any USD in your bank account, you can consider using Tiger Brokers or moomoo (powered by FUTU SG) to exchange your SGD for USD. This is because compared to DBS Remit and FTX, the exchange rate is more favourable on these platforms.

If you’re looking to generate tax reports for your crypto trades, you can consider using Koinly, which allows you to track your transactions from 350+ exchanges and 50+ crypto wallets.

👉🏻 Referral Deals

If you are interested in signing up for any of the products mentioned above, you can check them out below!

Are you passionate about personal finance and want to earn some flexible income?