Last updated on August 26th, 2021

You have some money in your Revolut account, but are not sure how to withdraw your funds?

You’ve come to the right place!

Here’s all you need to know about withdrawing your money from Revolut:

Contents

How to withdraw from Revolut

Here are 2 ways that you can withdraw funds from your Revolut account:

- Withdrawing to a bank account

- Withdrawing from an ATM

How to withdraw from Revolut to bank account

These are the steps to withdraw your funds from Revolut to a bank account:

- Go to ‘Send’ on your dashboard

- Select ‘Bank Account’

- Enter the bank account details

- Enter the recipient’s address

- Select the amount you wish to transfer

- Receive the money in your bank account

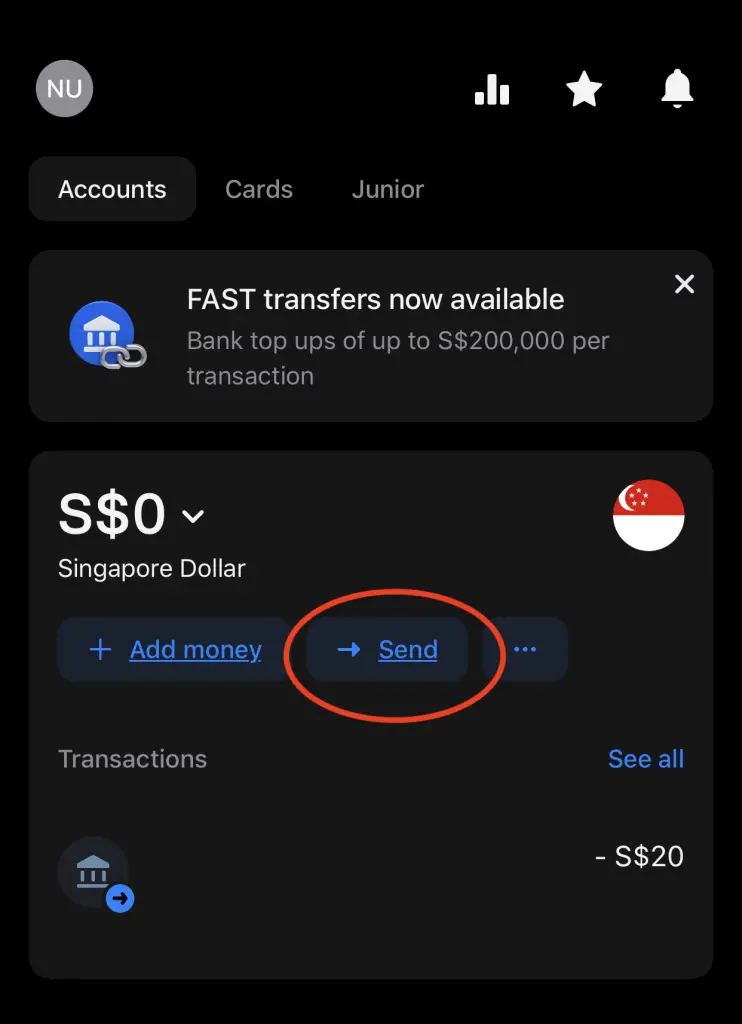

#1 Go to ‘Send’ on your dashboard

You will need to go to the ‘Send‘ function on your Revolut app dashboard.

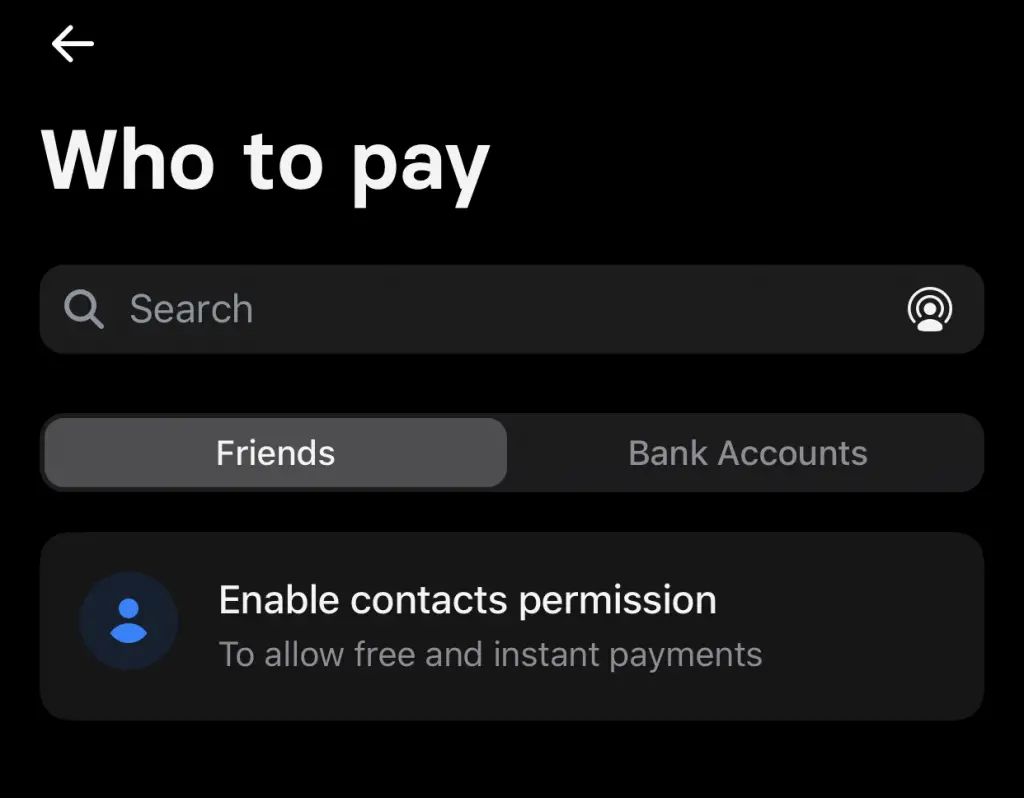

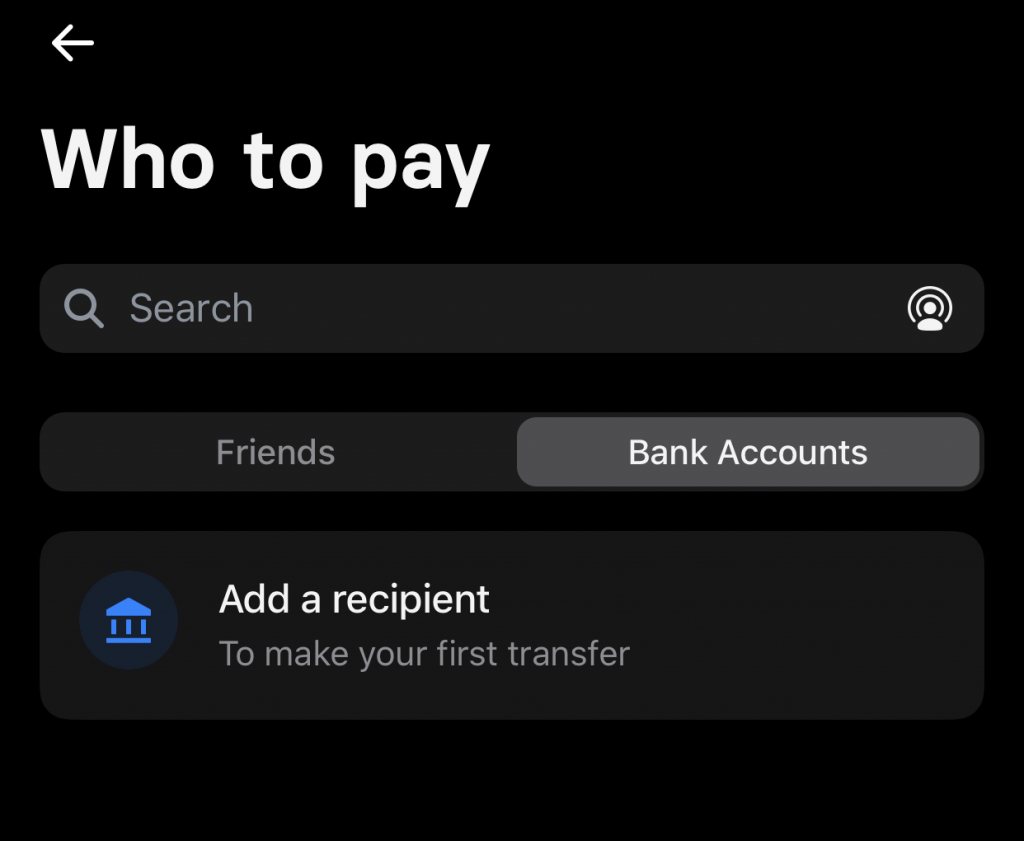

#2 Select ‘Bank Account’

You will be brought to the ‘Send’ page, where you can send money to your contacts who have a Revolut wallet too.

You’ll need to go to the ‘Bank Account‘ tab and add a bank account instead.

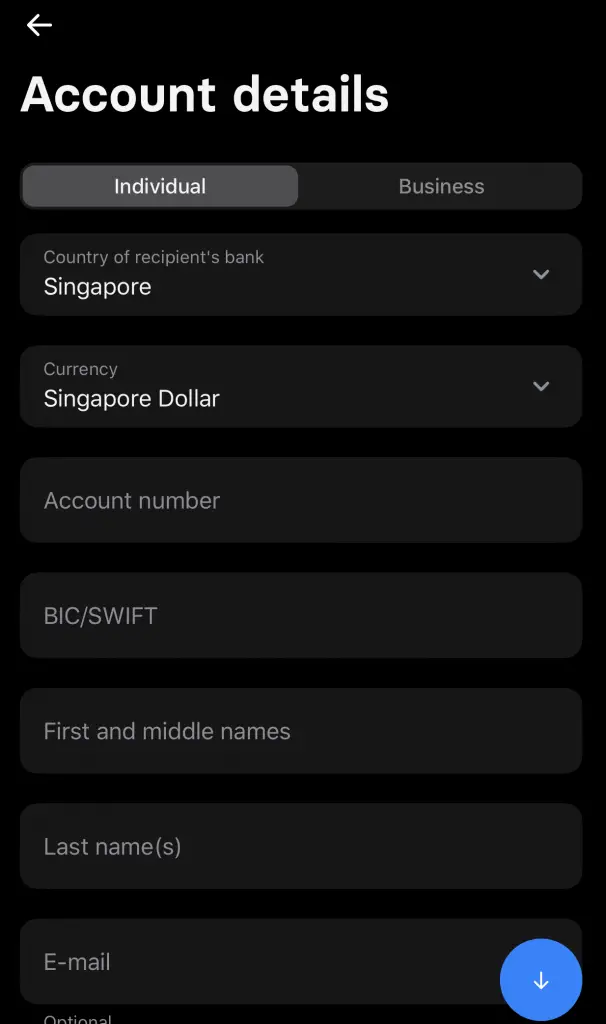

#3 Enter the bank account details

You will need to enter the details of the bank account you wish to transfer to.

The most important details include:

- Account number

- BIC/SWIFT code

- First and middle names

Here are some of the SWIFT codes of common banks in Singapore:

| Bank | Swift Code |

|---|---|

| DBS / POSB | DBSSSGSG |

| OCBC | OCBCSGSG |

| UOB | UOVBSGSG |

| Standard Chartered | SCBLSG22 |

You may wonder why DBS and POSB have the same SWIFT code. This is because they are actually the same bank!

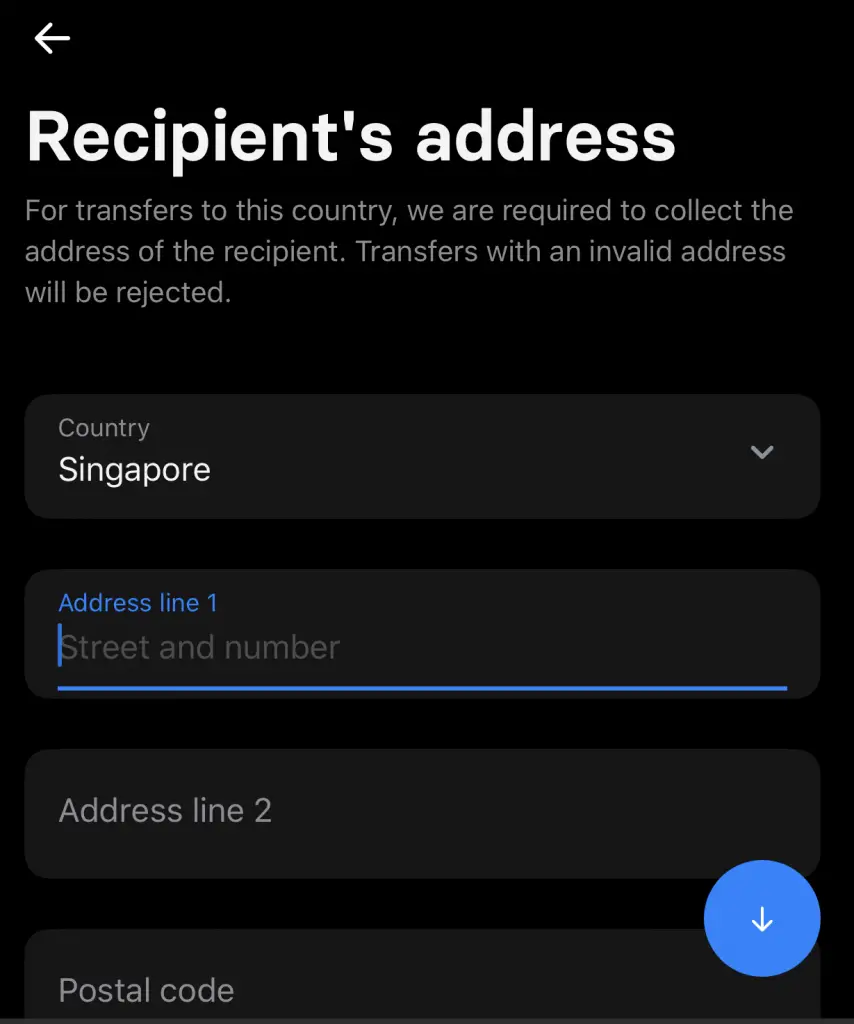

#4 Enter the recipient’s address

You’ll need to enter the details of the recipient’s address into the app as well.

This could be due to certain regulations set out by the MAS.

You’ll need to enter the recipient’s address and postal code.

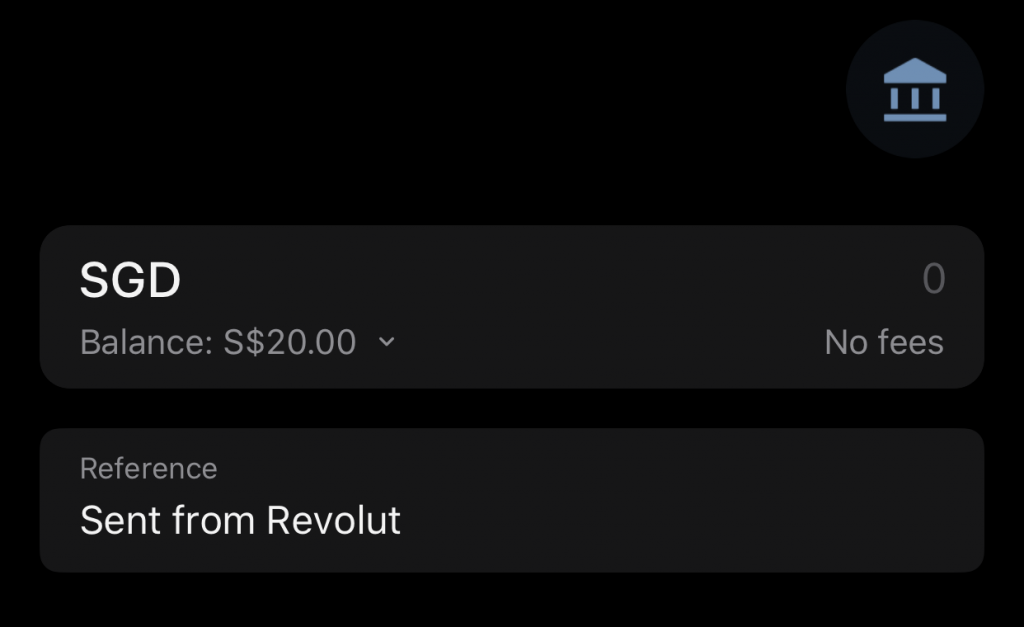

#5 Select the amount you wish to transfer

You’ll need to select the amount you wish to transfer to the bank account.

In this page, you can see the fees you’ll incur for your bank transfer. Revolut does not disclose the fees when you are transferring to a bank account on their site.

We’ll let you know in the Revolut app if any charges apply, before you make the transfer.

However, there does not seem to be any fees charged for a withdrawal to a Singaporean bank account!

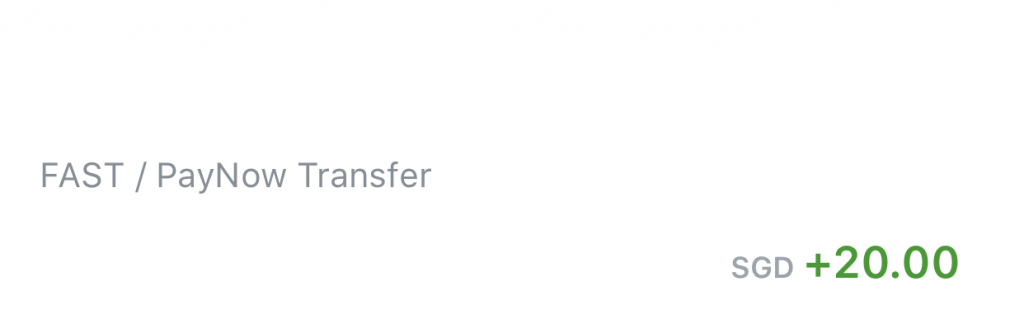

#6 Receive the money in your bank account

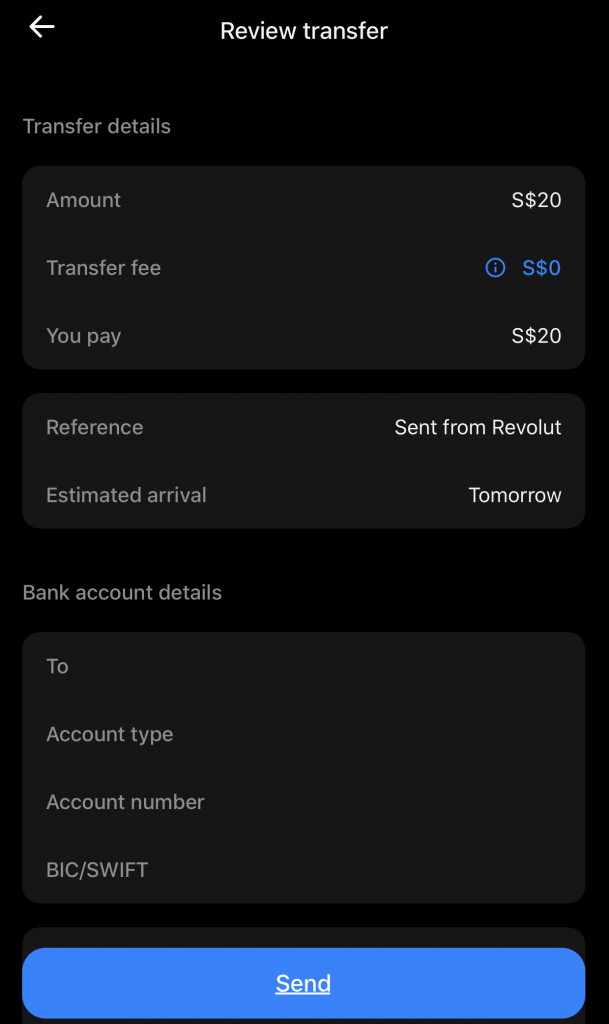

You can review the details of the transfer before you confirm the transaction.

Once you’ve confirmed it, Revolut mentions that it will take around a day for the transfer to go through.

However, it took 2 working days before my amount was credited into my bank!

You are not charged any fees for withdrawing SGD from your Revolut card. This is much better compared to other multi-currency cards out there!

| Card | Withdrawal Fees |

|---|---|

| Revolut | None |

| BigPay | $1 |

| YouTrip | Unable to withdraw |

| MCO Visa Card | Unable to withdraw |

Revolut may seem to be the best card to use if you perform a lot of overseas transactions!

Can you withdraw money from an ATM with Revolut?

You are able to perform an ATM withdrawal with your Revolut card at international ATMs. However, you are unable to use your Revolut card to make a withdrawal in Singapore.

You can use your Revolut card to make an ATM withdrawal.

However, this can only be done at international ATMs! This is similar to other multi-currency cards too.

The reason why you can’t make any local ATM withdrawals could be due to MAS regulations.

For ATM withdrawals, you are able to withdraw up to SGD$350 worth of foreign currency for free.

If you withdraw any amount that exceeds SGD$350, you will incur a 2% fee for the amount that you withdraw!

Here is how Revolut’s overseas ATM withdrawals compare with the other cards:

| Card | Limit | Withdrawal Fee |

|---|---|---|

| BigPay | $2,500 daily | 2% per withdrawal |

| YouTrip | $5,000 daily | $5 per withdrawal |

| MCO Visa Card | $500 – $2,000 depending on tier | 2% fee after limit ($200 – $2,000 depending on tier) |

| Revolut | $30,000 (monthly) | 2% after SGD$350 |

It seems that Revolut has really attractive fees compared to the other multi-currency cards!

Conclusion

The Revolut card and wallet allows you to withdraw your money from your mobile wallet to your bank account.

It does not charge a fee to withdraw it to a Singaporean bank account, which makes it really attractive.

However, it may take a while before your funds are transferred!

You are also able to make ATM withdrawals. These can only be done overseas and not in Singapore.

Nevertheless, Revolut still provides really reasonable rates for overseas withdrawals!

👉🏻 Referral Deals

If you are interested in signing up for any of the products mentioned above, you can check them out below!

Revolut Referral (Receive a $100 sign up bonus)

If you are interested in signing up for Revolut, you can use my referral link.

Here are the steps you need to receive your $100 sign up bonus:

- Sign up for a Revolut account

- Pass the KYC checks

- Transfer money to your Revolut account by connecting your bank account or debit card

- Order a physical Revolut card

- Complete 3 purchase transactions (of ≥ $10) with your new Revolut card

After completing all of this, you will be able to receive $60 in your Revolut account!

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?