Last updated on August 29th, 2021

If you are looking to fund your property’s purchase entirely with your CPF funds, you may want to consider the interest you accrue on these funds.

When you sell your flat, you will need to return the funds you’ve used, plus any accrued interest back into your OA!

This will mainly affect you if you want to receive the profits of your flat’s sale in cash.

Here’s what you need to know about the interest you’ll accrue on your CPF OA funds.

Contents

- 1 What is the CPF accrued interest?

- 2 Who does the CPF accrued interest belong to?

- 3 How to calculate CPF accrued interest?

- 4 How do I check CPF accrued interest on the CPF Portal?

- 5 How can I reduce my CPF accrued interest?

- 6 How can I pay back CPF accrued interest?

- 7 Should I pay back my CPF accrued interest?

- 8 What happens to the CPF accrued interest when I die?

- 9 Conclusion

What is the CPF accrued interest?

The CPF accrued interest is the interest the funds you withdrew from your CPF OA would have earned if they had remained in your CPF. On top of the downpayment and monthly instalments, you will need to pay the accrued interest for any CPF grants you received.

For example, let’s say you used $40,000 from your CPF OA to pay for your BTO or resale downpayment.

If you sell the house in 30 years time, you will need to pay the $40,000, plus the interest this $40,000 would have earned if it stayed in your OA.

You’ll still need to consider other payments that you’ve paid with your CPF OA

This example is very simplified, where you only used your CPF to pay for your downpayment.

However, you may use your CPF to pay for other expenses, such as

- Repayment of your housing loan

- Stamp duty

- Survey fees

You’ll need to take into account the interest that you’ve accrued for the grants that you’ve taken, such as the Enhanced Housing Grant (EHG).

All of these would have accrued interest along the way, so you’ll need to repay the interest for these payments too.

Why does CPF accrued interest matter?

You may be wondering, why should I be worried about interest?

It mainly boils down to the amount of cash proceeds you will receive after selling your house.

Let’s say you are paying $50,000 downpayment for a $500,000 flat.

Let us look at the 2 extremes that you can use to pay for this downpayment:

- 100% in cash

- 100% using your CPF OA funds

After 20 years you may have sold your flat for $600,000.

If you used 100% cash to pay for your downpayment, you will be able to receive the $100,000 cash profit.

If you used 100% of your OA funds, you wil need to return the $50,000 downpayment, along with the accrued interest.

Assuming a 2.5% compound interest rate, you will need to pay back a total of $81,931.

($50,000 downpayment + $31,931 accrued interest)

The cash profits you receive will only be $18,069, instead of the $100,000 that you would have received if you used 100% cash!

Who does the CPF accrued interest belong to?

The accrued CPF interest ultimately belongs to you, but it will be locked up in your CPF OA. If you fully paid for your house with your CPF OA funds, this may reduce the cash proceeds you receive, as the accrued interest will be returned to your CPF.

To understand why the CPF board is charging you this accrued interest, you will need to understand the true purpose of CPF.

Your CPF funds are primarily meant for your retirement.

CPF was always meant to build up your retirement nest egg. However, you are still able to use some of it to pay for your housing needs.

When you sell your house, you will need to return the funds to your CPF account.

Ultimately, this accrued interest will still be your money. However, it will be locked up in your CPF OA, instead of you being able to use it as cash.

Even though your CPF funds are quite illiquid, they are still assets that should be considered in your net worth calculation.

If you are intending to sell your house for a cash profit, you may receive less than you originally expected.

How to calculate CPF accrued interest?

You are able to manually calculate the interest that you owe using an Excel spreadsheet. This can be quite troublesome. An alternative way you can use is to check the amount on the CPF portal, which has already been calculated for you.

If you want to manually calculate the interest that you owe CPF, it can be rather complicated.

This would be really complicated if you’re using your OA funds to pay for your housing loan.

To make things easier, you are able to check how much interest you owe CPF in the portal.

How do I check CPF accrued interest on the CPF Portal?

Here are 4 steps you’ll need to check the accrued interest on your CPF:

- Log in to the CPF Portal

- Go to ‘My Statement’

- Scroll down to ‘Section C’

- Check your accrued interest

Here is each step explained in-depth:

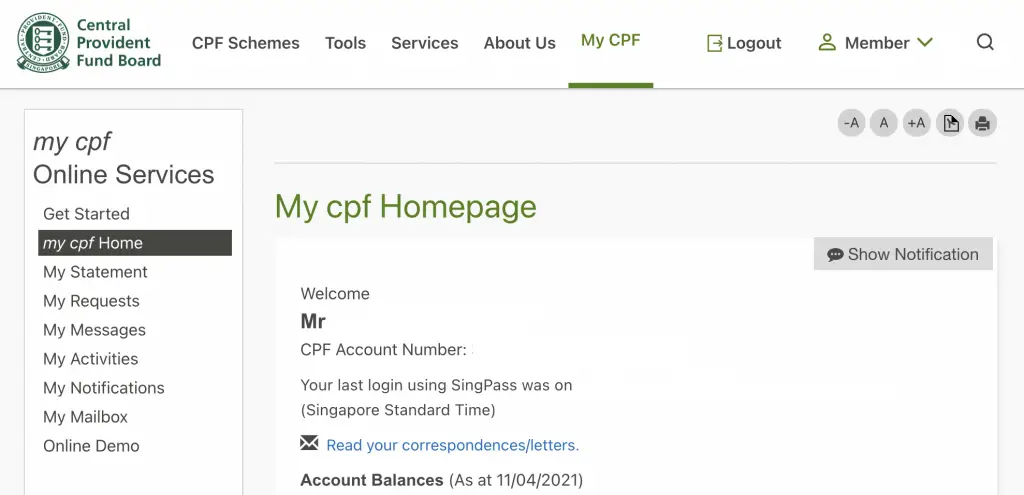

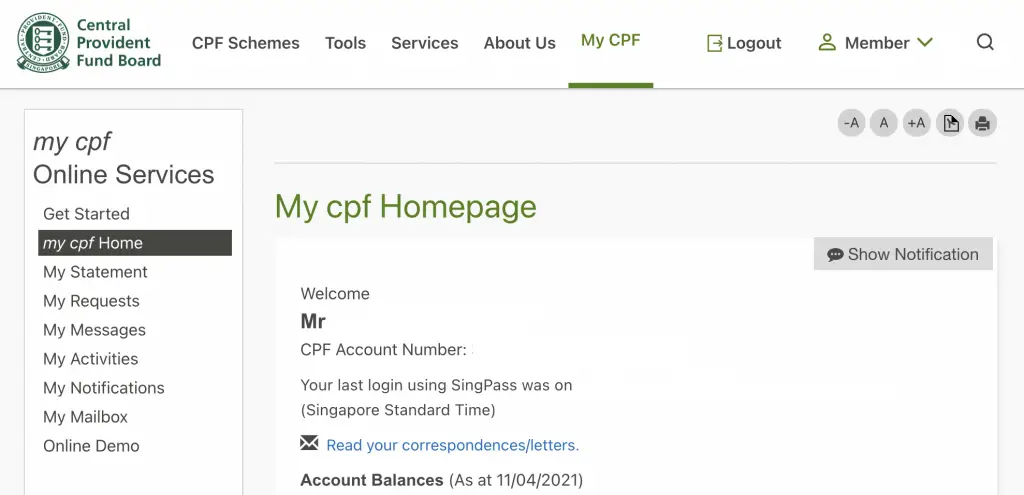

#1 Log in to the CPF Portal

To check the accrued interest for your CPF, you’ll need to login to the CPF portal.

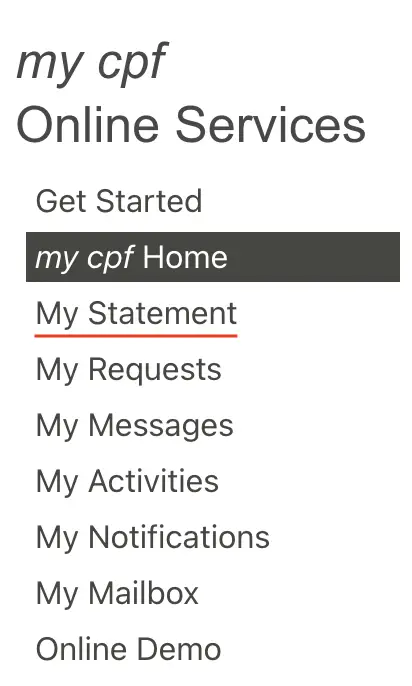

#2 Go to ‘My Statement’

On the sidebar, you will see ‘My Statement‘.

You’ll need to click on it to view your CPF accrued interest.

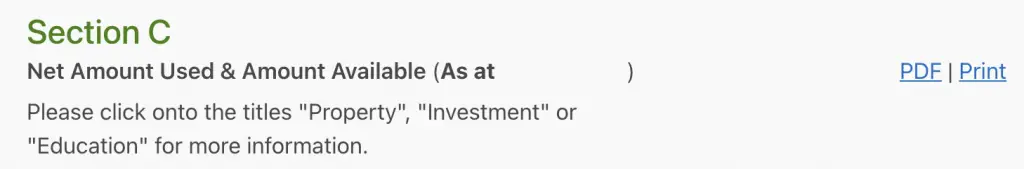

#3 Scroll down to ‘Section C’

Once you’re on the ‘My Statement’ page, you’ll need to scroll down to ‘Section C‘ of the statement.

This section allows you to see the ‘Net Amount Used and Amount Available‘ for your CPF.

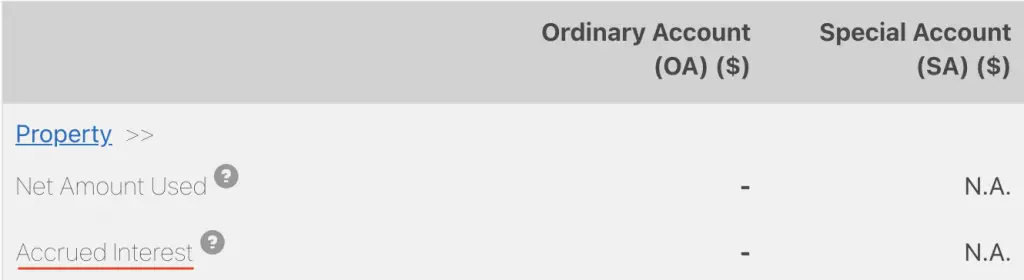

#4 Check your accrued interest

For the first part of the Section C, you will be able to view the accrued interest on your CPF loan.

How can I reduce my CPF accrued interest?

You can reduce the amount of accrued interest you owe your CPF OA by making a cash top-up to your CPF account. This will lower the amount that you need to return to your CPF when you sell your house.

How can I pay back CPF accrued interest?

Here are 6 steps you can take to pay back your CPF accrued interest:

- Log in to the CPF Portal

- Go to ‘My Requests’

- Select ‘Property → Make A Housing Refund With Cash’

- Click ‘Start’ to begin the application

- Select the mode of payment

- Make the payment to CPF

#1 Log in to the CPF Portal

To check the accrued interest for your CPF, you’ll need to login to the CPF portal.

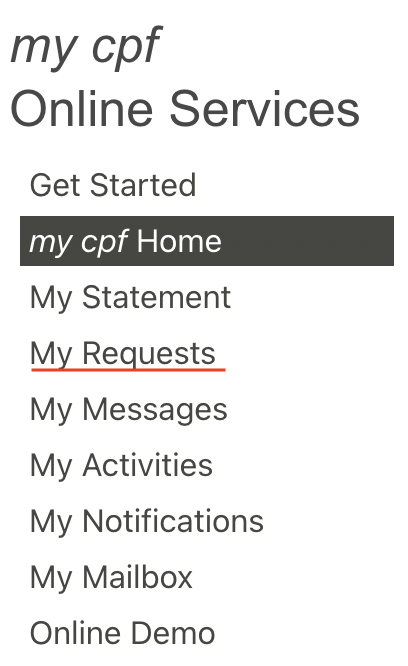

#2 Go to ‘My Requests’

On the sidebar, you will see ‘My Requests‘.

You’ll need to click on it to view your make a request to pay back your CPF accured interest.

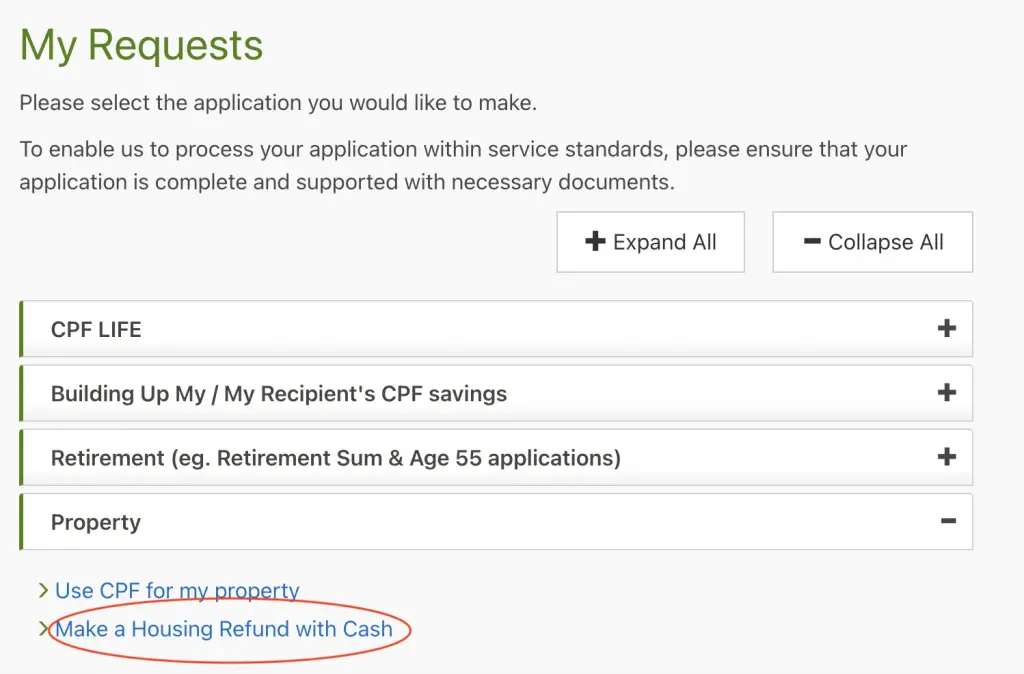

#3 Select ‘Property → Make A Housing Refund With Cash’

When you are on the ‘My Requests‘ page, you’ll need to scroll down and expand the ‘Property‘ tab.

After that, you’ll need to click on ‘Make a Housing Refund with Cash‘.

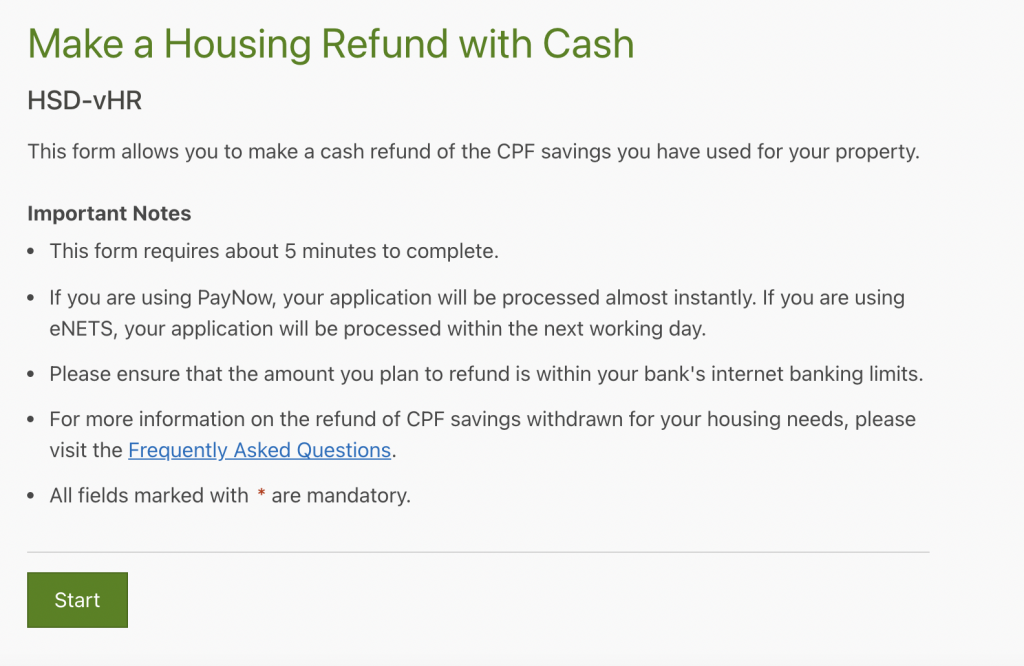

#4 Click ‘Start’ to begin the application

You’ll be brought to a page informing you about the application. You can press ‘Start‘ to begin your request.

#5 Select the mode of payment

You will need to select either eNETS or PayNow as the payment method to repay your interest.

#6 Make the payment to CPF

After making payment to CPF, you should receive a confirmation email of your successful transaction.

If you are still unsure, you can view 2 video guides on CPF’s website to pay back your accrued CPF interest via:

Should I pay back my CPF accrued interest?

You can consider making regular cash top-ups to your CPF to reduce the amount of accrued interest you need to pay. This will allow you to have more cash on hand and give you more flexibility. However, if you are intending to buy another house with the proceeds, this may not be necessary.

If your main aim of selling your property is to receive more cash, you should consider paying back your accrued interest earlier.

However, if you are intending to buy a home with the profits of your house’s sale, you don’t need to worry so much.

You are still able to use the funds in your OA to pay for your next house!

As such, paying back your accrued interest really depends on the aim of you selling your house.

What happens to the CPF accrued interest when I die?

When you pass on, the person who inherits your property will not need to pay back the CPF savings (including the accrued interest) that you used to buy that property. Furthermore, your share of the property will be passed on to the remaining owners of the property.

The CPF website did not explicitly state what happens to the CPF accrued interest when you die. However, they did mention this on their website.

Since you do not need to refund the CPF savings which the deceased used to buy that property, it would be safe to say that you do not need to pay back the accrued interest as well!

Conclusion

The interest that you accrue from using your CPF OA to fund your house can be quite high if it is left for a long period of time.

This is because the interest will continue to compound. Eventually, you’ll have to return even more funds into your CPF!

However, the accrued interest will mainly affect you if:

- You want to sell your house in the future

- You want to receive your profits in cash for other uses

As such, paying back your accrued interest early will depends on the goals you want to achieve with the sale of your house!

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?