Last updated on August 9th, 2021

You have decided to open an SRS account in order to invest your excess savings and supplement your post retirement payout.

At the same time, you may also be wondering how to take advantage of the tax relief incentive while not over contributing and risk paying a penalty for an early withdrawal due to inadequate savings.

This article will allay your uncertainties by helping you understand your SRS account and give bite-sized tips on how to save effectively with SRS.

Contents

An introduction to your SRS account

The Supplementary Retirement Scheme (SRS) is an additional savings avenue for Singaporeans to save for their retirement. As it name suggests, it supplements the mandatory CPF Life scheme, whose payments meet only the basic needs during your retirement.

Despite its voluntary nature, Singaporeans are increasingly using SRS as part of their investment plan. In fact, there are over 185,000 SRS holders, with contributions growing at an annual rate of over 17% since 2011!

You can open an SRS account with any one of the following banks:

- DBS

- POSB

- UOB

From your account, you can make investments through your bank in instruments including:

- Unit Trusts

- Endowment Plans

- Stocks

- Fixed deposits

Alternatively, you can also invest through online platforms such as FSMOne and robo-advisors. Currently, only these robo-advisors are capable of managing SRS funds:

What is the interest rate for the SRS account?

If you leave your SRS funds within your account, it will only generate 0.05% of interest per annum. This is the same interest rate that you will receive with a basic savings account.

It is not worth to transfer money to your SRS account solely for tax relief. Ultimately, your SRS funds will lose value due to inflation as the interest rate is only 0.05%.

As such, you are encouraged to invest your SRS funds immediately after you make each contribution.

How much can I transfer to SRS account each year?

As a Singaporean, you can contribute up to a maximum of $15,300 to your SRS account each year. These contributions are eligible for tax relief.

What do I need to take note when withdrawing my SRS monies?

Unfortunately for beginners new to SRS, there are many rules to withdrawing from your SRS account. Fret not, here are the more important rules that you may want to take note of:

#1 Penalty for withdrawing early

Being an account designed to save for your retirement, your SRS monies are meant to be withdrawn after the statutory retirement age.

The statutory retirement age is fixed to the date when you created your SRS account.

Therefore, if you withdraw at any time before the statutory retirement age, you will incur a penalty of 5% of your withdrawal amount. Furthermore, your withdrawal amount will be fully subjected to income tax for the year of withdrawal.

For example, John has a balance of $100,000 in his SRS account, and his assessable income for that year is $80,000. If he were to withdraw all his SRS monies to pay for a large purchase, he will need to return $5000, which consists of the 5% penalty.

In addition, his assessable income for that year will be $100,000 + $80,000 = $180,000, resulting in an increase of up to $14,200 in tax payments!

In total, he would have paid $19,200 just to withdraw his $100,000 in SRS.

SRS monies are meant for your retirement, and it is unwise to withdraw them before the statutory retirement age.

Waiver of penalty on medical grounds

However, this penalty for early withdrawal may be waived on certain medical grounds. If you are able to prove that you are either:

- Physically or mentally incapacitated from being employed in future, or

- Suffering from terminal illness,

only 50% of your withdrawal will be subjected to taxation without the 5% penalty.

#2 Maximum of 10 years to fully withdraw funds

From the year that you make your first penalty-free withdrawal, you will be given up to 10 years to withdraw all your SRS funds.

This refers to the first withdrawal made at or after the statutory retirement age.

Any balance in your SRS account at the end of the 10 year period will be ‘deemed withdrawn’, a process which subjects 50% of the remaining balance to a one time taxation. You may still retain the balance thereafter; however, it will be regarded as a normal investment in future.

#3 50% of your withdrawal is subject to tax

When you make a penalty-free withdrawal, 50% of the withdrawal amount will be subjected to income tax for that year.

For example, if you make a penalty-free withdrawal of $100,000 from your SRS, your assessable income that year will increase by $100,000 x 50% = $50,000.

Therefore, SRS can be seen as a form of tax deferment, as you delay paying taxes during your working years till your retirement age. As you will fall under a lower income tax bracket after you retire, the amount of tax paid in return will be less.

When executed correctly, SRS allows you to save a significant amount on taxes over your lifetime.

How much tax relief do I receive for topping up my SRS account?

You are eligible for tax relief equal to the contributions you made to your SRS account that year. Therefore, the amount of tax relief you will receive is based on the annual income bracket you fall under.

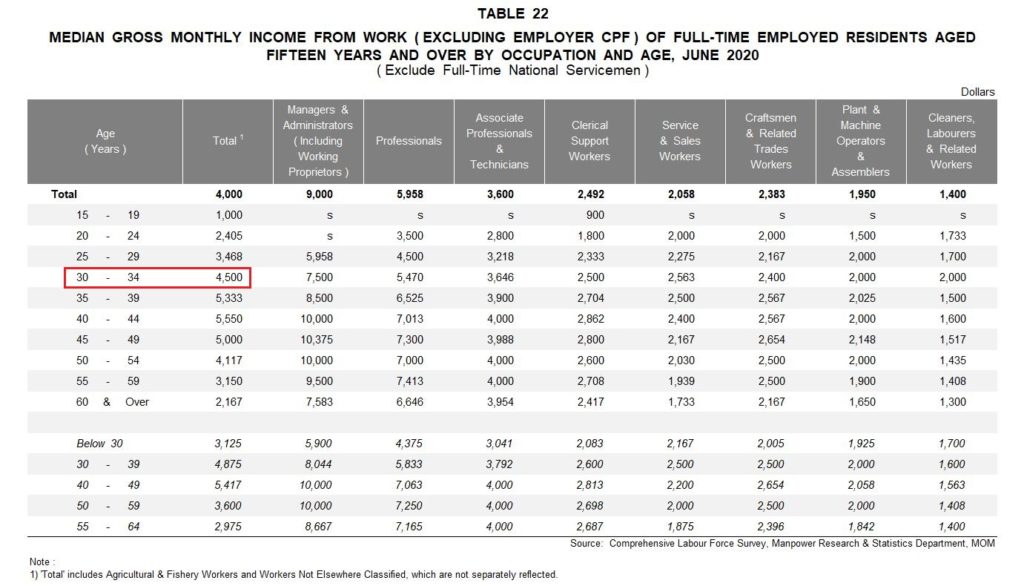

For example, to represent a worker who has paid off his education debts and just started to accumulate savings, we take the median gross monthly income for Singaporeans aged between 30 – 34 in 2020, which stands at $4,500.

Excluding all CPF contributions (which are also eligible for tax relief), his taxable annual income is 12 x ($4500 x 0.8) = $43,200. With his annual income between $40,000 to $80,000, his maximum tax rate bracket will be at 7%.

Assuming he topped up $10,000 to his SRS account, his final taxable income will be $43,200 – $10,000 = $32,300. This top up would have lowered his maximum rate bracket to 3.5%, and gave him a tax savings of $462!

Despite the modest savings, it is possible to maximise it even more by making multiple top ups over time. Furthermore, you can reinvest the savings to achieve higher returns!

As Singapore uses a progressive tax system, the amount of tax paid by high income earners is much higher than low income earners.

Hence, higher income earners will benefit much more from the tax relief benefit of SRS!

What is an optimal target to save in SRS?

Although topping up your SRS account is a great way to save on taxes, the opposite is seen when it comes to withdrawing our SRS funds. This is because 50% of the yearly withdrawal amount is taxable.

In order to maximise both your tax savings and investment returns in SRS, we will need to find an optimal target to save in your SRS account.

The target will be the balance in your SRS account on your first non-penalty withdrawal year.

In this calculation, it is assumed that the withdrawals are done after you retire and do not have any other taxable income.

From the tax rate table above, we can see that the first $20,000 of your assessable income is tax free. Since only 50% of our SRS withdrawal is taxable, we can withdraw up to $40,000 each year from our SRS without tax.

Over a withdrawal period of 10 years, an optimal target to save in our SRS will be $40000 x 10 = $400,000.

How much do I need to contribute to SRS?

With the optimal target of $400,000 to save in your SRS, you may wonder how much you need to save and invest in your SRS.

Factors to consider if an instrument is suitable for you include your:

- Time horizon

- Risk level

- Target return

There are many different ways to invest your SRS funds. This ranges from safe instruments such as fixed deposits to the most riskiest (and potentially high yielding) unit trusts.

One such method you can do so is through equity funds.

Equity funds are unit trusts that invest mainly in a basket of stocks

If you have a moderate appetite for risk and still have a substantial amount of time before your retirement (at least 10 years), you can consider to invest your SRS monies in equity funds.

This provides a balance between the high returns of stocks and risk management (through investing in a variety of stocks).

A standard benchmark for measuring equity fund performance is the S&P 500, which tracks the performance of the largest 500 companies in the US.

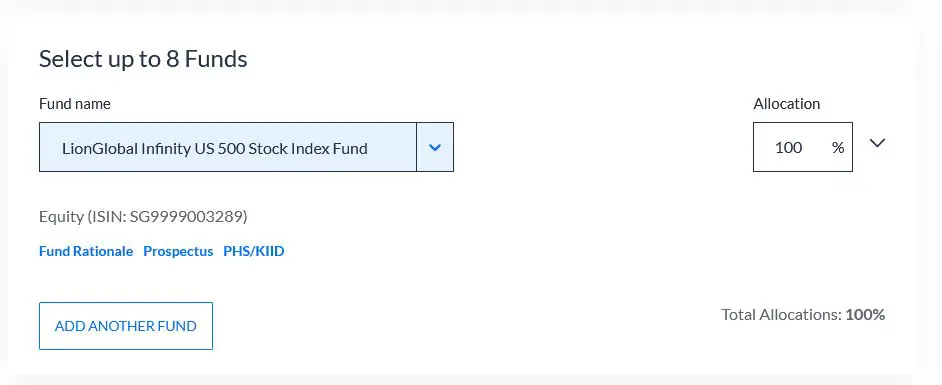

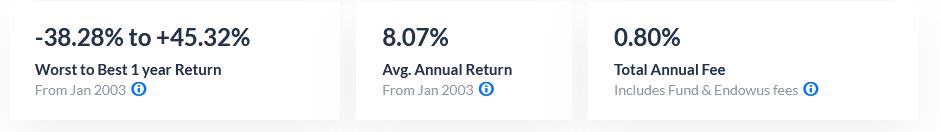

With your SRS funds, it is possible for you to invest in the S&P 500 through the LionGlobal Infinity US 500 Stock Index Fund, which tracks the S&P 500’s performance through the Vanguard® U.S. 500 Stock Index Fund.

You can invest in the LionGlobal Infinity US 500 Fund through Endowus.

After accounting for fees, this fund has yielded an average of about 7.2% per annum over the past 18 years. Assuming that investments in this fund will continue to compound at this rate, the following table shows approximately how much you need to save each year to reach the optimal amount using the Time Value of Money principle:

The Time Value of Money method calculates the future value of an investment by compounding both its present value and future cash flows by an estimated return rate.

| Years to save | Amount to save every year | Total amount to save |

|---|---|---|

| 16 | $14,105 | $225,680 |

| 20 | $9,546 | $190,920 |

| 25 | $6,145 | $153,625 |

| 30 | $4,085 | $122,550 |

As past performance does not equal future returns, you may want to treat the above calculations with discretion!

From this table, we can derive two strategies on how to save using your SRS:

#1 Saving in your SRS midway through your career

From the table, it would take you a minimum of 16 years and save $225,680 to reach the optimal amount of $400,000 through investing in an equity fund. This is assuming that you are contributing at least $14,105 per year into your SRS account.

At the same time, you may want to note of the contribution cap of $15,300 per year.

If you are in your 40s and with a stable career and income, SRS will be able to maximise the tax return benefits in two ways.

Firstly, you would have saved a larger sum in your SRS in order to achieve the optimal amount. Hence, you will enjoy tax benefits on a larger amount of assessable income.

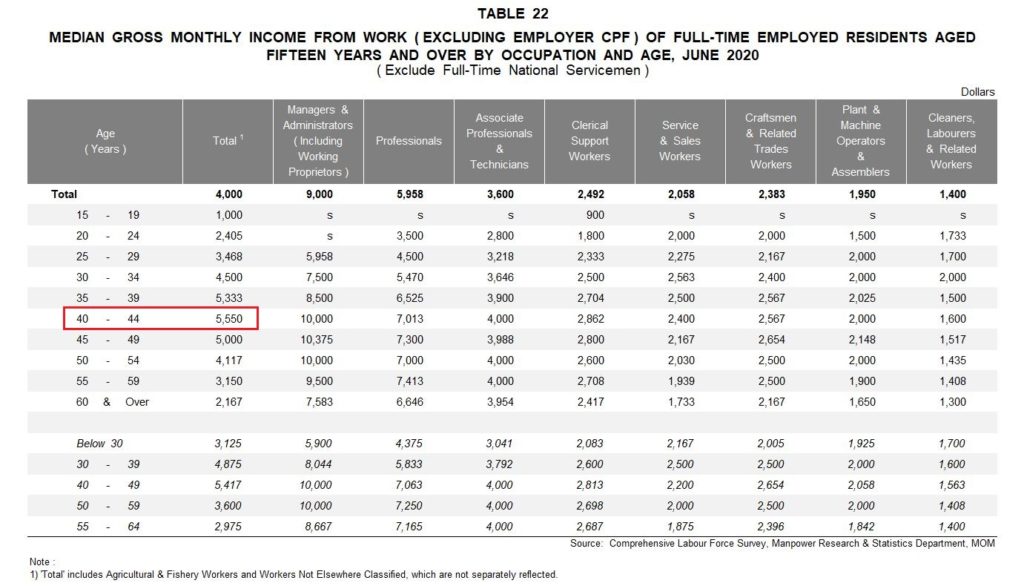

Secondly, your tax savings will be at its maximum based on your income bracket. Based on the median gross monthly income from work in 2020, the income of Singaporeans peaked between the ages of 40 – 44. Thus, your tax rates rates will be at its highest at this stage of your life.

With your SRS account, you can enjoy tax savings on a larger portion of your assessable income at a higher rate if you start midway through your career.

#2 Start contributing to your SRS when you’ve just started your career

On the other hand, if we start saving in our SRS at the start of our career, we can take advantage of this powerful asset: Compound Interest.

Let’s assume that you start saving in your SRS at around age 30 (when you have paid off your student loans and set up your emergency fund). With 30 years to accumulate the optimal amount, You will only need to contribute at least $4,085 per year, saving $122,500 in the process.

Compared to the scenario in which you had started 15 years later, you only need to save half that amount here!

Why does the amount you need to save differ so much?

By using the power of compound interest do its work of multiplying your money more quickly, the earlier we start to save, the less we need to save for the same amount (in this case; $400,000).

“Compound interest is the eighth wonder of the world. He who understands it, earns it; he who doesn’t, pays it.”

Albert Einstein

Although the tax benefits are not maximised due to the lower total amount saved, the net return from investments would have outweighed any loss in tax savings.

The extra savings not invested in SRS can also be invested elsewhere to generate higher returns.

Alternatively, if you intend to invest in safer but lower yielding instruments, you will need to allocate more time to save up this optimal amount.

What’s the best withdrawal strategy for the SRS account?

To optimise the withdrawal strategy for your SRS account, you should aim to have as little sources of other taxable income as possible when you start withdrawing from your account. This maximises the amount of tax relief you will obtain from making SRS withdrawals.

Everyone’s pace of life are different, and so are their retirement needs. Nevertheless, the best withdrawal strategy for your SRS takes these factors in mind:

- Your retirement age

- Other sources of taxable income

#1 Your retirement age

From age 62 (the statutory retirement age as of 2021), you are able to withdraw your SRS funds penalty-free. However, if you intend to retire later than 62, it will be a better idea to start your withdrawal only at the age when you fully retire.

This move has two benefits. Firstly, your SRS can fully provide for your expenses post-retirement. This is a period when you will not be receiving the substantial income compared to when you were employed.

Secondly, you are able to maximise the tax concession benefits of SRS. By withdrawing them in years when you do not have any employment income, you will be taxed at a lower income bracket.

Furthermore, the first $40,000 that you withdraw from your SRS account will be tax free.

#2 Other sources of taxable income

As 50% of SRS withdrawals are taxable, it is recommended that you avoid starting your SRS withdrawals on years when you have significant sources of taxable income. Other than employment income, another form of taxable income include property rental collections.

For example, Mr. Lim, a retiree, is currently collecting rental of $2,000 a month from his second property. His annual taxable income will be $2,000 x 12 = $24,000.

If he chooses to withdraw $40,000 from his SRS that year, his taxable income will increase to $44,000. This translates to an increase of up to $750 in tax payments that year.

However, gains from lottery and investments are counted as one-off capital gains. These are not counted as taxable income.

As such, it is important to the types of income you are earning, and whether they are taxable or not!

You can view a list of taxable and non-taxable incomes on IRAS’ website.

Conclusion

Although most people are aware of SRS, you may not be aware of its intricacies. If used the right way, your SRS account can potentially form an integral part of your retirement planning through appropriate budgeting and investment.

At the same time, you may also want to be mindful of its rules, and use them to your advantage!

Do you like the content on this blog?

To receive the latest updates, you can follow us on our Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?