Last updated on November 16th, 2021

Welcome to this cozy corner of the internet, where you can pick up little nuggets of financial knowledge to improve your personal wealth.

After working for a number of years, you have accumulated some savings which you intend to set aside for your retirement goals. However, you are unsure on whether to save them in your CPF Special Account (SA), or grow them through investments in your Supplementary Retirement Scheme (SRS) account.

This article will help you to make a more informed choice by first making a comparison between the two schemes, followed by some suggestions on how to save for your retirement using both your SA and SRS.

Contents

Should you top up your CPF SA or SRS?

Your method of growing your retirement savings will guide you on which account you should choose to top up.

If you intend to leave your monies in a risk free environment where your returns grow at a steady rate of 4 – 5 % per annum, you should top up your SA via the RSTU. However, if you intend to utilise your investing acumen, topping up your SRS is the wiser choice as your investments have the potential to beat the returns of the SA.

Comparison between topping up your CPF SA and SRS

Let us do a comparison between topping up your CPF SA and SRS to find out their similarities and differences.

#1 Method of Contribution

If you are under the age of 55, you can top up your SA through two ways:

These contributions can be made on top of the monthly contributions from your salary. However, this is subject to the CPF Annual Limit.

Retirement Sum Topping-Up (RSTU) Scheme

Under the RSTU scheme, you can top up your SA either through cash or your CPF Ordinary Account (OA) monies.

The RSTU allows you to transfer funds from your CPF OA account to your CPF SA account.

Furthermore, you can also top up the SA (if they are below the age of 55) or the CPF Retirement Account (RA) (if they are above 55) of your loved ones.

One perk of the RSTU scheme is that your top ups are tax deductible, which will be elaborated further below.

CPF Voluntary contributions

You can also top up your SA through Voluntary Contributions using cash. However, this method involves topping up all 3 CPF accounts, namely your OA, SA and Medisave Account (MA) at once. The proportion in which each account is topped up is based on your CPF allocation rate of your age group.

The following table shows the CPF allocation rate as of 2021, which is inclusive of both employee and employer contributions:

| Age | Ordinary Account (% of wage) | Special Account (% of wage) | MediSave Account (% of wage) |

|---|---|---|---|

| 35 and below | 23 | 6 | 8 |

| 36 – 45 | 21 | 7 | 9 |

| 46 – 50 | 19 | 8 | 10 |

| 51 – 55 | 15 | 11.5 | 10.5 |

| 56 – 60 | 12 | 3.5 | 10.5 |

| 61 – 65 | 3.5 | 2.5 | 10.5 |

| Above 65 | 1 | 1 | 10.5 |

Notice how the allocation towards your SA increases steadily until the age of 55 before falling off sharply.

This is because boosting contributions towards the SA in the years preceding to retirement is part of the government’s plan to provide Singaporeans with a foundation for their retirement needs.

On top of your monthly CPF contributions from both yourself and your employer, you can make VCs up to the CPF Annual Limit each year.

As of 2021, the CPF Annual Limit stands at $37,740

You may also want to note that there is another type of VC that involves only topping up your MA. However, this will not be discussed in this article.

SRS top ups are only done via cash

There is only one way to top up your own SRS account, and that is through cash. From your SRS account, you can invest in a variety of products that suits your appetite.

However, you can only contribute a maximum of $15,300 per year to your SRS account.

#2 Tax Relief

Strategising on lowering your taxable income can save a lot in taxes in the long run.

By pretending you are a shopper looking for a discount, I’m sure you will find saving on taxes enjoyable!

Luckily under the Singaporean framework, you can save for your retirement and slash your taxes at the same time. This can be done by topping up either or both your:

- SA under the RSTU scheme

- SRS account

Retirement Sum Topping-Up (RSTU) Scheme

Under the RSTU scheme, the maximum tax relief you can claim from topping up your own SA in a calendar year is $7,000.

Furthermore, you can claim up to another $7,000 in tax relief if you top up the SA or RA of your loved ones. This means that you can potentially reduce your taxable income by up to $14,000!

Loved ones whom you can top their SA for include your family members such as grandparents, parents, spouse and siblings.

Unfortunately, there are certain restrictions to this tax relief perk.

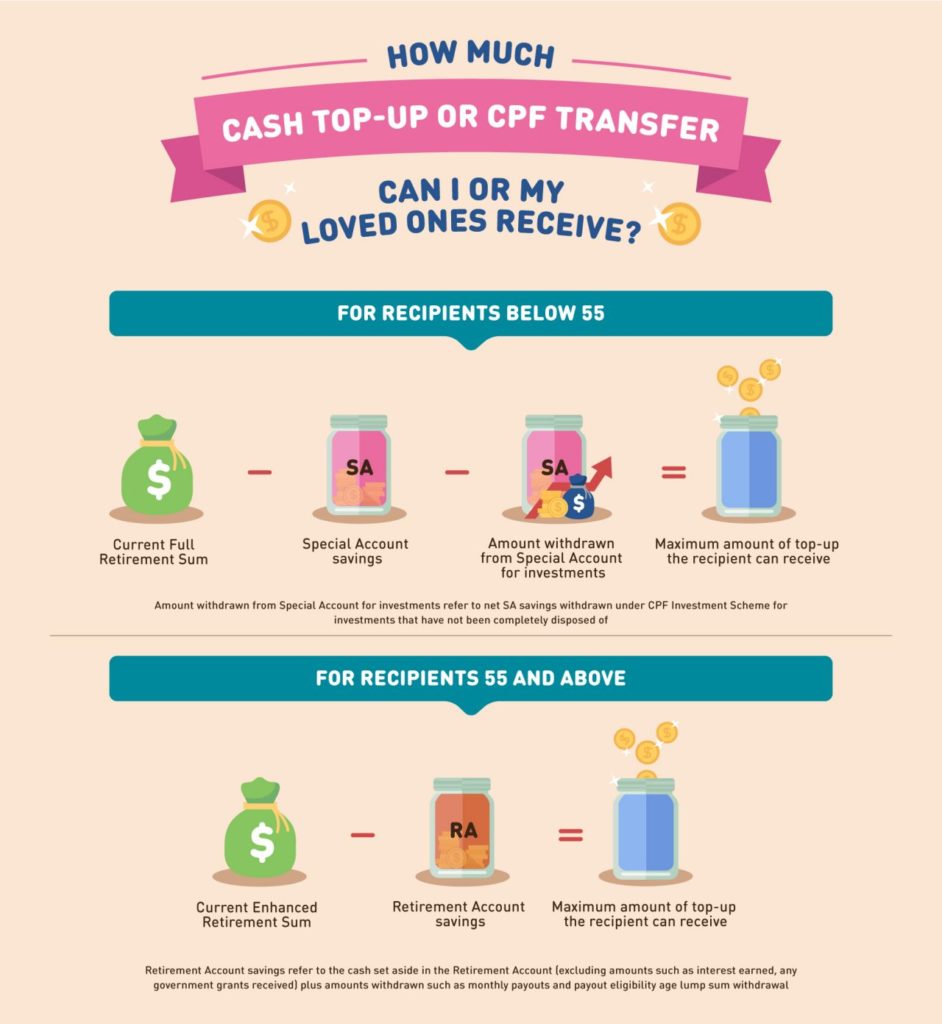

SA / RA Restrictions

If you or your recipient has already accumulated the Full Retirement Sum in your/ his:

- Combined SA and savings withdrawn from SA under the CPF Investment Scheme (under 55), or

- RA (age 55 and above),

any top ups above the FRS cannot be claimed for tax relief!

For example, Hafiz (aged 40) wants to top up his own SA under the RSTU scheme. Apart from the balance in his SA, he also has some of his SA funds invested under CPFIA.

This is the profile of his SA:

| Amount | ||

|---|---|---|

| (a) | Current FRS (As of 2021) | $186,000 |

| (b) | SA balance | $150,000 |

| (c) | CPFIA funds withdrawn from SA | $30,000 |

| (d) | Amount qualified for tax relief: (a) – (b) – (c) | $6,000 |

From the above table, we can see that Hafiz is only able to claim up to $6,000 in tax reliefs in 2021.

Meanwhile, Hafiz is also interested in topping up the RA of his father, Salleh (aged 63). Here is the profile of Salleh’s RA:

| Amount | ||

|---|---|---|

| (a) | Salleh’s FRS (After July 2013) | $148,000 |

| (b) | RA balance | $145,000 |

| (c) | Amount qualified for tax relief: (a) – (b) | $3,000 |

As Salleh is only $3,000 shy from meeting his FRS, Hafiz can only claim up to that amount in tax reliefs from topping up his father’s SA.

Income Restrictions for Spouse / Sibling Top Up

Furthermore, if your spouse or sibling has earned an annual income exceeding $4,000 in the preceding year, your top ups cannot be claimed for tax relief.

In other words, this tactic for tax relief is highly unlikely to work if you are intending to top up for your spouse or sibling who is currently working.

CPF Voluntary Contributions

For CPF VCs, the system for tax reliefs differs for employees and self-employed persons.

Employees

If you are employed in a company, your VCs are not tax deductible.

This is because employees are already enjoying tax reliefs for their compulsory CPF contributions under the CPF Act.

Without this tax relief perk, VCs are not a recommended way if you intend to only top up your SA.

In fact, the voluntary contribution to all 3 of your CPF accounts is the only way for you to top up your OA. Similarly, you’ll also need to consider the fact that do not receive tax reliefs from this contribution.

Self-employed

On the other hand, you will be able to enjoy tax reliefs from VCs if you are self-employed.

Self-employed persons are not subject to compulsory OA and SA contributions, hence they do not enjoy the tax reliefs employees do.

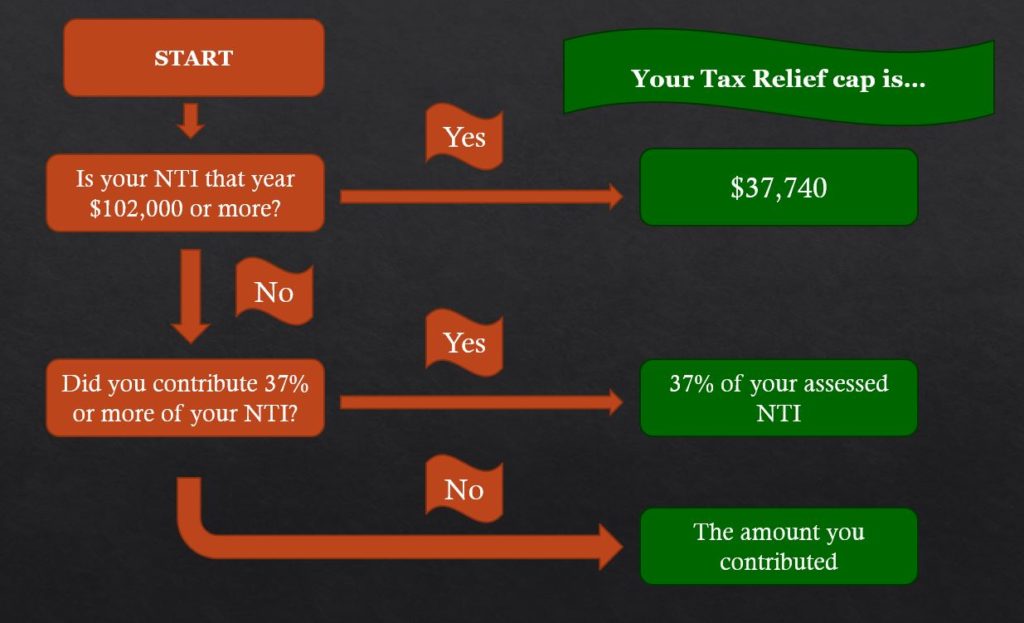

However, your tax reliefs will be capped at the lower of:

- 37% of your Net Trade Income (NTI) assessed; or

- CPF relief cap of $37,740 (The Annual Limit) ; or

- The amount you contributed

NTI is your gross trade income minus all allowable business expenses, capital allowances and trade losses as determined by the Inland Revenue Authority of Singapore (IRAS).

Source: CPF

As of 2021, the net trade income ceiling for self-employed persons is at $102,000.

This is comparable to the Additional Wage ceiling that employees contribute to their CPF.

With a maximum contribution rate of 37% (which is the same as that of employees), you will also get a cap of $37,740 from your income contributions.

In essence, the second cap restricts high income earners from using CPF contributions as a tax haven.

With the flowchart below, you can find out which tax relief cap applies to you as a self-employed person.

You may want to note that the tax reliefs you enjoy here apply to contributions to all 3 accounts, and not just your SA.

SRS

Meanwhile, you are able to claim tax returns for your SRS top ups until the annual contribution cap of $15,300.

As the tax relief cap for SRS is higher than the RSTU’s (along with the convenience of contributing to one account), SRS top ups is the more attractive method if you aiming to maximise your tax reliefs.

Tax reliefs from VCs are not included in this comparison as it varies greatly from person to person, depending on their NTI.

#3 Returns

Now to the crux of why we are saving up for our retirement: The Returns.

I believe that you would have heard before that the key to saving up for your retirement is to beat inflation and use the power of time to compound your money.

While everyone would definitely want higher returns for their savings, here is some food for thought:

Are you prepared to see your retirement savings fall during a market downturn?

This question will lead you to the answer of whether you should prioritise topping up your CPF SA or SRS first.

CPF SA

Rain or shine, your SA funds will return a fixed interest of 4 – 5 % per annum.

SA funds that make up the first $60,000 of your combined CPF balance earns 5 % interest, while the remainder earns 4 % p.a.

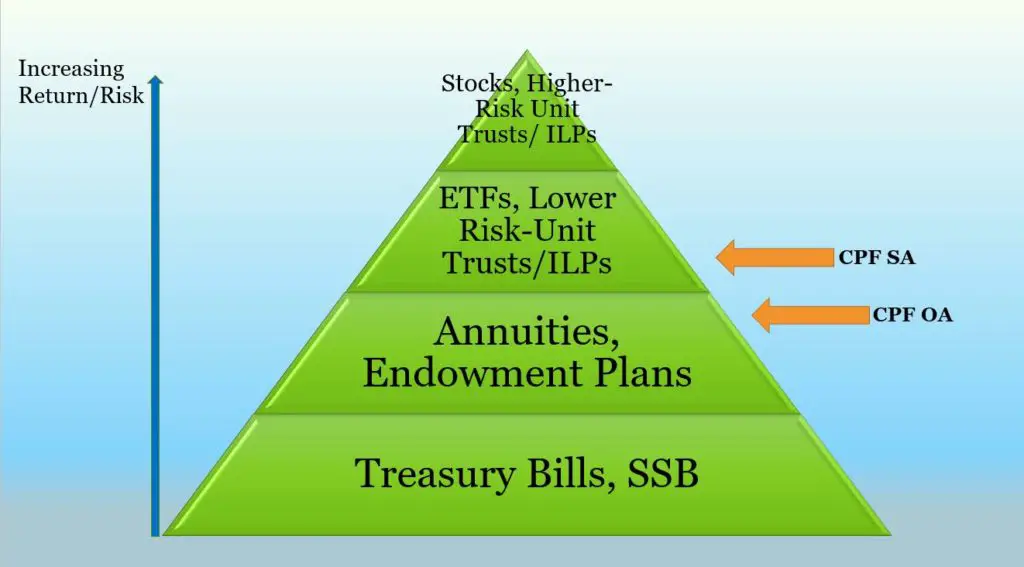

While you can invest your SA in certain investments, products which are approved for CPF SA investments tend to fall into lower risk categories.

By only allowing investments in products with lower risk, the chances that you’ll have inadequate savings for your retirement is reduced.

As such, I would recommend that you only invest in products which has the potential of beating these interest rates (4 – 5 %). Otherwise, it would be better to leave your funds in this ‘almost risk-free’ account!

SRS

Monies left uninvested in your SRS account earn an interest rate of 0.05% per annum.

As such, you are encouraged to invest your SRS funds immediately after you make each contribution.

With your monies invested, returns from your SRS are highly dependent on your risk tolerance. If you expect higher returns, you will need to shoulder greater risk in your portfolio.

During a market downturn, the value of riskier portfolios tend to fall more sharply than that of their safer counterparts.

The following infographic shows the potential returns (and risk) you can expect by investing in the various investment products in the long run. The returns of the CPF OA and SA have also been included as references.

If you are considering to beat the returns in your CPF SA, you will need to invest in higher-risk products such as:

- Stocks

- Unit trusts or ILPs that invest in stocks

Higher risk products may not be suitable for everyone. This is because they are more volatile, and you may not have the time horizon or risk appetite to realise positive returns.

To bypass the jargons and intricacies in shopping for good unit trusts, one convenient way to beat the SA interest rate is to track the market through major indices such as the S&P 500.

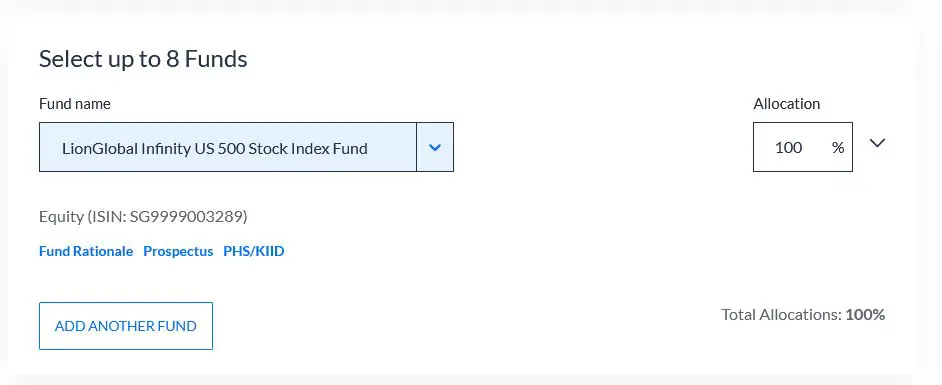

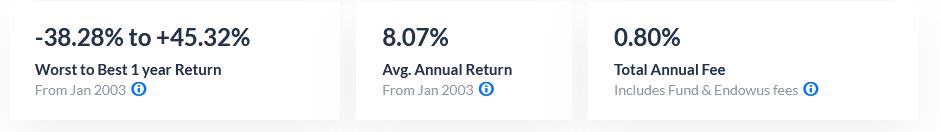

Fortunately, you can do just that with your SRS funds through the LionGlobal Infinity US 500 Stock Index Fund. This fund tracks the S&P 500’s performance through the Vanguard® U.S. 500 Stock Index Fund.

You can invest in the LionGlobal Infinity US 500 Fund through Endowus.

After accounting for fees, this fund has yielded an average of about 7.2% per annum over the past 18 years, handily beating the SA’s interest rate of 4 – 5% per annum.

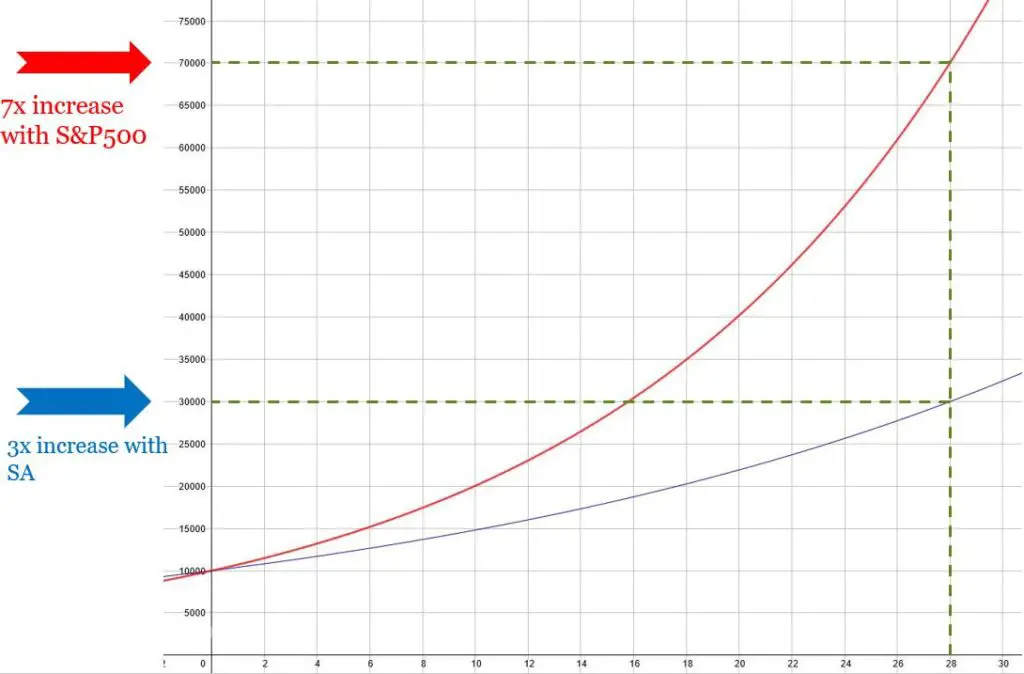

Let us see how much difference this translates to the growth in your savings.

If you had started out your investment journey at age 35 with $10,000, you would have multiplied your money by 7 times by the time you reach 63!

At the same time, the same amount would only have grown 3 times if left in your SA.

Passive investing, as this method is known, gives normal people like you and me the chance to get rich with just basic financial knowledge!

Interested to know more on how you can invest your savings? You can check out this guide to see how the CPFIS and SRS can help you!

#4 Fees

There are no fees incurred in keeping your monies in your SA.

However, the fees for investing your SRS monies varies greatly depending on what you are investing in.

Here is a quick breakdown of the fees you can expect to pay for the various products available:

| Investment Product | Estimated fees (% p.a.) |

|---|---|

| Higher-risk Unit Trusts/ILPs | 0.75% – 2.5% |

| Lower-risk Unit Trusts | 0.6% – 1.25% |

| ETFs | 0.0945% – 0.7% |

| Treasury Bills, SSBs | 0 % |

In addition, some products (such as endowment plans and annuities) are labelled as ‘Savings Plans’. These also come with fees that are payable to the advisor and company managing your funds!

In short, it is important to know about how much fees you are paying for before you sign up for any investment.

Excessive fees may eat into your returns, making the investment less worthwhile to make!

If the projected net return of your investment after accounting for fees is less than 4 % p.a., you may want to consider contributing to your SA instead.

#5 Withdrawal of Investments

Knowing when you can withdraw your investments is also important. After all, no one wants to retire and suddenly find themselves in the harsh reality of not being able to provide for their own survival!

CPF SA

After setting aside your Full Retirement Sum (FRS) in your CPF Retirement Account (RA) at age 55, you can withdraw the balance amount in your SA anytime. This will be done in the form of cash and your funds can be transferred to you either through Interbank GIRO or PayNow.

Your SA savings will be withdrawn first, followed by those in your OA.

If you have not saved up the FRS in your SA, all your funds will be channeled to your RA.

The consolation here is that you can withdraw up to $5,000 from your RA.

As the FRS is a significant sum to save up, you may want to note that the amount that you can withdraw is much lower than the figure in your SA.

Gradually withdrawing your SA funds helps to both manage your spending and grow your remaining savings. This is because the remaining amount can still earn up to 5 % p.a. while it is still in your SA!

SRS

While you can withdraw your SRS funds anytime, it is recommended that you do so after your statutory retirement age.

Withdrawing before the statutory retirement age will result in a 5 % penalty of the amount withdrawn, and a full reversal in tax benefits.

From the year that you make your first penalty-free withdrawal, you will be given up to 10 years to withdraw all your SRS funds. Furthermore, 50% of the withdrawal amount will be subjected to income tax for that year.

A penalty-free withdrawal refers to a withdrawal made at or after the statutory retirement age.

Any balance in your SRS account at the end of the 10 year period will be ‘deemed withdrawn’, a process which subjects 50% of the remaining balance to a one time taxation. You may still retain the balance thereafter; however, it will be regarded as a normal investment in future.

Verdict

Here is a summary of the comparison between the CPF SA and SRS:

| CPF SA | SRS | |

|---|---|---|

| Method of Contribution | – RSTU Scheme: Cash or CPF OA – VCs: Cash | Cash only |

| Tax Relief | – RSTU Scheme: Up to $14,000 p.a. – VCs: None for employees, variable if you are self-employed | Up to $15,300 p.a. |

| Returns | 4 – 5 % p.a. | Varying, depending on investment |

| Fees | No fees | Varying, depending on investment |

| Withdrawal of Investments | Withdrawal from age 55 once FRS set aside in RA | – Can withdraw anytime (Subject to penalty and tax relief reversal before retirement age) – Up to 10 years to withdraw funds from first penalty-free withdrawal |

How can I make use of my CPF SA and SRS for my retirement?

The short answer is, you can use both your CPF SA and SRS for that well rounded retirement plan!

Now comes the tricky bit:

What goals should I save for using my SA and SRS?

Here is one possible strategy on how to allocate your CPF SA and SRS funds for your retirement:

Keep your CPF SA funds in your SA account to accumulate interest

Firstly, your retirement plan will need a stable foundation to ensure that your savings will not be adversely affected by a sudden financial downturn near your retirement.

The role of this foundation can be borne by your SA funds. By leaving them in your SA, your monies enjoy a decent 4 – 5 % interest rate that is essentially risk free.

It is almost impossible to find products in the market which offer such high guaranteed returns combined with such a low risk.

Therefore, there is not much point in investing your SA funds. Instead, they are better off left in your SA to form the bulk of your FRS in your RA.

One method that emphasises accumulating in your CPF SA is the 1M65 movement pioneered by Loo Cheng Chuan.

Using some math and the power of compound interest, Loo proposes that if you and your spouse each save $130,000 in your CPF SA and MA at age 30, both of you will have a combined CPF balance of $1 million at age 65!

As $130,000 in your SA savings is definitely unattainable from your salary alone, you will need to perform top ups to reach this amount.

However, being fresh into my career, I would prefer to invest my excess savings instead of topping up my SA. This is because I can use the long time horizon to achieve greater returns.

Invest using your SRS for your retirement dreams

Given that your SRS has a 10 year withdrawal period starting from your first penalty-free withdrawal, your SRS funds are not meant to fully support your retirement needs.

With the current life expectancy of Singaporeans in 2020 at 84 and expected to rise further, our SRS can only last through a part of our retirement period.

However, since your day to day retirement needs have been covered by your CPF, you can now make your retirement dreams come true with your SRS funds!

Be it that round the world holiday or the new hobby that you want to pick up, you can rely on your SRS investments to make all of them happen.

You can find out more about maximising your SRS with this guide.

Conclusion

As the rising cost of living makes budgeting our salary ever increasingly difficult, congratulations on making the brave first step to save up for your retirement!

There are 2 main strategies on how you want to prepare for retirement:

| Strategy | Recommended Route |

|---|---|

| Slow and steady | SA |

| Fast and furious | SRS |

If you prefer a slower (and more risk free) approach to building up your retirement funds, topping up your SA may be more suitable. With it’s almost risk-free interest rate of 4 – 5 % p.a., you are able to steadily grow your retirement funds over the years.

One thing to note is that you can only withdraw the remainder of your SA after setting aside your FRS. This means the amount that you can withdraw may be much lower than what you expect!

However, you may want to take more risks and are confident that you can beat the 4 – 5 % returns of the SA. By investing your SRS funds, it may be possible to do so, especially if you have a longer time horizon.

You will need to stay invested in the long term and not panic sell the moment your portfolio’s value starts to decrease!

Over time, the power of compounding will help your SRS funds to grow rather significantly.

Once you are comfortable with the differences between the two schemes, you can take your retirement saving plan a step further by combining them together to create that well rounded retirement plan!

Do you like the content on this blog?

To receive the latest updates, you can follow us on our Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?