If you’re looking for the ultimate passive investing strategy, you may have heard of either investing in VWRA, or a combination of IWDA and EIMI.

What is the difference between these 2 and which is more suitable for you?

Here’s what you need to know:

Contents

What does VWRA vs IWDA + EIMI mean?

VWRA is an all-in-one ETF that tracks both developed and emerging markets. Meanwhile, IWDA only tracks developed markets, and EIMI tracks emerging markets. As such, the idea was to buy both IWDA and EIMI to receive exposure to both markets, which may be similar to the exposure that you receive from just buying VWRA.

There are both pros and cons to either strategy, and here’s a breakdown to see which strategy is more suitable for you:

Indices tracked

VWRA tracks the FTSE All-World index, where it aims to cover 98% of the world’s investable market capitalisation.

This index tracks the performance of large and mid-cap stocks from both developed and emerging markets, and contains stocks from 49 different countries, including:

- USA

- Japan

- Germany

- Singapore

- Denmark

- China

- Kuwait

There are a total of 4101 constituents in the index, which makes it really diversified!

IWDA tracks the MSCI World Index

IWDA is a fund that tracks the performance of the MSCI World Index, which includes 1560 large and mid-cap holdings from across 23 different countries.

The countries in the MSCI World index come from 23 developed markets, and it is heavily weighted in the United States.

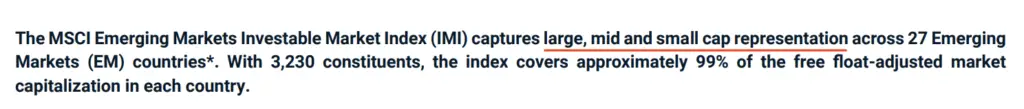

EIMI tracks the Emerging Markets Investable Market Index (IMI)

Meanwhile, EIMI tracks the Emerging Markets index that was created by MSCI, which contains 27 emerging market countries including:

- China

- Taiwan

- Brazil

- South Korea

There are around 3,230 constituents in this index.

One unique thing about EIMI is that it tracks small caps stocks as well.

This is not found in either VWRA or IWDA, as both of these ETFs only track large and mid-cap stocks. As such, EIMI may be even more diversified in the emerging markets compared to VWRA.

Number of holdings

Here are the number of holdings for each ETF:

| VWRA | IWDA | EIMI | |

|---|---|---|---|

| Number of Holdings | 3,816 | 1,549 | 2,986 |

Although each ETF is supposed to track a particular index, they may not contain all of the holdings of the index.

If you compare the number of holdings of VWRA and IWDA + EIMI, IWDA + EIMI may be more diversified as it has around 600+ more holdings compared to VWRA.

Fund manager

VWRA is managed by Vanguard, while both IWDA and EIMI are managed by BlackRock.

IWDA and EIMI were started earlier (2009 and 2014 respectively), while VWRA was only incepted in 2019. Moreover, VWRA has lower assets under management (AUM) compared to both IWDA and EIMI.

| VWRA | IWDA | EIMI | |

|---|---|---|---|

| AUM | $12.7 billion | $45.6 billion | $17.5 billion |

Currency and exchange

All 3 of these ETFs are denominated in USD, and are listed on the London Stock Exchange (LSE).

If you want to find out more about buying LSE stocks from Singapore, you can check out my guide here to find out more.

As such, there is no difference in terms of the currency and exchange for all 3 ETFs.

Estimated unit price

Here are the estimated unit prices for each ETF:

| VWRA | IWDA | EIMI | |

|---|---|---|---|

| Price | $117 | $88 | $35 |

The estimated unit price is rather similar if you intend to do either of the following:

- Buy 1 unit of VWRA

- Have a 1:1 allocation between IWDA and EIMI (i.e. buy 1 unit of IWDA and 1 unit of EIMI)

However, if you want to have a different allocation between IWDA and EIMI (e.g. 60% IWDA and 40% EIMI), the number of units you buy for each ETF may be different.

Ultimately, this may make buying both IWDA and EIMI more costly for you.

Dividend distribution

All 3 funds are accumulating funds, which means that your dividends will be automatically reinvested for you at no extra charges.

This is great if you initially intended to reinvest your dividends, as the fund managers will do it for you!

You can read my comparison between an accumulating and distributing fund to find out more.

Dividend withholding tax and estate tax

Since all of these 3 ETFs are domiciled in Ireland, you will only incur a 15% dividend withholding tax for any US stocks that you own.

This 15% tax will be deducted even for accumulating funds, so you will still incur the tax from US stocks even if you did not receive any dividends.

Another advantage for Irish-domiciled ETFs is that you do not incur the hefty US estate tax which will be imposed if you own any stocks listed on the US stock exchanges.

Expense ratio

On top of the trading commissions you’ll need to pay the broker, you will have to pay an expense ratio to the fund manager as well.

The expense ratio is charged by the fund manager to cover the costs of running the fund.

Based on the value of your assets in the fund, you will be charged an annual fee.

Here are the expense ratios for the 3 ETFs:

| VWRA | IWDA | EIMI | |

|---|---|---|---|

| Expense Ratio | 0.22% | 0.20% | 0.18% |

The expense ratio for a combination of IWDA and EIMI will always be lower compared to VWRA.

For example, a 60/40 allocation towards IWDA and EIMI will result in a 0.19% expense ratio, which is lower than the 0.22% for VWRA.

The higher the allocation you have towards IWDA, the higher your expense ratio. However, your expense ratio will not be higher than that of VWRA.

Even though the expense ratios may seem very similar since the difference is really small, it may actually compound over time and affect your overall returns!

Liquidity

If you are looking to actively trade using these ETFs, you may want to look at their liquidity. One of the indicators you may want to look at is the ETF’s trading volume.

| VWRA | IWDA | EIMI | |

|---|---|---|---|

| Average Trading Volume | 7,064 | 33,000 | 39,000 |

Since both IWDA and EIMI have been around for much longer, it would be expected that their average trading volume would be higher compared to VWRA.

This would mean that you may not be able to buy or sell VWRA at your intended price, since it has lower liquidity compared to both IWDA or EIMI.

Verdict

While we have been comparing these 3 ETFs separately, let’s look at how VWRA fairs with a combination of both IWDA and EIMI:

| VWRA | IWDA + EIMI | |

|---|---|---|

| Index Tracked | FTSE All-World index | MSCI World Index + MSCI Emerging Markets Index |

| Number of Holdings | 3,816 | 4,535 (combined) |

| Fund Manager | Vanguard | BlackRock |

| AUM | $12.7 billion | $62 billion (combined) |

| Exchange | LSE | LSE |

| Currency | USD | USD |

| Estimated Unit Prices | $117 | $88 (IWDA) and $35 (EIMI) |

| Dividend Withholding Tax | 15% | 15% |

| Dividend Distribution | Accumulating | Accumulating |

| Estate Tax | NA | NA |

| Expense Ratio | 0.22% | 0.20% (IWDA) + 0.18% (EIMI) |

| Average Trading Volume | 7,000 | 72,000 (combined) |

Both of these ETFs seem very similar, so which one should you choose?

Choose VWRA for the convenience

If you are looking to just receive the best exposure possible to the entire market with one ETF, VWRA will be the better choice. When you are buying this ETF, you are exposed to the top stocks that come from both developed and emerging markets.

This is perfect for a buy and hold strategy where you do not need to worry about rebalancing your portfolio depending on your intended allocation towards developed and emerging markets.

Since you are only buying one ETF, you will not incur additional costs as compared to IWDA + EIMI where you will need to buy 2 different ETFs. The fees for trading on the LSE are quite high compared to buying on the US stock exchanges, so this will be an additional cost to bear.

However, the expense ratio for VWRA is higher (0.22%) compared to any combination of IWDA + EIMI. This may ultimately affect your long term returns as the fees start to compound.

Choose IWDA + EIMI for greater flexibility in your allocation

If you want to choose the allocation of your funds towards both the developed and emerging markets, IWDA + EIMI will be a better choice for you.

Moreover, EIMI has exposure to small cap stocks, which further increases the diversity of your holdings.

You can decide to have a greater allocation towards either developed or emerging markets, while you are fixed by the allocation that is set by VWRA.

However, the trading costs will definitely be higher since you are buying 2 ETFs each time. If you are buying IWDA + EIMI each month, the costs can really add up over time!

Conclusion

Both VWRA and IWDA + EIMI provide great exposure to both the developed and emerging markets. Since they are both rather similar, the strategy that you choose may depend on:

- The flexibility that you wish to have to allocate your funds

- The convenience of having to buy 1 vs 2 ETFs

- The amount of trading fees and expense ratio that you are willing to incur

- The exposure you wish to have toward emerging small cap stocks

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?