Last updated on January 7th, 2022

Decentralised finance, or DEFI, is the next generation of cryptocurrencies that claim to change the current financial system.

Two of the biggest DEFI projects and tokens include Uniswap (UNI) and Chainlink (LINK).

Are you wondering how do both of these coins differ from each other? Let’s take a deep dive to find out more.

Contents

The difference between Uniswap (UNI) and Chainlink (LINK)

Uniswap is a decentralized exchange while Chainlink is a blockchain oracle. Both coins are ERC20 tokens that run on the Ethereum network. UNI can be used to vote for community initiatives to improve Uniswap, while LINK is used by companies for payment on the Chainlink.

Here is a further explanation about the differences between these tokens.

Type of network

The transaction of a coin, such as UNI or LINK, takes place through a blockchain network.

There are different types of blockchain networks, such as the Ethereum network, Binance Smart Chain and Polkadot.

Let’s compare the networks of UNI and LINK.

Both UNI and LINK run on the Ethereum network

To be on the Ethereum network, the code of a coin has to follow a set of rules fixed by Ethereum. There are many sets of rules by Ethereum, to fit different uses of the coins.

The most common set of rules on Ethereum is the ERC20.

Both Uniswap and Chainlink follow the rules of ERC20, so they are both ERC20 tokens on the Ethereum network.

Uniswap is a decentralized exchange

Decentralised exchange (DEX) is a peer-to-peer (P2P) marketplace that connects cryptocurrency buyers and sellers. In contrast to centralized exchanges (CEXs), decentralized platforms are non-custodial, meaning a user remains in control of their private keys when transacting on a DEX platform.

– Definition of a decentralised exchange by Gemini

Simply put, these exchanges do not have a middleman between the buyer and seller.

This is different from centralized exchanges like Binance where they manage and hold your coins.

Chainlink is an oracle network

An oracle is a blockchain middleware that creates a secure connection between smart contracts and various off-chain resources that they need to function. It acts as the middle layer between a blockchain and an API (from a computer) that translates information for the blockchain to read.

– Definition of a blockchain oracle by Chainlink

Even though blockchain applications have many functions, they may still need certain data that is outside of the blockchain system.

This is also known as off-chain data.

For example, the Uber app needs Google Maps to track the location of the car and guide the driver to the destination within the app.

This location tracking from Google is a set of data from outside of the Uber app.

Usually, this process of connecting data is simple since they operate on the same computing system.

They record data and transmit data in the same way, which makes them compatible to connect data across the platforms.

However, if Uber was on the blockchain, there is a problem translating the Google Maps data into data that the blockchain can understand.

In this way, Chainlink can help to connect the external data (in this case, Google Maps) and apps on the blockchain (our blockchain Uber).

There has to be a link between real-world information and the smart contracts for the most efficient use.

As for Uniswap, the platform also works as an oracle. Uniswap will determine the price between any coin pair (e.g. 5,000 USDC tokens for 1 ETH coin).

It has to collect information about the market price of ETH in USDC through platforms that are not on the blockchain (off-chain platforms) first.

Only then will it be able to generate an accurate price on the blockchain.

However, Uniswap is not officially recognized as an oracle coin!

Nevertheless, Vitalik Buterin, the creator of Ethereum, did propose that Uniswap is in a good position to become an oracle coin.

“I recommend that Uniswap and the UNI token step in and provide such an oracle […] specialized to providing price data that’s robust and extremely costly to manipulate and attack.”

Vitalik Buterin, on proposing UNI becoming an oracle

Other than the functionality of the coin, let’s also look at how to earn through these networks.

Uses of the token as a user

Let’s say you recently bought UNI or LINK. Other than leaving them in your wallet, here are some alternative ways that you can use these tokens:

UNI – Voting for Initiatives

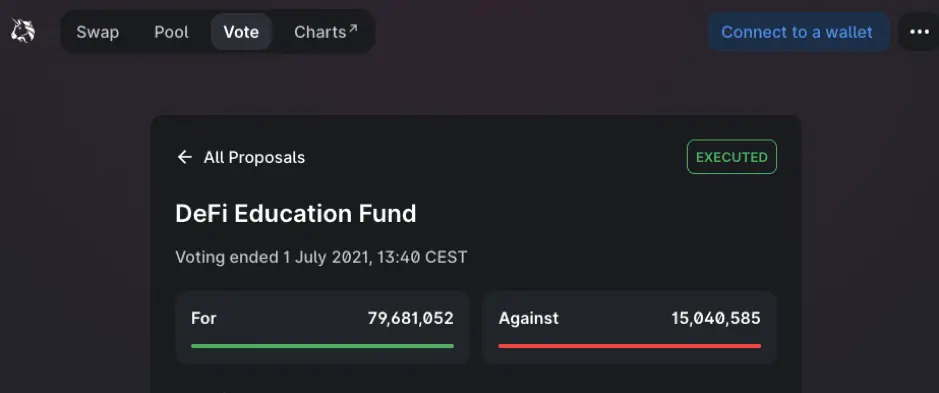

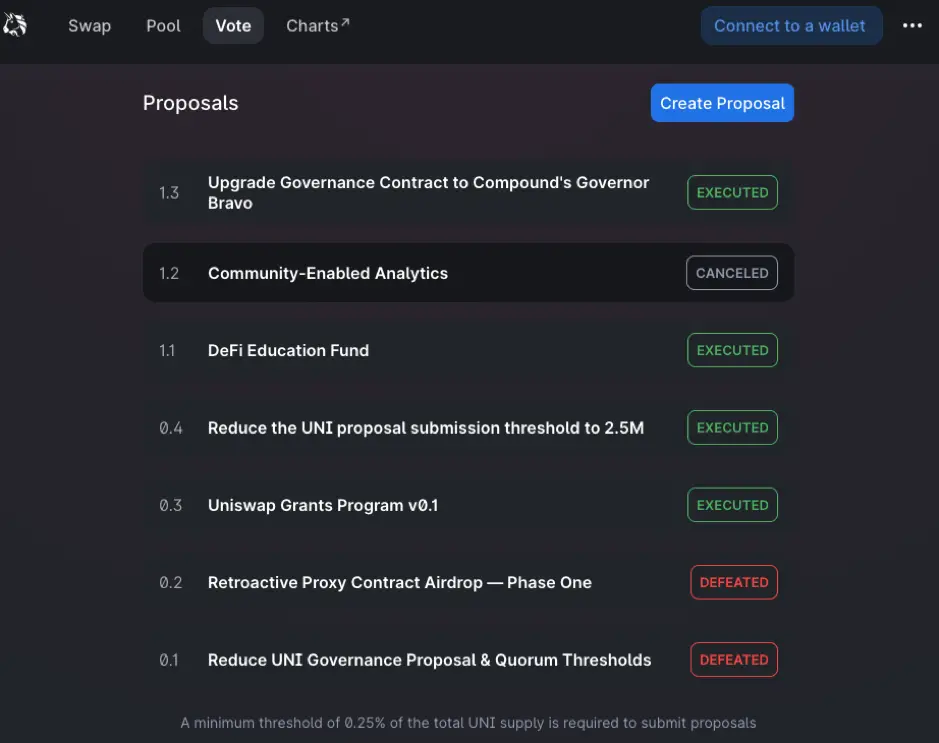

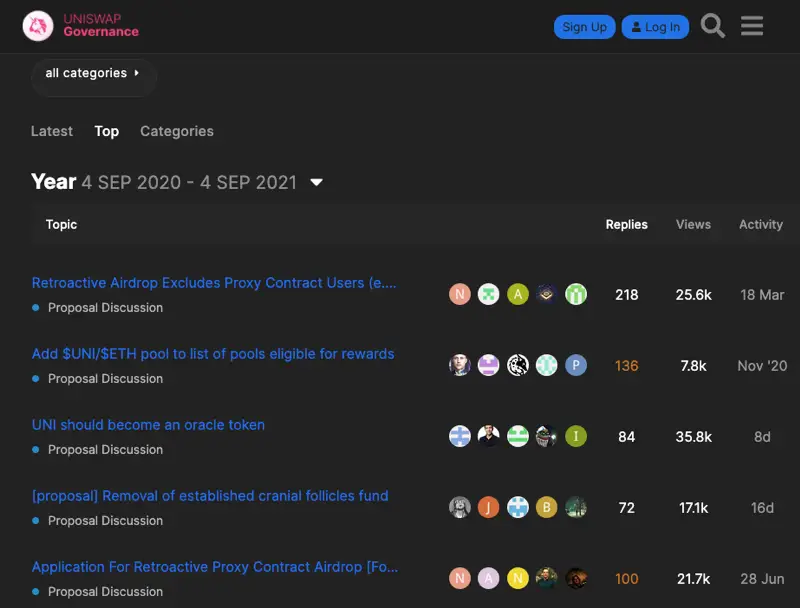

Holders of UNI tokens can suggest, vote or propose new ideas on Uniswap’s website.

If you have at least 0.25% of the total UNI token supply, you can submit a proposal about the protocol or the community.

A proposal can be any idea that you have to improve the way Uniswap is being done. It can also be a suggestion

You also vote on the other proposals that the other users have suggested.

Some proposals include:

- lowering the minimum UNI tokens needed to create a proposal from 10 million UNI to 2.5 million UNIs

- DeFi Education Fund set aside UNI tokens to teach the policymakers about DeFi and how it works.

This is interesting as you can directly influence the direction of the project or protocol as a token holder. However, the minimum coins to submit a proposal is quite high.

If you are just a casual investor in UNI, it may be difficult to submit a proposal as you may not have enough coins.

However, all is not lost. If you do not have enough UNI to create a proposal, you can still start a discussion on the UNI forum to get people talking about your idea.

When you are a token holder of Uniswap, you can vote for interesting ideas for Uniswap directly.

ChainLink – Pay for transactions

If you run a blockchain app that needs Chainlink as a middleman, you will have to use LINK tokens to pay for the transaction fees.

As a retail investor, there are limited uses of the coin. This is because Chainlink is mainly for businesses to perform transactions, rather than people like you and me.

Instead, you can invest in the value of the coin by trading and holding. If more people adopt Chainlink to make payments, the value of the token may start to increase!

Another way is to operate a node to earn these transaction fees paid by these businesses.

We will talk about this in the next section.

Earning money through the network

If you want to earn money from the tokens you’ve purchased, here are some ways you can do so:

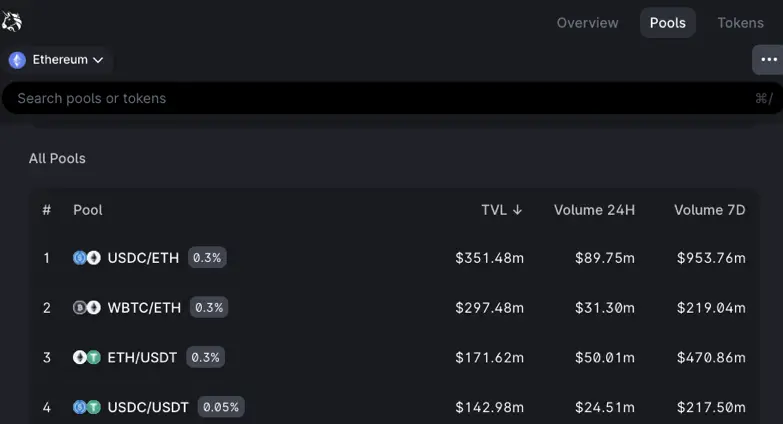

Earning as a Liquidity Provider on UNI

One of the possible ways for you to earn money from Uniswap is by being a liquidity provider.

As a liquidity provider, you can earn the transaction fees when users swap coins.

Why Liquidity Providers Are Needed

Since UNI is a decentralized exchange, they rely on the users to provide the coins needed for the exchange.

In a centralized exchange, the company holds a pool of coins that can be used when an exchange is needed.

However, being a decentralized exchange, Uniswap does not store any coins.

This is why Uniswap needs users to store their coins on the network to be exchanged if a trade is to be made. This is also called providing liquidity.

By locking up your coins on the network, you are staking your coins.

You can stake one of the listed coins. Furthermore, you are not just limited to staking UNI tokens, but you can stake other coins as well!

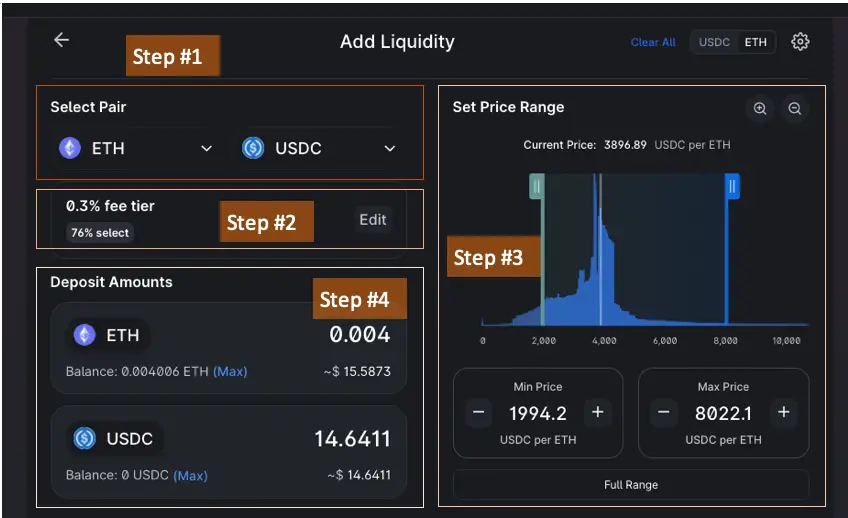

To stake on Uniswap, you have to follow these steps below:

- Select your coin pair

For example, USDC/ETH. - Select a fee tier to charge the users who swap your selected coin pair.

The website will suggest the most optimized fee. - Select a price range of the swap

Let’s say the range for USDC/ETH can be set between 2000 USD per ETH to 8000 USDC per ETH.

As for price range, the wider the range, the less the rate of return. At the same time, if the current price of the coin pair is outside of your range, you do not earn anything.

As such, you will need to find a balance between the range and your return. - Deposit the required amounts.

You have to deposit both coins. In our example of USDC and ETH, you have to provide both USDC and ETH into the pool. - Approve and add to the pool

Look through the details and you’re done!

Here is a full guide to providing liquidity by Uniswap if you are interested for more details.

If you plan to buy and hold these cryptocurrencies, providing liquidity is a good way to earn passively with your coins.

Earning with a Node on CHAINLINK

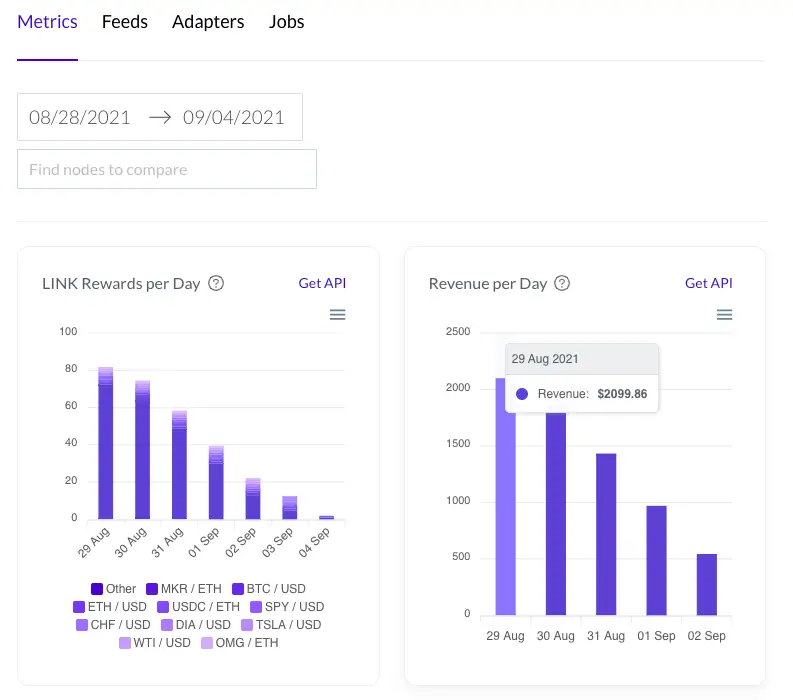

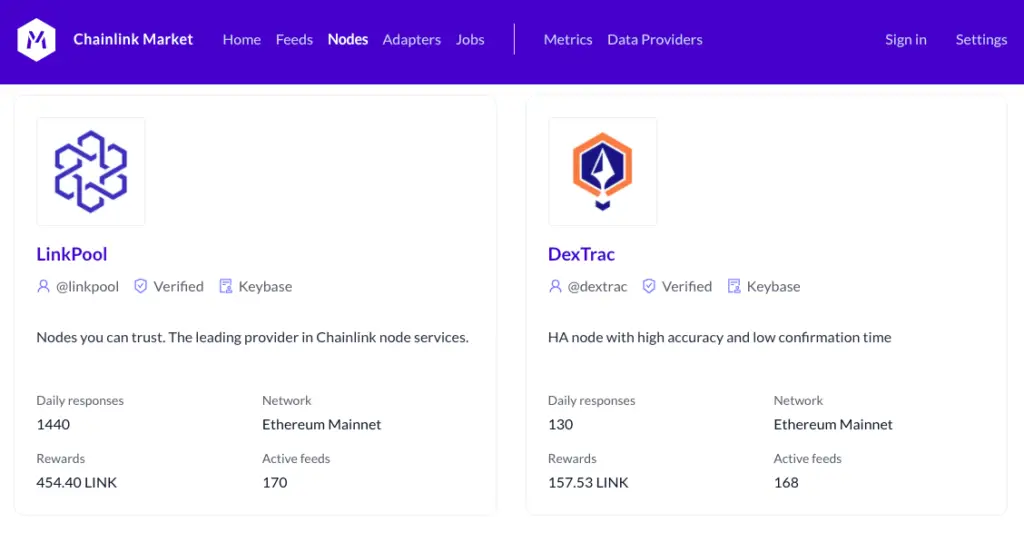

Another way to earn passively with crypto is to run a node. You can do this on Chainlink.

To run a node, you do not need extensive hardware.

However, you will need to download the necessary software on your computer, and ensure that you have enough storage and processing speed to run the node efficiently.

Here are some technical requirements to run a Chainlink node:

- Download Docker-CE

- The computer should run on at least 1 core and 1 GB of RAM

- You will need to have a connection to an Ethereum client. The different type of clients can be found here.

Setting up a node is extremely technical, and it requires much more effort compared to being a liquidity provider on Uniswap. However, the rewards for operating a node are much higher!

The daily revenue of running a node can be up to $2000 USD per day! These returns are much higher than providing liquidity on Uniswap.

If you would like to read more about it, here’s a guide by Chainlink to help you set up your first node.

Investing in the coin

Earning through the projects and investing in the coin are different strategies. By investing, you are buying the coin and holding it in your wallet.

Let’s look at the options for holding. Here are the yearly interest rates for these coins in popular crypto exchanges:

| Uniswap (Yearly Interest) | Chainlink (Yearly Interest) | |

|---|---|---|

| Binance Earn | 0.67% guaranteed | 0.20% guaranteed |

| Gemini Earn | 3.59% | 2.75% |

| Crypto.com Earn | 0.5% basic to 5.0% with conditions | 0.5% basic to 5% with conditions |

This is slightly different from a liquidity provider on Uniswap, where you need to stake 2 coins at once to provide liquidity.

However, in this case, you are only lending out one coin to earn interest in this case.

Now, let’s look at the scale and achievements of the company.

UNI as the leading decentralized exchange

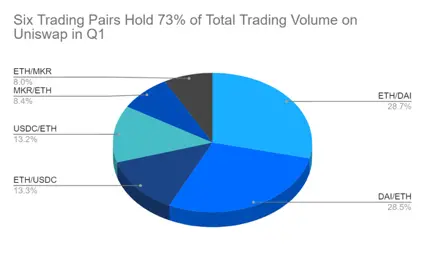

In September 2021, Uniswap was generating fees of approximately US$4 million daily for liquidity provider who facilitate liquid markets for the cryptocurrencies being exchanged.

Uniswap is currently the top decentralised exchange in the world by their 24 hour trading volume.

The second largest, PancakeSwap, has almost half of Uniswap’s 24 hour volume!

By being the market leader of decentralised exchanges, Uniswap can be considered as a reputable and stable exchange.

LINK is recognized by the World Economic Forum (WEF)

Chainlink is recognized worldwide by the WEF as the startup in its 100 most promising Technology Pioneers of 2020.

In terms of market capitalization, Chainlink is the largest oracle network. The second largest oracle network is the Band Protocol (BAND) with a market capitalization of only 286 million USD.

Meanwhile, Chainlink has a market capitalization of 5.86 billion USD, which about 20 times more than that of BAND.

Both Uniswap and Chainlink are the largest networks in their own niches.

By investing in either coin, you are guaranteed that you are investing into 2 stable companies.

Management team

When looking at the investment value of cryptocurrencies and their companies, another factor you’ll need to consider is the management team.

These are the people are creating the vision of the project and pushing the company forward. Here’s a few points that you can consider when you look at the members and founders:

- The team’s relevant experience

- How much of the coins do they or the company hold

With these pointers in mind, let’s look at the founders and team of Uniswap and Chainlink.

Founders of Uniswap

Uniswap is a relatively young company. It was first launched in 2018 by Hayden Adams. who stumbled onto blockchain and coding after being fired at Siemens.

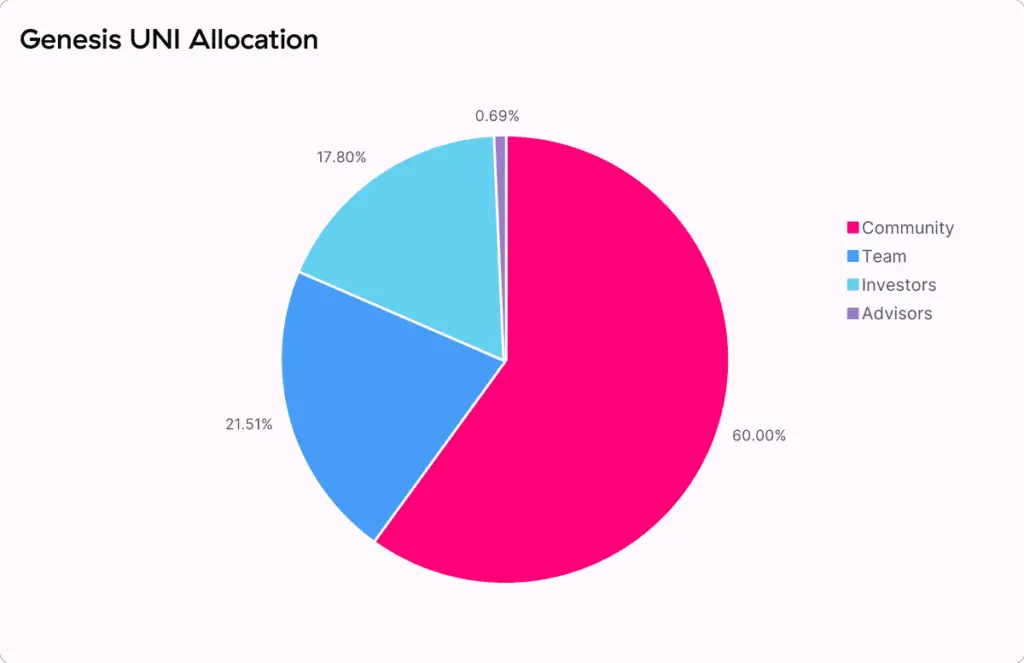

At its initial coin offering (ICO), about 22% of UNI tokens were allocated to the team members and future employees. Furthermore, the team must hold onto their coins for 4 years, before they can sell it to anyone else.

This means that there is less chance of them selling all their coins to a high price and dumping the coin within the first 4 years.

For example, the founders of Polywhale finance sold their coins when it hit a high price, leaving retail investors like us to be left with a coin that has lost value.

Most of these cryptocurrencies are known as ‘pump and dump’ coins.

However, the Uniswap team members do not have a huge allocation of coins with them. As such, they are unable to manipulate the price at such a large scale.

As a DEX, Uniswap as a company does not have any revenue.

Transaction fees are earned by those who stake and those who process the transaction. Generally, this is a good sign as the ecosystem is driven by the users, and not solely by the company.

This way, the founders have fewer reasons to abandon the project or transfer the company to another person at a high price

Founders of Chainlink

The CEO of Chainlink is Sergey Nazarov, while their CTO is Steve Ellis. 30% of the coins were allocated to the team members and founders. However, they did not state if they are required to hold the coins or exactly how many coins was allocated.

Chainlink started earlier than Uniswap.

The parent company of Chainlink is Smart Contract, and the founders were involved in the space since 2014. They are considered one of the early movers in the blockchain scene.

Many other team members from Smart Contract also moved to Chainlink. With their experience, they can better help develop Chainlink in the long run.

Final Verdict

Here is a summary of the comparison between UNI and LINK:

| UNI | LINK | |

|---|---|---|

| Type of network | • ERC20 token •Decentralised exchange | • Ethereum Network • Oracle network |

| Uses of the token | Vote for initiatives by the community | Pay transactions fees to Chainlink validators |

| Earning money through the network | Earn as a liquidity provider | Earn with a node |

| Investing into the coin | 3.59% interest per year on Gemini Earn | 2.75% interest per year on Gemini Earn |

| Management team | • Started in 2018 •22% of UNI tokens were allocated to founders and team members | • Started in 2017, with founders in the space since 2014 • 30% of LINK tokens were allocated to founders and team members |

Both Uniswap and Chainlink have great underlying value and use cases. These ERC20 tokens are essential to the existing blockchain ecosystem.

It is a reasonable bet to hold either of these coins for the long run.

If you want to earn tokens through either network, providing liquidity on Uniswap is easier to understand as a consumer.

This is because running a node on Chainlink involves much more technical knowledge!

If you are starting with a small amount of money to earn passive income, I would recommend starting with providing liquidity on Uniswap. It doesn’t require as much money and time to learn and earn.

However, if you are looking for big project with high returns, you can consider running a node on Chainlink.

Although you spend a long time setting it up, you can get much better returns!

Conclusion

Both Uniswap and Chainlink are great companies with good fundamentals.

Although they are both running on the Ethereum network, they perform rather different functions.

To decide which one to invest, it really depends on what type of investor you are. As a beginner, you can start with staking on the crypto platforms or being a liquidity provider on Uni.

If you would like to explore more on cryptocurrencies, you can also set up a node on Chainlink.

Do you like the content on this blog?

To receive the latest updates, you can follow us on our Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?