Last updated on June 10th, 2021

You may be thinking: if you save enough cash, you should have enough for retirement right?

However, have you factored in inflation in your calculations?

By leaving your cash in a bank account, its value will slowly erode away due to inflation!

I used to think that by saving money, you should have enough to last you in the future. However, here’s what I believe you should be doing with your cash instead.

Contents

How much cash should I have in savings in Singapore?

The amount of cash you should have in your bank account should be some of your emergency funds, as well as some funds for your everyday spending. The rest of your savings should be invested in other instruments that are able to give you a higher rate of return.

You may be wondering, why should you have so little cash on hand?

The main problem is that savings accounts provide extremely low interest rates. Over time, your cash savings will lose its value!

To stay on par with, or even beat inflation, you will need to invest your cash in assets that provide you with higher returns.

The only cash you should have is your emergency funds and everyday spending

I believe that the only cash that you should have in a savings accounts are for 2 main purposes:

- A part of your emergency funds

- Your everyday spending

For your savings for other goals, these should be placed in instruments that can earn a better return.

You can consider placing a part of your emergency fund in a savings account

You may have heard of an emergency fund, which is a liquid fund that you can use for any unexpected purchases.

Depending on the type of income you earn, you should have at least 3-6 months of your monthly expenditure in your emergency fund.

The main purpose of this fund is to be very liquid. This allows you to access your cash at any time, in case there is an emergency.

However, do you really need your entire 6 months worth of monthly expenditure to be very liquid?

Even if you lose your job, you will probably only need 1 month of your expenditure each time.

This is why I would like to suggest that you build a tiered emergency fund instead.

This is because while savings accounts are extremely liquid, their interest rates are very low. Your emergency fund will erode in value over time due to inflation!

I’m using 3 different instruments to store my emergency fund:

| Account | Rate of Return |

|---|---|

| Standard Chartered JumpStart | 0.4% for first $20k |

| SingLife Account | 1.5% for first $10k |

| Syfe Cash+ | ~ 1.5% (no limit) |

While JumpStart is the most liquid option, I am only receiving a 0.4% yield. I am placing around 10% of my emergency fund inside, which will help me to pay for any immediate emergencies.

For the rest of my funds, I want them to earn a higher return, so that it does not lose value in the long term.

This is why I have chosen to place them in places that earn a slightly higher yield, with relatively lower liquidity.

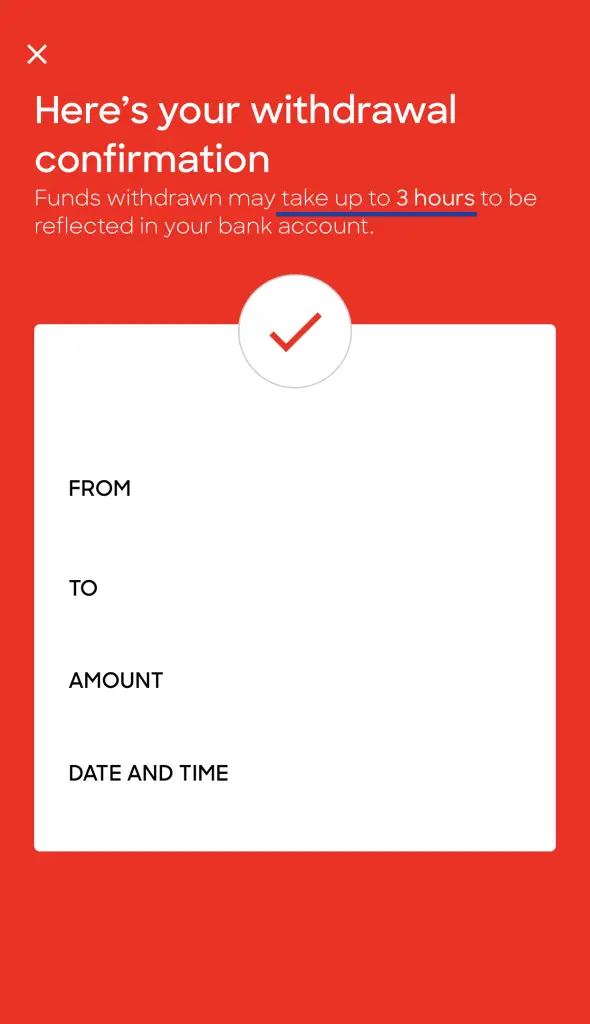

For example, the SingLife Account will transfer your funds in around 3 hours.

Meanwhile, Syfe Cash+ takes around 2-3 business days to credit your funds in your bank account.

These options are still relatively liquid. In the event that I have an emergency that is greater than the amount in JumpStart, I can still choose to withdraw from the SingLife Account.

A part of your emergency fund should always be in cash

While you may be tempted to place all of your emergency funds in other instruments, I believe that some of it should still remain in cash.

This is because the emergency you face may require the cash immediately. In this way, you are still able to pay for these emergencies with the funds in your bank account.

If you leave all of your emergency funds in less liquid options, you may face some liquidity issues when you need the cash right away.

You should have some funds in your savings account for your everyday spending

The other component that you should leave as cash is the funds for your daily expenditure.

When you receive your salary, you should be setting aside a part of it for your daily expenditure.

The remaining amount should be placed towards saving for your different financial goals!

Since you will need this cash at hand to pay for your everyday needs, it should be kept in a savings account.

I would recommend that you place it in an account with no minimum amount. In this way, you are able to fully deplete the account without having to pay any fall-below fees.

The rest of your cash should be used for different goals

When you are saving money, you are most likely saving it for different goals that you want to achieve.

The 2 most common types of goals you’ll be saving for include:

- Short term goals

- Long term goals

Both of these goals have a different time horizon. You can consider investing these funds into different products to help you earn a higher rate of return that your savings account.

You should place funds from your short term goals in instruments with relatively good liquidity

You may be saving for a short term goal, such as:

- Your BTO flat downpayment

- A car

- Your house’s renovation

- A holiday

Instead of leaving your funds in a low interest rate savings account, you can consider leaving it in another instrument that earns you a higher return.

Here are some examples:

| Instrument | Examples |

|---|---|

| Cash management accounts | Syfe Cash+ StashAway Simple Endowus Cash Smart |

| Insurance savings plans | Dash PET Dash EasyEarn |

| Endowment plans | Various insurance companies and banks |

| Bonds | Bonds Bond ETFs Robo-advisor bond-only portfolios |

Most of these products offer you a higher rate of return compared to a savings account.

There are some conditions that you may need to fulfil when you are using these plans, such as:

- Lock-in periods

- Transaction fees for withdrawals

The good thing about short term goals is that you are able to plan the date when you will need the cash.

This allows you to plan ahead and withdraw your funds from these instruments in advance.

You should place your savings for long term goals in instruments that give you a high return

When you are saving for a long term goal, the time horizon you have is typically 10 years or more.

This means that you will only need the money in the next 10 years. Most likely, your major long term goal will be saving for your retirement.

Due to this long time horizon, you are able to afford more risk on your savings. This is because with higher risks, you should be able to receive a higher rate of return.

There are many ways that you can invest your savings, including:

- Stocks

- ETFs

- REITs

- Real estate

- Cryptocurrencies

The main aim that you are buying into these instruments is to receive a high return when you sell them in the future.

This means that you should only be selling your investments when you are reaching your goal!

Since these instruments have higher risks, there will be a chance that your investment portfolio will be volatile.

There will be days when your portfolio is up, and there are other days when your portfolio will crash.

You will need to see the long term picture when you make each investment. This means that you should buy the instrument, and then hold it until you are reaching your goal.

If you panic sell your investments too early, you may be incurring losses! As such, I would advise against checking your investments everyday.

Conclusion

The aim of having as little cash as possible is to make your money work for you.

If you leave your cash inside a savings account, it will erode in value over time.

If you’re investing your cash in something that gives a better rate of return, you may be able to be equal to, or even beat inflation!

As such, the amount of cash that you should have on hand is some of your emergency funds and your daily expenses. The rest should be placed in instruments that give you better returns.

Investing your money will always come with risks. The type of instruments that you invest in depends on your time horizon and risk profile.

In the end, you should choose an investment product that will help you to achieve your goals in the given time period!

👉🏻 Referral Deals

If you are interested in signing up for any of the products mentioned above, you can check them out below!

Syfe Referral (Up to $30,000 SGD managed for free for 3 months)

If you are interested in signing up for Syfe, you can use the referral code ‘FIPHARM‘ when you are creating your account. You will have your first $30,000 invested with Syfe managed for free for your first 3 months.

You will be able to save up to $75 worth of fees!

This applies only to the money that you’ve invested in Syfe’s 3 portfolios. If you are using only Syfe Cash+, you will not be charged any fees by Syfe!

You can view more information about this referral program on Syfe’s website.

Endowus Referral (Receive a $20 Access Fee Credit)

If you are interested in signing up for Endowus, you can use my referral link to create your account.

You will receive a $20 access fee credit, irregardless of the amount that you start investing with Endowus.

The access fee does not have any expiry date. As such, you can invest at any pace that you wish, and still get $20 off your fees!

StashAway Referral (Up to $40,000 SGD managed for free for 6 months)

If you are interested in signing up for StashAway, you can use my referral link to sign up.

Here’s what you’ll need to do:

- Sign up for a StashAway account

- Make a deposit of ≥ $10k within 4 weeks of signing up

- Receive a fee waiver for 6 months (up to $40k)

You can find out more about this program on SingSaver.

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?