Last updated on June 18th, 2021

Cryptocurrencies have made 25 year olds into millionaires due to the huge spike in prices. This may make you very tempted to jump into buying a cryptocurrency that is touted to be the next Bitcoin.

You may have a ‘fear of missing out (FOMO)‘ tendency in your investments and want to rush into buying cryptocurrencies. However, do you really know what you are investing in?

Here are some tips I have to avoid FOMO-ing into a coin, which may eventually cause you to lose money in the crypto market.

Contents

- 1 How to avoid FOMO in cryptocurrency

- 2 Only invest in projects you strongly believe in

- 3 Look at profiting long term rather than through short term gains

- 4 Diversify your crypto portfolio as much as possible

- 5 Dollar cost average into the cryptocurrencies you intend to invest in

- 6 Avoid constantly checking the prices of your cryptocurrencies

- 7 Avoid blindly buying the dip

- 8 Invest money you have, and are willing to lose

- 9 Conclusion

How to avoid FOMO in cryptocurrency

Here are 7 tips to help you to avoid FOMO in cryptocurrency:

- Only invest in projects you strongly believe in

- Look at profiting long term rather than through short term gains

- Diversify your crypto portfolio as much as possible

- Dollar cost average into the cryptocurrencies you intend to invest in

- Avoid constantly checking the prices of your cryptocurrencies

- Avoid blindly buying the dip

- Invest money you have, and are willing to lose

Only invest in projects you strongly believe in

There are many different cryptocurrencies found in the market. Each currency has their own use cases. Some of them have the potential to have a life-changing impact, while others may just be ‘meme’ coins.

So how do you know which coins are the ones that you should be investing in?

Furthermore, you may get really jealous of someone’s profits in the crypto market, and want to replicate those returns. He or she may tell you to get into the market now.

This is because they believe that there is still potential for the cryptocurrency to increase in price.

However, you should not blindly follow the person’s advice!

I believe that the best way to choose which cryptocurrency you invest in is by doing your own research.

By understanding the coins that you are investing in, you are able to come up with your own reasons to why you are buying it. In this way, you take responsibility for your investment decisions.

While it’s good to listen to others’ opinions, you should form your own opinion on the projects you strongly believe to have the potential to do well.

Look at profiting long term rather than through short term gains

Buying low and selling high is the main thing you’ll want to achieve when you invest. You would expect to see a return of investment (ROI) whenever you place funds into an instrument.

You may have seen some coins such as SHIB, which spiked in price between May 8 and May 11 2021. However, it slowly decreased in value over the next month.

Rather than looking for these short spikes to ‘get rich quickly‘, you may want to look at the long term potential of these projects instead.

If a coin has a real-world use case that brings value to its users, these coins have the potential to do well in the future. With wider adoption of the coin, it will increase in value too!

Having a long-term outlook on your crypto investments will help you to understand their potential returns. This is especially useful if you do not want to actively trade crypto.

It is also possible to hold onto your crypto, and earn returns either through staking or lending out your crypto.

Diversify your crypto portfolio as much as possible

You may have heard of a certain coin that is ‘going to the moon‘, and are looking to invest all of your money into that single coin. While this can be a very profitable move if the currency spikes in price, you are taking a lot of risks with this strategy.

If the currency that you’ve bought drops in price, your entire portfolio will be in the red!

One way would be to buy a basket of different cryptocurrencies, instead of only buying one. This helps to diversify your portfolio into different coins.

Even if one coin drops in value, the others may increase in value. Overall, your portfolio may still increase in value.

For example, you may want to choose between investing in Cardano, Polkadot or Ethereum as the best smart contract platform. However, why not invest in all 3 of them?

Instead of concentrating your risk into one currency, you are spreading it out over a few. This means that your portfolio does not depend on the performance of just one currency.

Dollar cost average into the cryptocurrencies you intend to invest in

Dollar cost averaging is a strategy where you invest the same amount of money into a cryptocurrency at fixed periods. This is done regardless of the price of the currency.

Ultimately, this means that you’ll be buying more of the cryptocurrency when it’s price is low.

In contrast, you will be buying less of the cryptocurrency when the price is high.

The average price of the coin should be between the highest and lowest prices of all your trades.

Dollar cost averaging helps to take emotions out of your investment. Instead, you are constantly investing into the market, no matter what price the currency is at!

The best way would be to set aside a part of your salary, and invest into the cryptocurrencies that you chose every month.

Although some platforms like Crypto.com or Gemini have recurring buys, you are buying these coins with your credit card. This may cause you to incur quite a lot in fees! Instead, I would recommend manually buying these cryptocurrencies each month.

This process requires you to be extremely disciplined and not to be swayed by emotions. However, the outcome that you receive may be more favourable, as you are not trying to time the market!

Avoid constantly checking the prices of your cryptocurrencies

If you are constantly looking at your crypto portfolio to see how much you have gained or lost, you may want to reconsider this habit.

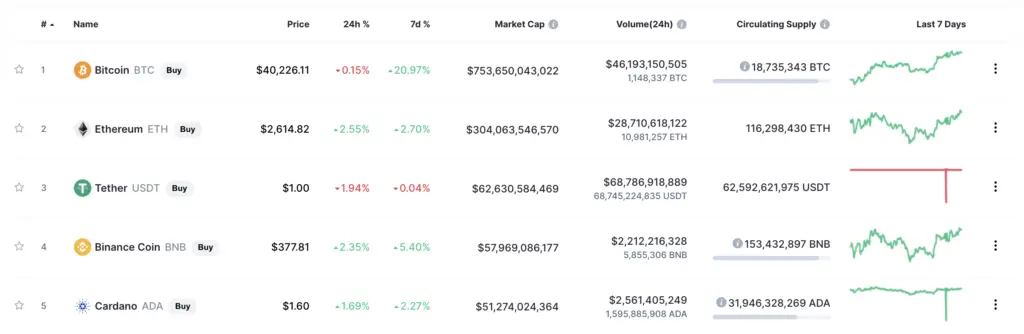

It can be very addictive to look at how the prices fluctuate everyday on platforms like CoinMarketCap.

By checking the prices of your investments very frequently, you may be swayed by emotion to sell them when they are decreasing in price!

Checking the prices frequently would only be suitable if you are a trader. However, if you are a long-term investor, you are intending to buy and hold these currencies.

As such, the day-to-day fluctuations would not really matter much to you! Instead of worrying how your portfolio is doing all the time, I’m sure there are better things you can do with your time!

To combat the temptation of checking your crypto portfolio, you can consider staking or lending them out. This gives you the impression that you are ‘locking up‘ your funds, which may prevent you from panic selling in a bear market.

Avoid blindly buying the dip

‘Buying the dip‘ has been a very popular term, especially when the crypto markets start to crash. This is done where you are buying the cryptocurrencies on the cheap, and you are expecting to make huge profits when they increase in price.

However, you may want to evaluate why the prices are dipping.

Is it out of FUD (fear, uncertainty and doubt), or could it be that the token’s fundamentals have changed?

Even if all the prices are falling, I would caution you against buying any coin in hopes that they will increase in price. Some of these coins may go down further in price, and take a really long time to recover!

As such, I believe that you should only invest in projects that you believe in, and have the long-term potential to do well.

Invest money you have, and are willing to lose

Even if you think that a cryptocurrency has a high potential of increasing in value, I want to caution you against borrowing money to invest in this currency.

I believe that investing with money you have is much safer compared to borrowing money to invest. By being in debt, you may be tempted to take on more risks to pay back your debt.

Furthermore, the crypto space is extremely risky and volatile. The amount that you invest has to be something that you are perfectly fine with losing.

There are many investment asset classes out there. You should choose to invest in some of the traditional asset classes first, which are less volatile.

For example, you can invest in stocks or bonds as your core portfolio. Meanwhile, crypto can be a part of your satellite portfolio.

Even if your cryptocurrency portfolio does poorly, it will not affect your entire investment portfolio!

Conclusion

Investing is all about risk management. You’ll need to make sure that you are not taking more risk than you can stomach. Although the returns you can receive from cryptocurrencies are extremely high, the volatility is really high too.

Even though everyone is rushing in to buy the ‘next Bitcoin’, I would suggest that you do not blindly follow them. It is always better to do your research first and justify to yourself why this coin is worth investing in.

This will ensure that you take more educated risks when you invest your funds!

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?